Econ 4.1.5-4.1.9 - Trading blocs, restrictions on free trade, BOP, exchange rates, International competitiveness

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

What is a regional trading bloc?

A regional trading bloc is a group of countries within a geographical region that protect from imports from non-members.

Sign an agreement to reduce or eliminate tariffs, quotas and other protectionist barriers among themselves. Examples are NAFTA (NA), the EU and ASEAN (Asia).

Most regional trade agreements are bilateral agreements, which is a trade or political deal made within 2 countries to promote mutual interests like reducing tariffs. Some agreements are multilateral.

Used as a broad category which other trading blocs fit into.

What are PTA’s, FTA’s? (Types of trading blocs)

Preferential trading areas (PTA) - Where tariffs and other trade barriers are reduced on some but not all goods traded between member countries.

Free trade areas (FTA) - Occur when 2 or more countries in a region agree to reduce or eliminate trade barriers on all goods coming from other members. Each member is able to impose its own tariffs and quotas on imports from outside the trading bloc.

What are Customs unions and common markets? (Types of trading blocs)

Customs unions - Involves the removal of tarrif barriers between members and the acceptance of a common external tariff against non-members. Example is the EU.

Common markets - The first step towards full economic integration and occurs when members trade freely in all economic resources so barriers to trade in goods, services and labour are removed. Also impose a common external tariff on imported goods from outside the market.

What is a monetary union? (Types of trading blocs)

Monetary unions - 2 or more countries with a single currency, with an exchange rate that is monitored and controlled by 1 or several central banks with closely coordinated monetary policy.

An example is the eurozone, where the European Central Bank distributes notes and coins, sets interest rates, and maintains a stable financial situation. In the EU, the governments agreed not to exceed a fiscal deficit of more than 3% and not to have a national debt of more than 60%.

For it to be successful, there should be free movement of labour, capital mobility and wage and price flexibility. Countries should also share the same business cycle.

What are the advantages and disadvantages of a monetary union?

+ Share one currency and so exchange rate costs are reduced.

+ Easy for prices to be compared across the union.

- Financial costs involved with starting the new currency and there would be costs if the union broke up.

What is an economic union? (Types of trading blocs)

Economic union - Final step of economic integration. There will be a common market with coordination of social, fiscal and monetary policy.

What are the advantages of trading blocs?

Free trade encourages increased specialisation, which increases output according to comparative advantage. Also helps firms benefit from economies of scale, causing lower prices and costs.

Firms may be able to grow larger by having a larger customer market, but this may be difficult given different customer markets in different countries. It will be easier for some products like cars, and between closer countries.

Removal of barriers means domestic industries face greater competition. This encourages innovation and lower prices, leading to improved efficiency.

There will be greater consumer choice.

What are the disadvantages of trading blocs?

Countries are no longer able to benefit as much from trade with countries in other blocs and the blocs are likely to distort world trade. Leads to trade diversion.

The most successful countries in the bloc will attract capital and labour due to the easy mobility, so this heightens regional inequality as the richest countries experience faster rates of growth.

What is trade creation?

Trade creation is derived from a countries membership of a customs union.

The removal of tariffs leads to welfare gain and higher consumer surplus, and is when consumption shifts from a high cost domestic producer to a low cost partner producer.

What is trade diversion?

Trade diversion occurs where consumption shifts from a lower cost producer outside the trading bloc to a higher cost producer within it.

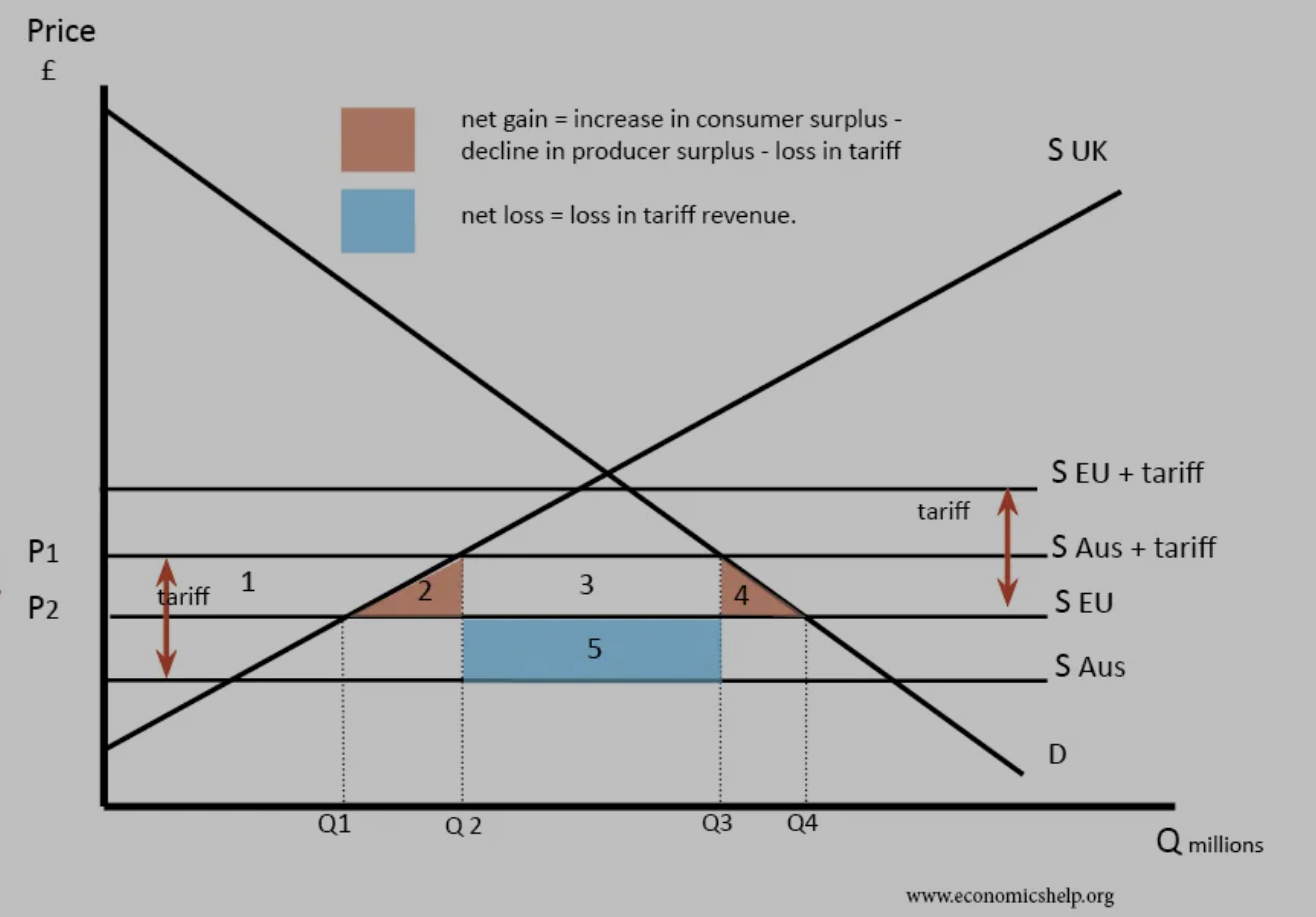

One example is the UK switching from cheaper New Zealand butter to European butter when they joined the EU. Before, there would’ve been the same tariffs on both, so it was better to buy the more efficiently produced New Zealand one. However, joining the EU means the tariff was removed so this became cheaper. This leads to a reduction in world-wide efficiency as countries aren’t buying from the most efficient supplier. This can be shown by the tariff diagram.

If joining a trading bloc leads to more trade creation than diversion, welfare improves. If otherwise, it reduces welfare.

What is the tariff diagram?

What is the role of the WTO?

Role of the WTO:

The WTO was set up in 1995 and has 2 aims: to bring trade liberalisation and to ensure countries act according to the trade agreements they have signed. According to the WTO, ideal trade should be non-discriminatory, free from barriers (Protectionism), Predictable and promote fair competitions.

Roles of the WTO - Set and enforce rules on international trade, resolve trade disputes, provide a forum for negotiating trade, monitor trade liberalisation

What are conflicts with the WTO?

Regional trade agreements go against the WTO’s principles as a common external tariff outside the trading bloc introduces protectionism.

Many systems are based on protectionism such as USA and China, which goes against the WTO’s system.

Reasons for restrictions on international trade

Infant industry system - An infant industry is one just being established in a country. However, they lack the reputation and customer base to compete internationally and so the government protects them until they are able to compete on their own

Job protection - Governments may be concerned that allowing imports causes domestic producers to lose out to international firms, so there will be job losses within the country.

Protection from potential dumping - Dumping is when a country with surplus goods sells these goods off to other areas of the world at very low prices, harming domestic producers in those countries. For example, China planed tariffs on stainless steel tubes from the EU and Japan to prevent dumping.

Protection from unfair competition - Domestic producers may be unable to compete with international firms which have very low labour costs, potentially as a result of very low health and safety regulation.

Types of restriction on international trade

Tariffs - These are taxes placed on imported good which make them more expensive to buy, making people more likely to buy domestic goods.

Quotas - These are limits placed on the level of imports allowed into a country, meaning people are forced to buy domestic goods if they want that good and the quota is already used up.

Subsidies to domestic producers - These are payments to domestic producers which lower their costs and help them to be more competitive enabling cheaper prices.

Non-tariff barriers - Countries can introduce an embargo, which is a total ban on imported goods. Can also introduce import licensing when countries/firms need a license to be able to import, and by reducing the number of licenses given out, the government can restrict the level of imports.

What is protectionism?

Protectionism refers to economic policies and practices that are designed to protect a country's domestic industries from foreign competition. The mentioned restrictions on trade are all examples of protectionist policies.

What are the effects of protectionism on consumers?

For consumers, there are higher prices as they are unable to buy imports at the cheapest price. It tends to raise the price of domestic producers since goods and services needed for the production of these goods may also suffer from these controls. Consumers also will have less choice.

What are the effects of protectionism on producers?

Domestic producers tend to benefit as they have less competition so can sell more goods at a higher price. However, they may suffer from higher costs of production as there are controls on imports needed for production. Foreign producers lose out as they are limited in where they can sell their goods.

What are the effects of protectionism on workers?

Protectionist policies protect firms from foreign competition and so increase their job security. However, there may be unemployment in many areas which are export-driven, such as cars. This is because other countries are likely to retaliate with their own policies.

What are the effects of protectionism on the government and living standards?

Government - In the short run governments benefit as they gain tariff revenue. However, can lead to an inefficient economy due to reduce competition.

For living standards, imposition of import controls result in deadweight welfare less, as shown by the tariff diagram.

What is the Balance of payments and what does it consist of?

BOP shows all flows into and out of a country. Split into the current account, which itself is split into trade in goods, trade in services and income and current transfers. Also split into the capital and financial account.

The capital account records transfers of immigrants and emigrants taking money abroad or bringing money into the UK.

The financial account is split into 3 parts, foreign direct investment (FDI), portfolio investment and other investments.

FDI is the flow of money to purchase 10%+ of a foreign firm, such as BT buying a 15% share of a firm in Brazil. Portfolio investment is the same thing buy less than 10% of a company. Other investments include loans, purchasing of currency and bank deposits.

What are the short term causes of deficits and surpluses on the current account?

There can be deficits and surpluses on particular part of the accounts; a country can run a deficit on the current account if they are able to have a surplus on the capital account.

Short term causes - Can be caused by high levels of consumer demand. If real household spending grows more quickly than the supply side of the economy can deliver, the only way of meeting this demand is by importing these goods and services. Could also be caused by a strong exchange rate, leading to cheaper imports and more expensive exports.

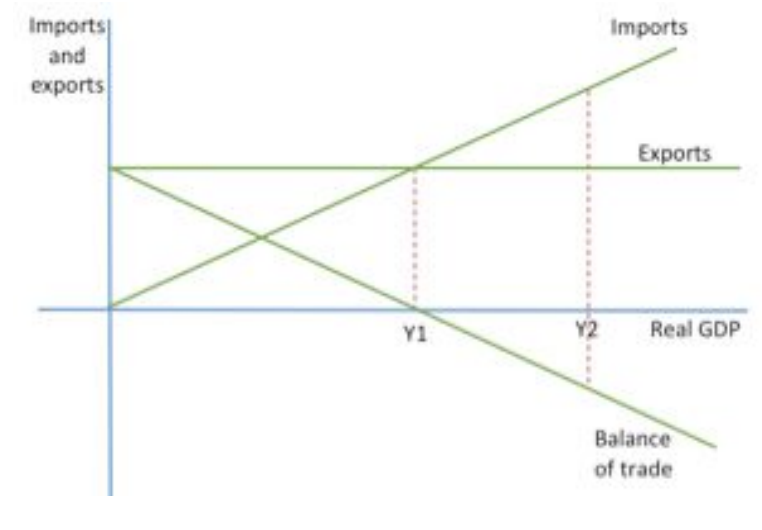

Diagram to show how changes in income can affect the trade in goods and therefore current account?

The diagram shows that an increase in income causes a rise in imports, as imports are highly income elastic.

What are the medium and long term causes of deficits and surpluses on the current account?

Medium term causes - As a country loses its comparative advantage, people will transfer their purchases to other countries

Long term causes - A lack of capital investment means firms lack productivity, for example Germany has 35% higher productivity per hour worked than the UK.

- Countries with high natural resources tend to export more, and if they have a small population tend to have a current acc surplus.

How to reduce deficits in the current account using Demand and Supply side policies?

Demand side policies - Deflationary policies can be used to reduce AD. This reduces income so reduces demand for imports. Should be effective due to the high income elasticity for imports. However, only works short term and limits output of the economy, reducing growth and living standards.

Supply side policies - Could be used to improve productivity and efficient or improve quality. However, these are much longer term solutions.

How to reduce deficits in the current account using expenditure switching policies?

Refers to government policies to encourage consumers and businesses to switch their spending from foreign goods to domestic ones. One example is tariffs, which make foreign goods more expensive.

Depreciating the pound also makes imports more expensive and exports cheaper.

Controlling inflation also means that the price of British goods rise slower, and therefore become more competitive over time, leading to a fall in demand for foreign goods.

However, limits economic growth and therefore increases unemployment. These policies are also unable to solve long term causes of a deficit.

What are the different types of exchange rate systems?

A free floating system is where the value of the currency is determined purely by the market demand and supply of the currency, with no target set by the government and no intervention in the market.

Managed floating is where the value of the currency is determined by demand and supply but the central bank prevents large changes on a day to day basis. This is done by buying and selling currency and by changing interest rates.

A fixed system is when a government sets their currency against another and that exchange rate doesn’t change.

What are the 2 types of peg systems (Exchange rate systems)?

An adjustable peg system is where currencies are fixed against another but the level at which they’re fixed can be changed.

Crawling peg system are a form of this but have a mechanism which allows the value to vary over time

Managed float is where the government intervenes to ensure macroeconomic stability.

What are the terms for a change in the currency value and against another currency?

An appreciation is an increase in the value of the currency using floating exchange rates.

A revaluation is when the currency is increased against the value of another under a fixed system, whereas a devaluation is the opposite.

What factors affect floating exchange rates (Normal exchange rates)?

Floating exchange rates are determined by the interaction of supply and demand.

In general is affected by the level of exports and imports, the level of investment in and out of the UK, and the amount of people wanting to go on holiday or place their money in our outside the UK.

Supply is determined by imports, investment from the UK out of the UK, and people wanting to holiday abroad. Demand is the opposite.

Government intervention to influence the value of a currency

If they want to increase or decrease demand, they can use interest rates.

Governments can also use gold and foreign currency reserves to manipulate the value of their currency. If the value of the pound is too high, they can increase supply by buying foreign currency or gold with pounds. To strengthen it, they can increase demand by selling their foreign currency or gold. However, this has little impact in the long term.

What is Competitive devaluation/depreciation?

Where a country deliberately intervenes in forex markets using foreign currency reserves or gold to drive down the value of their currency to improve competitiveness. However, this can cause inflation and may reduce competitiveness in the long term.

What are the impacts of changes in exchange rates on the current account?

Marshall-lerner condition states that the sum of the price elasticities of imports and exports must be more than one (elastic) if a currency depreciation is to have a positive impact on the trade balance.

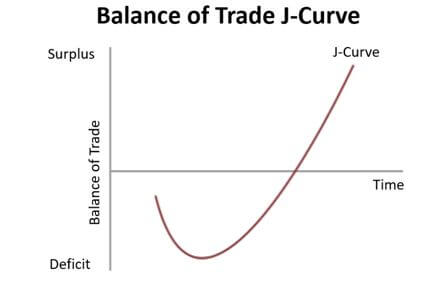

The J-curve shows how the current account will worsen before it improves when the currency depreciates. This is because people won’t immediately recognise that British exports are cheaper and it will take a while to find a source for them, whilst UK consumers will not see that imports are more expensive straight away.

What is the J-curve?

What are the impacts of changes in exchange rates on economic growth, FDI and inflation?

Economic growth and unemployment - A weaker exchange rate is likely to increase exports, increasing AD and therefore employment and economic growth.

FDI - A fall in the currency may increase FDI because it’s cheaper to invest.

Rate of inflation - Falls in the exchange rate increases inflation as imports become more expensive, causing a rise in prices and a fall in SRAS - Cost-push inflation. Also, the net imports increase so AD rises and so inflation rises further.

What is international competitiveness?

International competitiveness is the ability of a country’s producers to compete successfully in the world markets.

The lower the level of international competitiveness, the more likely the country will face a current account deficit. For goods to be internationally competitive, they must be cheap, good quality and have good marketing.

How is international competitiveness measured?

Relative unit labour costs - Unit labour costs are the costs of employing workers for each unit of good. A rise in relative unit labour costs shows that labour CPU is rising raster in the UK compared to other countries and so the UK is becoming less competitive

Relative export price - This is the price of UK exports compared to that of other countries. A rise in relative export prices means UK export prices have risen more than others so the UK has become less competitive.

What factors influence international competitiveness? (Ex rates, productivity, investment)

Exchange rates - A rise in the pound causes exports to be more expensive, causing UK goods to be less competitive. However, depends on the elasticity of the good.

Productivity - A rise in productivity reduces costs so prices fall.

Investment - Investment in infrastructure improves productivity and ensures firms can deliver and produce their goods reliably, cheaply and efficiently.

What factors influence international competitiveness? (Taxation, inflation, FOP)

Taxation - High taxation reduces investment and therefore international competitiveness in the long run.

Inflation - Low levels mean UK goods increase in price over time by less than other countries, so help they be competitive

Factors of production - A country with a lot of good quality factors of production will be able to produce more better quality goods.

What are the benefits of competitiveness?

By being competitive, a country will experience current account surpluses. This allows them to invest in overseas assets, which profits, dividend and interest can be earned by.

A competitive economy is likely to attract inflows of foreign investment, leading to a transfer of knowledge, skills and technology to firms.

Benefits of increased AD, such as higher employment and economic growth.

What are the problems of competitiveness?

A current account surplus may lead to a rise in the exchange rate due to an increased demand for exports and therefore currency, decreasing competitiveness. Shows its hard to maintain competitiveness.

Countries who are more competitive may also be more dependent on exports meaning they may suffer from large issues if there’s a global recession.