Measures of economic performance theme 2

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

71 Terms

GDP

the value of all goods and services produced in an economy in a one year period

Nominal GDP

The actual value of all goods and services produced in an economy not adjusted to inflation

Real GDP

The value of all goods and services produced in an economy, adjusted to inflation

GDP per capita

GDP/Population

shows the mean wealth of each resident in a country

Makes it easier to compare standards of living between countries

Negative of using GDP

Doesn’t consider the income earned by its citizens while operating outside of the country

What does value of GDP mean

The monetary worth

What does the volume of GDP mean

The physical number

GNI

Measures the total income earned by a country’s residents and businesses regardless of where is is generated during a given period

adjusts for cross-border income flows

What is GNI often used for

To compare the economic well being of a country’s residents

To set eligibility thresholds for development assistance because it traces income to the nationality of the earner rather than to the geographic place of production

National income statistics

Useful for making comparisons between country’s

They provide insights on the effectiveness of government policies

Allow judgements to be made about the relative wealth and standard of living within each country

allow for comparisons to be made over the same or different time periods

Why real GDP is better than nominal GDP

One country may have a much higher rate of economic growth but also a much higher rate of inflation.

Real GDP provides a better comparison

HOWEVER

Using real GDP/capita provides better information than real GDP as it takes population differences into account

Using real GNI/capita is a more realistic metric for analysing the income available per person than GDP/capita

Purchasing Power Parity

It shows the number of units of a country's currency that are required to buy the same baskets of products in the local economy, as $1 would buy of the same products in the USA or another country

Aim of PPP

to help make a more accurate standard of living comparison between countries where goods and services cost different amounts

If a basket of goods cost $150 in Vietnam (once the currency has been converted) and the same basket of goods cost $450 in the USA, the purchasing power parity would be 1:3

It seems like the cost of living is much higher in the USA

However, if the USA GNP/capita is more than three times higher than the GNP/capita of Vietnam, it could be argued the USA has better standards of living

difficulties of PPP

Countries have different tastes and preferences.

Choosing the items to use in the basket of products is difficult.

For example, cheese may not be popular in some countries and there are lots of different types of cheese too

Limitations of Using GDP Data To Compare Living Standards Between Countries and Over Time

Lack of information provided |

|

|---|---|

Quality of goods/services |

|

Does not include unpaid/voluntary work |

|

Differences in hours worked |

|

Environmental factors |

|

National happiness

happiness focuses on health, relationships, the environment, education, satisfaction at work and living conditions

provide normative data over positive

Easterlin Paradox

Happiness and increases in income have a direct relationship up to a point

Beyond that point, the relationship is less evident

Inflation

The sustained increase in the average price level of goods/services in an economy

Deflation

Fall in the average price of goods and services in an economy

Disinflation

When the average price level is still rising but at a lower rate than before

CPI

A 'household basket' of 700 goods/services that an average family would purchase is compiled on an annual basis

A household expenditure survey is conducted to determine what goes into the basket

Each year, some goods/services exit the basket and new ones are added

Goods/services in the basket are weighted based on the proportion of household spending

E.g. More money is spent on food than shoes, so shoes have a lower weight in the basket

Each month, prices for these goods/services are gathered from 150 locations across the UK

These prices are averaged out

The price x the weighting determines the final value of the good/service in the basket

These final values are added together to determine the price of the 'basket

The percentage difference in CPI between the two years is the inflation rate for the period

limitations of CPI

The CPI provides a level of inflation for the average basket and the basket of many households is not the average basket

Depending on what households buy, the level of inflation for each one can vary significantly

As an average, it also ignores regional differences in inflation

The CPI is one of several methods used by countries in determining inflation; another is the retail price index (RPI)

This can make comparisons between countries less meaningful, as one may use the RPI and another the CPI

The CPI does not capture the quality of the products in the basket

Product quality changes over time, so the comparison with different time periods is less useful

The CPI only measures changes in consumption on an annual basis

Changes in consumption can occur more frequently and the index is always behind these changes

RPI

The retail price index (RPI) is calculated in exactly the same way as the CPI

Certain goods/services that are excluded from the CPI are included with the RPI

These include council tax, mortgage interest payments, house depreciation, and other house purchasing costs such as estate agents fees

RPI as a measure of inflation

Inflation measured using the RPI is usually higher than the CPI

This is mainly due to its sensitivity to interest rate changes, which affect mortgage interest

It's argued that the RPI is a more accurate indication of household inflation

Demand pull inflation

Caused by excess demand in the economy (increased AD)

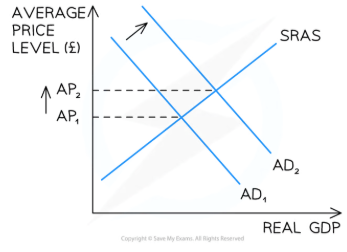

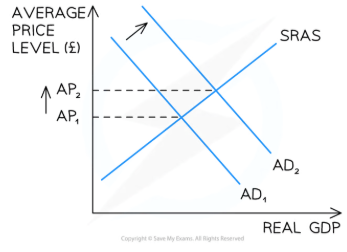

Diagram analysis of demand pull inflation

If any of the four components of AD increase, there will be a shift to the right of the AD curve from AD1 → AD2

At the original price (AP1), there is now a condition of excess demand in the economy

As prices rise, there is a contraction of AD and an extension of SRAS

Prices for goods and services are bid up from AP1 → AP2

Demand pull inflation has occurred

Cost push inflation

Cost push inflation is caused by increases in the costs of production in an economy

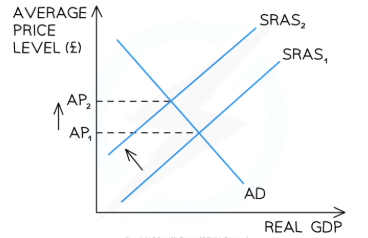

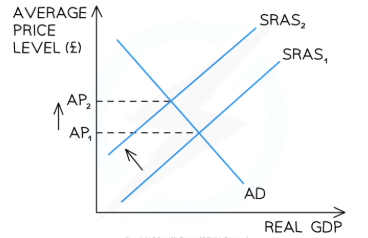

Diagram analysis of cost push inflation

If any of the costs of production increase (wages, raw materials, etc.), there will be a shift to the left of the SRAS curve from SRAS1→SRAS2

At the original price (AP1), there is now a condition of excess demand in the economy

As prices rise, there is a contraction of AD and an extension of SRAS

Prices for goods/services are bid up from AP1→AP2

Cost-push inflation has occurred

Changes to the money supply

If the Central Bank lowers the base rate, there is likely to be increased borrowing by firms and consumers

This will result in an increase in consumption and investment

It is likely to lead to a form of demand-pull inflation

The Central Bank can also increase the money supply through quantitative easing

This will result in increased liquidity and lower interest rates

It is likely to lead to a form of demand-pull inflation

Change to Wages

Increased aggregate demand in an economy causes demand pull inflation

Workers now feel less well off as their wages no longer have the same purchasing power

Workers may demand wage increases to compensate for the higher prices

Those wage increases are now a form of cost-push inflation (increased costs of production) and drive prices even higher

This economic phenomenon is called the wage-price spiral

Effects of Inflation on Firms

Uncertainty. Rapid price changes create uncertainty and delay investment

Menu change costs. Price changes force firms to change their menu prices too and this can be expensive

Effects of inflation on consumers

Decrease in purchasing power

Decrease in the real value of savings (as money will be worth less in real terms)

Fall in real income for those on fixed incomes/pension

effects of inflation on the government

Inflation erodes international competitiveness of export industries

Trade-offs involved in tackling inflation e.g reducing inflation may increase unemployment and/or reduce economic growth

effects of inflation on workers

Demand higher wages to compensate for reduced purchasing power

If wage increases ≠ inflation, motivation and productivity may fall

unemployment

Someone is considered unemployed if they are not working but actively seeking work

Labour force

The labour force consists of all workers actively working and the unemployed (who are seeking work)

Usually between the ages of 16-65

Non labour force

The non-labour force includes all those not seeking work e.g. stay-at-home parents, pensioners, schoolchildren, and students

Economically inactive are those between 16 and 65 and not working or not seeking work, e.g. early retire

ILO

An extensive survey is sent to a random sample of ≈ 60,000 UK households every quarter

Respondents self-determine if they are unemployed based on the ILO criteria

Ready to work within the next two weeks

Have actively looked for work in the past one month

The same survey is used globally so it's useful for making international comparisons

The claimant count

Counts the number of people claiming job seekers allowance (JSA) in the UK

More stringent requirement to be considered unemployed than with the ILO survey

Requires claimants to meet regularly with a 'work coach'

Underemployment

They want to work more hours than they currently work

They are working in a job that requires lower skills than they have, e.g. an architect working as a gym instructor

What type of unemployment is underemployment

Often a response to cyclical unemployment

Workers who have lost their jobs in a weak economy are willing to take part-time jobs or accept roles outside of their main skill base

Underemployment is also a consequence of structural unemployment

Unless workers retrain and gain new skills, it will be hard for them to gain full employment

Changes in rates of the Employment rate

The employment rate could be increasing even as the unemployment rate is increasing.

May be caused by increased immigration, which causes working-age population to increase

May be caused by a decrease in the inactivity rate as people move from inactive to employed

Changes in unemployment rates

Unemployment rates do not capture the hidden unemployment that occurs in the long term

Workers look for a job but may eventually give up and become economically inactive

This actually improves the unemployment rate as fewer people are actively seeking work

Structural unemployment

Occurs when there is a mismatch of skills in the economy

e.g. the secondary sector is declining and the tertiary sector is growing: deindustrialisation

Cyclical unemployment

Caused by a fall in AD in an economy

As output falls in the economy, firms lay off workers

Seasonal uneployment

Occurs as certain seasons come to an end and labour is not required until the next season

E.g. fruit pickers; summer seaside resort workers; ski instructor

Frictional unemployment

Occurs when workers are between jobs

This is usually short-term unemployment

Workers have voluntarily left their previous job to search for another

Real wage unemployment

Occurs when wages are inflexible at a point higher than the free-market equilibrium wage

Usually caused by the existence of minimum wage laws

The higher wage creates an excess supply of labour

This excess supply represents real wage unemployment

Importance of Labour

Labour is a key factor of production and one way to expand output in an economy is to increase the amount of labour available

This is often achieved through easing the inward migration policies (immigration)

UK migration

The UK has experienced significant immigration since the 1990's, especially from Eastern Europe

Net migration is the difference between inward migration and outward migration (emigration)

Less developed economies generally have net outward migration

More developed economies generally have net inward migration

More developed economies usually have skilled workers emigrating

Significance of migration on employment

The immigrants usually fill vacancies that the local citizens cannot (or will not) fill

These tend to be manual labour, dangerous, and low-skilled jobs

The increased supply of labour may push down wages in the economy, especially for low-skill jobs

Lower average wages are an incentive for employers to hire more workers

Employment may increase as a result

Immigration results in an increased population, which increases consumption in the economy

Greater output requires more labour so it creates more jobs

Significance of migration on unemployment

Immigrants may displace some local workers, increasing the level of unemployment

Dependents of immigrants may be unable to find work and register as unemployed

Effects of unemployment on Firms

Loss of sales revenue

loss of output

changes in the skill level in the economy

Effects of unemployment on the government

Increased speding on benifits

less tax revenue

increased spending on retraining

Effects of unemployment on the economy

Increased crime and vandalism

increased anti social behaviour

increased homelessness

Effects of unemployment on individuals

Loss of income

health issues

mental instability

sense of failure

suicide

What is balance of payments

A record of all the financial transactions that occur between a country and the rest of the world

Sections of the BoP

Current account

Capital account

Financial account

What is the current account

a record of all the transactions related to goods/services along with payments related to the transfer of primary and secondary income

What is the financial and capital account

all transactions related to savings, investment and currency stabilisation

What is Currency stabilisation

Refers to the government intervention in exchange markets so as to influence the price of a currency

Why is the current account considered the most important

It records the net income that an economy gains from international transactions

what is a credit

The provision of funds (loans, overdrafts, mortgages, credit cards) that allow spending before income is received, with the agreement to repay in the future (often with interest).

Recieved

What is a debit

A debit is an entry in accounts that usually represents money flowing out of an account, or a reduction in value for the owner

what the business owns or spends.

Sent

Net income

Consists of income transfers by citizens and corporations

Credits are received from UK citizens who are abroad and send remittances home

Debits are sent by foreigners working in the UK back to their countries

Current transfers

Typically payments at government level between countries, e.g. contributions to the World Bank, foreign aid

The Current Account balance is often expressed as a % of GDP

This allows for easy international comparisons

Current account deficit

Occurs when the value of the outflows is greater than the value of the inflows

Usually occurs when the debits from imports > credits from exports

Current account surplus

Occurs when the value of the inflows is greater than the value of the outflows

Usually occurs when the debits from imports < credits from exports

UK government current account

The UK government has a macroeconomic aim to reduce the Current Account imbalance to achieve as close to equilibrium as possible

The UK has run a current account deficit since 1985

Export-led economic growth would help it become less negative, although realistically this is unlikely for a long time

However, with increasing income and wealth in an economy, the value of imports rises

Consumers enjoy the variety of goods/services abroad

Rising imports push the balance towards a greater deficit

How to correct the current account deficit

The government could raise tariffs

This would likely decrease imports bought by households

Firms that rely on imports for raw materials used in production would now face higher costs of production

These higher costs are likely to be passed on to consumers in the form of higher prices

Reducing the current account deficit has come at the expense of increased inflation in the economy; there has been a trade-off

The interconnectedness of economies through trade

The world is more connected than ever and there is a high level of interdependence between economies

COVID-19 and the Ukraine War demonstrated how disruptions in one part of the world cause widespread problems in others

One country's imports are another country's exports

Theoretically, the global value of exports will be equal to the global value of imports

Producers all over the world are often highly dependent on imported raw materials used in production