1.2 - Business Ownership

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

What is a sole trader?

A form of business that is owned and managed by one person

What are the advantages of sole traders?

You don't need to register with the government or fill in lots of forms, they're easy to set up, you can make your own decisions fast, you can keep the profits and you are your own boss

What are the disadvantages of sole traders?

Unlimited liability, it can be stressful making decisions yourself, it may lack finance (with only one source), you may not have all the skills required, it's difficult to take a holiday (the business may come to a standstill) and if you die, so does the business

What does unlimited liability mean?

It means that if the business goes wrong, you could lose everything

What is a partnership?

A business that is owned and run by between 2 and 20 people. It's created when 2 or more people join together in a business enterprise to pursue profit

What is a deed of partnership?

A legal document that sets out the rules of the partnership

What does a deed of partnership include?

how decisions are made,

how to value the business if someone wants to leave

how to decide if someone wants to join the partnership.

The aim is to avoid disputes

What are the advantages of a partnership?

more people being consulted means a possibility of better decisions being made,

partners can cover for each other (Sick day),

a better and broader service can be provided by sharing skills

What are the disadvantages of a partnership?

Decisions are slower if everyone is consulted, the rewards are divided, there can be disputes about how to solve a problem, if a mistake is made by 1 partner then all the partners must pay the price (unlimited liability)

What does PLC stand for?

A public limited company

What does LTD stand for?

Private limited company

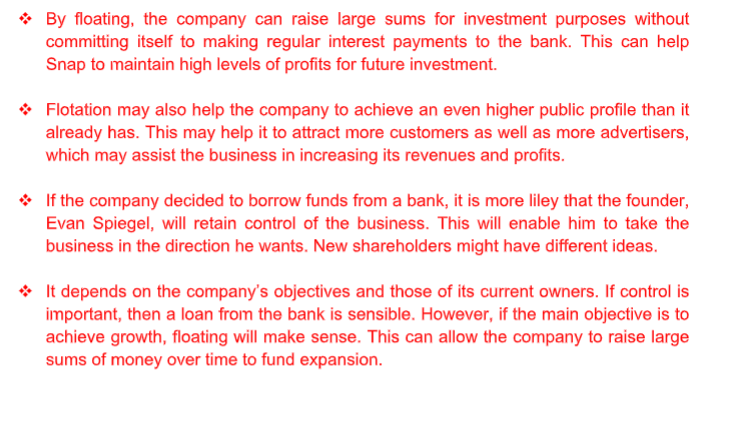

What is a PLC?

In a PLC, shares are sold to the public on the stock market.

Shareholders become part owners of the business and have limited liability. A CEO and board of directors manage and oversee the activities

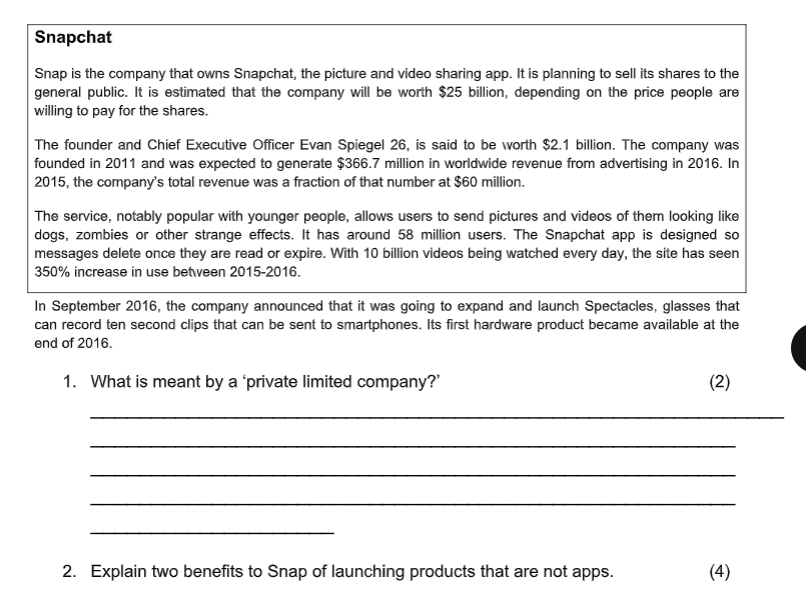

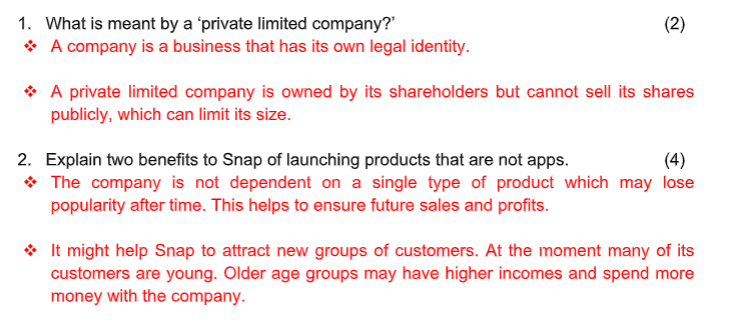

What is a private limited company?

The owners of a LTD are called shareholders. Shareholders have to invited by the business before purchasing a share and have limited liability.

LTDs pay corporation tax (a tax on the profits of a business)

What are the advantages of a PLC?

The business can raise finance through share capital, there are increased negotiation opportunities with suppliers as PLCs can achieve economies of scale, the shareholders have limited liability (they only lose what they have invested)

What are the disadvantages of a PLC?

There is a greater risk of a hostile takeover by a rival company (if they directly approach the shareholders), it is expensive to set up - min. £50,000, there are more complex accounting and reporting requirements

What are the advantages of a LTD?

The owners have limited liability, shares can be sold to raise money (raise finance through share capital) , shareholders are invited - this protects the business from outside influence

What are the disadvantages of LTDs?

There is often more paperwork, it can be time consuming, limited sources of finance, may require outside help for finances, sometimes other people can view the business' financial info.

What is an ordinary partnership?

A partnership which only contains general partners

What is a limited partnership?

A partnership that contains general and sleeping partners

What is a general partner?

A partner who has a say in how the partnership is run and has unlimited liability if it goes wrong

What is a sleeping partner?

A partner who doesn't have a say in how the partnership is run and has limited liability if it goes wrong - they put capital in and receive profit, however.

What is limited liability?

When someone can only lose what they have invested into a business

What is a stakeholder?

Someone who has interest in a company and can affect/be affected by the business

What is a shareholder?

The owners of limited companies

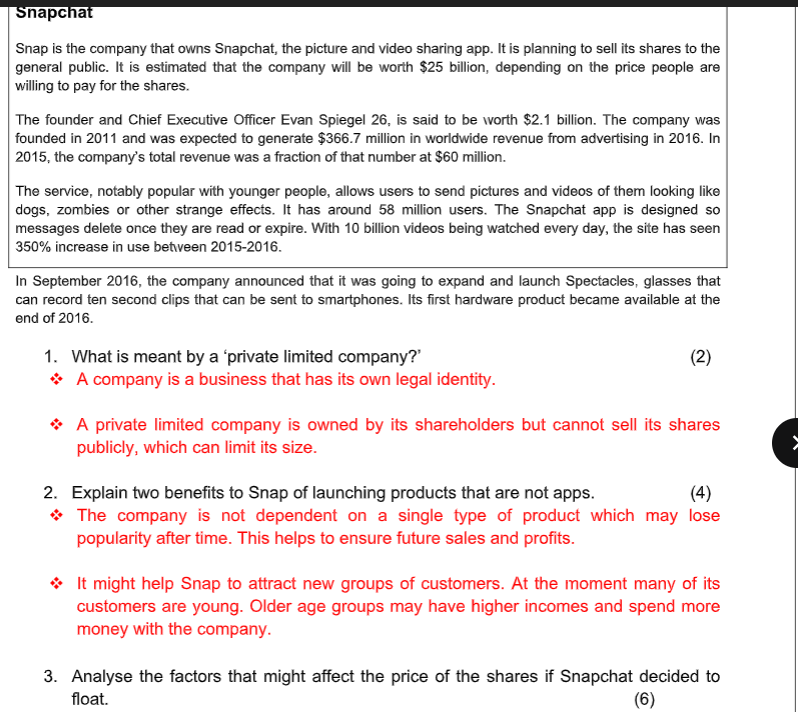

What is flotation?

Converting from LTD to PLC by selling shares to the public

A type of organisation that doesn't earn profits for its owners. All of the money earned is used in pursuing the organisation's objectives and keeping it running. They are normally tax-exempt

What is a disadvantage of being a not-for-profit?

Close scrutiny by the Charity Commission

Similarties between PLCs and LTDs

- In both, stakeholders have limited liability

- For both, the business is a separate legal identity from the name of its owners

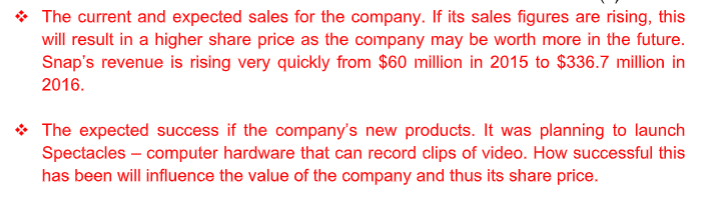

Risk can cause a fall in share prices

What is it important to remember about older age groups?

They may have higher incomes and spend more money with the company