AS-AD Model

1/18

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

19 Terms

What are some assumptions about GDP and price level in the short run?

Prices are flexible or “sticky”

Output may be constrained by capacity

Some factor prices are fixed

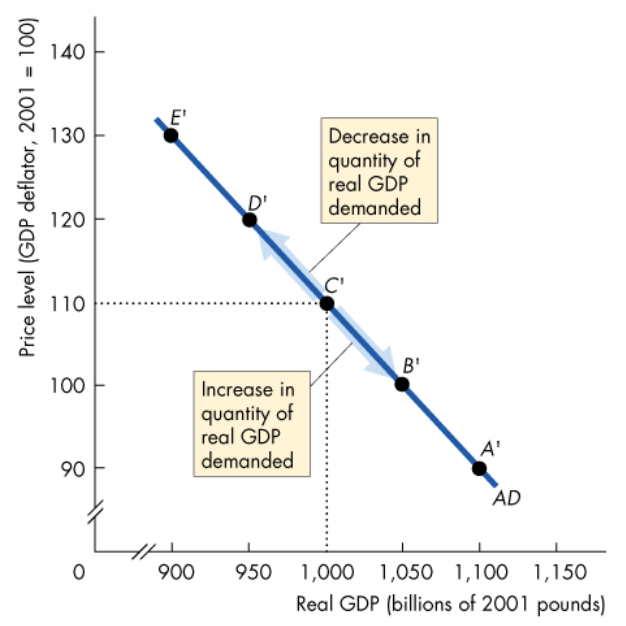

What is aggregate demand (AD), and how is it plotted?

Relationship between the quantity of real GDP demanded, and the price level

Plotted with price level (P) on the y-axis against real GDP (Y) on the x-axis

Price level calculated by doing Nominal GDP/Real GDP

How does the wealth effect cause a higher price level to reduce AE?

An increase in the price level (P) reduces real GDP (Y), as people save more and spend less to restore their wealth

A decrease in P increases Y, people spend more and save less, as people have more wealth.

What is the intertemporal substitution effect, and how does it affect AE?

It’s the substitution across time due to changes in the cost of borrowing

An increase in P decreases Y,

An increase in P decreases the real value of money, pushing up interest rates. This means people borrow less and spend less, decreasing Y.

A decrease in Y increases P,

A decrease in P increases the real value of money, decreasing interest rates. This means that people borrow more and spend more, increasing Y.

What is the international substitution effect, and how does it affect AE?

It’s the substitution across goods made in different countries, due to the changes in the relative price

An increase in P decreases Y

An increase in the UK price level increases the price of UK goods relative to foreign goods, meaning UK imports (M) increase and UK exports (X) decrease, leading to decreased Y

A decrease in P increases Y

A decrease in the UK price level decreases the price of UK goods relative to foreign goods, meaning UK X increase and UK M decrease, leading to increased Y

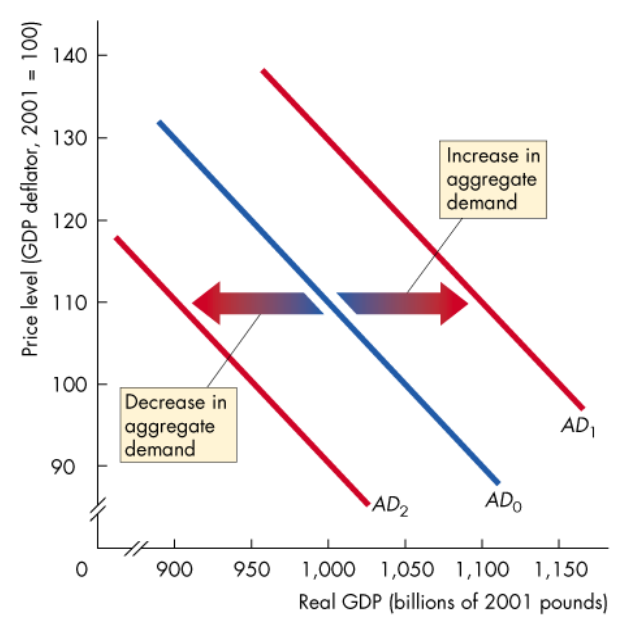

What causes a shift in the Aggregate Demand (AD) curve?

A change in any influence on expenditure plans other than the price level

Main influences include:

Fiscal Policy

Monetary Policy

The World Economy

Expectations

What is fiscal policy, and how does it influence expenditure plans?

Fiscal policy is a shift in the govt expenditure

Tax cuts or increased transfer payments increases households’ disposable income, which leads to increased consumption which increases Y

Lower taxes also mean a higher expenditure multiplier

Increasing G known as an expansionary FP

Decreasing G known as a contractionary FP

What is monetary policy, and how does it influence expenditure plans?

MP consists of changes in the interest rate and the quantity of money in the economy

An increased quantity of money increases buying power, increasing AD.

A cut in interest rates increases expenditure, increasing AD, shifting AD curve rightwards.

How does the World Economy influence expenditure plans?

A fall in foreign exchange rates lowers the price of UK goods relative to foreign goods, increasing UK exports, decreasing UK imports, whilst increasing UK AD.

An increase in foreign income increases the demand for UK exports, increasing UK AD.

How do expectations influence expenditure plans?

Increases in expected future incomes increases people’s C today, increasing AD

An increase in the expected inflation rate makes buying goods cheaper today than in the future, increasing AD today

Increases in expected future profits boosts firms’ investment, increasing AD today

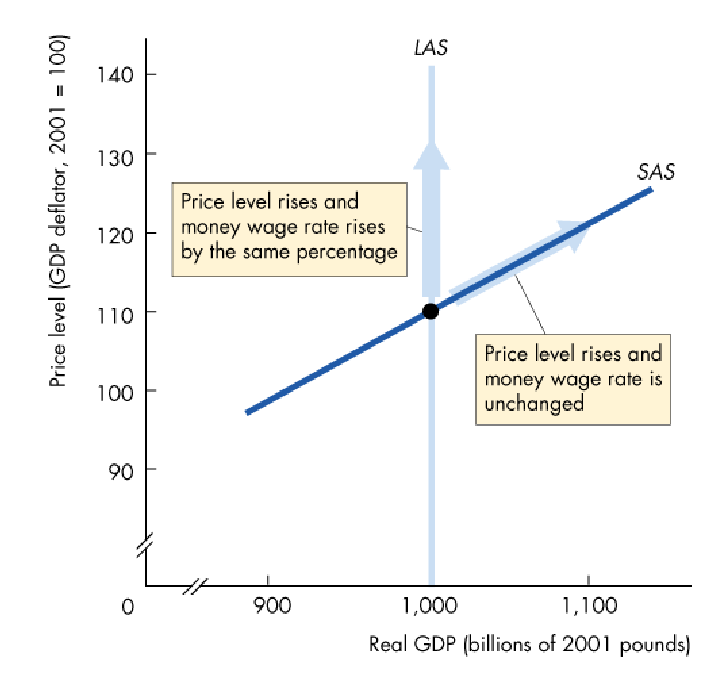

What is the Aggregate Supply (AS) schedule?

It’s the total amount of G+S that firms supply at any given price level

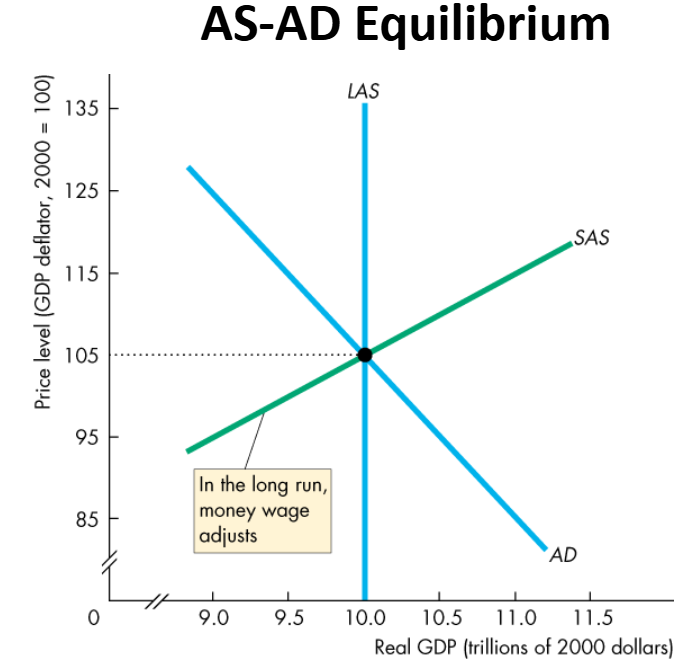

How is AS different between the short run and the long run?

In the long run, all markets have fully adjusted, meaning all prices and wage rates vary by the same %, so the relative prices and real wage rate remain constant

LRAS curve is a vertical line at potential GDP

In the short run, there’s an incomplete market adjustment, as some prices of factors of production are fixed

SRAS curve is upward sloping as wages in the short run are sticky, and are sort of fixed in the short run. Also caused due to misperceptions.

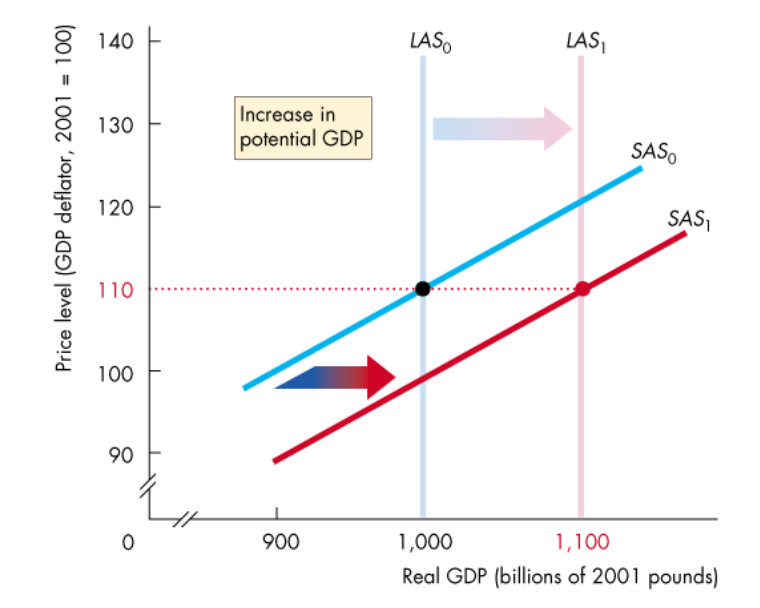

What causes the LRAS curve to shift?

Changes in the potential GDP due to shifts in:

Labour

Capital

Natural Resources

Technological Knowledge

What are some conditions for the SRAS curve to be upward sloping?

Upward sloping due to sticky wages, sticky prices and misperceptions.

Will be upward sloping if the Money wage rate, the prices of other factors of production, and potential GDP are constant.

What causes a shift in SRAS curve?

SRAS curve shifts if any influence on production plans, other than the price level, change.

It shifts when:

Resource prices (e.g. money wage) changes

Increase in resource prices decreases SRAS and vice versa

An increase in the money wage increases the costs of production, which reduces the amount firms can supply at each price level, shifting SRAS curve left

Potential GDP changes

Increase in potential GDP increases SRAS and vice versa

What does the AS-AD model allow us to understand?

4 features of macroeconomic performance:

Unemployment

Inflation

Business Cycles (Expansions and recessions)

Macroeconomic Policy

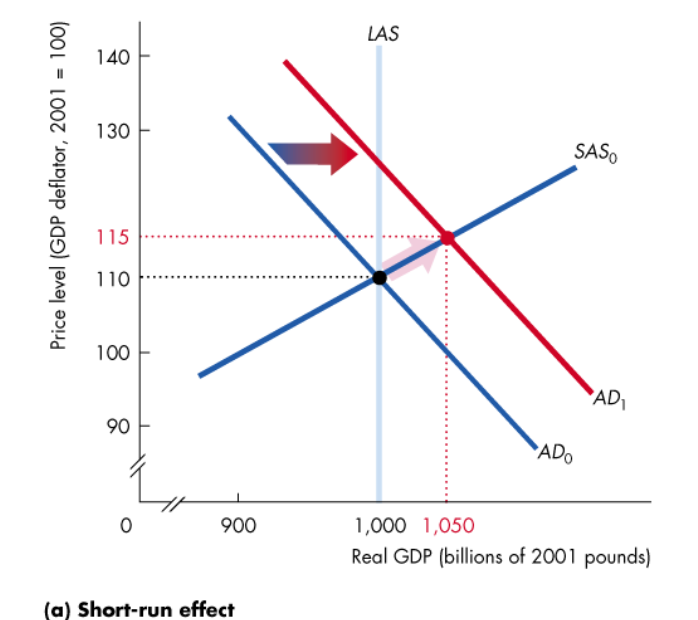

What happens in the short run when there’s a sudden AD shock (e.g. an increase in G)?

An increase in G increases AD, shifting AD curve right

Real GDP now less than SR equilibrium GDP so firms increase production and increase prices

Produces a movement up SRAS curve to new equilibrium

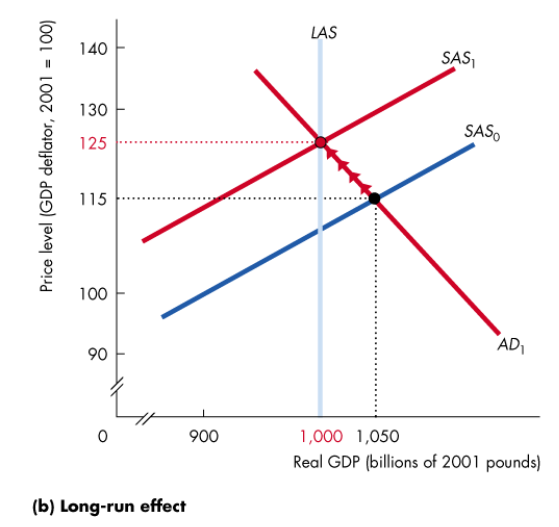

What happens in the long run when there’s a sudden AD shock?

Real GDP is greater than potential GDP

Wage rate begins to rise as employment is above full employment level, shifting SRAS curve left

Price level rises, and GDP returns to potential GDP level

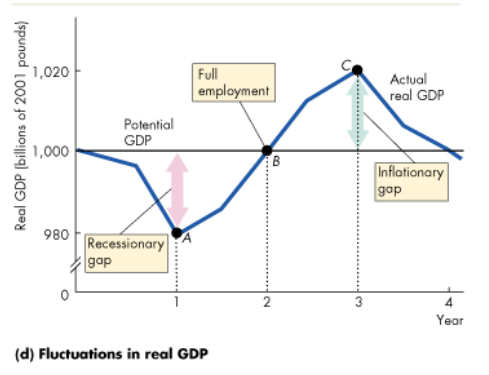

Why do business cycles occur?

Due to AD and SRAS fluctuating. Due to a fixed or sticky money wage rate, short run equ. can be above, below or at potential GDP

Below full employment is when real GDP < potential GDP, creating a recessionary gap

Above full employment is when real GDP > potential GDP, creating an inflationary gap