financial accounting

0.0(0)

0.0(0)

Card Sorting

1/50

Earn XP

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

51 Terms

1

New cards

cash flow from operating activities

- working capital = current asset - current liabilities

- indicator of company's ability to generate sustainable cash flows through operations and management of working capital

- focus on income statement and changes in current assets and liabilities from balance sheet

- indicator of company's ability to generate sustainable cash flows through operations and management of working capital

- focus on income statement and changes in current assets and liabilities from balance sheet

2

New cards

Cash inflows for operating activities

1. sale of goods or services

2. collection of interest and dividends

2. collection of interest and dividends

3

New cards

cash outflows for operating activities

1. purchase of inventory

2. payment for operating expenses

3. payment of interest

4. payment of income taxes

2. payment for operating expenses

3. payment of interest

4. payment of income taxes

4

New cards

cash flow from investing activities

focus on changes in PPE, long term investments and assets from balance sheet(depreciation, gains/losses on sale of PPE and other LT assets)

5

New cards

cash inflow for investing activities

1. sale of debt/equity investments

2. sale of PPE

3. Collection of loan/notes receivable

2. sale of PPE

3. Collection of loan/notes receivable

6

New cards

cash outflow for investing activities

1. purchase of PPE

2. purchase of debt or equity

3. loans to other corporations

2. purchase of debt or equity

3. loans to other corporations

7

New cards

cash flows from financing activities

focus on long-term debt and stockholder's equity from balance sheet

8

New cards

cash inflows for financing activities

1. issuance of bonds or notes payable

2. issuance of stock

3. reissuance of treasury stock

2. issuance of stock

3. reissuance of treasury stock

9

New cards

cash outflows for financing activities

1. repayment of bonds or notes payable

2. acquisition of treasury stock

3. payment of dividends

2. acquisition of treasury stock

3. payment of dividends

10

New cards

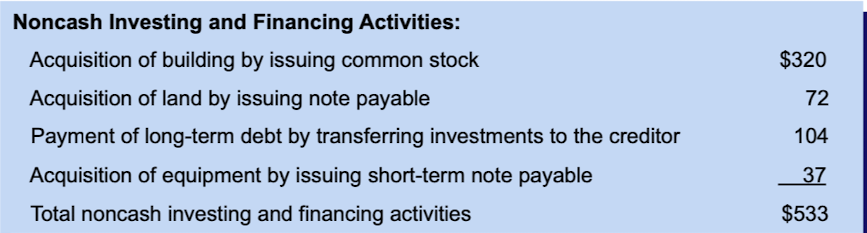

noncash activities

-significant investing and financing activities that do not affect cash

-reported after the cash flow statement or in a note to the financial statements

Examples

- purchase long term assets by issuing debt

-reported after the cash flow statement or in a note to the financial statements

Examples

- purchase long term assets by issuing debt

11

New cards

indirect method (operating activities)

1. begin with net income

2. list adjustments to net income to arrive at operating cash flows

2. list adjustments to net income to arrive at operating cash flows

12

New cards

direct method (operating activities)

adjust the items in the income statement to directly show the cash inflows and outflows from operations

13

New cards

operating activities (indirect method adjustments)

1. Non cash items (depreciation expense)

2. Non operating items (gains and losses on sale of assets)

3. changes in current assets and current liabilities (increase in account receivables is the amount of revenue reported in the income statement but not yet collected in cash)

2. Non operating items (gains and losses on sale of assets)

3. changes in current assets and current liabilities (increase in account receivables is the amount of revenue reported in the income statement but not yet collected in cash)

14

New cards

indirect method (adjustment for non-cash activities included in net income)

+ amortization expense

+depreciation expense

+depreciation expense

15

New cards

indirect method (adjustment for non-operating activities included in net income)

+ loss on sale of assets

- gain on sale of assets

- gain on sale of assets

16

New cards

indirect method (adjustment for non cash part of operating activities included in net income)

- increase in a current asset

+decrease in a current asset

-increase in a current liability

+decrease in a current liability

+decrease in a current asset

-increase in a current liability

+decrease in a current liability

17

New cards

direct method (cash received from customers)

net sales-increase in accounts receivable=cash received from customers

18

New cards

direct method (cash paid to suppliers)

cost of goods sold - decrease in inventory = purchases

purchases + decrease in accounts payable = cash paid to suppliers

purchases + decrease in accounts payable = cash paid to suppliers

19

New cards

direct method (cash paid for operating expenses)

operating expenses + increase in prepaid rent = cash paid for operating expenses

20

New cards

direct method (cash paid for interest expense)

interest expense - increase in interest payable = cash paid for interest

21

New cards

direct method (cash paid for income taxes)

income tax expense + decrease in income tax payable = cash paid for income taxes

22

New cards

cash flow from operating activities

+sale of long-term assets

-purchases of long term assets

+collections of notes receivables

-loans to others

-purchases of long term assets

+collections of notes receivables

-loans to others

23

New cards

cash flows from financing activities

+ issuance of shares

- purchases of treasury shares

+ sale of treasury stock

+issuance of notes and bonds payable (face value)

-payment of notes and bonds payable

-payment of dividens

- purchases of treasury shares

+ sale of treasury stock

+issuance of notes and bonds payable (face value)

-payment of notes and bonds payable

-payment of dividens

24

New cards

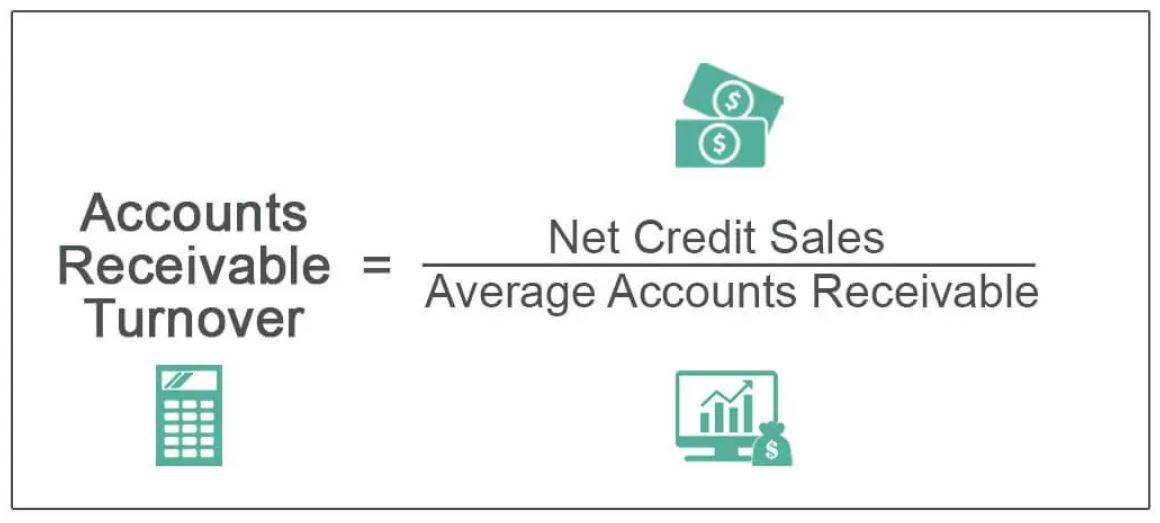

receivables turnover ratio (risk ratio)

measures how many times receivables are collected during year

higher ratio indicates ability to quickly turn receivables into cash

low ratio indicates trouble collecting receivables

higher ratio indicates ability to quickly turn receivables into cash

low ratio indicates trouble collecting receivables

25

New cards

average collection period(risk ratio)

measures the days it takes to convert receivables into cash

shorter period maximize the speed of cash inflow

AVP= 365/receivables turnover ratio

shorter period maximize the speed of cash inflow

AVP= 365/receivables turnover ratio

26

New cards

inventory turnover ratio(risk ratio)

measures how many times average inventory is sold during the year

ITR= cost of goods sold/average inventory

ITR= cost of goods sold/average inventory

27

New cards

Average days in inventory(risk ratio)

measures the average number of days it takes to sell its entire inventory during the year

ADI=365/inventory turnover ratio

ADI=365/inventory turnover ratio

28

New cards

current ratio(risk ratio)

compares current asset to current liabilities

A high current ratio indicates sufficient assets to cover its current obligations

CA= current assets/current liabilities

A high current ratio indicates sufficient assets to cover its current obligations

CA= current assets/current liabilities

29

New cards

Acid-test ratio(risk ratio)

more conservative measure of a company's ability to pay current liabilities

ATR= (cash+current investments+A/R)/current liabilities

ATR= (cash+current investments+A/R)/current liabilities

30

New cards

Debt to Equity Ratio(risk ratio)

indicates the risk of bankruptcy

DtoER=Total liabilities/stockholder's equity

DtoER=Total liabilities/stockholder's equity

31

New cards

times interest earned ratio(risk ratio)

compares interest payments with income available to pay them

measure of solvency

TIER=(net income + interest expense +tax expense)/interest expense

measure of solvency

TIER=(net income + interest expense +tax expense)/interest expense

32

New cards

gross profit ratio (profit ratio)

indicates the portion of each dollar of sales above its cost of goods sold

GPR=gross profit/net sales

gross profit = net sales - cost of goods sold

GPR=gross profit/net sales

gross profit = net sales - cost of goods sold

33

New cards

return on assets (profit ratio)

measures the income the company earns on each dollar invested in assets

ROA=net income/average total assets

net income/average total assets=(net income/net sales)*(net sales/average total assets)

ROA=net income/average total assets

net income/average total assets=(net income/net sales)*(net sales/average total assets)

34

New cards

profit margin (profit ratio)

measures the income earned on each dollar of sales

PM=net income/net sales

PM=net income/net sales

35

New cards

asset turnover (profit ratio)

measures sales volume in relation to the investment in assets

AT = net sales / average total assets

AT = net sales / average total assets

36

New cards

return on equity (profit ratio)

measures the income earned for each dollar in stockholders' equity

ROE= net income/average stockholders' equity

ROE= net income/average stockholders' equity

37

New cards

earnings per share (profit ratio)

EPS= (net income - dividends on preferred stock)/(average shares of common stock outstanding)

38

New cards

price-earnings ratio (profit ratio)

compares a company's share price with its earnings per share

PER= stock price/earnings per share

PER= stock price/earnings per share

39

New cards

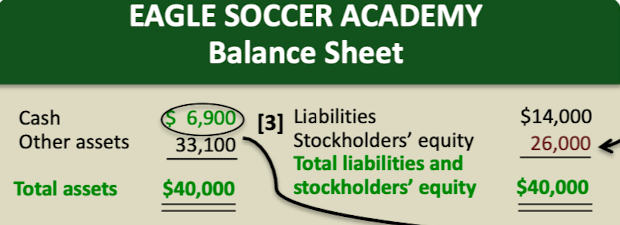

balance sheet

Asset= liabilities + equity

assets = liabilities + (stockholder's equity + (revenue-expenses)-dividends)

net assets = assets - liabilities

assets = liabilities + (stockholder's equity + (revenue-expenses)-dividends)

net assets = assets - liabilities

40

New cards

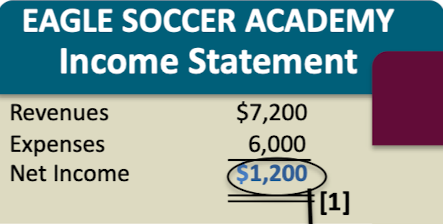

income statement

Net income = revenues - expenses

41

New cards

statement of stockholder's equity

ending retained earnings = beginning retained earnings + net income - dividends

stockholder's equity = common stock/ share capital + retained earnings

stockholder's equity = common stock/ share capital + retained earnings

42

New cards

matching principle

Revenue of the period is matched with expenses required to create those revenues

43

New cards

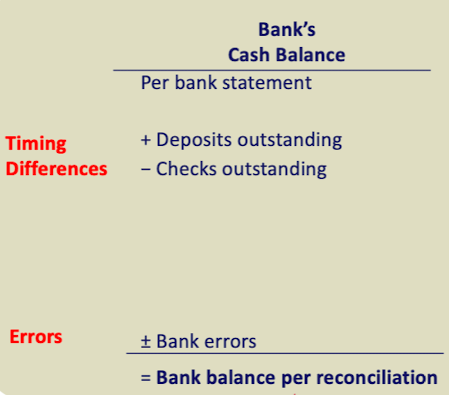

Bank's cash balance (bank reconciliation)

per bank balance

+deposit outstanding

-checks outstanding

+/- banks errors

+deposit outstanding

-checks outstanding

+/- banks errors

44

New cards

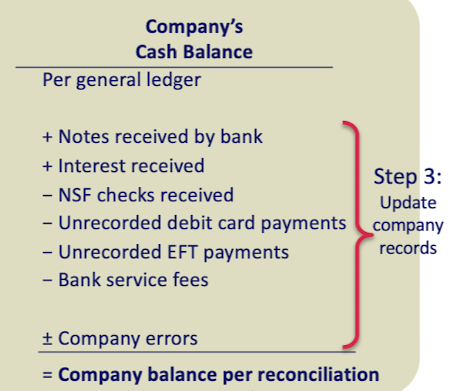

company's cash balance (bank reconciliation)

per general ledger

+notes received by bank

+interest received

-NSF checks received

-unrecorded debit card payments

-unrecorded EFT payments

-bank service fees

+/- company errors

+notes received by bank

+interest received

-NSF checks received

-unrecorded debit card payments

-unrecorded EFT payments

-bank service fees

+/- company errors

45

New cards

net sales

sales revenue (including trade discounts)-sales returns and allowances - sales discounts = net sales

46

New cards

FOB shipping point

-buyer pays for the freight charge

-freight is part of inventory cost

-buyer records it when the goods leave the supplier

-seller records it when the goods leave the seller

-freight is part of inventory cost

-buyer records it when the goods leave the supplier

-seller records it when the goods leave the seller

47

New cards

FOB shipping destination

- freight charge is paid by the seller

- freight charges become part of cost of goods sold

-buyer records it when they receive the goods

-seller records it when the buyer receive the goods

- freight charges become part of cost of goods sold

-buyer records it when they receive the goods

-seller records it when the buyer receive the goods

48

New cards

inventory purchases

purchase price + freight in - purchase returns - purchase allowances - purchase discounts = net purchases

49

New cards

freight in

transportation cost paid by the buyer under FOB shipping point

50

New cards

Inventory sales

sales revenue - sales returns and allowances - sales discounts = net sales

51

New cards

weighted average cost

average cost per unit = cost of goods available/number of units available

goods available = beginning inventory + purchases

goods available = beginning inventory + purchases