FIN 4250 Vocabulary

0.0(0)

0.0(0)

Card Sorting

1/52

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

53 Terms

1

New cards

Multinational corporations (MNCs)

firms that engage in some form of international business

their managers conduct international financial management and intend to maximize value of the MNC

their managers conduct international financial management and intend to maximize value of the MNC

2

New cards

agency problem

conflict of goals between a firm's managers and shareholders

3

New cards

comparative advantage

allows firms to penetrate foreign markets

4

New cards

imperfect market

conditions where factors of production are somewhat immobile

costs and other restrictions affect the transfer or labor and other resources used for production

costs and other restrictions affect the transfer or labor and other resources used for production

5

New cards

product cycle theory

a firm first becomes established in its home market, where information about markets and competition is readily available

6

New cards

international trade

conservative approach that can be used by firms to penetrate markets (by exporting) or to obtain supplies at a low cost (by importing)

7

New cards

licensing

arrangement whereby one firm provides its technology (copyrights, patents, trademarks, or trade names) in exchange for fees or other considerations

8

New cards

franchising

arrangement, one firm provides a specialized sales or service strategy, support assistance, and possibly an initial investment in the franchise in exchange for periodic fees, allowing local residents to own and manage the specific units

9

New cards

direct foreign investment (DFI)

direct investment in foreign operations

10

New cards

joint venture

business that is jointly owned and operated by two or more firms

11

New cards

acquisitions of existing operations

firms frequently acquire other firms in foreign countries as a means of penetrating foreign markets

acquisitions represent DFI because MNCs directly invest in a foreign country by purchasing the operations of target companies

acquisitions represent DFI because MNCs directly invest in a foreign country by purchasing the operations of target companies

12

New cards

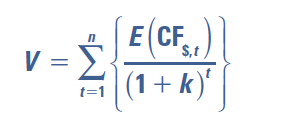

domestic valuation model

purely domestic firm, does not engage in any foreign transactions

n = number of future periods in which cash flows are received

E(CF..) = denotes expected cash flows to be received at the end of period t

k = weighted average cost of capital and required rate of return by investors and creditors that provide funds to the MNC

n = number of future periods in which cash flows are received

E(CF..) = denotes expected cash flows to be received at the end of period t

k = weighted average cost of capital and required rate of return by investors and creditors that provide funds to the MNC

13

New cards

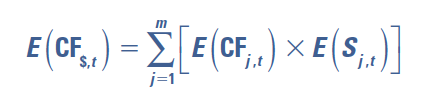

multinational valuation model

deals with multiple currencies

CFj,t = amount of cash flow denominated in a particular foreign currency j at the end of period t

Sj,t = exchange rate at which the foreign currency can be converted to dollars at the end of period t

CFj,t = amount of cash flow denominated in a particular foreign currency j at the end of period t

Sj,t = exchange rate at which the foreign currency can be converted to dollars at the end of period t

14

New cards

uncertainty surrounding MNC cash flows

exposure to international economic conditions

exposure to international political risk

exposure to exchange rate risk

exposure to international political risk

exposure to exchange rate risk

15

New cards

foreign exchange market

allows for the exchange of one currency for another

16

New cards

foreign exchange dealers

serve as intermediaries in the foreign exchange market by exchanging currencies desired by MNCs or individuals

17

New cards

spot market

market where foreign exchange transactions is for immediate exchange

18

New cards

spot rate

exchange rate at which one currency is traded for another in the spot market

19

New cards

interbank market

where trading between banks occurs

20

New cards

bid price

buy quote of currency

21

New cards

ask price

sell quote of currency

22

New cards

bid/ask spread

difference between the bid and ask prices and meant to cover the costs associated with fulfilling requests to exchange currencies

= (ask rate - bid rate) / ask rate

= (ask rate - bid rate) / ask rate

23

New cards

factors that affect bid/ask spread

order costs

inventory costs

competition

volume

currency risk

= f(+order costs, +inventory costs, -competition, -volume, +currency risk)

inventory costs

competition

volume

currency risk

= f(+order costs, +inventory costs, -competition, -volume, +currency risk)

24

New cards

direct quotations

quotations that report the value of a foreign currency in dollars

number of dollars per unit of other currency

= 1/indirect quotation

number of dollars per unit of other currency

= 1/indirect quotation

25

New cards

indirect quotations

quotations that report the number of units of a foreign currency per dollar

= 1/direct quotation

= 1/direct quotation

26

New cards

cross exchange rate

The amount of one foreign currency per unit of another foreign currency

Found using foreign exchange quotations

Found using foreign exchange quotations

27

New cards

forward contract

an agreement between an MNC and a foreign exchange dealer that specifies the currencies to be exchanged, the exchange rate, and the date at which the transaction will occur

28

New cards

forward rate

the exchange rate specified in the forward contract, at which the currencies will be exchanged

29

New cards

forward market

market in which forward contracts are traded

over-the-counter market, the main participants are the foreign exchange dealers and the MNCs that wish to obtain a forward contract

over-the-counter market, the main participants are the foreign exchange dealers and the MNCs that wish to obtain a forward contract

30

New cards

currency futures contract

specifies a standard volume of a particular currency to be exchanged on a specific settlement date

31

New cards

futures rate

the exchange rate at which an entity can purchase or sell a specified currency on the settlement date in accordance with the futures contract

32

New cards

currency call option

provides the right to buy a specific currency at a specific price (strike price or exercise price) within a specific period of time

33

New cards

currency put option

provides the right to sell a specific currency at a specific price within a specific period of time

34

New cards

eurodollars

The dollar deposits in banks in Europe (and on other continents)

35

New cards

Asian money market

accommodates dollar-denominated bank accounts

36

New cards

London Interbank Offer Rate (LIBOR)

currency's money market is highly influenced

interest rate most often charged for short-term loans between banks in international money markets

interest rate most often charged for short-term loans between banks in international money markets

37

New cards

international money market securities

When MNCs and government agencies issue debt securities with a short-term maturity

(one year or less) in the international money market

(one year or less) in the international money market

38

New cards

syndicate

join together

39

New cards

foreign bond

an international bond issued by a borrower foreign to the country where the bond is placed

40

New cards

parallel bonds

currency denominating each type of bond is determined by the country where it is sold

41

New cards

eurobonds

bonds that are sold in countries other than the country whose currency is used to denominate the bonds

42

New cards

American depository receipts (ADRs)

certificates representing bundles of the firms stock

43

New cards

depreciation

decline in currency's value

44

New cards

appreciation

increase in currency value

45

New cards

percent change in foreign currency value

S = spot rate

S t-1 = spot rate at earlier date

S t-1 = spot rate at earlier date

46

New cards

real interest rate

adjusts the nominal interest rate for inflation

= nominal interest rate - inflation rate

= nominal interest rate - inflation rate

47

New cards

forward contract

an agreement between a corporation and a financial institution (such as a commercial bank) to exchange a specified amount of a currency at a specified exchange rate (called the forward rate) on a specified date in the future

48

New cards

non-deliverable forward contract (NDF)

often used to hedge currencies in emerging market

agreement regarding a position in a specified amount of a specified currency, a specified exchange rate, and a specified future settlement date

agreement regarding a position in a specified amount of a specified currency, a specified exchange rate, and a specified future settlement date

49

New cards

currency futures contracts

contracts specifying a standard volume of a particular currency to be exchanged an a specific settlement date

- used to hedge foreign currency positions

- used to hedge foreign currency positions

50

New cards

currency call option

grants the right to buy a specific currency at a designated price within a specific period of time

51

New cards

exercise price/strike price

price at which the owner is allowed to buy the currency

- desirable when one wishes to lock in a maximum price to be paid for a currency in the future

- desirable when one wishes to lock in a maximum price to be paid for a currency in the future

52

New cards

factors affecting currency call option premiums

spot price relative to strike price

length of time before the expiration date

volatility of the currency

length of time before the expiration date

volatility of the currency

53

New cards

currency put option

the right to sell a currency at a specified price (strike price) within a specified period of time

- owner of put option is not obligated to exercise the option

- owner of put option is not obligated to exercise the option