TERMS Unit 3: Finance and accounts Chapter 14: Intro to finance and sources of finance

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

start-up capital

capital needed by an entrepreneur to set up a business

working capital

the capital needed to pay for raw materials, day-to-day running costs and credit offered to customers. In accounting terms: working capital = current assets - current liabilities;

WC = CA - CL

management buy-out

the existing managers of a business purchase it from the owners to take full control

internal finance

raised from the business's own assets or from profits left in the business (ploughed-back or retained profit)

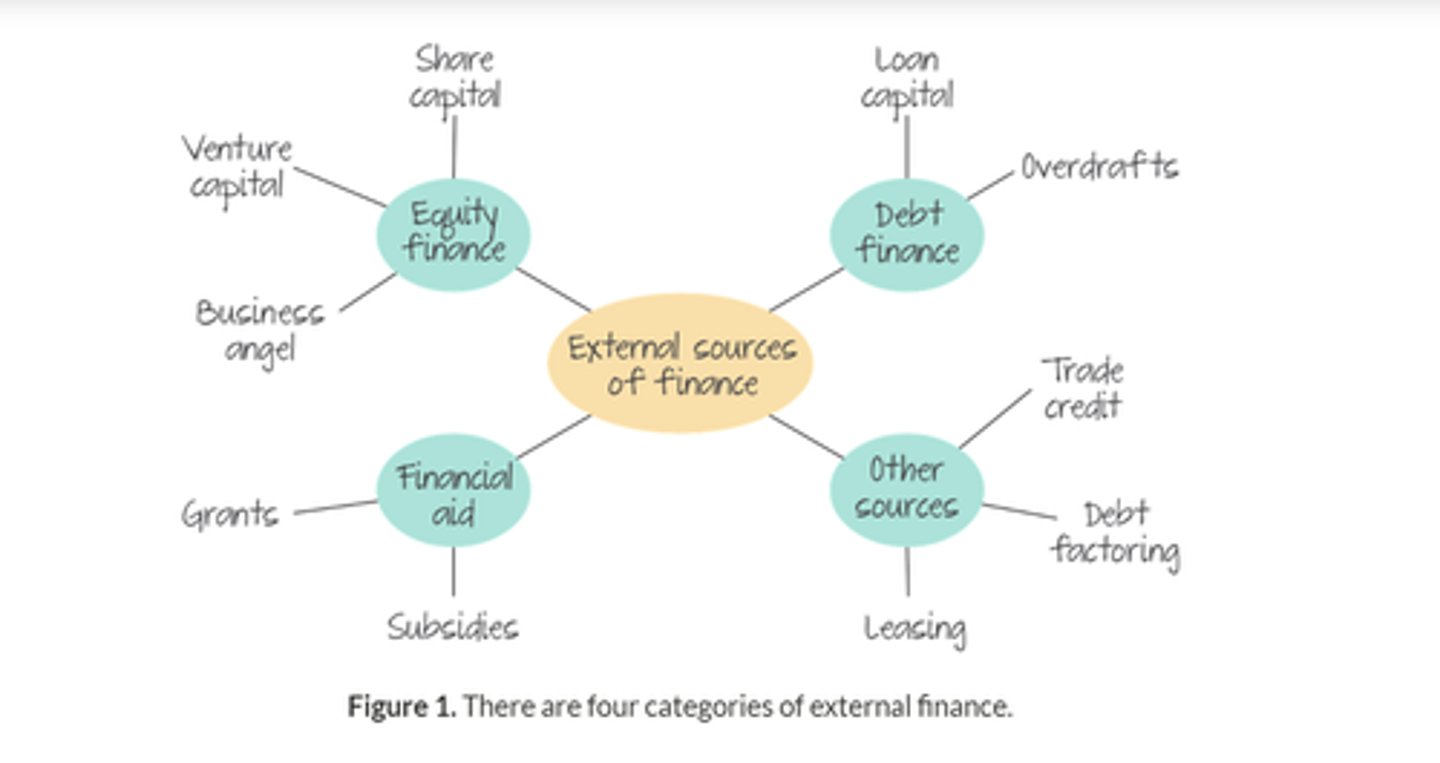

external finance

raised from sources outside the business

retained profit

the profit left after all deductions, including dividends, have been made; this is invested back into the company as a source of finance

liquidity

the ability of a firm to pay its short-term debts

overdraft

an arrangement with a bank that their customer can withdraw up to an agreed limit from their account as and when required; this is a form of borrowing

hire purchase

an asset is sold to a company which agrees to make fixed repayments over an agreed time period; the asset belong to the company once the final payment is made

leasing

obtaining the use of equipment or vehicles and paying a rental or leasing charges over a fixed period. This avoids the need for the business to raise long-term capital to buy the asset; ownership remains with the leasing company

equity finance

permanent finance raised by companies through the sale of shares

long-term loans

loans that do not have to be repaid for at least one year

debentures (or corporate bonds)

bonds issued by companies to raise debt finance, often with a fixed rate of interest

rights issued

existing shareholders are given the right to buy additional shares at a discounted price

business angel

an individual, usually with business experience, who directly invests part of their wealth in new and growing businesses

crowdfunding

the use of small sums of capital from a large number of individuals to finance a new business venture

microfinance

the provision of very small loans by specialist finance businesses, usually not traditional commercial banks