Market Structure and Game Theory

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Why does a market fail?

Due to agents not being price-takers, the market is unable to arrive at efficient outcome due to the pricing mechanism

Simple monopoly model

A single firm with a cost structure c(q) is facing an inverse demand curve p(q)

The firm maximises p and q for π(p,q) = pq - c(q) s.t p = p(q)

By incorporating the constraint, one can just maximise π(q) = p(q)q - c(q)

The solution to this gives the marginal revenue, equal to the marginal cost, which is dc(q)/dp

This leads to a deadweight loss in the market

What is a game?

Requires a set of players, sets of strategies, timing, information, and payoffs

A game has these features

What types of games are there?

Cooperative and non-cooperative games

Simultaneous and sequential games

Complete information and incomplete information

We might also include one-shot and continuous games

What is normal form?

The simplest way of representing a game and its outcomes

What is a dominant strategy?

A strategy which is best for one player regardless of what their opponent chooses

Nash Equilibrium

When players play their mutual best responses

It also requires the absence of regrets; upon knowing what your opponent is doing you do not change your mind

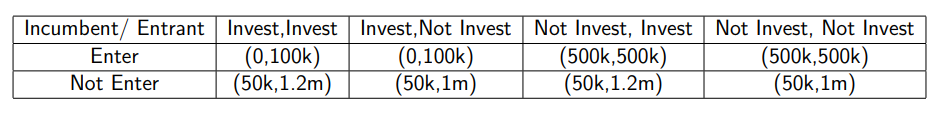

Entry deterrence

Suppose a sequential game where a firm is enjoying a monopoly

Another firm wants to enter the market; the firm in monopoly might decide to react heavily or lightly to this; they might perform an action which doesn’t provide them with the greatest monetary value but it discourages others from entering the market

In sequential games, games are represented by trees

Strategies in sequential games

A strategy is redefined as the set of actions a person undertakes at every node

This means that in the sequential game, where the second player responds to the first, although the first only makes one decision, the second persons best strategy is to act conditionally on the first

This allows for an expanded normal form

A non-credible threat

A threat of adopting a particular strategy which has no weight because the actor would want to deviate from it once it gets to their turn in the game

What is a subgame?

It is a part of sequential games and can standalone as its own game; it has well defined players, strategies, payoffs etc

These games can have their own Nash equilibria — subgame perfect nash equilibria

What is subgame perfect nash equilibrium?

The set of strategies which constitutes a nash equilibrium in all the subgames

To compute this we use backwards induction, which involves deciding what the first player will choose given the decisions of the subsequent players

What are some features of repeated games?

Much of the problems in these games concern whether cooperation is sustainable; there are infinite strategies if a game repeats forever

For a finite game, taking the last subgame in isolation, we know they will defect as there is no further repeat, but knowing they defect tomorrow means they will also defect today, such that the only SPNE seems to be non-cooperation for every stage

In infinite games the strategies become ridiculously numerable; some strategies are those like ‘Grim Trigger’, ‘Tit-for-tat’ and always cooperate/defect

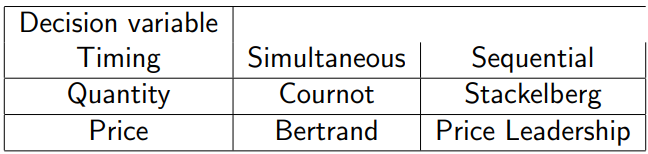

What are the four types of duopoly model?

Cournot, Bertrand, Stackelberg, and Price Leadership

The Cournot Duopoly Model

Each firm determines the quantity of supply simultaneously and market price is determined at aggregate supply

One firms quantity supply affects the others prices, so a NE depends on this quantity provided; quantity supplied is the strategy and profit is the payoff

In the case of 2 firms, MC = 1, P = 10 - Q, and Q = q1 + q2, and at the Nash Equilibrium, q1 = q2 = 3

The Bertrand Duopoly Model

This is a simultaneous price-setting model which assumes that individual firms have the capacity to meet all of the demand in the market — there is incentive to undercut the other firms price

Strategies become prices, and payoffs are profits

This is difficult to solve analytically; π1 = 0 if p1 > p2, and profit is a function of revenue - costs if p1 < p2 or the same as it

Best responses aren’t well defined; in a perfect market prices are the same as the marginal cost

This leads to completely perfect competition which can be conceived of as a bid for customers

The Stackelberg duopoly model

This is a sequential capacity-setting model, with prices determined afterwards in the market, which assumes a leader firm and a follower firm, the first which can decide which overall outcome they want; strategies are quantities supplied

This can be solved by backward induction; we solve the maximisation problem for the follower and then implant it in the leader’s solution

This is referred to simply as a quantity leadership sequential game

Collusion

This is the case where firms recognise that they don’t necessarily need to compete; they could cooperate and set prices, thus achieving maximum profits and splitting them

If two firms in a market agree to cooperate and they believe that the other will stay at a fixed price level, there is an incentive to cheat and increase output whilst the other remains fixed

What is price leadership?

The case where a dominant firm moves first and all other firms in the market match this price

What is a duopoly?

A market with only two firms; we use this to model the strategic interactions of oligopolies without importing the notational difficulty which comes with many other firms

An oligopoly is simply a market structure with a limited number of firms such that no firms effect on price is negligible

What is the residual demand curve?

The demand curve given to a price leader which is equal to total market demand minus the supply curve of the other firm in the market

They are choosing price, not quantity, and thus only decide this

R(p) = D(p) - S(p)

Equilibrium condition occurs where MR = MC; because the Residual Demand Curve, R(p) is linear, the MR has the same intercept but is twice as steep

How do firms adjust to equilibrium in the Cournot model?

Quantity produced is based on the expectations a firm has about the other firms supply, y1t+1 = f1(y2t)

Thus, if a firm 1 suspects the other will stay producing at y2t, it will move left to the other firms reaction function; the other firm has a similar incentive, and moves upwards until it reaches firm 1’s reaction function; this zig-zag movement is a convergence towards the Cournot equilibrium

How do cartels mitigate against cheating?

Cartels introduce a punishment risk which causes people to not cheat; one firm might threaten another by saying that if they agree to maintain the fixed price, fine, but if they don’t, then they will adopt the Cournot price forever

What is a mixed strategy?

This allows for an agent to perform different strategies at different times by assigning a probability weight to each strategy

If they’re indifferent between two strategies, neither of which leads to an equilibrium, they might assign a probability of a half to each strategy

This type of strategy cares about average payoff rather than single-game payoff

What is a focal point?

Generally occurring in a game with Nash equilibria, a focal point is an equilibrium which feels more natural than another strategy

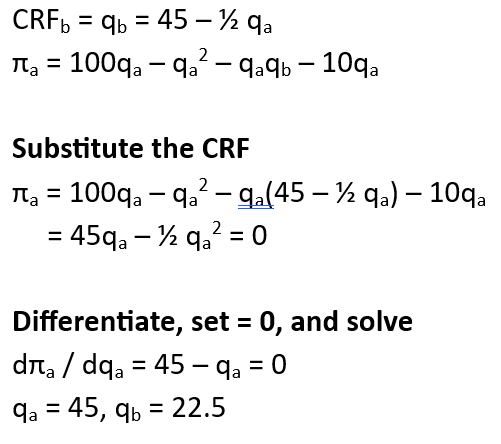

How to calculate optimal quantity for a Stackelberg model

Find the Cournot Response functions, given by maximising the profit functions and solving simultaneously

Substitute the CRF of firm B into firm A’s profit function; this is effectively the mathematical process of backwards induction

Expand and differentiate firm A’s profit function with firm B’s CRF substituted into it

Set equal to 0 and solve for the optimal quantity of firm A

Substitute the optimal quantity, qa* into firm B’s CRF to get qb*

Stackelberg Optimum Quantity Calculation Example

How to calculate the Cournot Reaction Functions

Derive both of the profit functions (given an inverse market demand function and cost, subtract the costs from the equation, then multiply the whole thing by ‘qa’)

Maximise both of the profit functions wrt the quantity involved

Set the functions equal to each other and solve simultaneously to get expressions in terms of each other