Economics: U2 Personal Finance, Savings, and Investments

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

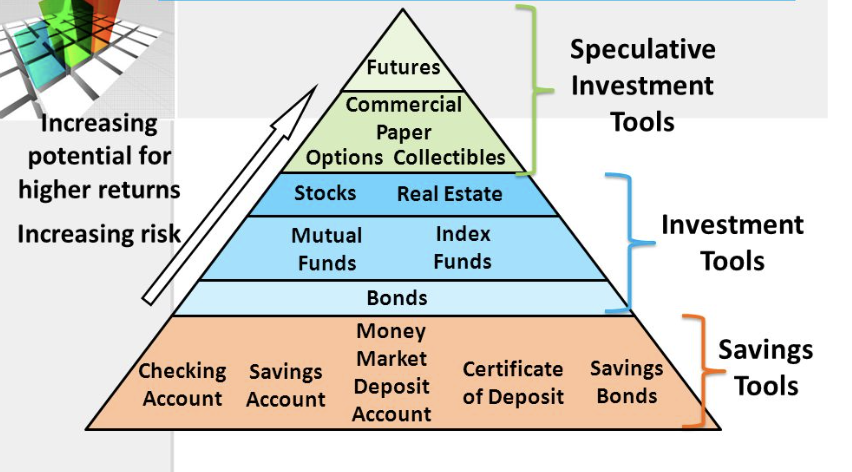

financial risk pyramid

financial risk pyramid

low to high risk: saving tools, investment tools, speculative investment tools

saving tools

money market, checking account, savings account, deposit account, certificate of deposit, savings bonds

investment tools

stocks, real estate, mutual funds, index funds, bonds

speculative investment tools

futures, commercial, paper, options, collectibles

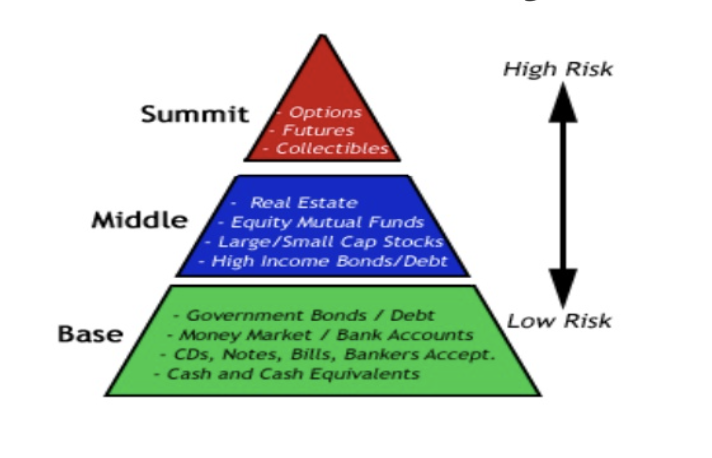

investment risk pyramid

investment risk pyramid

low to high risk: base, middle, summit

base

government bonds/debt, money market/bank accounts, CDs, notes, bills, bankers acceptance, cash, cash equivalents

middle

real estate, equity mutual funds, large/small cap stocks, high income bonds/debt

summit

options, futures, collectibles

diversification

spreads out investment risk

"pre-tax", pay later

traditional IRAs, 401(k) plans, 403(b) plans, profit sharing accounts, 457 plans

"post-tax", pay now

Roth IRAs, savings accounts, certificates of deposit, money-market accounts, regular taxable brokerage accounts (where you can buy just about any investment such as mutual funds, stocks, bonds, or annuities)

bad credit score

300-629

fair credit score

630-689

good credit score

690-719

excellent credit score

720-850

character

honesty to pay a debt when it's due; how past debt obligations were handled

capacity

person's ability to pay a debt when it's due; how much debt can a person handle

capital

current available assets that could be used to repay debt if income was to become unavailable

SMART goals

specific, measurable, attainable, realistic, timely

interest rates

proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding

compound interest

interest calculated on the principal amount and the accumulated interest from previous periods

certificate of deposit (CD)

savings account that holds a fixed amount of money for a fixed period of time, during which the issuing bank pays interest on the deposited funds

stocks

share in the ownership of a company

bonds

debt instrument where issuer borrows money from investor, promising to repay the principal amount at a specific date (maturity) and to pay interest at regular intervals

mutual funds

shared investment fund where each investor owns a small piece of the fund's holdings

savings account

deposit account held at a bank/financial institution that provides a safe place to store your money while also earning interest

traditional IRA

retirement savings plan that offers tax-deductible contributions, tax-deferred growth, taxable withdrawals, required minimum distributions

Roth IRA

individual retirement account that offers tax-free growth and tax-free withdrawals in retirement

return on investment (ROI)

metric that measures the profitability of an investment by comparing the gain or loss to its cost

liquidity

ease and speed with which an asset can be converted into cash without significantly impacting its market price

portfolio profile

visual and detailed presentation of your work and skills, often used in job applications or for showcasing your professional abilities; more tangible examples than a resume

income/wealth inequality

uneven distribution of income and assets among individuals and households in a society