BU111 Midterm Review

0.0(0)

0.0(0)

Card Sorting

1/41

Earn XP

Description and Tags

Covers all Models & How they Connect

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

42 Terms

1

New cards

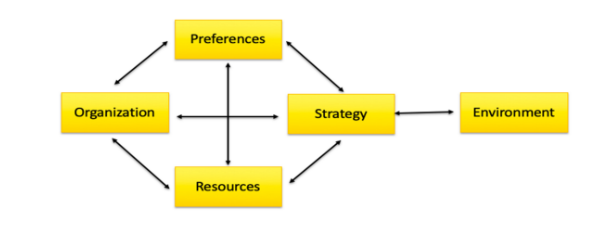

Diamond E Model: (Definition)

Matches internal characteristics with external solutions. It is the plan the business uses to pursue opportunities & avoid threats. Determined using Diamond-E, KSF, or Porter’s Generic Strategies.

\

Internal Strategy: What CAN we do?

External Strategy: What SHOUD we do?

\

Internal Strategy: What CAN we do?

External Strategy: What SHOUD we do?

2

New cards

Diamond E Model (connecting internal qualities of the company to the external environment)

Internal Qualities (Strengths/Weaknesses)

* Management Preferences

* Organization

* Strategy

* Resources

\

External Environment (Opportunities/Threats)

* Determined using PEST or Five Forces

* Management Preferences

* Organization

* Strategy

* Resources

\

External Environment (Opportunities/Threats)

* Determined using PEST or Five Forces

3

New cards

Diamond E Model Application

1- Is the current strategy aligned with future opportunities and threats?

2- What new strategies are feasible and worthwhile?

3- What are our strengths and how can we use them for competitive advantage in the environment?

4- What do we need to execute a strategy? Can we get it? Where are we inconsistent?

2- What new strategies are feasible and worthwhile?

3- What are our strengths and how can we use them for competitive advantage in the environment?

4- What do we need to execute a strategy? Can we get it? Where are we inconsistent?

4

New cards

Diamond E Model Steps

**1- Look Internally, i.e. What do we want and what can we do?**

\

**Management Preferences:**

* What does management want? **Ambitions? Objectives? Vision? Biases?**

* What are its **Priorities?**

* How comfortable is it with **Risks?**

* Does it value some strategies over others?

* Does it value some resources over others?

\

**Organization:**

* **Company Culture** - “Who we are”

* **Company Capabilities** - “ What are we good at” ex: Marketing, supply chain, etc.

* **Specialist** (efficiency) vs **Generalist** (integrative)

* **Innovation vs Stability**

\

**Resources:**

* F**inancial:** Cash on hand, equity, debt, ability to take out loans

* **Intangibles:** Human Capital, reputation, patents, knowledge

\

**2- Deal with Strategy - Environment Linkage**

* Assess forces at work and their implications

* Adjust internal or adjust strategy, because there are variables we can change

\

**3- Create a Strategy**

* Once you have examined all internal factors, create strategy to tackle the external factors, i.e Environment

\

**Management Preferences:**

* What does management want? **Ambitions? Objectives? Vision? Biases?**

* What are its **Priorities?**

* How comfortable is it with **Risks?**

* Does it value some strategies over others?

* Does it value some resources over others?

\

**Organization:**

* **Company Culture** - “Who we are”

* **Company Capabilities** - “ What are we good at” ex: Marketing, supply chain, etc.

* **Specialist** (efficiency) vs **Generalist** (integrative)

* **Innovation vs Stability**

\

**Resources:**

* F**inancial:** Cash on hand, equity, debt, ability to take out loans

* **Intangibles:** Human Capital, reputation, patents, knowledge

\

**2- Deal with Strategy - Environment Linkage**

* Assess forces at work and their implications

* Adjust internal or adjust strategy, because there are variables we can change

\

**3- Create a Strategy**

* Once you have examined all internal factors, create strategy to tackle the external factors, i.e Environment

5

New cards

Business Situation Framework #1 (Customer)

Customer:

* Who buys, uses, why, how much, how often, and in what context?

* Segments (size, growth, % of market)

* How do they make buying decisions?

* Distribution channel preference

* Who buys, uses, why, how much, how often, and in what context?

* Segments (size, growth, % of market)

* How do they make buying decisions?

* Distribution channel preference

6

New cards

Business Situation Framework #2 (Company)

Company:

* Capabilities, expertise, resources, distribution channels

* Financial situation

* Organizational structure

* Preferences, vision, mission

* Intangibles (reputation, brand equity, human capital)

* Capabilities, expertise, resources, distribution channels

* Financial situation

* Organizational structure

* Preferences, vision, mission

* Intangibles (reputation, brand equity, human capital)

7

New cards

Business Situation Framework #3 (Competition)

Competition:

* Market share concentration

* Strategy (position/target, products, pricing, distribution)

* Best practices (are they doing something we aren’t/can’t)

* Barriers to entry - new competitors?

* Regulations

* Market share concentration

* Strategy (position/target, products, pricing, distribution)

* Best practices (are they doing something we aren’t/can’t)

* Barriers to entry - new competitors?

* Regulations

8

New cards

Business Situation Framework #4 (Product)

Product:

* Nature of product (how it’s used, why it’s valuable?

* Differentiated?

* Complementary goods needed?

* Substitutes

* Life cycle stage

* Nature of product (how it’s used, why it’s valuable?

* Differentiated?

* Complementary goods needed?

* Substitutes

* Life cycle stage

9

New cards

Principle Logic (ICE-A)

**Internal Consistency:**

* Good management/execution of internal business practices

\

**External Allignement:**

* Correct strategy, optimized for the environment

\

* Good management/execution of internal business practices

\

**External Allignement:**

* Correct strategy, optimized for the environment

\

10

New cards

P+G Strategy-Structure (2000)

* Internally inconsistent and externally misaligned strategy

* Wrongly focused on diversifying their product lineup

* Customers lost interest, too much variety for target audience

* Suppliers were also short on resources for the expansion, causing shortages

* Wrongly focused on diversifying their product lineup

* Customers lost interest, too much variety for target audience

* Suppliers were also short on resources for the expansion, causing shortages

11

New cards

Ikea Strategy-Structure

* Internally consistent and externally aligned strategy

* Noticed many customers did not have the space for large furniture in their smaller apartments/homes

* Adapted to environment, shipping furniture in pieces so it could be fit in any home and built there.

* Consider their financial resources, they were able to use large buildings as retail warehouses and create different product lines to appease their target audience.

* Noticed many customers did not have the space for large furniture in their smaller apartments/homes

* Adapted to environment, shipping furniture in pieces so it could be fit in any home and built there.

* Consider their financial resources, they were able to use large buildings as retail warehouses and create different product lines to appease their target audience.

12

New cards

Success Key Factors (SKF)

13

New cards

SKF - Financial Resources (3 KPI)

**Financial Resources:**

* Profits

* Growth

* ROI

\

Key Performance Indicators:

* **Revenue/Profits:** Describes net profit. Higher is better, growth is better.

* **ROI:** Returned revenues on initial investment

* **Firm Value:** The value of the company if sold today

* Profits

* Growth

* ROI

\

Key Performance Indicators:

* **Revenue/Profits:** Describes net profit. Higher is better, growth is better.

* **ROI:** Returned revenues on initial investment

* **Firm Value:** The value of the company if sold today

14

New cards

SKF - Employees (4 KPI)

**Employees:**

* Enable Firm Operation

* Hire qualified personnel that enjoy working for you

* Give your employees chances to succeed, ex promotions

* Motivate them with profit sharing, flexibility, development, opportunities, etc.

\

Key Performance Indicators:

* **Employee Commitment:** Describes the loyalty, passion, and commitment of employees. These workers are significantly more productive.

* **Employee Turnover:** Amount of employees you have to replace, year over year (Lower is better)

* **Productivity:** The amount of output the company’s employees generate

* **Application:** Employees tend to be attracted to work at companies with good employee relations.

* Enable Firm Operation

* Hire qualified personnel that enjoy working for you

* Give your employees chances to succeed, ex promotions

* Motivate them with profit sharing, flexibility, development, opportunities, etc.

\

Key Performance Indicators:

* **Employee Commitment:** Describes the loyalty, passion, and commitment of employees. These workers are significantly more productive.

* **Employee Turnover:** Amount of employees you have to replace, year over year (Lower is better)

* **Productivity:** The amount of output the company’s employees generate

* **Application:** Employees tend to be attracted to work at companies with good employee relations.

15

New cards

SKF - Customers (5KPI)

**Customers:**

* Provide Revenue

* Create brand loyalty

* What do you have to offer?

* Who needs/wants it the most?

\

Key Performance Indicators:

* **Customer Satisfaction:** When a company anticipates their target market’s needs.

* **Market Share:** Percentage of overall market you control/own in $ influenced by firm size

* **Share of Wallet:** the % of money that consumers regularly spend on a company’s products rather than their competitors. (Higher is better)

* **Net Promoter Score:** Measuring advocacy of your customers, such as if customers regularly recommend a company’s products to others. (Higher is better)

* **Churn:** % of customers the firm loses every year. Measures customer loyalty. (Lower is better)

* Provide Revenue

* Create brand loyalty

* What do you have to offer?

* Who needs/wants it the most?

\

Key Performance Indicators:

* **Customer Satisfaction:** When a company anticipates their target market’s needs.

* **Market Share:** Percentage of overall market you control/own in $ influenced by firm size

* **Share of Wallet:** the % of money that consumers regularly spend on a company’s products rather than their competitors. (Higher is better)

* **Net Promoter Score:** Measuring advocacy of your customers, such as if customers regularly recommend a company’s products to others. (Higher is better)

* **Churn:** % of customers the firm loses every year. Measures customer loyalty. (Lower is better)

16

New cards

SKF - Products/Services (7 KPI)

**Products/Services:**

* The “Means of Revenue”

* Concerns perceived quality

* Optimize your inputs, production process

\

Key Performance Indicators:

* **Quality:** Concerns the product’s perceived value, consistency and reliability

* **Reliability:** Products expected life span is directly related to its perceived value

* **Returns:** Happens when consumers are not satisfied with product (Lower is better).

* **Defects:** Products that are not up to company’s quality quality standards. High defect rates creates perception of inconsistent product quality.

* **Warranty Claims:** Higher number of warranty claims show product does not live up to its expected life cycle

* **Waste:** Inefficiencies in manufacturing process, usually due to low quality inputs

* **Value:** You get what you pay for and are okay with it because you expect it.

* The “Means of Revenue”

* Concerns perceived quality

* Optimize your inputs, production process

\

Key Performance Indicators:

* **Quality:** Concerns the product’s perceived value, consistency and reliability

* **Reliability:** Products expected life span is directly related to its perceived value

* **Returns:** Happens when consumers are not satisfied with product (Lower is better).

* **Defects:** Products that are not up to company’s quality quality standards. High defect rates creates perception of inconsistent product quality.

* **Warranty Claims:** Higher number of warranty claims show product does not live up to its expected life cycle

* **Waste:** Inefficiencies in manufacturing process, usually due to low quality inputs

* **Value:** You get what you pay for and are okay with it because you expect it.

17

New cards

SKF - Innovation (6KPI)

**Innovation:**

* Improves Environmental Alignment

* Culture, structure, and rewards

* Includes small things like the WAY you serve customers.

* Can create valuable change

\

Key Performance Indicators:

* **New Products:** New forms of the product, new approaches to selling the products, etc.

* **Idea Generation:** New ideas are encouraged and are being explored by employees in the company

* **Cycle Time:** How long it takes to go from idea generation to full implementation (Faster is better, indicates better and more efficient organization).

* **Company Culture:** Can be accepting of change, gives employees rewards for pushing innovative ideas/

* **Company Structure:** Can provide employees opportunit**ies** to explore change/creativity.

* **Rewards:** Employees can be rewarded for thinking outside the box

\

* Improves Environmental Alignment

* Culture, structure, and rewards

* Includes small things like the WAY you serve customers.

* Can create valuable change

\

Key Performance Indicators:

* **New Products:** New forms of the product, new approaches to selling the products, etc.

* **Idea Generation:** New ideas are encouraged and are being explored by employees in the company

* **Cycle Time:** How long it takes to go from idea generation to full implementation (Faster is better, indicates better and more efficient organization).

* **Company Culture:** Can be accepting of change, gives employees rewards for pushing innovative ideas/

* **Company Structure:** Can provide employees opportunit**ies** to explore change/creativity.

* **Rewards:** Employees can be rewarded for thinking outside the box

\

18

New cards

SKF - Uniqueness (3KPI)

**Uniqueness:**

* Creates market advantage

* R&D needed

* What’s going to attract employees and customers to your business instead of your competitors?

\

Key Performance Indicators:

* **Distinctive Competitive Advantage:** Valuable & sustainable differentiation from competitors

* **Strong Unique Reputation:** Extracted from market research. How the market (consumers, competitors, employees) perceives the firm

* **Superior Competitive Performance:** Is the firm able to produce cheaper, faster, is the firm able to charge more, attract better employees, compared to competition.

* Creates market advantage

* R&D needed

* What’s going to attract employees and customers to your business instead of your competitors?

\

Key Performance Indicators:

* **Distinctive Competitive Advantage:** Valuable & sustainable differentiation from competitors

* **Strong Unique Reputation:** Extracted from market research. How the market (consumers, competitors, employees) perceives the firm

* **Superior Competitive Performance:** Is the firm able to produce cheaper, faster, is the firm able to charge more, attract better employees, compared to competition.

19

New cards

Why Consider KSF?

* Guide strategic and daily actions. like a daily checklist

* Ensure long-term success

* Ensure holistic thinking

\

Reminds you that KSF are connected. Organizations are made up of interconnected components.

* Ensure long-term success

* Ensure holistic thinking

\

Reminds you that KSF are connected. Organizations are made up of interconnected components.

20

New cards

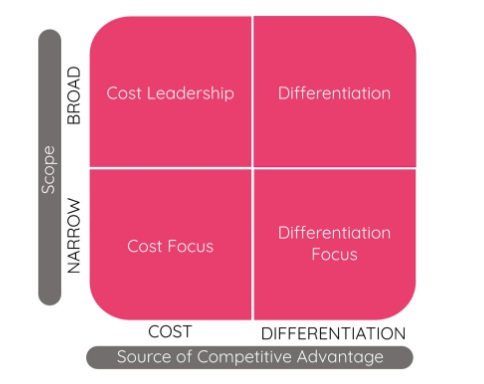

Porter’s Generic Strategies (Definition)

Offers insights on competitive position strategies a firm can take and what is needed to pursue them.

21

New cards

Porter’s Generic Strategies

**Competitive Scope (Y):**

**Broad Target:** Appeal to a broad group of customers

**Narrow Target:** Identify an underserved niche market, and target them.

\

**Competitive Advantage (X):**

**Cost:** Advantage resides in offering products cheaper than competitors. Can the firm deliver goods at the lowest cost and still turn a profit?

**Differentiation:** Advantage resides in how firm’s products are distinct from competitors. How can the firm make consumers pay more for their product?

**Broad Target:** Appeal to a broad group of customers

**Narrow Target:** Identify an underserved niche market, and target them.

\

**Competitive Advantage (X):**

**Cost:** Advantage resides in offering products cheaper than competitors. Can the firm deliver goods at the lowest cost and still turn a profit?

**Differentiation:** Advantage resides in how firm’s products are distinct from competitors. How can the firm make consumers pay more for their product?

22

New cards

PGS #1: Cost Leadership

**Description:**

* Appeals to **BROAD** market at **LOW** price

* Has the capacity to produce at large volumes and has the capabilities to produce more cheaply than others

* Does the large portion of the overall market value lower priced offering?

* Appeals to **BROAD** market at **LOW** price

* Has the capacity to produce at large volumes and has the capabilities to produce more cheaply than others

* Does the large portion of the overall market value lower priced offering?

23

New cards

PGS #2: Differentiation

**Description:**

* Appeals to **BROAD** market at **HIGH** price

* Products provide unique features that consumer pay extra for, and has the capacity to product at a large capacity

* Are the unique features broadly appealing?

* Appeals to **BROAD** market at **HIGH** price

* Products provide unique features that consumer pay extra for, and has the capacity to product at a large capacity

* Are the unique features broadly appealing?

24

New cards

PGS #3: Cost Focus

**Description:**

* Appeals to **NARROW** market at **LOW** price

* Serves their niche at the lowest price possible

* Does a simpler, lower performance, cheaper product appeal to small but enough portion of the market

* Appeals to **NARROW** market at **LOW** price

* Serves their niche at the lowest price possible

* Does a simpler, lower performance, cheaper product appeal to small but enough portion of the market

25

New cards

PGS #4: Differentiation Focus

**Description:**

* Appeals to **NARROW** market at **HIGH** price

* Company targets small group that are willing to pay substantially more.

* Would customers be willing to pay a lot more?

* Appeals to **NARROW** market at **HIGH** price

* Company targets small group that are willing to pay substantially more.

* Would customers be willing to pay a lot more?

26

New cards

PEST Factors: Look For’s in External Analysis

**Present:**

* Current Environmental situation

* Firm should constantly look for ways to adapt to its current environment

\

**Trends:**

* Observable Environmental changes that will come in the future

* Firms should anticipate changes and adapt ahead of time. Ex: Society’s social structure changer over time

\

**Quick Changes:**

* Predictable or surprising changes

* Anticipate and plan contingency strategies

* **Predictable Changes:** Interest rates changes

* **Surprising Changes:** Covid-19, natural disasters

\

* Current Environmental situation

* Firm should constantly look for ways to adapt to its current environment

\

**Trends:**

* Observable Environmental changes that will come in the future

* Firms should anticipate changes and adapt ahead of time. Ex: Society’s social structure changer over time

\

**Quick Changes:**

* Predictable or surprising changes

* Anticipate and plan contingency strategies

* **Predictable Changes:** Interest rates changes

* **Surprising Changes:** Covid-19, natural disasters

\

27

New cards

PEST Factor #1: Political

**Descriptions:**

* Laws

* Regulations

* International Trade Laws

* Trade Agreements

\

**Opportunities/Threats:**

* **Expansion.** Ex. If governments negotiate trade agreements with foreign countries a business will have opportunities to expand into foreign markets

* **Barriers.** Ex. Regulations bar the average Canadian from creating their own chartered banks.

* **Competition.** Ex. If trade agreement reduced tariffs, foreign companies are now competing with you for the same population

\

* Laws

* Regulations

* International Trade Laws

* Trade Agreements

\

**Opportunities/Threats:**

* **Expansion.** Ex. If governments negotiate trade agreements with foreign countries a business will have opportunities to expand into foreign markets

* **Barriers.** Ex. Regulations bar the average Canadian from creating their own chartered banks.

* **Competition.** Ex. If trade agreement reduced tariffs, foreign companies are now competing with you for the same population

\

28

New cards

PEST Factor #2: Economic

**Descriptions:**

* GDP

* Inflation

* Employment

* Exchange Rate

* Interest Rates

\

**Opportunities/Threats:**

* **Input Cost.** Ex. When inflation is high, input costs are higher. When CAD exchange rate is high, input costs are lower.

* **Demand.** Ex. If firm wants to expand into country with high GDP, demand will be higher because citizens have plenty of money.

* **Funding.** Ex. Higher interest rates lower access to easy loans

* **Competitive Pricing.** Ex. High CAD is better for importers as it allows them to import for for the same amount of money. Low CAD is better for exporters as it makes them more competitive, people with a stronger currency can buy more of the Canadian firm’s products.

* GDP

* Inflation

* Employment

* Exchange Rate

* Interest Rates

\

**Opportunities/Threats:**

* **Input Cost.** Ex. When inflation is high, input costs are higher. When CAD exchange rate is high, input costs are lower.

* **Demand.** Ex. If firm wants to expand into country with high GDP, demand will be higher because citizens have plenty of money.

* **Funding.** Ex. Higher interest rates lower access to easy loans

* **Competitive Pricing.** Ex. High CAD is better for importers as it allows them to import for for the same amount of money. Low CAD is better for exporters as it makes them more competitive, people with a stronger currency can buy more of the Canadian firm’s products.

29

New cards

PEST Factor #3: Social

**Descriptions:**

* Values/Attitudes

* Customs

* Habits

* Demographics

\

**Opportunities/Threats:**

* **Customers.** Ex. Values, attitudes, customs and habits affect what they demand and how the firm communicates with them in marketing material

* **Employees.** Ex. Canadian’s attitudes towards working in an office post COVID have changed. Many Canadians prefer working from home, at least more than they did pre-Covid.

* **CSR (Corporate Social Responsibility).** Ex. Management, who control CSR plan, are constrained by the morals and values of their society. Many companies in the east would not promote pro-LGBTQ initiatives because of public backlash.

* Values/Attitudes

* Customs

* Habits

* Demographics

\

**Opportunities/Threats:**

* **Customers.** Ex. Values, attitudes, customs and habits affect what they demand and how the firm communicates with them in marketing material

* **Employees.** Ex. Canadian’s attitudes towards working in an office post COVID have changed. Many Canadians prefer working from home, at least more than they did pre-Covid.

* **CSR (Corporate Social Responsibility).** Ex. Management, who control CSR plan, are constrained by the morals and values of their society. Many companies in the east would not promote pro-LGBTQ initiatives because of public backlash.

30

New cards

PEST Factor #4: Technology

**Descriptions:**

* IT

* Internet

* Materials & Equipment

* Has Biggest Impact on Organizations

\

**Opportunities/Threats:**

* **Barriers.** Ex. Tech can create or reduce barriers of entry to many industries. Airbnb entered hotel industry by using technology, instead of buying lots of real estate.

* **Innovation.** Ex. Changes in steel production allowing steel to be lighter but just as resilient.

* **Strategy.** Ex. Companies use technology to adapt new trends, such as retailers integrating e-commerce capabilities in their business model.

* IT

* Internet

* Materials & Equipment

* Has Biggest Impact on Organizations

\

**Opportunities/Threats:**

* **Barriers.** Ex. Tech can create or reduce barriers of entry to many industries. Airbnb entered hotel industry by using technology, instead of buying lots of real estate.

* **Innovation.** Ex. Changes in steel production allowing steel to be lighter but just as resilient.

* **Strategy.** Ex. Companies use technology to adapt new trends, such as retailers integrating e-commerce capabilities in their business model.

31

New cards

Questions to Answer From PEST Analysis

* Are social factors changing how I hire or what customers want? How are customers different in foreign markets?

* Can I use tech to improve product quality, meet customer needs, or increase profitability?

* Will changes in laws, regulations or tech reduce barriers to entry?

* What legal protection do I have or what laws do I have to comply with?

* What do future economic conditions look like and how will they impact my firm?

* Can I use tech to improve product quality, meet customer needs, or increase profitability?

* Will changes in laws, regulations or tech reduce barriers to entry?

* What legal protection do I have or what laws do I have to comply with?

* What do future economic conditions look like and how will they impact my firm?

32

New cards

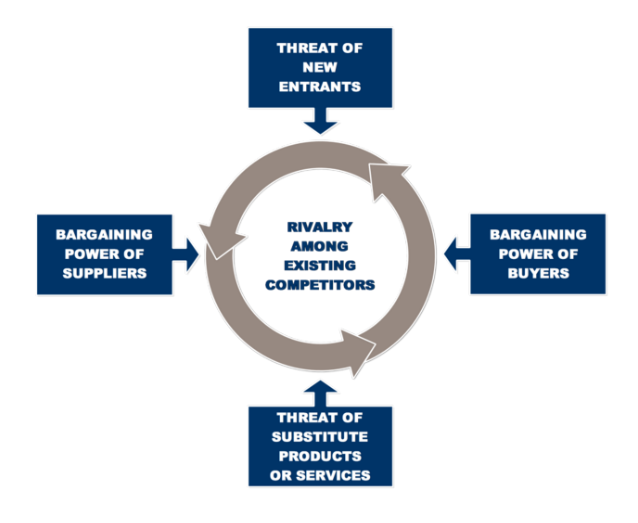

Porter’s Five Forces: Focus

* Focuses on evaluating INDUSTRY environment

* Helpful on identifying COMPETITION in industry

* Identifies challenges or constraints

* Identifies what the competitive environment look like

* Identifies external factors affecting the industry

* Identifies the industries that might be worth entering

* What barriers will a firm face if they choose to expand into this industry?

\

**Caveat:** Power and influence of each force will vary by industry. One weakness of Five Forces.

* Helpful on identifying COMPETITION in industry

* Identifies challenges or constraints

* Identifies what the competitive environment look like

* Identifies external factors affecting the industry

* Identifies the industries that might be worth entering

* What barriers will a firm face if they choose to expand into this industry?

\

**Caveat:** Power and influence of each force will vary by industry. One weakness of Five Forces.

33

New cards

PORTER’S 5 Forces:

34

New cards

P5F Breakdown: Existing Competitors (6)

**Existing Competitors:**

* Biggest factor

* More competition = less profit, no above-normal returns

* Includes all current competitors

\

**Factors:**

**Homogenous Competitors:**

* When competitors are similar to each other

* Lack of competitive advantage

* Companies have to work extra hard to gain market share

* Very aggressive competition

* Ex: Bread, Milk, etc.

\

**Low Industry Growth Rate:**

* Lower volume long term

* More aggressive competition

* Low profitability n

* Niche markets like umbrella market

\

**The capacity of Competitors:**

* If competitors are at max production capacity, competition is not aggressive

* High profitability

* Ex. Lemonade stands are at max production capacity on hot days’ they will run out of lemons

\

**Low Consumer Switching Costs:**

* If consumers can switch easily (churn), competition is more aggressive

* Low profitability

* Ex. Gum, many brands have similar flavors, so low switching costs

\

**Products viewed as Commodities or Perishable:**

* If consumers view the product as a commodity (homogenous), they will not care which brand they buy

* Price competition is much more aggressive

* Very low profitability

* Ex. Fruits and Vegetables

\

**Exit Barriers:**

* Low exit barriers allow customers to leave the market whenever they want.

* Aggressive competition to retain customers.

* Ex. Companies make leaving subscription plans complicated to create exit barriers.

\

**Solutions:**

* Grow Market Share

* Acquisition of competitors

* Create/increase consumer switching costs

* Differentiation

* Look at Diamon-E to determine the best solution

* Biggest factor

* More competition = less profit, no above-normal returns

* Includes all current competitors

\

**Factors:**

**Homogenous Competitors:**

* When competitors are similar to each other

* Lack of competitive advantage

* Companies have to work extra hard to gain market share

* Very aggressive competition

* Ex: Bread, Milk, etc.

\

**Low Industry Growth Rate:**

* Lower volume long term

* More aggressive competition

* Low profitability n

* Niche markets like umbrella market

\

**The capacity of Competitors:**

* If competitors are at max production capacity, competition is not aggressive

* High profitability

* Ex. Lemonade stands are at max production capacity on hot days’ they will run out of lemons

\

**Low Consumer Switching Costs:**

* If consumers can switch easily (churn), competition is more aggressive

* Low profitability

* Ex. Gum, many brands have similar flavors, so low switching costs

\

**Products viewed as Commodities or Perishable:**

* If consumers view the product as a commodity (homogenous), they will not care which brand they buy

* Price competition is much more aggressive

* Very low profitability

* Ex. Fruits and Vegetables

\

**Exit Barriers:**

* Low exit barriers allow customers to leave the market whenever they want.

* Aggressive competition to retain customers.

* Ex. Companies make leaving subscription plans complicated to create exit barriers.

\

**Solutions:**

* Grow Market Share

* Acquisition of competitors

* Create/increase consumer switching costs

* Differentiation

* Look at Diamon-E to determine the best solution

35

New cards

P5F Breakdown: Threat of New Entrants (3)

**The threat of New Entrants:**

* The easier it is for new competitors to enter the market, the more profitability declines.

* The market will become saturated

* The ability to keep future competitors out determines profitability long term

* Determined by barriers to entry

* New entrants often use innovation to permeate the market, such as Airbnb and UBER.

\

**Barriers To Entry:**

**Cost Related:**

* Economies of scale (high output)

* Capital requirements

* Other cost advantages such as learning curves, specialized assets like tech

* Ex. Entry may require large capital requirements such as the automobile industry

\

**Customer Related:**

* Differentiation: Customers are either brand loyal or have high switching costs.

* Distribution Channels: Firms secure contracts with distributors. Ex Lays will secure a contract with Sobeys to secure shelf space, making it harder for other potato chip manufacturers to enter the market.

* Ex. Apple has high brand loyalty and switching costs

* Ex. Sobeys may negotiate an exclusive distribution deal with Lays.

\

**Government Regulations:**

* Regulations make entering the market harder.

* Ex. Banking and cell phone service. Government has to give you permission to create a bank.

\

**Solutions:**

* Grow to achieve scale

* Control distribution network

* Lobby government to create regulations

* Differentiate, and create brand loyalty and identity

* Lock customers in

\

\

* The easier it is for new competitors to enter the market, the more profitability declines.

* The market will become saturated

* The ability to keep future competitors out determines profitability long term

* Determined by barriers to entry

* New entrants often use innovation to permeate the market, such as Airbnb and UBER.

\

**Barriers To Entry:**

**Cost Related:**

* Economies of scale (high output)

* Capital requirements

* Other cost advantages such as learning curves, specialized assets like tech

* Ex. Entry may require large capital requirements such as the automobile industry

\

**Customer Related:**

* Differentiation: Customers are either brand loyal or have high switching costs.

* Distribution Channels: Firms secure contracts with distributors. Ex Lays will secure a contract with Sobeys to secure shelf space, making it harder for other potato chip manufacturers to enter the market.

* Ex. Apple has high brand loyalty and switching costs

* Ex. Sobeys may negotiate an exclusive distribution deal with Lays.

\

**Government Regulations:**

* Regulations make entering the market harder.

* Ex. Banking and cell phone service. Government has to give you permission to create a bank.

\

**Solutions:**

* Grow to achieve scale

* Control distribution network

* Lobby government to create regulations

* Differentiate, and create brand loyalty and identity

* Lock customers in

\

\

36

New cards

P5F Breakdown: Threat of Substitutes (4)

**The threat of Substitutes:**

* More substitutes = less profit

* Cheap substitutes eat away at the bottom end of your market

* Not as convenient, or comfortable, but since it is cheaper people make do.

* The cheaper and better the substitute, the more likely it steals market share

* Substitutes put a cap on your prices (price ceiling)

\

**Factors:**

**Many Good Substitutes:**

* Consumers have many good options

* Aggressive competition

* Low profits

* Ex. Ritz Crackers, have many different substitutes like cookies or chips

\

**Low Switching Costs:**

* Consumers can switch easily or cheaply

* Aggressive competition

* Lowe profits

* Ex. Switching from one gum brand to another is really easy, consumers do not think twice

\

**High Buyer Propensity to Substitute:**

* The likelihood that consumers will substitute for a competitor rather than your product

* Consumers are more likely to switch to other substitutes instead of you

* Firms will spend more money on marketing

* Aggressive competition

* Low Profits

* Ex. Butter can easily be substituted for margarine

\

**Improvements in Price vs Performance Trade-Off:**

* Over time, substitutes innovate and improve

* Substitutes become better, but the price stays the same

* Lowers price ceiling

* Ex. One Plus Phones, cheaper for better

\

**Solutions:**

* Strong marketing/differentiation

* Create switching costs

* Lock in customers

\

\

* More substitutes = less profit

* Cheap substitutes eat away at the bottom end of your market

* Not as convenient, or comfortable, but since it is cheaper people make do.

* The cheaper and better the substitute, the more likely it steals market share

* Substitutes put a cap on your prices (price ceiling)

\

**Factors:**

**Many Good Substitutes:**

* Consumers have many good options

* Aggressive competition

* Low profits

* Ex. Ritz Crackers, have many different substitutes like cookies or chips

\

**Low Switching Costs:**

* Consumers can switch easily or cheaply

* Aggressive competition

* Lowe profits

* Ex. Switching from one gum brand to another is really easy, consumers do not think twice

\

**High Buyer Propensity to Substitute:**

* The likelihood that consumers will substitute for a competitor rather than your product

* Consumers are more likely to switch to other substitutes instead of you

* Firms will spend more money on marketing

* Aggressive competition

* Low Profits

* Ex. Butter can easily be substituted for margarine

\

**Improvements in Price vs Performance Trade-Off:**

* Over time, substitutes innovate and improve

* Substitutes become better, but the price stays the same

* Lowers price ceiling

* Ex. One Plus Phones, cheaper for better

\

**Solutions:**

* Strong marketing/differentiation

* Create switching costs

* Lock in customers

\

\

37

New cards

P5F Breakdown: Bargaining Power of Suppliers (5)

**Bargaining Power of Suppliers:**

* Provides the key inputs for the firm

* Changes in cost of inputs affects market as a whole

* The more power suppliers have to negotiate prices, the less profitability in industry

\

**Factors:**

**Few Suppliers:**

* Suppliers know you need them, since there is less choice

* Can negotiate higher prices

* There may be many good substitutes for this input

* Less supply for required inputs, causes aggressive competition and bidding wars

* Low profits

* Ex. Diamond Mines, can be substituted for other gems

\

**Few Good Substitute Suppliers:**

* More supplier negotiating power, as there are no alternatives

* Low profits

* Ex. In the automobile industry there are no rubber tire substitutes

\

**High Switching Costs:**

* If cost to change inputs are high, you will be resistant to switching supplier

* Unique inputs usually have high switching costs

* Low profits

* Ex. Factory can give bulk discounts, or can lock a buyer into contracts

\

**Low Importance:**

* You will be less likely to negotiate low prices if you are unimportant

* You need supplier, but supplier does not need you

* Ex. Walmart has a lot of negotiating power with suppliers because they are a huge chain

\

**Threat of Forward Integration:**

* Concern that the supplier may enter industry and become a direct competitor

* Ex. Disney and Netflix. Disney stopped supply Disney movies to Netflix and instead launched their own streaming service.

\

**Solutions:**

* Form strategic alliance with supplier

* Internal supply, create your own products, like Netflix making shows.

* Long run: redesigned product or reevaluate inputs

* Provides the key inputs for the firm

* Changes in cost of inputs affects market as a whole

* The more power suppliers have to negotiate prices, the less profitability in industry

\

**Factors:**

**Few Suppliers:**

* Suppliers know you need them, since there is less choice

* Can negotiate higher prices

* There may be many good substitutes for this input

* Less supply for required inputs, causes aggressive competition and bidding wars

* Low profits

* Ex. Diamond Mines, can be substituted for other gems

\

**Few Good Substitute Suppliers:**

* More supplier negotiating power, as there are no alternatives

* Low profits

* Ex. In the automobile industry there are no rubber tire substitutes

\

**High Switching Costs:**

* If cost to change inputs are high, you will be resistant to switching supplier

* Unique inputs usually have high switching costs

* Low profits

* Ex. Factory can give bulk discounts, or can lock a buyer into contracts

\

**Low Importance:**

* You will be less likely to negotiate low prices if you are unimportant

* You need supplier, but supplier does not need you

* Ex. Walmart has a lot of negotiating power with suppliers because they are a huge chain

\

**Threat of Forward Integration:**

* Concern that the supplier may enter industry and become a direct competitor

* Ex. Disney and Netflix. Disney stopped supply Disney movies to Netflix and instead launched their own streaming service.

\

**Solutions:**

* Form strategic alliance with supplier

* Internal supply, create your own products, like Netflix making shows.

* Long run: redesigned product or reevaluate inputs

38

New cards

P5F Breakdown: Bargaining Power of Buyers (5)

**Bargaining power of Buyers:**

* Who pays for your product?

* Effects: Reduces price that you can charge; increases costs.

\

**Factors:**

**Few/Concentrated Buyers:**

* If buyers are few in number, they have more bargaining power over you, and can demand lower price

* Low profit

* Ex. Niche markets like designer umbrella market

\

**Discretionary Purchase; Purchase Significance:**

* Non essential items people buy if they have extra money

* Low purchase significance = it is not a need

* Keep prices low to motivate buyers

* Ex. Includes recreational activities like yoga classes are non essential

* Ex. Life threating meds like insulin are essential

\

**Standardized Products; Switching Costs:**

* These products have low switching costs, reducing profitability

* Makes it easy to switch between brand, company has to work harder to keep customer loyal

* Ex. Commodities such as milk or gas.

\

**Financially Motivated:**

* Determines motivation of the buyers to buy your product

* **Cost Significance:** As things get more expensive consumers try to negotiate the price. Ex. Cars, houses.

* **Profitability:** If you affect buyer’s profitability, they will not negotiate the price. Ex: A gumball from a gumball machine

* **Cost Savings:** How much the consumer saves when they buy from you vs competition. Ex. Consumers love to shop at stores when they are running sales.

\

**Threat of Backwards Integration:**

* If buyer may become competitor, that is a problem

* You lose a buyer as well as gain a competitor

* Gives buyer more bargaining power

* Lower profits

* Ex. Apple bought intel chips, then decided to create their own chips

\

**Solutions:**

* Form alliance with other sellers (illegal, price fixing)

* Strong marketing/differentiation

* Create high switching costs, lock customers in

\

\

* Who pays for your product?

* Effects: Reduces price that you can charge; increases costs.

\

**Factors:**

**Few/Concentrated Buyers:**

* If buyers are few in number, they have more bargaining power over you, and can demand lower price

* Low profit

* Ex. Niche markets like designer umbrella market

\

**Discretionary Purchase; Purchase Significance:**

* Non essential items people buy if they have extra money

* Low purchase significance = it is not a need

* Keep prices low to motivate buyers

* Ex. Includes recreational activities like yoga classes are non essential

* Ex. Life threating meds like insulin are essential

\

**Standardized Products; Switching Costs:**

* These products have low switching costs, reducing profitability

* Makes it easy to switch between brand, company has to work harder to keep customer loyal

* Ex. Commodities such as milk or gas.

\

**Financially Motivated:**

* Determines motivation of the buyers to buy your product

* **Cost Significance:** As things get more expensive consumers try to negotiate the price. Ex. Cars, houses.

* **Profitability:** If you affect buyer’s profitability, they will not negotiate the price. Ex: A gumball from a gumball machine

* **Cost Savings:** How much the consumer saves when they buy from you vs competition. Ex. Consumers love to shop at stores when they are running sales.

\

**Threat of Backwards Integration:**

* If buyer may become competitor, that is a problem

* You lose a buyer as well as gain a competitor

* Gives buyer more bargaining power

* Lower profits

* Ex. Apple bought intel chips, then decided to create their own chips

\

**Solutions:**

* Form alliance with other sellers (illegal, price fixing)

* Strong marketing/differentiation

* Create high switching costs, lock customers in

\

\

39

New cards

Application of Porter’s Five Forces

**Expansion Questions:**

* How profitable is this industry? Do I enter or not?

* Can I enter? What are the barriers to entry?

\

**Profitability Questions:**

* What factors are affecting our revenues and costs?

* What can we do to be more profitable?

\

**Competition Questions:**

* Concerns reducing rivalry to improve profitability

* What barriers to entry can we create?

* What are our competitors and how do we reduce head-to-head competition?

* How profitable is this industry? Do I enter or not?

* Can I enter? What are the barriers to entry?

\

**Profitability Questions:**

* What factors are affecting our revenues and costs?

* What can we do to be more profitable?

\

**Competition Questions:**

* Concerns reducing rivalry to improve profitability

* What barriers to entry can we create?

* What are our competitors and how do we reduce head-to-head competition?

40

New cards

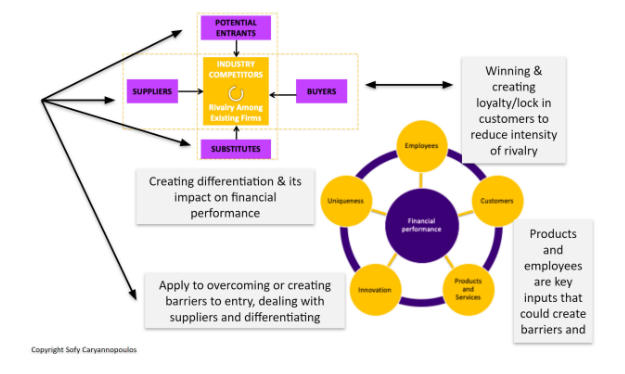

Steps to Connect Models to Solve Issues

1- Identity KSF affected by the problem

\

2- Identify KPI that affect the KSF

\

3- User Porter’s Five Forces and PEST to determine if the issue is industry-wide

* If it is an industry issue, analyze competitors to determine the strategy

* If it isn’t an industry issue, use DIamond-E or Generic Strategies to reevaluate strategy

\

2- Identify KPI that affect the KSF

\

3- User Porter’s Five Forces and PEST to determine if the issue is industry-wide

* If it is an industry issue, analyze competitors to determine the strategy

* If it isn’t an industry issue, use DIamond-E or Generic Strategies to reevaluate strategy

41

New cards

Connecting The Models

**Key Success Factors:**

* Apply to overcome or create barriers to entry

* Am I doing a poor job in one or more KSF or KPI?

* What tactics/strategies can I Implement to fix this?

\

**Porter’s Five Forces:**

* Is the cause an industry factor? Compare your situation to competitors.

* What tactics/strategies can I implement to fix this?

\

**PEST Factors:**

* Has something changed in one of these factors? Is this change an underlying cause of issues identified above?

* Apply to overcome or create barriers to entry

* Am I doing a poor job in one or more KSF or KPI?

* What tactics/strategies can I Implement to fix this?

\

**Porter’s Five Forces:**

* Is the cause an industry factor? Compare your situation to competitors.

* What tactics/strategies can I implement to fix this?

\

**PEST Factors:**

* Has something changed in one of these factors? Is this change an underlying cause of issues identified above?

42

New cards

Cross Model Connections:

* Under what conditions does pursuing a broad versus narrow target make sense? How does the Diamond-E inform the selection among the four generic strategies?

* How can you harness insights from Porter’s Five Forces to understand the significance and the impact of key success factors by profitability? How do actions recommend for KSF’s align with strategies recommended by Porter’s Five Forces?

* What KPI’s might be affected (and in what way) by factors related to Porter’s Five Forces? How might they indicate SWOT in Diamond-E?

* Identify some key success factors that are related to reducing the negative forces on profitability that you might identify using Porter’s.

* How does the Diamond-E connect to Porter’s Five Forces? Provide an example of how you would apply Diamond-E to identify strategies for dealing with challenges using Porter’s Five Forces.

* How can changes in PEST impact each of Porter’s Five Forces? Identity specific elements of PEST that might change and explain the connection to the Porter’s Force and the effect it will have.

* How can you harness insights from Porter’s Five Forces to understand the significance and the impact of key success factors by profitability? How do actions recommend for KSF’s align with strategies recommended by Porter’s Five Forces?

* What KPI’s might be affected (and in what way) by factors related to Porter’s Five Forces? How might they indicate SWOT in Diamond-E?

* Identify some key success factors that are related to reducing the negative forces on profitability that you might identify using Porter’s.

* How does the Diamond-E connect to Porter’s Five Forces? Provide an example of how you would apply Diamond-E to identify strategies for dealing with challenges using Porter’s Five Forces.

* How can changes in PEST impact each of Porter’s Five Forces? Identity specific elements of PEST that might change and explain the connection to the Porter’s Force and the effect it will have.