Financial Markets - (5) Stocks

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

Stocks - Legal Definition

Share capital, representing ownership rights in a corporation, is divided into individual securitized shares that reflect each shareholder's equity claim.

In Germany, share capital (Grundkapital) is the total of the face value of shares issued, with a minimum face value of 1 Euro, while capital reserves (Kapitalrücklage) come from the agio, the difference between the issue price and face value. (მაგ. 1 ევროიან აქციას ყიდიან 5 ევროდ, სხვაობა – 4 ევრო – გადადის რეზერვში). ამას ეწოდება აგიო (Agio).

In contrast, the United States does not make this distinction, viewing it as economically irrelevant.

Terms

Symbol | Georgian Explanation (ქართულად) | English Explanation |

|---|---|---|

P₀ | აქციის ფასი დღეს (დასაწყისში) – რამდენად იყიდი ერთ აქციას ამჟამად. | Share price today (at time t₀); how much you pay now for one share. |

Dₜ | დივიდენდი t წელს – რამდენს გადაგიხდის კომპანია თითო აქციაზე წლის ბოლოს. | Dividend per share in year t – payment you receive from the company. |

EPSₜ | მოგება თითო აქციაზე t წელს – რამდენი სუფთა მოგება მოდის ერთ აქციაზე. | Earnings Per Share – profit allocated to each share in year t. |

rₑ | საკუთარი კაპიტალის ღირებულება – ინვესტორის მოთხოვნილი სარგებელი აქციაზე. | Cost of equity – the return an investor expects from the stock. |

P / E | ფასის და მოგების შეფარდება – გვაჩვენებს, რამდენჯერ მეტი ღირს აქცია მოგებაზე. | Price-to-Earnings ratio – how expensive the share is compared to earnings. |

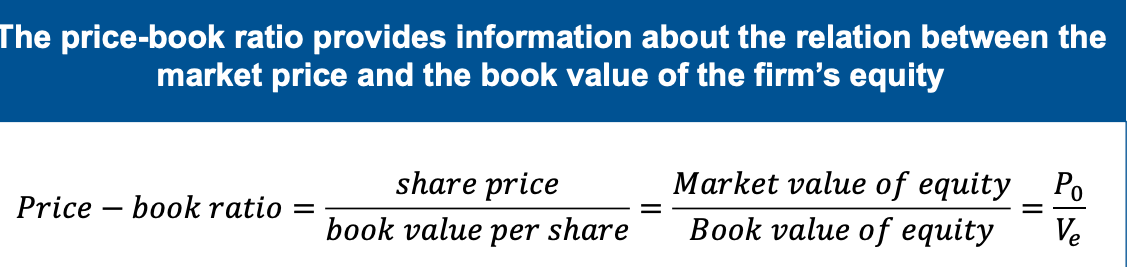

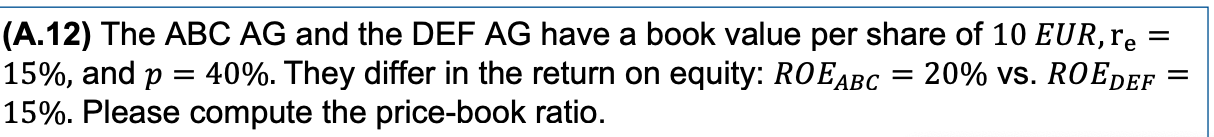

P / B | ფასის და ბალანსური ღირებულების შეფარდება – რამდენად განსხვავდება ბაზრის ფასი კომპანიის ბუღალტრული ღირებულებისგან. | Price-to-Book ratio – compares market price to book value of equity. |

w | ზრდის ტემპი – რამდენად იზრდება მოგება ან დივიდენდი წელიწადიდან წლამდე. | Growth rate – how fast earnings/dividends grow yearly. |

p | დივიდენდის წილი – რა ნაწილი მოგებიდან ნაწილდება დივიდენდის სახით. | Dividend payout ratio – part of earnings paid out as dividends. |

ROE | კაპიტალის მოგებიანობა – რამდენი მოგება გამოიმუშავა კომპანია თავისი კაპიტალიდან. | Return on Equity – how efficiently the company uses shareholders’ equity to generate profit. |

Vₑ | კომპანიის კაპიტალის მთლიანი ღირებულება – ყველა აქციის ღირებულების ჯამი. | Equity value – total market value of all shares (P₀ × number of shares). |

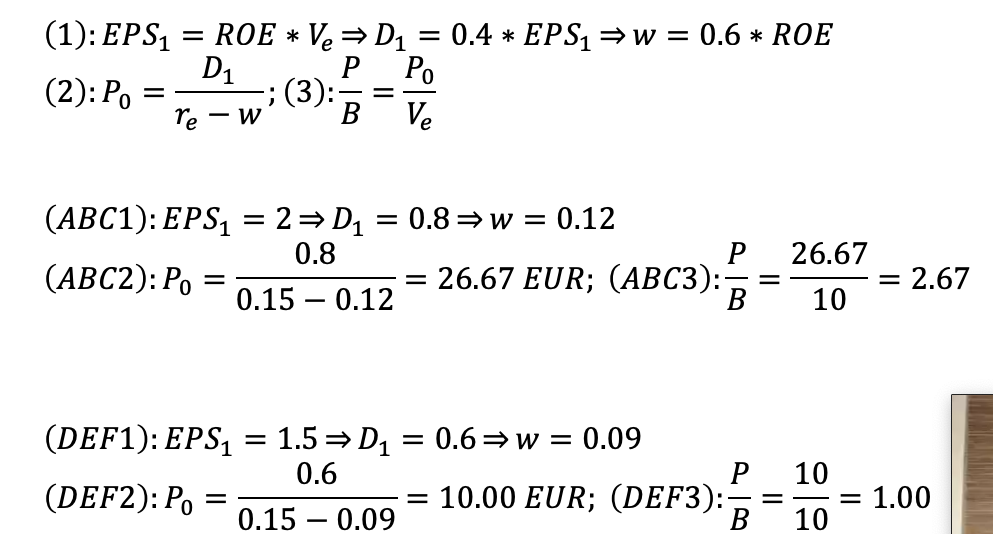

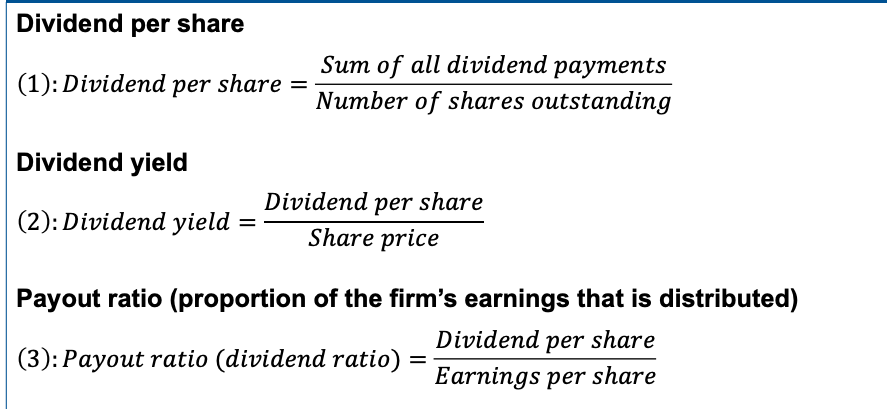

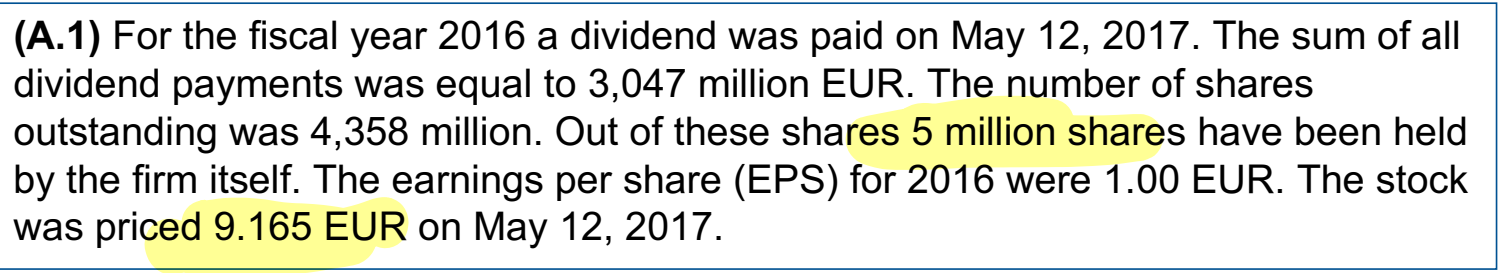

What are Dividends

1) გვიჩვენებს, თითო აქციაზე რამდენი დივიდენდი გადაუხდია კომპანიას.

(sum D / n)

2) გვიჩვენებს, რამდენად მომგებიანია აქციის ყიდვა დივიდენდის თვალსაზრისით. (DPS/P)

3) გვიჩვენებს, კომპანიის მოგების რა წილს განაწილებს დივიდენდად. (DPS/EPS)

“Price is what you pay, value is what you get.”

“Price is what you pay, value is what you get.”

the Law of One Price, a stock's price should equal the present value of its future cash flows (discounted cash flow principle).

in reality, stock value can differ from its price due to specific market conditions and inefficiencies.

In a perfect capital market, stock price equals its fundamental value. Conditions for a perfect market include:

a large number of investors without market power, equal access to information, fully rational economic actors, and no transaction costs.

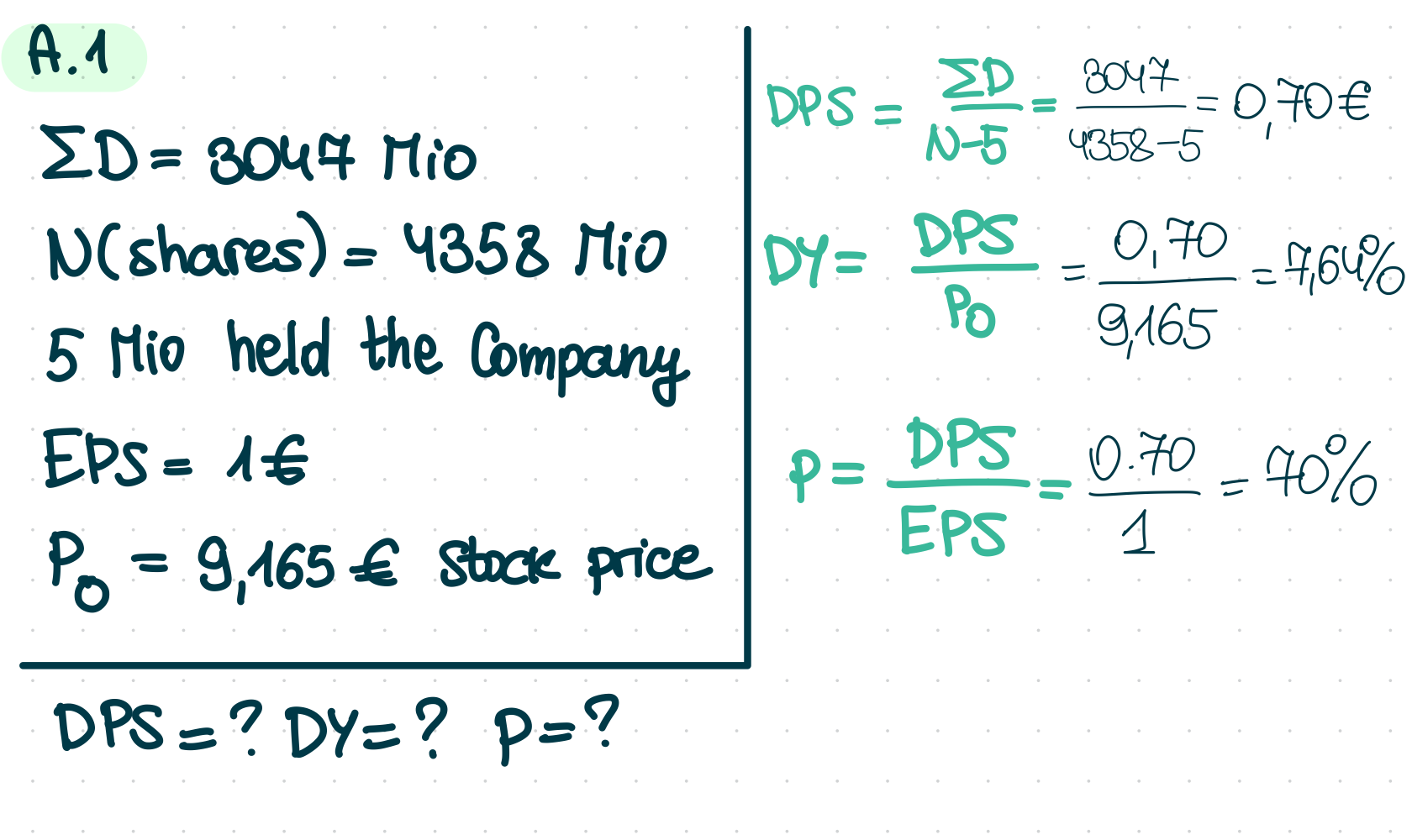

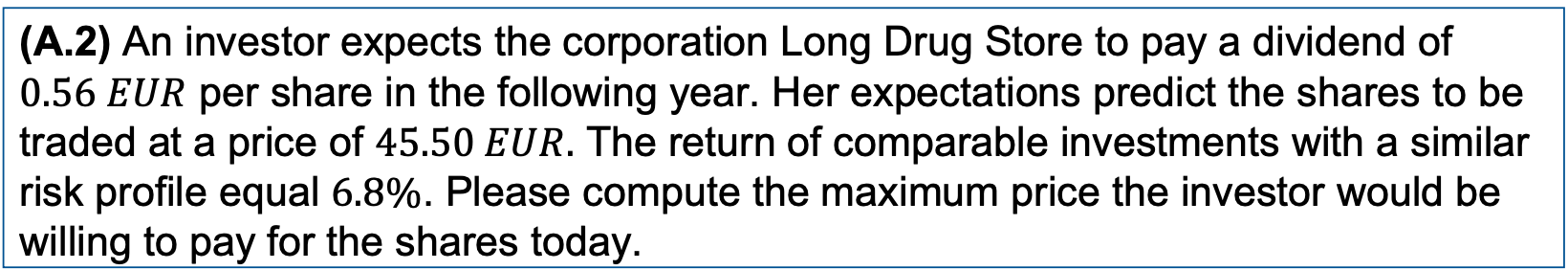

Stock return with one-year inverstment horizon

Investors determine a share price based on their expectations of D1, P1, and the required return (re). This price is set where the net present value is zero. Due to cash flow uncertainty, these cash flows must be discounted using the cost of equity, which reflects the expected return from similar-risk investments, akin to the discount rate (r) in bond pricing.

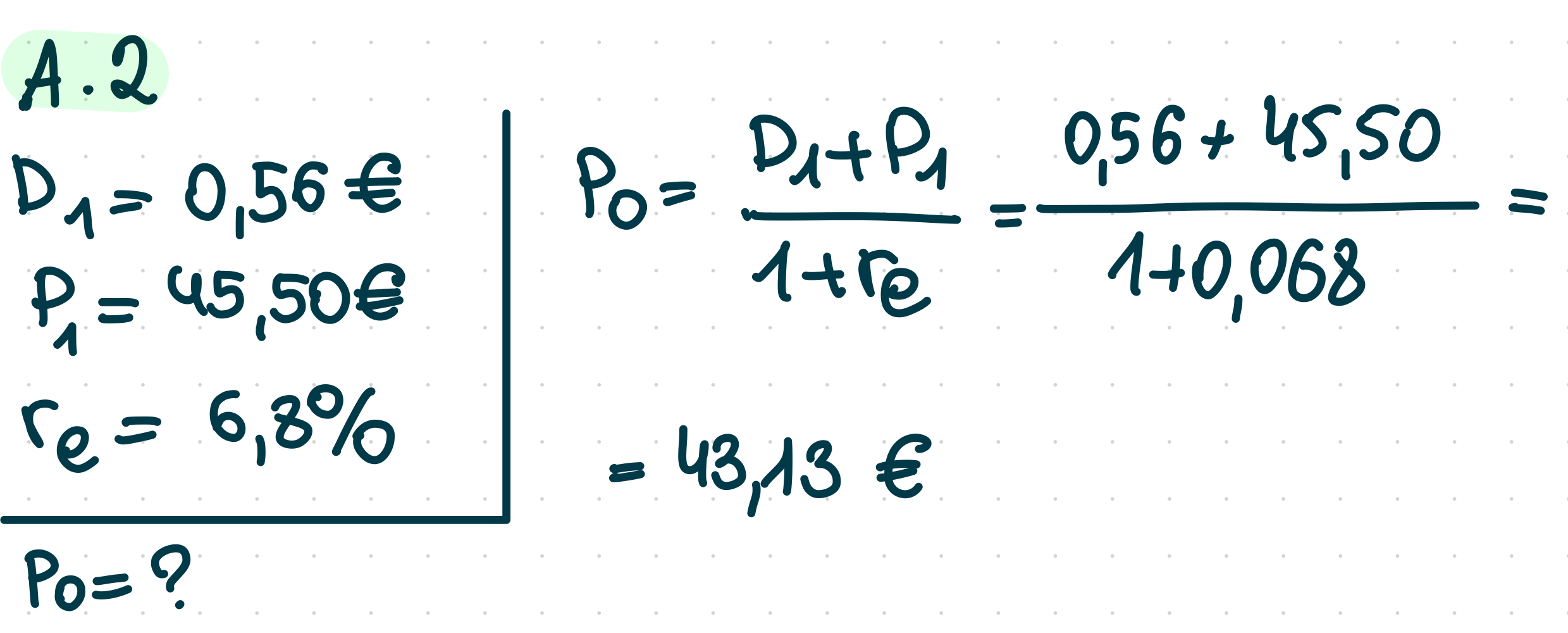

Stock return with a two-year investment horizon

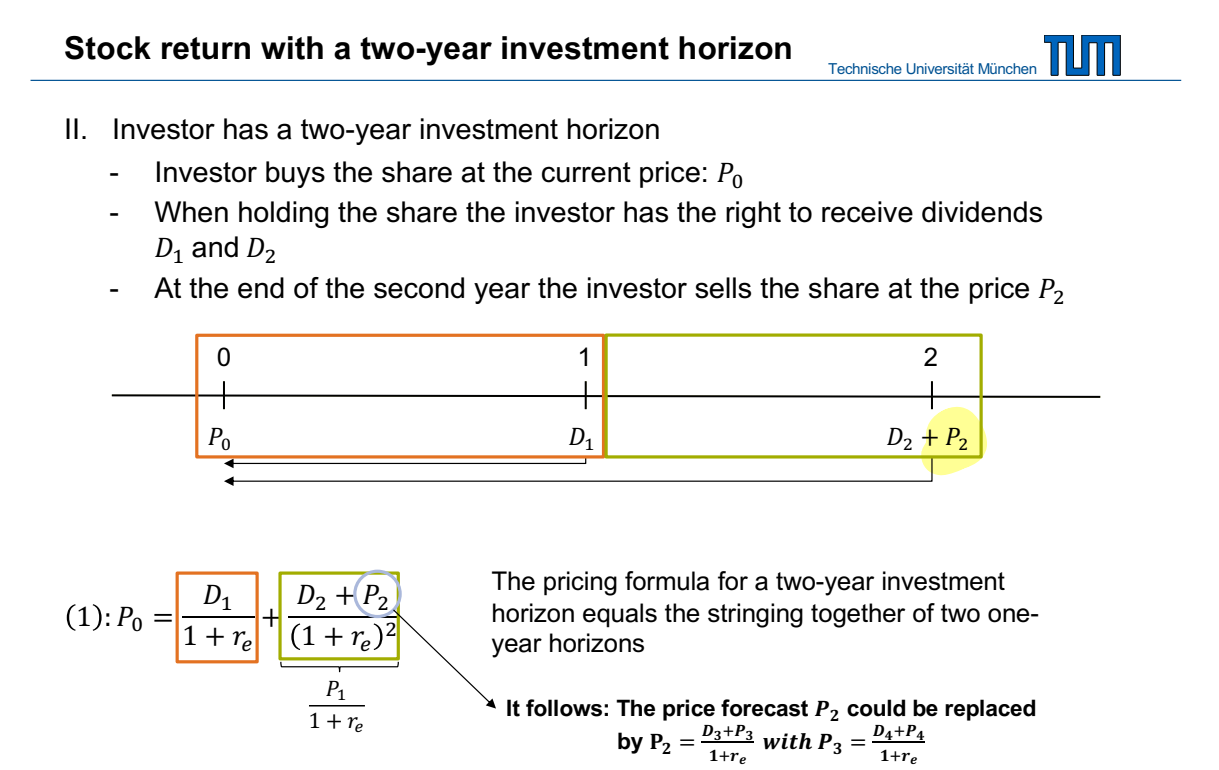

Dividend Discount Model - time horizen larger then 2 years

An investor with a time horizon longer than two years uses the Dividend Discount Model (DDM) to value stocks.

Thus, the stock price equals the present value of all expected future dividend payments.

Predict future Divdends

- Challenge: How can we predict future dividends?

- To determine a stock's price today, we need to forecast its dividends indefinitely.

- There are several common models for predicting future dividends:

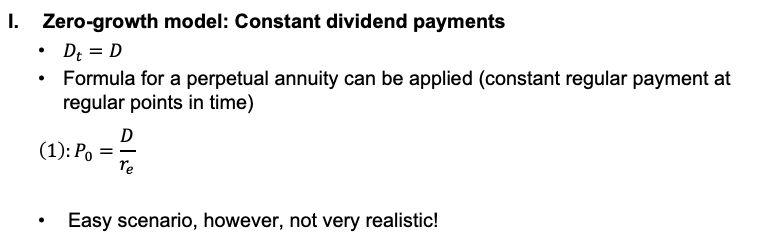

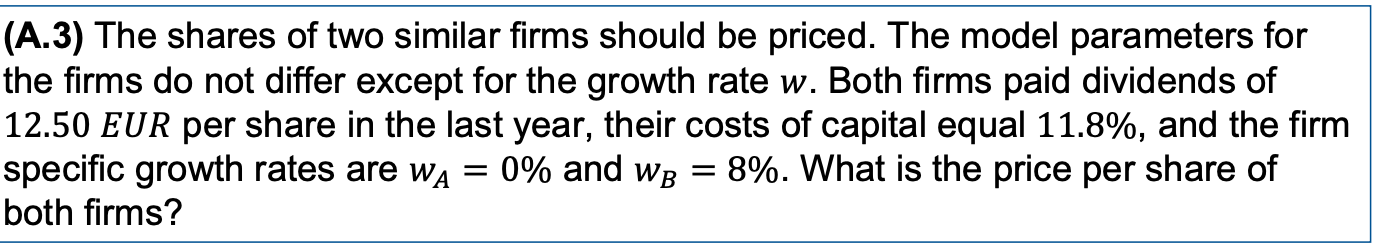

1. Zero-growth model

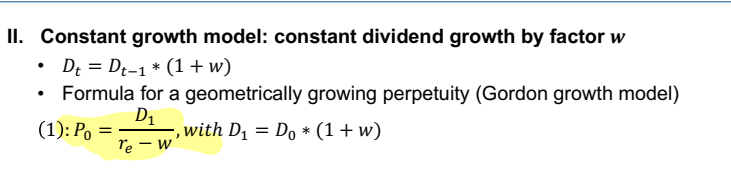

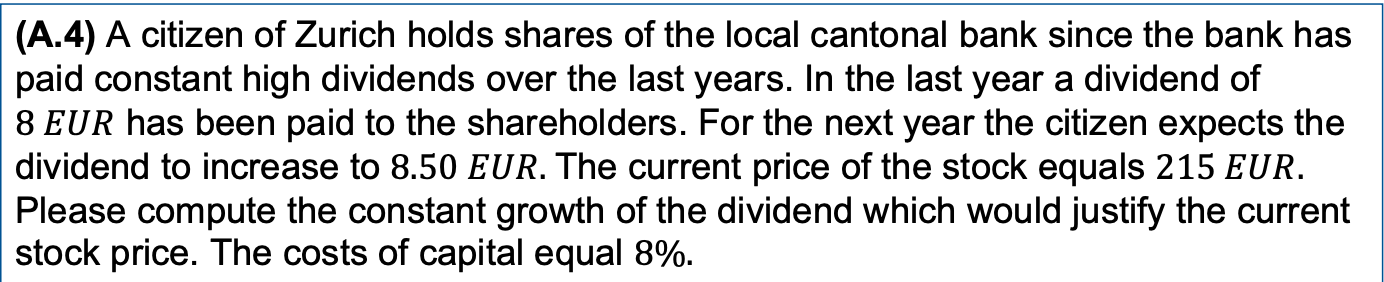

2. Constant growth model

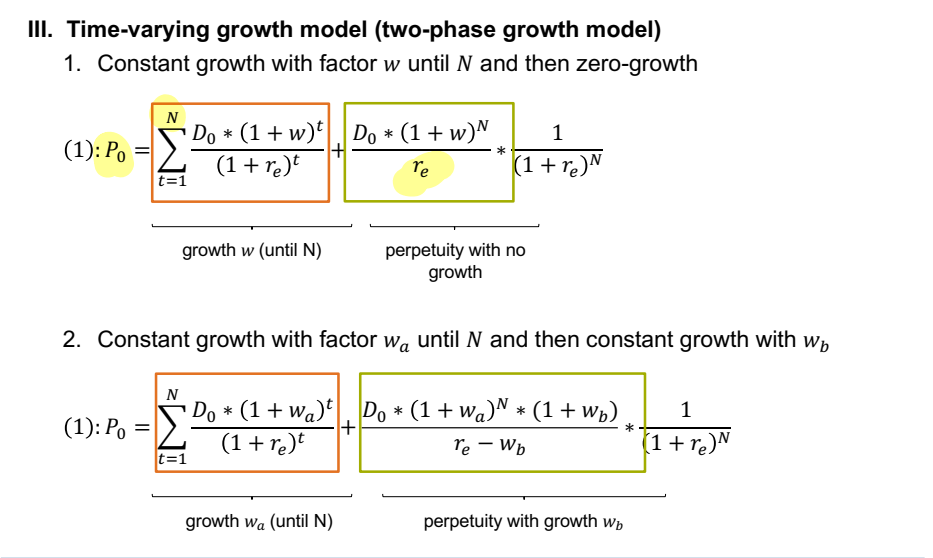

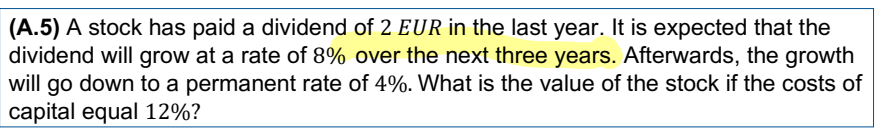

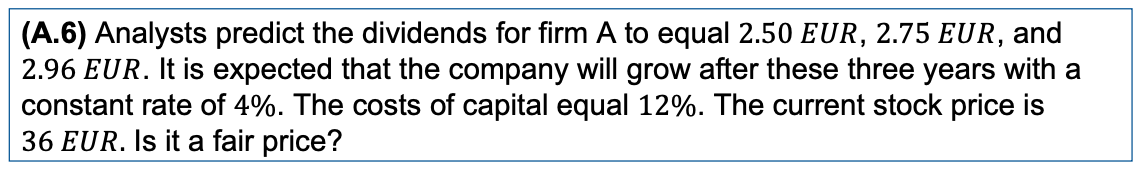

3. Time-varying growth model

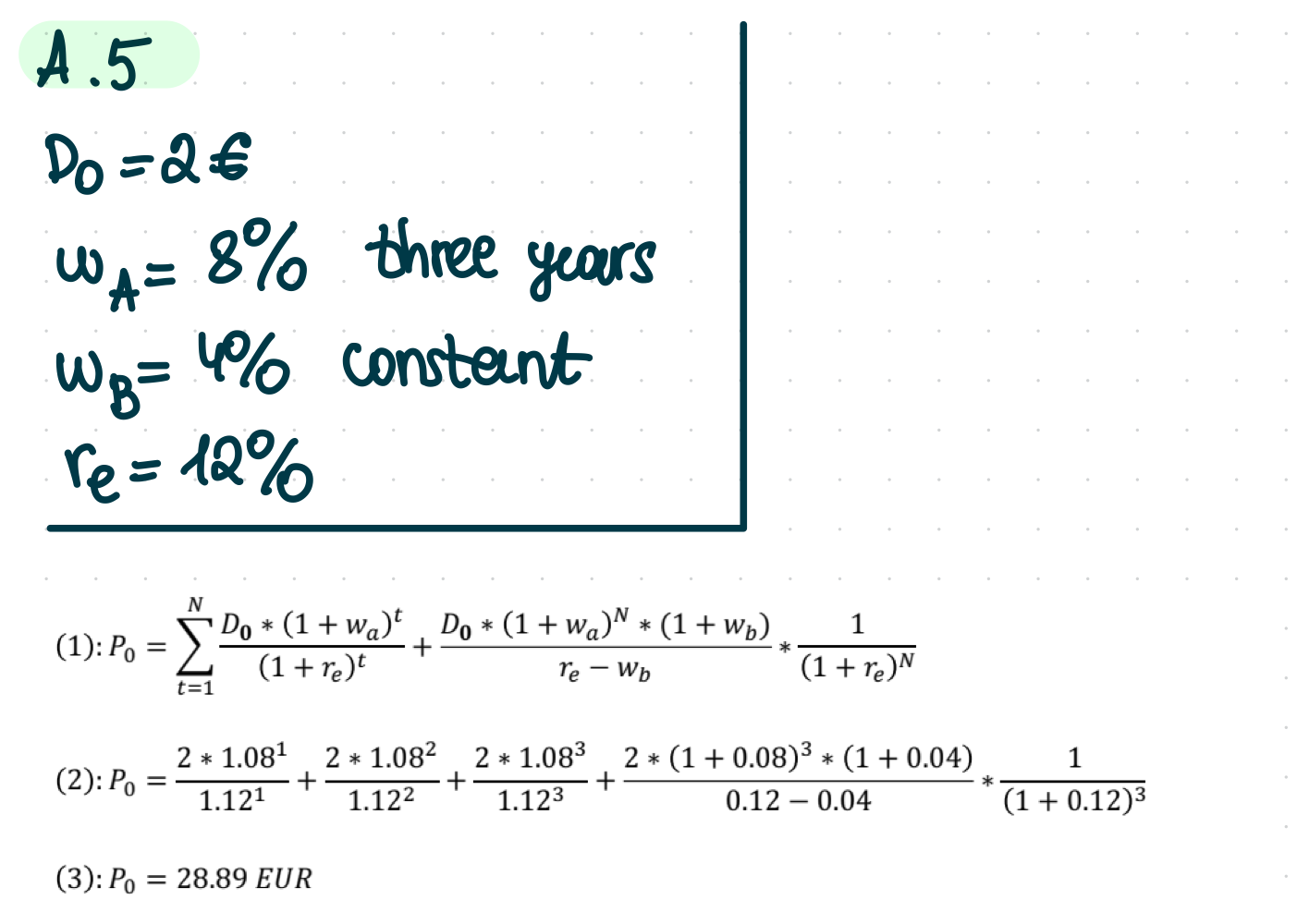

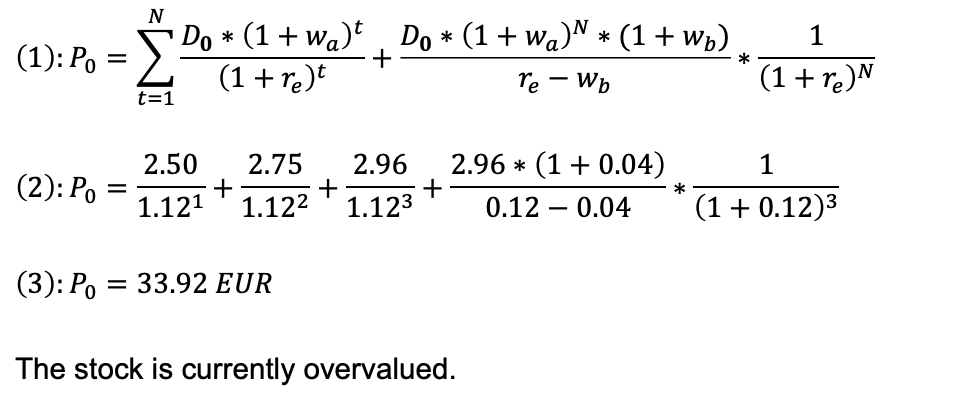

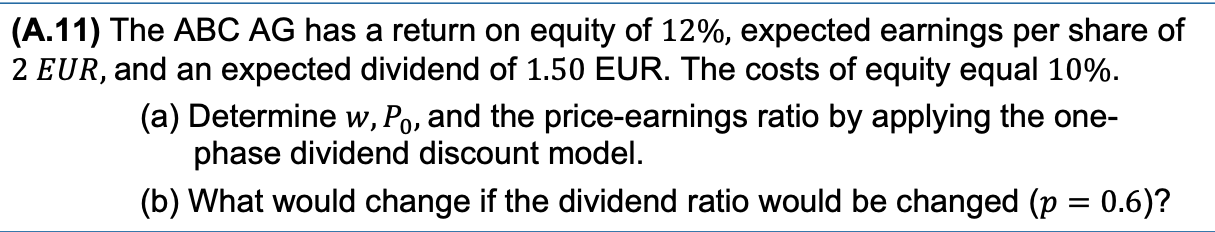

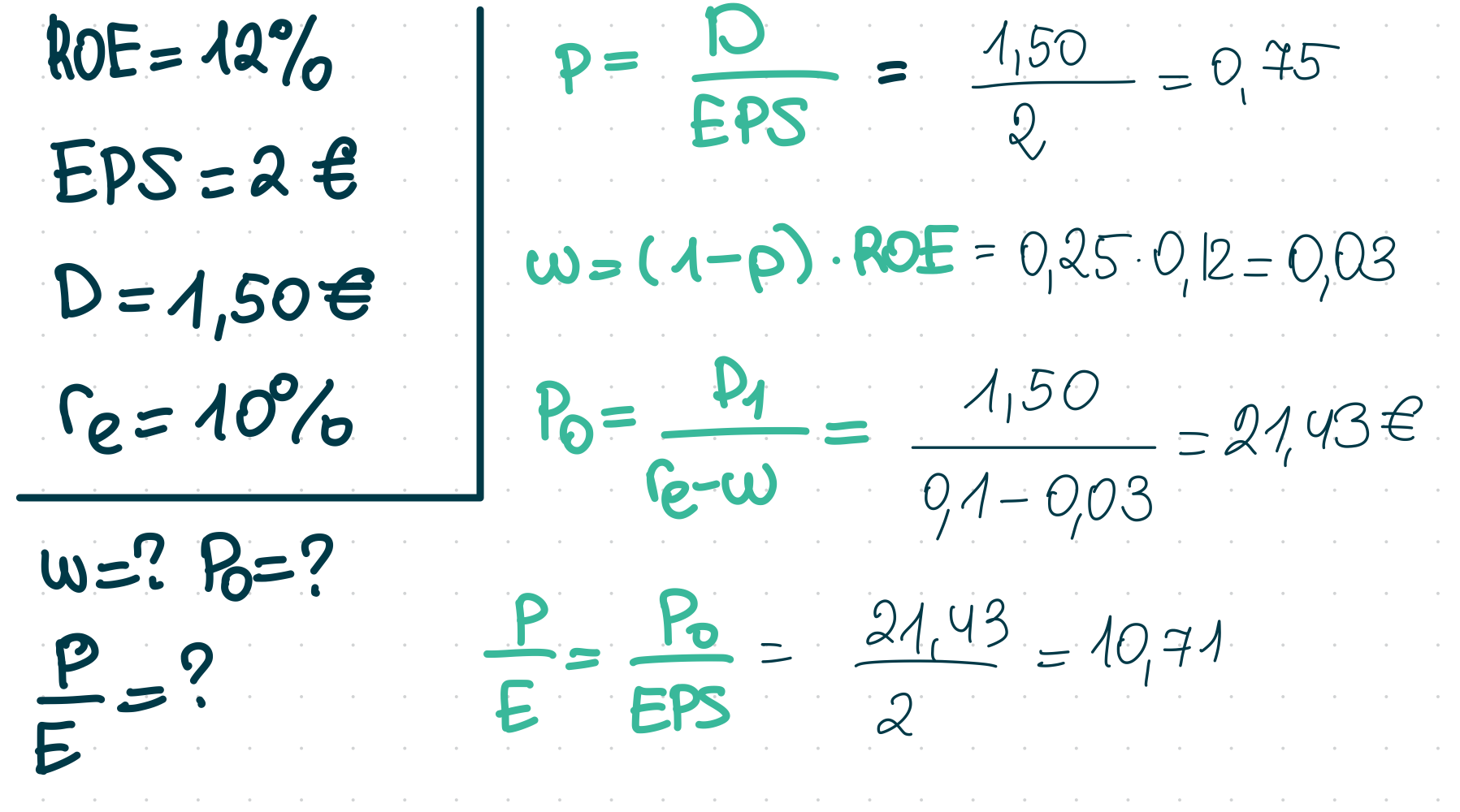

Time varying growth model

EPS, dividend ratio p, net investments I, ROE

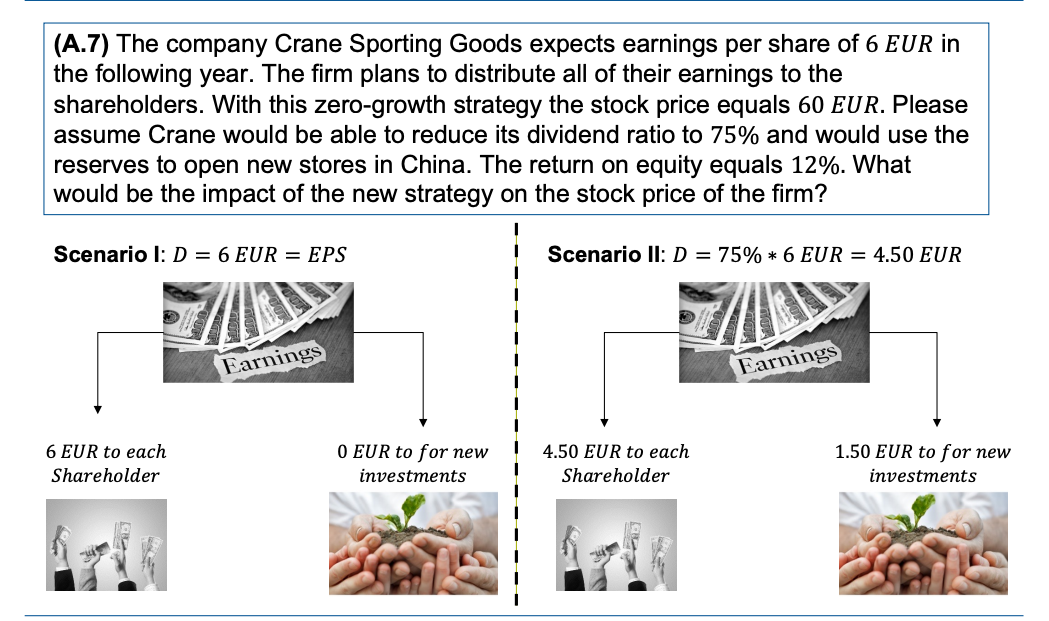

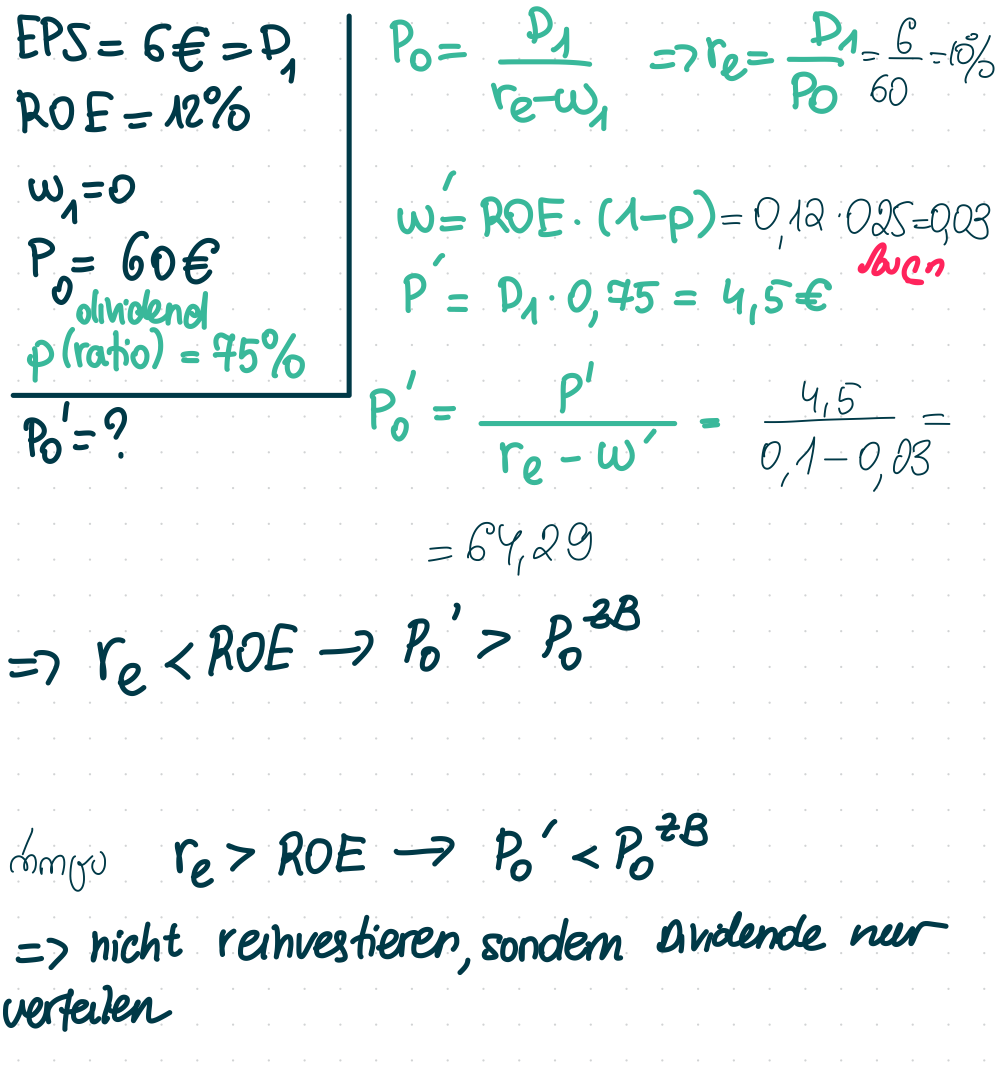

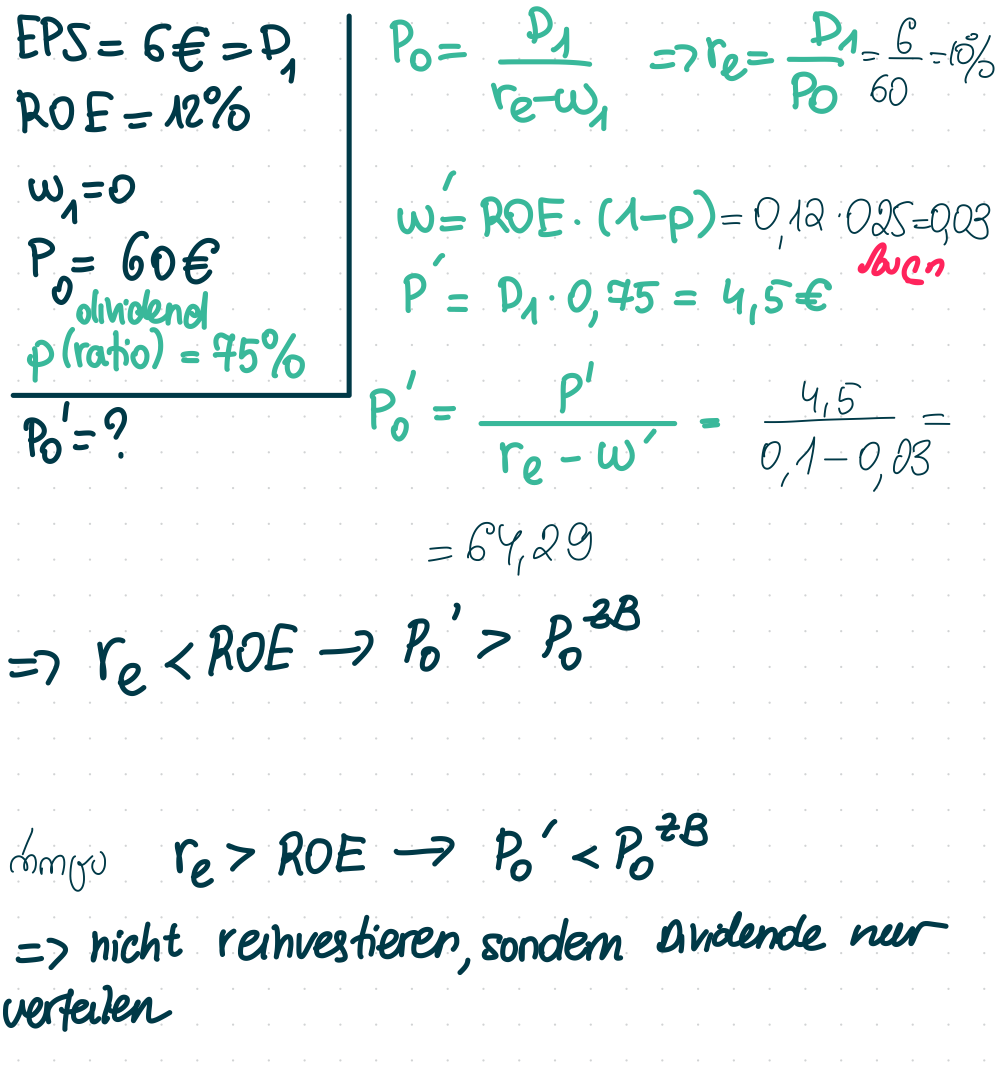

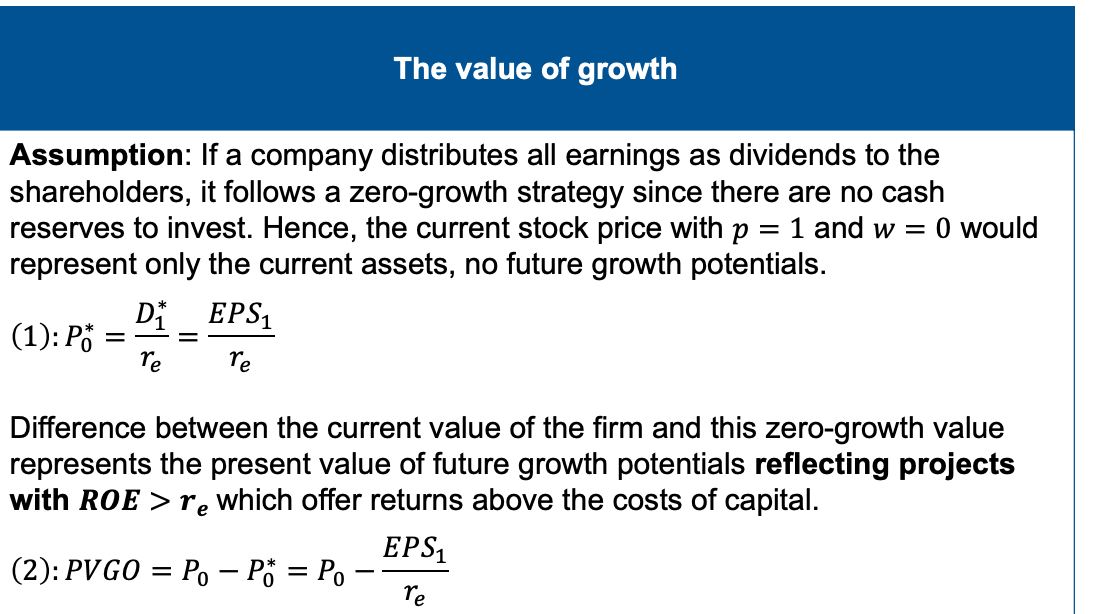

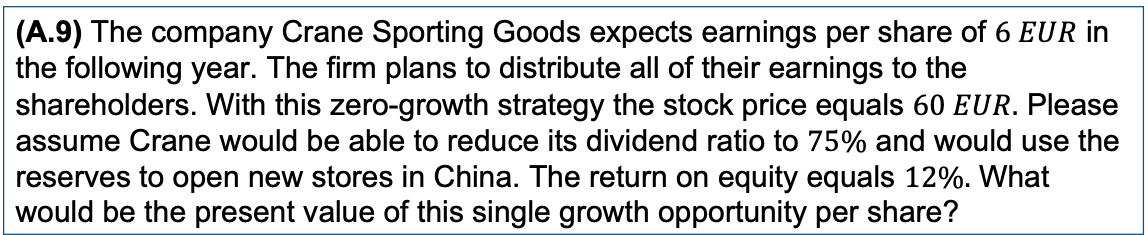

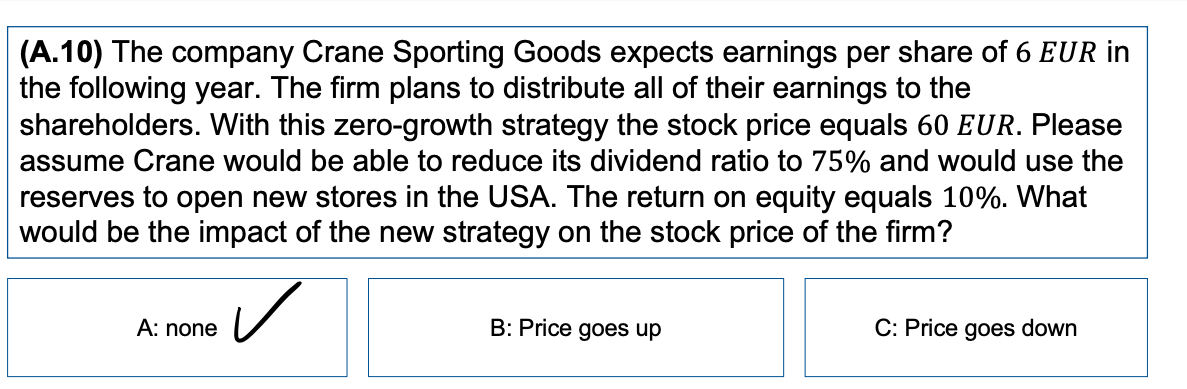

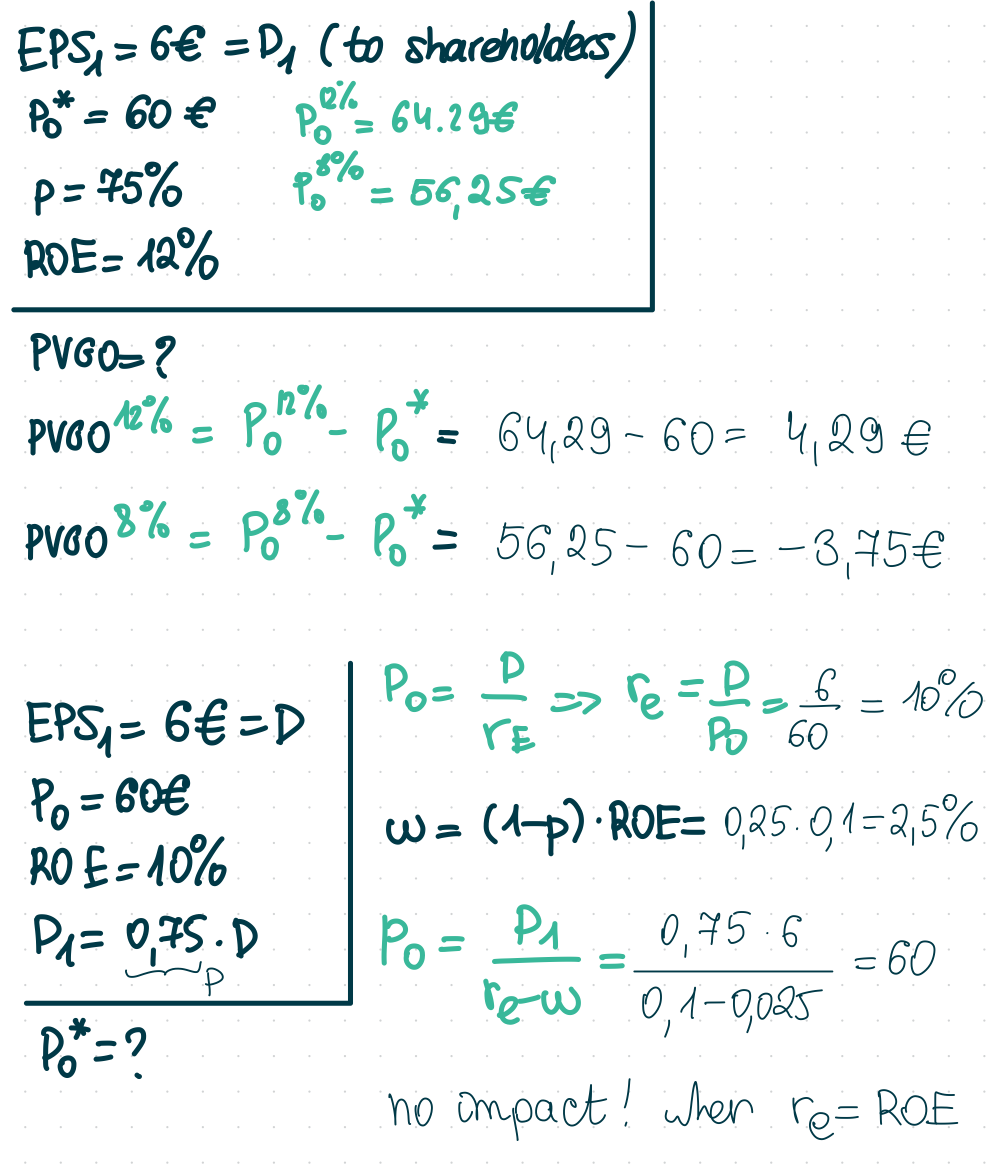

The value of growth

ნაბიჯი 1: რას ნიშნავს Zero-Growth?

როცა კომპანია ყველა მოგებას გასცემს დივიდენდად

ანუ არ ინვესტირებს მომავალში, შესაბამისად არ იზრდება (1)

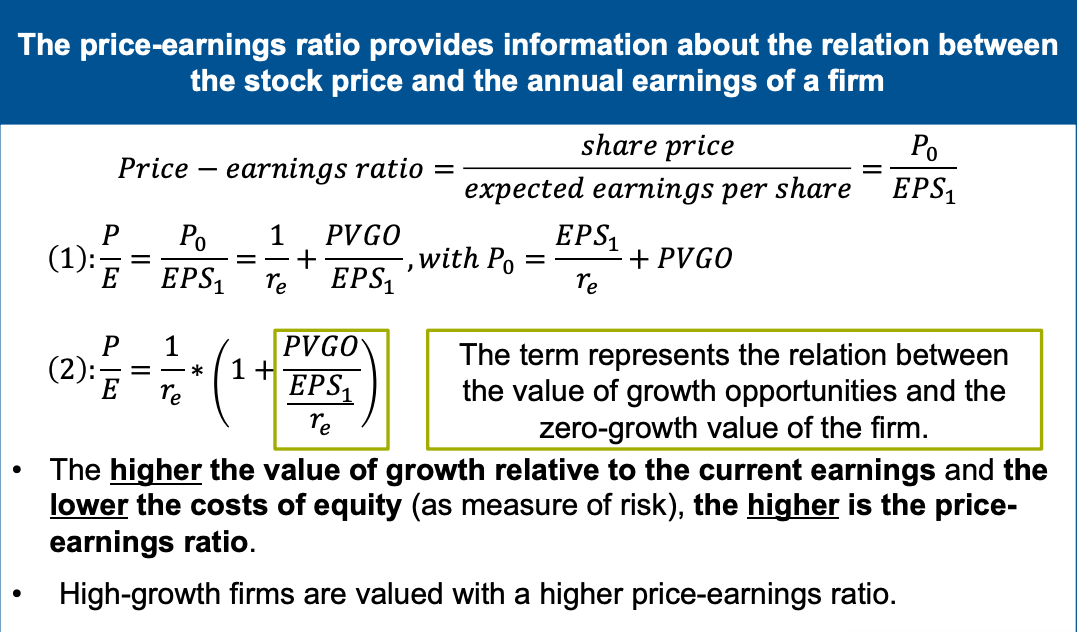

price-earnings ratio

price - book ration