Economics section 3

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

Forms of money

Money - any commodity that can be used as a medium of exchange for the purchase of a good or service.

Bank deposits - money reserves placed in commercial bank accounts

Central Bank reserves - money held by the central bank and used by the commercial bank to make payments between themselves.

4 Functions of money

Medium exchange - way to conduct trade

Measure of value - measures the market value of different goods + services

Store of value - can be stored and used in the future

Standard of deferred payment - used as a standard for future payments of debt

6 characteristics of money

durable - fairly long lasting

acceptability - widely recognised and accepted as a medium of payment

divisibility - must be divisible

Uniformity - all forms of a particular banknote should look the same

Scarcity - money must be limited in its supply to hold its value

Portability - money must be conveniently portable

bartering

swapping items in exchange for other items

functions of the central bank

sole issuer of banknotes and coins

The governments bank - performs the same service for the government as a commercial bank to its customers

The bankers bank

The lender of last resort - all commercial banks are required to keep a percentage of their money at the central bank incase of a financial emergency.

central bank definition

monetary authority that oversees and manages an economies money supply and banking system

functions of a commercial bank

accepting deposits- from individuals, businesses, government

making advances - providing loans to their customers

credit creation - increase the money supply in an economy by making money available to borrowers

(Secondary-)

(collecting and clearing cheques on behalf of clients, offering additional financial services, providing safety deposits, providing money transfer facilities, offering credit card facillities)

Current vs Capital expenditure

current - money spent on goods and services that will be consumed within a year. food, clothing, entertainment

Capital - money spent on fixed assets that will last more than 12months. e.g car,computer

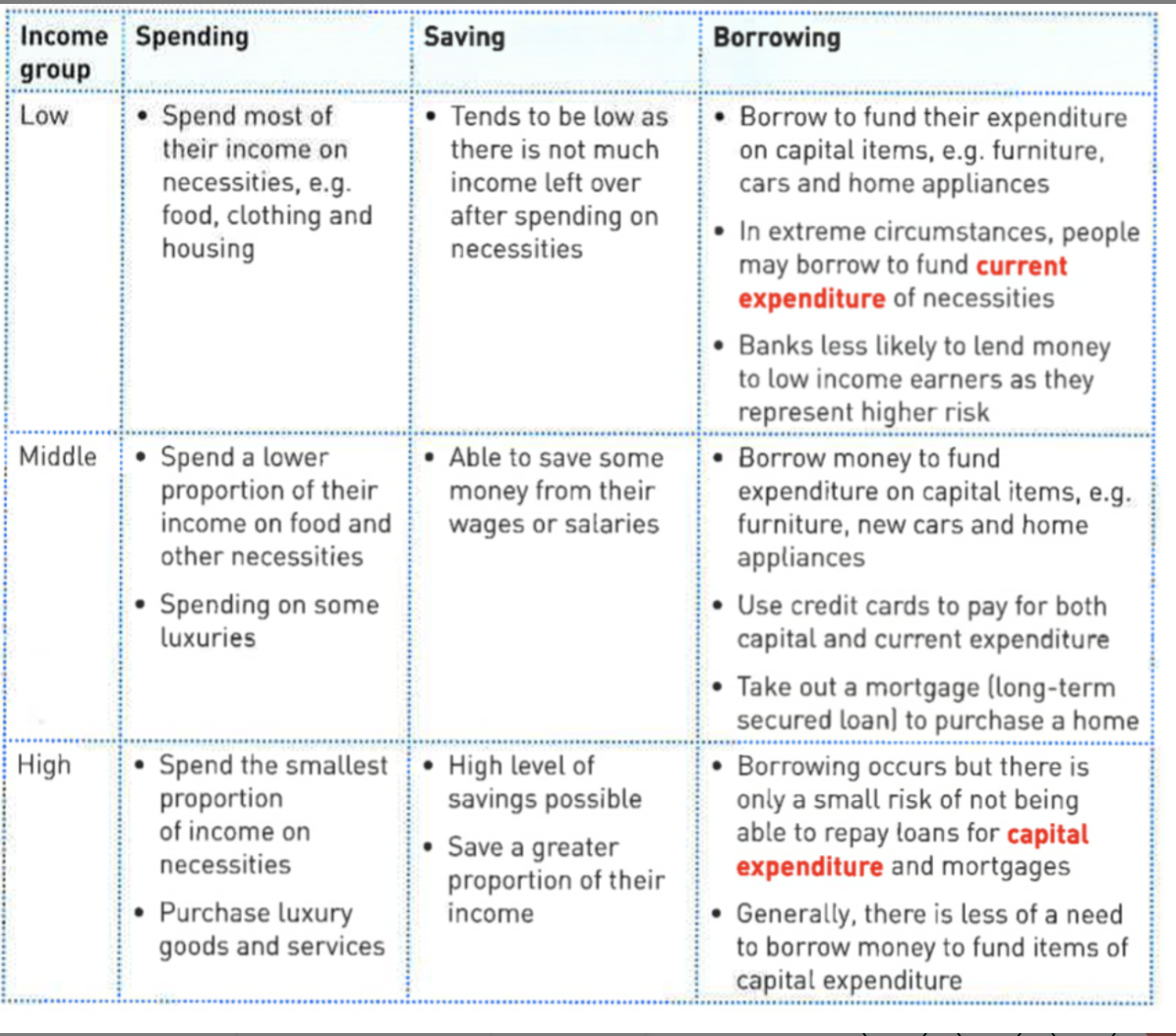

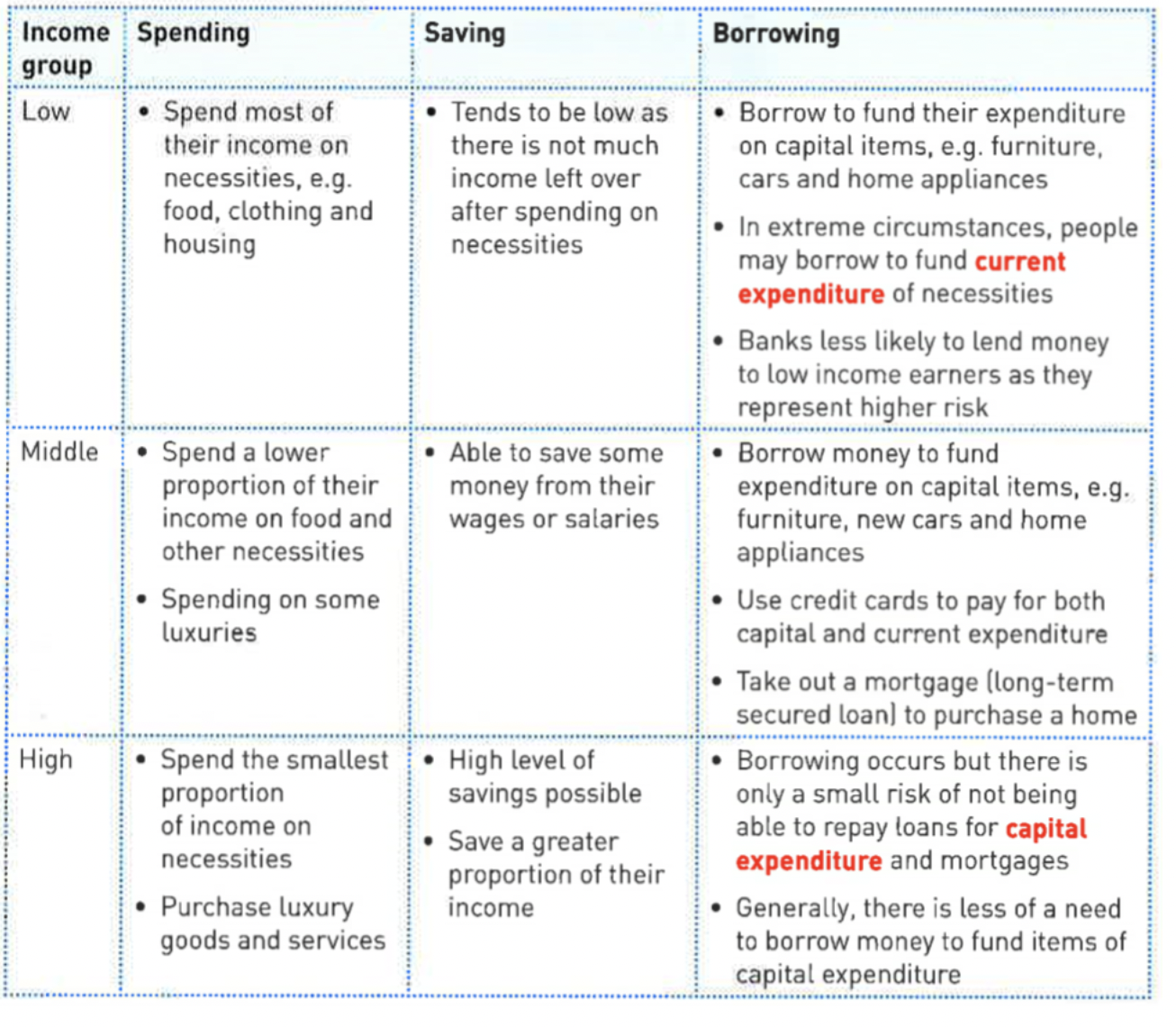

Low, middle, high income groups

Low- spending is mostly on necessities, saving is small, borrowing is unlikely as they are risky for banks, can borrow for current items.

Middle- most money is spent on necessities but can afford some luxuries, some saving, can borrow money for capital items, can pay with credit cards.

High - smallest amount of income is spent on necessities most in spent on luxuries, most amount of savings, can borrow but it is unlikely that they need to

Wealth + positive wealth affect + Negative equity + conspicuous consumption

wealth - amount of assets a person owns - liability

positive wealth affect - value of assets such as property and investment increase

negative equity - value of a secure loan or mortgage exceeds the market value of property

conspicuous consumption - when people purchase goods / services to increase their status + image

effects of Interest rates

borrowing becomes more expensive → demand for loans fall

savings become more attractive due to higher return → people save more + spend less

If a individual has an existing loan or mortgage the increase in interest repayments is likely to cause a fall in disposable income, spending falls

Influences on household spending

Income

Interest rates

Inflation

age

size of households

Influences on household borrowing

Availability of funds

confidence levels

interest rate

credit cards

store cards

wealth

Wages vs Salary vs Piece rate vs commission vs profit related pay vs share options (WAGE FACTORS)

Wages - time based, payed hourly,monthly weekly,etc.

Salary - payed monthly at a fixed rate no matter how much work was done

Piece rate - fixed amount payed per item produced or sold

commission - a percentage of the value of products or services sold.

profit related pay - additional payment to workers based on the amount of profit made by the firm

Share options - workers receive shares of the firm( gives incentive to work hard)

Non wage factors

level of challenge

level of danger

level of training required

level of experience required

career prospects

recognition in the job

personal satisfaction gained from the job

derived demand

labour is not demanded for itself but the goods/services it is used to produce

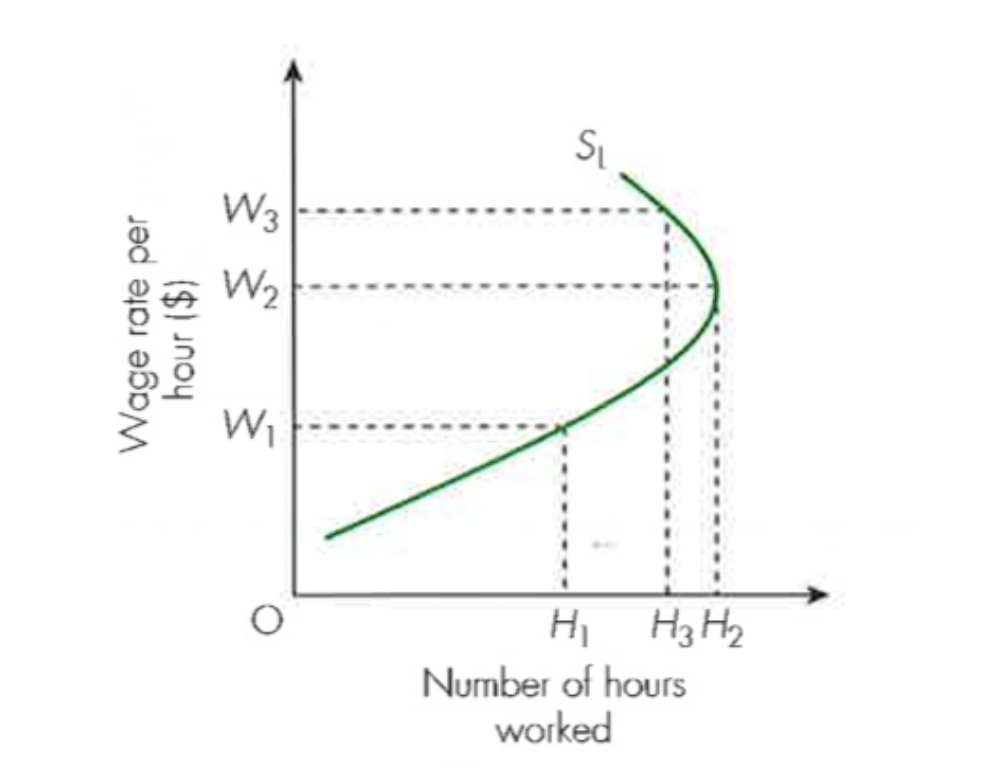

Back-ward bending supply of labour curve

when wage rates rise high and allows workers to work less

factors influencing labour force participation rate

availability + level of welfare benefits

changing social attitudes

occupational mobility

geographic mobility

labour force/total working age population

collective bargaining + corporate social responsibility

collective bargaining - trade union reps negotiating on behalf of the workers

corporate social responsibility - the ethical approach taken by firms

Types of trade union

Craft- organise workers of a particular skill(egineers)

Industrial- all workers in a industry (oil)

white collar- represent professional + non manual workers

general- accept anyone

Role of trade unions in a economy

better pay raise and working conditions

ensuring equipment at work is safe to use

giving support to members when they are made redundant

Providing financial + legal assistance to workers who have been unfairly dismissed or disciplined

Pursuing the government to pass legislation for workers

factors influencing strength of trade unions

number of members, degree of unity

reasons for higher membership - widening wealth gap, increase in manufacturing jobs

Negatives of trade union memberships

strikes → loss of productivity

better pay and conditions → firms production costs increase

profits reduced → government revenue falls

How to measure size of firms

number of employees, Market share, Market capitalization (total amount of shares x current price of shares), sales revenue (unit price of product x quantity sold)

Internal vs external economies of scale

internal- cost saving that arise from within the business(purchasing, techincal financial)

external - economies that arise due to the location of the firm and are external to the business

(proximity to related firms-easy access to supplies

availability of skilled labour-makes recruitment easier

reputation of geographical area-free publicity

access to transport networks-roads,ports)

Diseconomies of scale

average costs of production increase as firm size increases.

( operate in areas they don't have expertise in, workers may loose motivation → reduced productivity, may be necessary to employ new empolyees and build new buildings, unsuccessful merger, slow decision making)

production vs productivity

production - total output of goods and services in the production process

productivity - measure of efficiency output per unit of a factor input

factors of production + productivity = production

Importance of higher productivity for an economy

economies of scale - reduce per unit cost leading to reduction in prices for customers

Higher profits

Higher wages - attract best workers

improved competitiveness- firms can compete at a global scale

economic growth - raise standards of living + employment

Influences in productivity

investment - expenditure on capital

innovation - the commercialization of new ideas and products

Skills + experience - enhancing human capital(training)

entrepreneurial spirit - take risks in the production process in pursuit of profit

competition - rivalery between businesses creates incentive to be more productive

advantages of small firms

can provide more personal services,

able to adapt to changes in the market quickly,

if demand for product is small a firm producing it cannot be large

disadvantages of small firms

cannot enjoy economies of scale- spend more on raw materials

don’t have name recognition

can’t attract talented workers as easily

harder to expand - have to rely on loans

Different types of costs

total costs - sum of all fixed + variable costs

average fixed - fixed costs per unit

average variable - variable cost per unit

average total - total costs of making one product.

objectives of firms

survival- need to be profitable

social welfare- business activity with concerns for the quality of life in society

growth- increasing size of business to enjoy greater customer loyalty + economies of scale

profit + profit maximization -

Market structure

the key characteristics of a particular market

number + size of firms

degree + intensity of price and non price competition

Nature of barriers to entry

competitive market characteristics

Price - Firms are price takers

Quality - firms sell homogeneous products

Choice - focus on selling differentiated products

Profit - both buyers + sellers have access to information about the product + prices being charged by competitors

High competition → benefit to customers

characteristics of a monopoly

single supplier

Price maker - controls enough of the market supply to be able to charge higher prices

Imperfect knowledge - has the ability to protect prestigious position and trade secrets.

High barriers to entry - obstacles preventing other firms from entering the market

Advantages of monopolies

enjoy economies of scale

ability to invest in innovation - reaserch + development expenditure helps to develop new ideas.

Eliminate wasteful competition

disadvantages of monopolies

restrict output of a product

charge a higher price

Demand is price inelastic as monopolists are price makers

High barriers to entry limits competition

less incentive to innovate than competative markets