2.2- how the macroeconomy works

1/107

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

108 Terms

what is national income

the total value of the goods and services a country produces in one year

how is national income measured

GDP, GNP and GNI

what is real GDP

the value of GDP adjussted for inflation

what is nominal GDP

the value of GDP not adjusted for inflation

what is GNP

the market value of all products produce in an annum by the labour and proprty supplied by citizens of a country

what does GNP include

GDP plus income earned from overseas minus income earned by overseas residents

what is GNI

the sums of value added by all producers who reside in a nation

what does GNI include

product taxes , receipts from primary income from abroad minus subsidies

what are the two components of the circular flow of income

firms and households

what is the circular flow of income

it is how firms and households interact and exchange resources in an economy

how do households interact in the circular flow of income

supplies firms with the factors of production e.g. labour and capital

households receive wages and dividends

how do firms interact in the circular flow of income

they supply goods and services to households

consumers pay for this

what does saving income do

removes it from the circular flow and is a withdrawal

name another withdrawal

taxes

name an injection into the circular flow

gov. spending on public and merit goods

what else is included in the circular flow

international trade, exports and imports w

what is an export in the circular flow

injection into the economy and goods are sold to foreign countries

what is an import in the circular flow

withdrawals from the economy, since money leaves the country

what is full employment income

total output of an economy when unemployment is minimised or is at the gov. target. helps to account for frictional unemployment

what is the formula for the circular flow

income = output = expenditure

when does an economy reach equilibrium

when rate of withdrawals = rate of injections

wha happens if there is a net injection in the economy

there will be an expansion of national output

what happens if there is a net withdrawal from the economy

there will be a contraction of production, so output decreases

what is aggregate demand

the total demand in the economy

what does ad measure

spending on goods and services by consumers, firms, the gov. and overseas consumers and firms

when are there movements along the ad curve

fall in price level causes expansion in demand

a rise in price level causes contraction in demand

movements are caused by a change in price level

why does the ad curve slope downward

higher prices leads to a fall in value of real incomes so goods become less affordable

high UK inflation means a high average price level so foreign goods seem cheaper

more imports and therefore a deficit on the current account increases and AD falls

high inflation means higher interest rates which discourages spending

saving becomes more attractive and borrowing becomes expensive

when does the AD curve shift

by changes in the components of AD (C + I +G or X-M)

what does a shift tp the right in an AD curve represent

a rise in economic growth

chain of reasoning for a rise in economic growth

rise in consumer and firm confidence so they invest and spend more as they feel like they will get a higher return on them

what happens if the MPC lowers interest rates

becomes cheaper to borrow and reduces incentive to save

spending and investment increase

however, there are time lags between the change in interest rates and the rise in AD so this is not suitable if a rise in AD is needed immediately

how does lower taxes affect AD

consumers have more disposable income, so AD rises

how can the gov. boost AD

increase gov. spending

how does depreciation affect AD

m is more expensive

x is cheaper

AD increases

what does a rise in house price affect

people feel wealthier, so they are likely to spend more

the wealth effect

what is aggregate supply

it shows the quantity of real GDP which is upplied at different price levels in the economy

why is the AS curve upward sloping

at a higher price level, producers are willing to supply more because they earn more profits

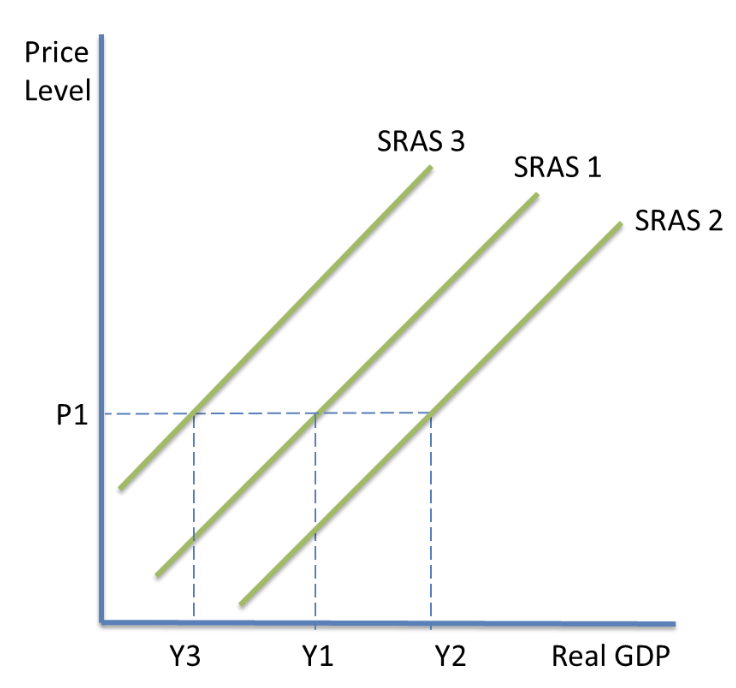

when are there movements along the AS curve

when there is change in price level

AD increases, there is an expansion in SRAS

AD falls, there is a contraction in SRAS

when does the SRAS curve shift

when there are changes in the conditions of supply

what conditions of supply can change for SRAS

cost of employment e.g wages/taxes

cost of other inputs e.g. raw materials, exchange rate

gov. regulations or interventions e.g environmental laws

why is SRAS different to LRAS

SRAS only covers the period immediately after a change in price level

shows the planned output of an economy when prices change

cost of production and productivity remains constant e.g. wage rate/ technology

what does LRAS show

the potential supply of an economy in the long run

when prices and the costs and productivity of factor inputs can change

why is LRAS vertical

supply is assumed not to change as price level changes

how is economic growth shown on the LRAS curve

a rightward shift

when is macreconomic equilibrium reached

when the rate of withdrawals = the rate of injections

AD = AS

what is a demand side shock

a temporary change in AD, can be negative or positive

what is a supply side shock

sudden, unexpected change in the cost of a factor of production or a disruption to the production process

how is a supply side shock shown on the diagram

at a price above equilibrium, there will be excess supply

what happens if there is a shift in as

if the economy becomes more productive supply will shift to the right

this lowers the average price level and increases national output

what happens if AS shifts inwards

price increases and national output decreases

when might AD shift inwards

if firms have less confidence or there is a recession

what happens if AD increases

price level and level of national output increases

what is aggregate demand

the total demand of the economy. it measures spending on goods and services by consumers, firms, the government

what are the components of AD

C + I + G + (X-M)

what is C

consumer spending

what is consumer spending

this is how much consumers spend on goods and services and is the largest component of AD

makes up 60% of GDP

what is disposable income

the amount of income consumers have left over after taxes and social security charges have been removed

what is a consumer’s margin propensity to consume

it is how much a consumer changes their spending following a change in income

what is a consumer’s marginal propensity to save

the proportion of each additional pound of household income that is used for saving

what is equal to 1

A consumer’s marginal propensity to consume added to the marginal propensity to

save

what are the influences on consumer spending

interest rates, consumer confidence and capital investment

how do interest rates affect consumer spending

lowering interest rates means it is cheaper to borrow and reduces the incentive to save

so spending and investment increase.

there are time lags between the change in interest rates and the rise in AD, so this is not suitable if a rise in AD is needed immediately

what do lower interest rates do for consumers

Lower interest rates also lower the cost of debt, such as mortgages. This

increases the effective disposable income of households.

how does consumer confidence affect consumer spending

consumers and firms have higher confidence levels, so they invest and spend

more, because they feel as though they will get a higher return on them.

This is affected by anticipated income and inflation.

If consumers fear unemployment or higher taxes, consumers may feel less confident about the economy, so they are likely to spend less and save more.

This delays large purchases, such as houses or cars.

how does capital investment affect consumer spending

accounts for around 15-20% of GDP in the UK per annum,

¾ of this comes from private sector firms.

¼ is spent by thegovernment on, for example, new schools.

This is the smallest component of AD

what are the influences on investment

rate of economic growth, business expectations, demand for exports, interest rates, access to credit, influence of gov. and regulations

how do the rate of economic growth affect investment

If growth is high, firms will be making more revenue due to higher rates of consumer spending. This means they have more profits available to invest

how does business expectations and confidence affect investment

If firms expect a high rate of return, they will invest more.

expectations about society and politics could affect investment. For example, a change in government might happen, or commodity prices are due to rise, businesses may postpone their investment decisions.

what term did Keynes coin

animal spirits when describing instincts and emotions of human behaviour, which drives the level of confidence in an economy

how does the demand for exports affect investment

he higher demand is, the more likely it is that firms will invest.

This is because they expect higher sales, so they might direct capital goods into the markets where consumer demand is increasing

how do interest rates affect investment

Investment increases as interest rates falls. This means that the cost of borrowing is less and the return to lending is higher.

The higher interest rates are, the greater the opportunity cost of not saving the money.

high interest rates might make firms expect a fall in consumer spending, which is likely to discourage investment

how does access to credit affect investment

If banks and lenders are unwilling to lend, firms will find it harder to gain access to credit, it is either more expensive or not possible to gain the funds for investment.

Firms could use retained profits

the availability of funds is dependent on the level of saving in the economy.

The more consumers are saving, the more available fund are for lending, and therefore for investing

how does the influence of gov. and regulations affect investment

The rate of corporation tax could affect investment. Lower taxes means firms keep more profits, which could encourage investment.

what is the accelerator effect

suggests that the level of investment in an economy is related to the change in GDP

A higher rate of economic growth causes more investment.

If the rate of economic growth is slowing, but the economy is still growing, the level of investment might fall.

The level of investment is more volatile than the rate of economic growth.

what is gov. spending

how much the government spends on state goods and services, such as schools and the NHS. It accounts for 18-20% of GDP

what are influences on gov. expenditure

the trade cycle, fiscal policy, exports minus imports

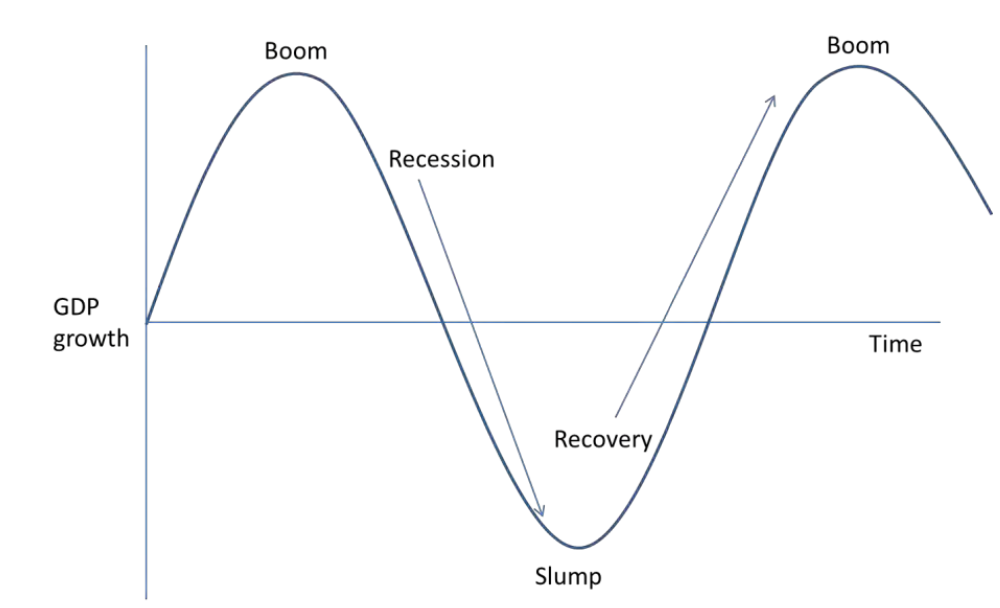

what is the trade cycle

refers to the stage of economic growth that the economy is in where there are periods of booms and busts

features of trade cycle

boom, recession, slump, recovery and shows GDP growth over time

explain how the trade cycle works

real output increases when there are period so f economic growth- recovery stage

boom is when economic growth in fast, could be inflationary or unstable

recessions, there real output in the economy falls, and there is negative

economic growth

what do the gov. do during recessions

governments might increase spending to try and stimulate the economy. This could involve spending on welfare payments to help people who have lost their jobs, or cutting taxes

this will increase the gov. deficit

what does the gov. receive during economic growth

governments may receive more tax revenue since consumers will be spending more and earning more.

they may decide to spend less, since the economy does not need stimulating, and fewer people will be claiming benefits

when do governments use fiscal policy

when it involves changing gov. spending and taxation, they might spend on public goods and merit goods

what type of policy is fiscal policy

a demand-side policy as it works by influencing the level or composition of AD

what is discretionary fiscal policy

a policy which is implemented through one-off policy changes

what are automatic stabilisers

policies which offset fluctuations in the economy.

These include transfer payments and taxes.

They are triggered without government intervention

what is expansionary fiscal policy

used during periods of economic decline

involves increasing spending on transfer payments or on boosting AD, or by reducing taxes

what is contractionary fiscal policy

involves decreasing expenditure on purchases and transfer payments.

tax rates might increase.

This reduces the size of the government budget deficit

what is X-M

this is the value of the current account on the balance of payments.

A positive value indicates a surplus, whilst a negative value indicates a deficit.

what are the influences on trade balances

real income, exchange rates, state of the world economy, degree of protectionism, non-price factors

how does real income affect trade balances

periods of economic growth, consumers have higher incomes

as consumers can afford to consume more, there is a larger deficit on the current account

consumers increase spending on imports and exports

how does appreciation of the pound affect trade balances

Stronger Pound Imports Cheaper Exports Dearer

what is the relationship between interest and exchange rates

if one increases so does the other

what non-price factors affect trade balances

trade deals and trade blocs influences a country’s exports

competitiveness influenced by supply side policies

more innovation

higher quality of products

how do interest rates affect exchange rates (when it goes down)

interest rate goes down

return on investments made from investments will be lower

means investors will not invest in the UK as it does not generate high returns

demand for pound goes down

value of pound goes down

factors that increase AD

lower income tax

lower interest rates

positive wealth effect

depreciation

increases in consumer/ producer confidence

what is the multiplier process

occurs when there is new demand in an economy.

leads to an injection of more income into the circular flow of income, which leads to economic growth.

leads to more jobs being created, higher average incomes, more spending, and eventually, more income is created

what does the multiplier effect show

refers to how an initial increase in AD leads to an even bigger increase in national income

what is the multiplier ratio

the ratio of the rise national income to the initial rise in AD

what are interest rate

the cost of borrowing and the reward for saving

what happens if interest rates go down

if interest rates go down, consumption goes up

if interest rates go down, investment increases

if interest rates go down, gov. spending goes up