Group Accounting Standards

1/3

Earn XP

Description and Tags

There are 5 accounting standards that you need to know in relation to groups.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

IFRS 10 - Consolidated Financial Statements

IFRS 10 - Consolidated Financial Statements - Control is identified by the standard as the sole basis for consolidation and comprises the following three elements:

Power over the investee, where the investor has existing rights that gives it the current ability to direct activities that significantly affect the investee’s returns (dividends)

Exposure, or rights to, variable returns from involvement in the investee; and

The ability to use power over the investee to affect the amount of the investor’s returns

They key principle underlying group accounts is the need to reflect the economic substance of the relationship (control).

Principles based approach to determine whether or not control is exercised, which may require the use of judgement (should lead to more consistent judgements been made, therefore greater comparability of financial info). The standard lays out the circumstances that need to be considered when determining whether or not this control exists.

Investors should regularly consider whether control over an investee has been gained or lost.

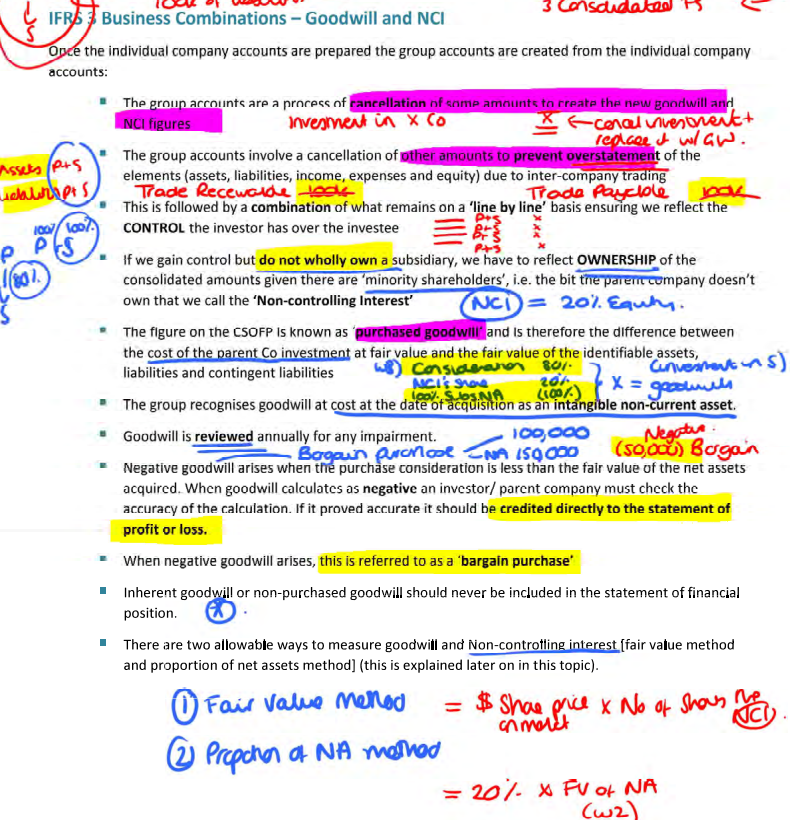

IFRS 3 - Business Combinations

The objective of this standard is to specify how to account which one entity gains control of another (referred to a business combination).

Group accounts are prepared in addition to individual company accounts.

l

l