IB, Business and Management, Unit 1

1/89

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

90 Terms

1.1 What is a business?

an entity that combines resources to create a good or service in exchange for money/capital to satisfy customers.

Resource input - Process to add value - Product outputs

Resource input

- Human

- Physical

- Financial

- Enterprise

The process to add value

- Production

Product outputs

- Goods

- Services

Input

- Human: People required for a process

- Physical: Quality and quantity of materials (even machines)

- Financial: money required for product

- Enterprise: least tangible but important. the IDEA and functionality of a business.

production processes

- capital intensive: ss that use a large proportion of land or machinery inputs. (a lot of money) e.g. car factory

- labor-intensive: a large proportion of labor both low skilled and high skilled

outputs

- goods: tangible products. physical. primary/secondary sector

- services: intangible. not physical

business functions

large might need special managers for each

- HR: Employing people, rewards, recruits, train, fire

- Marketing: promote product, price, package, distribute

- Finance/Account: Funds available for service. Forecast, record, finance

- Production: Appropriate processes. Desired quality. Control stock, methods of production, efficiency

the success of a business depends on these departments.

business tactics

business tactics

- plan to achieve TACTICAL OBJ

- short term requiring middle manager

sectors of a business

goods

- primary: raw materials form the primary sector. extraction. Eg. fishing, mining. Ma harm environment

- secondary: processed raw materials into other good. usually manufacturing. durable/non-durable and capital goods. Eg. iPad

Services

- tertiary: services provided with secondary goods. growth in this sector. Eg. healthcare, education

- quaternary: services focused on knowledge. E-services, IT.

chain of production

step through sectors to create a good or product.

business growth

see diagram

horizontal

- intend to increase market share and power

- take advantage of economies of scale

vertical

- lower transaction costs. market power

- reliability of supply increases

sectoral change

- constantly changes in size due to development

- measured by no. of people working on each sector

- business adapts to changing the environment. developing countries move away from primary sector

entrepreneur and intrapreneurship

- vital as innovates products and new business opportunities

ENTRE/INTRA

- entre: self-employed or central in the start-up of the business

- intra: employed by organizations to innovate

- balance risk of failure vs. success

INNOVATION BY:

- marker reading: observe customers and competitors. Change?

- need seeking: communicate to find new needs and satisfy

- technology driving: research and development to improve

reasons for starting a business

- Rewards: not possible to get all rewards if working for someone

- independence: own boss and can make own decisions

- necessity: if you can't find work

- challenge: personal. overcome yourself

- interest: enjoy what you do

- finding a gap: USP. something worthy/profitable

- sharing an idea: share something you like

process: idea. and planning

1. organizing the basics: Where? How? What?

2. Researching the market: Gap? Will it work? Satisfy need?

3. planning the business: narrow down. business plan detailed elements

4. legal requirements: meet al law requirements for business

5. raise finance: get the money needed to start the business

6. test market: what will occur? pilot. test consumers. will it succeed?

problems in starting own business:

- organization: location, name, structure, supplies

- market search: poor, target not appropriate, too optimistic

- plan: not convincing, goals vague or contradicting

- legal: labor laws, registration, taxes

- finance: cash flow, raising capital

*start-ups high probability of failure

business plan purpose

purpose:

- support the launch of the idea

-attract funds and investors

- support strategic planning

- identify resources needed

- focus for development

business plan elements:

- ideas, aims and objectives

- organization

- HR

- finance

- marketing

- operations

executive summary:

summary of business plan

1.2 types of business organization

1.2

sole trader

FOR PROFIT (COMMERCIAL) ORGANIZATION

the simplest form of business one person fulfills reasons to start a business

- sole trader owns and runs the business: may employ others but decisions and managing rely on him.

- no legal distinction between a sole trader and business. the sole trader is the business. unlimited liability

-limited finance: usually comes from personal savings, etc.

- closed customer: small business allows interaction between business and customer

- privacy: and limited accauntability. usually don't need to declare finance exept to TAX authorities

- registring: relatively easy and not expensive. less legal paperwork

sole trader advantages

- all profits belong to sole trader

- control over decisions (complete)

- flexibility (own boss)

sole trader disadvantages

-competition (hard because small business)

- high stress from al decisions

- lack of continuity if accident to sole trader

-limited expansion and financing

- unlimited liability

partnership

FOR PROFIT (COMMERCIAL) ORGANIZATION

2 or more people. often friends or family (2-20 generally)

-decisions made by partners: own and run together

- no legal distinction: between business and partners

- unlimited liability

- finance: more capital than sole traders. considered more stable

- "sleepy partners" provide finance. but not active in roles of business

- more variation of services that sole traders. bigger business

- greater accountability: often declare finance (not legally everywhere)

- deed of partnership: done because it provides the rights and duties of partners like responsibilities, financing, profit division, liabilities, etc.

- not necessarily share profits equally. depends on agreement

partnership advantages

- more production and efficiency

- under range of experience

- greater stability and continuity

partnership disadvantages

- each has unlimited liability

-still few access to finance vs. LTD (private) & PLC (public)

- not complete control

- profit shared between partners

- disagreement in decisions

corporations

FOR PROFIT (COMMERCIAL) ORGANIZATION

companies:

OTHER ORGANIZATIONS AND PARTNERSHIPS

organization stabilized for specific purpose. restricted by regulation

Private Limited company

(LTD)

- ownership and transparency sell shares to friends and family. not public. has accountability so it needs to publish books and finances in some cases. only sell shares privately

- finance: capital from shareholders. new partners may require to pay a fee. easier access to bank loans and financing as it is more stable

- limited liability

- control/decisionmaking: according to the agreement signed. authority handed down usually to family connections.

public limited company

(PLC) very similar, but stocks are public and are sold in the stock market. difficult decisions as many partners and decisions made by voting in the annual meeting of shareholders.

for profit social enterprises

form of business that has a social and beneficial purpose. improve well being.

- want profit without minimalizing social benefit

corperatives

OTHER ORGANIZATIONS AND PARTNERSHIPS

- form of the partnership but more than 20

- each participates actively in the running of the business

- financial coorporatives (casas de empeños)

sells for low prices, however still gain profit

- housing

- workers

- producer

- consumer

microfinances

- low. income economies.

- small finance to those who can't get and charge interest forprofit

- public private partnerships

- between public and private sector to generate profit and benefit eg. supervia

- profit = important but not the priority

- collaboration between business and local community

- greater democracy

- operate same functions than other businesses

public private partnerships advantages

- favorable legal status

- strong community deal

- a benefit to all stakeholders

public private partnerships disadvantages

decision making is complex because of transparency

- may be insufficient capital for growth and financial strength

non-profit enterprise

supports beneficial to social

don't want to make profit

non governmental

eg. greenpeace, cruz roja

surplus

surplus

similar to profit

but not distributed

it is reinvested for purpose

surplus = total revenue - total costs

non-governmental organizzazione (NGO's)

NON-PROFIT SOCIAL ENTERPRISE

pay taxes

charities

NON-PROFIT SOCIAL ENTERPRISE

aim to provide as much relief as possible for others (philanthropy)

don't pay tax

- profit not generated

- donations are important as it can't rely on government funding

- unclear ownership and control

charities advantages

- help people

- spirit of community

- foster discussions about the allocation of resources

- can innovate

charities disadvantages

- lack control

- employees may serve as all force. Eg. Greenpeace pirates

- funding is irregular

1.3 organizational objectives

1.3

mission statement:

what company currently does

why?

Who we are?

what needs to be done?

targeted to stakeholders

may be affected by external environment

vision statement

what do we want

- desired position

- future

- stakeholders and motivate employees

- vision should not change

objectives

- strategic: medium-long term to guide company in rigth direction

tactical: short medium terl. to obtain strategic objectives

- operational: day 2 day set by floor managers to achieve tactical

aim

long term goals to reach vision

heriarchy:

vition statement

aims

mision statement + objectives

strategical

tactical

operational

also:

- corporate obj

-department obj

- team obj

- individual obj

business strategy

- plan to achieve strategic obj in order to work towards aim

- medium & long term

- require senior managers for decisions and aprove by CEO

- careful analysis of:

- where business is

- development of plan to get aims

- consideration of strategy implementations

- periodic evaluation process. determine if plan is working or not

business tactics

- plan to achieve TACTICAL OBJ

- short term requiring middle manager

SMART objectives

Specific

Measurable

Achievable

Relevant

Time specific

business tactics

- plan to achieve TACTICAL OBJ

- short term requiring middle manager

need for organizations to change objectives

- change in:

- internal environment

- external environment

internal environment

changes in:

- leadership: change aim & obj or style

- HR : alter heriarchy

_ organization: merge or adquisition change

- product

- operation

external environment

- STEEPLE

Social

Technological

Economical

Ethical

Political

Legal

Ecological

ethical objectives

social or environmental benefit

good image for company

custometr loyalty

positive work environment

reduces risk of legal issues

satisfy expectations for ethical behabviour

increase profit

IMPACTS: business itself, competition has to respond, suppliers have to become ethical as well, customer loyalty, local community, government

corporate social responsibility

: business has obligation to operate in a way that will have a positive impact on society

importance of CSR

provides benefits of ethical obj

closely relatedº

SWOT analysis

first stages in planning process

based on perception

positive negative

internal Strength Weakness

external Opportunities Threats

more sources is more reliable

if done poorly can mislead business

only useful if properly done

SWOT and market position

can be strengthened by pairing key factors from each quadrant

Strength Weakness

Opportunity growth re-orientation

Threat defusing defensive

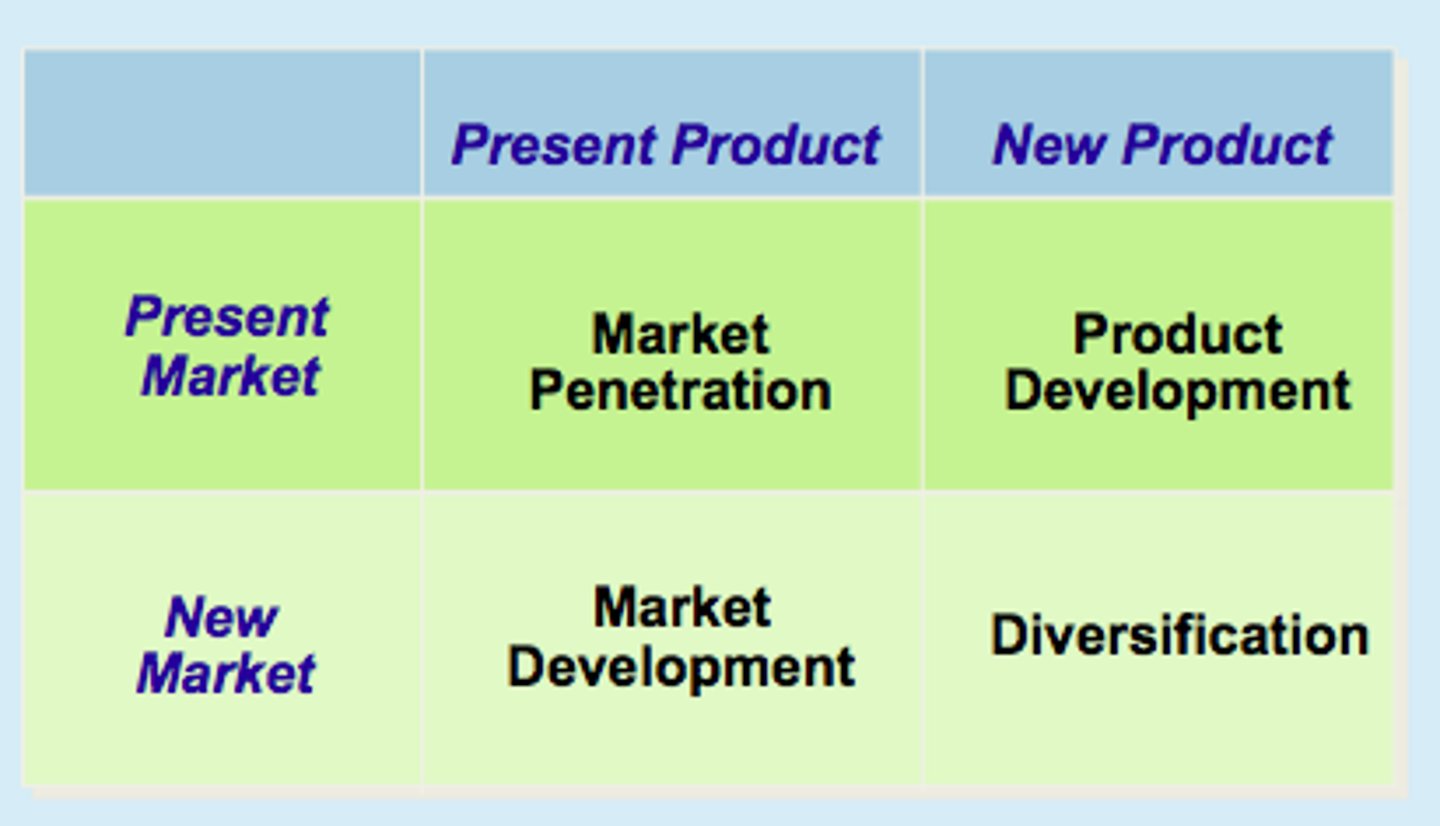

ansoff matrix

helps plan and set obj

groth strategies

considers existing markets and products

market penetration

sell more existing products in existing market

market development

new markets for existing products

opening walmart in australia failure

product development

new product in existing market

b¡diversification

new market new product

riskier

to reduce risk use effective market research

1.4 stakeholders

1.4

stakeholders

individuals or groups that have direct interest in business because actions will affect them

INTERNAL: work within business

EXTERNAL:outside business

GREY AREAS: may come together . Eg. worker of business afected as it lives where business is located

interest of internal stakeholders:

- shareholders return of investment

- CEO/manager to satisfy shareholder

- managers (senior and middle) supervisors focused on obj

workers protecting rights and working conditions

interest of external shareholders

gov: how business operates in the environment

suppliers: mantain relationship

community: products meet their needs. local impact

finances: return investments

pressure groups: impact on the area concern

Media: news & stories

stakeholder analysis

prioritizes ranks and interests of stakeholders

inside circle

- owners

-managers

middle circle:

- employees

-consumers

-finances

-suppliers

out circle

-community

-media

-gov

-pressure groups

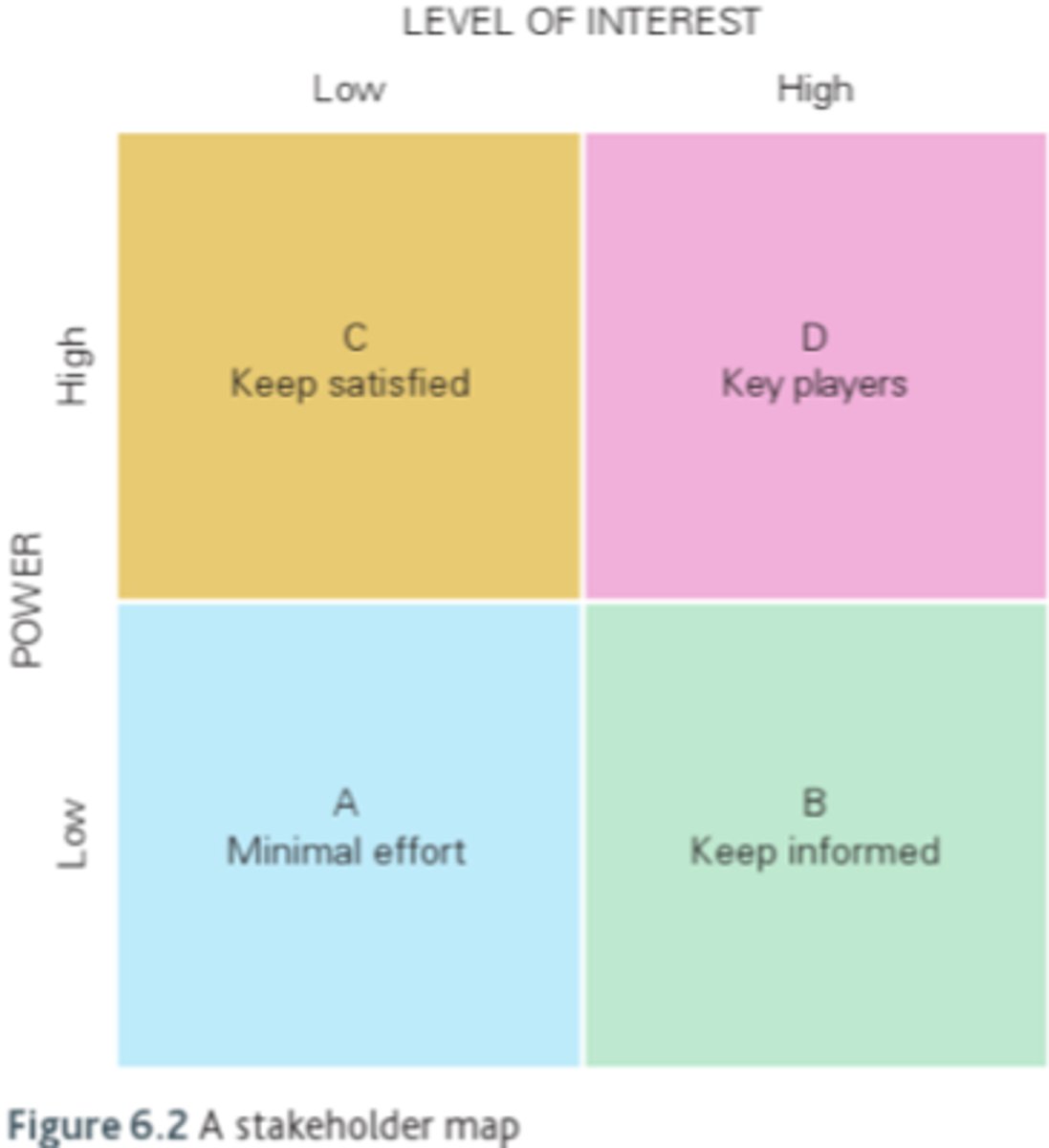

stakeholder mapping

A. rarely problem for business

B. make feel important

C. satisfied as they have power

D. most important. consult for decissions

importance:

least A B C D most

1.5 the external environment

high impact on business

steeple

Social

- lifestyle, education, social mobility, fashion / taste

Technological

- improvements, ICT, new tech, research, development cost, infrastructure

Economic

- eco cycle, growth rate, inflation, unemployment, exchange rate

Ethical

- corruption, codes of conduct, transparency, fair trade

Political

- stability,regional policies, trade policies

Legal

- regulations, health and safety laws, employment laws, competitor laws

Ecological

1.6 Growth and evolution

1.6

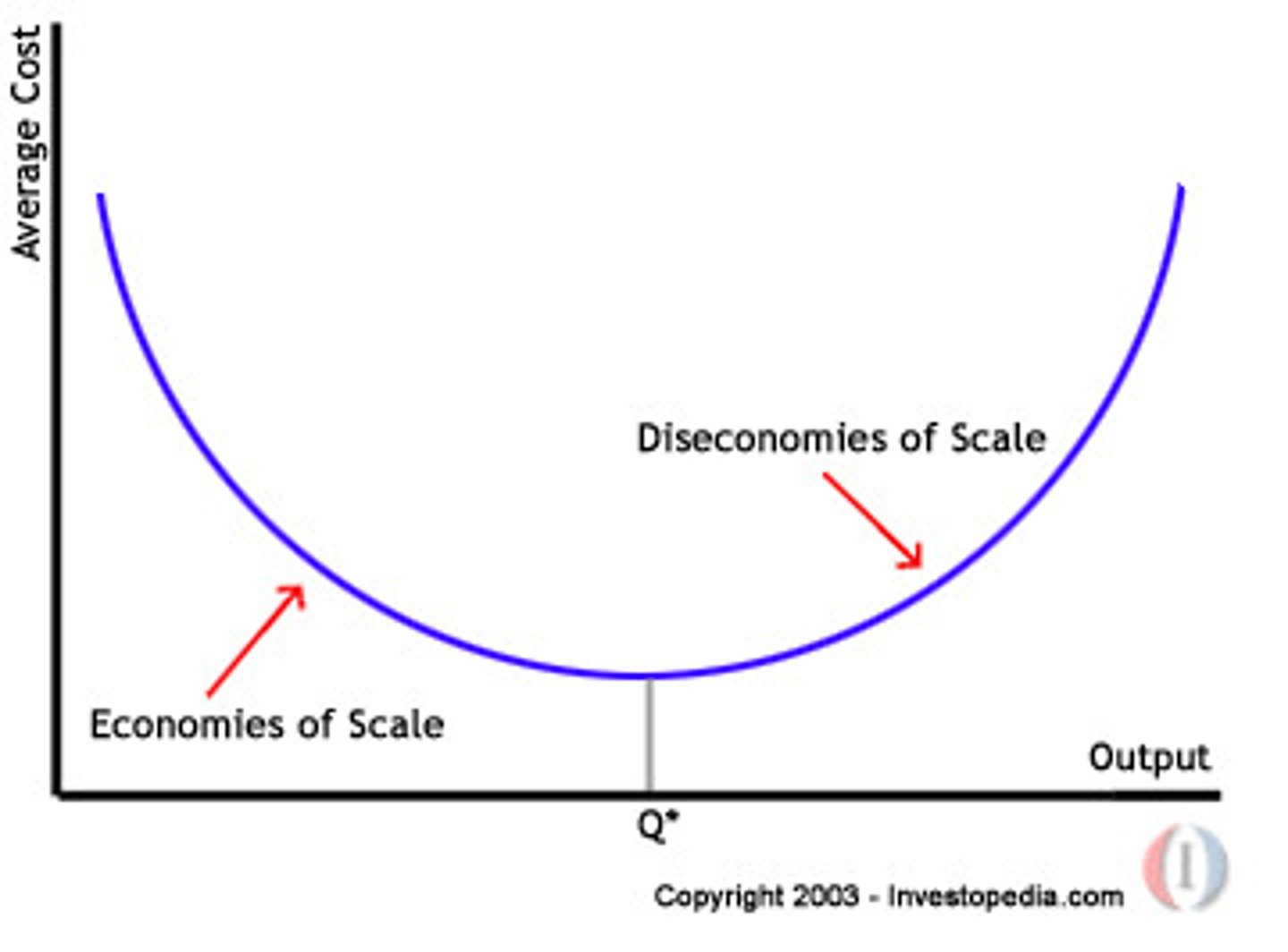

economies and diseconomies of scale

increase sale of operations become more efficient.

size and volume of output

economies of scale

reduction of average unit cost as increases size

sometimes becomes inefficient when growing. this is diseconomie of scale. increase in price per unit. if they grow past 100% capacity utilization, need to expand to continue production

efficiency: measured in terms of cost of production per unit

Total cost = fixed + variable cost

average cost = total cost / quantity produced

when growing, VC increases but FC spreaded in greater quantity

grow too much will need to expand rising costs and a bit of sales but not enough. this leads to diseconomies.

internal economies of scale

technical: law variable proportions. increase in VC but spread of FC

managerial: specialized

less risky than smaller business: financial

marketing: direct more effective campaigns

purchasing: bulk buying. - less costs

risk bearing: bigger product portfolio. less chance of failure

external economies of scale

consumers: more costumers if wider range. of products

employees: labour concentration. cheaper recruitment / training

internal diseconomies of scale + external

opposite advantages shown in economies of scale

-tech:

- managers too specialized inefficient

- financialy poor investments

. big marketing mistakes

- buy too much stock

- too high risks

- storage of skilled workers

Small vs. Big

Small

-greater focus on client

-exclusiv

-more motivation

-competitive advantage

-less competition

-more managable debts

-friend work environment

big

- greater chance of survival

-economies of scale

-higher status

-market leader

- increased market share

-loosing staff less worry

internal growth

organic growth

slow and steady

less risk

selling more products

develop product range

finance from banks, loans and retained profit

external growth

quick and risky

enter arrangement to work with another business

Joint ventures

external growth

agree to combine resources for goal.

strategic alliances c

collaborate for specific goal between business

more tha. 2 business may be part

franchise

external growth

expand

franchisor: original

franchisees: buy product to sell. have to be consistent with. franchisor. (% of sales)

franchisor provides:

stock

fitting

uniforms

staff training

legal financial aid

advertising and promotions

franchisee will

employ

set prices

wages

pay royalty (%)

local promotions

sell only franchisor products

advertise locally

globalization

world's regional economies becoming one

due to factors like technology

Impact of Globalization

increased competition: force business to become more efficient

greater brand awareness

known worldwide

skill transfer

and knowledge from all the world

closer collaboration

and new business opportunities

reasons for growth of multinational companies

- operating or registered in more than 1 country

- sometimes generate more reserve than actual countries

factors that allow MNC

improved communication - networks

dismanteling of trade barriers

disregulation of worlds financial market

increasing economic and political powe of mnc

IMPACT of MNC

economic growth

new. ideas

skill transfer

profits going elsewhere

brain drain

loss of market share

short term plans

environmental impact

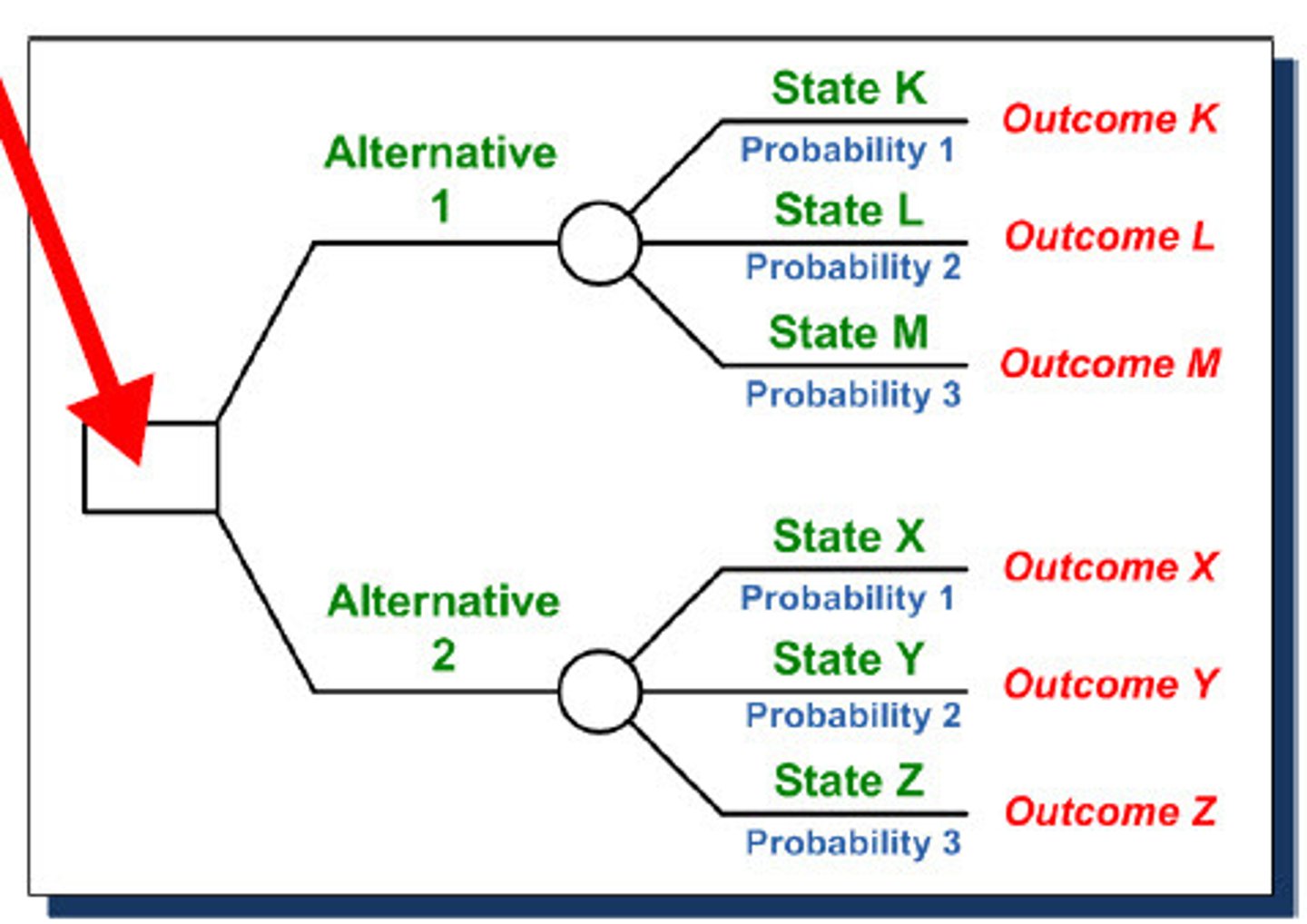

Decision trees

decision making problems

squares - business decision

circles - options

lines to circle - the cost of the option

lines from the circle - success/failure prob

over circle - expected outcome (prob of success x outcome of success) + (prob of failure x outcome of failure)

over/under square - final outcome calculated by (value over circle - the cost of the option)

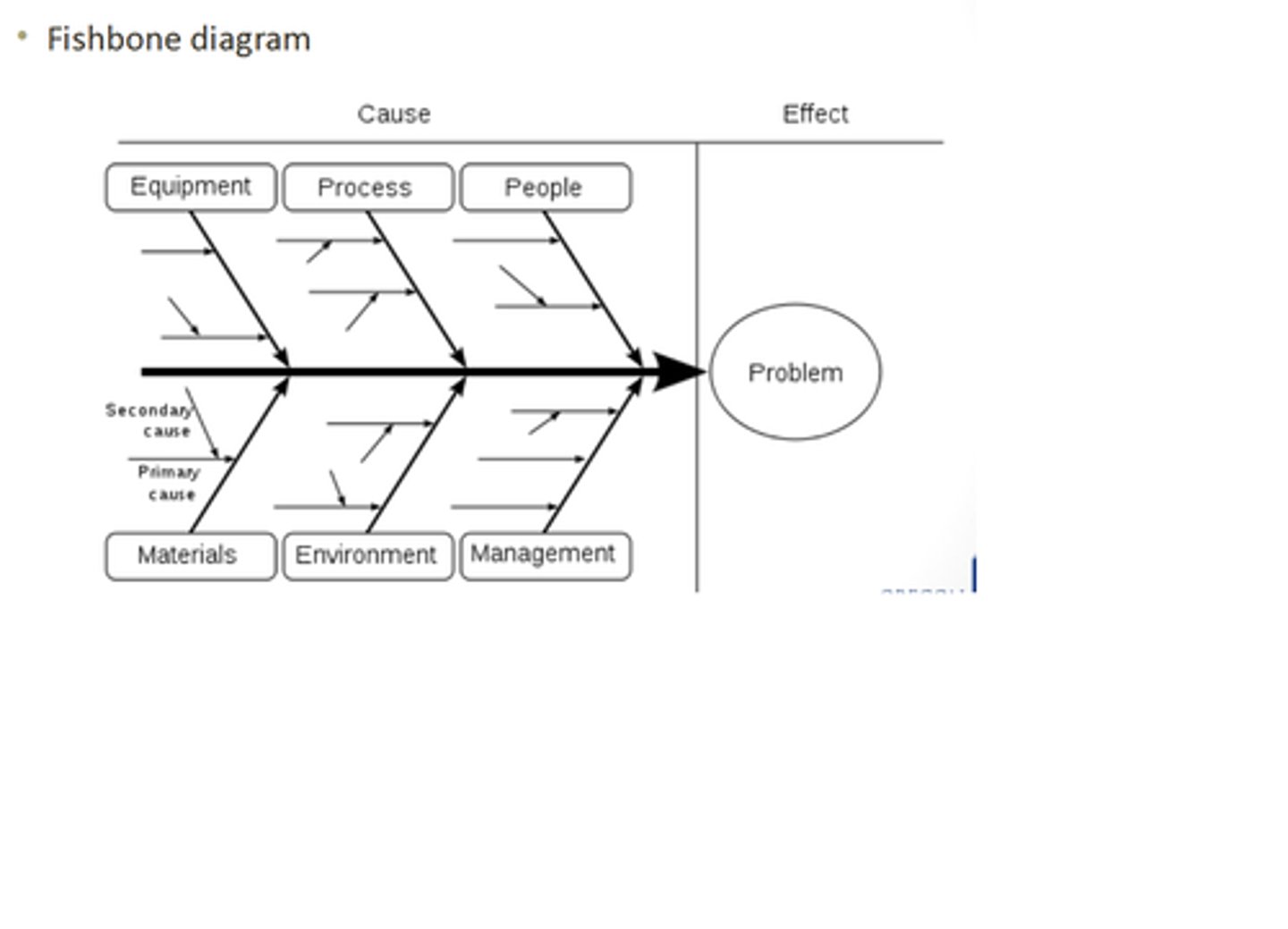

fishbone analysis

cause and effect diagram

identifies causes for effect or problem

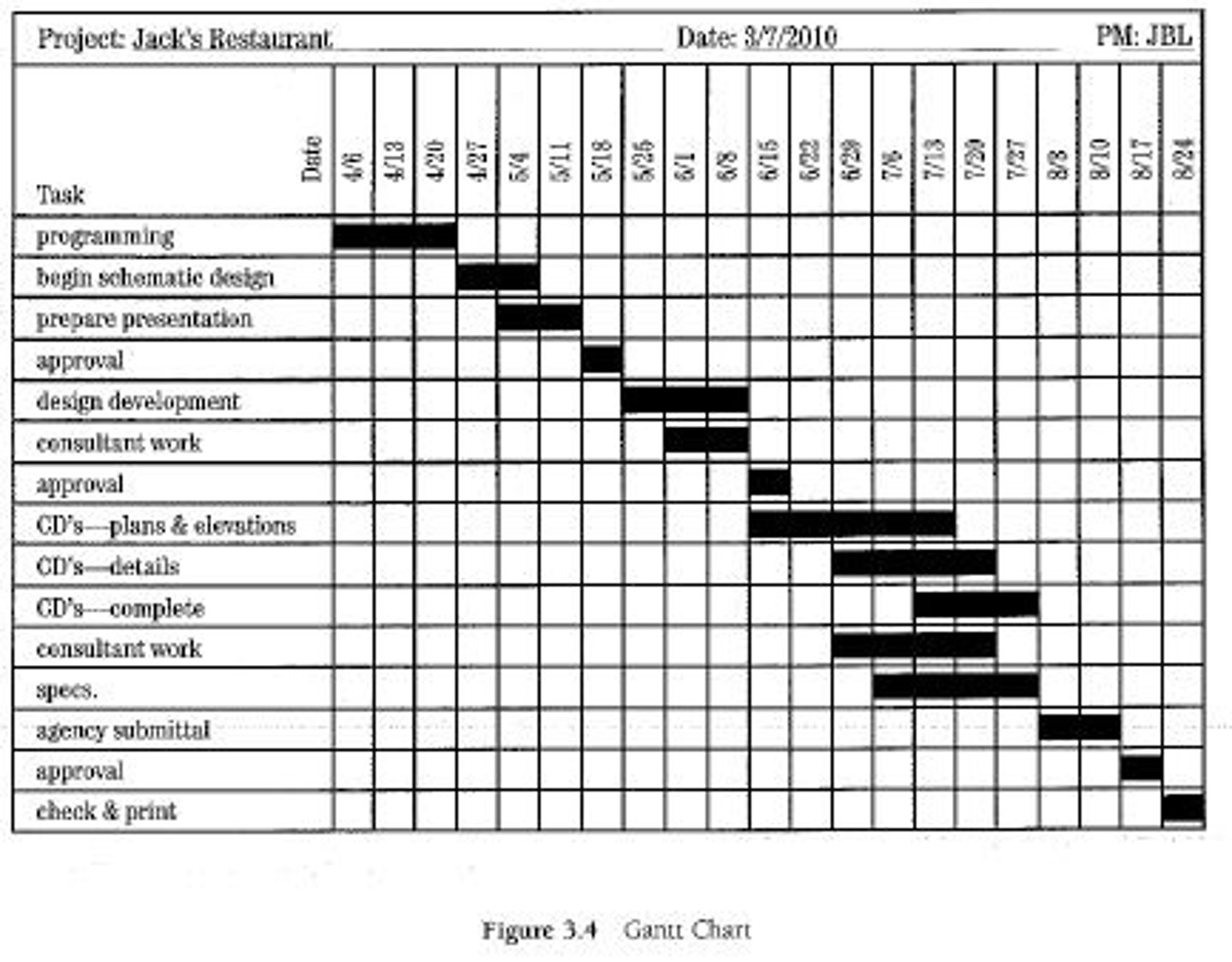

Gantt chart

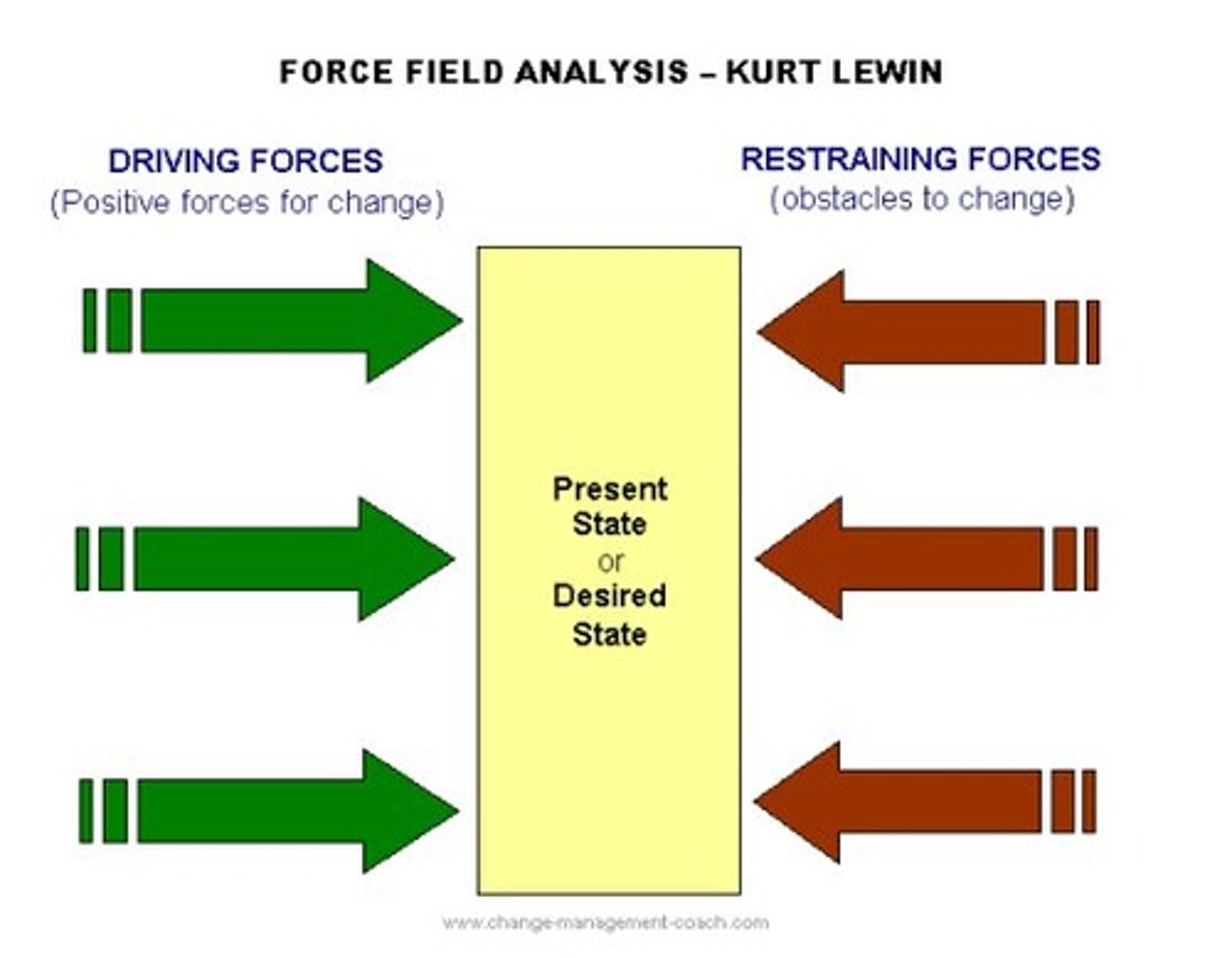

force field analysis

driving forces . initiate change and keep it going

restraining forces. decrease driving forces

0-5