Economics HL all units

1/314

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

315 Terms

Gross Domestic Product (GDP)

the total monetary value of all final goods and services produced in an economy within a given period of time

Gross National Income (GNI)

the total income of nation’s people and businesses; GDP - net income from abroad

GDP per capita

GDP divided by the population number; gives the average income per citizen

Circular flow of income

a model that illustrates the interaction between the economic agents in an economy

the output method (of measuring GDP)

consists of counting the total output of firms in a certain period of time

the income method (of measuring GDP)

consists of adding up the incomes of all workers in a country

the expenditure method (of measuring GDP)

consists of adding up the total sales of goods and services in an economy: consumption expenditure + investment spending + government expenditure + net exports

business cycle

the boom-bust cyclical nature of the economy

World Happiness Report

an annual survey of the state of global happiness that ranks 156 countries based on where citizens place themselves on the Cantril ladder

OECD Better Life Index

a measure of 11 indicators (housing, income, jobs…) of 35 countries

Gross National Happiness

a measure of progress in a country considering ecological diversity, health, education, etc.

Happy Planet Index

a composite indicator that shows how well countries are doing at achieving a long, happy sustainable life through well-being, life expectancy, inequality of incomes and Ecological Footprint indicators.

Aggregate Demand

the total demand for goods and services produced in an economy; consists of consumer expenditure, investment spending, government expenditure and net exports.

determinants of aggregate demand: consumption

confidence, unemployment, interest rates, wealth, taxes, indebtedness

wealth

the asset accumulation that retains value and can change value; e.g. property and financial investment

determinants of aggregate demand: investment

confidence, interest rates, taxes, technology, indebtedness

investment

expenditure by firms on capital stock; it is planned investment for expansion.

determinants of aggregate demand: government

change in priorities, change in political parties, health of the economy

determinants of aggregate demand: net exports

income of trading partner, exchange rates, changes in trade policies (quotas and tariffs)

exchange rates

the value of a currency in terms of another

tariff

a tax on imports; it encourages consumers to purchase more domestic goods and move away from foreign goods.

quota

a physical limit to the volume of a particular good entering from abroad.

protectionism

a set of policies designed to protect domestic firms from the competition of foreign firms in the domestic market (quotas, tariffs, subsidies).

Aggregate Supply

the total quantity of goods and services produced in an economy over a specific period of time when resource prices stay relatively constant.

determinants of aggregate supply

resource prices, government intervention (regulation, subsidies, taxes), supply shocks

Monetarists

a school of thoughts that believes that money supply is the most effective and direct way of regulating the economy.

Keynesian

a school of thought that believes that government intervention and policies to manage aggregate demand is the best method of addressing the economy and preventing economic recessions.

Long-Run Aggregate Supply

a country’s potential capacity in terms of factors of production; determined by the quantity and quality of the factors of production.

determinants of LRAS

land, labour, capital, entrepreneurship, improvements in technology, efficiency and changes in institutions (degree of private and public ownership of resources, degree of competition, quantity and quality of government regulations, bureaucracy).

equilibrium in the short-term

intersection of the short-term aggregate supply curve and the aggregate demand curve

deflationary gap

where aggregate demand falls, creating a negative output gap, meaning that the output is below full employment level of output.

inflationary gap

when aggregate demand increases, the economy overheats and produces above full employment.

stagflation

when the economy experiences high unemployment, rising inflation and lower real GDP; this is caused by a fall in SRAS

equilibrium in the long-run

when all resources are being employed and the economy is operating at a natural rate of unemployment; LRAS, SRAS and AD intersect.

recessionary gap

where the economy slows down and operates below full employment; this creates unemployment

human capital

the skills, knowledge, and experience of the workforce

monetary policy

where the central bank uses money supply and interest rate to manage the economy.

money supply

the total amount of money in circulation

interest rates

the cost of borrowing money

minimum reserve requirement

a minimum amount of the deposits that commercial bank must keep in its vault; decided by the central bank

minimum lending rate

the rate at which the central bank charges commercial banks for charging money; it influences the interest rate offered by commercial banks.

quantitative easing

where the central bank creates digital money to buy bonds.

real interest rate

interest rate adjusted for inflation

demand for money

the ability and willingness to hold money at certain interest rates at a certain moment in time

MPC - marginal propensity to consume

the proportion of the addition to income that consumers spend

MPS - marginal propensity to save

the proportion of the addition to income saved

MPM - marginal propensity to import

the proportion of the addition to income that is spent on imports

MPT - marginal propensity to tax

the proportion of the addition to income that is taxed

economic growth

an increase in real GDP

short-term growth

an increase in the actual output of an economy

long-term growth

an increase in the quality or quantity of the factors of production; an increase in the production possibility of the economy

unemployment rate

percentage of people who are of working age, actively seeking for work and unemployed relative to the labour force (employed + unemployed)

cyclical/demand-deficient unemployment

when a lack of aggregate demand forces the economy to make workers redundant

real-wage unemployment

a gap between the people willing and able to work for a certain wage and the number of jobs available a surplus in the labour market

natural rate of unemployment

the percentage of people who are unemployed because of a frictional, seasonal or structural reason

frictional unemployment

those who are between jobs or between schooling and a job and therefore unemployed

seasonal unemployment

those who are unemployed because their skills are needed only at certain times of the year

structural unemployment

a mismatch between the demand and supply for the labour caused by industrial changes or labour market rigidity

inflation

a sustained increase in the general price level over a period of time

deflation

a sustained decrease in the general price level over a period of time

disinflation

a decrease in the rate of inflation of a certain country

hyperinflation

when the inflation rate exceeds 50% a month

demand-pull inflation

inflation caused by a shift rightward of the AD curve

cost-push inflation

inflation caused by the shift leftward of the SRAS curve (usually increase in cost of production)

CPI - consumer price index

a weighted basket of goods and services that are bought in an economy by a typical family; used to measure inflation

Phillips curve

a diagram that plots the unemployment rate against the inflation rate in an economy

supply-side policies

policies which aim to increase the quantity and quality of the factors of production through increased efficiency and competition in the economy

market-based supply-side policies

policies that aim to increase the competition in the economy by encouraging the forces of the free market

interventionist supply-side policies

policies involving the government directly intervening in the economy to increase the quantity or quality of the factors of production

deregulation

removing rules and restrictions to production

privatization

the transfer of ownership from the public to the private sector

trade liberalization

the removal of trade barriers to increase trade with other nations

anti-monopoly regulation

regulation to increase competition in the economy by avoiding the dominance of one single firm

labour unions

an organized association of workers that aims to protect and further the rights and interests of workers

minimum wage

a price floor, where the government intervenes in the labour market and sets wages above equilibrium level

crowding out

when increased public sector borrowing and spending causes a decrease in loanable funds and an increase in interest rates; this can lead to lower investment in the economy

average tax rate

the share of income that a household pays in tax

marginal tax rate

the tax rate imposed on the last dollar earned by a household

international trade

the transnational exchange of goods and services which involves the sale of exports and purchase of imports

factor endowment

the quantity and quality of FOPs available in a country

benefit of trade - increased competition

domestic firms find greater competition as overseas firms can produce goods and services of higher quality and quantity at lower prices

local firms are forced to become more efficient and innovative which brings benefits to the consumer

benefit of trade - lower prices

more competition, efficiency, economies of scale due to the market being larger → lower average cost of production

domestic producers can buy FOPs from overseas which can be cheaper reducing the cost of production thus the final price

benefit of trade - greater choice

trade makes the market bigger, more goods and services from more firms are available

benefit of trade - acquisition of resources

different factor endowments mean different countries have resources suited to different FOPs

international trade can allow countries access to more natural and/or capital resources which would otherwise not be available thus bettering their production processes

benefit of trade - foreign exchange earnings

export earnings in the form of foreign currencies

exporting country can purchase goods and services from other countries (this is import expenditure)

benefit of trade - access to larger markets

greater quantity of consumers increases the quantity supplied which enables economies of scale

integration of economies through trading blocs further enables this

benefit of trade - economies of scale

increase in output lowers average costs of production

cost savings can be passed on to consumers in the form of lower prices

larger scale enables domestic businesses to utilise division of labour and specialisation, invest in capital machinery

benefit of trade - efficient resource allocation

international trade encourages an efficient allocation of scarce resources globally

relatively free international trade makes domestic firms increase the quality of their output due to overseas competition which improves resource allocation in the domestic economy

benefit of trade - efficient production

domestic and foreign firms engage in price and non-price competition

domestic consumers can access a greater quantity of goods and services at lower prices

inefficient and unproductive firms become uncompetitive so when competition increases they are forced to become more efficient in their production process

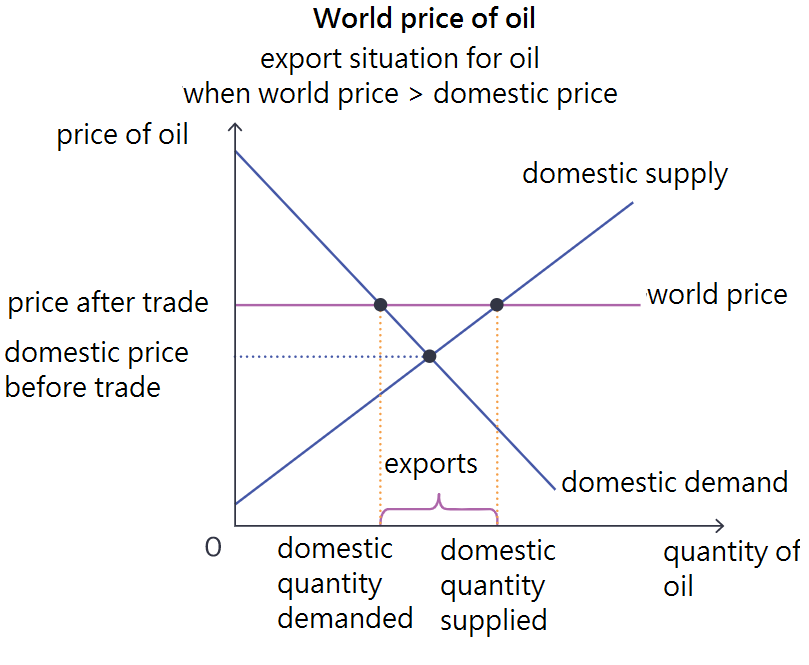

export situation diagram

when the world price is greater than the domestic equilibrium before trade occurs, producers benefit from free trade as they can export goods for higher prices and thus make more revenue and profits

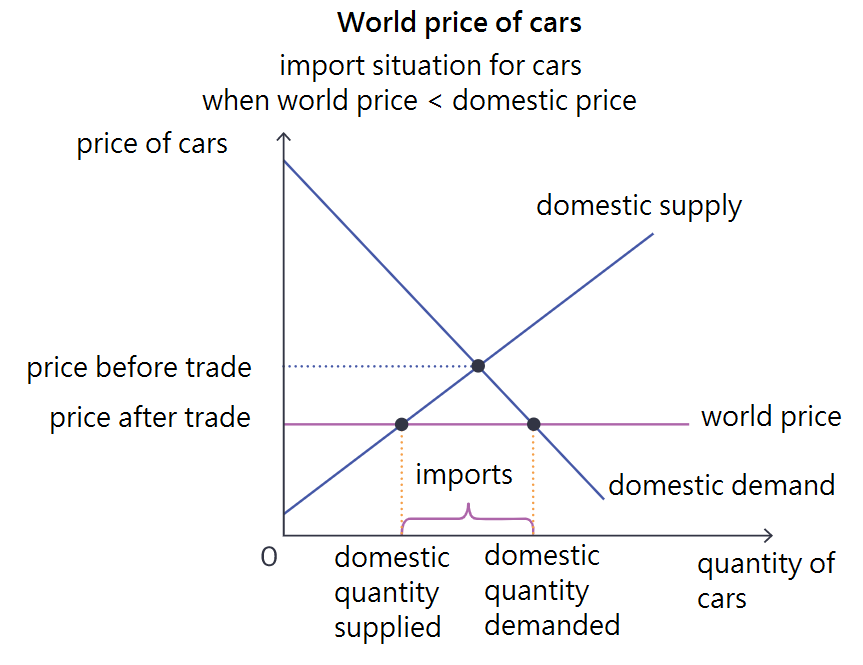

import situation diagram

when the world price is less than the domestic equilibrium before trade occurs, consumers benefit from free trade as lower priced goods are imported and thus reduce the domestic equilibrium price

the world price

the world price is horizontal meaning that the world will supply/demand any quantity of the good at one price

it assumes that the country has no influence over the world price — is a price taker

the World Trade Organisation

only global organisation dealing with rules of trade between nations

help producers and importers conduct their business

representatives from 150 nations

formed in 1995

positive = globalising the economy, allowing more trade to happen more smoothly

negative = developed countries increasing trade with developing countries without considerations for labour and environmental practices

protectionism

the use of barriers to trade to safeguard an economy from excessive international trade and foreign competition

barriers to trade

obstacles to international trade imposed by a government to safeguard national interests by reducing the competitiveness of foreign firms

comparative advantage

economies should specialise in the goods and services which they have a relatively low opportunity cost for when producing

increases efficiency and expands production capacity

tariffs

specific tax on imported goods and services

implemented unilaterally or as part of a trading bloc

increase the costs of production for foreign firms which raises the price of imported goods, so makes domestic products relatively cheaper

most common form of trade protection

quotas

quotas = quantitative limits on the importation of a good into a country

implemented unilaterally or as part of a trading bloc

restrict supply at the expense of foreign firms

quota creates more scarcity so increases the price

domestic supply shifts with the quota, additional amount is is the imported quantity

export subsidies

form of financial assistance to domestic firms which lowers their costs of production to help them compete against foreign firms

production subsidies = help reduce costs of production, most common

export subsidies = targeted at protecting specific export orientated firms

consumers pay Pw but producers receive Ps

reduces the quantity imported as the shortage in the domestic market is mitigated