ACYFARP17: Events after reporting period, RP disclosures, Interim Reporting, Operating Segment, NCAHS, Discontinued Operations

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Which statement is true in relation to events after reporting period?

a. Notes to the financial statements should give details of material adjusting events included in those financial statements

b. Notes to the financial statements should give details of material non-adjusting events which could influence the economic decision of users

c. A decline in the market value of investments would normally be classified as an adjusting event

d. The settlement of a long-running court case would normally be classified as a non-adjusting event

B

Which event after the reporting period would require adjustment?

a. Loss of plant as a result of fire

b. Change in the market price of investment

c. Loss on inventory resulting from flood loss

d. Loss on a lawsuit the outcome of which was deemed uncertain at year-end

D

DEF Company carried a provision of P2,000,000 in the draft financial statements for the year ended December 31, 2025 in relation to an unresolved court case.

On January 31, 2026, when the financial statements for the year ended December 31, 2025 had not yet been authorized for issue, the case was settled and the court decided the final total damages to be paid by the entity at P3,000,000.

What additional amount should be adjusted on December 31, 2025 in relation to this event?

a. P3,000,000

b. P2,000,000

c. P1,000,000

d. P0

C

GHI Company is completing the preparation of the draft financial statements for the year ended December 31, 2025. The financial statements are authorized for issue on March 31, 2026.

On January 31, 2026, a dividend of P2,000,000 was declared and a contractual profit share payment of P200,000 was made, both based on the profit for the year ended December 31, 2025.

On February 15, 2025, a customer went into liquidation having owed the entity P900,000 for the past 5 months. No allowance had been made against this debt in the draft financial statements.

On March 1, 2026, a manufacturing plant was destroyed by fire resulting in a financial loss of P2,500,000.

What total amount should be recognized in profit or loss for the year ended December 31, 2025 to reflect adjusting events after the end of reporting period?

a. P2,000,000

b. P3,600,000

c. P2,500,000

d. P1,100,000

D

Related parties include the following:

a. Parent and subsidiary

b. Associates

c. Key management personnel and close family members of such individuals

d. All of the above are related parties

D

Unrelated parties include all of the following, except

a. Two entities simply because they have a common director

b. Providers of finance or banks

c. Customers

d. Spouse of managing director

D

Which statement about an interim financial report is true?

a. An interim financial report must consist of a complete set of financial statements

b. An interim financial report must consist of a condensed set of financial statements

c. An interim financial report may consist of condensed set or complete set of financial statements

d. All of these statements are true

C

Which statement is incorrect about interim reporting?

a. Interim amount like property taxes that could benefit later interim periods are allocated

b. The integral view and the independent view are the two approaches of interim financial reporting

c. No accrual or deferral in anticipation of future events during the year should be reported

d. A complete set of financial statements is required

D

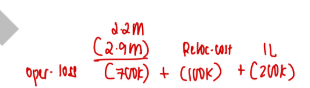

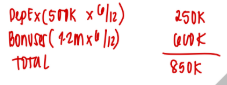

An entity has estimated that total depreciation expense for the year ended December 31, 2025 will amount to P500,000 and that 2025 year-end bonuses to employees will total P1,200,000.

In the interim income statement for the six months ended June 30, 2025, what total amount of these expenses should be reported?

a. P1,700,000

b. P1,100,000

c. P500,000

d. P850,000

D

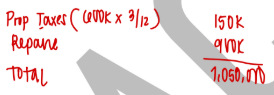

On March 15, 2025, XYZ Company paid property taxes of P600,000 on the factory building for calendar year 2025. On April 1, 2025, the entity paid P900,000 in unanticipated ordinary repairs to equipment. What total amount of these expenses should be included in the quarterly income statement ending June 30, 2025?

a. P1,050,000

b. P1,500,000

c. P450,000

d. P900,000

A

When is an operating segment reportable?

a. The segment external and internal revenue is 10% or more of the combined external and internal revenue of all operating segments

b. The segment profit or loss is 10% or more of the greater between the combined profit of all profitable segments and the combined loss of all unprofitable operating segments

c. The assets of the segments are 10% or more of the total assets of all operating segments

d. Under all of these circumstances

D

What is the quantitative threshold for the revenue that must be disclosed by reportable operating segments?

a. The total external and internal revenue of all reportable segments is 75% or more of the entity external revenue

b. The total external revenue of all reportable segments is 75% or more of entity external and internal revenue

c. The total external revenue of all reportable segments is 75% or more of the entity external revenue

d. The total internal revenue of all reportable segments is 75% or more of the entity internal revenue

C

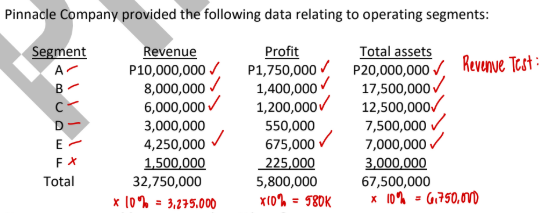

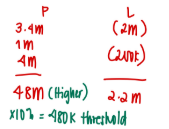

How many reportable segments does X have?

a. Three

b. Four

c. Five

d. Six

C

Mr. Accounting Company provided the following profit (loss) relating to operating segments:

A P3,400,000

B 1,000,000

C (2,000,000)

D 400,000

E (200,000)

What are the reportable segments based on profit or loss?

a. A, B, C and D

b. A, B and C

c. A and B

d. A, B, C, D and E

B

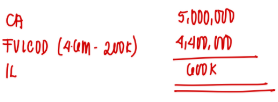

ABC Company is subject to the requirements of segment reporting. In the income statement for the current year, the entity reported revenue of P50,000,000 excluding intersegment sales of P10,000,000, expenses of P47,000,000 and net income of P3,000,000. Expenses included payroll costs of P15,000,000. The combined total assets of all operating segments at year-end amounted to P45,000,000.

What is the minimum amount of sales to a major customer?

a. P5,000,000

b. P4,000,000

c. P6,000,000

d. P4,500,000

A

ABC Company is subject to the requirements of segment reporting. In the income statement for the current year, the entity reported revenue of P50,000,000 excluding intersegment sales of P10,000,000, expenses of P47,000,000 and net income of P3,000,000. Expenses included payroll costs of P15,000,000. The combined total assets of all operating segments at year-end amounted to P45,000,000.

What is the minimum amount of external revenue to be disclosed by reportable segments?

a. P22,500,000

b. P30,000,000

c. P33,750,000

d. P37,500,000

D

A noncurrent asset is to be classified as held for sale because

a. The carrying amount will be recovered principally through sale rather than continuing use

b. The noncurrent asset is difficult to value

c. It is unlikely that the noncurrent asset will be sold within twelve months

d. It is unlikely that there will be an active market for the noncurrent asset

A

Noncurrent asset or disposal group is classified as held for sale when the asset is available for immediate sale in the present condition and the sale is highly probable. For the sale to be highly probable, which of the following statements is incorrect?

a. Management must be committed to a plan to sell the asset

b. An active program to locate a buyer and complete the plan must have been initiated

c. The asset must be actively marketed for sale at a reasonable price in relation to the fair value

d. The sale is expected to qualify for recognition as a completed sale within two years from the date of classification of the asset as held for sale

D

An entity shall measure a noncurrent asset or disposal group classified as held for sale at

a. Carrying amount

b. Fair value less cost of disposal

c. Lower between carrying amount and fair value less cost of disposal

d. Higher between carrying amount and fair value less cost of disposal

C

On December 31, 2025, CPA Company classified as held for sale an equipment with carrying amount of P5,000,000. On this date, the equipment is expected to be sold for P4,600,000. Disposal cost is expected to be P200,000. On December 31, 2026, the equipment had not been sold and management after consideration its options decided to place back the equipment into operations.

On December 31, 2026, the entity estimated that the equipment is expected to be sold at P4,300,000 with the disposal cost at P50,000. The carrying amount of the equipment was P4,000,000 on December 31, 2026 if the noncurrent asset was not classified as held for sale.

What is the impairment loss for 2025?

a. P600,000

b. P400,000

c. P200,000

d. P0

A

On December 31, 2025, CPA Company classified as held for sale an equipment with carrying amount of P5,000,000. On this date, the equipment is expected to be sold for P4,600,000. Disposal cost is expected to be P200,000. On December 31, 2026, the equipment had not been sold and management after consideration its options decided to place back the equipment into operations.

On December 31, 2026, the entity estimated that the equipment is expected to be sold at P4,300,000 with the disposal cost at P50,000. The carrying amount of the equipment was P4,000,000 on December 31, 2026 if the noncurrent asset was not classified as held for sale.

What is the measurement of the equipment on December 31, 2026?

a. P4,300,000

b. P4,000,000

c. P4,400,000

d. P4,250,000

B

On December 31, 2025, CPA Company classified as held for sale an equipment with carrying amount of P5,000,000. On this date, the equipment is expected to be sold for P4,600,000. Disposal cost is expected to be P200,000. On December 31, 2026, the equipment had not been sold and management after consideration its options decided to place back the equipment into operations.

On December 31, 2026, the entity estimated that the equipment is expected to be sold at P4,300,000 with the disposal cost at P50,000. The carrying amount of the equipment was P4,000,000 on December 31, 2026 if the noncurrent asset was not classified as held for sale.

What is the loss on reclassification in 2026?

a. P300,000

b. P250,000

c. P400,000

d. P150,000

C

The results of discontinued operations should be presented a single amount in the

a. Statement of changes in equity

b. Income statement in juxtaposition with income from continuing operations

c. Income statement, after tax, separately from income from continuing operations

d. Income statement, before tax, separately from income from continuing operations

C

If the ‘fair value less cost to sell’ is lower than the carrying amount of a noncurrent asset classified as held for sale, the difference is treated as a(n)

a. Depreciation expense

b. Note disclosure

c. Impairment loss

d. Prior period adjustment

C

On May 1, 2025, GHI Company approved a plan to dispose of a business segment. It is expected that the sale will occur on March 31, 2026. On December 31, 2025, the carrying amount of the assets of the segment was P2,000,000 and the fair value less cost of disposal was P1,800,000.

During 2025, the entity paid employee severance and relocation costs of P100,000 as a direct result of the discontinued operation. The revenue and expenses of the discontinued segment during 2025 were:

Revenue Expenses

January 1 to April 30 1,500,000 2,000,000

May 1 to December 31 700,000 900,000

What amount should be reported as pretax loss from the discontinued segment for 2025?

a. P1,000,000

b. P2,000,000

c. P700,000

d. P500,000

A