ACCTG 331 Exam 3 Review: Revenue Recognition & Balance Sheet

1/85

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

86 Terms

Revenues

Inflows enhancing assets or settling liabilities.

Revenue Measurement

Critical for accurate financial reporting.

Control Transfer Indicators

Signs control shifts from seller to customer.

Obligation to Pay

Customer must pay seller for goods/services.

Legal Title

Ownership rights to an asset.

Physical Possession

Customer physically holds the asset.

Risks and Rewards

Customer assumes ownership risks and benefits.

Accepted Asset

Customer acknowledges receipt of the asset.

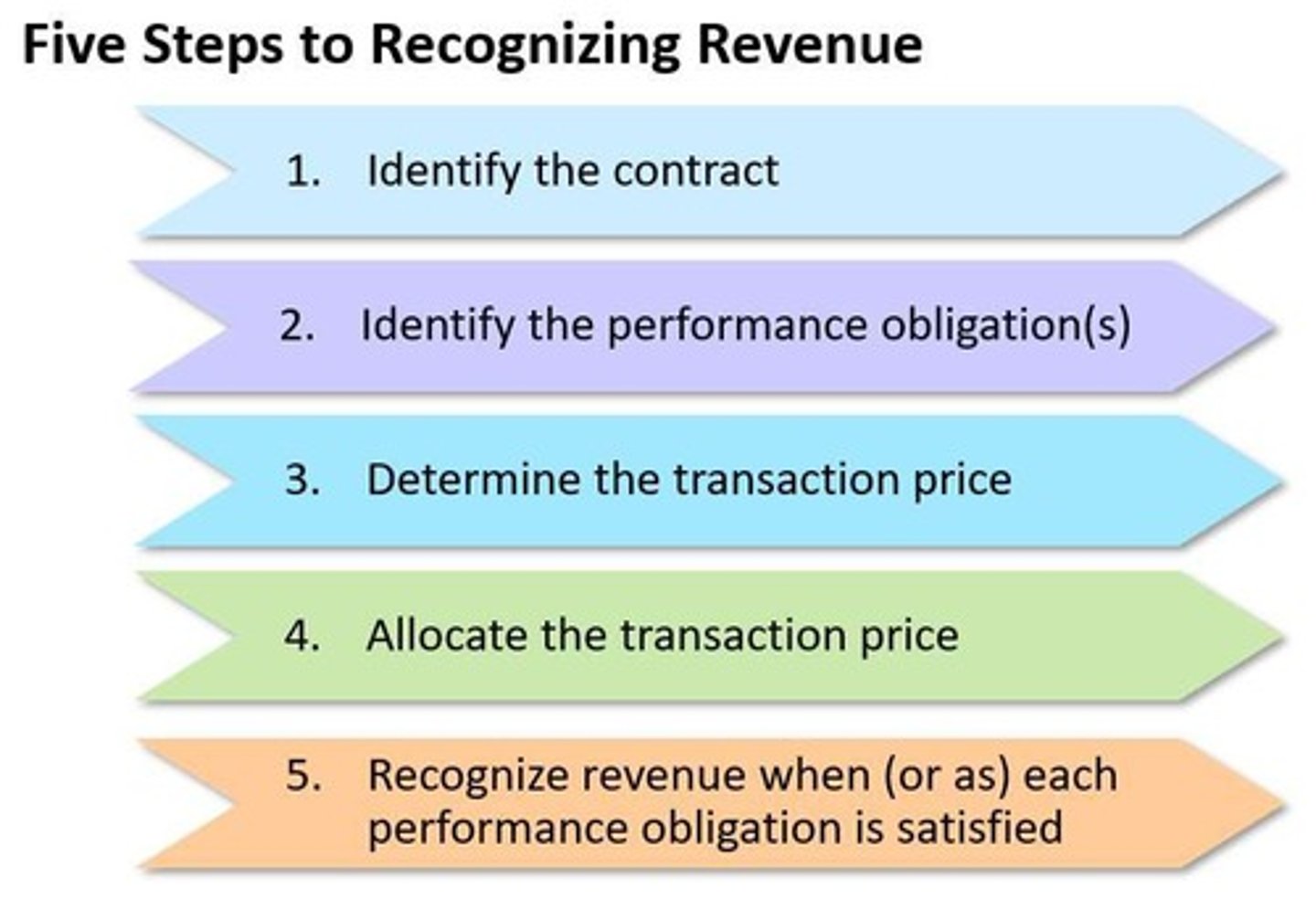

Revenue Recognition Criteria

Conditions for recognizing revenue over time.

Benefit Consumption

Customer uses seller's work as performed.

Asset Control

Customer controls asset during its creation.

No Alternative Use

Seller's asset has no other use.

Progress Payment Rights

Seller entitled to payment for work done.

Performance Obligation Satisfaction

Revenue recognized when obligation is fulfilled.

Output-Based Estimate

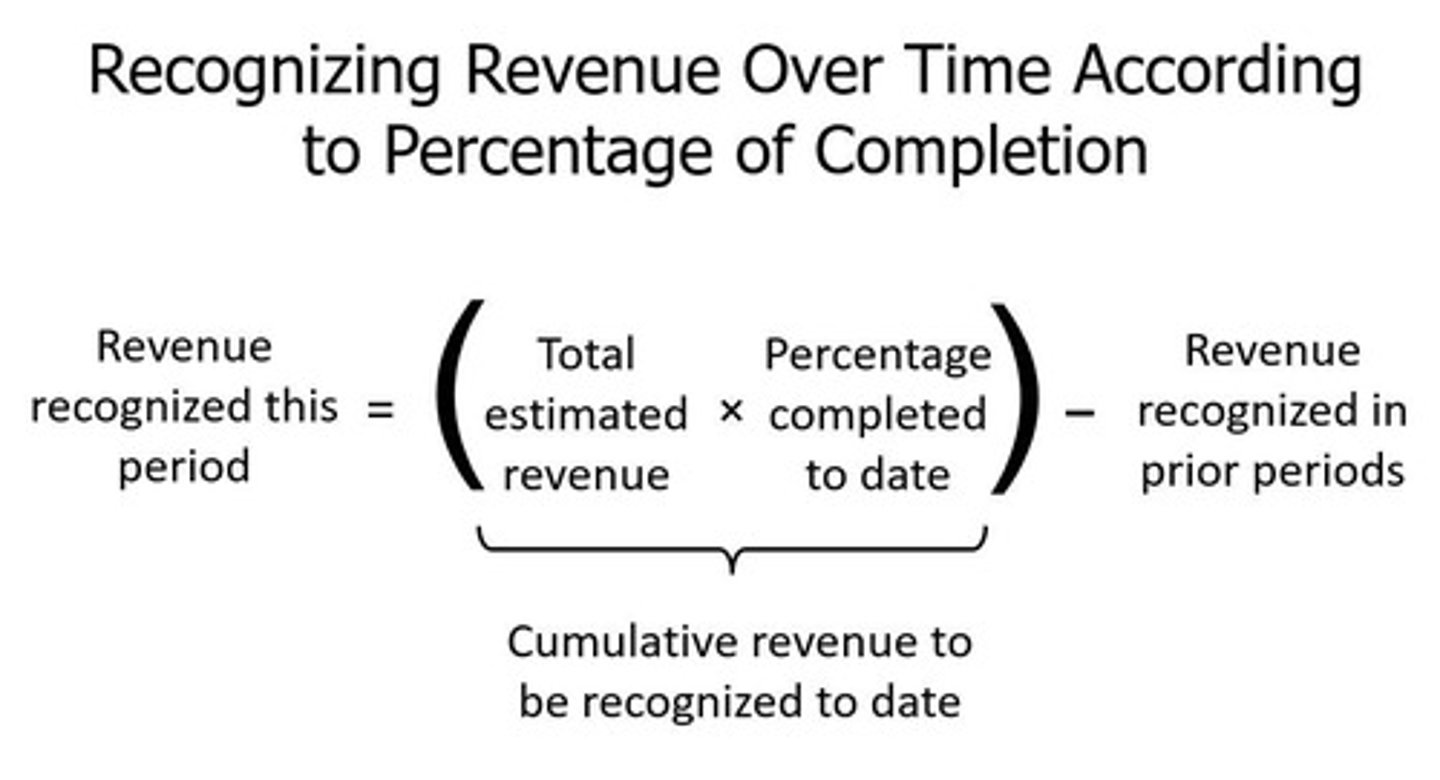

Measured by goods/services transferred to date.

Input-Based Estimate

Measured by effort relative to total expected.

Multiple Performance Obligations

Contracts with more than one obligation.

Identify Performance Obligation

Recognizing distinct goods/services in contracts.

Distinct Goods/Services

Capable of being separate and identifiable.

Prepayments

Part of transaction price, not obligations.

Quality-Assurance Warranties

Part of performance obligation for acceptable quality.

Right of Return

Potential failure to satisfy performance obligation.

Extended Warranties

Considered performance obligations in contracts.

Extended Warranty

Warranty purchased separately or beyond quality assurance.

Material Right

Customer receives something not otherwise available.

Transaction Price

Total amount seller expects to receive.

Variable Consideration

Price depends on future event outcomes.

Right of Return

Sales allowing customers to return products.

Principal vs Agent

Determines seller's role in transaction.

Time Value of Money

Value of money changes over time.

Seller Payments to Customer

Incentives or discounts provided to customers.

Adjusted Market Assessment Approach

Price based on market sale conditions.

Expected Cost Plus Margin Approach

Cost estimation plus profit margin added.

Residual Approach

Total price minus known selling prices.

Performance Obligation

Promise to transfer goods or services.

Revenue Recognition Timing

When revenue is recognized for obligations.

Franchise Arrangement

Franchisor grants rights to franchisee for products.

Intellectual Property License

Rights to use franchisor's intellectual property.

Long-Term Contracts

Contracts spanning multiple accounting periods.

Single Performance Obligation

Single promise in long-term contracts.

Revenue Over Time

Recognizing revenue as progress is made.

Contract Completion Revenue

Revenue recognized upon finishing the contract.

Construction Billings

Total billed amount for construction services.

Accounts Receivable

Money owed to a company for services.

Cash Collected

Total cash received from customers.

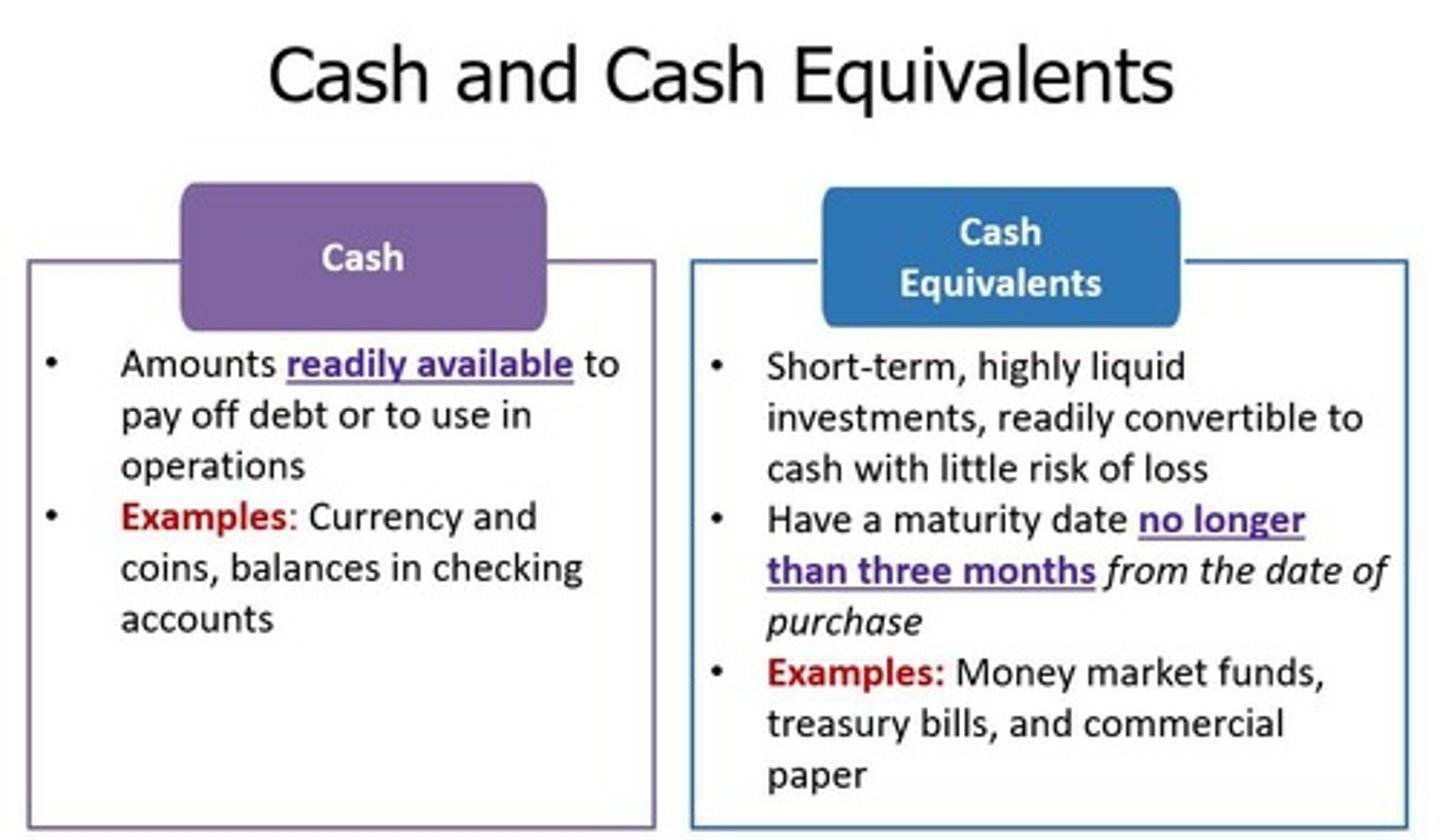

Restricted Cash

Cash not available for current use.

Debt Instruments

Require borrower to set aside funds.

Compensating Balance

Amount maintaining a minimum balance for loans.

Cash Equivalents

Highly liquid investments easily convertible to cash.

Accounts Receivable

Revenue recognized from credit sales.

Performance Obligation

Condition satisfied when delivery occurs.

Initial Valuation

Revenue equals amount entitled upon performance satisfaction.

Transaction Price Allocation

Distributing price among performance obligations in contracts.

Gross Method

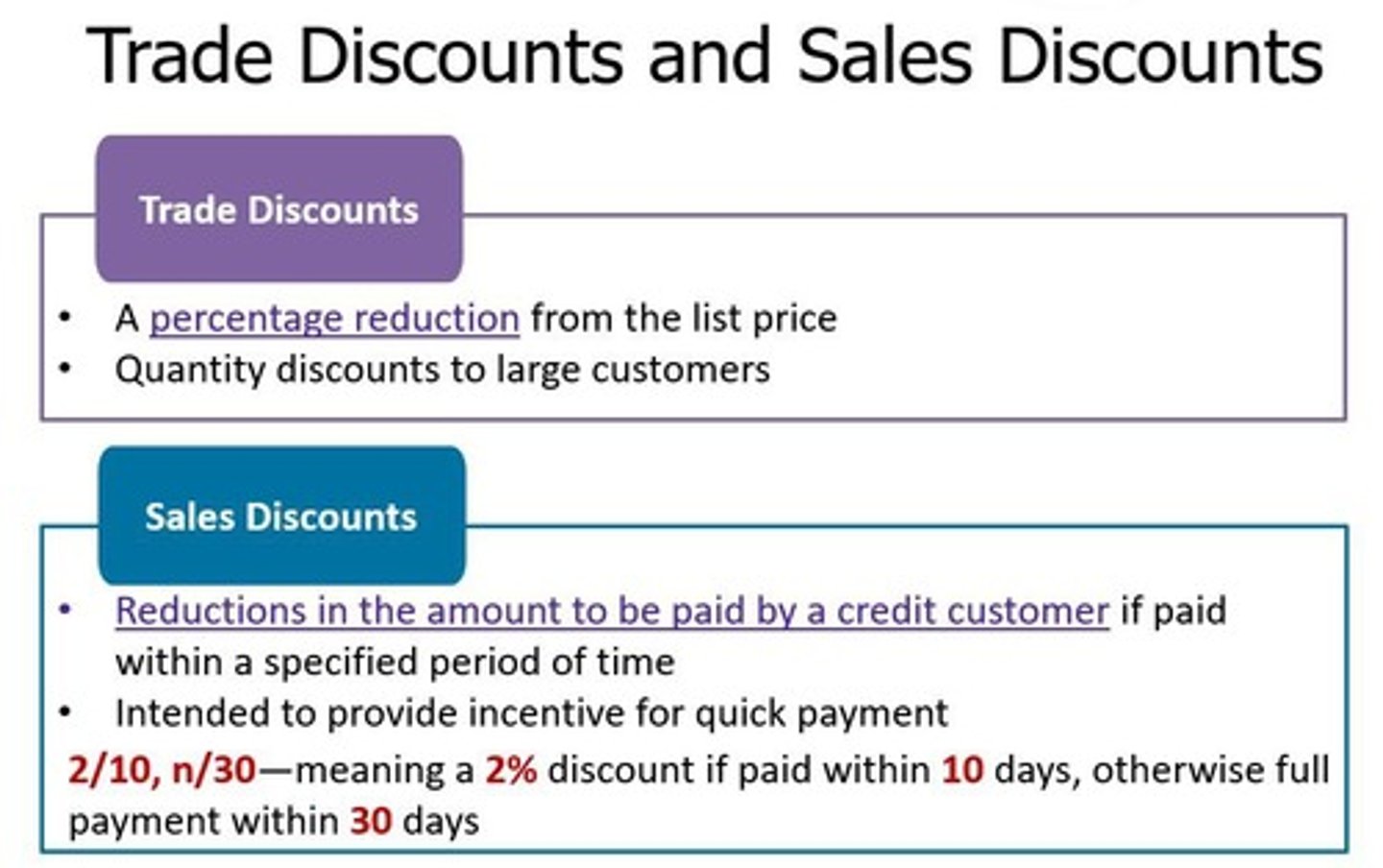

Records sales at full price, adjusts for discounts.

Net Method

Records sales net of discounts, adjusts for forfeits.

Sales Returns

Merchandise returned for refund or credit.

Sales Allowance

Price reduction incentive to avoid returns.

Accrual of Returns

Recognize returns at sale to avoid income distortion.

Credit Losses

Inherent costs of granting credit, often termed bad debts.

Subsequent Valuation

Assessing collectability of accounts receivable post-sale.

Noncurrent Restricted Cash

Restricted cash linked to noncurrent debt obligations.

Current Restricted Cash

Restricted cash linked to current debt obligations.

Effective Interest Rate

Actual interest cost higher than stated rate.

Low Interest Account

Account with minimal or no interest for balances.

Sales Discounts

Reductions in sales price for early payment.

Allowance for Doubtful Accounts

Estimate of uncollectible accounts receivable.

Direct Write-Off Method

Writes off bad debts when deemed uncollectible.

Allowance Method

Estimates bad debts and reduces receivables accordingly.

GAAP

Generally Accepted Accounting Principles for financial reporting.

Contra-Asset Account

Account reducing the carrying value of assets.

Bad Debt Expense

Recognized when estimating uncollectible accounts, not when written off.

Uncollectible Accounts

Accounts deemed unlikely to be collected.

Income Tax Purposes

Direct Write-Off Method is required for tax reporting.

Accounts Receivable

Money owed to a company by customers.

Balance Sheet

Financial statement showing assets, liabilities, and equity.

Carrying Value

Net amount at which an asset is recognized.

Discount on Note Receivable

Future interest revenue deducted from face value.

Short-Term Notes

Notes due within one year, often noninterest-bearing.

Face Amount

The nominal value of a note or bond.

Material Bad Debts

Significant amounts requiring estimation under GAAP.

Recognition of Bad Debt

Acknowledgment of potential losses before actual write-off.

Write-Off

Removal of an uncollectible account from records.

Future Interest Revenue

Interest expected to be earned over time.

Allowance for Uncollectible Accounts

Contra-asset account estimating future bad debts.

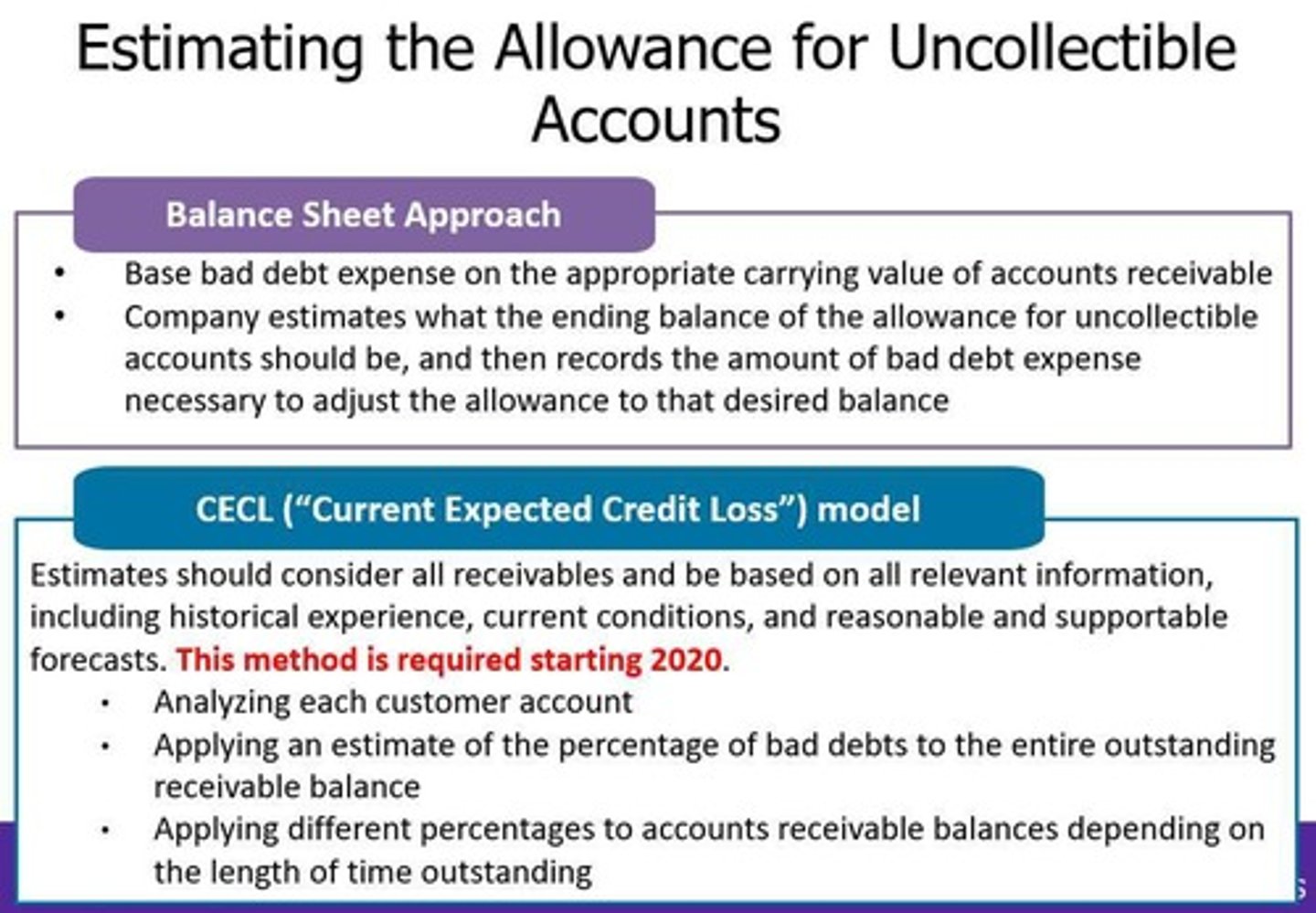

Balance Sheet Approach

Method for estimating allowance based on aging accounts.

Aging Information

Analysis of accounts receivable by the length of time outstanding.