AP Macro Unit 2 Test

0.0(0)

Card Sorting

1/46

Earn XP

Description and Tags

Last updated 6:24 PM on 9/16/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

1

New cards

Gross Domestic Product

is the dollar value of all final goods and services produced within a country's borders in one year

2

New cards

GDP

Consumer Consumption + Investment + Government Spending + Net Exports

3

New cards

% Change in GDP

YEAR2-YEAR1/ YEAR1 x 100

4

New cards

GDP Per Capita

GDP /by the population

-it identifies on average how many products each person makes

-is the best measure of a cation's standard of living

-it identifies on average how many products each person makes

-is the best measure of a cation's standard of living

5

New cards

Why do other countries have higher GDPs?

1. Economic System: Capitalist countries have historically had more economic growth

2. Property Rights: if protectd

3. Capital - the amount

4. Human capital: knowledge

5. Natural Resources

2. Property Rights: if protectd

3. Capital - the amount

4. Human capital: knowledge

5. Natural Resources

6

New cards

Expendentures Approach

add all the spending on final goods and services produced in a given year

7

New cards

Income Approach

add up all the income that resulted from selling all final goods and services produced in a year

Labor Income + Rental Income + Interests Income + Profit

Labor Income + Rental Income + Interests Income + Profit

8

New cards

Shortcomings of GDP

-Certain important work is left out of accounting, such as homeworkers and carpenters

-GDP does not measure the total quality of life

-Does no reflect improved product quality

-GDP does not measure the total quality of life

-Does no reflect improved product quality

9

New cards

Things not included in GDP

1. intermediate goods

2. used goods

3. financial transactions (stocks and bonds)

4. transfer payments

- Public (social security)

- Private (birthday money)

5. unreported legal activity

6. illegal activity (underground economy)

7. US corps producing overseas

2. used goods

3. financial transactions (stocks and bonds)

4. transfer payments

- Public (social security)

- Private (birthday money)

5. unreported legal activity

6. illegal activity (underground economy)

7. US corps producing overseas

10

New cards

Nominal GDP

GDP based on the prices that prevail when the outputs was produced is called unadjusted GDP

11

New cards

Real GDP

GDP that has been deflated or inflated ttp reflect changes in the price level

12

New cards

GDP Deflator

is a measure of the level f prices of all new, domestically produced, final goods and services in an economy

13

New cards

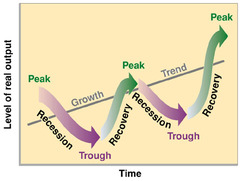

Business Cycle

- largely systematic ups and downs of real GDP

- trend line shows that over the long term, the economy is gradually growing despite cycles of expansion and recession

- trend line shows that over the long term, the economy is gradually growing despite cycles of expansion and recession

14

New cards

Recession

6 month period of decline in real GDP

15

New cards

Depression

18 month period of decline in real GDP

16

New cards

Macroeconomics

-measures these fluctuations and guides policies to keep the economy stable

-The government has the responsibility to

-promote long-term growth

-Prevent unemployment

-Prevent inflation

-The government has the responsibility to

-promote long-term growth

-Prevent unemployment

-Prevent inflation

17

New cards

Limit Unemployment

-workers that are acteively looking for a job but aren't working

-Rate: the percent of people in the labor force who want a job but are not working

# of unemployed / # in labor force x 100

-Rate: the percent of people in the labor force who want a job but are not working

# of unemployed / # in labor force x 100

18

New cards

Labor Force

-16 years old and up

-Able and willing to work

-not institutionalized

-not in military, in school full time, or retired

-Able and willing to work

-not institutionalized

-not in military, in school full time, or retired

19

New cards

Frictional Unemployment

temporary unemployment or being between jobs; individuals are qualified workers with transferable skills

20

New cards

Seasonal Unemployment

is a specific type of frictional unemployment which is due to time of ouear and the cature of the job

21

New cards

Structural Unemployment

Changes in labor force make some skills obselete; do not have transferable skills

-THESE WORKERS DO NOT HAVE TRANSFERABLE SKILLS and these ojbs will never come back, workers must learn new skills to get a job

-"creative destruction" - the permanent loss of these jobs

-THESE WORKERS DO NOT HAVE TRANSFERABLE SKILLS and these ojbs will never come back, workers must learn new skills to get a job

-"creative destruction" - the permanent loss of these jobs

22

New cards

Technological Unemployment

type of structural unemployment where automation and machinery replace workers

23

New cards

Cyclical Unemployment

Unemployment caused by recession

-as demand for goods and services falls, demand for labor falls and workers are fired

-this is called "demand deficient unemployment"

-as demand for goods and services falls, demand for labor falls and workers are fired

-this is called "demand deficient unemployment"

24

New cards

Natural Rate of Unemployment (NRU)

The amount of unemployment that exists when the economy is healthy and growing

Frictional and structural unemployment

Frictional and structural unemployment

25

New cards

Full Employment

4-6% in the U.S.

26

New cards

Discouraged Job Seekers

those who have officially given up looking for work and are discouraged

27

New cards

Underemployed Workers

those with part time or seasonal jobs who would rather have full time

28

New cards

Criticisms of the Unemployment Rate

*-misdiagnose actual unemployment rate*

1. Discouraged workers

2. Underemployed Workers

3. Racial/Age Inequalities: the overall unemployment rate doesn't show disparity for minorities and teenagers

1. Discouraged workers

2. Underemployed Workers

3. Racial/Age Inequalities: the overall unemployment rate doesn't show disparity for minorities and teenagers

29

New cards

Labor Force Participation Rate

Labor force/ Population (16 and older) x 100

30

New cards

Inflation

-is the general rising in the level of prices

-it reduces the "purchasing power" of money

-when inflation occurs, each dollar of income will buy fewer goods than before

-it reduces the "purchasing power" of money

-when inflation occurs, each dollar of income will buy fewer goods than before

31

New cards

Nominal Wage

wage measured by dollars rathe than purchasing power

32

New cards

Real wage

wage adjusted for inflation

33

New cards

How is inflation measured?

Government tracks the prices of specific "market baskets" that include the same goods and services

34

New cards

Market Basket

sets of goods and services that are bought and sold as stables in a functional economy

35

New cards

Inflation Rate

the percentage change in prices from year to year

36

New cards

Price Indexes

index numbers assigned to each year that show how prices have changed relative to a specific base year

37

New cards

Consumer Price Index

CPI = Price of Market Basket / PRice of market basket in a base year x 100

38

New cards

Problems of CPI

1. Subsittution Bias - as prices increases for the fixed market basket, consumers buy less of these products and more substitutes that maby not be part of the market basket

*Result* - CPI may be higher than what consumers are really paying

2. New Products: the CPI market basket may not include the newest consumer products

*Result* - CPI measures prices but no the increase in choices

3. Product Quality: the CPI ignores both improvements and decline in product quality

*Result* - CPI may suggest that prices stay the same though the economic well being has improved significantly

*Result* - CPI may be higher than what consumers are really paying

2. New Products: the CPI market basket may not include the newest consumer products

*Result* - CPI measures prices but no the increase in choices

3. Product Quality: the CPI ignores both improvements and decline in product quality

*Result* - CPI may suggest that prices stay the same though the economic well being has improved significantly

39

New cards

CPI v.s. GDP Deflator

The GDP deflator measures the prices of all goods produced, wheras the CPI measures prices of only the goods and services bought by consumers

An increase in the price of goods bought by firms or the government will show up in the GDP Deflator but not in the CPI.

THe GDP deflator includes only those goods and servuces produced domestically. Imported goods are not a part of GDP and therefore don't show up in the GDP deflator

GDP deflator = Nominal/Real x 100

An increase in the price of goods bought by firms or the government will show up in the GDP Deflator but not in the CPI.

THe GDP deflator includes only those goods and servuces produced domestically. Imported goods are not a part of GDP and therefore don't show up in the GDP deflator

GDP deflator = Nominal/Real x 100

40

New cards

Who are affected by unexpected inflation?

*Helped*

-Borrowers

-Business where the price of the product increases faster than the price

*Hurt*

-Lenders

-People with fixed Incomes

Savers

-Borrowers

-Business where the price of the product increases faster than the price

*Hurt*

-Lenders

-People with fixed Incomes

Savers

41

New cards

Causes of Inflation

1. The government prints too much money (quantity theory)

-government that keeps printing money to pay debts end up with hyperinflation

-*result* - Banks refuse ti lend so investment falls and people don't save up to buy things

2. Demand-Pull Inflation: demand pulls up prices

-"too many dollars chasing tee few goods"

-an overheated economy with excessive spending but same amount of goods

3. Cost-Push Inflation: Higher production costs increases prices

-negative supply shock increases the costs of production and forces producers to increase prices

-government that keeps printing money to pay debts end up with hyperinflation

-*result* - Banks refuse ti lend so investment falls and people don't save up to buy things

2. Demand-Pull Inflation: demand pulls up prices

-"too many dollars chasing tee few goods"

-an overheated economy with excessive spending but same amount of goods

3. Cost-Push Inflation: Higher production costs increases prices

-negative supply shock increases the costs of production and forces producers to increase prices

42

New cards

Real Interest Rate

the percentage increase in purchasing power that a borrower pays

Real Interest = nominal interest - expected inflation

Real Interest = nominal interest - expected inflation

43

New cards

Nominal Interest Rate

the percentage increases in money that the borrower pays not adjusting for inflation

Nominal = real interest + expected inflation

Nominal = real interest + expected inflation

44

New cards

Achieving the 3 goals

-the government roles is to prevent unemployment and prevent inflation the same time

-if the government focuses too much on preventing inflation and slows down the economy we will have unemployment

- if the government focuses too much on limiting unemployment and overheats the economy we will have inflation

-if the government focuses too much on preventing inflation and slows down the economy we will have unemployment

- if the government focuses too much on limiting unemployment and overheats the economy we will have inflation

45

New cards

Quantity Theory of Money Equation

M*V = P*Y

M= money supply

V=velocity

Y= Quantity Output

P= Price level

M= money supply

V=velocity

Y= Quantity Output

P= Price level

46

New cards

Menu Costs

the cost of printing new menus when a restaurant decides to reduces its prices, but lowering prices also creates other costs

when menu costs are present, firms may choose to avoid them by retaining current prices

when menu costs are present, firms may choose to avoid them by retaining current prices

47

New cards

Shoe Leather Costs

refers to the cost of time and effort that people spend trying to counter-act the effects of inflation, such as holding less cash and having to make additional trips to the bank.