Economics Exam 3 Review

5.0(1)

Card Sorting

1/56

Earn XP

Description and Tags

Study Guide

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

57 Terms

1

New cards

Interest Rate Effect

* Decline in price level means lower interest rates that can increase certain levels of spending

* As IR goes up, investments go down

* AD shifts left

* As IR goes up, investments go down

* AD shifts left

2

New cards

Real Balance Effect

* Price level falls, the purchasing power of existing financial balances rises

* As purchasing power goes up, AD will shift right

* As purchasing power goes up, AD will shift right

3

New cards

Foreign Purchase Effect

* Domestic prices go down, our good is cheaper compared to foreign goods

* As exports increase we will sell more to the world and AD will shift right

* As exports increase we will sell more to the world and AD will shift right

4

New cards

What way does the AD curve shift with expansionary (contractionary) Fiscal Policy?

* AD curve shifts to the right with expansionary fiscal policy

* AD curve shifts to the left with contractionary policy

* AD curve shifts to the left with contractionary policy

5

New cards

According to the foreign purchase effect, if price levels rise (lower) in the US relative to other countries what happens to NX?

It increases

6

New cards

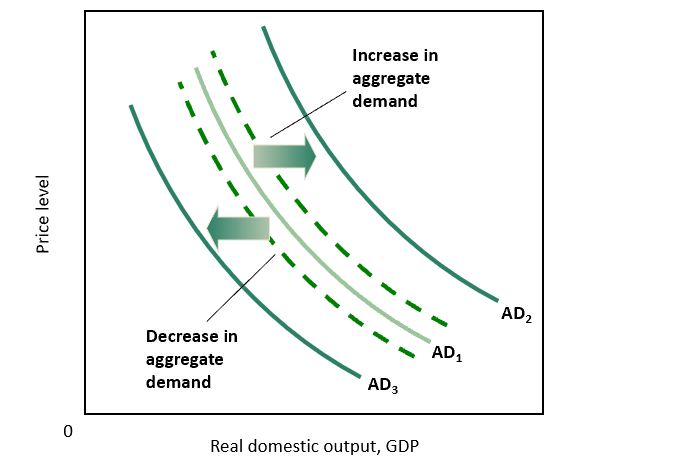

Know the determinants of Aggregate Demand and how if they change they would cause AD to shift

* Determinants: C, I, G, Xn

* Consumer spending, changes in interest rates or expected returns, gov spending, and changes in national income changes abroad

* Consumer spending, changes in interest rates or expected returns, gov spending, and changes in national income changes abroad

7

New cards

What is the money multiplier, how do you calculate it? If given numbers can you find the total amount of economic activity created given an injection of a certain amount.

\

Example - MPC = 0.75 and we inject 5 billion…AD would shift right by…

\

Example - MPC = 0.75 and we inject 5 billion…AD would shift right by…

* Definition: A change in spending changes real GDP more than the initial change in spending - when money is re-spent in the economy, how many times it is re-spent

* MM = 1/(1-MPC)

* Ex: = 4, so the MM would be 4. If 5 billion injected then GDP would go up to 20 billion

* MM = 1/(1-MPC)

* Ex: = 4, so the MM would be 4. If 5 billion injected then GDP would go up to 20 billion

8

New cards

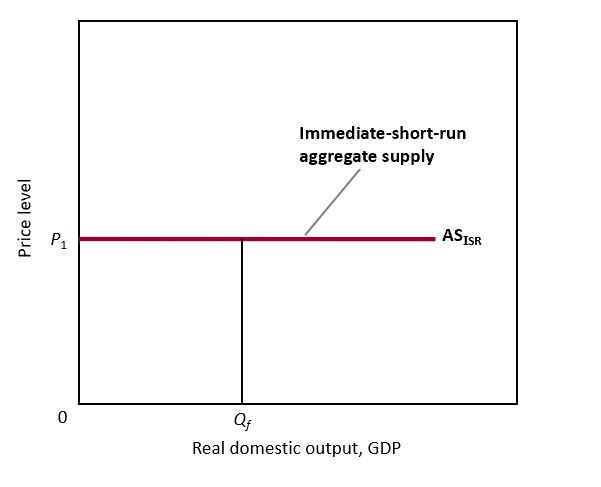

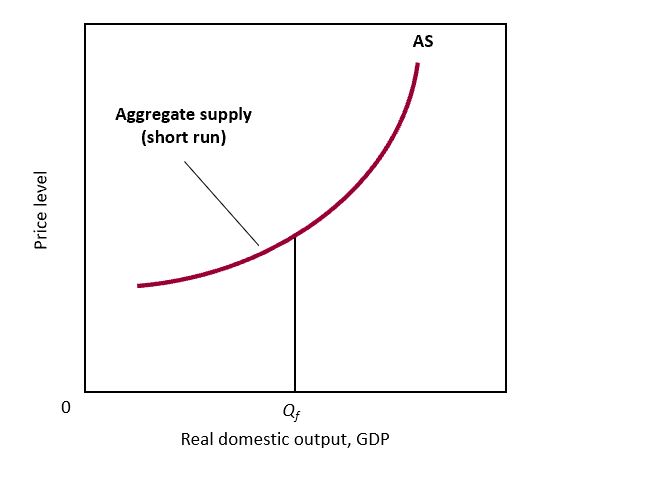

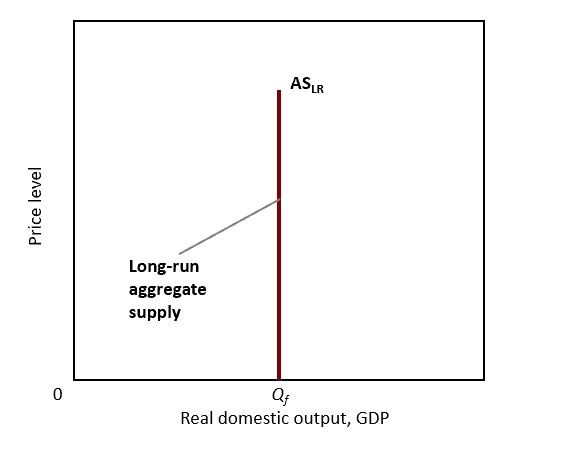

What are the 3 periods of time for Aggregate Supply and what is fixed or flexible in each one

* Immediate Short run - both input and output prices are fixed - straight horizontal line

* Short Run - input prices fixed, output flexible - bowing sloping supply, next 3-6 months

* Long Run - Both are flexible and can vary - straight up and down one, 1-3 years

* Short Run - input prices fixed, output flexible - bowing sloping supply, next 3-6 months

* Long Run - Both are flexible and can vary - straight up and down one, 1-3 years

9

New cards

What are some ways that AS in the short run will shift left or right?

* Anything that will cause firms to not have the ability to produce more or cause them to produce more.

* Taxes, input costs changing, wars, government regulations

* As input prices go up, supply less

* Input prices go down, so supply is more

* Increase corporation taxes - less money has for inputs so less outputs

* Taxes, input costs changing, wars, government regulations

* As input prices go up, supply less

* Input prices go down, so supply is more

* Increase corporation taxes - less money has for inputs so less outputs

10

New cards

What does productivity measure and how is it important to the AS curve?

* Productivity measures how much can you make, and how fast and how good = measures real output per unit of input

* Increases in productivity reduce costs and decreases in productivity increase costs therefore they are important to the AS curve

* Productivity affects supply

* Increases in productivity reduce costs and decreases in productivity increase costs therefore they are important to the AS curve

* Productivity affects supply

11

New cards

How do personal and business taxes effect AD and AS?

* Inversely, as taxes go up we spend less and firms have less cash flow to buy inputs

* Also works the other way around

* As corporations taxes go up, they have less money to use - businesses, buying less so producing less so AD would shift to the left

* Also works the other way around

* As corporations taxes go up, they have less money to use - businesses, buying less so producing less so AD would shift to the left

12

New cards

How is AD and AS possible effected with changes in the exchange rate (value of the dollar compared to other countries)

* As the dollar gets weaker, our goods are cheaper relative than before and we will export more and AD will shift to the right, AKA increase

* Dollar Depreciation -> AD increases

* Dollar Appreciation -> AD decreases

* Dollar Depreciation -> AD increases

* Dollar Appreciation -> AD decreases

13

New cards

Graphically how do we show demand-pull inflation or cost-push inflation?

o Demand-Pull- A shift in the AD graph to the right

o Cost-Push- A shift in AS to the left

14

New cards

Graphically how do we know/show a recession?

* When you are to the LEFT of your long run aggregate supply and long run output

* A leftward shift in Aggregate Supply when the price level is downwardly inflexible

* A leftward shift in Aggregate Supply when the price level is downwardly inflexible

15

New cards

Can you graphically give a situation to show how the AS/AD model would adjust?

\

i.e. graphically how would the graph change if the government issued everyone over the age of 18 a $1,400 stimulus check

\

i.e. graphically how would the graph change if the government issued everyone over the age of 18 a $1,400 stimulus check

Shift demand to the right, so this increases consumption, and causing the GDP to go up, causing AD to go right.

16

New cards

Discretionary fiscal policy vs. Nondiscretionary fiscal policy

* Discretionary - Sledgehammer, when Congress has to vote on changes in taxation or changes in government spending (ex. stimulus package/check or tax cuts)

* Nondiscretionary - Laws already in place that nudge GDP get back to long run output (ex. unemployment insurance, SNAP, WIC)

* Nondiscretionary - Laws already in place that nudge GDP get back to long run output (ex. unemployment insurance, SNAP, WIC)

17

New cards

Why are prices downward inflexible?

* Menu Costs - costs to reprint the menus (not going to lower or raise the prices because of recession)

* Wage Contract - Norwood is on contract with OU, so even if something happens with the economy, the wage he gets is constant

* Consumer Behavior - We freak out or we buy a lot depending on what is happening with the economy (If prices are low we will buy more)

* Wage Contract - Norwood is on contract with OU, so even if something happens with the economy, the wage he gets is constant

* Consumer Behavior - We freak out or we buy a lot depending on what is happening with the economy (If prices are low we will buy more)

18

New cards

What are some automatic stabilizers? What do they do?

* Taxes, Welfare, Unemployment insurance…

* Taxes very directly with GDP and transfers vary inversely with GDP

* There are laws that are already in place to help nudge the economy back to long run output.

* Taxes very directly with GDP and transfers vary inversely with GDP

* There are laws that are already in place to help nudge the economy back to long run output.

19

New cards

What business cycle phases go with each fiscal policy?

o During an expansion business cycle there should be contraction fiscal policy

o During a recessionary business cycle there should be a expansionary fiscal policy.

20

New cards

What is one major drawback with fiscal policy?

It is run by people that need to get elected to keep their jobs

21

New cards

What are the main tools of fiscal policy?

* Taxes

* Government Spending

* Government Spending

22

New cards

What is a budget deficit, how does it happen, and how is it different than the national debt?

* Budget Deficit: the year to year debt that the US government incurs

* Budget Deficit is caused by more Expansionary Fiscal Policy NOT being offset by Contractionary Fiscal Policy

* National Debt: Summation of all the yearly debts that we have incurred

* Budget Deficit is caused by more Expansionary Fiscal Policy NOT being offset by Contractionary Fiscal Policy

* National Debt: Summation of all the yearly debts that we have incurred

23

New cards

What is the crowding effect?

It is when Expansionary Fiscal Policy is used and it raises interest rates that then crowds out private investments from happening

24

New cards

What is the biggest variable that affects your personal spending?

income/disposable income

25

New cards

Holding all else equal when income goes up what happens to savings and consumption?

They also go up

26

New cards

When you save money you give up _______ money. In regards to the consumption schedule and saving schedule if you start to spend more how does your saving schedule shift? (remember it works vis versa)

* Spending

* Takes longer to save for later

* Takes longer to save for later

27

New cards

If personal taxes increase (decrease) what happens to your level of consumption and savings?

It goes down if there’s an increase because you lose more of you income to taxes.. so less to spend and less to save

28

New cards

How is the marginal propensity to consume calculated?

* MPC = It is the Change in Consumption divided by the Change in Income

* MPS = Change in Savings divided by the Change in Income

* Income 200, Consumption 220

* New Income 220 and Consumption is 230

* MPC = (230-220)/(200-220) = 10/20 = .5 = MPC

* MPS = Change in Savings divided by the Change in Income

* Income 200, Consumption 220

* New Income 220 and Consumption is 230

* MPC = (230-220)/(200-220) = 10/20 = .5 = MPC

29

New cards

What is dissavings?

* When you spend more than you make

* If you DI is $500 and consumption is $450 do you have Dissavings?

* No you do not

* If you DI is $500 and consumption is $550 do you have dissavings?

* Yes you do

* If you DI is $500 and consumption is $450 do you have Dissavings?

* No you do not

* If you DI is $500 and consumption is $550 do you have dissavings?

* Yes you do

30

New cards

What cause the investment demand curve to shift from the left or the right?

\

Hint changes in interest rates will NOT cause a shift but it will cause a slide along it.

\

Hint changes in interest rates will NOT cause a shift but it will cause a slide along it.

* Anything that will cause firms to not have the ability to produce more or cause them to produce more

* Taxes, input costs changing, wars, government regulations

* Taxes, input costs changing, wars, government regulations

31

New cards

What helped John Maynard Keynes come up with the aggregate expenditures model?

After the great depression he proposed this model

32

New cards

Referring to the Aggregate Expenditures Model as we added more parts of GDP to the model it would shift ____ or ____ depending on if the new component was positive or negative.

Left or right

33

New cards

What makes GDP goes up and down…

allows AD to shift right or left

34

New cards

Good Test Question: Marginal Propensity is 0.9%, inject 100, Multiplier is 10

1000 is the answer

35

New cards

What does MPC + MPS equal?

1

36

New cards

Government Spending increases, what happens?

* Aggregate Demand increases (as long as interest rates and tax rates do not change)

* More transportation projects

* More transportation projects

37

New cards

Government spending decreases, what happens?

* Aggregate Demand decreases

* Less military spending

* Less military spending

38

New cards

Input Prices

* Domestic Resource Prices

* Labor - increase or decrease in labor force

* Capital - machinery

* Land - the land you sit on or the strip mall

* Prices of imported resources:

* Imported oil - needed for almost all firms

* Exchange rates - input parts from overseas

* Labor - increase or decrease in labor force

* Capital - machinery

* Land - the land you sit on or the strip mall

* Prices of imported resources:

* Imported oil - needed for almost all firms

* Exchange rates - input parts from overseas

39

New cards

Productivity

* Real output per unit of input

* Increases in productivity reduce costs

* Decreases in productivity increase costs

* Productivity = total output/total inputs

* Per-unit production cost = total input cost/total output

* Increases in productivity reduce costs

* Decreases in productivity increase costs

* Productivity = total output/total inputs

* Per-unit production cost = total input cost/total output

40

New cards

Fiscal Policy is designed to:

* Achieve full-employment

* Control Inflation

* Encourage economic growth

* Control Inflation

* Encourage economic growth

41

New cards

Expansionary Fiscal Policy

* Use during a recession

* Increase gov spending

* Decrease taxes

* Combination of both

* Create a deficit

* Increase gov spending

* Decrease taxes

* Combination of both

* Create a deficit

42

New cards

Contractionary Fiscal Policy

* Use during demand-pull inflation

* Decrease government spending

* Increase taxes

* Combination of both

* Create a budget surplus

* Decrease government spending

* Increase taxes

* Combination of both

* Create a budget surplus

43

New cards

Tax Progressivity

* Progressive tax system

* Proportional tax system

* Regressive tax system

* Proportional tax system

* Regressive tax system

44

New cards

Problems of Timing - Fiscal Policy

* Recognition Lag - recognize when to react

* Administrative Lag - congress is voting and passing

* Operational Lag - we voted, stimulus check, go

* Administrative Lag - congress is voting and passing

* Operational Lag - we voted, stimulus check, go

45

New cards

Other problems with Fiscal Policy

* Political Considerations

* Future policy reversals

* Offsetting state and local finance

* Crowding-out effect

* Future policy reversals

* Offsetting state and local finance

* Crowding-out effect

46

New cards

What is owed to the holders of U.S. securities?

* Treasury Bills

* Treasury notes

* Treasury bonds

* U.S. Savings bonds

* Treasury notes

* Treasury bonds

* U.S. Savings bonds

47

New cards

What components are involved in Aggregate demand?

* Change in one of the determinants

* Multiplier

* Multiplier

48

New cards

Changes in Aggregate Demand

* Dashed lines - initial effect

* Solid lines - after the multiplier takes effect

* Solid lines - after the multiplier takes effect

49

New cards

Main driver of consumption

Disposable Income

50

New cards

Consumer Wealth

Difference between household assets (homes and stocks and bonds) and liabilities (loans and credit cards) - literally disposable income

51

New cards

Household borrowing

Borrow money now, spend now

52

New cards

Expected returns

The expected profit you will get from your investment

53

New cards

National Income Abroad

* Higher foreign income → AD increases

* Lower foreign income → AD decreases

* Lower foreign income → AD decreases

54

New cards

Aggregate Supply in the Immediate Short Run Graph

* Straight horizontal lone

* Flat, input is fixed, output is fixed

* Flat, input is fixed, output is fixed

55

New cards

**Aggregate Supply Curve Short Run Graph**

* Bowed a little

* Next 3-6 months of the production of goods and services in our economy

* Never leave out services

* Output is fixed

* Blip if something changed like if there is a shortage of wheat

* Next 3-6 months of the production of goods and services in our economy

* Never leave out services

* Output is fixed

* Blip if something changed like if there is a shortage of wheat

56

New cards

Aggregate Supply in the Long Run

* Straight vertical line

* For this to ever shift there has to be a permanent change to the economy like if we allowed more immigrants in, more workers mean more output, etc.

* For this to ever shift there has to be a permanent change to the economy like if we allowed more immigrants in, more workers mean more output, etc.

57

New cards

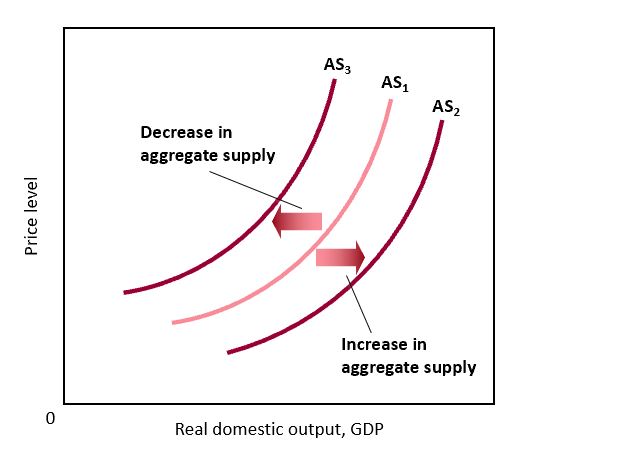

Changes in Aggregate Supply

* An increase is a shift to the right and a decrease is a shift to the left

* Pandemic - we saw a decrease

* One we marry agg supply and demand we can see all these changes

* Pandemic - we saw a decrease

* One we marry agg supply and demand we can see all these changes