Lecture 6a_Insourcing vs Outsourcing

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Efficient Supply chains

Designed for efficiency and low cost by minimizing inventory and maximizing efficiencies in process flows:

Goods/services with highly predictable demand

Stable product lines with long life cycles

Low contribution margins

Responsive Supply chains

Focus on Flexibility and responsive service

Demand is unpredictable

Short product life cycles

Fast response is main competitive priority

Customers require high customization

High contribution margin

Push system

Produces goods in advance of customer demand using a forecast and stores them as finished goods

Immediate availability of goods to customers

Reduce transportation costs through full truckload shipments

Pull system:

Produces only what is needed in responses to customers demand signals

Minimizes inventory and production costs

Postponement:

Delaying product customization until the product is closer to the customer at the end of the supply chain

Availability of information and communication has made international trade easier

Call Centers for US customers located in India

Developing countries represent opportunities for cost savings and new markets.

China and India are two well-known examples

Regions such as Africa and South East Asia represent new opportunities

Outsourcing and offshoring

Searching for low-cost labor – foreign operations

Searching for low-cost raw materials – foreign suppliers

Access to resources

International supply chains

Supply, production, and distribution take place at various facilities location around the world

Vertical Integration

The process of acquiring and consolidating elements of a value chain to achieve more control

Typically adds managerial complexity

Backward integration

Acquiring capabilities towards suppliers

Forward integration

Acquiring capabilities toward distribution (or customers)

Opposite is sourcing

Reduces control and increases risks.

Forces Shaping Global SC Decisions

Market forces

Higher than expected demand for new products

Competition

Technological forces

New technology like blockchain

Global cost forces

Lower labor costs, raw materials costs

Political and macroeconomic forces

Exchange rates, trade agreements, tariffs, export restrictions, political instability

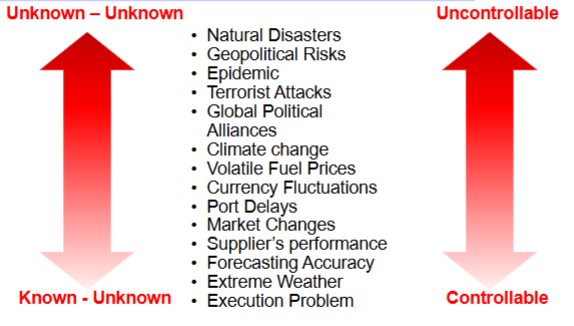

Risk sources and Their characteristics

Decisions on where to operate or who to source from impact every aspect of the SC

• Sourcing

• Manufacturing

• Transportation

• Distribution

Bottom Line:

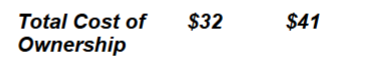

Consider the total cost of ownership

Many firms purchase internationally

International trade complexity

Logistical differences

Longer Supply Chain

Global Sourcing

Access to raw materials (e.g.: cocoa in Ivory Coast, cobalt in Congo)

Low-cost skilled labor

Economic factors (e.g.: tax breaks, low trade tariffs)

Global Sourcing

Potential Advantages

Cost (scale, labor, material, etc.)

Create a presence in a region/ country

Competition for domestic suppliers

Access to scarce materials, products, or parts

Quality advantages in specific locations

Technology and innovation

Currency and other financial considerations

Global Sourcing

Barriers

Security

Ethical issues

Lead time and other supply chain issues

Higher transportation costs

Currency fluctuation

Legal/ Governmental issues

Regulatory differences

Internal Communication

Supplier capability in certain locations

Global Manufacturing

Shrinking the supply chain

End consumers in a foreign country

Manufacturing customers

Potential cost advantages

Raw material & energy

Investment, economic/tax incentives

Industry clusters

Specialized labor

Government incentives

Global Manufacturing

Potential Issues

Factory setup

Government regulations

Environmental, safety, financial

Worker education & skill levels

Cultural issues

Infrastructure and Technology

Distribution complexity

Longer Lead times

Global Transportation

Potential I

Lead time requirements

Transport mode

Volume

Weight

Value

Customs

Tariffs

Local infrastructure

Starting a Global Supply Chain

Domestic → Regional → Global

Going from a domestics to a global scale can be extremely complex

Going from domestics to regional or “mega” regional can be a good compromise

Start in a country that you have existing resources if possible

Developed countries are good first step

Considering just the direct costs can get companies in trouble... fast

Organization must consider potential risks in their supply chain and take “TOTAL COST” Approach

Plant efficiency

Worker Productivity

Quality

Transportation differences

Raw materials vs Finished Gôds

Infrastructure

Cost of Emergency shipments

Political stability

Acts of God

Starting a Global Supply Chain Recent trends

With rising labor costs in China

Companies are moving to Southeast Asia

Companies are moving to Latin America

Companies are near-shoring

Moving production closer to end markets

Improve service levels

Reduce inventory in transit

Increase control over product quality

Companies are reshoring

Returning to home country

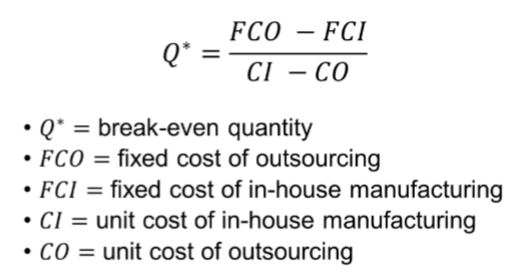

Break-Even Analysis for Outsourcing Decisions

A firm is evaluating the alternative of manufacturing a part that is currently

being outsourced from a supplier. For an in-house manufacturing, the annual

fixed cost is $45,000 and the unit cost per part is $130. Currently the unit cost

of purchasing the part from the supplier is $160. The demand forecast is 1200

units

a) Compute the cost of manufacturing in-house and outsourcing. What decision should the firm make?

b) Determine the break-even quantity for which the firm would be indifferent between manufacturing the part in-house or outsourcing it

c) What is the maximum price per part the manufacturer should be willing to pay to the supplier if the forecast is 800 parts?

a) Compute the cost of manufacturing in-house and outsourcing. What decision should the firm make?

Cin-house = FCI + CI x Q = 45000 + 130 x 1200 = 201,000

Coutsource = FCO + CO x Q = 0 + 160 x 1200 = 192,000

The firm should outsource

b) Determine the break-even quantity for which the firm would be indifferent between manufacturing the part in-house or outsourcing it

Q* = (FCO – FCI)/(CI-CO) = (0-45000)/(130-160) = 1500

c) What is the maximum price per part the manufacturer should be willing to pay to the supplier if the forecast is 800 parts?

Cin-house = FCI + CI x Q = 45000 + 130 x 800 = 149,000

Coat 800 units = 149,000/800 = $186.25

The firm is willing to pay under $186.25 per unit for outsourcing