Unit 3: Economic Activity (3.1 - 3.2)

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

GDP - Output Method

Summing all of the value added by firms in an economy, and subtracting the costs of input.

GDP - Income Method

Added values of all incomes earned in the economy.

GDP - Expenditure Method

C + I + G + X - M

GDP - Definition

National output = National income = National expenditure

GNI

GDP + Net income from abroad

Differences between rGDP/rGNI and GDP/GNI

Real GDP/GNI is GDP/GNI adjusted for inflation.

rGDP = GDP * 100/(100 + inflation)

rGDP/rGNI per capita

rGNI and rGDP divided by the total population.

Criticism of rGDP/rGNI as measurement of economic well-being, inaccuracies

- Inaccuracies:

The data used to calculate the various measures of national income come from a range of sources such as tax claims by households and firms, output data and sales data. Usually, figures become more accurate after a lag time as they are revised.

Criticism of rGDP/rGNI as measurement of economic well-being, informal markets

- Unrecorded or under-recorded economic activity:

The only income that can be recorded is income from legitimate markets. This means that if you were to paint your own house, it would not count towards the GDP. This makes comparisons difficult since some countries, like Mexico, have 30% of their GDP as 'hidden'.

Criticism of rGDP/rGNI as measurement of economic well-being, external costs

- External costs:

GDP does not take into account the costs of resource depletion, such as pollution to the atmosphere or the cutting down of trees.

Criticism of rGDP/rGNI as measurement of economic well-being, quality of life

- Quality of life concerns:

GDP may grow because people are working longer hours and not taking any holidays. While people enjoy higher incomes, they may not have higher standards of living.

Criticism of rGDP/rGNI as measurement of economic well-being, composition of output

- Composition of output:

A large part of a country's output may be in defence goods or capital goods. If this is the case, then it would be hard to argue that a higher GDP will raise living standards.

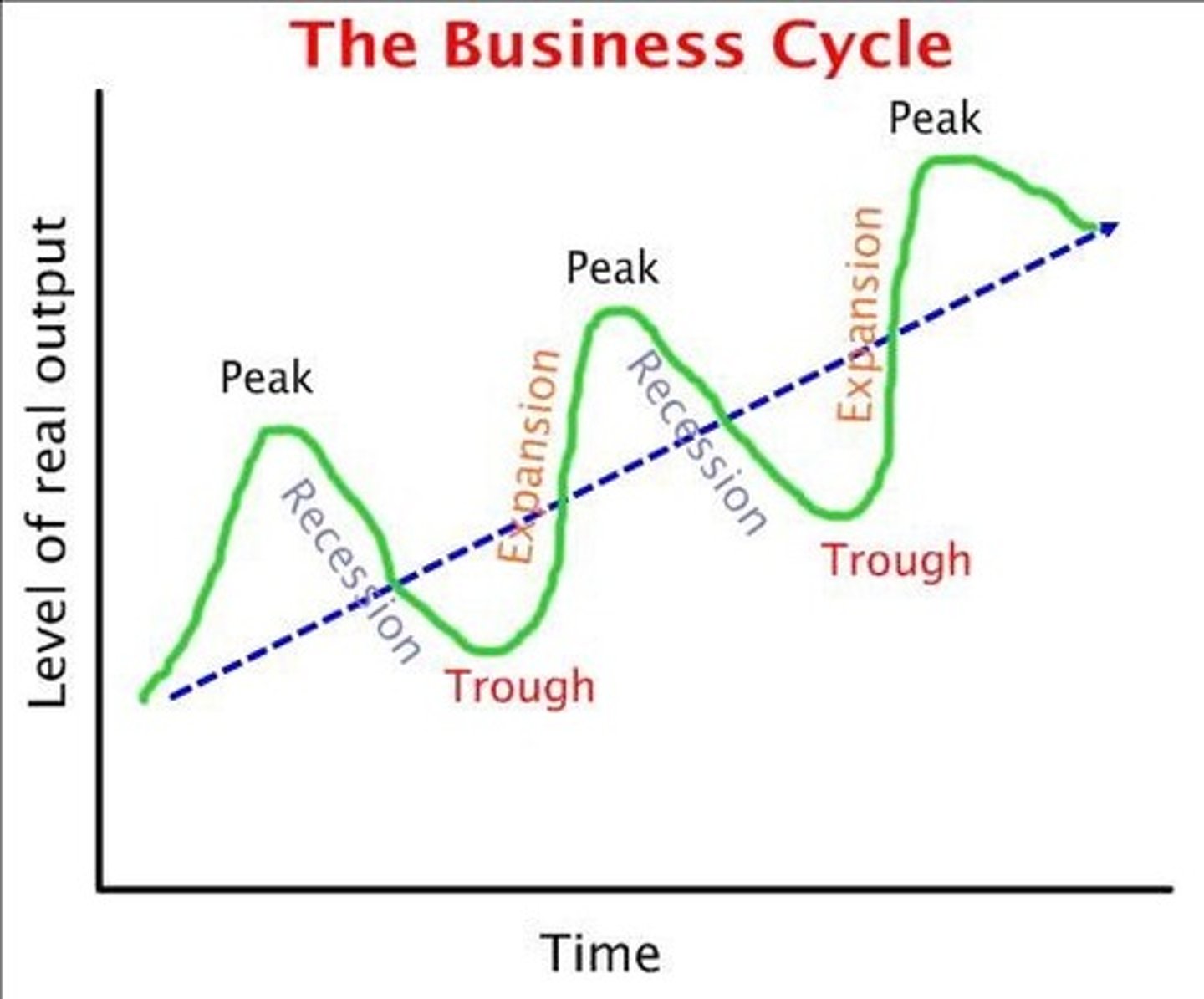

Business Cycle

Fluctuations in economic activity, such as employment and production.

Other measures of economic well-being, OECD Better Life Index

OECD Better Life Index

OECD stands for Organisation for Economic Co-operation and Development.

OECD index takes into account:

Material living conditions - housing, income, jobs.

Quality of life - community, education, environment, governance, health, life satisfaction, safety and work-life balance.

Other measures of economic well-being, Happiness Index

Happiness Index

Another composite index.

Considers:

GDP per capita,

Social support,

Healthy life expectancy,

Freedom to make choices,

Generosity,

Perceptions of corruption.

Other measures of economic well-being, Happy Planet Index

Happy Planet Index (HPI)

The HPI measures sustainable wellbeing.

It uses the equation below:

HPI = (Wellbeing * Life expectancy Inequality of outcomes) / Ecological footprint.

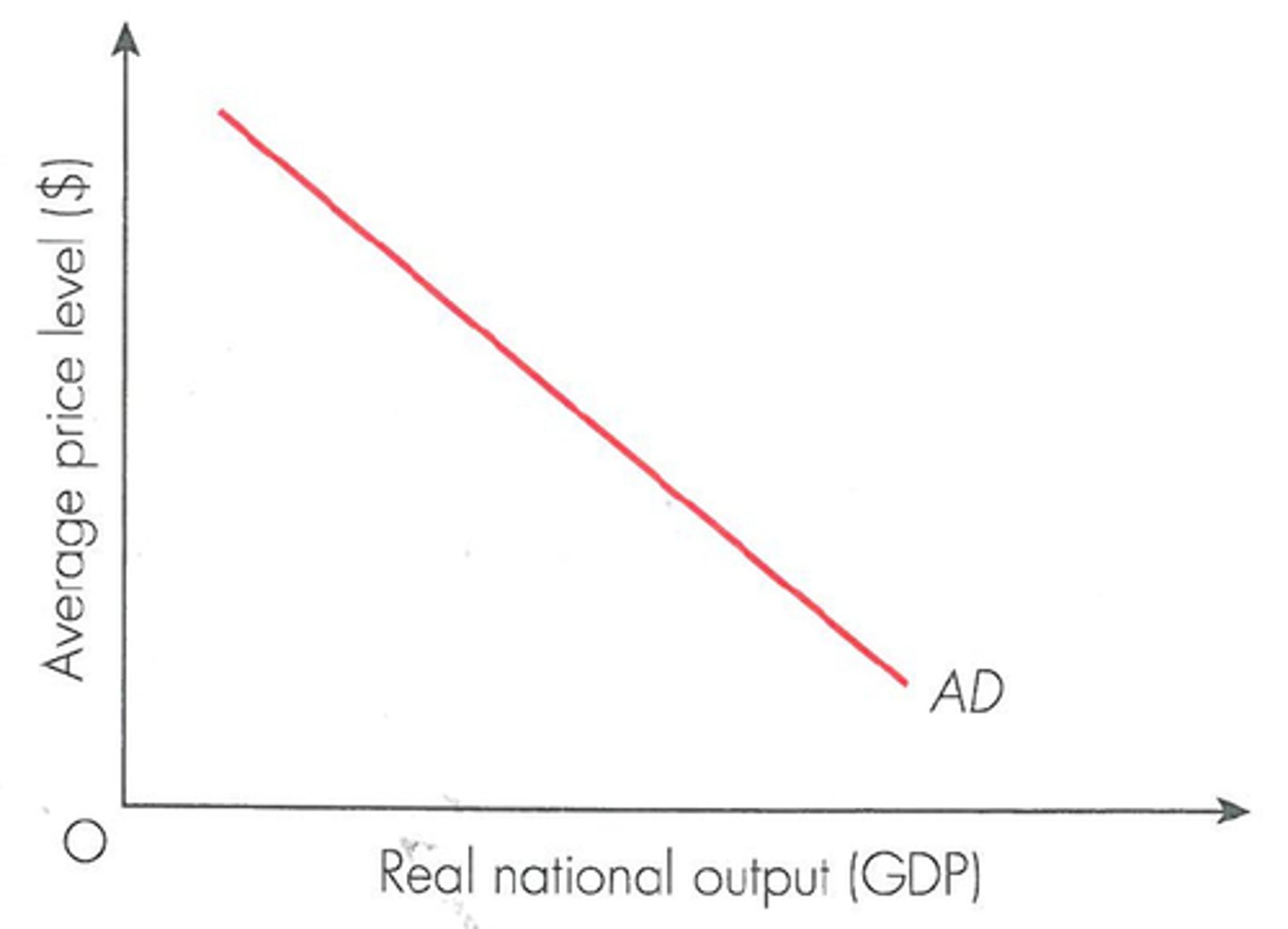

Aggregate demand (AD)

The total spending on goods and services in a period of time at a given price level.

C + I + G + X - M

Components of AD: Consumption

Consumption is the total spending by consumers on domestic goods and services.

Components of AD: Investment

Investment is defined as the addition of capital stock to the economy. Investment is carried out by firms.

Firms have two types of investment:

- Replacement investment occurs when firms spend on capital in order to maintain the productivity of their existing capital.

- Induced investment occurs when firms spend on capital to increase their output to respond to higher demand in the economy.

Capital stock:

All goods that are made by people and are used to produce other goods or services, such has factories, machines, offices or computers.

Investment is NOT buying shares or putting money in a bank.

Components of AD: Government spending

Government spending includes health, education, law and order, transport, social security, housing and defence.

Components of AD: Net exports

Net exports are exports - imports, since exports count as injections and imports count as leakages.

Changes in AD: Consumption, income taxes

Most significant determinant of consumption is income. If there is an increase in income taxes, people have less disposable income, so less spending from consumers and hence less consumption.

Changes in AD: Consumption, interest rates

Spending on non-durable goods is carried out with disposable income. Spending on durable goods comes from money which people borrow from the bank, and hence, an increase in interest rates will lead to less borrowing and less consumption.

Changes in AD: Consumption, wealth

Wealth is NOT income. Income is the money people earn, whereas wealth is the assets people own.

If there is a change in house prices in the economy, there is an increase in wealth and so consumers may be more inclined to increase their consumption.

If there is a change in the value of stocks and shares, then people may again be more inclined to increase their consumption.

Changes in AD: Consumption, consumer confidence

If people become more optimistic about their economic future, then they are likely to spend more now.

If consumers believe there will be an inflation, then they are likely to spend more money on durable goods in the present as they are relatively cheaper. The opposite is also true.

Changes in AD: Consumption, levels of household indebtedness

How willing households are to borrow money affects consumption. If households have a lot of debt, then they are very unlikely to borrow money.

Changes in AD: Investment

Changes in interest rates:

If interest rates increase then the investment from private firms will decrease as they would like to take advantage of the higher rates and make more money from savings.

Changes in business taxes:

If the government increases taxes on business profits, then businesses will have less profits, meaning they can invest less.

Changes in business confidence/expectations:

If businesses are confident that consumer demand will increase they will increase investment.

Changes in AD: Net exports

If exports increase then AD increases, if imports increase then AD decreases.

Short-run Aggregate Supply (SRAS)

The total amount of goods and services that all industries in the economy will produce at every given price level.

Changes in SRAS: Costs of FoP

A change in the costs of the factors of production will lead to a change in the SRAS, since firms depend on their factors of production.

A change could come from:

Wage rates,

Costs of raw materials,

Price of imports,

Government indirect tax or subsidy.

New Classical (LRAS)

In this view, the LRAS curve is perfectly inelastic. It is defined as the 'full employment level of output', and hence, shows the potential output of the economy.

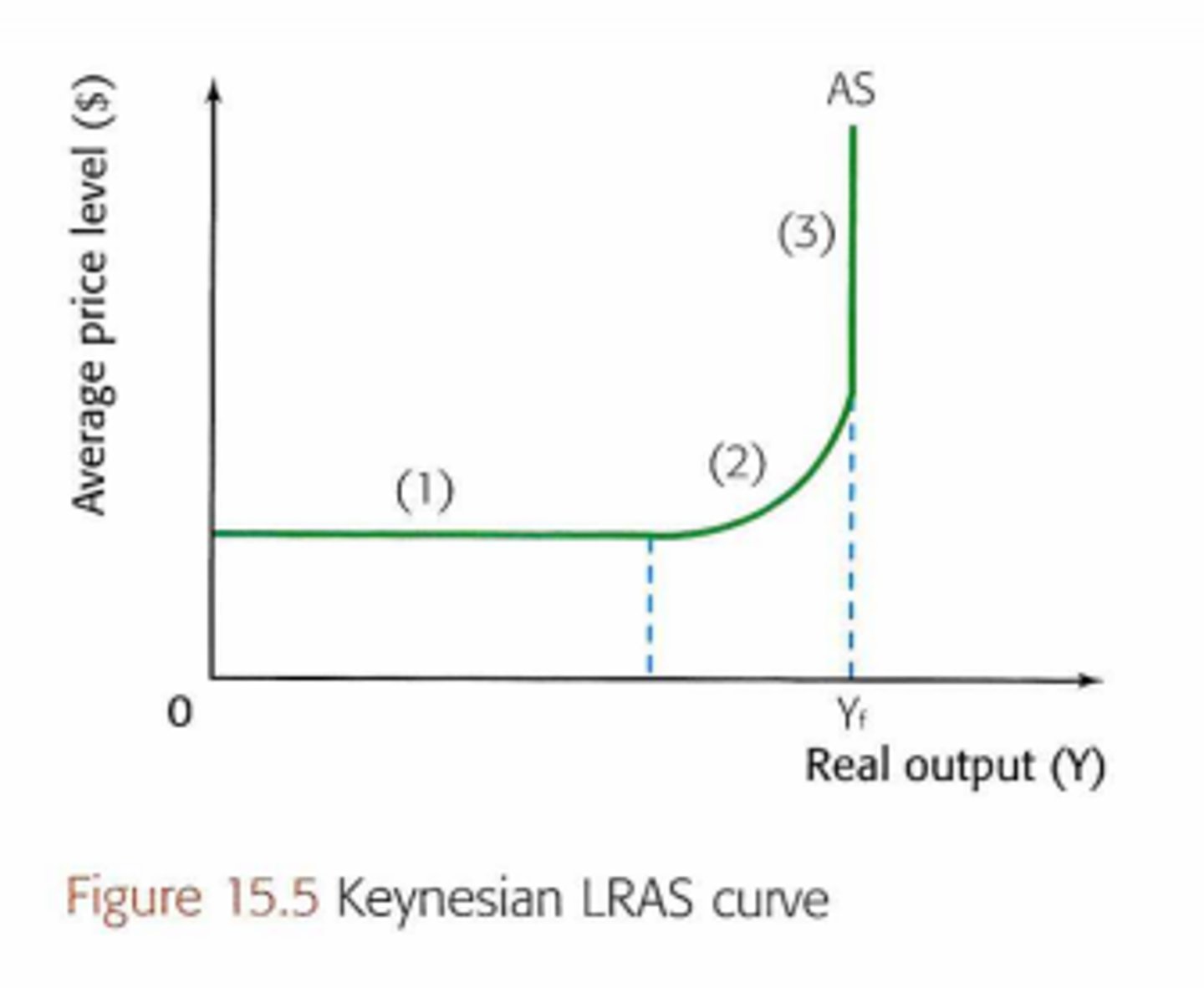

Keynesian AS (AS)

Keynesian AS has 3 phases:

Phase 1:

Perfectly elastic AS, since the economy is at a low level of output compared to the maximum capacity.

Phase 2:

As the economy approaches the maximum level of output, the spare capacity begins to be used up. This leads to an upward sloping AS.

Phase 3:

When the economy is at full capacity, it looks like a new-classical LRAS curve.

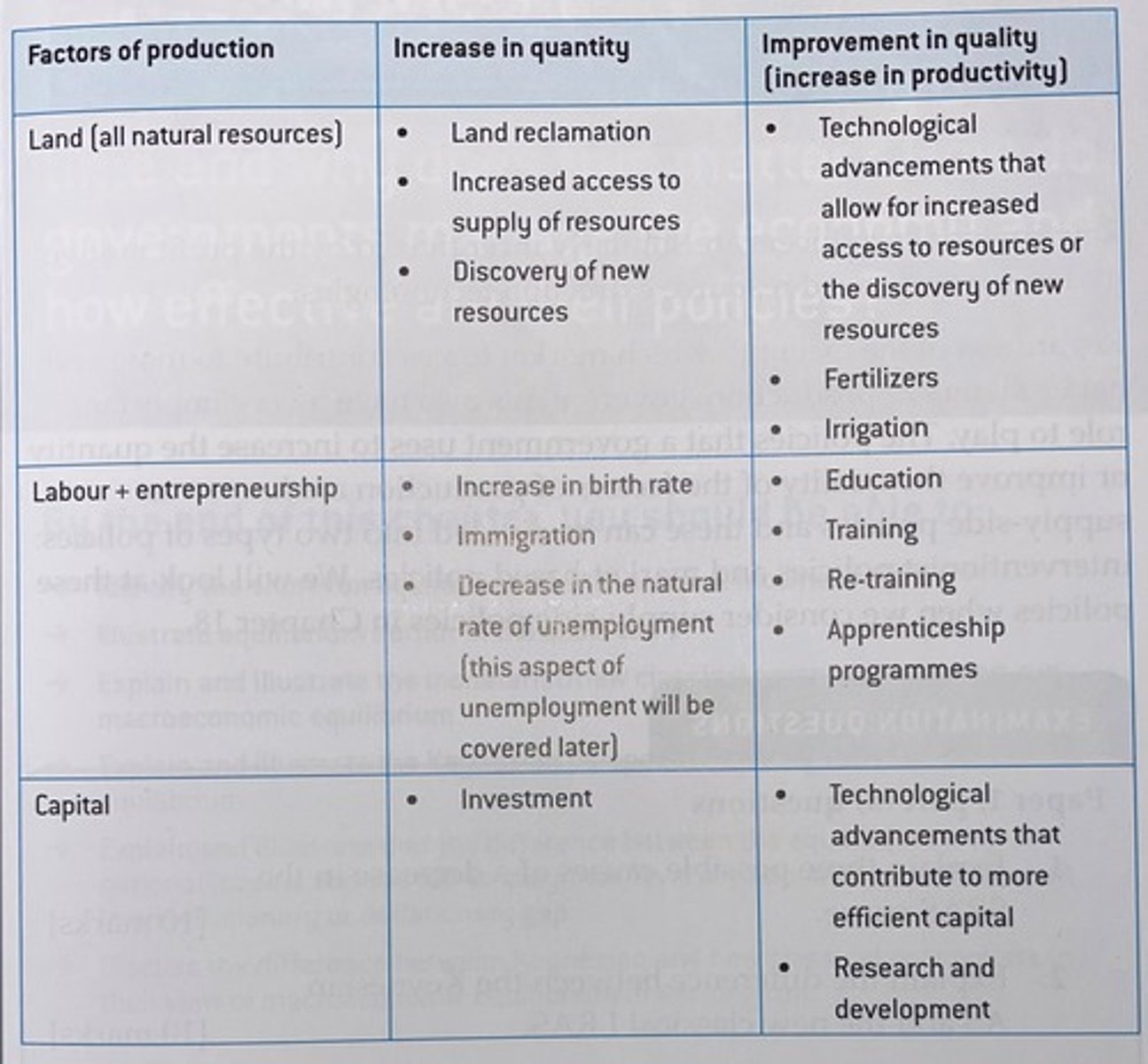

Shift in LRAS/AS

A shift in the AS of an economy will come from a change in the quality or quantity of the factors of production.

Equilibrium in New Classical (SRAS)

In new classical, the short-run equilibrium is represented by when SRAS = AD.

However, in the long-run, the equilibrium will always be at the point of LRAS, and a change in AD will only affect the price level.

New classical economists believe that the economy will always return to the long-run equilibrium level of output.

Full employment = natural rate of unemployment

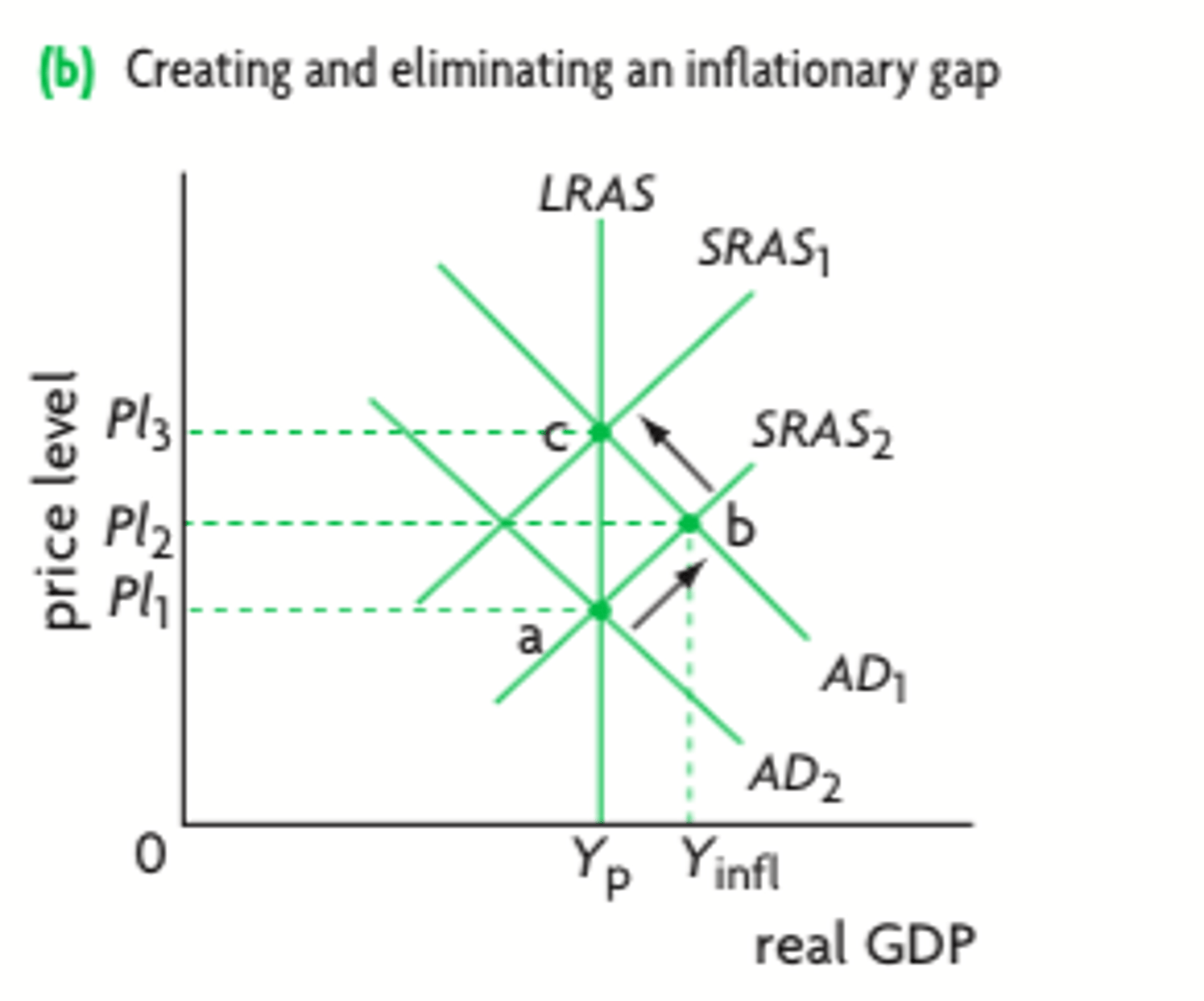

Equilibrium in New Classical (SRAS): Inflationary gap mechanism

In the new classical view, an inflationary gap caused by a short-run increase in aggregate demand is possible, even if it works past the maximum level of output, because firms can pay existing workers overtime wages to increase their output.

Because firms are competing with each other to increase their output and the resources are already fully employed, the average price level of the economy increases.

This increase in the APL also brings an increase in the costs of the factors of production, and so, there is a leftward shift in the SRAS.

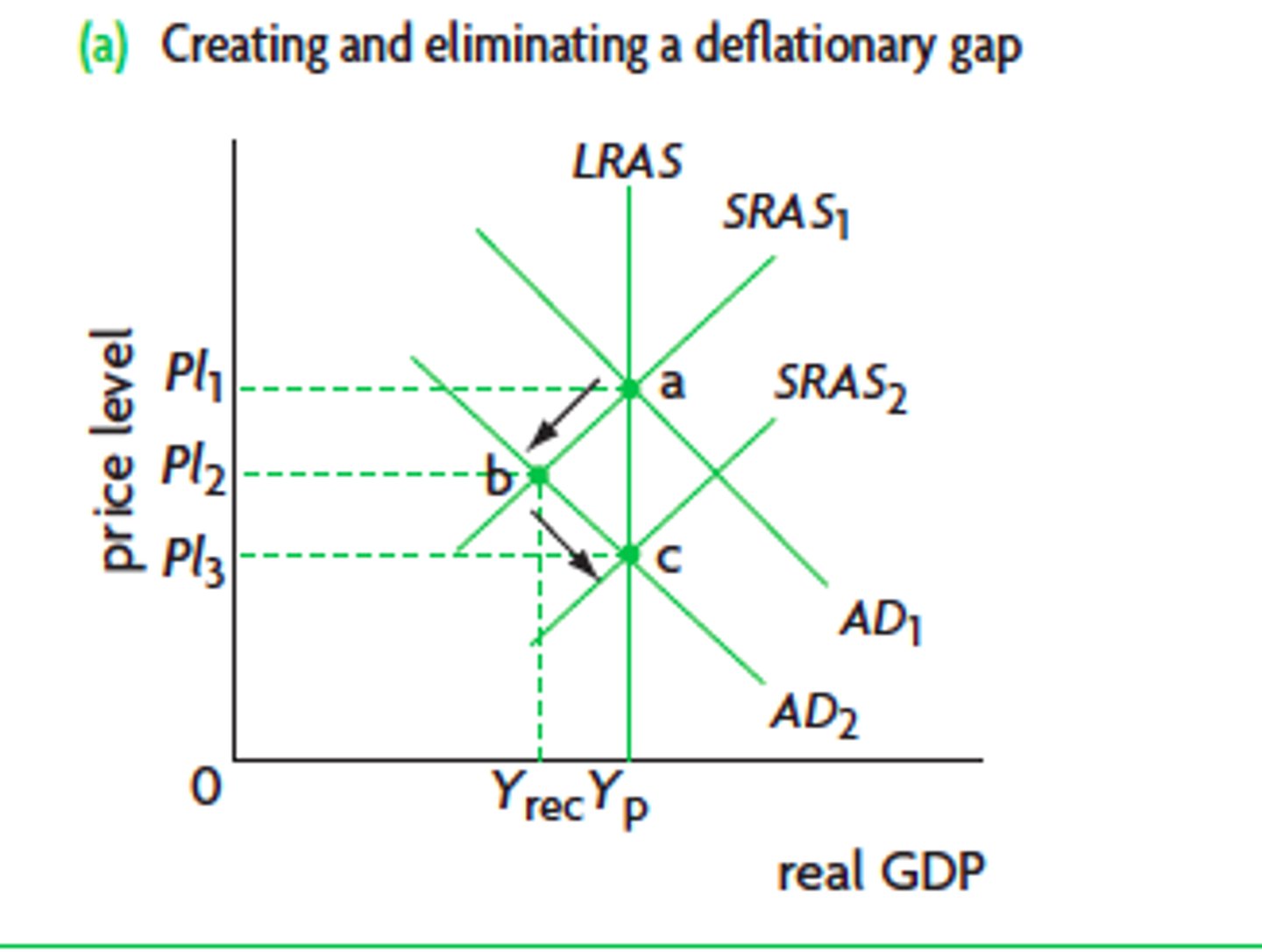

Equilibrium in New Classical (SRAS): Deflationary gap mechanism

In the new classical view, a fall in the AD of the economy will lead to a drop in the average price level. This drop means that the costs of the factors of production also drops, and so, SRAS shifts out, returning the economy to the maximum level of output.

According to this view, changes in the AD of an economy will be purely inflationary in the long run, so governments should avoid deliberately steering the economy towards full employment.

Equilibrium in Keynesian AS (AS)

In a Keynesian view, when the equilibrium happens before phase 3 of the Keynes AS curve, there is still spare capacity in the economy.

Keynesian economists believe that the long-run equilibrium of an economy is below the full level of output, and so, they believe that demand management is vital.