FHCE 3200 exam 1 Study Guide

0.0(0)

0.0(0)

Card Sorting

1/94

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

95 Terms

1

New cards

financial literacy

How well you can understand and use personal finance-related information

one of the most important predictors of

savings and investment success

and overall well-being.

one of the most important predictors of

savings and investment success

and overall well-being.

2

New cards

financial knowledge

the ability to understand personal finance information

3

New cards

financial risk tolerance

unwillingness to engage in financial endeavors that have uncertain outcomes.

4

New cards

key action steps to financial well-being

1. Keep good records

2. Spend less than you earn

3. Maintain appropriate insurance

4. Save money on a regular basis

2. Spend less than you earn

3. Maintain appropriate insurance

4. Save money on a regular basis

5

New cards

human capital

ability and willingness to work, learn, earn, and make wise decisions about how to save and invest money.

6

New cards

social capital

how well you are able to form connections with other people

7

New cards

Informal Social Capital

the interpersonal relationships you form with your family and close friends

8

New cards

Formal Social Capital

connect you with people in professional, recreational, leisure, and social communities

9

New cards

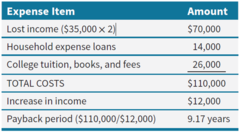

Calculate the Payback period

Total Costs/Increase in annual income

10

New cards

Risk

uncertainty associated with any physical, social, emotional, environmental, labor market, or financial activity

11

New cards

risk taking

doing something that involves the possibility of a gain or a loss

12

New cards

wealth creation and risk tolerance

In financial markets, the only way to accumulate a certain level of wealth is to take informed financial risks with your savings.

13

New cards

Identify the SMART goal process

Specific

Measurable

Attainable

Relevant

Timely

Measurable

Attainable

Relevant

Timely

14

New cards

Specific

Document the when, what, where, and how aspects of the goal

15

New cards

Measurable

Attach a quantifiable standard for achieving the goal

16

New cards

Attainable

Be realistic about whether you can achieve the goal

17

New cards

Relevant

Develop those financial goals that are crucial to improving your financial situation

18

New cards

Timely

Create a goal you can meet in a reasonable amount of time

19

New cards

Goal Time Horizons

time between creating a goal and achieving the goal

20

New cards

short-term time horizon

less than 1 year

21

New cards

long term time horizon

greater than 1 year

22

New cards

Past Oriented

based on memories, whether good or bad. Those who view past events negatively have the most trouble staying on their financial path

23

New cards

Present-Oriented

based on hedonistic perspective or fatalistic perspective

24

New cards

hedonistic perspective

doing things for pleasure, the experience, and excitement of the action

25

New cards

fatalistic perspective

unable to visualize a meaningful future

26

New cards

Future-Oriented

based on a calculation of the consequences of actions in terms of a future payoff

27

New cards

self-efficacy

how well you believe you can do something.

28

New cards

hyperbolic discounting

occurs when the value of future benefits is perceived to be lower than that of an alternative available right now.

29

New cards

Heuristics

•Based on past experiences

•Automatic and rarely used with forethought

•Can help you make quick decisions, however, they sometimes lead to problematic choices and outcomes

•Automatic and rarely used with forethought

•Can help you make quick decisions, however, they sometimes lead to problematic choices and outcomes

30

New cards

Status quo bias

the preference to keep things the way they are rather than change

31

New cards

loss-averse

characteristic of being very reluctant to do anything that might lead to loss

32

New cards

optimism bias

people believe that, compared with other people, they are more likely to experience positive events and less likely to experience negative events in the future

33

New cards

Confirmation bias

a tendency to search for information that supports our preconceptions and to ignore or distort contradictory evidence

34

New cards

interior finance

refers to your knowledge, attitudes, perceptions, and abilities

35

New cards

exterior finance

the observable actions you take with money and the associated outcomes such as

Loan payment amounts

saving rates

cash flow management

net worth

Loan payment amounts

saving rates

cash flow management

net worth

36

New cards

Interest

the price paid for the use of borrowed money

Borrowed money you pay back with interest (loan)

Lended money you generate interest (savings, loaning)

Borrowed money you pay back with interest (loan)

Lended money you generate interest (savings, loaning)

37

New cards

True/False:

It can take up to 99 years to receive your federally insured money from the Federal Deposit Insurance Corporation (FDIC).

It can take up to 99 years to receive your federally insured money from the Federal Deposit Insurance Corporation (FDIC).

False

38

New cards

BOTH Federal Deposit Insurance Corporation (FDIC) and National Credit Union Administration (NCUA) protect your deposit up to

$250,00

39

New cards

APR (Annual Percentage Rate)

annual sum of the periodic interest rates applied to the account, without considering the effect of compound growth.

40

New cards

APY (annual percentage yield)

The effective annual rate of return taking into account the effect of compounding interest.

41

New cards

APR Formula

periodic interest rate x number of periods in the year

42

New cards

APY Formula

[(1+Periodic Interest rate)^(number of periods in a year)]-1

43

New cards

Time Value of Money calculations

FV: Future Value

PV: Present value

N: # of periods

I/Y: Interest

PMT: a series of more than one payment or deposits

PV: Present value

N: # of periods

I/Y: Interest

PMT: a series of more than one payment or deposits

44

New cards

Time Vale of Money (TVM) formula

FV/(1+i)^N

45

New cards

future value of an annuity

the amount accumulated in the future when a series of payments is invested and accrues interest

46

New cards

Future value of an annuity formula

FVA=(PMT/i)[((1+i)^n)-1]

47

New cards

present value of an annuity

The amount at a present time that is equivalent to a series of payments and interest in the future.

48

New cards

Present Value of an Annuity formula

PVA=(PMT/i)(1-(1/[(1+i)^n]))

49

New cards

Amortized Payments

a payment of the same amount for a set number of months or years

50

New cards

Amortized Payments formula

Monthly Payment=PV((I × (1 + I)^N)/((1 + I)^N) - 1)

51

New cards

Future Value (FV)

how much current savings and investments will be worth at a certain date in the future

52

New cards

Present Value (PV)

Value today of a future amount

53

New cards

Annuity

a series of equal regular deposits

54

New cards

Rule of 72

The number of years it takes for a certain amount to double in value is equal to 72 divided by its annual rate of interest.

55

New cards

balance sheet

A financial statement that reports assets, liabilities, and owner's equity on a specific date.

56

New cards

Net Work formula

Assets-Liabilities=Owners equity (ALOE)

57

New cards

liquidity

How quickly and easily an asset can be converted into cash

58

New cards

fair market value

the price someone would realistically pay you to buy the asset

59

New cards

Appreciating Assets

assets that increase in value over time, for example, a house

60

New cards

depreciating assets

assets such as cars and computers, fall in value over time

61

New cards

short term liability

liability typically expected to be paid within one year or less

62

New cards

long-term liability

Liabilities with longer repayment schedule and would include student loans and money borrowed to purchase a house (i.e., a mortgage)

63

New cards

bad debt

borrow money to buy something that either goes down in value quickly or is consumed immediately.

64

New cards

good debt

The concept that sometimes it is worth taking on certain types of debt in order to generate income in the long run. Common examples include college education debt and real estate.

65

New cards

current ratio

current assets / current liabilities=1

66

New cards

debt ratio

total liabilities/total assets = 40%

67

New cards

savings ratio formula

total savings/total income=12% or higher

68

New cards

targeted saving rates based on age

69

New cards

Emergency Fund Ratio

cash and cash equivalents (Monetary Assets) / monthly non-discretionary cash flows(Necessary Expenses); benchmark = 3-6 months

70

New cards

consumer debt-to-income ratio

total consumer debt payments/total income = 15% or less

71

New cards

total debt to income ratio

Total debt payments/Total income=no more than 36% of income being used for debt payments

72

New cards

surplus

Income exceeds expenses

73

New cards

Sections of a budget

Income, Expenses, Surplus/Deficit (Profit/Loss)

74

New cards

deficit

Expenses exceeds income

75

New cards

Save More Tomorrow

Commit to putting half of every future raise towards your saving

76

New cards

Present Bias

A preference for choosing short term pleasures over long term investments

77

New cards

Income

broad term used to describe all sources of money obtained by individuals and households and can include:

•Allowances

•Public assistance

•Interest

•Dividends

•Social Security payments

•Allowances

•Public assistance

•Interest

•Dividends

•Social Security payments

78

New cards

Earnings

just one form of income:

•Compensation received for services performed for an employer

•Compensation received for services performed for an employer

79

New cards

Wage

•what an employer pays an employee to work

•usually based on an hourly rate

•usually based on an hourly rate

80

New cards

Salary

•payment for work for a set period of time

•usually an annual amount

•usually an annual amount

81

New cards

commission

•payment based on the sale of a product or service

82

New cards

Bonus

•an extra payment usually based on performance

83

New cards

Overtime

working more than 40 hours in one week. gets paid 1.5x regular wage

84

New cards

Six steps for creating a financial plan

1.Set a Financial Goal

2.Know Your Starting Point

3.Determine Your Financial Score

4.Determine Your Financial Capacity

5.Know Your Time Horizon

6.Formalize and Implement Your Financial Plan

2.Know Your Starting Point

3.Determine Your Financial Score

4.Determine Your Financial Capacity

5.Know Your Time Horizon

6.Formalize and Implement Your Financial Plan

85

New cards

Sole Proprietorship

unlimited liability, limited access to resources, easy start-up, sole receiver of profit

86

New cards

General Partnership

A partnership in which all owners share in operating the business and in assuming liability for the business's debts. unlimited liability

87

New cards

Limited Partnership

general partner manages the business and one or more limited partners invest money in the business

88

New cards

Limited liability partnership

•Partners are not liable for actions of other partners, but are liable for the general obligations of the business

89

New cards

Limited Liability Company (LLC)

A legal entity that is not taxable itself and distributes the profits to its owners, but shields personal assets from business debt like a corporation.

90

New cards

Corporation

A business owned by stockholders who share in its profits but are not personally responsible for its debts.

Very effective at limiting liability, but also expensive to form and maintain

Very effective at limiting liability, but also expensive to form and maintain

91

New cards

Earned Income

money from work primarily through the labor market.

•Salaries, wages, commissions, or bonuses

•Salaries, wages, commissions, or bonuses

92

New cards

Unearned Income

money from non-labor sources.

•Interest from savings accounts

•Dividends

•Capital gains

•Monetary gifts

•Government benefits

•Money received by inheritance

•Proceeds from savings bonds

•Interest from savings accounts

•Dividends

•Capital gains

•Monetary gifts

•Government benefits

•Money received by inheritance

•Proceeds from savings bonds

93

New cards

capital assets

almost everything you own or use for personal or investment purposes, according to the IRS

•Your home

•Your car

•Investments like stocks, bonds, and mutual funds

•Ownership interest in a small business you started

•Rental or other real estate you own

•Your home

•Your car

•Investments like stocks, bonds, and mutual funds

•Ownership interest in a small business you started

•Rental or other real estate you own

94

New cards

Calculate capital gain

Calculating steps:

Selling Price

- Basis (Purchase price)

- Selling costs

= Realized Capital Gain

Selling Price

- Basis (Purchase price)

- Selling costs

= Realized Capital Gain

95

New cards

Calculate capital loss

Original Price - Price Sold at