4. Equity Valuation, Payout Policy, Multiples, Real Options

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

Constant growth dividend discount model idea

• A mature dividend paying stock can be valued as the PV of an infinite stream of dividends that grow at a constant rate

• Used for stable firms with predictable growth

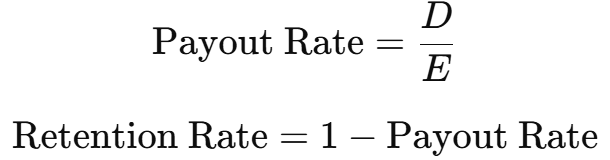

Dividend payout rate definition

• Payout rate is dividends divided by earnings for the period

• Retention rate is one minus the payout rate

Link between payout, ROE and earnings growth in simple model

• Higher retention combined with high return on new investment leads to higher earnings growth

• If new projects earn only the equity cost of capital growth does not create extra value

When a higher payout can reduce stock value in this framework

• If the firm has positive NPV reinvestment opportunities then increasing payout cuts valuable reinvestment

• Lower reinvestment reduces growth and lowers share value

When payout policy is irrelevant in this framework

• If new projects earn exactly the equity cost of capital or there are no good projects

=> Shifting between payout and reinvestment does not change firm value

Valuing a stock with finite high growth then stable growth

• Forecast dividends explicitly during the high growth phase and discount them

• Add a terminal value based on long run stable growth from the first stable year

Effect of share repurchases on earnings and dividends per share

• Repurchases reduce shares outstanding

• For given total earnings and dividends this increases earnings per share and dividend per share even if total cash paid out is unchanged

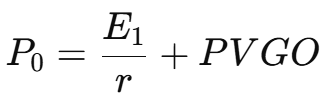

Present Value of Growth Opportunities concept

• PVGO is the part of the share price that comes from future growth projects rather than current assets

• High PVGO indicates value is driven by expected new investments

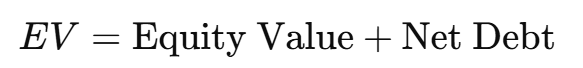

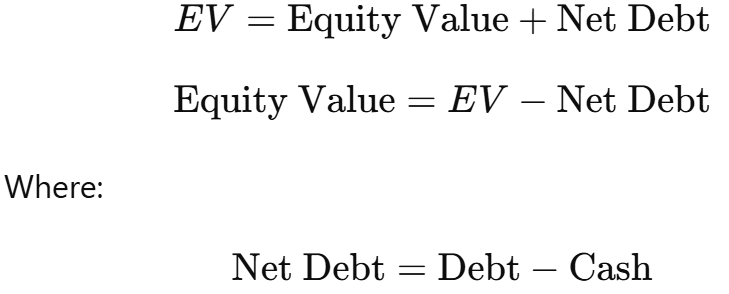

Enterprise value definition

• EV is total value of the operating business

• Equal to equity value plus net debt where net debt is interest bearing debt minus excess cash

Difference between firm value and equity value

• Firm or enterprise value reflects value of operations for all investors

• Equity value is what remains for shareholders after subtracting net debt and adding non operating assets

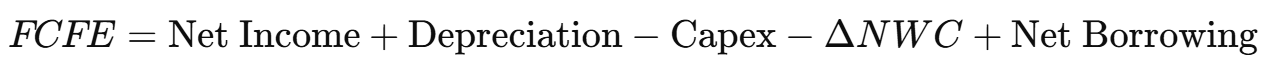

Free Cash Flow to Equity

• FCFE is cash remaining after operating costs taxes interest and necessary reinvestment plus net new borrowing

• It is the cash that can be paid out to shareholders

Purpose of using trading multiples (CCA)

• CCA uses valuation ratios from traded comparable firms to infer a value for the target

• They translate a financial metric like EBITDA into an implied EV or EqV

When trading multiples are most reliable

• When comparable firms have similar business model growth profitability and risk

• When accounting is comparable and capital structure differences are handled with EV based multiples

Why EV to EBITDA is often preferred to P/E for project value

• EV/EBITDA uses an operating cash flow proxy before interest and taxes

• It is less distorted by leverage or differences in interest expense than price to earnings

Real option

• A real option is the right but not the obligation to take a business decision such as invest, expand, shut down, or delay in response to new information

• Example right to open more stores after a pilot store succeeds

Option to delay investment intuition

• Waiting to invest can be valuable when uncertainty is high

• You give up immediate cash flows but gain information that helps avoid bad projects

Option to expand

• Successful early performance can trigger additional investment that was not mandatory

• This upside optionality makes the initial project more attractive than a static NPV suggests

Option to abandon

• Management can stop a loss making project and recover some value through sale or liquidation

• This limits downside risk and increases overall project value

Why simple DCF can undervalue projects with flexibility

• Standard DCF assumes a fixed plan and ignores future managerial choices

• Real options add value because managers can adapt decisions after uncertainty resolves

Basic steps in binomial valuation of a real option

• Build a tree of possible future values of the underlying project or asset

• Define option payoff at final nodes then work backward using replication or risk neutral probabilities and discounting at the risk free rate

Meaning of risk neutral probabilities in option valuation

• They are artificial probabilities adjusted so the expected return on the underlying equals the risk free rate

• They allow pricing by discounting expected future payoffs at the risk free rate