Risk and Insurance chapter 10

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

Basic Parts of an Insurance Contract

Declarations

Definitions

Insuring Agreement

Named Perils Coverage

Open-Perils (Special) Coverage

Conditions

Miscellaneous Provisions

Extra policy rules that explain how certain situations are handled

Examples:

Cancellation: When and how the policy can be ended

Subrogation: The insurer’s right to recover money from a third party who caused the loss'

Grace Period: Extra time to pay a premium right before coverage ends

Misstatement of Age: If someone lies about their age on a life policy, benefits may be adjusted

Declarations

Statements that provide key information about the property or activity being insured

Usually appear on the first page of the policy

In property insurance, declarations typically include:

Name of the insured

Location of the property

Period of protection (policy term)

Amount of insurance (coverage limit)

Premium (cost of the policy)

Deductible (amount you pay before insurance kicks in)

Example: John buys homeowners insurance. The declarations page shows his name, his house address, $300,000 coverage, $1,000 deductible, and the yearly premium of $1,200

Definitions

A section in the policy that explains the meaning of key terms used in the contract

Helps avoid confusion about insurance language

Example: The term “you” in the policy refers to the insured person (ex. John)

Insuring Agreement

Summarizes the major promises of the insurer — basically, what the insurance company agrees to cover

Example: The policy states the insurer will pay for damage to John’s house caused by fire or storm

Named Perils Coverage

Only covers the specific risks (perils) listed in the policy

Example: If the policy lists fire, theft, and windstorm, only damage from those causes is covered

Damage from an unlisted peril, like earthquake, is not covered

Open-Perils (Special) Coverage

Covers all losses except those specifically excluded in the policy

Insurers usually avoid saying “all” explicitly

“All-risks” coverage has fewer gaps, meaning more things are automatically covered

Burden of proof is on the insurer to deny the claim

Example: John’s house is damaged by a falling tree (not specifically excluded), the insurer pays because it’s not on the exclusion list

Exclusions

Items, losses, or perils that are not covered by the insurance policy

Insurance contracts commonly include three types of exclusions:

Excluded Perils — Specific risks that aren’t covered

Example: Flood damage or intentional damage caused by the insured

Excluded Losses — Certain types of losses are not covered by the policy

Example: A professional liability loss is excluded in a homeowners policy

Excluded Property — Certain property is not covered

Example: Tools used in a business are not covered as personal property in a homeowners policy

Why Are Exclusions Necessary?

Some perils are not commercially insurable

These are risks that would be too large or unpredictable for insurance companies to cover

Example: War causes widespread destruction, which makes it impossible for insurers to predict or afford the losses — so it’s excluded

Extraordinary hazards are present

When someone uses property in a riskier way than normal, insurers exclude that use

Example: Using your personal car as a taxi or rideshare creates extra risk, so it’s not covered under a normal auto policy

Coverage is provided by other contracts

Some losses are excluded because they’re already covered under a different type of insurance

Example: Homeowners insurance excludes car-related accidents because they’re covered by auto insurance instead

Moral Hazard Problems

Exclusions or limits help prevent people from intentionally causing or exaggerating a loss to collect insurance money

Example: Homeowners policies often limit cash coverage to $200, so someone can’t claim a huge loss of “cash” they might not have actually had

Attitudinal Hazard Problems

Exclusions discourage carelessness or neglect by making people responsible for certain losses

Example: If someone leaves their doors unlocked and their belongings are stolen, they might not be fully covered — this encourages responsibility

Coverage Not Needed by Typical Insureds

Some exclusions exist because most policyholders don’t need that coverage, so it keeps premiums affordable

Example: Homeowners insurance doesn’t cover aircraft, because most people don’t own one

Conditions

Rules or requirements in the policy that the insured must follow for coverage to apply

These conditions limit or qualify the insurer’s promise to pay

If the policyholder fails to meet a condition, the insurer can deny the claim

Example: If your auto policy requires you to report an accident within 30 days and you don’t, the insurer can refuse to pay

Definition of “Insured”

Named Insured

First Named Insured

Other Insureds

Policies may cover other parties even if they are not specifically named

Example: Homeowners policy automatically covers resident relatives under age 24 who are full-time students living away from home

Additional Insureds

Can be added using an endorsement (a formal policy amendment)

Example: A business contractor adds a client as an additional insured on its liability policy

Named Insured

The person or persons specifically listed in the declarations section of the policy

Example: John Smith is listed on his homeowner’s policy as the named insured

First Named Insured

The first person listed on the policy; has certain additional rights and responsibilities not shared by other named insureds

Example: Only the first named insured can request policy changes or receive cancellation notices

Endorsement (Property and Liability Insurance)

A written provision that adds to, deletes from, or modifies the original policy

Example: Adding an earthquake endorsement to a homeowners policy so earthquake damage is covered

Rider (Life and Health Insurance)

A provision that amends or changes the original policy

Example: A waiver-of-premium rider on a life insurance policy allows premiums to be waived if the insured becomes disabled

Deductible

A specified amount that is subtracted from the total loss payment that would otherwise be payable by the insurer

Example: If you have a $500 deductible and a $2,000 car repair claim, the insurer pays $1,500

Purpose of a Deductible:

Eliminate small claims that are costly to process

Example: A minor $50 fender scratch isn’t worth filing a claim

Reduce premiums paid by the insured

Example: Higher deductible — lower monthly or annual insurance

Reduce moral and attitudinal hazard

Example: People are less likely to file trivial claims or be careless if they must pay part of the loss

Straight Deductible

Aggregate Deductible

Straight Deductible

The insured must pay a specific amount for each loss before the insurer pays anything

Example: If your auto policy has a $500 deductible and your car repair costs $2,000, you pay $500 and the insurer pays $1,500

Aggregate Deductible

All losses that occur during a specified period (usually a year) are added together to satisfy the deductible

Example: In health insurance with a $1,000 aggregate deductible, multiple doctor visits and minor procedures add up; once total expenses reach $1,000, the insurer starts paying

Calendar-Year Deductible

A type of aggregate deductible where all medical expenses during a calendar year are accumulated until the deductible is met

If your calendar-year deductible is $1,500, doctor visits and procedures from January 1 to December 31 are added together; once total expenses reach $1,500, the insurer starts paying

Elimination (Waiting) Period

A stated period at the start of a loss during which no benefits are paid

Example: A disability income policy has a 90-day elimination period, so the insured must wait 90 days before receiving income replacement benefits

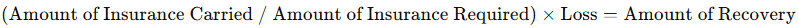

Coinsurance Clause

A policy provision that encourages the insured to insure their property to a specific percentage (like 80%) of its total insurable value

If the property is underinsured, the insured must share part of the loss as a coinsurer

Example:

A building worth $100,000 has an 80% coinsurance requirement, so the insured should carry $80,000 in coverage

If they only bought $40,000 and suffered a $10,000 loss

(40,000 / 80,000) * 10,000 = 5,000

— The insurer pays $5,000, and the insured pays the remaining $5,000

Fundamental Purpose of Coinsurance

To achieve equity in rating, meaning that each insured pays a fair premium based on how much of their property’s value they choose to insure

Why This Matters:

If one property owner insured for 100% of the property’s value (a total loss) while another insures for only 50%, it would be unfair for both to pay the same premium rate

Coinsurance ensures that those who fully insure their property get a rate discount, while those who underinsure are penalized through the coinsurance formula

Example:

Two identical homes each worth $100,000

Home A insures for $80,000 (meets 80% coinsurance)

Home B insures for only $40,000

Home A gets a lower rate per $1,000 of coverage since they meet the coinsurance requirement

Home B gets penalized if a loss occurs because they didn’t insure enough

Equity in Rating

Each policyholder pays a fair premium based on their level of insurance coverage

Example: If two people own houses worth $100,000, but only one insures the full amount, that person should pay more — coinsurance helps keep this fair by rewarding full insurance and penalizing underinsurance

Coinsurance in Health Insurance

Coinsurance Clause

The insured must pay a specified percentage of covered medical expenses after the deductible is met

Example: A policy with 20% coinsurance means the insured pays 20% of a $1,000 hospital bill after the deductible, so $200 is paid by the insured and $800 by the insurer

Purpose of Coinsurance in Health Insurance:

Reduce premiums — sharing costs between insurer and insured lowers the overall premium

Prevent overutilization of benefits — insureds are less likely to overuse medical services if they must pay part of the cost

Example: A patient may think twice about unnecessary tests if they have to pay 20% out-of-pocket

Other-Insurance Provisions

Clauses that prevent the insured from profiting from having multiple insurance policies and uphold the principle of indemnity

Example: If a homeowner has two policies covering the same house, these provisions ensure the total payout doesn’t exceed the actual loss

Pro Rata Liability

Contribution by Equal Shares

Primary and Excess Insurance

Coordination of Benefits Provision

Pro Rata Liability

Each insurer pays a share of the loss proportional to the amount of insurance they provide relative to total coverage

Example:

Home insured with $60,000 Policy A and $40,000 Policy B, total coverage = $100,000

Loss = $20,000

Policy A pays (60,000 / 100,000) * 20,000 = $12,000

Policy B pays (40,000 / 100,000) * 20,000 = $8,000

Contribution by Equal Shares

Each insurer shares the loss equally until each insurer has paid up to the lowest limit of liability under any policy, or the loss is fully paid

Example:

Two insurers cover a $10,000 loss; both have policy limits of $7,000

Each insurer pays $5,000 (equal share)

If the loss were $20,000, each insurer would still only pay up to their policy limit ($7,000 max)

Primary and Excess Insurance

The primary insurer pays first, and the excess insurer pays only after the primary policy limits are exhausted

Example:

Medical bills = $10,000

Primary insurance limit = $6,000 — insurer pays $6,000

Excess insurance limit = $5,000 — excess insurer pays the remaining $4,000

Coordination of Benefits Provision

In group health insurance, this provision prevents overinsurance by coordinating benefits if a person is covered under multiple plans, so total payments do not exceed actual expenses

Example:

Employee has two group health plans

Total medical bill = $2,000

Plan A pays $1,500 (primary), Plan B pays the remaining $500 (secondary)

Coordination of Benefits (COB) Rules (NAIC Guidelines)

Coverage as an employee is a primary to coverage as a dependent

Example: Jane has her own employer health plan and is also covered as a dependent on her spouse’s plan. Her own plan pays first

For dependents in families where parents are married or not separated, the plan of the parent whose birthday comes first in the year is primary

Example:

Child covered under both parents’ plans

Mom’s birthday = March 10, Dad’s birthday = July 5

Mom’s plan pays first, Dad’s plan pays second