4.1 International economics

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Globalisation

The process by which national economies have become increasingly inter-dependent + integrated into a single international market.

Factors causing globalisation

Trade liberalisation: removing trade barriers, allowing more free trade between nations.

Trading blocs: trading agreements within trading bloc. Trading blocs becoming deeper.

Technological advancements: easier transportation of goods, easier for businesses to set up in other countries, software development.

Mobility of labour+capital: more migration

Benefits + consequences of globalisation

BENEFITS

Lower prices (consumers+producers): nations become integrated→bigger market→more competition→lower prices→increases efficiency

Benefits of trade (government): greater growth+greater tax revenue from more trade(net exports), promote economic development

Greater employment (workers+government): bigger market size, firms grow bigger, quantities they can produce and sell increases, hire more workers to supply that output→higher incomes + standards of living

Free movement of labour+capital (FDI)(countries): cheaper + easier to move around internationally, businesses move cheaper + more easily as countries attract FDI through looser gov. policies + technology advancements→more investment leads to economic growth for a country.

COSTS

Greater structural unemployment: firms decline as they lose out to international competition →structural unemployment→lose jobs + income

Environmental costs: More pollution due to depletion of resources for production. Lack of sustainability: future generations don’t benefit.

Greater risk of external shocks: more export-led growth of countries leads to over-reliance on trade→if there is an external shock in a country/ industry, this affects all countries who import goods.

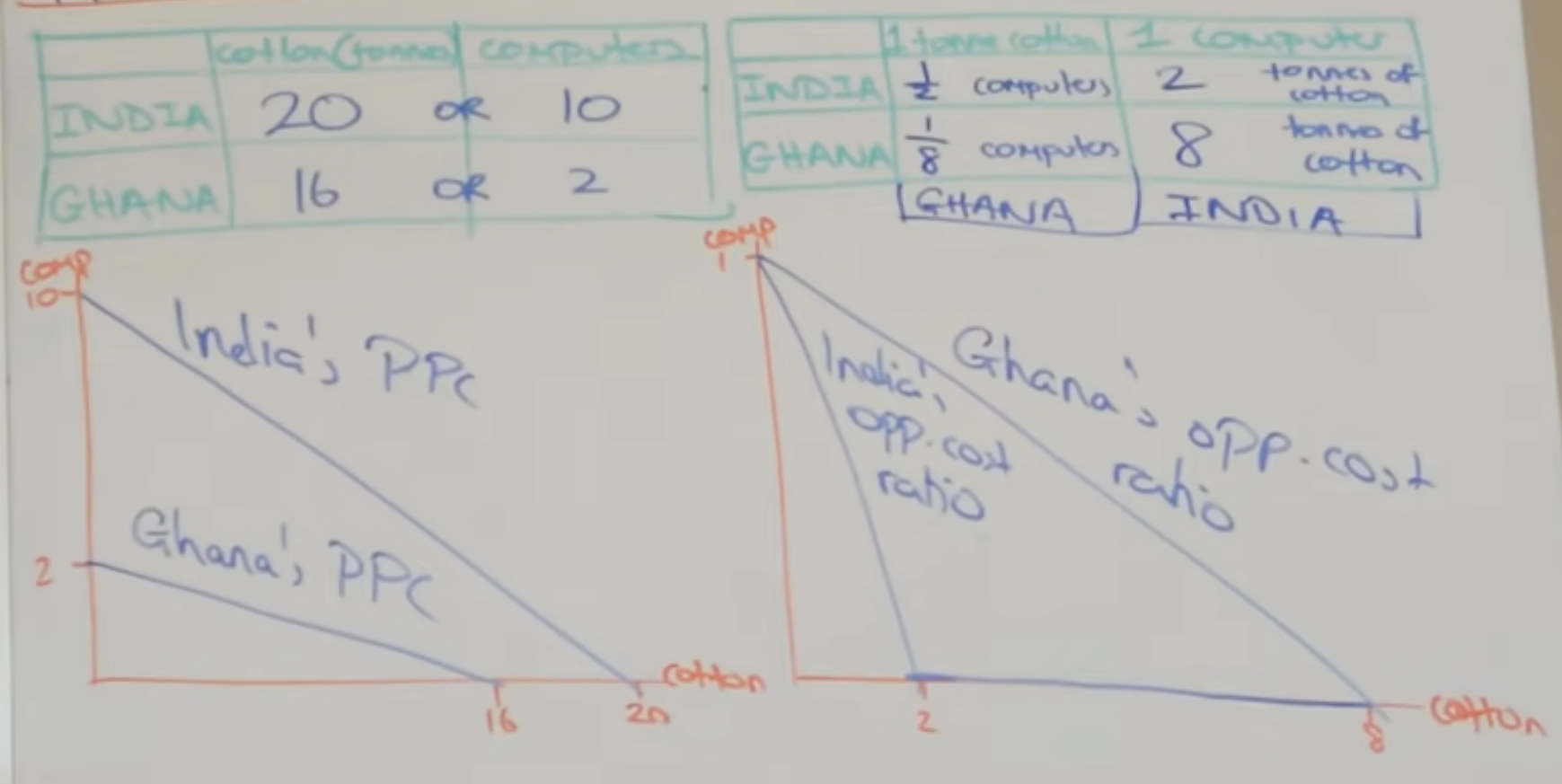

Absolute advantage

Occurs when a country can produce a product using fewer factors of production than another nation.

Ghana has the absolute advantage in producing both cotton + computers.

Comparative advantage

States that a country should specialise in the goods + services it can produce at the lowest opportunity cost, and then trade with another country.

Ghana have comparative advantage in producing cotton(lower opp. cost). India have comparative advantage in producing computers.

For trade to be mutually beneficial, rate of exchange must lie between the opp. cost ratios of production (2+8).

it is only worth selling if what they get back in return is more than what they could’ve made themselves.

Limitations of comparative advantage

Assumes perfect knowledge: consumers may not know where to buy good for lowest price

Assumes transport costs: huge transport costs for other nations to buy product→CA is less beneficial

Assumes no economies of scale: if countries have CA + supply the whole market, benefit hugely from economies of scale. However, diseconomies of scale may occur.

Advantages + disadvantages of specialisation

Advantages | Disadvantages |

|---|---|

Higher living standards: ↑ world output, ↑ real GDP, ↑ living standards | Based on unrealistic assumptions: they may prevent ↑ in real GDP due to higher costs |

May create economies of scale: ↑ quantity, ↓ LRAC, ↑ profits | May lead to overdependence on imports + exports |

Lower prices + more choice for consumers: ↓ LRAC, so AS shifts right, ↓ prices. | Causes demotivation: ↓ productivity and ↑ prices. |

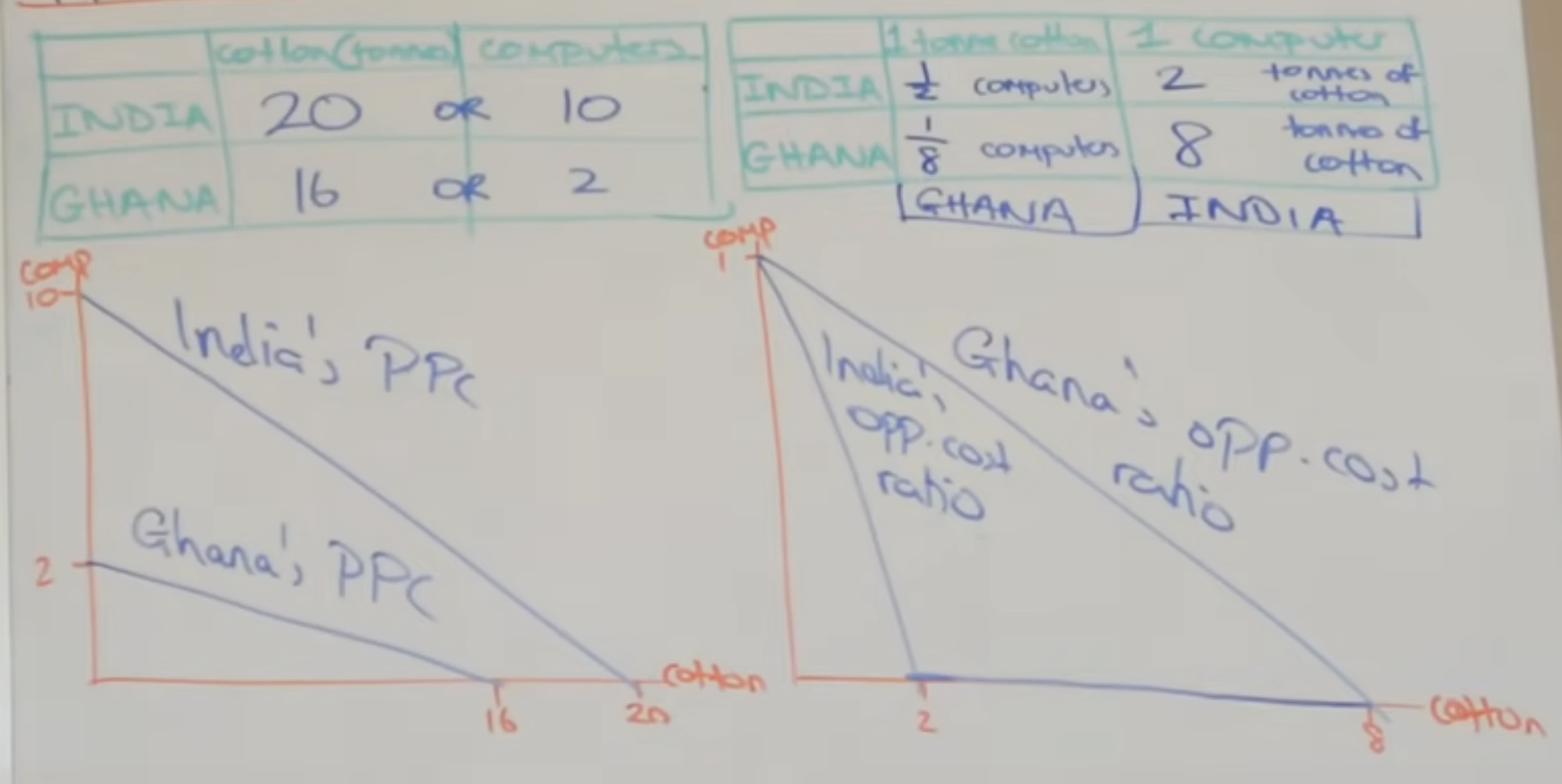

Terms of trade

The quantity level of exports that needs to be sold in order to purchase a given level of imports.

ToT ↑: Buy a greater quantity of imports for a given quantity level of exports.

When ToT ↑, it has improved. When ToT ↓, it has deteriorated.

index of export prices measures weighted average price of exports.

Factor’s affecting ToT

SR

Demand/ supply of exports/ imports: demand ↑ e.g. due to change in taste, increases price of exports. supply ↑ e.g. due to better weather conditions, price decreases.

Relative inflation rate: if inflation is higher than in other countries, this ↑ price of exports,↑ ToT.

Exchange rate: if pound appreciates(stronger), price of exports ↑.

LR

Advancement in technology: ↑ productivity, cost of production ↓, price of exports ↓.

Benefits + costs of improvement in ToT

BENEFITS

Increased export revenue: if D increases, price increases, increasing export revenue, profits, investment

↑ Standard of living: country can buy higher quantity of imports(more affordable), ↑ standard of living

COSTS

International competitiveness: ↑ inflation, ↑ price of exports, ↓ international competitiveness, ↓ exports, ↓ AD, ↓ GDP growth + employment.

CA deficit: quantity of exports bought for given level of imports ↓, export revenue decreases, CA deficit.

Economic integration

Process whereby countries coordinate to reduce trade barriers and to harmonise monetary+fiscal policy.

Trading bloc

A group of countries that join together and agree to increase trade between themselves.

Bilateral/ multilateral trade agreement

Agreement to reduce tariffs + quotas between two/ multiple countries.

Types of trading blocs (from least economically integrated to most)

Preferential trading area (PTA)

Free trade area(FTA)

Custom union

Common market

Monetary + economic union

Full economic integration

Preferential trading area (PTA)

Countries join together to reduce tariffs or quotas but only on certain goods + services.

FTA

Countries join together + agree to eliminate all trade barriers between each other, but are free to trade however they want to any country outside the FTA. e.g. NAFTA (North America)

Costs + benefits of free trade

BENEFITS

More efficient allocation of world’s resources: ↑ incentive for nations to specialise + produce goods + services where they have cost advantage(CA) to export them. Import goods which you can’t access domestically- more variety.

Lower prices: International competition→greater efficiency→lower costs→lower prices. EoS(internal+external)- Larger quantity supplied→lower AC→lower prices.

Economic growth: countries specialised in producing a good can supply world market→more exports→more AD→growth.

COSTS

No common currency(see monetary union): fluctuating exchange rate may affect business confidence.

Leads to trade diversion(see customs union)

Customs union

An FTA, but without the freedom of trade with countries outside the custom union. e.g. EU, ASEAN. Impose Common external barrier: imposed on all imports from non-member nations.

Trade creation in customs unions/ FTA’s

Movement from a high cost domestic producer to a lower cost producer inside the customs union.

+benefit from economies of scale for domestic producers

+greater technological transfer

+greater consumer surplus, lower prices

Trade diversion in customs unions

Movement from a low cost foreign producer to a higher cost producer within the customs union.

-with the tariff, the efficient price of an import from a non-member that was once cheaper increases higher than the inefficient price of the import from a member, increasing producer surplus.

-trade stops with non-members

-loss of consumer surplus, higher price

-deadweight loss of efficiency

-likelihood of retaliation from foreign countries against the EU

Costs + benefits of customs union

BENEFITS

Free trade: more job creation, higher GDP per capita, economic growth as nations exploit greater export market(export led growth).

↑ FDI: Businesses have access to other members- employment benefits, economic growth, technological advancements from FDI.

Huge market size: greater variety of goods, more competition→lower prices→greater consumer surplus.

Free movement of labour+capital: people can work abroad for free, companies can branch out + open up outlets in other member countries easily.

COSTS

Trade benefits could come from FTA’s instead: Negotiate trade deals with other members inside union AND members outside union- more benefits.

Forced to follow EU laws + regulations: can be costly e.g. strict environmental regulations, product safety, disincentivises firms from setting up in customs union. Loss of economic sovereignty.

More uncontrolled immigration: free movement of labour→drain public resources, take advantages of benefits system.

Common market

A customs union with deeper integration in terms of common policies. Allow free movement of labour, capital, businesses, between member nations. e.g EU

Costs+benefits of common markets

BENEFITS

Free movement of labour+capital: people can work abroad for free, companies can branch out + open up outlets in other member countries easily.

COSTS

More uncontrolled immigration: free movement of labour→drain public resources, take advantages of benefits system.

Economic + monetary union

Countries decide to adopt the same currency, same central bank + therefore same monetary policy. e.g Eurozone

Economic union: adopt same common policies, e.g. product regulation, freedom of movement of goods, etc.

Costs + benefits of monetary union

BENEFITS

Same currency- non-fluctuating exchange rate: stable currency where foreign investors have more confidence it will hold its value + reflect its PPP→greater investment. More international trade- easier to trade if they trust it will hold its value.

↓ Cost of currency conversion: Firms can trade without need to convert currency- money can go towards investment. Lower costs for consumers.

COSTS

Loss of monetary policy autonomy: If economic circumstance differs to other nations in trading bloc, the monetary policy set may not be suitable for your nation.

Cost of currency conversion is high: Reprinting money+getting rid of old currency is costly.

Full economic integration

Countries completely harmonise all policies: fiscal, monetary, political power given to one governing body. e.g. the UK

World Trade Organisation(WTO) + conflicts between WTO and regional trade agreements

International organisation that regulates world trade.

ROLES

Set + enforce rules on international trade: fines for those breaking rules

Provide a forum for negotiating trade liberalisation: Allow individual countries to get together + agree on trade policies- quicker + easier at WTO HQ in Geneva.

To monitor further trade liberalisation: Ensure trade is actually free + happening as agreed.

CONFLICTS

Common external tariffs- violate WTO’s principle of having all trading partners treated equally.

Protectionist barriers- imposed on non-members of a trading bloc

Protectionism

Any barrier that restricts free trade between nations.

Reasons for restrictions on free trade

Infant industries: newly developing firms- haven’t had time to grow like international rivals. Tariffs+quotas on imports to allow them to grow + EoS to compete internationally.

-allows room for inefficiencies

Protect against dumping: the sale of certain goods below its cost of production. e.g. due to excess supply. May sell to other countries, harming domestic producers. Taxes/ embargos placed on these goods.

-dumping taking place is hard to prove. If proven wrong, retaliation may occur.

Protect domestic employment: Gov. may use protectionism to protect domestic producers from competition of international firms.

-industry may already be in decline, so its better to let it happen naturally even if that means SR unemployment.

Raise gov. revenue(tariffs): Revenue can be used to fund public goods, merit goods, infrastructure.

Types of restrictions on trade

Tariffs: Tax placed on imports, ↑ price

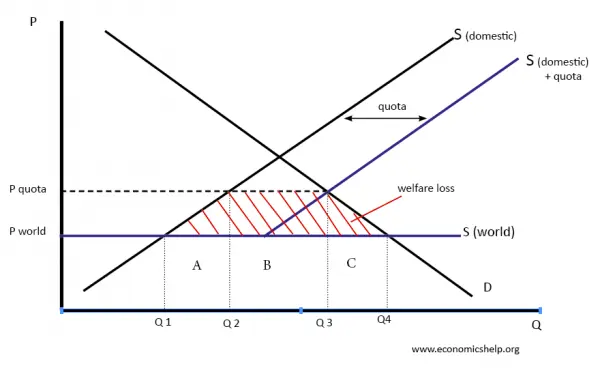

Quotas: limit on quantity imported

Subsidies to domestic producers

Non-tariff barriers- bans, quality conditions, licenses

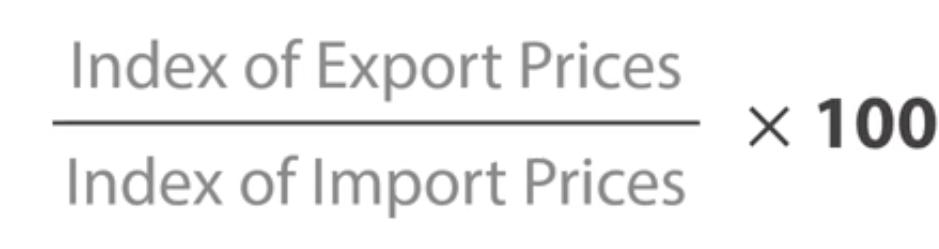

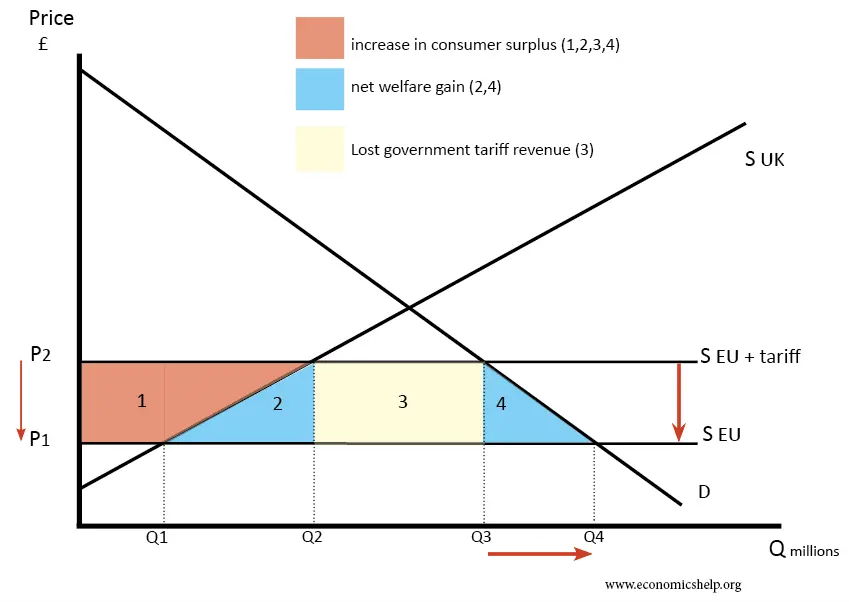

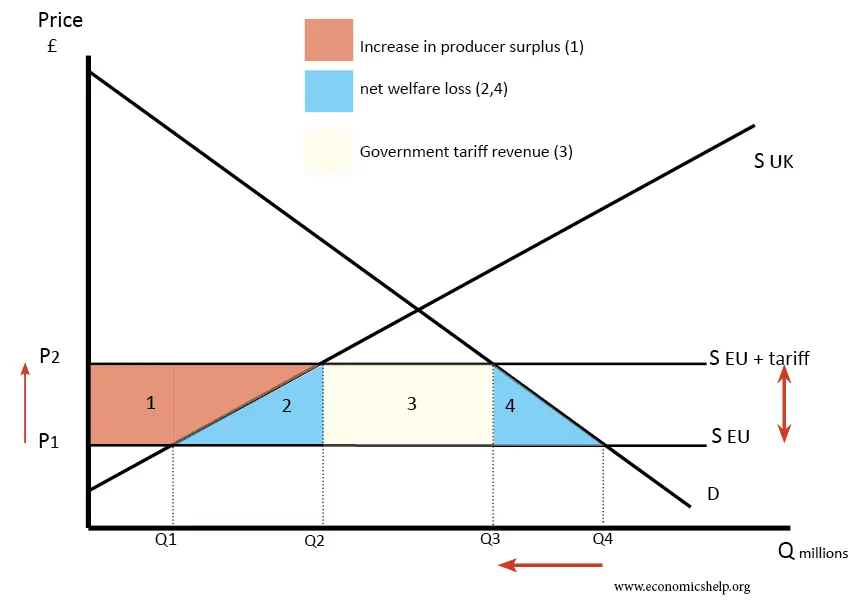

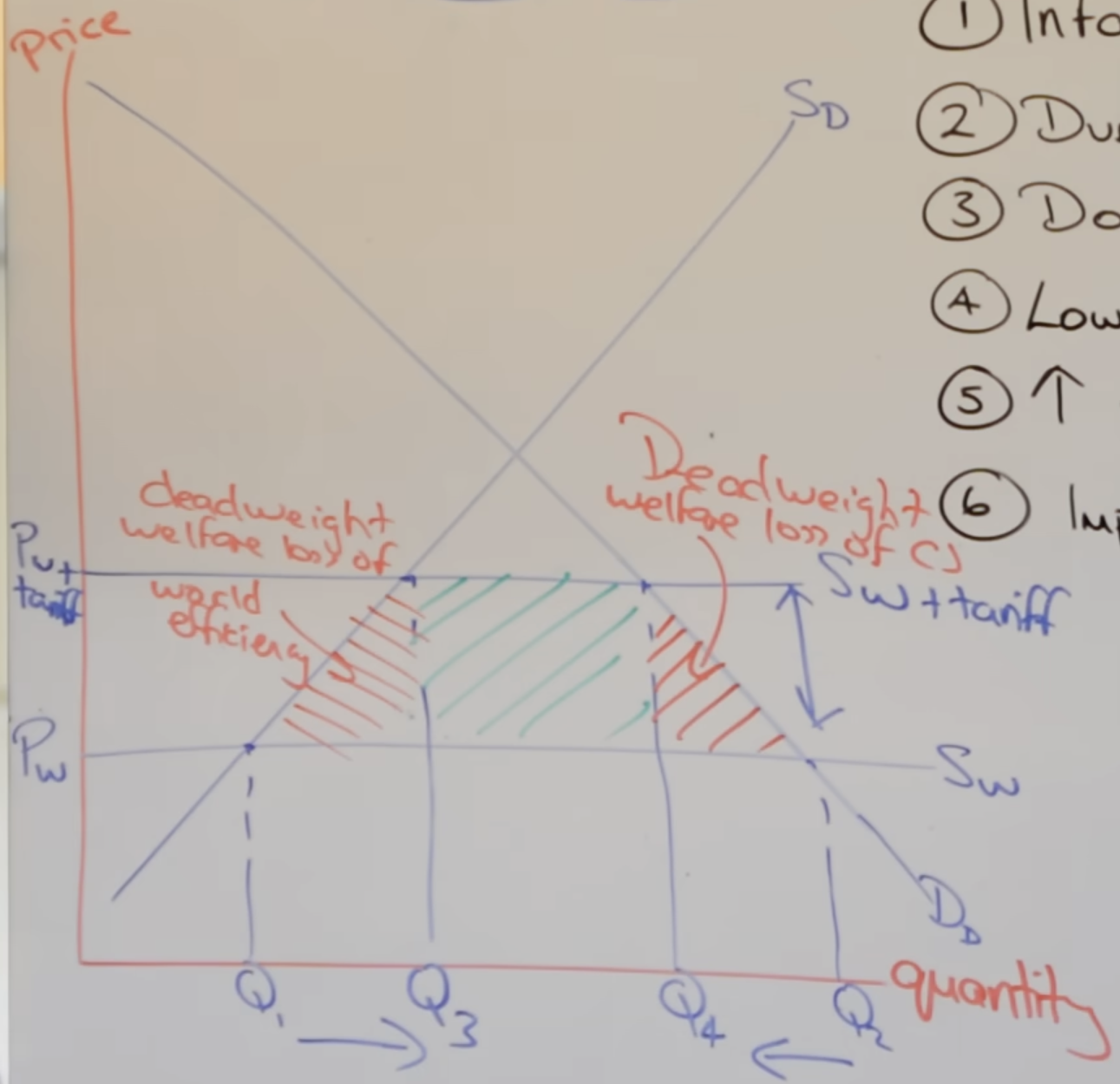

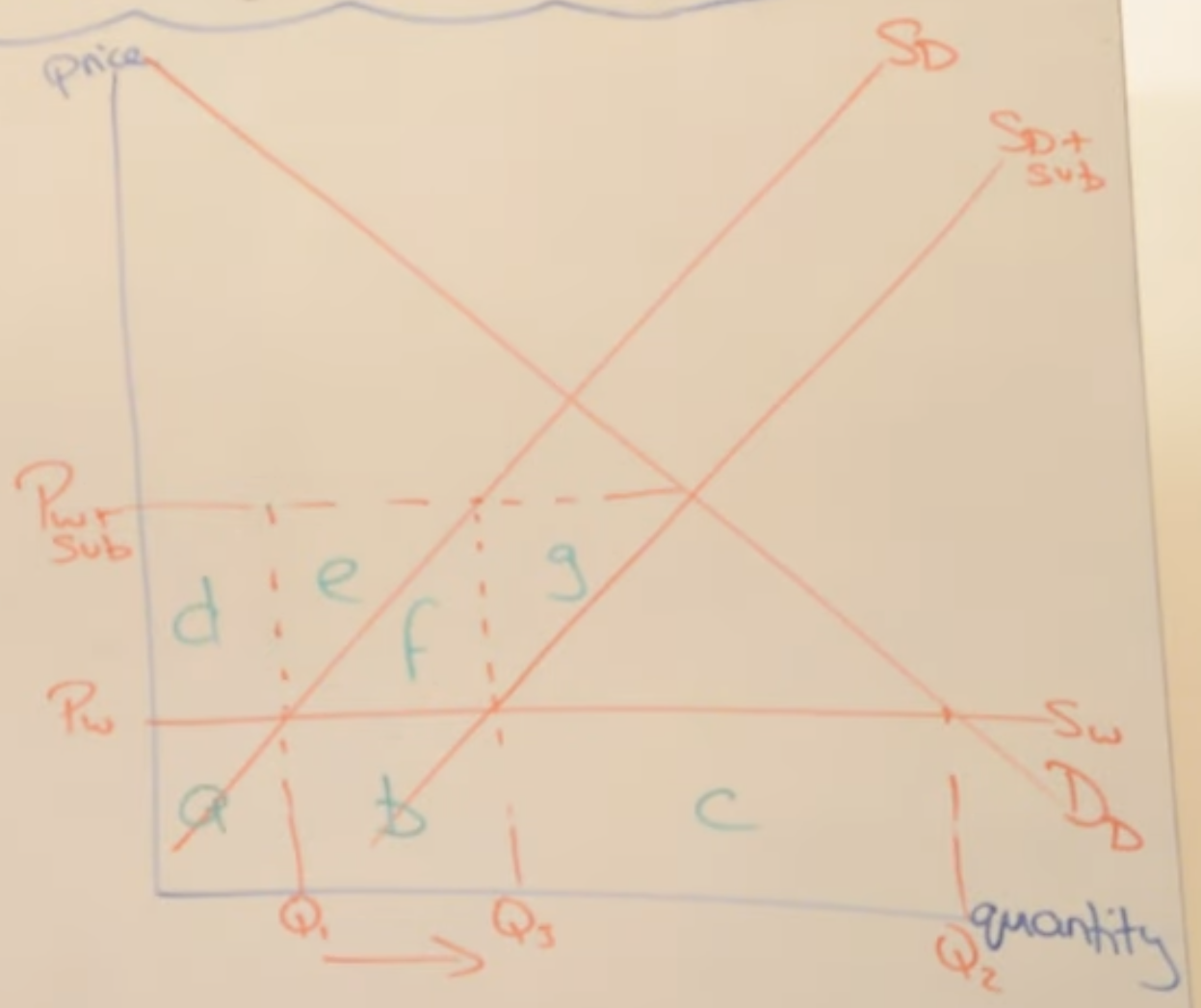

Import tariffs diagram

Sw = world supply

Sd = domestic supply

Imports = Q1Q2 to Q3Q4

Green box = gov. revenue

Import quotas diagram

Trade subsidy diagram

f = deadweight loss

Cons of protectionism

Market distortions: consumer surplus decreases, higher prices for consumers, loss of consumer choice as there’s a lower quantity imported from abroad.

Production inefficiencies: allocative inefficiencies- domestic suppliers produce at higher costs compared to world suppliers.

Retaliation: Putting protectionist measures on a country may allow them to retaliate much worse.

Inequality: Protectionism on essential items e.g. clothing which low income people buy- suffer from high prices. Worsens distribution of income.

EVALUATION

Size of tariff/ quota, Elasticity of S/ D (more inelastic=change in quantity supplied will be small)

BOP

Current account: (see 2.1)

Financial account:

Portfolio investment transactions: The buying + selling of financial assets e.g. bonds, shares, derivatives

If a US firm buy UK gov. bonds, this is an inflow into the UK.

Foreign direct investment(FDI): investment from one country into another.

German firm setting up in UK is an inflow

Capital account

Records sales of tangible assets, intangible assets(copyrights, patents), transfers of financial assets by migrants.

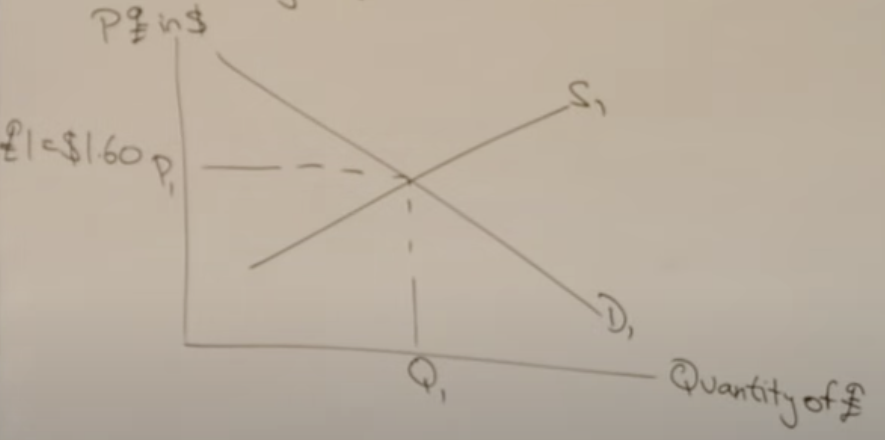

Exchange rate + floating

The price of one currency in terms of another.

e.g. £1 = $1.60

Floating exchange rate: exchange rate determined by the demand and supply of the currency.

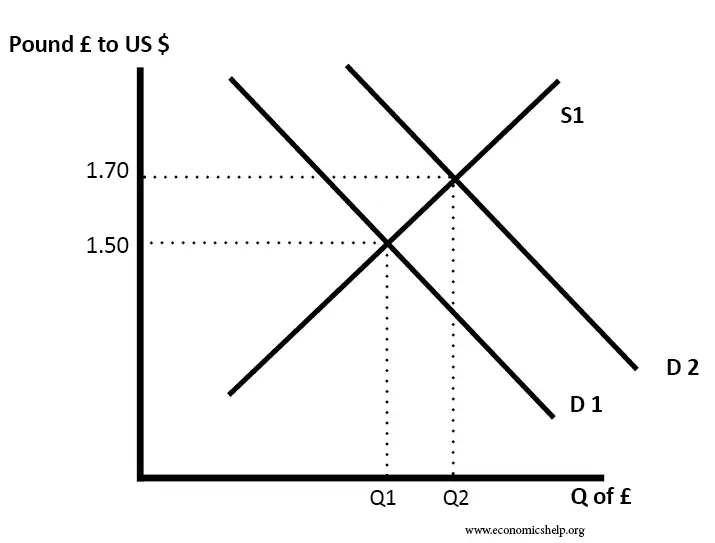

Why floating exchange rate appreciates (why demand for £ increases)

Floating exchange rate depreciation: supply of £ increases. (opposite)

Increase in relative interest rate: Interest rates higher in UK→greater rate of return on savings for foreigners→put their money in UK banks→swap foreign money for pounds→demand for pound increases.

Increase in FDI: foreign firms set up in UK→exchange currency for pounds→demand for pound increases→pound appreciates.

Rise in incomes abroad: foreigners demand more UK exports→buy in pounds by swapping currency→demand for pounds increase

Fixed exchange rate

The government or central bank are required to hold large amounts of (domestic + foreign) currency reserves (to manipulate demand and supply of domestic currency) to support a fixed exchange rate.

Sell the pound using currency reserves to buy foreign currency, ↑ supply of pound, reducing exchange rate.

Use foreign currency reserves to buy more pounds, ↑ demand of pound, increasing value of pound.

Interest rates may also manipulate exchange rates: ↓ interest rate to ↑ supply of currency, causing value of exchange rate to ↓.

However, it is not direct + has many side effects in the economy.

Depreciation vs devaluation

(appreciation vs revaluation for an ↑ in exchange rate)

Depreciation: when the floating exchange rate falls in value.

Devaluation: value of the pound decreases in a fixed exchange rate.

Impact of exchange rate appreciation

Strong

Pound

Imports

Cheap

Exports

Expensive

Lower growth+CA deficit: exports decrease as more expensive→CA deficit + AD decreases→growth decreases

High unemployment in domestic industries: domestic firms must compete with cheaper imports from abroad→can’t compete→sack workers

Lower cost push + demand pull inflation: demand for £ decreases or supply of £ increases→less inflation→exports more internationally competitive

Cheaper imports: consumers can afford more imports→increase happiness + standard of living

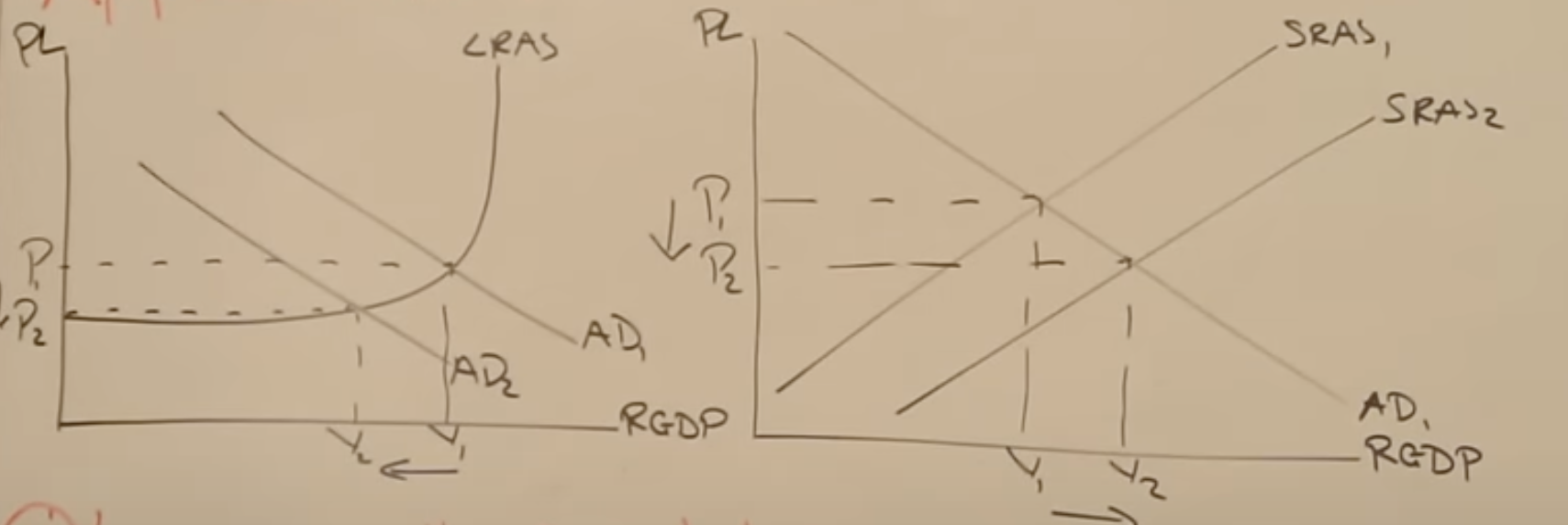

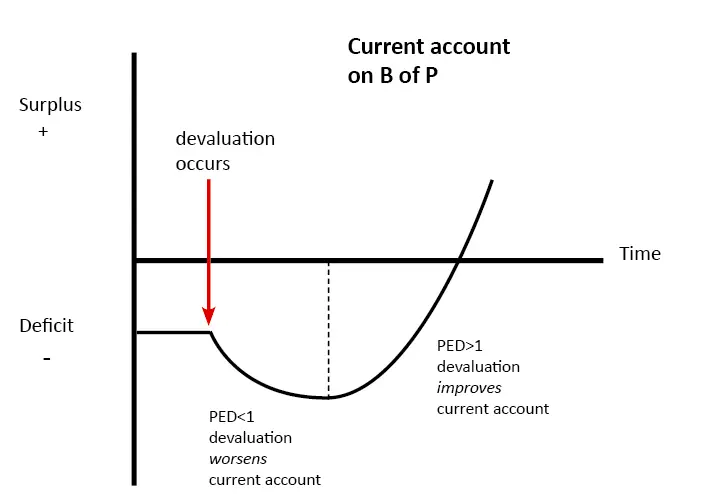

Marshall-Lerner condition + J curve effect on depreciation/ devaluation

The Marshall-Lerner condition states that a currency depreciation will only correct a current account deficit if:

PEDx + PEDm > 1

J curve effect

SR: demand for imports+exports is inelastic as it takes time for consumers to realise price of imports are more expensive + foreign countries to realise price of exports are cheaper.

LR: demand becomes elastic

Pros + cons of floating exchange rate

(opposite for fixed exchange rate)

PROS

↓ need for currency reserves: currency reserves are costly

Freedom for domestic monetary policy: fixed exchange rates need manipulation of interest rates. Interest rates can freely be changed to fix domestic issues in economy.

Automatic correction of trade deficit: depreciation reduces CA deficit

CONS

Exchange rate is volatile: reduces incentive for foreign investors to invest in domestic country + incentive to trade.

International competitiveness

The ability of a nation to compete successfully overseas and to sustain improvements in living standards and output.

Based on: price competitiveness, non-price competitiveness, ability to attract FDI (firms, labour, capital)

Measures of international competitiveness

Unit labour costs: total labour costs/ output. Minimum wages increase labour cost

Export prices: deterioration of ToT implies export prices are falling, increasing competitiveness.

Factors that determine international competitiveness

Productivity: high productivity increases output, decreasing unit labour cost.

Tax regimes: Low corporation tax attracts FDI, low income tax attracts workers from abroad.

Investment: Infrastructure- boosts efficiency of domestic firms as can transport goods quicker + cheaper, translating to lower prices. R&D- improves non-price competitiveness.

Regulation: Enforces costs, makes it difficult to make business decisions.

Pros + cons of being internationally competitive

Policies to improve international competitiveness

Tax incentives: lower corporation tax ↑ retained profits, use to invest on capital, innovation- ↑ efficiency + ↓ cost of production.

Deregulation: Taking away cost of environmental laws, product safety standards, etc- lower CoP + leads to lower prices.

Gov. spending on education: Apprenticeships- improve skills, ↑ productivity, ↓ unit labour costs.

Subsidies for firms

EVALUATION

Cost: gov. spending may cause tax to increase, ↓ IC. Opportunity costs.

No guarantee policies will work: e.g. retained profit from ↓ corporation tax may not go towards investment