ap micro

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

100 Terms

utility

what consumers want

profit

what producers want

goods

physical objects that satisfy wants and needs

services

actions and activities that satisfy needs and wants

needs

a basic requirement for survival without which you cannot live;its satisfaction brings utility

wants

something you desire that is unnecessary for survival; its satisfaction brings utility

inputs

resources used by firms to produce products

output

finished goods produced by firms for profit

wages

the price paid by firms to purchase inputs/factors of production

prices

income spent by consumers to purchase economic goods

costs

the combined wages paid by a firm to produce economic goods

revenue

price paid to the firm per unit of output sold(P*Q)

profit

revenue kept by firms after paying production costs

income

wages kept by consumers that are used to buy products

marginal cost

the cost for each additional unit of something; equal to supply

marginal benefit

the benefit from each additional unit of the good; equal to demand

explicit costs

costs in monetary form

implicit costs

opportunity cost and forgone benefits in non-monetary form

rational choice

made when MB is greater than or equal to marginal cost

excludable

a good that someone can be prevented from enjoying its benefits(Brink’s security, fish farm fish, concert)

nonexcludable

a good that someone cannot be prevented from enjoying its benefits(public police department, fish in ocean, TV concert)

rival

a good that, when it is used by one person, decreases the quantity available to another person

nonrival

a good that, when it is used by one person, does not decrease the quantity available to someone else

private good

a good that is rival and excludable; a can of soda

natural monopoly/ club goods

a good that is nonrival and excludable(produced at a lower cost than other firms)i.e., internet

common resource

a good that is rival and nonexcludable- it can only be used once, but no one can be prevented from using what is available

public good

nonrival and nonexludable goods- a good that can be consumed by everyone and no one can be prevented from experiencing its benefits

elasticity

the sensitivity of quantity to a change in price

percent change

(V2-V1)/V1

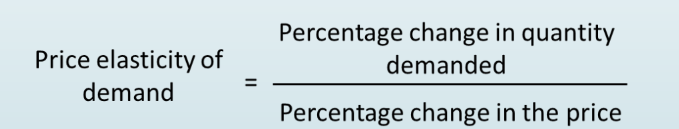

price elasticity of demand

how sensitive the quantity demanded is to a change in price; calculated by the (percent) change in quantity demanded divided by the (percent) change in price

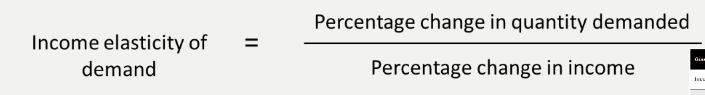

income elasticity of demand

the extent to which a goods demand changes when income changes

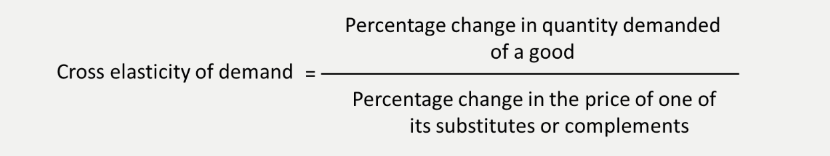

cross-price elasticity of demand

how demand for a good changes when the price of a substitute of a complement changes

Positive for substitutes, negative for complements

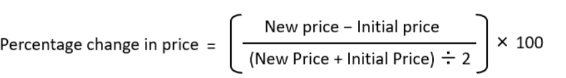

midpoint method

percentage change in price and qd

(new-initial/(new + initial)/2)*100

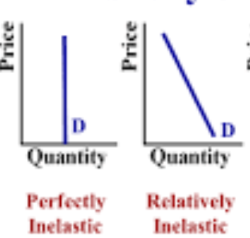

elastic

elasticity >1; QD change is greater than price change

perfectly elastic- QD changes immensely when price changes

inelastic

elasticity < 1: price change is greater than quantity demanded change

Perfectly inelastic- QD is not affected by price change and stays the same

unit elastic

elasticity = 1; Qd change = price change

total revenue test

if price and revenue move in the opposite direction, elastic demand

if they move in the same direction, inelastic demand

total revenue = PQ

substitutes and demand elasticity

a good with poor substitutes is a necessity and inelastic

a good with many subsitutes is a luxury and elastic

specificity of a good and demand elasticity

the more specific a good is the more elastic it is

the less specific a good is the more inelastic it is

time and elasticity

the longer since the time a price has changed for a good, the more elastic the goods demand is

income and elasticity

price rising means people cant afford the same q of a good; more income spent on a good = more elastic

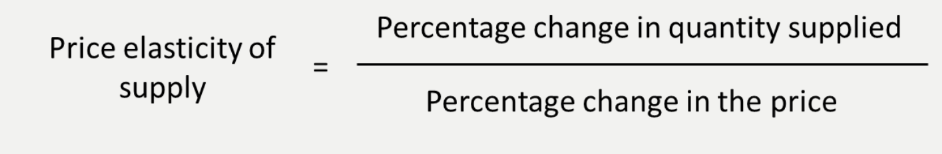

price elasticity of supply

quantity supplied sensitivity to price change

QS/P

PPC and elasticity

goods produced at a constant OC have elastic supply

storage and elasticity

goods that can be stored easily are elastic

normal good

elastic when >1, inelastic when between 0 and 1

inferior good

elasticity <1

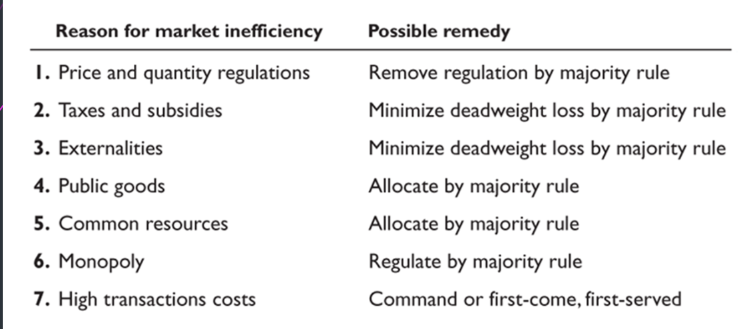

allocation method

market price- those who can pay get it

command/authority- someone determines who gets what

majority rule- people vote for a decision

contest- whoever wins

first come first serve- first to get there

sharing equally- using resources

lottery- pure luck

personal characteristics- people who align with whatever the good is good for

force- war or theft

value

what the buyer gets

price

what the buyer pays

cost

what a seller gives up

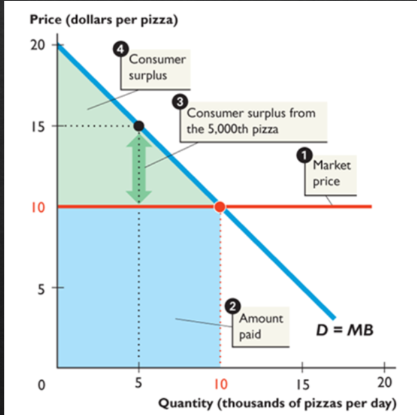

consumer surplus

the marginal benefit of a good or service subtracted by the price paid for it divided by the quantity consumed

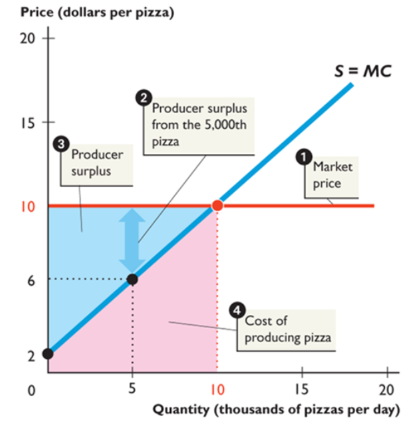

producer surplus

the price of a good minus the opportunity cost of producing it divided by the quantity produced

efficient

MB=MC

invisible hand

the total surplus is maximized, and consumers and producers pursuing their self interest serve the social interest

deadweight loss

decrease in total surplus from over/underproduction

Caused by p and q regulations, taxes and subsidies, externalities(cost or benefit to someone that isn’t the buyer), public goods and common resources

monopolies and high transaction costs

Market alternatives

fair rules

equality of opportunity

fair results

not fair if result isn’t fair

big tradeoff

tradeoff between efficiency and fairness

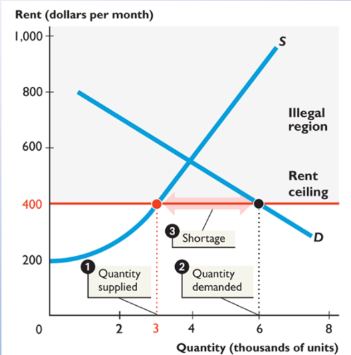

price ceiling

government regulation that places an upper limit on the price that a good can be traded; usually below equilibrium and causes a shortage

causes black markets and increased search activity

consumer surplus decreases and deadweight loss arises

rent ceiling

makes it illegal to charge more than a specific price for house rent

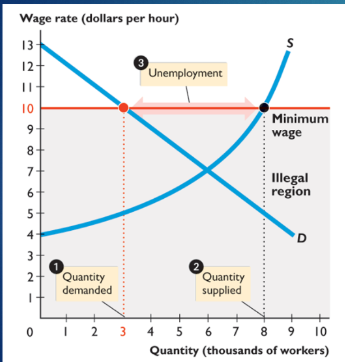

price floor

places lower limit on price; above equilibrium and causes a surplus

minimum wage

more people work at a higher wage but less people are hired

leads to illegal hiring and increased search activity

inefficient, decreasing firms and workers surplus

production quota

government regulation placing an upper regulation on the quantity supplied

inefficient and unfair

tax incidence

division of tax burden between buyer and seller

excess burden

deadweight loss; how tax cost exceeds revenue gov’t gets

elasticity and incidence

more inelastic demand means buyers pay

more elastic demand means sellers pay

budget line

limits to consumption and depends on consumer’s budgets and prices

Slope is OC

total utility

total benefit a person gets from the consumption of a good and service

marginal utility

the change in total utility that results from a one-unit increase in the quantity of a good consumed

diminshes

utility-maximizing rule

using entire budget and making marginal utility per dollar equal for all goods

marginal utility per dollar

marginal utility relative to the price paid; mu/p

firms goal

maximizing profit

accountant

cost and profit to ensure income tax is paid

economists

predict decisions a firm makes to maximize its profit

explicit cost

paid in money

implicit cost

an opportunity cost incurred by a firm when it uses a factor of production

economic depreciation

an opportunity cost of a firm using capital that it owns

normal profit

return to entrepreneurship; part of a firms OC

economic profit

total revenue - total cost(explicit + implicit)

short run

some resources are fixed

long run

all resources are variable

total product

total quantity of a good produced in a given period(units over time)

marginal product

change in total production over one unit increased in labor

average product

Total product/quantity

If marginal>average, average is increasing

If marginal<average, average is decreasing

If marginal= average, it is at max

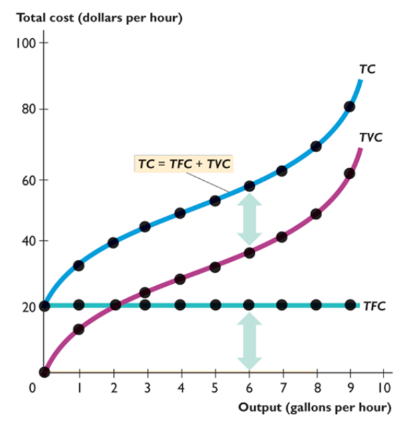

total fixed cost

cost of a firm’s fixed factors of production; does not change

total variable cost

cost of a firms variable factor of production

total cost

TFC + TVC

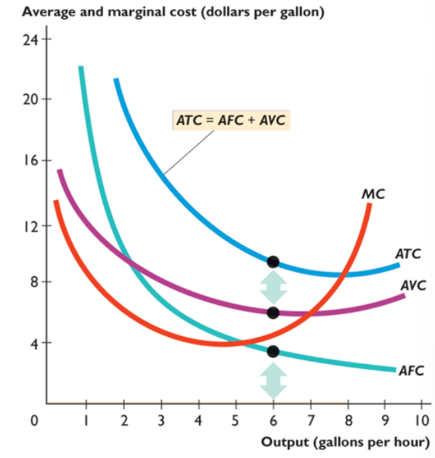

marginal cost

change in a firm’s total cost from a one-unit increase in total product

avg cost

total costs divided by quantity of output

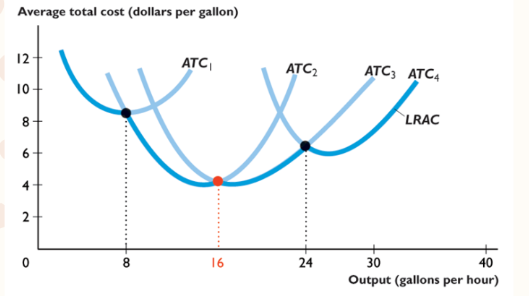

curves

all U shaped

MC intersects curves at minimum

Decreasing marginal returns and spreading fixed cost over a larger output

cost and product

when product rises, cost falls

small outputs

products rise, costs fall

intermediate outputs

MP and AVC falls, AP and MC rises

large outputs

product falls, cost rises

economies of scale

when labor increases and ATC decreases

caused by specialization

diseconomies of scale

when labor increases and ATC increases

Caused by difficulty of running a business

constant returns to scale

when labor increases ATC stays constant

due to firm replicating its production facility

Long Run Average Cost

shows lowest avg total cost at each output