module 10

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

Hard discounters bm

Assortment

stores

supply chain

Assortment hard discounters

low SKUs

PL oriented (90%)

Rock-bottem prices (PL up to 50% cheaper than nb)

stores hard discounters

small stores, in low-rent districts

low staffing level

basic and functional environment

supply chain hard discounters

simple buying process (low SKU and pl share)

stable long-term relationships with suppliers (10 years instaed of 1-2 years)

value equation

price x quality x convenience

hard discounters in value equation

price → reset price point (not only food)

price quality relationship → high quality low price

convenience: fast

how hard discounters get quality

partnership with high quality suppliers

continiuos quality testing

convenience in hard discounters

fast, since low SKU

suprise effect with products like matresses etc. giving larger assortment

dilemme hard discounters: middle income

a brands for one-stop shoppers

against business model: efficiency

solution: very limited brands make it→ carefull selection

why brand manuf see opp in collaborating with hard discounters

reach new shopper segments

seize the moment (share is grwoing + shelf space is decreasing)

risks for manuf

brand erosion: stores are cheap → brands do aswell…

cannibalization → sales from con retailers just move over and you dont reach new consumers

retaliation by conventional retailers: delisting/less brand support

minimize brand erosion

use innovative, dynamic brands (brands with strong growth outside hard discounters)

invest in outer package (better looking outer package design

keep the price difference between brand and pl is suffciently big (75%-150%)

how to avoid cannibalization + retaliation

create different offerings for hard discounters than conv retailers (size differences)

select a smaller (niche) brand for hard discounters

pinched conven retailers

amazon: endless aisles

hard discounters: rationalized assortment

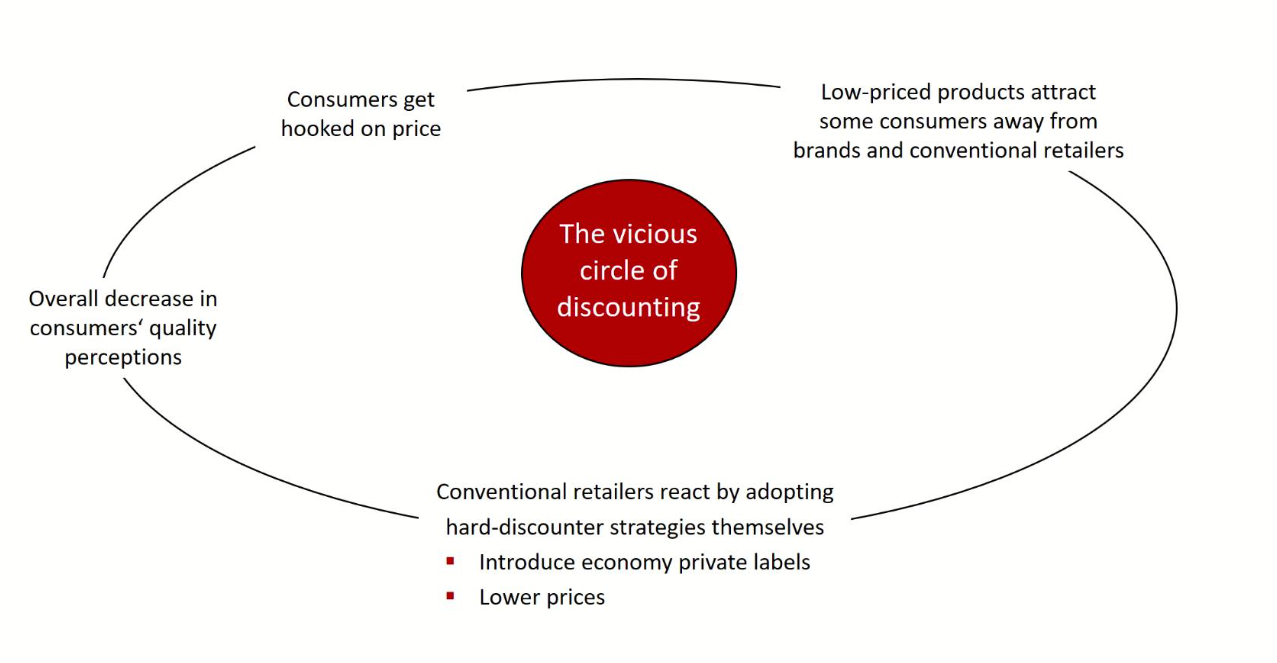

vicious cirlce of discounting

counter hard discount strategies

offer convenience (roll, out convenience stores → small stores in neigbourhood with high quality products)