Int Accct ll Ch 20 Earnings Per Share

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

Computing Earnings Per Share

Earnings per share indicates the income earned by each share of common stock.

Companies report earnings per share only for common stock.

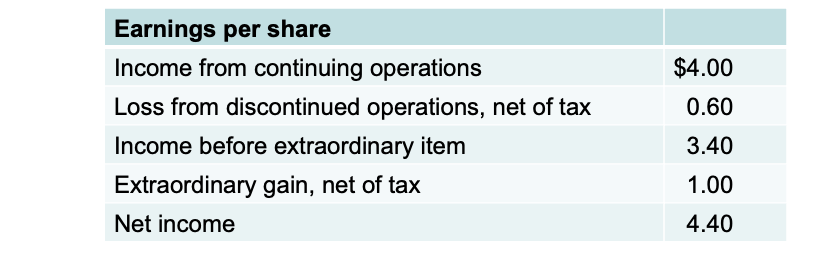

When the income statement contains intermediate components of income (such as discontinued operations or extraordinary items), companies should disclose earnings per share for each component.

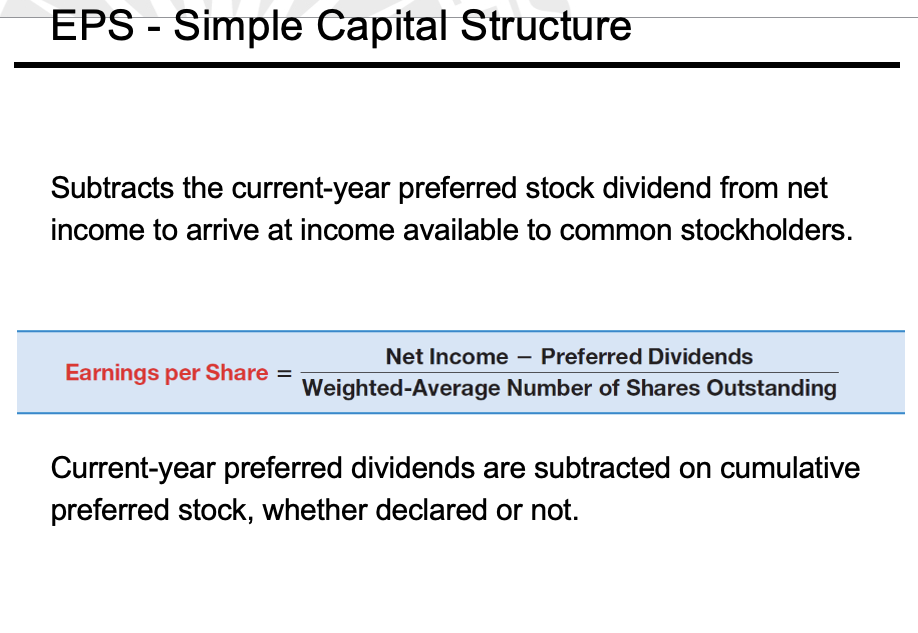

Earnings per Share—Simple Capital Structure

Simple Structure--Common stock; no potentially dilutive securities.

Complex Structure--Includes securities that could dilute earnings per common share.

“Dilutive” means the ability to influence the EPS in a downward direction.

EPS - Simple Capital Structure

Stock Splits and Stock Dividends

Stock splits and stock dividends affect shares outstanding.

Assume stock split or stock dividend occurs at the beginning of the year for shares that were outstanding as of the beginning of the year

For share issuances that occur before the split or dividend, the retroactive assumption assumes that the split or dividend occurred at the time of the issuance.

Stock Splits and Stock Dividends.

Stock splits and stock dividends also impact the computation of weighted-average common shares outstanding. For example, when Coca-Cola split its stock in 2012, the number of shares outstanding doubled from 2,251 million to 4,502 million. Therefore, to calculate EPS, the company needed to divide its net income available to common stockholders by a greater number of shares outstanding after the split.

The accounting assumes that a stock split or stock dividend occurs at the beginning of the year for shares that were outstanding as of the beginning of the year. For share issuances that occur before the split or dividend, the retroactive assumption assumes that the split or dividend occurred at the time of the issuance.

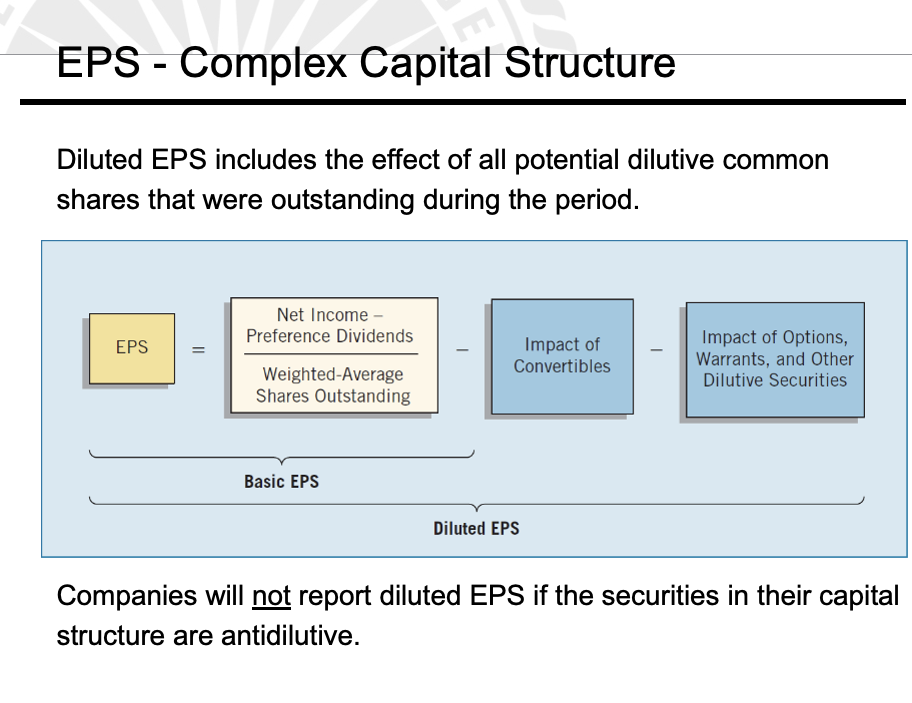

Earnings Per Share - Complex Capital Structure

Complex Capital Structure exists when a business has

convertible securities,

options, warrants, or other rights that upon conversion or exercise could dilute earnings per share.

Company generally reports both basic and diluted earnings per share.

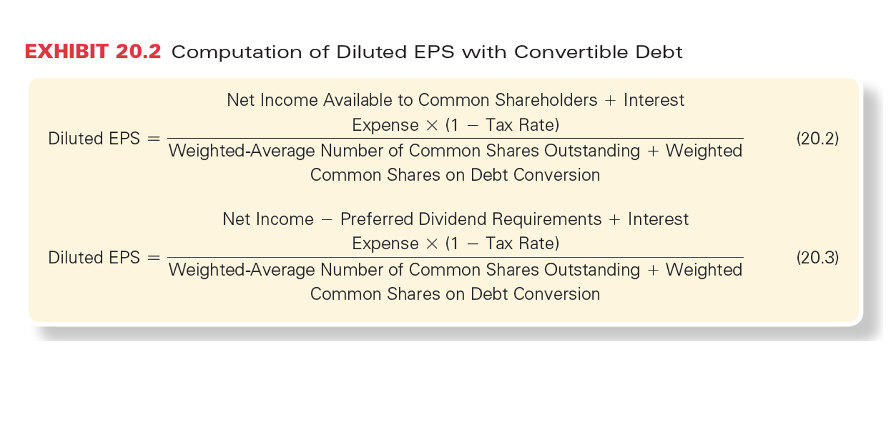

Diluted EPS - Convertible Securities

Measure the dilutive effects of potential conversion on EPS using the if-converted method.

This method for a convertible bond assumes:

the conversion at the beginning of the period (or at the time of issuance of the security, if issued during the period), and

the elimination of related interest, net of tax.