Economics IA1 ATAR

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

84 Terms

Open economy

Any nation that engages in international trade with other nations. This involves the exchange of goods, services and capital with other nations. Using the Circular Flow Model, an open economy would have an external/foreign sector.

External (foreign) sector

The sector of the circular flow model that identifies economic influences external to the domestic economy.

Exchange rates

The value of the currency of a nation expressed in terms of the currency of another nation.

Commodity prices

The prices of raw materials and primary products such as iron ore, coal, wheat, oil and gold, traded in global markets.

Tariffs

Taxes imposed by a government on imported goods and services, making imports more expensive.

External stability

An economy's ability to meet its international financial obligations without causing problems for the rest of the economy. This means maintaining a sustainable balance of payments, foreign debt and exchange rate stability.

Internal balance

A state of the domestic economy characterized by full employment and acceptable levels of inflation.

Economies of scale

Cost efficiencies derived from producing a large volume of standardized products. Economies of scale are the cost advantages a firm gains when it increases its level of production, causing the average cost per unit to fall.

Prima facie

Latin term meaning 'on the face of it,' referring to something that appears true at first glance.

Factor endowment

The quality and quantity of the factors of production (land, labour, capital and enterprise) which a country possesses.

Trade deficit

When the value of a country's imports exceeds the value of its exports.

Intertemporal efficiency

Producing goods and services while ensuring resources are available for future generations.

Infant industries

New or emerging industries not strong enough to compete with established foreign producers.

Imports

Goods that enter a nation from overseas.

Exports

Goods that a nation sells to foreign nations.

Multinational corporation (MNC)

An enterprise operating in multiple countries but managed from a single home country.

Intra-company trade

Trade between affiliates or subsidiaries of the same organization.

Transfer pricing

The price set for goods, services, or intellectual property traded between branches of the same company.

Percentage Change

Formula: (New - Old)/Old x 100.

Composition of trade

Refers to what we trade.

Direction of trade

Refers to where and with whom we trade.

Trade Theories

Theories explaining how trading partners can benefit from the exchange of goods and services.

Absolute Advantage

Adam Smith’s theory of absolute advantage states that a country should specialise in producing the goods it can make more efficiently (using fewer resources or at lower cost) than other countries, and trade for the goods it is less efficient at producing.

Lower direct resource cost

Fewer inputs required to produce one unit of output compared to another country.

Comparative Advantage

Comparative advantage is a theory that countries should produce the goods and services for which they have the lowest opportunity cost and buy or trade the other products from other economies.

Opportunity cost

The value of the next best alternative foregone when a choice is made.

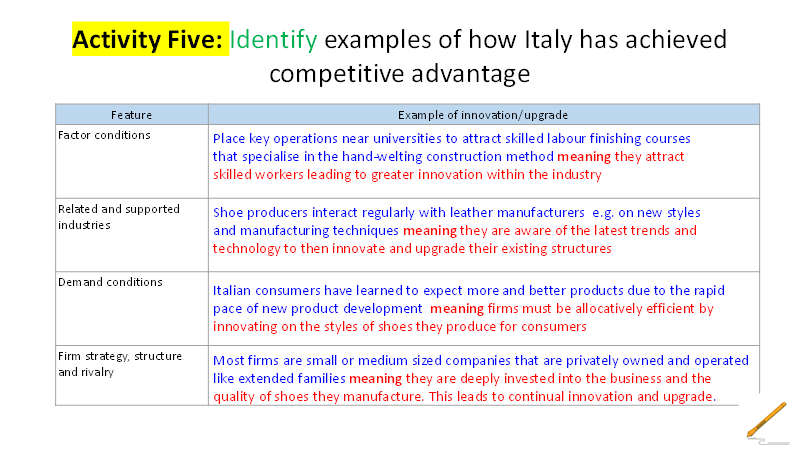

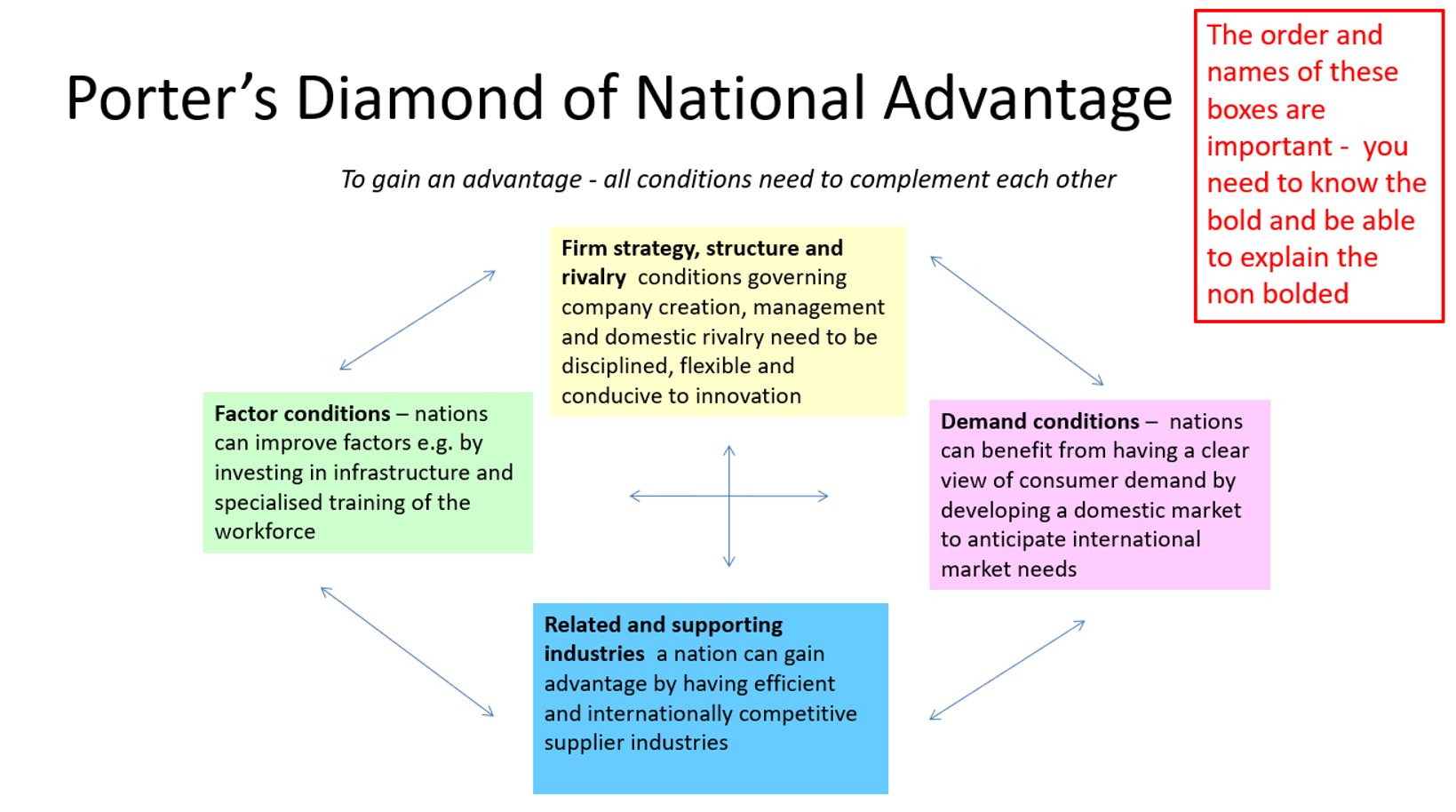

Competitive Advantage

Trade advantage obtained through the capacity of a nation’s ability to innovate and upgrade.

A nation’s ability to become internationally competitive in a certain industry depends on its ability to upgrade, innovate and adapt to new technology.

Firm strategy, structure and rivalry

Conditions governing company creation, management and domestic rivalry that promote innovation.

Demand conditions

Having a clear view of consumer demand to anticipate international market needs.

Related and supporting industries

Having efficient and competitive supplier industries can provide a national advantage.

Factor conditions

Investments in infrastructure and specialized workforce training that improve production factors.

Fixed Exchange Rates

A fixed exchange rate is a system where a country’s currency value is tied (pegged) to another currency, a basket of currencies, or a commodity like gold.

The central bank actively intervenes in the foreign exchange market to keep the exchange rate within a specific target or at a fixed level.

How it works:

If the domestic currency depreciates, the central bank buys its own currency using foreign reserves to push its value back up.

If it appreciates, the bank sells its own currency to increase supply and bring the value back down.

Example: If Australia pegged the AUD at 0.70 USD, the RBA would constantly buy or sell AUD in the forex market to keep it near that rate.

Managed Exchange Rates

A currency whose exchange rate is influenced by intervention from a central bank.

Floating Exchange Rates

A floating exchange rate is a system where the value of a currency is set by the Forex market based on the forces of supply and demand of the currency, without direct intervention by the government or central bank.

Tariff

A tax imposed by a government on imported goods, making domestic goods more competitive.

Quota

Limit on how many items can be exported.

Subsidies

Support from the government to reduce costs for industries, enabling economies of scale.

Embargo

A total ban on a good or service.

Terms of trade

The terms of trade measures the relationship between the price of exports relative to the price of imports.

A rise in the ToT represents that the value of Australian exports has increased relative to the value of imports; thus, a greater quantity of imports can be purchased per unit of exports.

Terms of trade index

An index number showing favorable or unfavorable movement in prices of exports and imports.

An index number of greater than 100 is said to be: A favourable or positive terms of trade. (i.e. we sell our exports at higher price relative to the price we pay for our imports)

An index number of less than 100 is said to be: An unfavourable terms of trade. (i.e. we pay a higher price for our imports relative to the price we sell our exports).

Commodity prices

Market prices for raw materials traded globally, affected by supply and demand.

Foreign investment

Funds invested in an economy by the rest of the world.

Foreign debt

Money borrowed from foreign lenders, which must be repaid with interest.

Foreign equity

Ownership by foreigners of part or all of a business or asset in Australia.

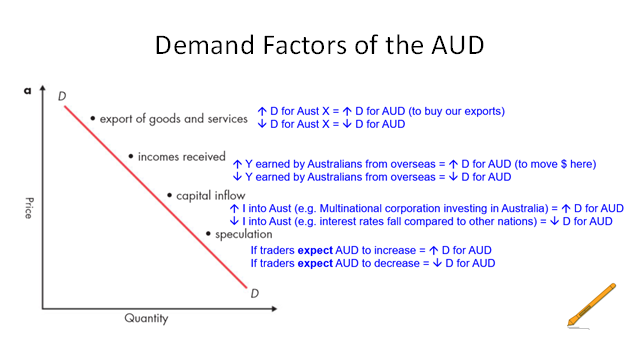

Demand factors of the AUD

1) Demand for Australian exports (X) = demand for AUD

2) Incomes received (from overseas)

3) Capital inflow (Investment (I) into Australia = Increased demand for AUD)

4) Speculation of the AUD - If traders expect the value of the AUD to increase, demand for AUD increases.

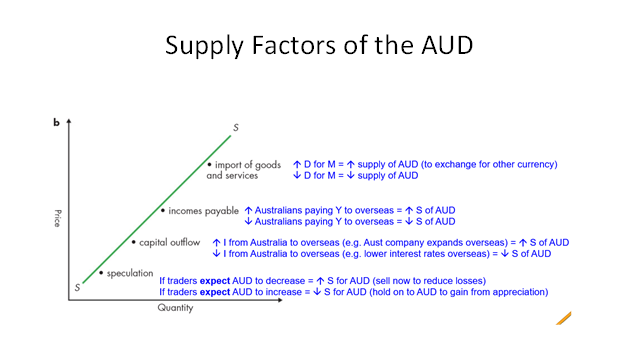

Supply factors of AUD

1) Increased Import of goods and services = increased supply of AUD (to exchange for other currencies)

2) Incomes payable - Australia paying income overseas increases supply of AUD on forex

3) Capital inflow - Investment from Australia to overseas

4) Speculation

If traders expect Aud to increase, reduced supply of AUD (hold on to AUD to gain from appreciation)

If traders expect AUD to decrease, Increased supply of AUD (sell now to reduce losses)

Free Trade

Free trade refers to the removal of trade barriers like tariffs and quotas so as to encourage the free exchange of good and services. Broadly, free trade boosts consumer welfare. Economies without trade barriers can obtain imports at a lower price, meaning that consumers can fulfill their material needs and wants at a lower cost. Furthermore, free trade policies enable consumers to import from a wide range of economies, therefore increasing the range of goods and services they can access, including products that are not produced domestically.

Trade liberalisation

Trade liberalisation means is where countries open up their markets by removing or lowering tariffs, quotas and other trade barriers to make it easier for goods and services to be moved between them.

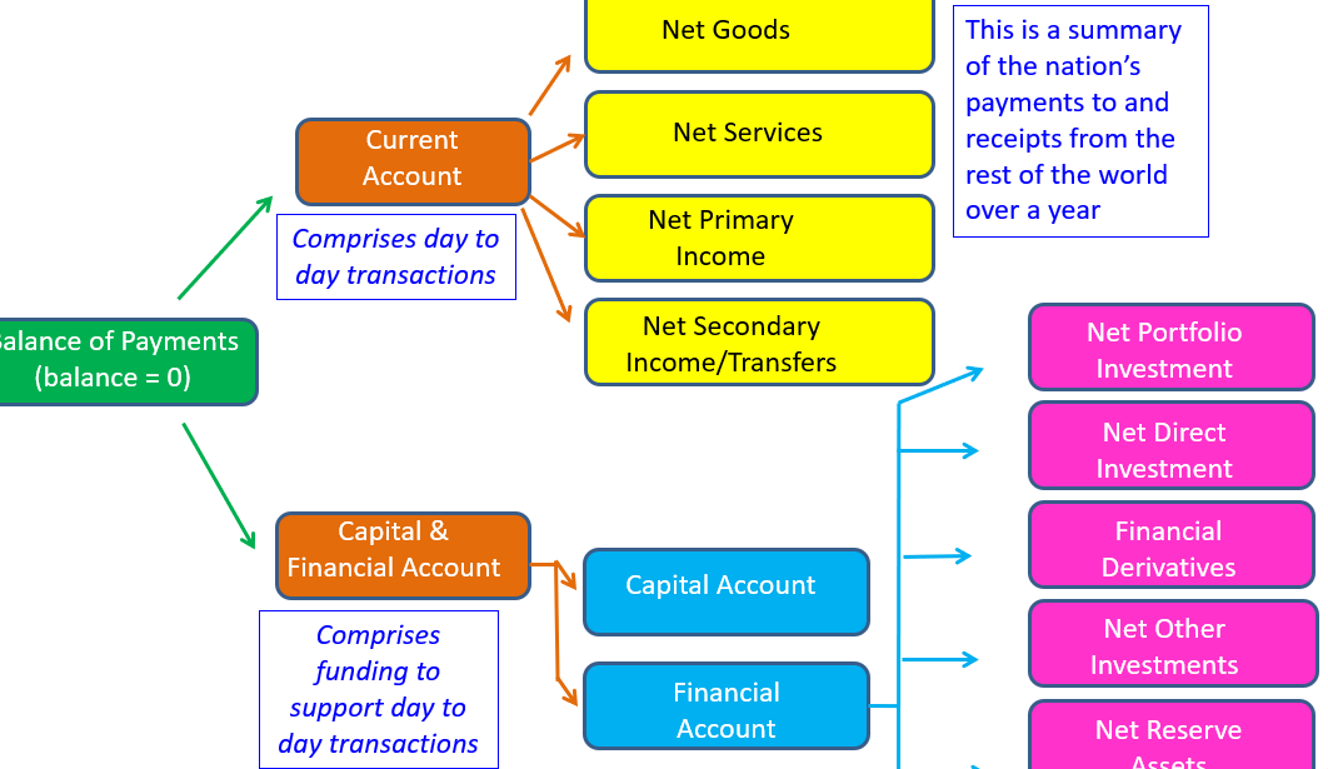

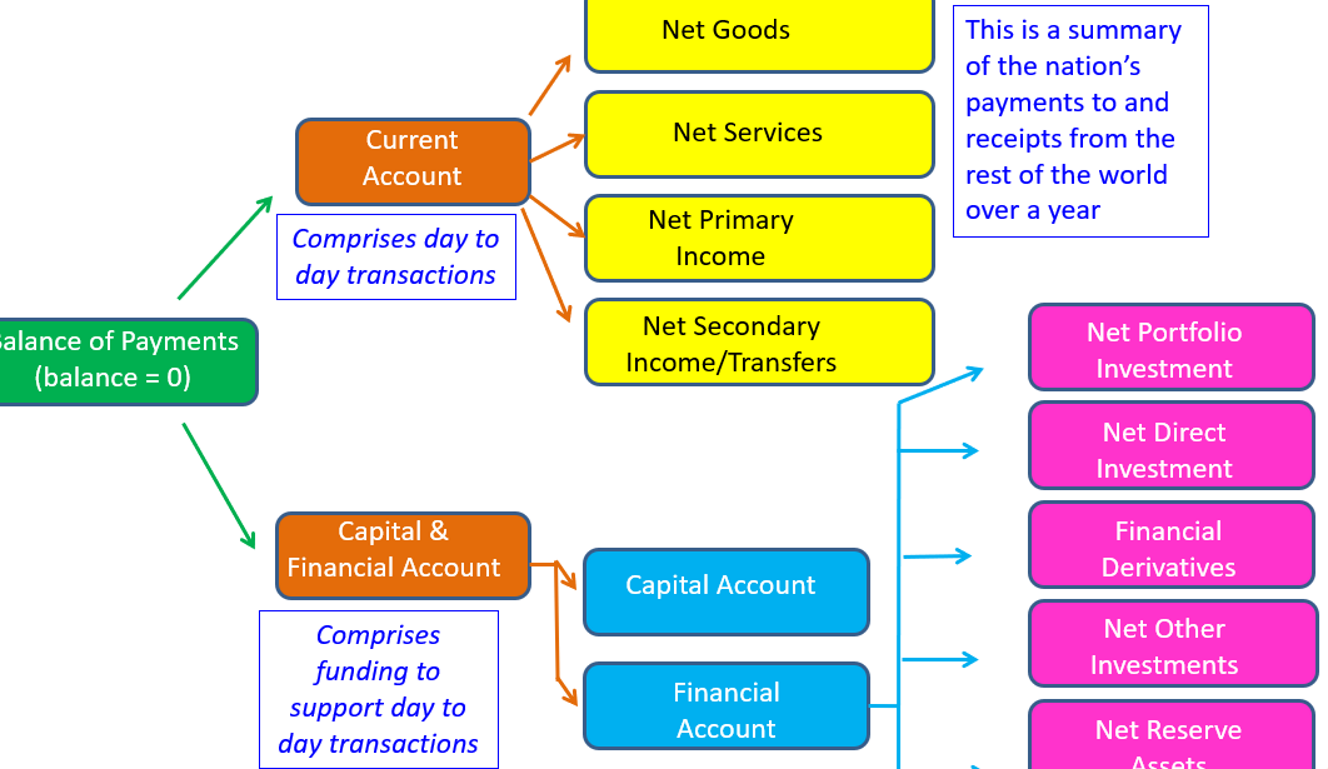

Balance of Payments (BOP)

Australia’s balance of payments is a record of all transactions between Australian residents and the rest of the world over a year. It divides transactions into two broad accounts: the current account, and the combined capital and financial account. The current account captures the net flow of money that results from Australia engaging in international trade, while the combined capital and financial account captures Australia’s net change in ownership of assets and liabilities; these two broad accounts are often referred to as the ‘two sides’ of the balance of payments

Surplus and deficit of BOP

When above 0% of nominal GDP its in surplus

When below 0% of nominal GDP its in deficit

Current Account (CA)

The current account records all day-to-day non-reversible transactions of goods, services, income, and current transfers between Australia and the rest of the world. It is made up of the Balance on Goods and Services, Net Primary Income, and Net Secondary Income.

An example of a credit (inflow) in the current account is the export of Australian goods or services. When a foreign buyer purchases an Australian export, Australia earns income from overseas. This foreign currency is then converted into AUD, creating an inflow recorded as a credit in the goods and services component of the current account.

Trade balance or balance of Goods and Services (BOGS)

Balance of goods and services (BOGS)

This records exports (credits) and imports (debits) of goods and services. Measures whether there is a trade surplus (X > M).

The largest contributor to the current account.

A trade surplus adds to the CA, while a deficit subtracts.

Net primary income

Net Primary Income under the Current Account

Income earned from the ownership of factors of production (labour and capital) between Australia and the world.

Includes:

Wages/salaries earned overseas or paid to foreign workers

Interest on loans

Dividends on shares (Returns on financial investments)

Profits from foreign investments

Rent and enterprise income

Essentially:

Earnings from working or investing abroad. Earnings in exchange for something.

Net secondary income

Net Secondary Income under the Current Account

Records one-way transfers where no good, service, or asset is exchanged.

Includes:

Foreign aid and donations

Tax payments and refunds

Pensions and remittances

Insurance transfers

Essentially:

Money given or received without getting anything in return.

Capital and financial account (KAFA)

Capital and Financial Account (KAFA)

The KAFA records the movement of capital funds between a nation and the rest of the world; made up of two sub-accounts, the capital account and the financial account.

The capital account records the transfer of non-financial instruments, with no obligation for repayment on these transactions.

Meanwhile, the financial account records the transfer of financial assets or instruments.

Capital Account

Capital Account

Smaller component.

Records capital transfers and transfer of non-financial assets. non-produced assets

Examples:Debt forgiveness

Migrants’ asset transfers

Sale/purchase of patents, copyrights, or land leases

Financial Account

Financial Account

Records flows of financial capital — borrowing, lending, and investment across borders. Assets and liabilities.

Shows how Australia finances its Current Account balance.

Includes:

Direct investment: Buying or establishing businesses overseas (or by foreigners in Australia)

Portfolio investment: Buying shares, bonds, or other financial assets

Other investment: Loans, deposits, trade credits

Reserve assets: Foreign exchange reserves held by the RBA

In short: the financial account tracks movements of money for investment; the capital account tracks once-off transfers of assets.

Real-world scenario applying the BOP

Example Scenario

Scenario: Izak (Australian) lends $2 million to Jim (US) at 5% interest.

Loan of $2 million to the US:

Money leaves Australia → Debit (DR) in the Financial Account (portfolio/other investment).

Interest income earned (5%):

Money flows back into Australia → Credit (CR) in the Net Primary Income component of the Current Account.

This example shows how the Current Account and the Financial Account are linked — one records the income from investments, the other records the funding of those investments.

Savings-investment gap

General Definition:

Savings–Investment Gap:

The difference between a nation’s level of domestic savings and its domestic investment needs.

If investment exceeds savings, the gap must be financed by foreign borrowing or investment, creating capital inflows and a corresponding current account deficit.

Australia-Specific Definition:

Australia’s Savings–Investment Gap:

Australia’s domestic savings are insufficient to fund its high investment demand — especially in capital-intensive sectors like mining and infrastructure.

This gap is filled by foreign investment, which generates income payments abroad (interest, dividends, profits), contributing to Australia’s persistent current account deficit.

Why do nations trade?

General Definition:

Reason for Trade:

Countries trade to gain from specialisation and comparative advantage — by producing goods and services they can make more efficiently and trading for those they can’t.

Trade allows nations to access cheaper imports, larger markets, greater variety, and higher overall living standards.

Australia-Specific Explanation:

Why Australia Trades:

Australia trades because it has a comparative advantage in resource-based goods (like iron ore, coal, and agriculture) but relies on imports of manufactured and capital goods.

By exporting its abundant natural resources and importing what it produces less efficiently, Australia maximises economic welfare, supports employment, and sustains national income growth.

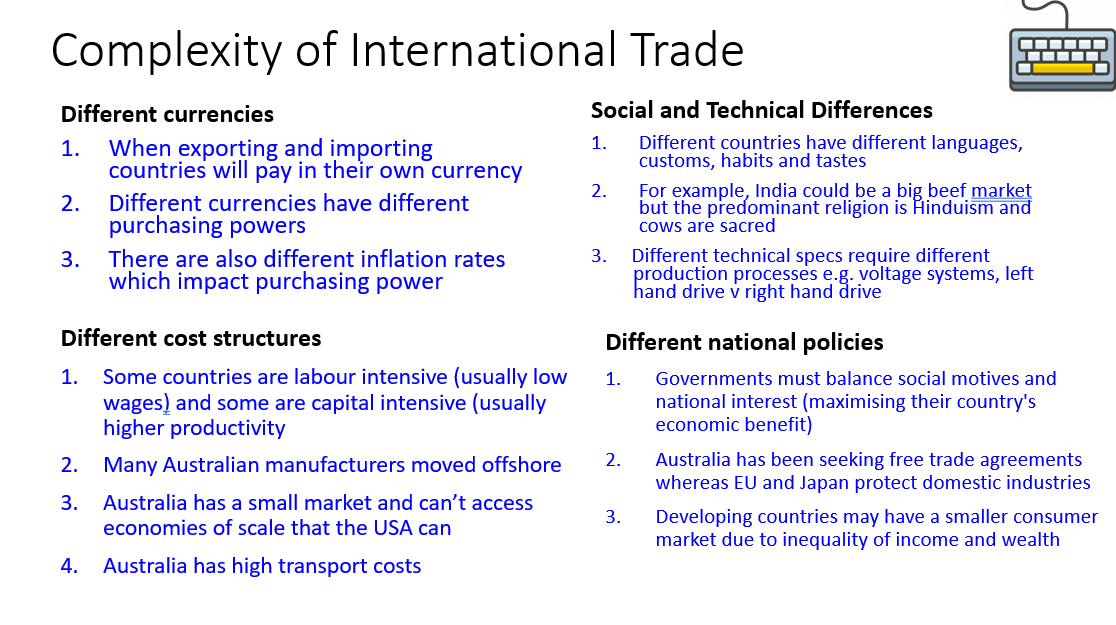

What are the four complexities of international trade?

What are the advantages of trade?

Advantages of Trade

Access to a greater variety of goods and services

Countries can import goods they cannot produce efficiently.

Consumers enjoy more choice and improved quality of life.

Exploitation of comparative advantage

Countries specialise in producing goods they can make relatively efficiently.

Leads to higher global output, more efficient resource allocation, and economic gains for all trading partners.

Economies of scale

Access to larger markets allows producers to increase production, lowering average costs and improving competitiveness.

Increased economic growth

Exports generate injections into the circular flow of income, boosting GDP, employment, and national income.

Access to technology and innovation

Trade exposes domestic firms to foreign technology, knowledge, and best practices, improving productivity.

6. Exposure to international competition forces inefficient domestic industries to exit the market, freeing up resources (labor, capital, and land) to be reallocated to more efficient industries, which improves overall productivity and economic efficiency.

Disadvantages of trade

Disadvantages of Trade

Domestic industries may suffer

Local firms may struggle to compete with cheaper or more efficient imports, risking job losses and business closures.

Dependence on foreign markets

Heavy reliance on exports or imports can make an economy vulnerable to global economic shocks, price fluctuations, or supply disruptions.

Trade can exacerbate inequality

Gains from trade may be unevenly distributed, benefiting capital owners or export sectors more than workers in import-competing industries.

Environmental and social costs

Increased production for export markets can lead to overuse of resources, pollution, or exploitation of labor in some sectors.

Balance of payments pressures

Persistent trade deficits can contribute to current account deficits, increasing foreign debt and vulnerability.

Dirty float

Dirty Float (Managed Float): A currency system where the exchange rate mostly floats with market forces, but the central bank occasionally intervenes to reduce volatility or achieve policy goals.

Australia: The AUD floats freely, but the RBA may intervene to smooth excessive fluctuations and bolster the value of the Australian dollar.

Why is BOP always equal to zero?

The balance of payments is an account which records all transactions between Australia and the rest of the world. It is comprised of two components: the current account, which records day-to-day transactions for which payments are made or received, and the capital and financial account, which records the movement of capital funds between Australia and the rest of the world during a specified period of time. The sum of the current and capital and financial accounts always adds to zero, as a credit in one account is recorded as a debit in the other, or vice versa. For example, if an Australian purchases a Japanese phone, this is entered as a debit in the current account. However, the financial entity which controls the forex market now holds AUD, which is considered a financial asset issued by the RBA, meaning a foreign financial entity now owns an Australian asset. This same amount of money is hence entered as a credit in the capital and financial account, meaning that the balance of payments is always zero.

Advantages of floating exchange rate system

The balance of payments is always in equilibrium; i.e. the deficit in the current account is always equal to the surplus in the capital finance account.

Automatic adjustment to external shocks

Exchange rates respond to supply and demand.

If exports fall or imports rise, the currency depreciates naturally, helping correct trade imbalances.

Monetary policy independence

The central bank can set interest rates to target inflation or growth, without worrying about maintaining the exchange rate at a fixed value. Greater flexibility in independent monetary policies.

Not necessary for the RBA to hold large amounts of foreign reserves

There is no need for the RBA to hold large amounts of foreign reserves to maintain the artificial exchange levels at a fixed rate. No need to buy or sell foreign currency (at large scale).

Disadvantages of a floating exchange rate system

Debt instability

The level of external debt can change when debt is largely measured in overseas currency, such as US dollars. If the AUD depreciates, each US dollar of debt now costs more AUD to repay. If the AUD appreciates, each US dollar of debt now costs fewer AUD to repay.Exchange rate volatility creates uncertainty for exporters and importers

Rates can fluctuate significantly due to short-term speculation, changing market sentiment, or external shocks. Exchange rate is volatile and difficult to predict. Makes it difficult for long-term investment planning and reduces stability and predictability for exporters.

4. Inflation Pass-Through: Exchange rate fluctuations can lead to changes in import prices, which can impact domestic inflation. A significant depreciation of the currency can contribute to imported inflation and erode real purchasing power.

Advantages of a fixed exchange rate system

1. Exchange rate stability

The value of the currency is fixed to another currency (or basket), reducing fluctuations.

Benefit: Firms and consumers can trade internationally with certainty, reducing exchange rate risk and encouraging imports, exports, and investment.

2. Encourages international trade and investment

Stable currency reduces uncertainty for exporters and foreign investors.

Benefit: Businesses can plan long-term investments without worrying about sudden currency swings.

3. Credibility and confidence

Pegging to a strong and stable foreign currency (e.g., USD) can boost confidence in the domestic currency.

Benefit: Attracts foreign investment and maintains investor trust in the economy even during times of uncertainty e.g. natural disaster.

Disadvantages of a fixed exchange rate system

1. Loss of monetary policy independence

The central bank must focus on maintaining the peg, not domestic priorities like controlling inflation or stimulating growth.

Effect: Limits ability to respond to recessions or other domestic shocks.

2. Requires large foreign reserves

To maintain the fixed rate, the central bank must buy or sell foreign currency constantly.

Effect: Ties up large amounts of reserves that could be used elsewhere.

3. Difficulty adjusting to external shocks

Fixed rates cannot automatically adjust to changes in global demand, commodity prices, or capital flows.

Effect: Can create prolonged trade imbalances or unemployment.

Reserve Assets

Foreign currency, gold and other highly liquid assets held by a country’s central bank to manage exchange rates, support the economy and stabilise the financial system

How does a depreciating AUD increase inflation, referring to the effect on producers.

A depreciation in the AUD means the Australian dollar falls in value relative to other currencies, meaning imports become more expensive. Since imports are more expensive, the cost of imported intermediate goods by the production sector increases. This creates a flow on effect where producers raise prices to cover increasing production costs, which is passed on to consumers through increased costs of purchasing goods and services. This causes an increase in the general price of goods and services, worsening inflation.

Thus, when AUD appreciates, the opposite can be said to be true.

Benefits of AUD depreciation

A depreciation of the AUD increases the international competitiveness of Australian exports because the same quantity of foreign currency can now purchase more Australian goods and services. This can boost export demand, raise production, and support employment in export sectors, improving national income.

Can improve balance of goods and services to lower current account deficit and stimulate economic growth.

Imports become more expensive while exports are more competitive, leading to an increase in exports relative to imports. This leads to net credits flowing into the economy, stimulating economic growth as exports are a major component of GDP, GDP = C + I + G (X-M).Can encourage domestic consumption and improve GDP.

Since imports are more expensive, domestic consumers are discouraged from purchasing foreign goods and services. This encourages greater domestic consumption, which stimulates GDP growth as it is a major component of GDP. As GDP = C + I + G (X-M). Creates flow on effect where producers output more, increasing demand for factors of production from households, increasing income and thus raising consumption.

Negatives of an AUD depreciation

Can cause higher inflation (cost-push inflation)

Depreciation means the AUD is less valuable relative to other foreign currencies. This reduces foreign purchasing power and raises import costs. Production costs then rise as firms spend more on intermediate goods and raw materials. Producers offset rising costs by hiking the prices of goods, leading to increased costs for consumers. This raises the general prices of goods and services, contributing to worsening inflation.Worsening foreign debt burden

Most of Australia’s foreign debt is in USD. If AUD depreciates, Australia must spend more AUD to repay the same value of USD, causing debt repayments to increase. This worsens the current account deficit.Can cause low investor confidence, reducing capital inflow and investment into Australia.

A depreciating AUD can signal a weakening economy, which lowers investor confidence in the AUD.

What are the likely effects of a favourable ToT movement?

A favourable movement in the ToT simply means an increasing in the ToT from one period to another. This means that export prices are rising faster than import prices, causing export revenue to grow faster than import spending. This has the effect of improving the BOGS, which may reduce Australia’s current account deficit.

What are the likely effects of an unfavourable ToT movement?

Economic integration

Economic integration refers to the process of reducing barriers to trade, investment, and movement of goods, services, and labour between countries, allowing their economies to become more interconnected.

It can range from simple trade agreements to full economic unions.

Levels include:

Free trade area

Customs union

Common market

Economic union

Economic Union

Economic Union

An economic union is the highest level of economic integration, where member countries:

Remove trade barriers

Share common external tariffs

Allow free movement of labour, capital, and goods

Harmonise economic policies (e.g., fiscal and monetary rules)

Some even share a common currency (e.g., the Eurozone).

Components of the Balance of Payments

The Current Account records the day-to-day transactions between Australia and the rest of the world involving goods, services, income flows, and current transfers. It captures the ongoing trading relationships that affect national income.

The Capital Account records one-off transfers of non-financial assets, such as debt forgiveness, migrant asset transfers, and the sale or purchase of intangible assets.

The Financial Account records the movement of financial capital, including foreign investment, loans, and the buying or selling of financial assets like shares and bonds.

Example of Australia’s Firm, strategy, structure and rivalry

Firm strategy, structure and rivalry.

Australia's mining industry benefits from intense domestic competition among major companies like BHP and Rio Tinto. This rivalry drives continuous innovation in technology, automation and operational efficiency.

Australia’s demand conditions

While Australia's domestic market is relatively small, the industry has developed by anticipating and serving massive international demand, particularly from Asia. Early understanding of China's infrastructure boom allowed Australian miners to scale their operations appropriately and efficiently.

Australia’s related and supporting industries

Australia has developed comprehensive mining systems including world-leading companies in drilling services, engineering consultancy, automation technology and mining software.

Example of Australia’s factor conditions

Factor conditions are the quality and quantity of the factors of production which a nation possesses. Australia possesses abundant natural factor endowment in raw goods and commodities such as iron ore, coal and lithium. Additionally, Australia has heavily invested in specialised mining engineering education through universities. These factor conditions give Australia a competitive advantage in global commodity markets.