International Finance - International Debt Markets

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

what is Centralized debt denomination

borrow in headquarters' currency

ex.: US company in Belgium debt is issued in USD

what is Decentralized debt denomination

borrow in different currencies of subsidiaries

Ex.: US company in Belgium issue debt in Euro

what are domestic bonds

Bonds that are issued and traded in the domestic market (and denominated in the domestic currency)

what are International bonds

Bonds traded outside the country of the issuer

what are Foreign Bonds

Issued in a domestic market by a foreign borrower (Ex. US company issuing JPY bond in Japan)

Denominated in domestic currency

Marketed to domestic residents

Regulated by domestic authorities

what are Eurobond

Issued simultaneously in various markets, outside the specific jurisdiction of any country

Denominated in one or more currencies

This label, set before the euro creation, does not mean that they are issued in EUR

They mature in less than 10 years (usually 5)

Straight fixed-rate

Zero coupon bonds or coupon

Floating-rate notes

Coupon based on base rate such as LIBOR or Euribor

Equity-related bonds

Convertible bond: Convertible into a number of shares of equity

Warrant: Grants the bondholder the right to purchase a certain amount of common stock at a specified price

what is Dual-currency bond

Issued and paying coupons in one currency but paying back principal in another

how to calculate the annual yield

annual yield = (1+semiannual yield)² - 1

what are Eurobonds

Issued by corporations/institutions/sovereigns to the public

Fixed or floating interest

Listed and traded on exchanges

Long maturities

Issuance process is relatively long and time consuming

what are Eurocredits

Borrowed from banks Banks are lenders

Generally floating interest

Not listed, not traded

Any maturity

Relatively easy issuing process

what is a credit line

allows borrower to withdraw as a loan any amount of money up to a fixed limit

what is a term loan

loan with a fixed maturity for a fixed amount

what are syndicating loans

involves multiple lenders (banks) joining together to provide a large loan to a borrower.

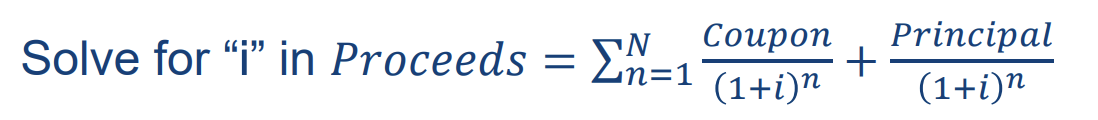

what is the formula of the All-in-cost (AIC)

Why source debt internationally

Lower the AIC

Access more liquid debt markets

Diversify funding sources

Hedge foreign currency revenues