Chapter 30 Money Growth and Inflation

1/85

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

86 Terms

What is the quantity theory of money? In terms of inflation

Prices rise when the government prints too much money

What is P?

P is the price of a basket of goods (in money)

It’s the price level, eg. CPI or GDP deflator

What is the value of money?

The value of money refers to the amount of goods and services that one unit of currency can buy?

What is the value of money formula?

Value of money = 1/P, (measured in goods)

ex: if the basket is 1 candy bar,

P = 2, the value of $1 is 1 / 2 candy bars

P = 3, the value of $1 is 1/3 candy bars

What is the relationship between inflation and value of money?

What happens when money drives up the price?

Inflation and the value of money have an inverse relationship

When inflation drives prices/price level up, the value of money goes down

D

What is the quantity theory of money? In terms of the philosopher

the quantity of money determines the value of money

Who determines the money supply?

The fed, banking system and consumers

What is the difference between price and price level?

price = the cost of a specific good or service

price level = the average of all prices of goods and services

What is money demand?

How much people want to hold wealth in money (liquid form), not stocks or bonds

What does money demand rely on?

P, price level

What happens when there’s an increase or a decrease in P, how does that affect the value of money? Talk about how that affects the formula too

money value = 1/P.

Case 1: Smaller P (Lower Price Level)

Suppose the price of an apple (P) is $1. Value of Money= 1/p = 1/1 = 1

With $1, you can buy a whole apple.

Higher value of money.

Case 2: Larger PPP (Higher Price Level)

Suppose the price of an apple (P) is $5. Value of Money = 1/p = 1/5 = 1/5th

With $1, you can only buy 1/5th of an apple.

Lower value of money.

increase P→ reduces the value of money

decrease P→ increases the money value

In terms of the denominator, why does an increase P→ reduces the value of money and a

decrease P→ increases the money value

since the formula is 1/P:

As P increases, the denominator becomes larger, and 1/P (value of money) becomes smaller.

As P decreases, the denominator becomes smaller, and 1/P (value of money) becomes larger.

What happens to the demand when price increases?

When price increases, the value of money decreases, making the demand for more money higher.

There’s a demand for more money because people need more money to carry out the same level of transactions, as goods and services have become more expensive due to higher prices.

How is quantity of money demanded related to 1. value of money 2. related to P (price level)

Quantity of demand is…

negative related to the value of money, is that the value of money is high, you can buy a lot with 1 dollar, not much is demanded, and vice versa

positively related to the price level, the price is high, more money is wanted

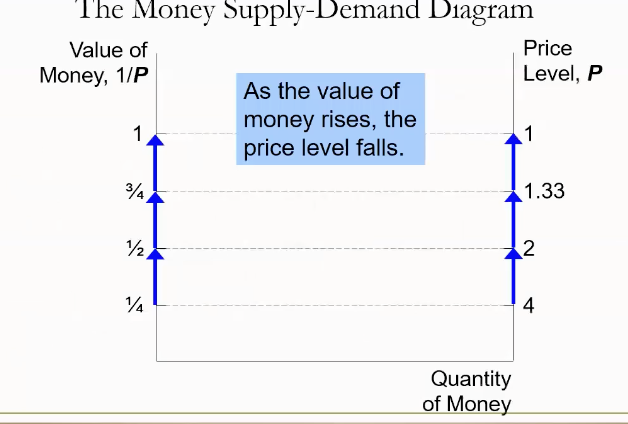

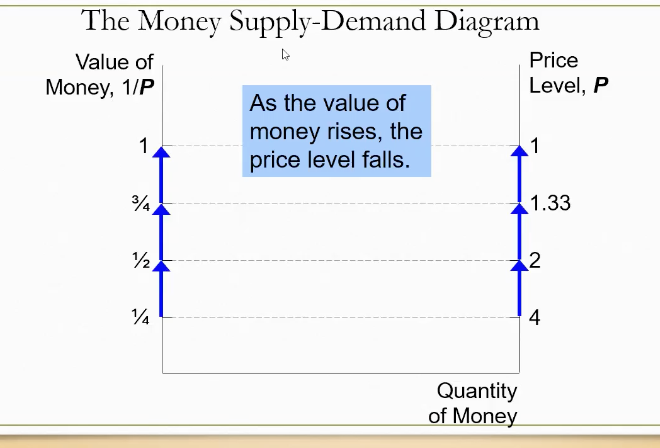

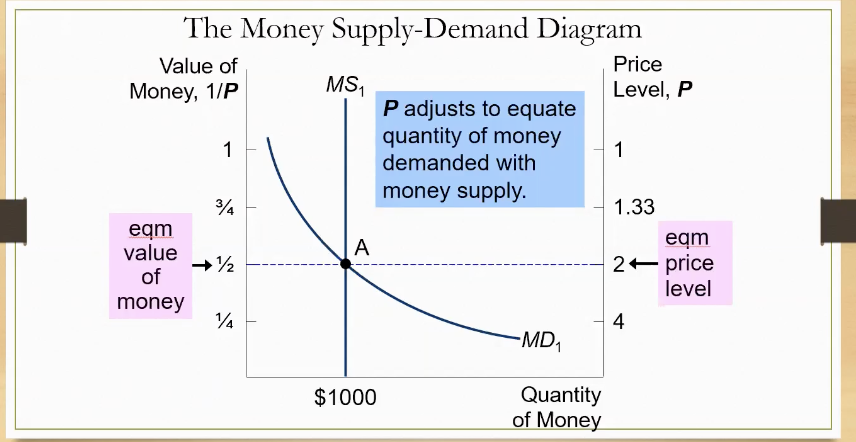

What does the money supply-demand diagram’s X value, and Y values

X value = quantity of money

Y value = Price level (P) & Value of Money (1/P)

What relationship does the money supply-demand diagram show between P and Value of money?

as the price increases, the value of money decreases & vice versa

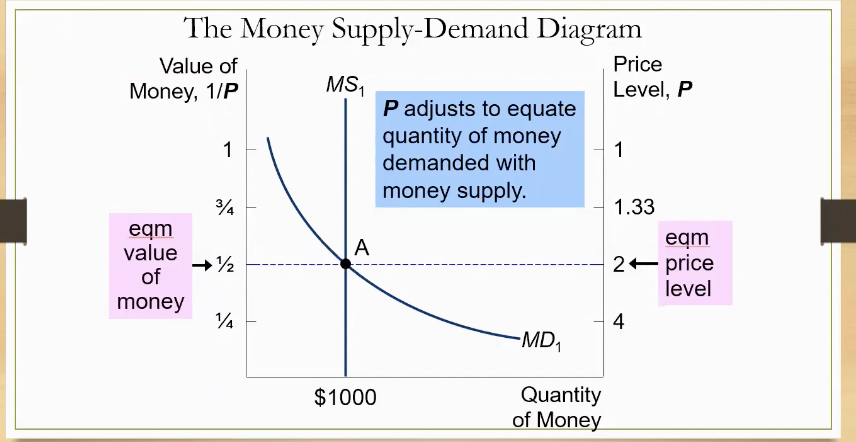

Why is the money supply (MS1) curve fixed? What shape is it?

Because it is constant, it’s what the Fed sets regardless of P. Making the shape vertical

Why is the Money Demand (MD1) curve negative and downward sloping?

As the value of money decreases, the quantity of money increases. They are inversely related

Where is the equilibrium on the money supply demand diagram?

Equilibrium is at the intersection between money demanded and money supplied curve.

It shows that people demand just as much as the fed is supplying

What does the equilibrium of the money supply demand diagram show you?

It shows the…

equilibrium value of money

equilibrium price level

equilibrium quantity supplied

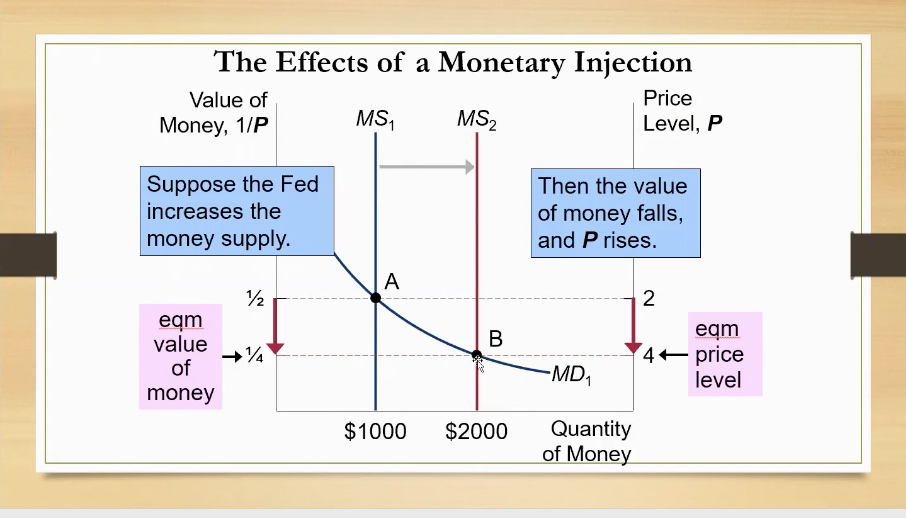

What happens if the fed increases the money supply to 2000?

As MS increases, it slides down the MD curve, resulting in a higher eqm price level (4) and lower eqm value of money (1/4)

Why does an increase in MS lead to a rise in P?

When MS increases to 2000, at the price level of 2 there is an excess supply of money.

People have more money, MS > MD

The economy’s output hasn’t changed, but there’s excess money → increase demand for goods and services pushes up the price → P increases → value of money falls → move down the money demand curve till you reach the new equilibrium. New equilibrium has a higher price and a lower value of money

What are nominal variables?

Nominal variables are measured in money/coins

eg. GDP, nominal interest rate, nominal wage ($ per hour)

What are Real Variables?

variables measured in physical units

eg. real GDP, real interest rate, real wage (measured in output)

B

Nominal prices of goods

normally measured w/ money

ex: 10/pizza or 15/cd

How do you find the price with real variables?

with relative prices

What’s relative prices?

Price of one good relative to another

How do you find the relative price of a CD?

15/ Cd 10/pizza

relative price of a CD = price of a cd/price of a pizza

15(cd)/10(pizza) = 1.5 pizza/cd

What is nominal wage (W)?

price of labor eg. 15/hour

How do you figure out the real wage?

Real wage = W (nominal wage) / P (price level)

What’s the real wage if nominal wage (w) = 15 and price level (p) = 5

Real wage = W (nominal wage) / P (price level)

Real Wage = (15/hour) / (5/unit of output) = (3 unit of output/hour)

What is the classical dichotomy?

theoretical separation between real economic variables (like output and employment) and nominal variables (like prices and wages)

changes in the money supply only affect nominal variables (like prices and wages)

without impacting real variables (such as output and employment)

So if I double the money supply, w/ classical dichotomy, will real n nominal variables be affected

just nominal, not real

What is Monetary nuetrality?

changes in the money supply do not affect real variables

With monetary neutrality, what happens when you double the money supply? Nominal and relative prices…

all nominal prices double

but relative prices remain unchanged

What’s the difference between classic dichotomy and neutrality of money?

"classical dichotomy" = theoretical separation between real economic variables (like output and employment) and nominal variables (like prices and wages)

"neutrality of money" = changes in the money supply only affect nominal variables, meaning money has no impact on real economic activity in the long run, essentially making it "neutral" in its effect on the real economy

neutrality of money being a direct consequence of the classical dichotomy.

If real wage (w/p) remains unchanged, what happens to quantity of labor supplied, demanded, and total employment of labor?

They all don’t change

What describes the economy in the long run?

classical dichotomy & neutrality of money

What affects the economy in the short run?

changes in money can have important short-run effects on real variables

What is the formula for nominal GDP?

Nominal GDP = P x Y = price level x Real GDP

What is velocity?

number of transactions dollar is being used?

What is the quantity equation?

M x V = P x Y

M = Money supply

V = Velocity

P = Price level

Y = Real GDP

When there’s a change in Money Supply, what gets affected?

V - no change, stable and constant

Y - change in money doesn’t affect GDP’s relative proportion. So, no change because Y, it is determined by tech & resources

P changes as much as M

GDP (P x Y) changes as much as M

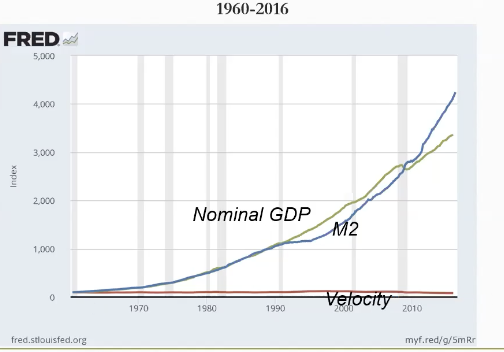

What’s the formula for velocity?

V = P x Y / M

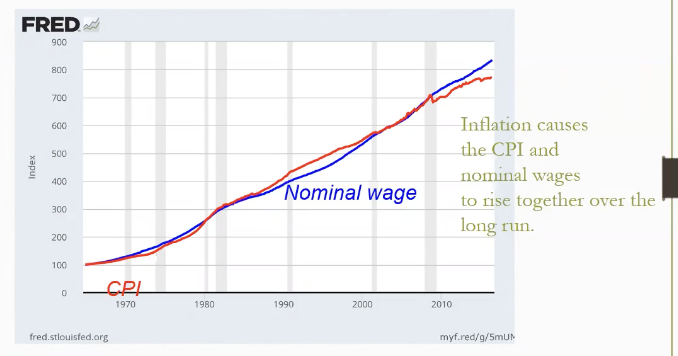

*image shows how constant velocity is

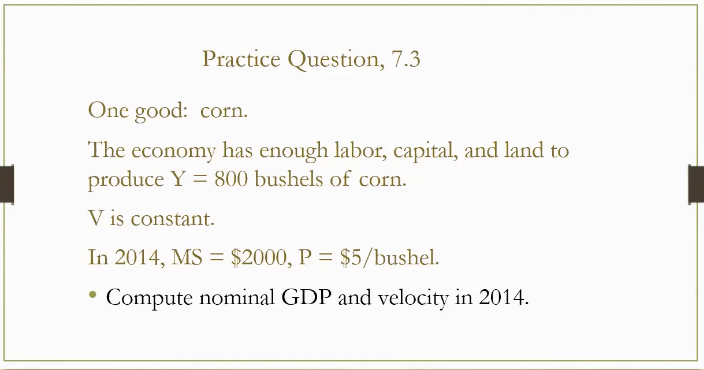

Y = 800, V = constant, MS = 2000, P = 5

nominal GDP = (P x Y) = 5 × 800 = 4000

Velocity = (P x Y) / M = 4000/2000 = 2 (the average dollar is used 2 times)

How do you calculate inflation rate?

new P - old P / old P x 100%

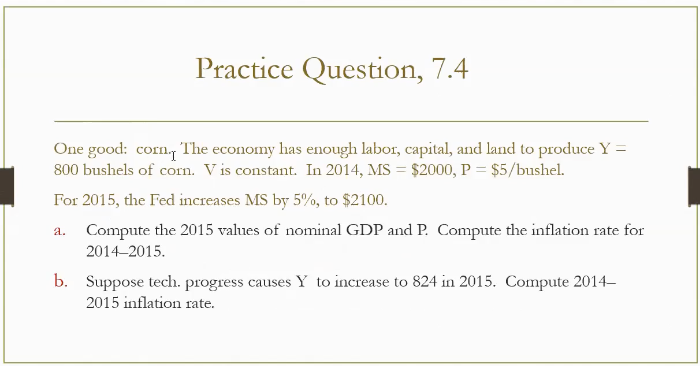

a.

2015 nominal GDP = ((Y x P) = (MS x V)), (MS x V) = 2100 × 2 = 4200

2015 P = P = (Y x P), P = (MS x V)/Y, P = 4200/800 = 5.25

2014-2015 Inflation Rate (5.25-5.00)/5.00 = 5%

b.

Solve for P = (M x V) / Y = (2100 × 2) / 824 = 5.10/unit of corn

Inflation = (5.10 - 5.00)/5.00 = 2%

If the Real GDP is constant, what happens to inflation rate and the money growth ratethe

If the Real GDP is constant, the inflation rate = the money growth rate

If the Real GDP is growing (maybe because of technological costs), what happens to the inflation rate and the money growth rate? And why does that happen?

If the Real GDP is growing, the inflation rate < the money growth rate.

Why does scenario 2 have a lower inflation rate than scenario 1?

Economic growth leads to an increased number of transactions. Some money is needed for these extra transactions. Some of the inflation is absorbed (that’s why scenario 2 has 2% inflation, scenario 1 has 5% inflation) and the excess money growth causes inflation

(M x V) = (Y x P)

If V is constant, and M increases, and Y has not changed, then whats the relationship between M and P?

An increase in M would also have an increase in P

(M x V) = (Y x P)

If V is constant, and M increases, and Y is increasing due to the real factors, then what’s the relationship between M and P?

An increase in M would be more than the increase in P

What’s hyperinflation?

Inflation exceeding 50% per month,

What causes hyperinflation?

governments generally have high spending but low tax revenues and limited ability to borrow

the government uses money creation as a way to pay for it

B

What is the inflation tax?

When the government raises revenue by printing more money. It taxes everyone

What happens when the government raises revenue by printing more money?

it causes inflation → the price level rises → the dollar becomes less valuable

Reminder, how do you calculate real interest rate?

Real interest rate = Nominal Interest rate - Inflation Rate

How do you calculate Nominal Interest Rate?

Nominal Interest Rate = Inflation Rate + Real Interest Rate

What is the real interest rate determined by?

Demand and supply by loanable funds

How does the growth in money supply affect the inflation rate and the real interest rate, in the long run?

Money is neutral, change money growth rate affects inflation rate, but not real interest rate

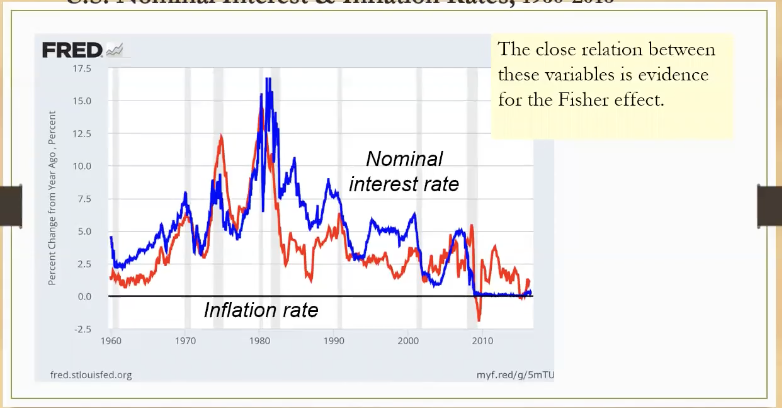

What is the fishers affect?

The nominal rate adjusts one for one with changes in the inflation rate

What happens when the feds increase the rate of money growth in the long run?

It results in both a higher inflation and a higher nominal interest rate

Why are the nominal interest rate and and inflation rate sometimes not aligned

the real interest rate is changing, this could occur if there were changes in the supply and demand for loanable funds

What’s the inflation fallacy?

most ppl think inflation erodes real income

How does inflation affect income?

wages/incomes are rising at a similar rate to the increase in the prices of goods and services.

What is real incomes determined by?

Real variables (K, H, N, and A) not inflation rate

What are the costs of inflation?

shoe leather cost

menu cost

misallocation of resources from relative-price variability

confusion and inconvenience

tax distortion

What is the Shoe Leather Cost?

when inflation is high, ppl hold less money in their wallets, and more in interest-bearing savings account.

Reasources are wasted when inflation encourages ppl to reduce their money holding

What is menu cost?

With high inflations, firms have to change the prices more frequently, print new menus, main new advertisements

misallocation of resources from relative-price variability

firms don’t raise all prices at the same time, so relative prices vary, allocations aren’t good for scarce reasources

Confusion and inconvience

inflation changes how we measure transactions

hard for long-range planning

Tax distortions

some taxes aren’t adjusted for inflation, causing ppl to pay more even if income doesn’t increase

Real interest rate formula

nominal interest rate - inflation rate

total tax amount, when placed on nominal interest income formula

Tax rate x nominal interest rate x deposit

After-tax nominal interest rate formula

Nominal Interest Rate×(1−Tax Rate) x 100

After-tax real interest rate

After-tax interest rate - inflation rate

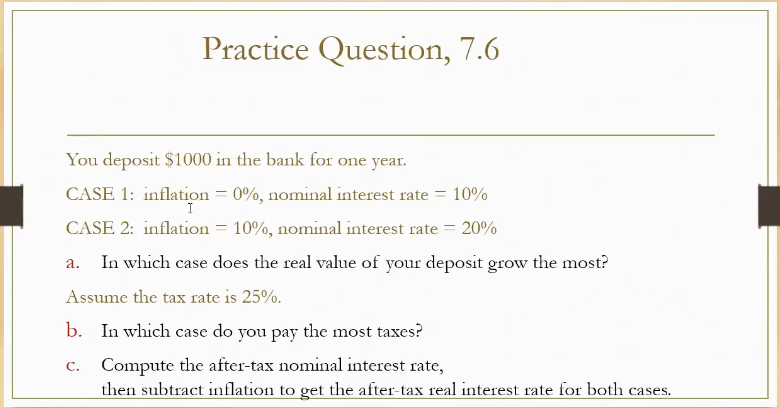

Real interest rate = nominal interest rate - inflation rate

Case 1: 10 - 0 = 10%

Case 2: 20 - 10 = 10%

Answer: both r equal

Tax Rate 25% on Nominal Interest Income (not real interest income bc tax doesn’t effect it), $1000 deposit

Tax rate x nominal interest rate x deposit

Case 1: .25 tax rate x (.10 nominal interest rate x $1000 deposit)) = 25

Case 2: .25 x (.20 nominal interest rate x $1000 deposit) = 50

Answer: case 2

After-tax nominal interest rate = Nominal Interest Rate×(1−Tax Rate) x 100

After-tax real interest rate = After-tax interest rate - inflation rate

Case 1:

After-tax nominal interest rate = .1 x (1-.25) x 100 = 7.5%

After-tax real interest rate = 7.5% - 0% = 7.5%

Case 2:

After-tax nominal interest rate = 20% x (1-.25) x 100 = 15%

After-tax real interest rate = 15% - 10% = 5%

What’s the relationship between inflation and after-tax real interest rate? What does it result in customer behavior?

inflation lowers after-tax real interest rate, discourages people from saving

What is Arbitrary redistribution of wealth?

higher than expected inflation transfers purchasing power from creditors to debtors, debtors repay money that isn’t worth as much

Does Tax or inflation rate affect real interest rates?

Inflation, yes bc Real Interest Rate = Nominal - inflation

Tax, yes, affects nominal which affects real

How do you achieve zero inflation?

the money growth rate must equal the growth rate of real output.

How does an increase in nominal wage affect the real wage?

only if prices remain unchanged or change at a slower rate than the nominal wage increase. If prices rise at the same rate as the nominal wage, the real value of the wage remains unaffected.