3.6 Debt/Equity Ratio Analysis

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

Efficiency Ratios

Assess how well a firm uses its assets and liabilities; include stock turnover, debtor days, creditor days, and gearing ratio

All Efficiency Ratios

1. Stock turnover ratio

2. Debtor days ratio

3. Creditor days ratio

4. Gearing ratio

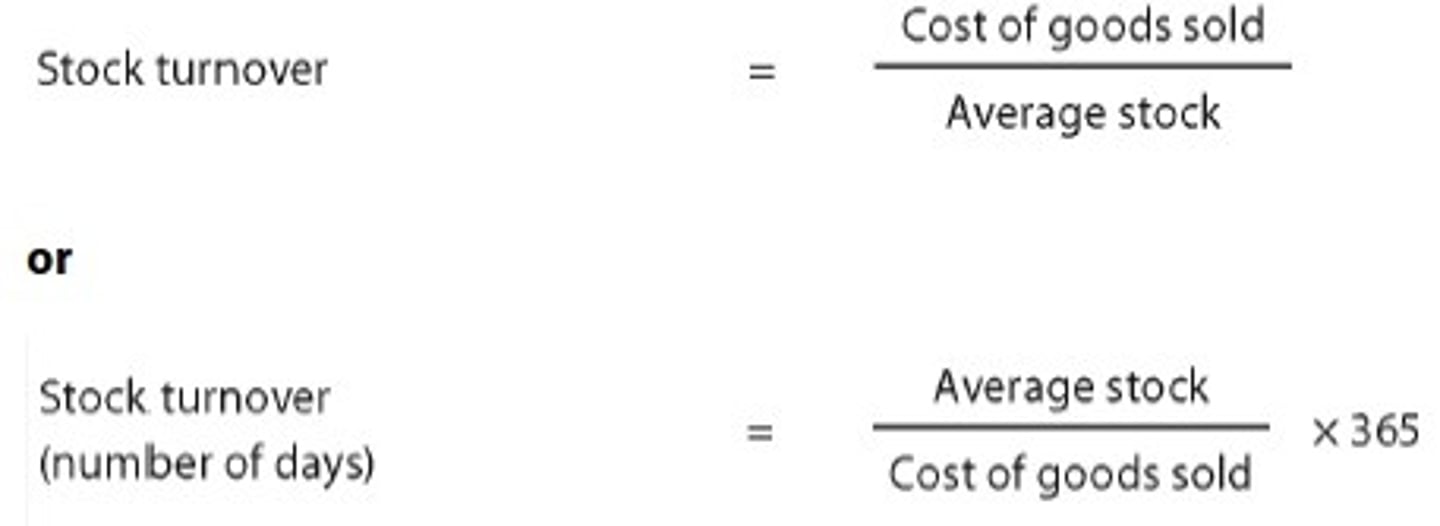

Stock turnover ratio

measures how quickly a firm's

stock is sold and replaced over a given period

Strategies to improve stock turnover ratio

• Dispose of slow/obsolete stock → frees space/cash, but risk of lost sales revenue.

• Narrow product range → focus on best-sellers, but reduces consumer choice.

• Keep lower stock levels → cuts storage costs, but risk of shortages if demand spikes.

• Adopt JIT → efficient, no stock holding, but delays in supply can halt production/sales.

Debtor days ratio

measures the average number

of days a firm takes to collect

its debts

Strategies to improve debtor days ratio

• Discounts/incentives → faster payments, but less revenue.

• Penalties for late payers → discourages delays, but may lose loyal customers.

• Stop further sales to debtors → pressures payment, but risks losing them.

• Legal action → enforces payment, but damages reputation.

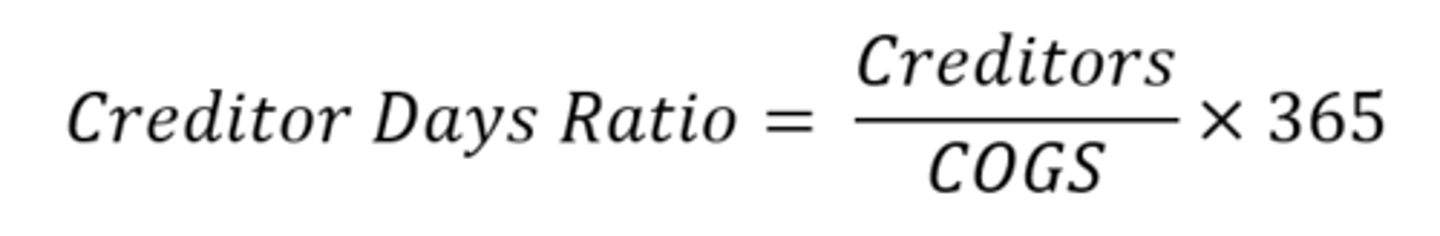

Creditor days ratio

measures the average number

of days a firm takes to pay its

creditors

Strategies to improve creditor days ratio

• Negotiate longer credit terms → boosts cash flow, but risks supplier refusal or lost support.

• Effective credit control → balance paying early vs delaying, but depends on cash flow needs and timing.

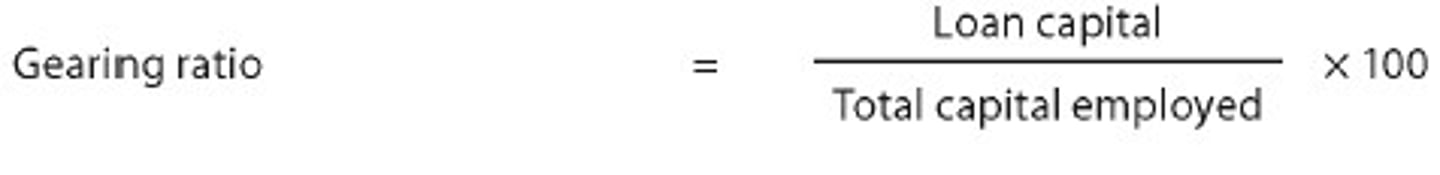

Gearing ratio

measures the extent to which the capital employed by a firm is financed from loan capital

Strategies to improve gearing ratio

• Issue more shares → lowers debt reliance, but dilutes ownership and takes time.

• Retain profits (cut dividends) → strengthens equity, but may upset shareholders.

Insolvency

A financial state where a person or firm cannot meet debt payments on time

Bankruptcy

A legal process when a person or firm declares they can no longer pay their debts to creditors

Insolvency vs. Bankruptcy

Insolvency: when a business cannot pay debts (liabilities > assets or can't pay bills on time).

Bankruptcy: the legal process that follows insolvency, where courts resolve debts (e.g., liquidation or restructuring).