the global economy (4.6, 4.7, 4.8, 4.9, 4.10)

1/73

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

74 Terms

balance of trade

net exports = exports - imports

(New Zealand shows a trade deficit of $14.81 billion, slightly better than the previous $15.41 billion. It highlights an increase in exports to $5.40 billion and a decrease in imports to $7.11 billion)

trade surplus

exporting more than is imported

trade deficit

exporting less than is imported

trade gap

credit items

payments received from consumers, firms or governments located outside of the economy

debit items

payments made to consumers, firms or governments outside of the economy

balance of trade

includes only goods & services

balance of payments

summary of a country’s international trade

considers all international transactions

current account

capital account

financial account

current account

a record of trade flows, income flows and income transfers across borders

all exports & imports of g&s +net investment income (from overseas assets) + net balance (of transfers made between countries by individuals, firms and governments)

balance of trade in goods- all imports & exports of physical goods between a country and the rest of the world

balance of trade in services- all imports & exports of services between a country and the rest of the world

income- income receipts (inflows or credit items) earned from foreign investments - income payments (outflows or debit items) of factor incomes paid to foreign investors (essentially inflows & outflows of payments to the factors of production)

current transfers- inflows & outflows of money that are not made in exchange for trade or output

(india deficit at $9.2 billion down by $17.9 billion from the same quarter in the previous year, due to marginally higher trade deficit in merchandise and marginally lower surplus in invisibles)

capital account

records the different forms of capital inflows & outflows of a country during a given time period

capital transfers- forms of capital inflows & outflows of a country

transactions in non-produced- non-financial assets are the legal property rights to natural resources and intellectual property rights to intangible assets (they produce income for the country)

financial account

record of the transactions that relate to the change in ownership of assets (cross-border investments)

foreign direct investment

portfolio investment

reserve assets- stocks of foreign currencies & liquid assets held by central banks used to balance international transactions & payments

official borrowing- government borrowing

interdependence between accounts

the overall balance of payments must balance because in the long term, a country can only spend as much as it earns

sum of credits = sum of debits

current account = capital account + financial account (+ errors & omissions)

errors and omissions

represent statistical discrepancies when compiling the account

sustainable development

economic development that meets the needs of the present generations without compromising the ability of future generations to meet their own needs

social sustainability

the ability of an economy to develop social processes & structures that enable its current population to live optimally and to support the ability of future generations to do the same

economic sustainability

the optimal use of scare resources in such a way as to ensure future generations are not disadvantaged

environmental sustainability

the responsible use of the planet’s natural resources so that future generations are not compromised

multidimensional nature of sustainable development

development includes more than just growth but also indicators such as reduction in poverty, income inequality, gender inequality, political oppressions and unemployment

mercantilism

political & economic policy that focused on wealth creation through international trade

single indicator

statistical measure of economic development through focus on one indicator

GDP/GNI per capita at PPP

the average income in an economy divided by poopulation size

purchasing power parity

(PPP)

exchange rate that enables residents to purchase a common basket of goods and services in different countries

health indicators

use of health-related determinants of quality of life

life expectancy

under 5 mortality rates

education indicators

use of education-related determinants of quality of life

literacy rates

mean years of schooling

economic/social inequality indicators

societal indicators use measures that determine the extent to which social factors contribute to development

health & education indicators

shelter & housing

crime & homicide rates

safety & degree of trust

energy indicators

use of factors that create affordable, reliable, sustainable and modern energy for all citizens

environmental indicators

use of environmental issues that influence or determine the quality of life

global warming & climate change

desertification

deforestation

waste disposal management systems

loss of biodiversity and ecosystems

composite indicators of measuring development

statistical method that combines single indicators into a combined index

human development index

measure of economic development comprising

real income

life expectancy

educational attainment

(China has new long-term development strategies that will improve the HDI, environment, and human development, HDI is about 0.768. Life expectancy rose by 17 places, education rose by 29 places and income index rose by 38 places)

gender inequality index

calculates gender disparities through reproductive health, empowerment and labor market participation

inequality-adjusted human development index

average level of human development by accounting for inequalities in society

happy planet index

a measure of sustainable human wellbeing

how individuals & countries are able to achieve long, happy and sustainable lives

well being

life expectancy

inequality of outcomes

ecological footprint

strengths and limitations of approaches to measuring economic development

fail to consider qualitative factors

different members of society need to measure development differently

measuring economic well-being is a multilayered, complex process that changes over time

some indicators better portray a strength of a country (not full picture)

economic growth

increase in GDP per capita or other measure of aggregate income, typically reported as an annual change in real GDP

driven by improvements in productivity (producing more goods/services with the same inputs of capital, labor, energy and materials

increase in quantitative output

economic development

increase in standard of living in a nation’s population with sustained growth from a simple low-income economy to a modern high income economy

involves the processes by which a nation improves the economic, politic and social well-being of people

a qualitative measurement

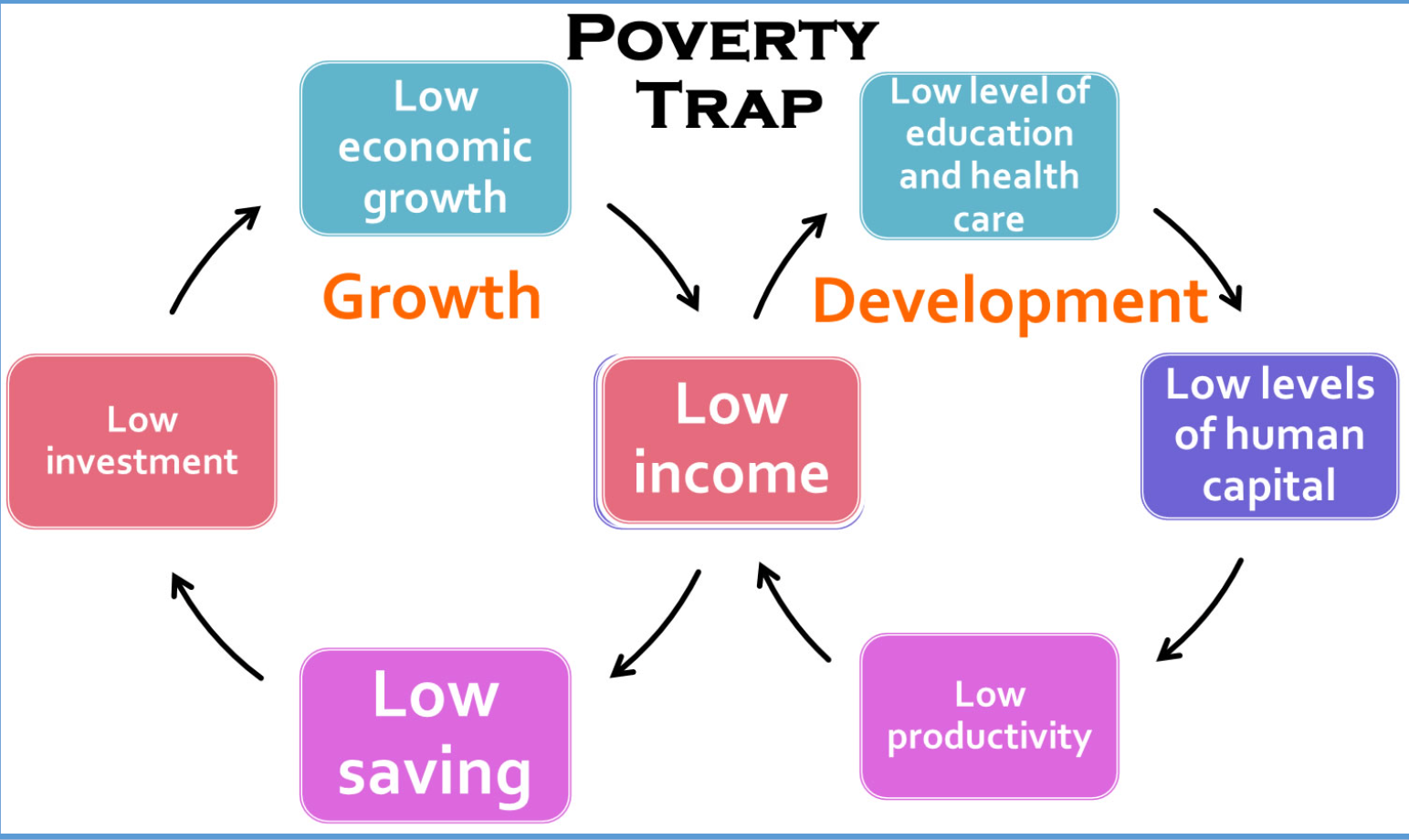

poverty trap

when an economic system requires a significant amount of capital in order to earn enough to escape poverty

not having capital makes it difficult to acquire capital, creating a cycle of greater poverty and deprivation from one generation to the next

economic barriers to economic growth/development

rising economic inequality

lack of access to infrastructure &technology

low levels of human capital

low access to education & healthcare

dependence on primary sector production

lack of access to international markets

informal economy

capital flight

indebtedness

geography

tropical climates & endemic diseases

informal economy

economic activities that are not officially part of a country's GDP

capital flight

withdrawal of money, resources and assets from a country due to economic/political uncertainties

thus hindering investor confidence

indebtedness

condition of owing money

overall debts to creditors by individuals, businesses and government of the country

political/social barriers to economic growth/development

weak institutional framework

legal system

taxation structures

banking system

protection of property rights

gender inequality

unequal political power & status

lack of good governance → corruption

institutional framework

established systems, contexts and structures that shape economic behavior in a country

micro-credit

loans of exceedingly small amounts to individuals on low income for self-employment projects that generate revenue so that they can become self-reliant

property rights

entitlement to tangible & intangible assets owned by individuals, organizations or governments

measures of good governance

voice & accountability

political stability

absence of violence

govt. effectiveness

regulatory quality

rule of law

control of corruption

significance of barriers

resource endowment

history

political systems & stability

climate

population

factors of ELDC development

education and health

use of technology

women’s empowerment

access to credit/micro-credit

income distribution

all have positive externalities of production & consumption

trade strategies

potential net gains for countries engaged in international trade

import substitution- encourages domestic production & consumption through protectionist policies

export promotion- focus on greater international trade

economic integration- process of countries becoming more interdependent and economically unified

import substitution

advantages:

increase in domestic production

increase in domestic employment

less dependence on imports (resilience from external shocks)

reduced transport costs

disadvantages:

detrimental to economic efficiency (distorts market forces of d&s for imports & exports)

consumers pay higher prices & have less choice

reduced competitiveness thus reducing attractiveness of exports

export promotion

advantages:

use of international specialization & export-led growth strategies increases productive capacity of country

domestic firms can access larger markets (greater economies of scale and larger profits)

efficiency (transfer of skills & tech → productive gains)

disadvantages:

ELDC exporters face stiff competition & struggle to compete against larger corporations

other countries’ protectionist policies discourage export promotion from ELDCs

opportunity cost of G to support strategy

economic integration

advantages:

greater flows of g&s between countries → economic benefits for trading partners

increased choice & higher quality (bc of international specialization & competition)

lower/removing trade barriers → reduction in prices, gain in productivity (bc of competition & efficiency)

disadvantages:

compromise/adjust internal policies

have to impose common trade restrictions

diversification

countries broadening their supply of g&s in export markets

advantages:

helps ELDCs overcome over-specialization → create new employment opportunities

reduce vulnerability to fluctuating prices in primary sector output

disadvantages:

risk of failure → ELDCs lack experience & expertise

higher costs → broader range of products produced

requires long-term plans → time consuming & expensive

(Malaysia wants to advance in the manufacturing sector, aiming to invest more in the high-tech industry in goods such as chips and electric vehicles)

social enterprise

organization that focuses on meeting specific social objectives

advantages:

encourages volunteerism & civic commitment

receive govt. support (tax incentives & preferential support programs) to encourage participation

attracts attention from news & media

disadvantages:

small bc of low funding

profit generated goes to funding ongoing expenditures → less funds to invest in country

fall short of expectations (lack of commitment)

market based policies

dynamic, outward-looking macroeconomic strategies using free market forces (liberating industries & improving market incentives)

trade liberalization- reduction/ removal of trade barriers to increase competition, productivity & efficiency

privatization- transfer of ownership of govt. assets from public sector to owners in private sector

deregulation- reduction/removal of govt. rules in an industry

trade liberalization

advantages:

encourages free & fair trade → reduction in costs of conducting international trade

reduction in regulatory costs → overall reduction in prices

increased competition, productivity & efficiency

disadvantages:

intense competition → no longer profitable for domestic firms

dumping on ELDCs

cheaper flow of g&s → producers lack environmental & ethical compliance to cut costs

privatization

advantages:

cuts G on maintaining assets & raises one-time revenue

private sector achieves more optimal allocation of scarce resources (bc of incentive to work & invest)

private sector fosters competition → reduced prices, improved quality and more choice

disadvantages:

privates cut jobs to remove inefficiencies → unemployment

rising price (profit motive)

deregulation

advantages:

limits inefficiencies brought about by excessive govt. control & administrative processes

allows market forces to allocate resources → quicker decision-making

disadvantages:

market exposed to uncertainties & fluctuations

increase in deceptive schemes & corruption

interventionist policies

tax policies- used to redistribute wealth to protect & support poorest members of society

transfer payments- financial assistance made to less fortunate members of society (including state pensions, child allowance and unemployment benefits)

minimum wage policies- lowest amount of money employers are legally obliged to pay their workers

(Malta’s child allowance is set to rise by 250 euros per child in order to alleviate the rising levels of poverty)

provision of merit goods

education programs- allocate a portion of govts budget to education & training

health programs- preventative healthcare system prevents spread of disease

infrastructure- physical structures & facilities required for efficient running of a country

(UK is investing 600 million GBP to improve education, where every student will have to mandatorily study some sort of maths and english until the age of 18.)

inward foreign direct investment

direct investment into production in a country by a MNC in another country

(focuses on enhancing Tajikistan's economic potential through better investment and business environments: reforms in investment law and tax codes, and modernizing investment promotion strategies, strengthening sectors like mining, manufacturing, and agriculture)

foreign aid

the international transfer of capital, g&s from a country or org. for the benefit of the recipient country

advantages:

helps escape poverty cycle (humanitarian, economic and political benefits)

increases production & productivity in ELDCs

injection into circular flow of income → help reduce inequalities & unemployment in ELDCs

disadvantages:

economic dependence

corrupt govts misuse aid

if concessionary loan → interest repayments (financial burden)

(UK government committed to raising £11.6 billion, half of which will be spent aiding foreign countries that aren’t as developed to adapt to the impacts of climate change)

humanitarian/development aid

helps recipient countries achieve economic development & improve quality of life

provided by individual countries, NGOs, multilateral org

grants- non-repayable financial assistance

concessional long-term loans- loans w/ highly favorable terms & conditions

project aid- helps specific developmental projects

program aid- support a specific industry

conditional aid- capital, grants or loans on condition it is used for policy reforms and structural adjustments

tied aid- spend foreign aid on buying products from donor

debt relief

partial or total remission of foreign debts

heavily indebted poor country- nation w/ huge outstanding debt

debt rescheduling- renegotiating length of time to repay loans

official development assistance

foreign aid from donor govts rather than NGOs or non-proft orgs

bilateral aid- govt → govt

multilateral aid- govt → international org → reducing poverty in developing nations

non-government organizations

(NGOs) agents in provision of foreign aid

multilateral development assistance

financial support delivered through international institutions

(The Health Impact Investment Platform is providing an initial €1.5 billion in concessional loans and grants to strengthen primary health care services in low- and low-to-middle-income countries, aiming to strengthen health systems in countries like Angola, Ethiopia, and Rwanda)

institutional change

improved access to banking

increasing women’s empowerment

reducing corruption

extending & protecting property rights

uploading land rights

(432 million women of working age in India, out of which 343 million are employed in the unorganised sector → estimated that just by offering equal opportunities to women, India could add US$ 770 billion to its GDP by 2025. At present the contribution of women to the GDP remains at 18%)

improved access to banking

enables more individuals to have access to credit

ELDCs don't have necessary funds to invest, hindering innovation & skills development of the workforce

used for investment to increase production & productive capacity

more employment, less inequality in income, less poverty

microfinance- small sums borrowed by individuals for self-employment

mobile banking- allows conduction of financial transfers remotely

increasing women’s empowerment

ignoring gender disparities is detrimental

gender equality helps end social & cultural discrimination against females

huge impact on their self-esteem and mental wellbeing

in long-term → positive effects on maternal health and reduces child mortality

reducing corruption

corruption is fraudery & dishonesty by people in power/authority

well-structured/enforced legal systems & good governance are essential to creating an institutional framework and an environment conducive to national and international trade

land rights

ability of individuals to obtain, use & hold land

land ownership is an important source of security, income and wealth

property rights

entitlement to tanglible & intangible assets

property rights of an economic good or service:

the right to use the asset

the right to earn income from the asset

the right to transfer the good or service to others

the right to enforce property rights of the asset

strengths and limitations of strategies for promoting economic growth and economic development

dependent on different factors, including the context of the country, budgetary constraints, political and social influences, and the degree of good governance

government intervention to achieving economic growth/development

strengths:

provision of essential infrastructure

investment in human capital

establishment of a stable economy

provision of a social safety net

weaknesses:

excessive bureaucracy

poor planning

corruption

market-oriented policies to achieve economic growth/development

strengths:

efficiency

competitiveness

economic growth

benefits of free trade

investment opportunities

weaknesses:

market failures

development of a dual economy- when two distinct economic sectors exist within a country, with different levels of development

income and wealth inequalities