ACYTAXN: Local Taxation and Preferential Taxation

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

Where does the local tax authority emanate from?

a. Legislature b. Sanggunian

c. Executive d. Supreme Court

B

Which of the following is not a fundamental principle of local taxation?

a. It shall be uniform in each local sub-unit

b. It shall evolve a progressive system of taxation

c. The revenues collected under the Local Government Code shall inure solely to the benefit of and subject to disposition by the LGU levying the tax or other imposition (autonomy)

d. Collection of local taxes can be delegated to any private person

D

Which of the following is not one of the fundamental principles of real property tax?

a. Real property shall be appraised at its current and fair market value

b. Real property shall be classified for assessment purposes on the basis of actual use

c. Real property shall be assessed on the basis of uniform classification within each LGU

d. None of the above

D

Which of the following is incorrect regarding situs of local business tax?

a. When there is a sales outlet or branch, the situs is the LGU where the outlet is situated

b. When there is no sales outlet or branch, the situs is the LGU where principal office is situated

c. When the manufacturer's office is the same as factory outlet or plant, the situs is the LGU where the manufacturer’s principal office is situated

d. When the manufacturer's office is different from factory outlet or plant, the situs is 70% by the LGU where the principal office is located and 30% by the LGU where the project office or plant is located

D

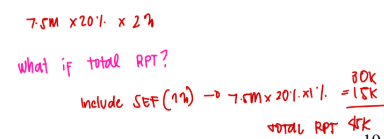

A parcel of land in Metro Manila was assessed as commercial with a fair market value of P7,500,000. How much would be the highest possible amount of annual basic real property tax that can be collected from the owner?

Situation 1: The property is located in a city.

a. P3,750,000

b. P75,000

c. P37,500

d. P0

B

A parcel of land in Metro Manila was assessed as commercial with a fair market value of P7,500,000. How much would be the highest possible amount of annual basic real property tax that can be collected from the owner?

Situation 2: The property is located in a municipality and assessed as residential.

a. P1,500,000

b. P15,000

c. P30,000

d. P0

C

How much is the maximum annual additional community tax for individuals?

a. P20,000 b. P10,000

c. P15,000 d. P5,000

D

The maximum annual additional community tax for corporations is:

a. P20,000 b. P10,000

c. P15,000 d. P5,000

B

Which of the following is not one of the benefits of senior citizens?

a. 20% discount and exemption from Value Added Tax on certain goods and services for their own use

b. A minimum of 5% discount on water and utility bills up to 100 kilowatt hours of electricity and 30 cubic meters of water, registered under their name

c. Mandatory PhilHealth coverage

d. Groceries worth up to P2,500 per week enjoy 10% off the retail prices of at least four kinds of basic necessities and prime commodities

D

Which of the following is not one of the benefits of PWDs?

a. 20% discount and Value Added Tax (VAT) exemption when buying certain products and services nationwide

b. 5% discount on basic necessities and prime commodities

c. Express lanes for PWDs

d. A minimum of 5% discount on water and utility bills up to 100 kilowatt hours of electricity and 30 cubic meters of water, registered under their name

D

It is defined as any business enterprise engaged in production, processing, or manufacturing products, including agro-processing, as well as trading and services, with total assets of not more than P3 million. Such assets shall include those arising from loans but not the land on which the plant and equipment are located.

a. Economic zones

b. RHQs/ROHQs of Multinational Corporations

c. Barangay Micro Business Enterprise (BMBEs)

d. PEZA registered entities

C

Which of the following is not one of the benefits of BMBEs?

a. Exemption from the coverage of the Minimum Wage Law

b. Income tax exemption from income arising from the operations of the enterprise

c. Priority to a special credit window set up specifically for the financing of BMBEs

d. Exemption from payment of any and all local government imposts, fees, licenses, or taxes.

D

In general, in order to avail of relief from double taxation on income earned within the Philippines in the form of decreased tax rates thereon or exemption therefrom, what must be submitted by a non-resident alien to the International Tax Affairs Division (ITAD) of the BIR?

a. Tax treaty law of the host country

b. Tax treaty relief application (TTRA)

c. None of the above

d. Memorandum of agreement between the taxpayer and host country

B

It is the Philippines government agency tasked to promote investments, extend assistance, register, grant incentives to and facilitate the business operations of investors in export-oriented manufacturing and service facilities.

a. Board of Investments

b. Bureau of Customs

c. Philippine Economic Zone Authority

d. National Economic Development Authority

C

Which of the following is not one of the incentives of PEZA-registered companies?

a. Income Tax Holiday (ITH) – 100% exemption from corporate income tax

b. Tax and duty free importation of raw materials, capital equipment, machineries, and spare parts.

c. Exemption from wharfage dues and export tax, impost or fees.

d. Exemption from VAT on local purchases of goods and services, subject to compliance with BIR and PEZA requirements.

D

The Philippine Board of Investment (BOI) is an agency under the

a. National Economic Development Authority

b. Department of Trade and Industry

c. Office of the President

d. Bureau of Domestic Trade

B

Which of the following is not one of the incentives of BOI-registered companies?

a. Income tax holiday

b. Duty exemption on imported capital equipment, spare parts, and accessories

c. Additional deduction for labor expense (ADLE)

d. 5% gross income tax upon expiration of the income tax holiday

D