Business - 3.7

1/236

Earn XP

Description and Tags

AQA A-level Business Strategic positioning

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

237 Terms

mission statement

sets out the purpose of an organisation and provides its reason for existing

what do mission statements focus on

what the business wants to be, its values, the range of activities, the importance of different groups such as employees, customers and investors

benefits of mission statements

employees know what they are aiming for, all actions directed at the same gal, decision-making is easier (as can compare) and motivate staff

vision statement

sets out what the business wants to be or do in the future (aspirational and long-term)

factors that influence the mission statement (x5)

values of founders

values of employees

industry e.g. fashion = creativity ad uniqueness vs tech = innovation and R&D

societal values

ownership (public vs private sector)

corporate (or strategic) objectives

objectives which make the mission statement attainable and quantifiable (SMART goals) which are set by senior managers and provide guidance to those lower down

factors influencing strategic decisions and objectives (x4)

business ownership as private owned businesses may be under more pressure of high returns instead of social impact e.g. John Lewis = benefit all employees (partners)

pressures for short-termism

internal environment including performance, leadership (e.g. Harriet Green for Thomas Cook) and culture

external environment including state of the economy, prices on global market, tech changes and patterns of migration

tactical decisions

how to implement a business’s strategy e.g. change in supplier or a temporary change in promotional activities which are short-term and involve fewer resources and uncertainty

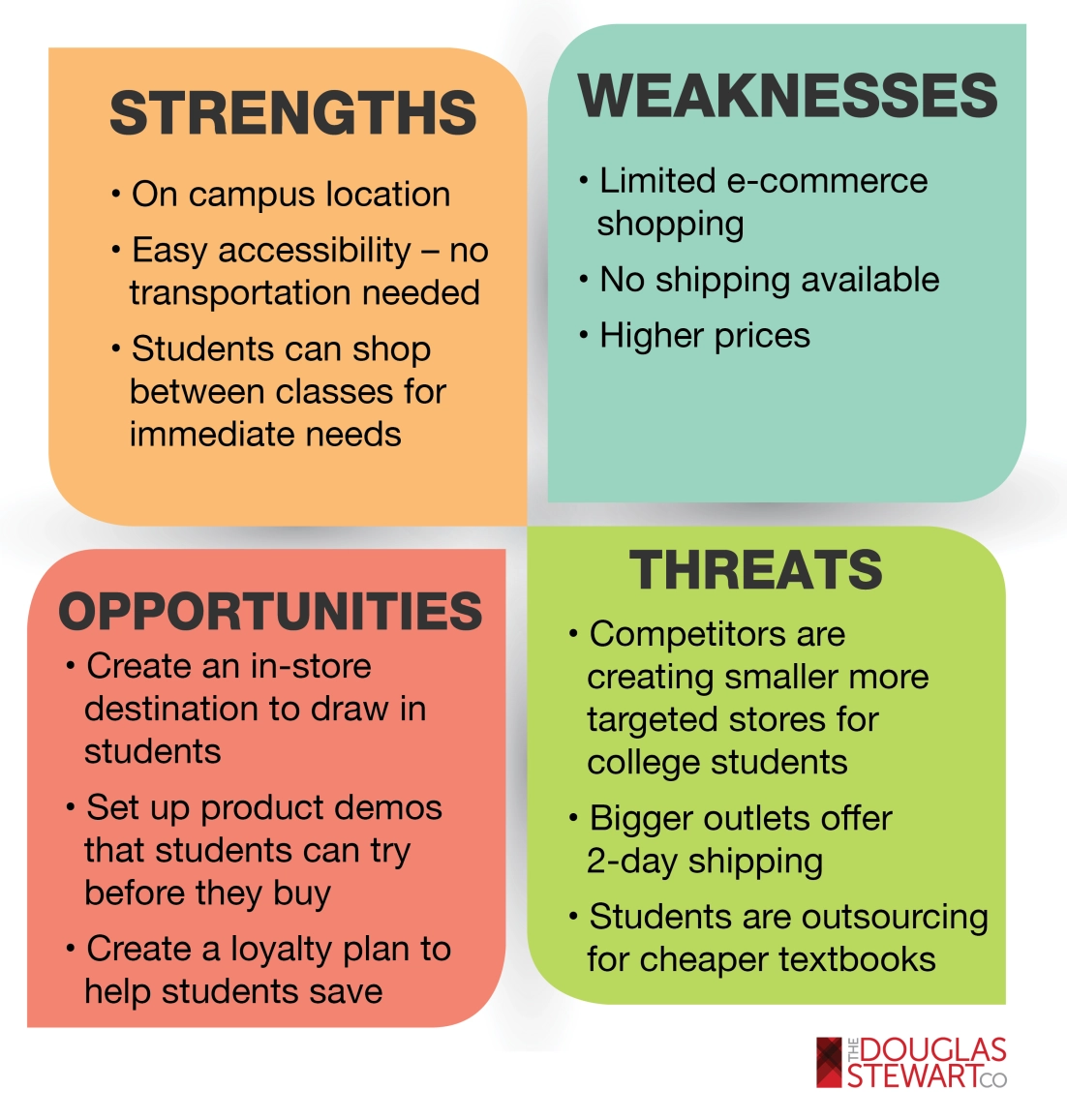

SWOT analysis

benefits of a SWOT analysis (x5)

low cost and straightforward technique

assist managers in thinking in a structured manner whilst focus on both internal and external environment

encourages logical plans in context

helps recognise and assess risk

can be combined with PESTLE easily

limitations of a SWOT analysis (x6)

difficult to address two sided or uncertain factors e.g. both an opportunity and threat

have to analyse, interpret and make sense of information

time-consuming

offers no assistance in judging relative importance

can be subjective

data is likely to become out of date quickly

balance sheet

a document describing the financial position of the business at a particular point in time

compares value of items owned and owed

non-current assets

assets owned by the business which have a ‘life’ of over one year e.g. land, buildings, machinery, computers etc.

current assets

assets in the business which have a life of less than one year e.g. stock (inventory), bank accounts, cash and receivables

non-current liabilities

debts due for repayment after more than one year e.g. mortgages, debentures and long term or medium term loans

current liabilities

debts due to be repaid within the year e.g. bank overdrafts, corporation tax, shareholders’ dividends, payables etc.

share capital

funds provided by the shareholders through the purchase of shares

reserves

the profits kept back by the business and not distributed back

purpose of the balance sheet (x5)

allows financial assessment as can show overall worth of the business by calculating net assets

may give information about the nature of the business e.g. supermarkets = high inventories

identify the business’s liquidity position by calculating current ratio

showing sources of capital

recognises any undesirable changes so can mitigate

current assets calculation

inventories + receivables + cash

working capital calculation

current assets - current liabilities

net assets calculation

non-current assets + current assets - current liabilities - non-current liabilities

assets employed calculation

net currents assets + non-current assets

total equity calculation

share capital + reserves

capital employed calculation

total equity + non-current liabilities

income statement

an account showing the income and expenditure of the business over a period of time (usually a year)

purpose of the income statement (x7)

helps managers review progress before the end of the financial year

allows shareholders to assess whether their investment is generating a return

managers and investors can see if profit is being utilised sensibly

satisfies legal requirements

stakeholders can see if the firm is meeting their needs

comparisons can be made (inter-firm, intra-business and through time)

shown to potential financial investors to prove success and ability to repay

expenses / overheads

costs that are not directly related to producing the goods or service e.g. marketing, rent, depreciation of non-current assets

finance income

interest from money held in banks/lent out and finance costs (from banks/financial providers)

tax on profits made

incorporated companies pay corporation tax on profits while unincorporated pay income tax

profit for the year

details how much goes to shareholders and how much is retained

exceptional items

items that have a ‘one off’ effect on profits e.g. downsizing will incur huge redundancy costs or sale of major machinery

gross profit calculation

revenue - cost of sales

operating profit calculation

revenue - cost of sales - expenses (+ or - exceptional items)

profit before tax calculation

operating profit + finance income - finance costs

profit for the year calculation

profit before tax - taxation

why are financial documents required and what is their importance? (x9)

banks for deciding whether to lend funds

managers to measure success

employees for security

owners and investors to compare financial alternatives

government to assess tax liability and assess impact of economic policies

competitors to compare and benchmark

suppliers to ensure can pay on time

customers for guarantees and after-sales service agreements

local community as reliant for employment

revenue expenditure

spending on day to day items e.g. raw materials, inventories, wages and electricity etc.

capital expenditure

spending on items which can be used over and over again and have a long term life in the business (non-current assets)

matching principle

when calculating a firm’s profits, any income should be matched to the expenditure involved in creating it

depreciation

calculating the cost of a tangible or physical asset over its useful life

prudence

accounts should ensure that the worth of the business is not exaggerated to impress potential investors

profit utilisation

the way in which profit is being used i.e. retained or distributed to shareholders

dividends paid to shareholders

shareholders want it to be as high as possible which may place pressure on the business to distribute as much profit as possible back to shareholders

retained profits

to fund expansion plans and capital investment (avoiding needing to borrow)

inter-firm comparisons

a business compares itself to rival businesses (in the same market and of a similar size) to assess its own performance

time comparisons

year-on-year as can register trends in efficiency and allow for exceptional circumstances in a particular year

intra-firm comparisons

the efficiency of different divisions within the business are compared

standard comparisons

certain levels of performance are recognised as being efficient for a particular industry and so can be compared to objectively assess performance

gross profit margin calculation

gross profit / revenue x 100

analysis of GPM

for every £1 made in sales, £… is made in gross profit after the cost of goods sold has been deducted

ways to improve GPM (x2)

reduce variable costs (e.g. find a cheaper supplier)

increase sales without increasing cost of goods sold

operating profit margin calculation

operating profit / revenue x 100

analysis of OPM

tells you how well a business is managing its resources and efficiently creating profit from its main operations

ways to improve OPM (x3)

reduce variable costs

increase sales without increasing cost of goods sold

improve inventory management

net profit margin calculation

net profit / revenue x 100

analysis of NPM

for every £1 made in sales, £… is left as net profit after all expenses have been deducted

ways to improve NPM (x3)

reduce expenses (e.g. cheaper premises)

increase sales without increasing cost of goods sold

reduce variable costs

return on capital employed calculation

operating profit / capital employed x 100

analysis of ROCE

assess a company’s profitability and capital efficiency

the higher and more stable the %, the more profitable the business is as it shows £… profit is being made per £1 of capital employed#

often compared to interest rates to decide if investment should be made

current ratio calculation

current assets / current liabilities

analysis of current ratio

shows the amount of current assets in relation to its current liabilities (x:1) e.g. for every £… owned in current assets, it owes £… in current liabilities

Morrison’s current ratio

0.5:1 but survive as they are a large company with a large sales turnover

ways to improve current ratio (x2)

cut down on current liabilities e.g. pay off suppliers, raise share price

sell some of their debts or non-current liabilities

gearing calculation

non-current liabilities / total equity + non-current liabilities x 100

analysis of gearing

shows the proportion of assets invested in a business that are financed by long-term borrowing/debt (which must then be paid back)

high gearing = above 50%

low gearing = less than 25%

benefits of high capital gearing (x4)

most of the business financed through debt so no dilution of ownership

fewer shareholders so quicker/easier decision making

company can benefit from low interest rates

often larger companies use this as high profits minimise the risk of liquidity issues anyway + less dividends

benefits of low capital gearing (x2)

financing through equity means no interest repayment (less likely to have liquidity problems)

impact of an increase in interest rates is minimised

how to reduce gearing (x5)

focus on profit improvement e.g. cost minimisation

repay long-term loans

retain profits rather than pay dividends

issue more shares

convert loans into equity

how to increase gearing (x5)

focus on growth - invest in revenue growth rather than profit

convert short-term debt into long-term loans

buy back ordinary shares

pay increased dividends out of retained earnings

issue preference shares or debentures

payables days calculation

trade payables / cost of sales x 365

analysis of payables days

on average, it takes the firm … days to pay their suppliers and other creditors

want to maximise this to avoid liquidity problems BUT holding on after the agreed credit period can have consequences e.g. loss of trust

ways to improve payables days (x2)

delay payment to suppliers

gain favourable credit terms

recievables days calculation

trade receivables / sales x 365

analysis of receivables days

on average, it takes customers … days to pay for their purchases

want to minimise this with the ideal figure being around 30 days as shows how efficient the business is at collecting money that is owed

bad debt

when a customer cannot afford to pay off the money owed and it has to be “written off”

ways to improve receivables days (x4)

reduce credit terms

credit rating checks

debt factoring

early payment incentives

inventory turnover calculation

cost of sales / (beginning inventory + end inventory / 2)

analysis of inventory turnover

shows the number of times the business restocks/turns over stock in one year and so indicators how quickly inventory is converted into sales

the higher the better

factors influencing the rate of inventory turnover (x6)

nature of the product (perishable / dated = high)

importance of holding inventory e.g. clothes retailers encouraged to hold different sizes etc.

length of product lifecycle (fashionable = sell quickly = higher)

inventory management systems = JIT = high

quality of management as order stock

variety of products

ways to improve inventory turnover (x2)

inventory analysis (pricing, demand, stock mix, purchasing strategy etc.)

training to address purchasing decisions

users + advantages of ratio analysis (x6)

managers = identify efficiency, can plan ahead, control operation and assess effectiveness of policies

employees = afford wage rises and see if profits allocated fairly

government = review success of economic policies

suppliers = payment terms offered to other suppliers and whether they can afford to pay

customers = to know if the future of a firm are secure

shareholders = financial benefits of investment

limitations of ratio analysis (x5)

firms have different aims and objectives so financial performance may not be the firms measure of success

reliability of information as may be unreliable (asset valuation is subjective + may windowdress to show favourable)

historical basis so not necessarily a useful guide to the future and no WHY

external factors needed to explain ratio

no two firms or divisions face identical circumstances

performance metrics

quantifiable measures used to judge success e.g. customer retention rates, repeat custom, absenteeism, staff turnover, average unit costs, productivity, financial ratios, cash flows etc.

limitations of using non-financial methods to measure performance (x7)

no standardisation of measures to use and even when there is, there is not always widespread agreement on what is considered a desirable level

qualitative data is subjective and open to interpretation

often interdependent meaning when one is achieved, it is likely others will be too

often reflect what has already happened

relative importance changes over time

excessive monitoring and analysis can be de-motivating

businesses may want to use objective ‘measurable’ methods instead

core competences

unique strengths and assets that set your company apart as they cannot be easily replicated by competitors

therefore, managers should concentrate on activities which are vital to the business improving competitiveness

how to identify core competences (x3)

does it make a significant contribution to the benefits that customers believe they are receiving from buying the end product?

does it help to provide potential access to a wide variety of markets?

is it difficult for companies to copy/replicate?

Apple’s core competences

implementing elegant but functional design to all products/ranges meaning consumers get products that work intuitively and Apple are able to enter new markets due to the high brand loyalty (+ allows price skimming)

limitation of core competences

drives businesses to concentrate too much on outsourcing (driven by cost minimisation) as non core competences encouraged to be outsourced

potential loss of control that can affect quality of the final product + CSR

E.G. Dell = customer satisfaction dropped as outsourced call centres to India

short-termism

the tendency of the business to prioritise current performance rather than the long term sustainability of the business

e.g. 1975 = average time a shareholder held shares was 6 years, 2015 = 6 months

unilever case study

stopped updating the stock market on its performance every quarter in 2009 to encourage a long-term perspective + launched a sustainable living plan

corporate social responsibility

trying to assess and avoid the negative effects business activity might have on future generations

elkington’s triple bottom line

profit

people (e.g. suppliers, customers, employees, local residents etc.)

planet (environment inc. emissions, quantity of waste, non-renewable resources etc.)

examples of ETBL (x3)

COSTCO → closes over main holidays as believes workers should be at home, pay double minimum wage to retain workers yet profits remain over $2 billion

NIKE → ‘Transparency 101’ ensuring public awareness of all business practices + ‘Reuse a Shoe’ = recycle shoes

TESLA → caused no drop in profits over long-term as increased efficiency, lower wastage etc.

benefits of ETBL (x7)

encourages more social responsibility

encouraged governments to think about making aspects a legal requirement for PLCs

philanthropic presence may encourage employee retention and decrease attrition

may provide a USP

encourages CSR reporting

“companies that treat their workers better, do better”

COULD cut costs

limitations of ETBL (x6)

certain elements are difficult to measure or compare e.g. child labour vs disposal of waste

depends on economic cycle

not very useful as an overall measure

no legal requirements

depends on target market e.g. Primark customers want the low price

increase in costs e.g. higher wages, better quality materials etc.

political environment

the range of government policies and their impact on the business

legal environment

the range of legislation and regulation that has been passed and its impact on the business

reasons for government policies

want to encourage people and organisations to develop their ideas and establish businesses

seek to reduce risk with business (especially for start-ups) and stimulate innovation

assessed through level of self-employment (15% in 2015)

British Business Bank

manages all UK government programmes that help smaller businesses to gain access to finance and advice (1st year = £660 million)