Macro Final Exam Review

1/144

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

145 Terms

what are the major types of unemployment

what can we learn from unemployment data

types of unemployment

structural, frictional, cyclical

interpreting unemployment

ways to look at unemployment/shortcomings

unemployment

you are not called unemployed if you don’t have a job

1) not have a job

2) prove that you actively looked for a job in the last four weeks

when a worker who is not currently employed is searching for a job without success

U3

BLS

bureau of labor statistic measures unemployment

Unemployment rate (u)

the percentage of the labor force that is unemployed

unemployed/labor force * 100

structural unemployment

unemployment caused by changes in the industrial makeup of the economy

-arises due to structural changes in the economy

cause: creative destruction

ex: work in a video store and the store goes out of business and you are now unemployed

ex: decline in bookstore leading to job losses in the book sale industry

creative destruction

when the intro of new products and tech leads to the end of other industries and jobs

-sign of a healthy growing economy

ex: book sales

ways to reduce structural unemployment

-workers must retrain, reeducate, relocate, or change expectation abt work and pay

-the gov can help with training programs or relocation subsidies

Luddites

somebody who is actively against tech/someone who doesn’t know or learn how to use it

nineteenth-century english textile workers

-destroyed automated looms that could be operated cheaply to produce clothing

Goal- trying to protect themselves from structural unemployment

Question to think abt- the industrial revolution left many ppl structurally unemployed. What are the trade-offs of tech progress and structural unemployment?

frictional unemployment

unemployment caused by delays in matching available jobs and workers

(frictions in the hiring process- the process isn’t instantaneous)

-no matter how healthy the economy, there is always frictional unemployment

ex: recent college grads

Causes of frictional unemployment

info availability

-any factors that shorten job searches also decrease frictional unemployment

gov policies

-any factors that lengthen the job search process increase frictional unemployment

Cyclical Unemployment

unemployment caused by economic downturns

-causes greatest concern among policymakers and economists

Cause- an unhealthy economy

EX- unemployment due to covid

Natural Rate of Unemployment

Natural rate of unemployment: typical unemployment rate that occurs when the economy is growing normally

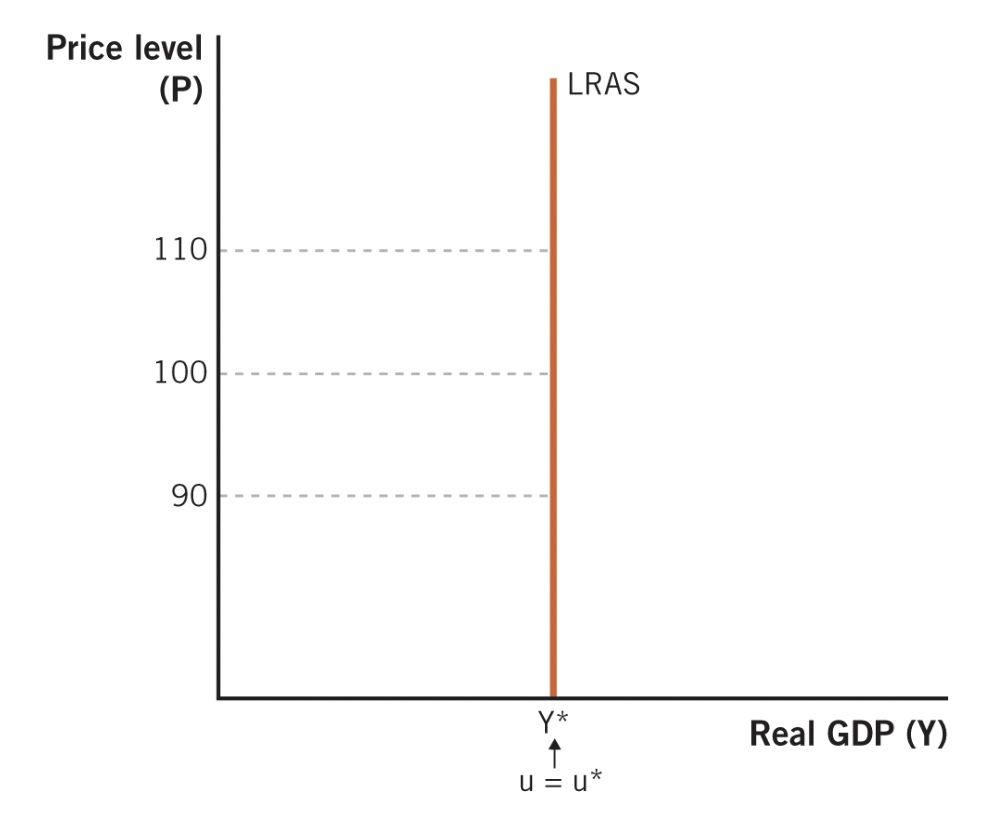

(insert screenshot from pp)

The natural rate of Unemployment and Full-Employment Output

Full employment output- output by an economy with no cyclical unemployment

(insert pic)

Population breakdown: Work-eligible population

civilian, non-institutionalized, and age 16 or older

Labor force

people who are employed or are actively seeking work

-accounts for just 25 percent of Americans

Unemployment rate (u)

the percentage of the labor force that is unemployed

Labor Force Participation Rate (LFPR)

The percentage of work-eligible population that is in the labor force

US unemployment rate and recessions (1970-2021)

There is always some unemployment, but when the economy is in a downturn (shaded area), cyclical unemployment increases

US labor force participation rate (1995-2021)

In the past two decades, the LFPR has decreased and is expected to keep doing so as baby boomers retire

Trends in the US Labor force participation (1950-2020)

Since 1950 the proportion of men in the labor force has steadily declined, and the LFPR of women, despite significantly increasing since 1950, has also decreased in the past decade

Shortcomings of using the Unemployment Rate

1) it can be too narrow

2) it doesn’t reveal who is unemployed

3) It is a lagging indicator

Unemployment rate can be too narrow

those who are not working, have looked for a job in the past 12 months and are willing work, but have not sought employment in the past four weeks

-referred to as a marginally attached workers

-EX: PhD student bagging groceries

underemployed workers: those who have part-time jobs but would prefer to work full time

-EX: person who works in the mornings but would like to work all day

A broader measure of US labor market problems (2000-2021)

In recessions, more people become discouraged and underemployed, increasing the gap between U-3 (officially unemployed) and U-6 (employed + discouraged and underemployed workers

Does not reveal who is unemployed

Lagging indicator

usually changes AFTER the economy as a whole changes so it doesn’t have much predictive power

EX: average duration of unemployment

EX: change in the price index

leading indicator

helps us predict what’s coming and will usually change BEFORE the economy as a whole does

EX: average weekly hours for manufacturing

EX: building permits

Unemployment rate Conclusions

monitoring as an indicator of macroeconomic health

-helps us gauge labor market conditions

-can be misleading and incompletely, since it lags behind economic activity and doesn’t account for unemployment and discouraged workers

-includes different types of unemployment, some worse than others

-Can be influenced by government policy. This seems to have played a big part in propping up rates in the aftermath of the 2008 recession

time deposit

(fixed deposits/certificates of deposit) locking a saving in for a certain amount of time. (can’t withdraw the money for a certain amount of time) (more time=more interest)

market

interest rates

equilibrium

supply

income and wealth

time preferences

consumption smoothing

demand

productivity of capital

investor confidence

gov borrowing

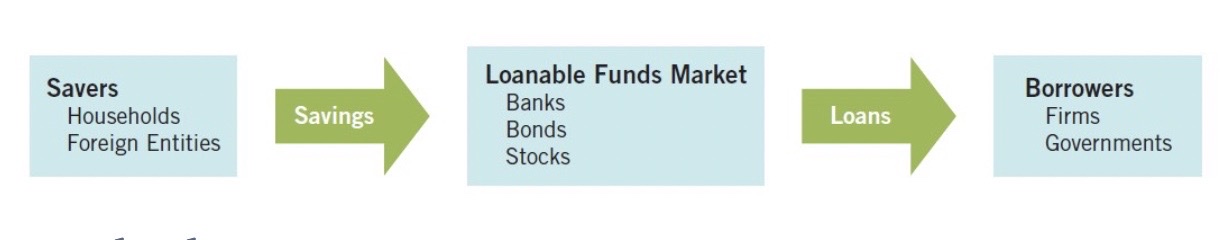

Loanable Funds Market

The market where savers supply funds for loans to borrowers

Includes places such as:

- stock exchange

-Investment banks

-mutual fund firms

-commercial banks

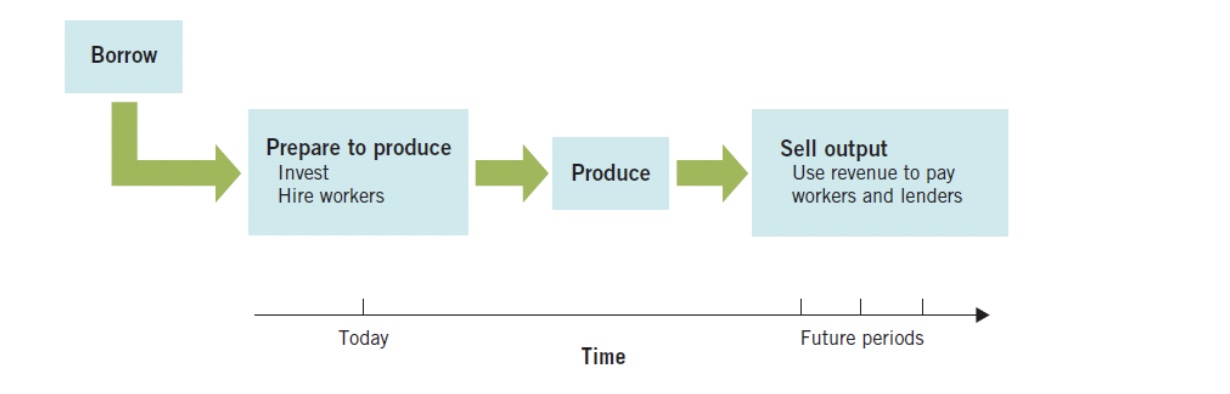

What do firms need to borrow?

-Most businesses cannot fund capital and other investment purchases with cash alone

-without the loanable funds market, much investment would be impossible and production and GDP would falter

Where do firms get their funds from?

every dollar borrowed requires a dollar saved

lenders can’t lend money they don’t have

Savings provides funds for lenders to lend

_____________________________________________

Ch 6 summary

Loanable funds markets channel funds from savers to borrowers.

Supply of loanable funds: household savings

•Suppliers provide the funds for firms to expand through investment.

Demand for loanable funds: firms borrowing to invest

Equilibrium in this market determines the level of savings, investment, and interest rates.

Savings → Borrowing → Investment → Growth

Financial Markets and Securities

Financial Markets

• Financial intermediaries

• Direct and indirect

financing

Financial Tools

• Bonds

• Stocks

• Treasury securities

• Home mortgages

Financial Intermediaries

• Borrowers and lenders come together in financial markets.

• Financial intermediaries are firms that help to channel funds

from savers to borrowers.

• Example: banks

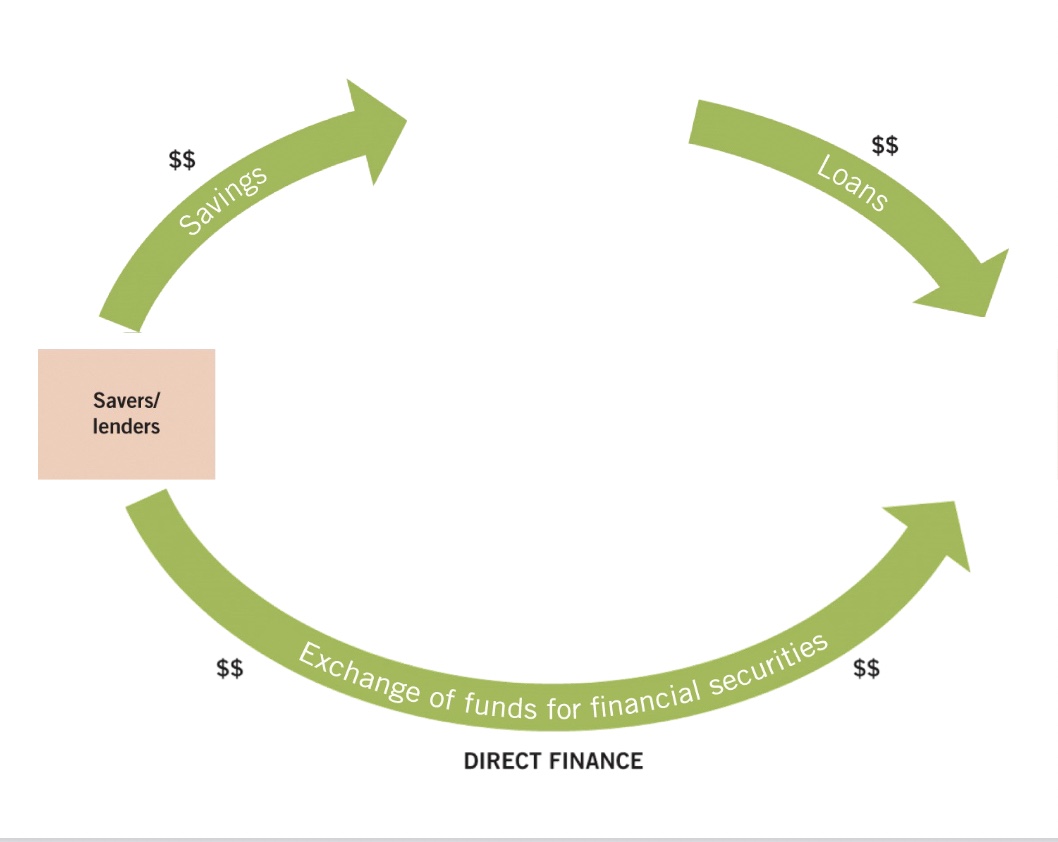

Direct Finance

• When borrowers go directly to savers for

funds

• Firms sell a security (stock or bond)

directly to the public in exchange for funds

Indirect Finance

• When savers lend funds to financial

intermediaries, which then loan these funds

to borrowers

Direct vs indirect finance

Financial Tools

Tools used in financial markets:

• Bonds

• Stocks

• Treasury securities

• Home mortgages

• Private-sector securities

Bonds

a formal IOU, a contract specifying who owes how much and a date for payment.

Firms will issue bonds to the public in order to borrow money and use those funds for investment.

This is an example of direct finance.

What 3 important pieces of info do bonds contain

Bonds contain three important pieces of information:

1. The name of the borrower

2. The repayment date

• This is also known as the maturity date.

3. The amount due at repayment

• Also referred to as the face value or par value

• It is the bond’s value at maturity.

Interest Rates

Bond prices are generally quoted in interest rates.

The interest rate on a bond is the growth rate of the

original funds invested.

• Bond buyers (savers) want the highest interest rates

(greatest return on their money).

• Bond sellers (borrowers) want the lowest interest rates

(lowest cost for borrowing money).

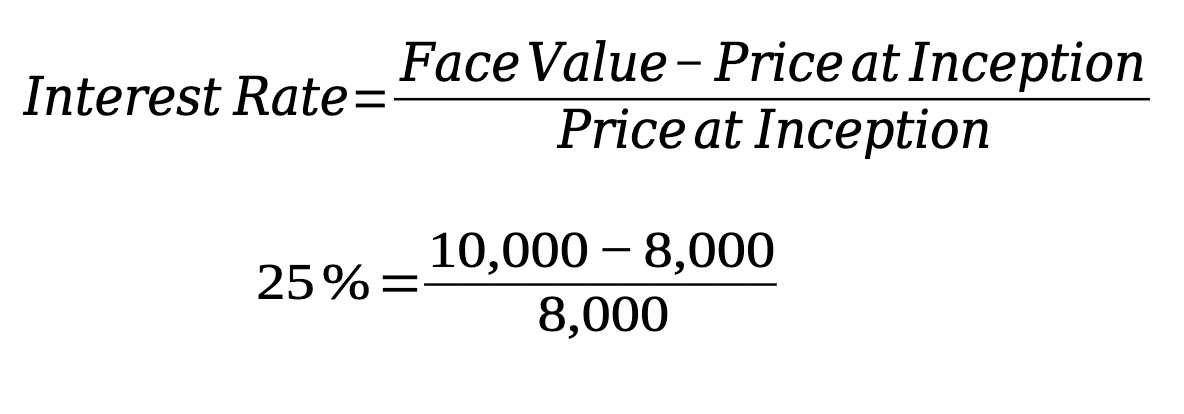

Interest rates formula example

if you buy a bond for $8,000 and one year later, it is worth

$10,000, the interest rate is 25%.

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑅𝑎𝑡𝑒=

𝐹𝑎𝑐𝑒 𝑉𝑎𝑙𝑢𝑒 − 𝑃𝑟𝑖𝑐𝑒 𝑎𝑡 𝐼𝑛𝑐𝑒𝑝𝑡𝑖𝑜𝑛

𝑃𝑟𝑖𝑐𝑒 𝑎𝑡 𝐼𝑛𝑐𝑒𝑝𝑡𝑖𝑜𝑛

25 % = 10,000 − 8,000

8,000

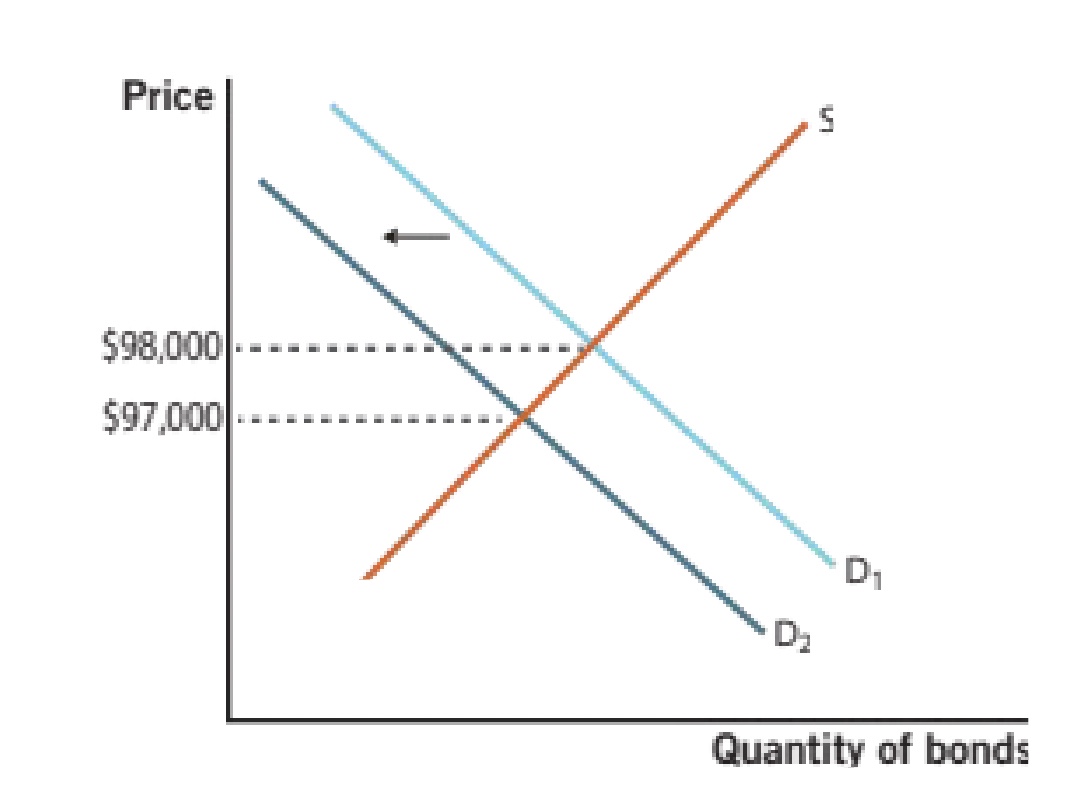

Bond Principles

The dollar price of a bond determines its interest rate (and vice versa).

The dollar price and the interest rate have a negative relationship.

Example: Consider that a $10,000 bond is being offered.

-Inverse relationship between the price at which u buy the bond and interest rate of the bond

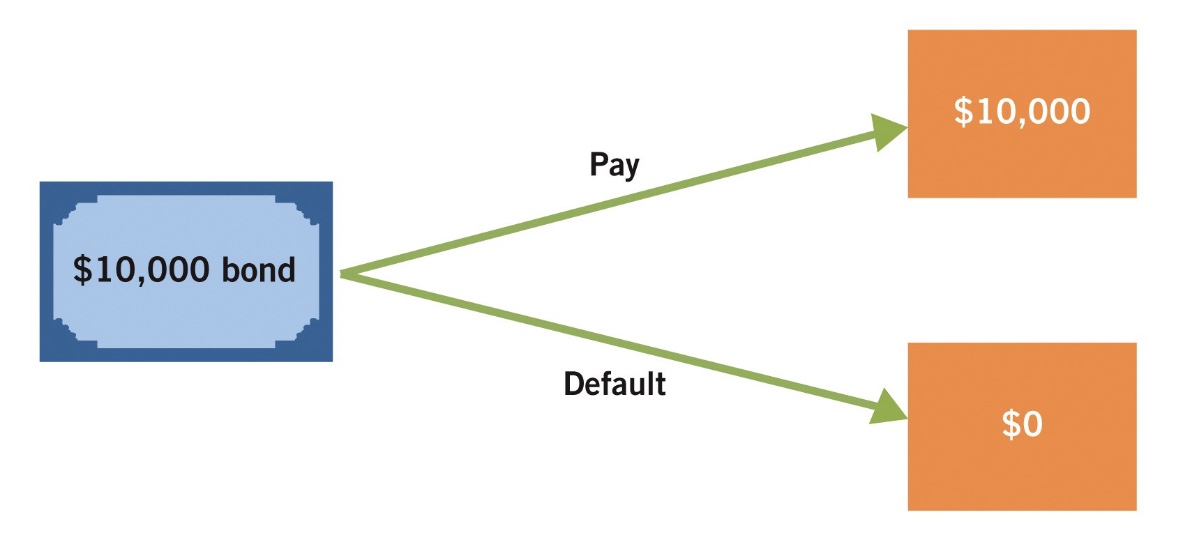

Default risk

Default risk is the risk that the borrower will not pay the face value of a bond on the maturity date.

The greater the risk of default, the lower the price (and higher the interest rate) of the bond.

Bond interest rates rise with default risk.Two possible outcomes for the bond:

• The borrower pays maturity value of the bond to lender.

• The borrower defaults on the loan (lender gets $0 back).

Bond ratings and default risk

Default risk is very important for bondholders, but it is very difficult for typical consumers to judge the risk of default or even one firm.

Rating agencies

evaluate the default risk of all borrowing entities and give a grade showing the likelihood of defaulting.

Examples:

• Moody’s

• Standard and Poor’s (S&P)

• Fitch

Price falls when bonds are downgraded

Stocks

In addition to issuing debt through bonds, firms can also sell part of their ownership.

Stocks are ownership shares in a firm.

• Shareholders have some influence in the operations of the firm.

Firms might prefer to sell part of their ownership because they can sell shares and move forward without the burden of debt from having to pay back a bond in the future.

Secondary Markets

are markets in which securities are traded after their first sale.

They are important because they enable firms to sell bonds at higher prices (lower interest rates) since demand for assets increases when they can be resold.

Stock markets are secondary markets.

• New York Stock Exchange (NYSE)

• National Association of Securities Dealers Automated

Quotations (NASDAQ)

Secondary Markets Make Securities More Valuable

Treasury Securities

• Treasury securities are the bonds sold by the U.S. government to pay for the national debt.

• The interest rate is determined by auctions.

• Low risk

• Active secondary market

when the interest rate rises ppl who put their money into bonds loose out bc they could have put the same amount of money into the savings and earned a 5 percent return. People then sell the bond for a price much lower than they bought it for.

However, if the interest rate decreases to 1% in savings your 3% bond will have a higher value and you can sell it for more money.

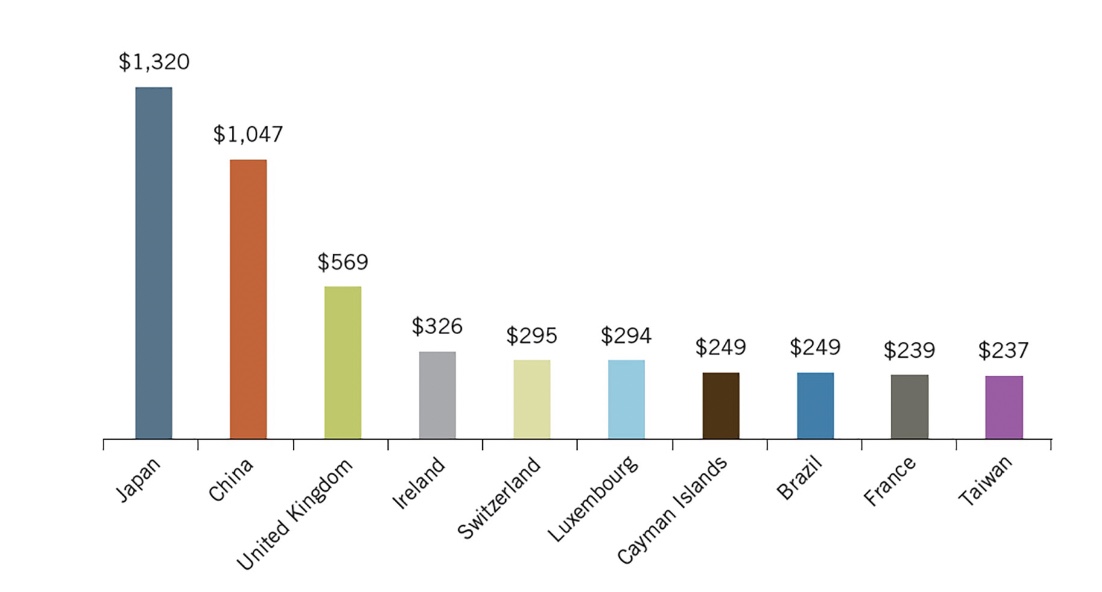

Major US Treasury Security Holds, 2021

Of the $30 trillion of U.S. government debt in 2021,

foreigners held approximately ____%.

Mortgages

• Mortgages are loans that individuals

use to pay for homes.

• Becoming increasingly important

tools as more and more people are

owning homes

U.S. Home mortgage market (1990-2021)

The market declined for a time after the 2008 recession but

then recovered and resumed its upward climb.

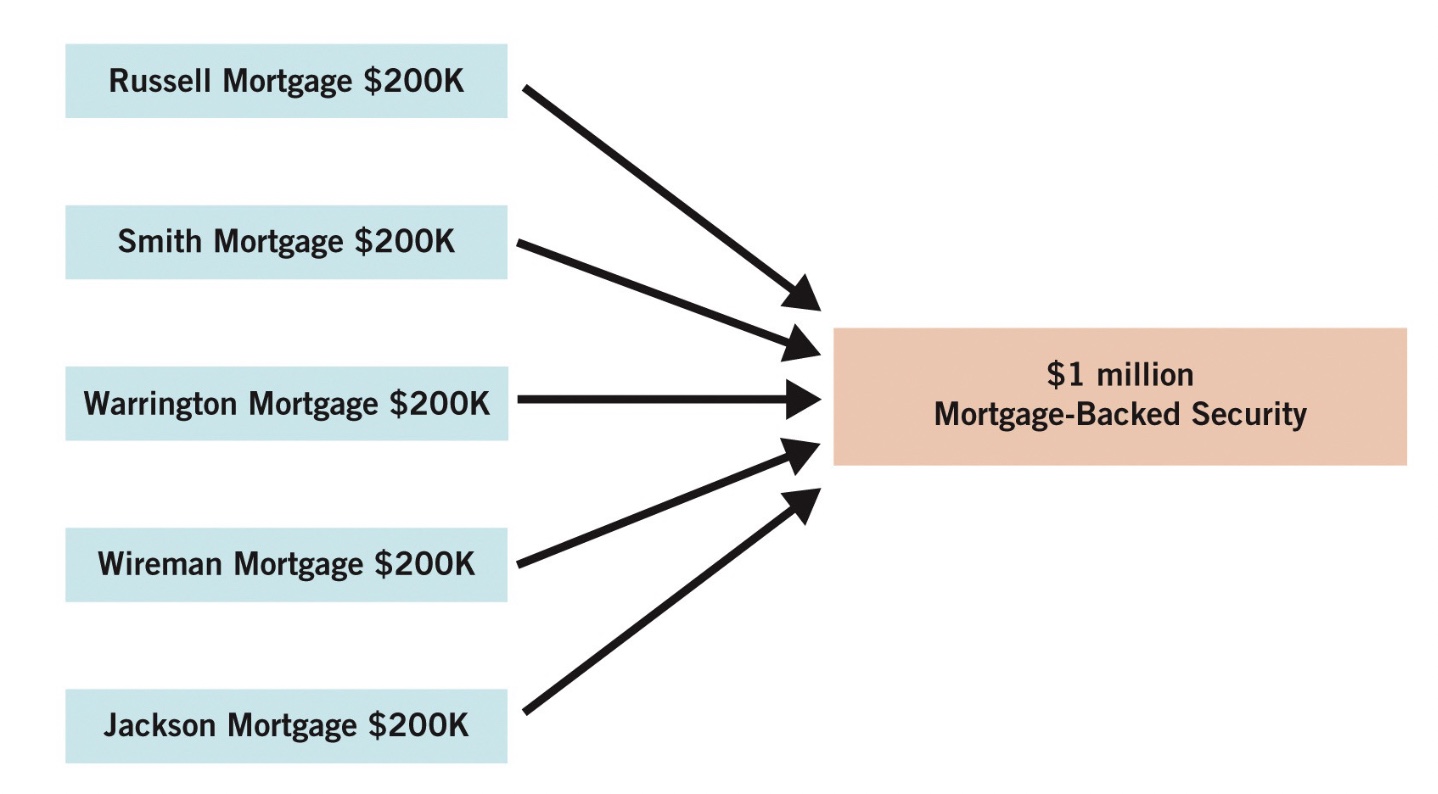

Securitization

Securitization is the creation of a new security by combining

otherwise separate loan agreements.

Example: Mortgage-backed securities are combinations,

or bundles, of mortgages.

Benefits borrowers because interest rates are lowered which

increases investment opportunities

Helps lenders because it offers new opportunities

Example: Anyone in the world can buy securities tied to

the U.S. mortgage market.

New security is a bundle of other loans

conclusion

• Indirect finance is when savers and lenders utilize banks

in the market for loans.

• Direct finance is when borrowers go directly to lenders

(stock or bond purchases).

• Bonds are loan contracts that are typically traded in

secondary markets.

• Stocks are ownership shares in firms.

• U.S. Treasury securities are the bonds used by the

federal government to finance the national debt.

• Mortgages are loans that people use to pay for homes.

Chapter 7 big questions

1. What is the aggregate demand–aggregate supply

model?

2. What is aggregate demand?

3. What is aggregate supply?

4. How does the aggregate demand–aggregate supply

model help us understand the economy?

Aggregate Demand

Consumption

Investment

Gov spending

Net exports

LR aggregate supply

resources

tech

institutions

long run= anything greater than a decade

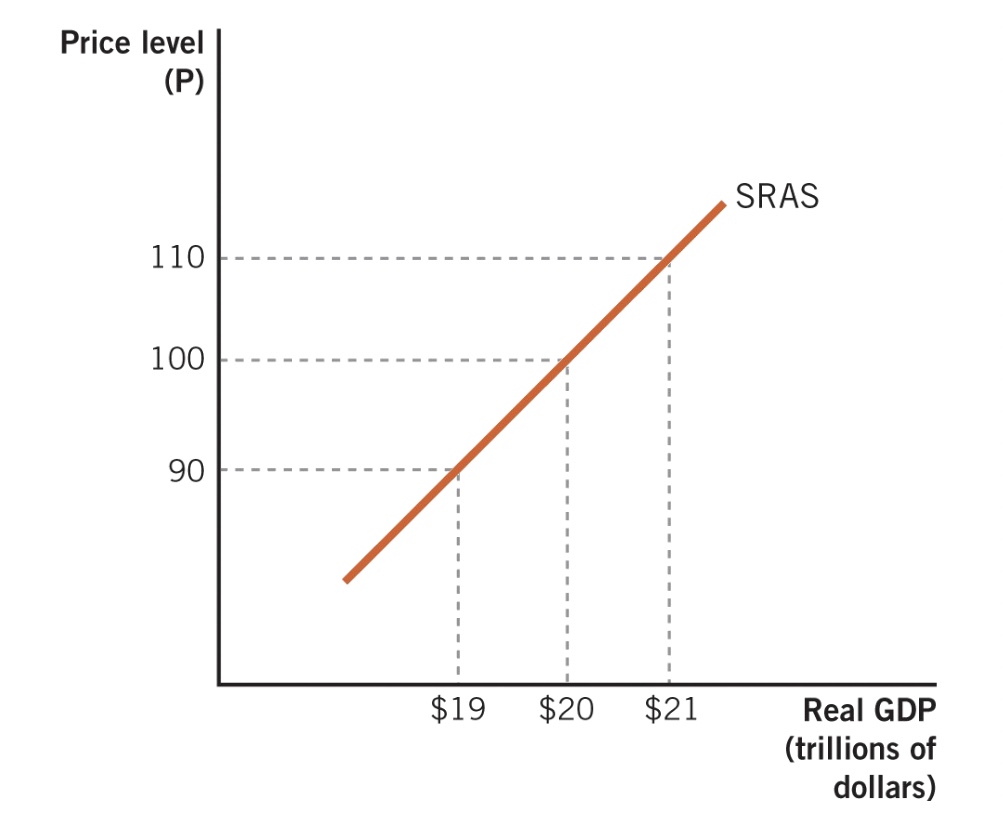

SR aggregate supply

(dependent on inflation)

sticky input prices

Menu Costs

Money illusion

short run=anything under a decade

any period of time when at least one factor of production is in limited supply

What are the two paths of study in macro

1. Long-run growth and development

2. Short-run fluctuations, or business cycles

Long run growth and development

focuses on theories and policies that affect economies over several decades

Short run fluctuations or business cycles

Focuses on time horizons of five years or less

U.S. Real GDP and Tecessions, 1990–2021

GDP growth is typically positive during economic

expansions, and negative during recessions.

U.S. Unemployment Rates, 1990–2021

In recessions unemployment rises, while in

expansions unemployment falls.

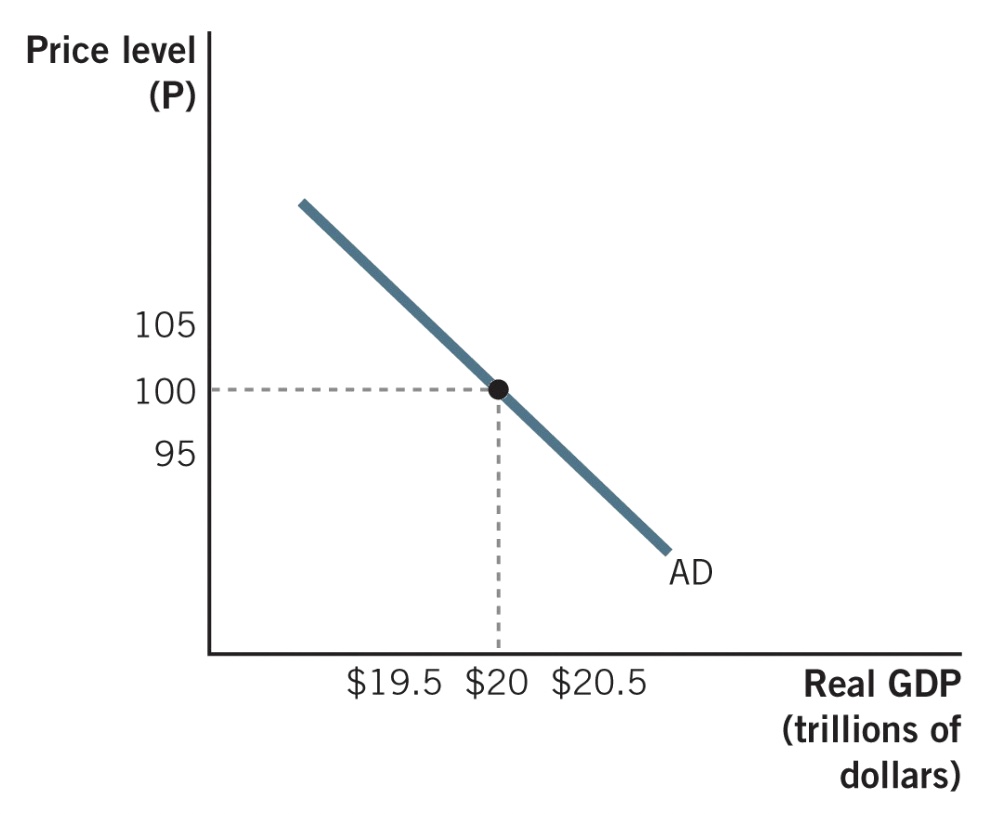

Aggregate Demand and Aggregate Supply Model

• Model used to study business cycles.

• Built on demand and supply model.

• Considers demand and supply for all final goods in

an economy.

• Aggregate = total.

Aggregate Demand

Aggregate demand: The total demand for final

goods and services in an economy.

It is the sum of spending in the economy.

where:

• Consumption is C

• Investment is I

• Government spending is G

• Net exports is NX

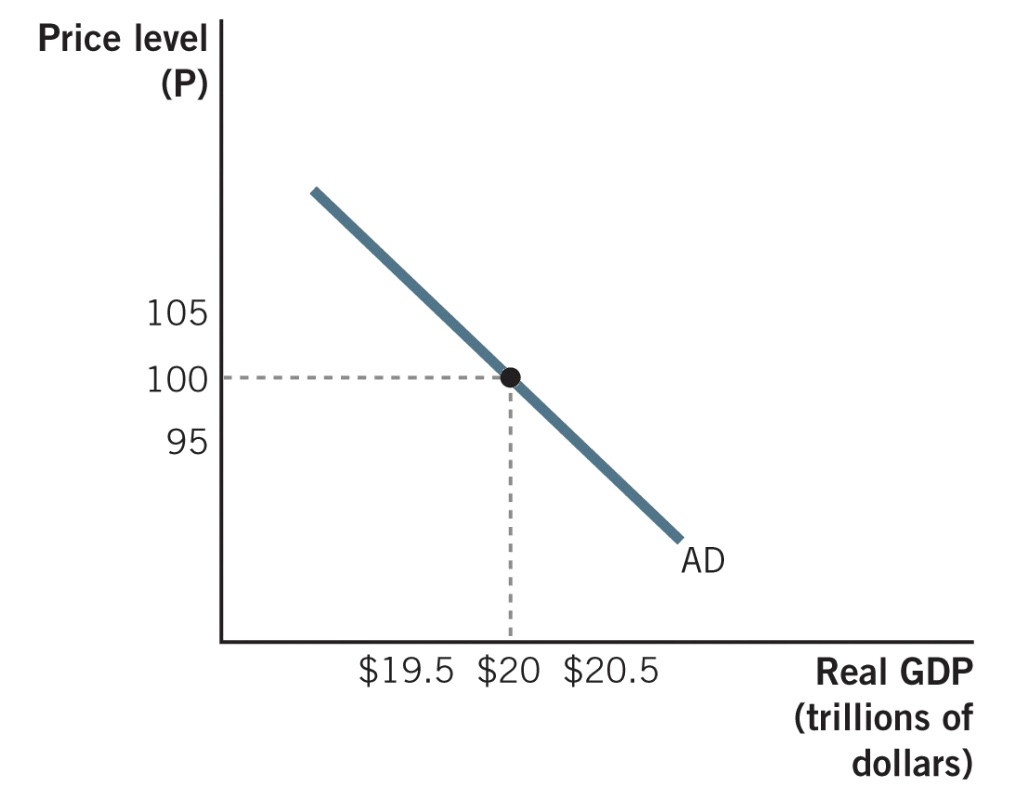

Aggregate Demand

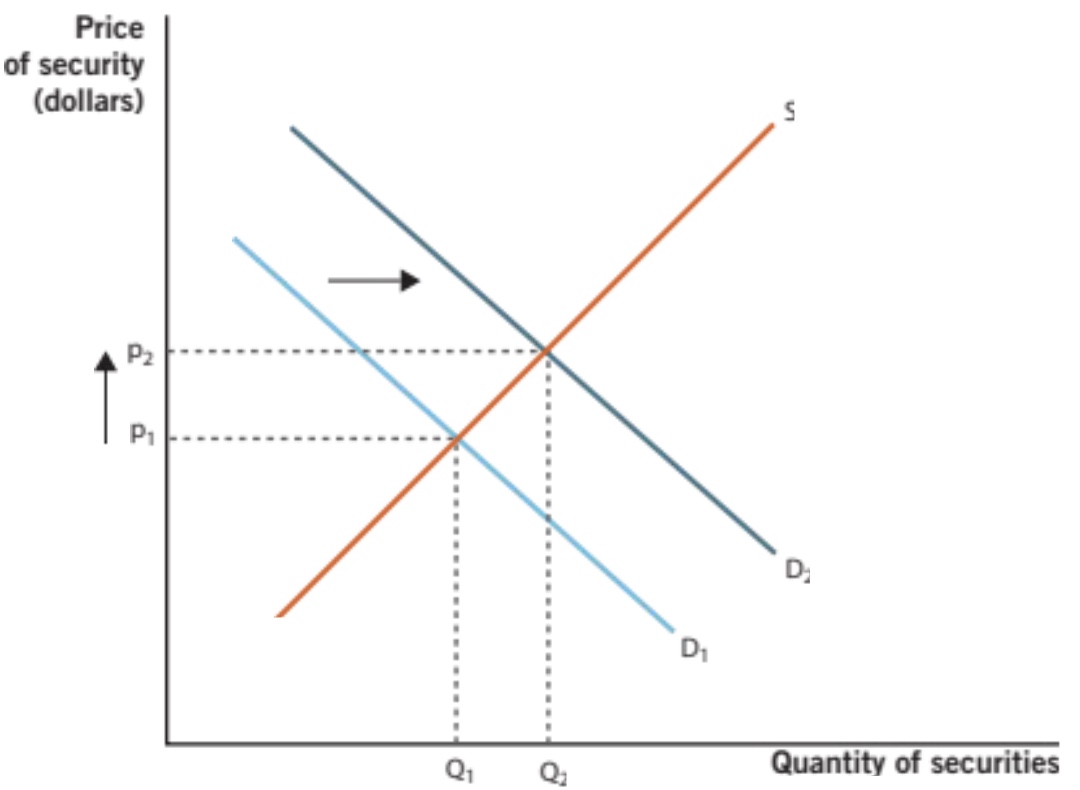

Slope of the AD curve

the three reasons for the neg relationship between qty of aggregate demand and price level are:

1) the wealth effect

2) the interest rate effect

3) the international trade effect

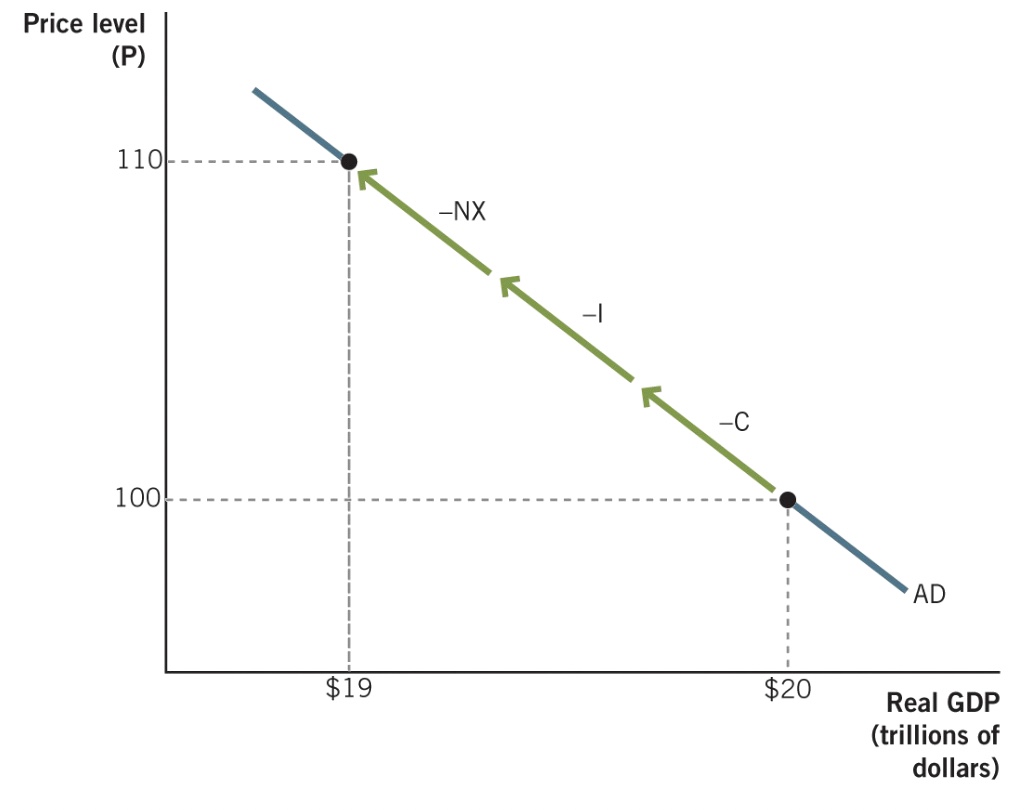

Wealth Effect

The change in the quantity of aggregate

demand that results from wealth changes due to price-level

changes.

Wealth

The net value of one’s accumulated assets.

This effect is related to consumption.

Example: If real estate prices drop, people that have stored

their wealth in the form of homes will consume less.

Interest Rate Effect

Occurs when a change in the price level

leads to a change in interest rates and therefore in the

quantity of aggregate demand.

This occurs through the loanable funds market.

• Changes in the price level affect saving.

• This directly impacts the supply of loanable funds.

Example: If price levels rise, people will save less which will

increase interest rates. This will decrease investment.

international trade effect

Occurs when

a change in the price level leads to a

change in the quantity of net exports

demanded.

Happens due to changes in relative

price levels.

Example: If Japanese goods are cheaper

relative to U.S. goods, more people will

demand Japanese goods.

Slope of the Aggregate Demand Curve

Shift factors in aggregate demand

When people’s demand for goods

and services at all price levels

changes, AD will shift.

The main categories are:

• Consumption

• Investment

• Government Spending

• Net Exports

Consumption

Consumption spending accounts for about 70% of all

spending in GDP. Consumption is influenced by:

1. Changes in real wealth

• Stock market rises or falls

• Widespread change in real estate values

2. General expectations about the future

• Changes in expected income

• Change in consumer confidence

3. Changes in taxes

Investment

Investment shifts when decision-makers at firms decide to

increase or decrease spending on capital goods.

1. Investor confidence

• As investor confidence rises, so does investment.

2. Interest rates

• At lower interest rates, investment increases.

3. Quantity of money in the economy

• More money will lead to lower interest rates, which

will increase investment.

Gov Spending

Factor influenced most directly by policymakers.

These changes may be made in response to economic

conditions.

Example: If people become more pessimistic about the

future, the government might decide to spend on roads and

highways to offset the decrease in consumption and

investment.

Net exports

Net exports shift in response to changes in foreign income

and the value of the U.S. dollar.

As income in other nations rises, their demand for U.S. goods

increases.

• As nations become wealthier, net exports increase.

When the value of the dollar increases, people in the U.S. can

buy more foreign goods but people outside of the U.S. can

buy less U.S. goods. So, net exports decrease.

• A stronger dollar leads to a decline in net exports.

Shift factors in aggregate demand supply

Movement along the AD curve

• Start with a change in the

price level.

• Affect the quantity of

aggregate demand through

the three effects.

• Examples: Wealth effect,

interest rate effect,

international trade effect.

Shifts in the AD curve

• Occur when something other

than the price level changes.

• Examples: Changes in real

wealth, businesses

confidence, value of the

dollar.

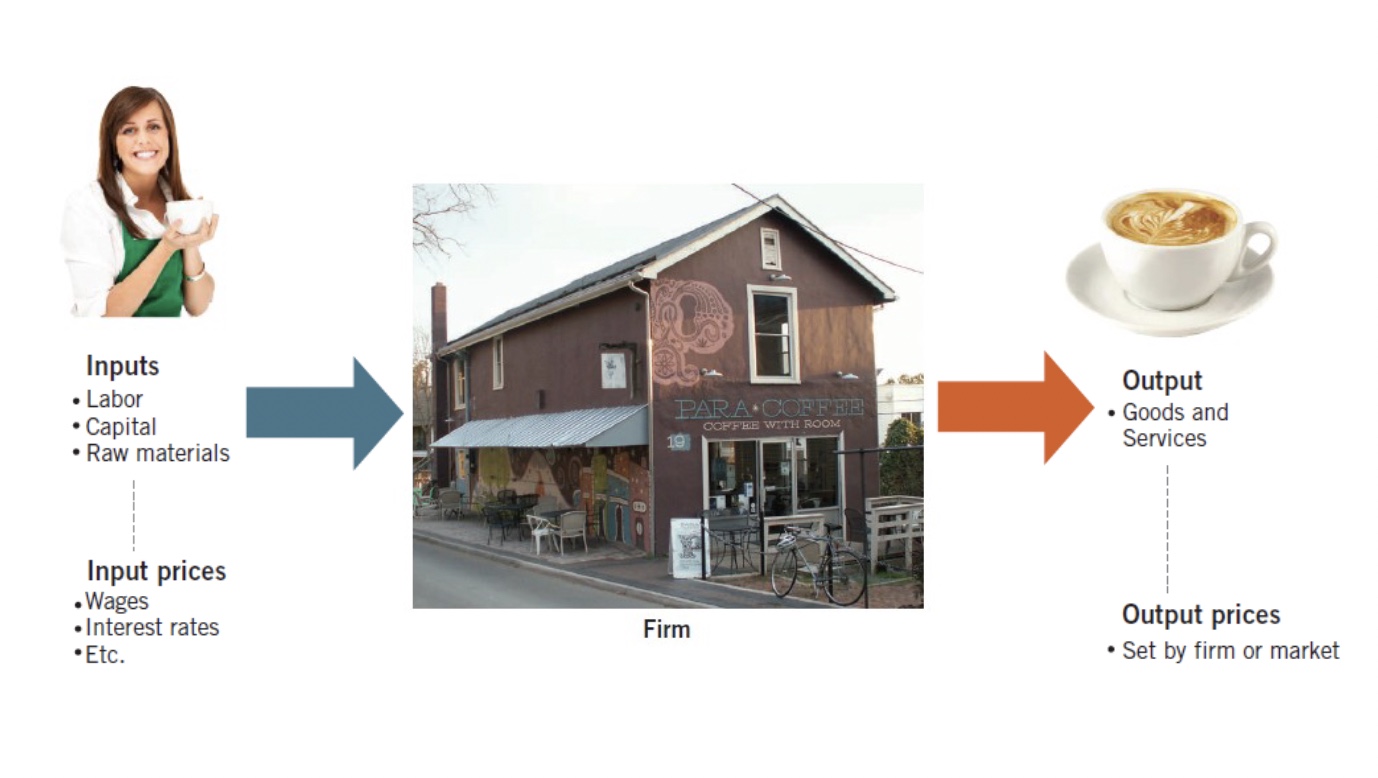

function of a firm

Aggregate Supply

• How do changes in the price

level affect the supply

decisions of the firm?

• It depends.

• Economists use two different

time horizons:

1.Long-run

2.Short-run

Long Run

A period of time sufficient for all prices to adjust

The level of output produced when an economy is at the natural rate of unemployment

It depends on an economy’s resources, tech, and institutions

Vertical line:

• Not affected by changes in price.

• An economy’s ability to produce is the same regardless

of how much paper money is present.

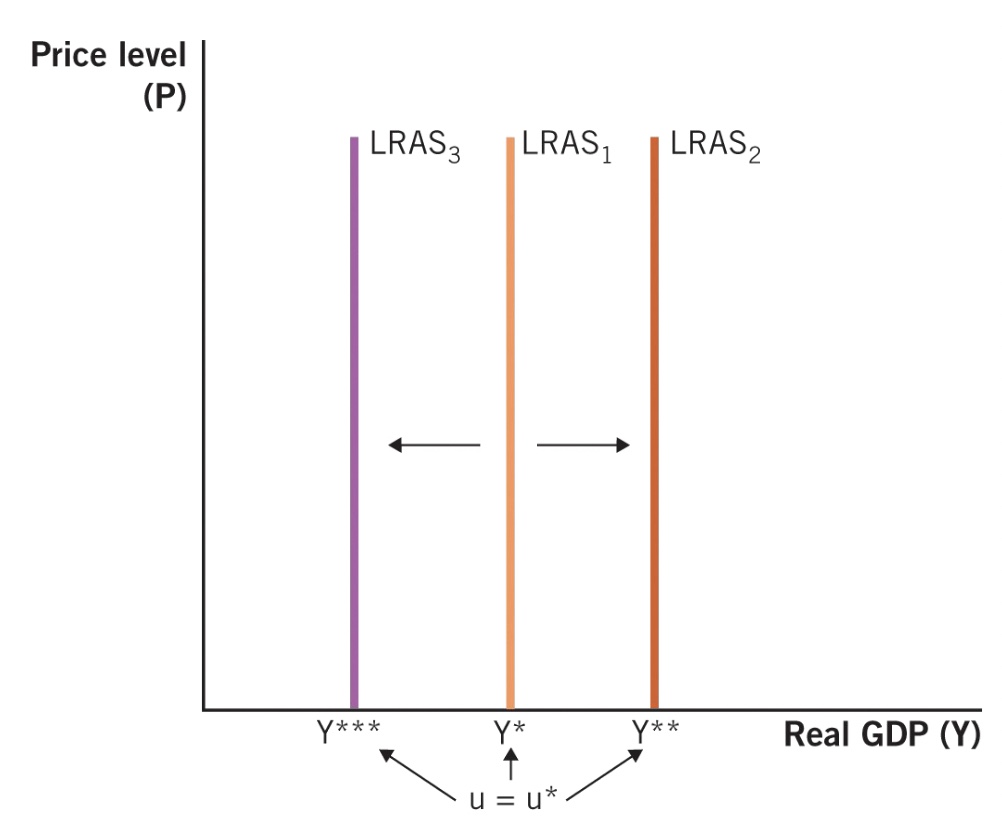

Long Run aggregate supply

Shifts in Long-Run Aggregate Supply

• LRAS changes when a nation’s ability to produce output

changes.

• This occurs with changes in:

1.Resources

3.Institutions

Shifts in LRAS

Short run

The period of time in which some prices have not

yet adjusted.

There are three reasons why there is a positive relationship

between the price level and the quantity of aggregate supply:

• Sticky input prices

• Menu costs

• Money illusion

Short Run AS Curve