3.1 Business growth and 3.2 business objectives

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Reasons why firms grow

Owners/shareholders desire for higher levels of profit

Desire to reduce average costs by benefiting from economies of scale

Growth provides opportunities for product diversification

Desire for stronger market power (monopoly) so as to increase profits

Reasons why small firms exist

They offer a more personalised service and focus on building relationships with their customers

Many small firms operate in mass markets with low barriers to entry

They provide a product that is in a niche market - smaller market size but can be very profitable

Owners goal is not profit maximisation but rather an acceptable quality of life (satisficing)

Economies of scale

Occurs when an increase in the sale of output results in a lower cost per unit

Product diversification

Occurs when a firm is able to increase the number of products that it offers and reduces risk

if one product fails others may well still be successful

barriers to entry

Conditions that make it difficult to enter a market to compete with the existing suppliers

diseconomies of scale

Occurs when an increase in the sale f output results in a higher cost per unit

Public sectors

owned and controlled by the Government

Their goal is not profit maximisation but to provide a service

There are a wide variety of government owned organisations in the UK

private sector

organisations are owned and controlled by private individuals

Types of ownership vary from sole trader to partners to company shareholders

The goal of most private sector organisations is profit maximisation

This often means the private sector is more efficient than the public sector, with higher levels of productivity

not-for-profit orgnaisations

They exist to provide a service or meet a need

Many sell goods/services and use the profits they generate to further their objectives, e.g. The British Heart Foundation

The government exempts them from paying direct taxes

How businesses grow

organic growth

forwards and backwards vertical integration

horizontal integration

conglomerate integration

Organic growth (internal)

usually generated by

gaining greater market share

product diversification

opening a new store

international expansion

Investing in new technology/production machinery

Inorganic growth

Vertical integration (forward or backwards)

Horizontal integration

Conglomerate integration

forward vertical integration

nvolves a merger or takeover with a firm further forward in the supply chain

E.g. A dairy farmer merges with an ice-cream manufacturer

merger

Occurs when 2 firms combine to create a new firm

takeover

The purchase of a controlling interest in one firm by another

Backward vertical integration

Involves a merger/takeover with a firm further backward in the supply chain

E.G An ice-cream retailer takes over an ice-cream manufacturer

Vertical integration

Refers to a merger/takeover of another firm in the supply chain/different stage of the production process

Horizontal integration

A merger/takeover of a firm at the same stage of the production process

Conglomerate integration

Merger/takeover of firms in an entirely different industry

Advantages of organic growth

The pace of growth is manageable

Less risky as growth is financed by profits and there is expertise in the industry

Avoids diseconomies of scale

The management know and understand every part of the business

Disadvantages of organic growth

The pace of growth can be slow and frustrating

Not necessarily able to benefit from economies of scale

Access to finance may be limited

advantages of vertical integration

Reduces the cost of production as middle party profits are eliminated

Lower costs make the firm more competitive

Greater control over the supply chain reduces risk as access to raw materials is more certain

Quality of raw materials can be controlled

Forward integration adds additional profit as the profits from the next stage of production are assimilated

Forward integration can increase brand visibility

Disadvantages of vertical integration

Reduces the cost of production as middle party profits are eliminated

Lower costs make the firm more competitive

Greater control over the supply chain reduces risk as access to raw materials is more certain

Quality of raw materials can be controlled

Forward integration adds additional profit as the profits from the next stage of production are assimilated

Forward integration can increase brand visibility

advanatages of horizontal integration

Rapid increase of market share

Reductions in the cost per unit due to economies of scale

Reduces competition

Existing knowledge of the industry means the merger is more likely to be successful

A firm may gain new knowledge or expertise

Disadvantages of horizontal integration

Diseconomies of scale may occur as costs increase, e.g. unnecessary duplication of management roles

There can be a culture clash between the two firms that have merged

constraints on business growth

The size of the market: the more niche the market, the smaller the number of potential customers. Even large firms face this constraint as they move closer to capturing the domestic market - to increase market size, they will have to expand internationally

Access to finance: small firms find it harder to access loans as they are considered to be more risky than larger firms. Due to the perceived risk, interest rates for any loans acquired tend to be higher

Owner objectives: Many owners desire to grow a business to a point that provides a desired lifestyle or standard of living - and not beyond

Regulation: Large firms are often constrained by competition regulation that aims to limit monopoly power. Firms that sell demerit goods also find growth can be limited by government policies such as age restrictions, minimum prices and indirect taxes

reasons for demergers

Reducing diseconomies of scale 0- Decreasing the size of the firm can reduce the diseconomies and lower the cost/unit which increases the profitability

Cultural differences- Sometimes these differences are irreconcilable and not worth the expense to change

remove loss making divisions - It can be more profitable to remove loss-making divisions and replace them with outsourcing

Increased business focus- If efforts and resources are scattered across a large number of firms/ industries it can be hard to maintain focus and profitability. Narrowing the focus can improve profitability

Impact of demerges on the firm

Opportunity for a more narrow focus on the core business

Removing loss-making portions of the business

Increased efficiency and lower costs/unit

Increasing the annual profits for the year that the demerger occurred

Removing some difficult cultural differences

impact of demergers on employees

Some workers may lose their jobs

Reduced friction from cultural differences can help build better team dynamics

A smaller workforce provides more opportunity for promotion

Less complications in daily tasks due to more narrow focus

impacts of demergers on consumers

If successful, better quality products and customer service

If successful, lower prices due to the firms new efficiencies

If unsuccessful, a narrower product range and perhaps worse quality/customer service

Business objectives

profit maximisation

revenue maximisation

sales maximisation

satisficing

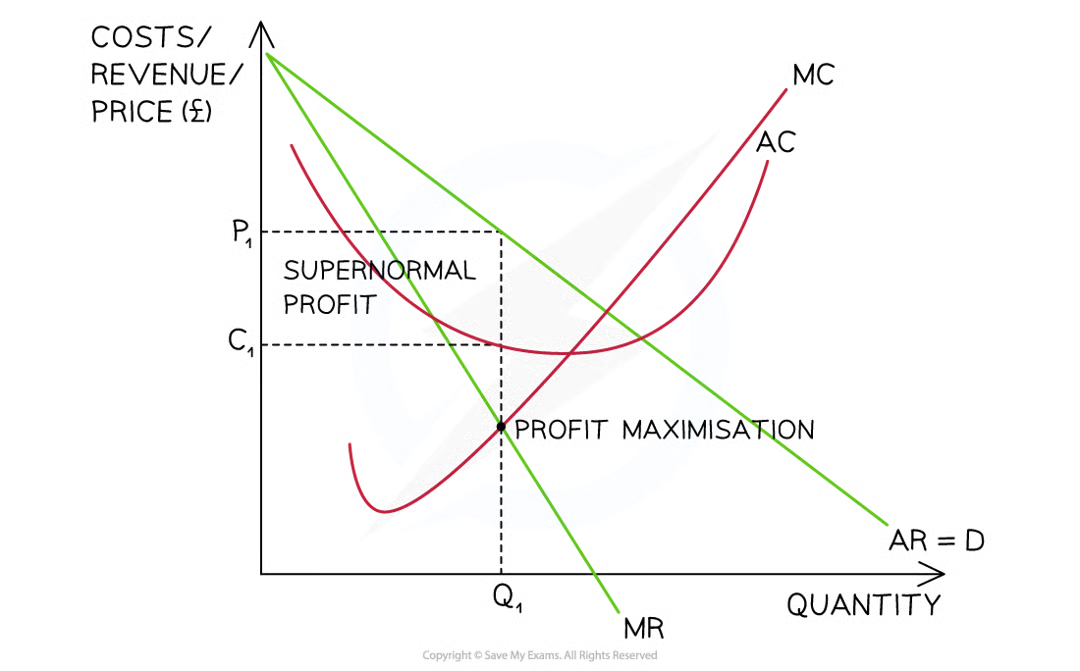

profit maximisation

When MC < MR additional profit can still be extracted by producing an additional unit of output

Profit maximisation rule = A firm should continue producing additional units until MC= MR

At the profit maximisation level of output (MC = MR)

The selling price is P1

The average cost is C1

The supernormal profit =(p1-c1) x Q1

Revenue maximisation

Firms will also maximise revenue in order to increase output & benefit from economies of scale

In the short-term firms may use this strategy to eliminate the competition as the price is lower than when focusing on profit maximisation

level of output where MR = 0

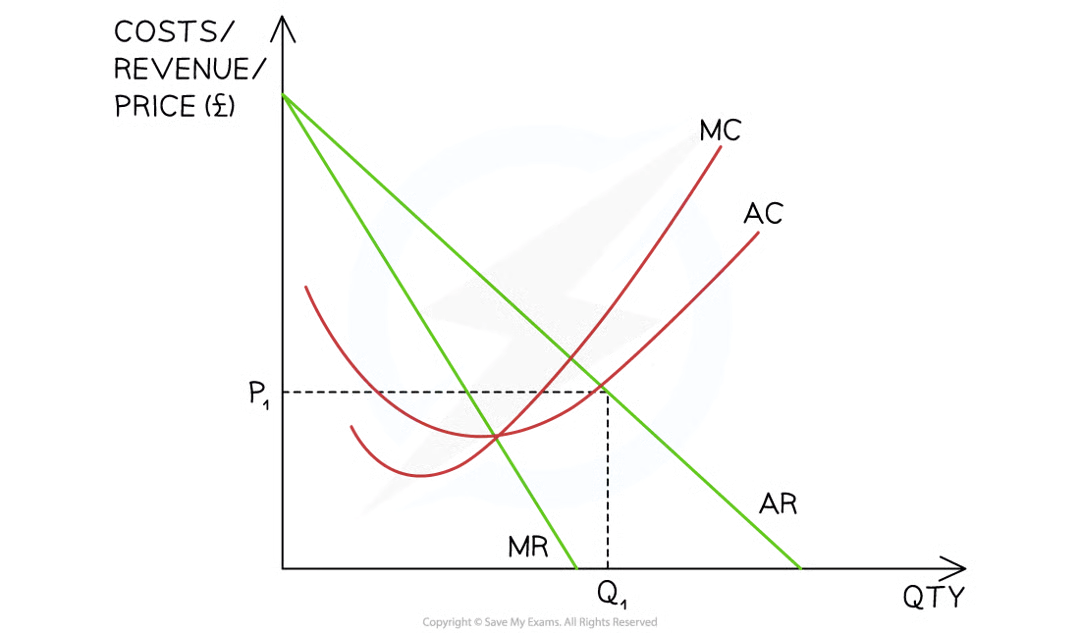

Sales Maximisation and satisficing

This occurs at the level of output where AC = AR (normal profit/breakeven)

In the short-term firms may use this strategy to clear stock during a sale

They sell remaining stock without making a loss per unit

At the sales maximisation level of output (AC = AR)

The selling price is P1

The average cost is also at P1

The firm is breaking even (normal profit)

Satisficing

Opting for a satisfactory level of profit rather than profit maximisation

occurs as a result of the principle agent problem

principle agent problem

Occurs when one group (the agent) makes decisions on behalf of another group (the principle) often placing their priorities above the principles

Rationally, managers know shareholders want to profit maximise

Rationally, managers want to maximise sales or revenue so as to increase their wages

Managers (who control the business) settle for a level of output somewhere between profit and sales maximisation

This increases their wages and reduces potential conflict with shareholders