Accounting

1/52

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

Types of accounting

Financial accounting

Management accounting

Financial accounting

Provides information to users outside the business

Information is provided about historical data after accounting year ends

Regulated by Company law/ accounting standards, requires standard format

Involves bookkeeping system, collection and organisation of data and transactions

Management accounting

Provides information to internal users (managers)

About the future

Helps decision making process and resource control

Reporting cycle: as frequently needed by managers

More detailed information than financial accounting

Not subject to regulation, designed around manager’s needs

Both non-financial and financial information

What is business?

Defined as an organisation or enterprising entity engaged in commercial, industrial or professional activities. Can be for-profit or non-profit entities.

Types of business:

Company- Public limited companies (PLC): shares listed and traded on stock exchange. OR Private limited company (Ltd) where shares are held by family or a larger company and cannot legally be traded on the stock exchange

Sole trader- Alone in business, capital raised individually, unlimited (unprotected) liability

Others

What is accounting?

Concerned with collecting, analysing and communicating financial information.

Provides financial information to make decisions such as:

Whether to invest in the organisation if you are an investor

Whether to lend money to an organisation

Whether to develop a new product as a manager

Main users of accounting information

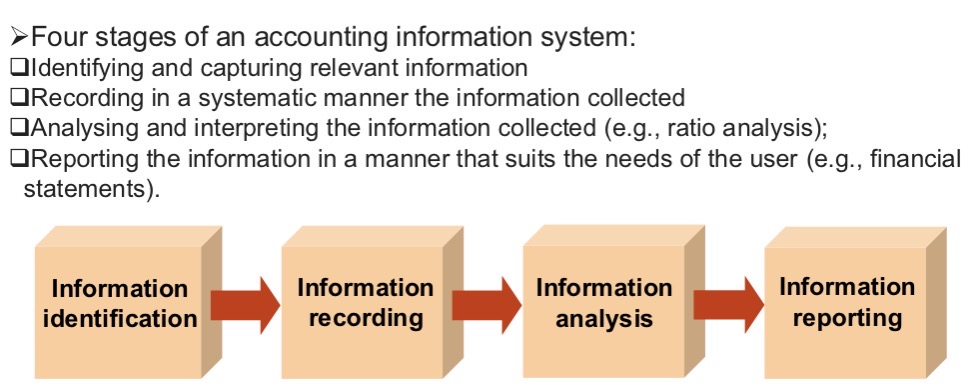

Accounting information system

Involves the identification, collection, analysis and reporting of accounting information

Accounting information characteristics

Accounting information is used to help users (internal+external) make a decision

Characteristics of useful accounting information:

Relevance: should i invest? Etc.

Faithful representation: accurately reflect condition of business

Comparability: over time and between businesses

Verifiability: correct information

Timeliness: made available in time

Understandability:

Materiality

What is capital?

Amount owners have invested in the business

What are drawings?

Amounts taken out of business for owners personal use

What are purchases?

Costs incurred by business to buy goods it plans to sell to customers. Purchase is usually recognised when goods are received from supplier.

What are sales/revenue/turnover?

Income earned from selling goods or services

What are expenses/costs?

Costs incurred by businesses to enable trading

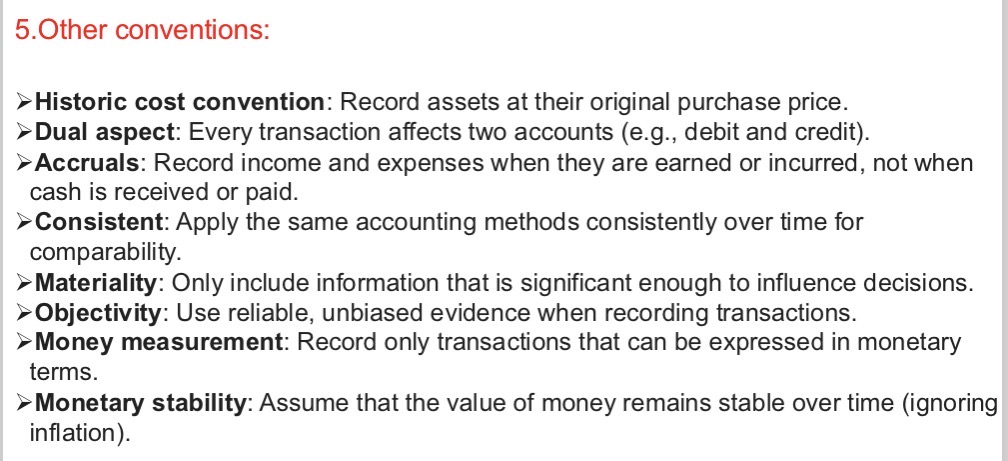

What are accounting conventions and what are examples of some?

Generally accepted rules that accountants tend to follow when preparing financial statements

E.g. Business entity convention, prudence, going concern, matching, other conventions

What is a business entity convention?

For accounting purposes, business and it’s owner(s) are treated separately

Clear distinction between business and personal assets

What is prudence?

Caution should be exercised when preparing financial statements

Revenue and profits aren’t anticipated, but recognised only when realised in the form of cash or other assets

The expected expenses and losses are allowed to be recognised

Ensure revenues aren’t overestimated or expenses are underestimated

What is going concern?

Convention that assumes that the business will continue operations for the foreseeable future unless there is a reason otherwise

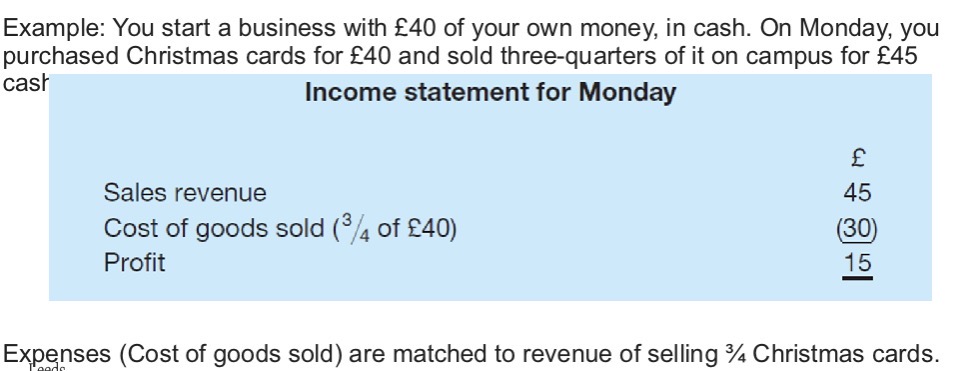

What is matching?

When measuring income, expenses should be matched to revenues that they helped generate, in the same accounting period as those revenues were realised

Examples of other conventions:

Types of accounts

Assets

Liabilities

Revenue/Income

Expenses

Equity

Drawings

Assets Account: What is an asset and current asset? + examples

Asset: Resource controlled by the business for future economic benefits

Current assets: Held for a short amount of time

Held for sale or consumption during the business’s normal operating cycle (e.g. inventories for resale)

Expected to be sold within a year

Held for trading

Examples:

Cash and cash equivalents, such as commercial paper, short term government bonds

Inventories

Trade receivables and prepayment

Assets account: What are non-current assets? + examples

Non-current assets: Assets used in an organisation on a long-term basis in order to generate wealth.

Examples:

Land

Buildings

Machinery and equipment

Vehicles

Furniture and fixtures

Plant equipment

Assets account: What are intangible assets? When are they included in financial statements?

Intangible assets: Non-physical assets like patents, trademarks, goodwill, and brands. Valuable to a business but difficult to measure in comparison to tangible assets.

Included in financial statements: When acquired through arm’s-length transaction, e.g. purchasing another business, given a measurable value.

Excluded from financial statements: Internally generated intangible assets are excluded due to difficulty in reliability measuring their value.

Liabilities account: Definition and examples of current and non-current liabilities

Liabilities: An amount owed by the business to a third party (e.g. bank), normally arise when organisations lend money to a business.

Examples of current liabilities:

Bank overdraft

Trade payables

Short-term loans

Examples of non-current liabilities:

Long-term loans

Equity account: Definition and examples

Equity: The remaining value of the owners’ interest in a company after subtracting all liabilities from total assets.

Examples:

Share capital

Retained earnings

Types of financial statements

Statement of financial position (or balance sheet): Show the assets, liabilities and equity (owners’ interest) at the end of a period

Statement of profit or loss (income statement): Show revenue and expenses to determine profit or loss for an accounting period

Statement of cash flows: Show the major sources and uses of cash during a period

Accumulated wealth=

Asset - Liability

Statement of financial position

Reports the assets of a business on one hand and the claims against the business on the other

Asset: resource controlled by a business that produces future economic benefits

Claims against the business include: Equity: Claim of the owner/investors against the business

Liabilities: Claims of other parties, business has an obligation to make a payment of the owed amount

Assets=

Equity + Liabilities

Equity=

Assets - Liabilities

Statement of profit or loss (Income statement): Definition and formula

Shows revenue and expenses to determine profit or loss for an accounting period

Profit/ Loss for the period= Total revenue for the period - Total expenses incurred in generating that revenue

Profit if revenue exceeds expenses

Loss if expenses exceeds revenue

What are sales/ revenue/ turnover?

Income earned from selling goods or services

What is cost of sales?

The cost of goods sold in a period

What is gross profit?

Calculated as the difference between sales revenue and the cost of goods sold

What is operating profit?

The profit calculated after all the operational expenses have been deducted

What is net profit?

The profit calculated after all business expenses have been deducted

Examples of expenses

Cost of sales: cost of goods sold in a period

Operating expenses: cost incurred through normal business operations

E.g. Salaries and wages

Rent

Heat and light

Interest and taxation

Process of preparing financial statements

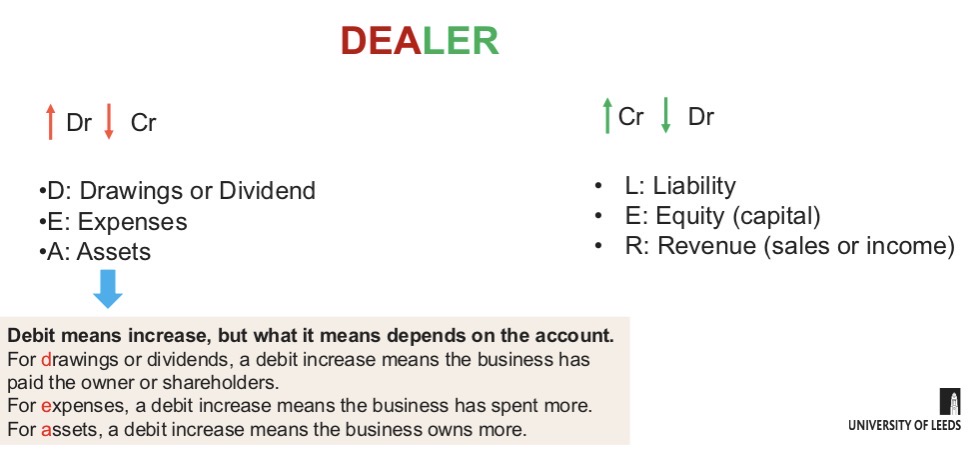

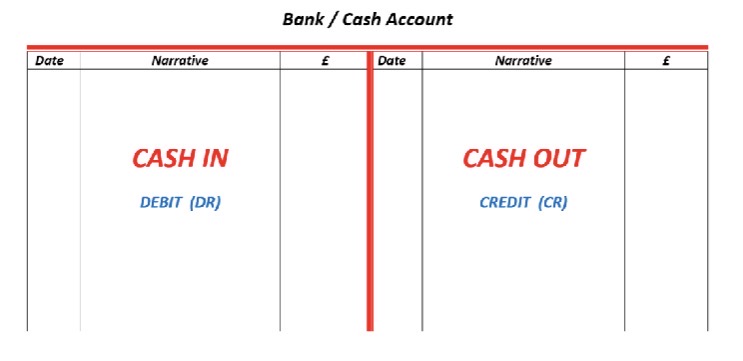

Record transactions: Recorded with two entries, Debit (Dr) and Credit (Cr). This ensures that accounting equation (Assets= Liabilities + Equity) remains balanced. E.g. When cash is received, the cash account is debited, while the corresponding revenue account us credited.

Prepare and close off T accounts: Visual layout of individual accounts resembles a T shape, also known as Ledger accounts.

Compile Trial Balance: Used in bookkeeping to list all the balances in the business’s general ledger accounts.

Post year-end adjustments: Adjustments are made at the end of an accounting period to record any unrecognised transactions.

Prepare financial statements: Prepared to reflect the financial position and performance of the business.

Preparing financial statements: Recording transactions

DEALER rule

Preparing financial statements: Prepare and close off T accounts

Preparing financial statements: Compile Trial Balance (TB)

Trial balance: An accounting report prepared at the end of an accounting period to ensure that the general ledger is accurate and that total debits = total credits

Aims to identify any accounting errors, including transposition errors where digits may have been reversed. Checks for accuracy.

Debits=

Assets + Expenses + Drawings

Credits=

Equity (capital) + Liabilities + Revenue

Preparing financial statements: Post year- end adjustments

Adjustments made at the end of an accounting period to record any unrecognised transactions

The trial balance is the starting point of preparing financial statements

Adjustments after trial balance:

Accruals and prepayments

Depreciation and disposal

Inventory and cost of sales

Accruals and prepayments

Recording income and expenses when they are earned or incurred, not when cash is received or paid

Expenses must be recorded in the correct accounting period when they are incurred, even if cash is paid in a different period

Prepayment: If a business paid before using the service (asset).

Where a business has paid amounts relating to future accounting periods

E.g. paid next months rent in advance

Accrual: If a business has used the service first but has not paid yet (liability).

Business has not paid all its expenses incurred for current accounting period

E.g. Used electricity this month but not paid

Depreciation

Most non-current assets (e.g. furniture, equipment) have a limited useful life. They wear out with use so decrease in value over time.

At the end of their useful life, the non-current asset will either be sold for a small sum or scrapped. Known as the residual value. May often be 0.

Land is an exception here since it tends not to wear out or reduce in value.

Depreciation calculation: Straight-line

Same depreciation amount each year during useful life

Annual depreciation= (Historical cost of assets - Estimated residual value) / Useful life

→ Historical cost: initial cost of purchase

→ Estimated residual value: amount for which a non-current asset is expected to be sold when the business has no use for it. May be 0

→ Useful life: Estimate of useful years of asset

Question may give depreciation rate instead of the useful life, depreciation rate= 1 / Useful life

→ Therefore calculation can also be Annual depreciation= (Historical cost of assets - Estimated residual value) x Straight-line depreciation rate

Net book value definition and calculation

Net book value: Value of asset recorded after deducting accumulated depreciation

Net book value= Historical cost - Accumulated depreciation

Accumulated depreciation: The total amount of depreciation expense allocated to a specific asset since the asset was put into use

Reducing balance depreciation method

Compared to straight-line depreciation, this method has higher depreciation in the earlier years (because accumulated depreciation is very limited in earlier years) and have lower depreciation in later years

Net book value= Cost of assets - Accumulated depreciation

Annual depreciation= Net book value x Depreciation rate

Reducing balance method: Reducing balance depreciation=

Depreciation= (Historical cost of assets - Accumulated depreciation) x Depreciation rate

→ Historical cost: initial cost

→ Accumulated depreciation: sum of depreciation of an asset up to this period

→ depreciation rate: percentage rate of depreciation each year

Don’t need to subtract residual value when calculating annual depreciation under the reducing balance method

Disposal of assets

Previous situations show that we hold all non-current assets until the end of their useful life

However, in reality, we may sell such assets before the end of their useful life

How to calculate the disposal price of the machine with the net book value recorded in financial statement

Calculate annual depreciation

Calculate net book value after 2 years

Calculate the profit/ loss for the disposal of assets using the disposal price - NBV