Lesson 5 Standard Model of Trade/External Economies of Scale

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Which model doesn’t use the comparative advantage due to resource abundance or technological differences to explain the benefits of international trade?

I) Differences in consumer preferences

II) Differences in labor productivity

III) Increasing returns or economies of scale

IV) Differences in capital intensity

III) Increasing returns or economies of scale

Consider the example of the Cobb-Douglas production function we studied before:

y = LaKb

if a + b < 1, what does this imply?

I) This production displays the feature of decreasing return to scale.

II) This production displays the feature of increasing return to scale.

III) This production displays the feature of constant return to scale.

IV) We cannot tell from the Cobb-Douglas prediction function.

I) This production displays the feature of decreasing return to scale.

Which of the following best describes the role of international trade in the context of increasing returns to scale and consumer preferences for variety?

I) Trade allows countries to focus on producing goods they have a technological advantage in while ignoring economies of scale.

II) International trade restricts countries to produce only those goods that are in high demand domestically, ensuring maximum profitability.

III) International trade compels countries to produce a wide range of goods, sacrificing economies of scale, to meet global consumer demands.

IV) Trade enables countries to specialize in the production of a limited range of goods, benefiting from economies of scale, while still allowing consumers to enjoy a variety of goods.

IV) Trade enables countries to specialize in the production of a limited range of goods, benefiting from economies of scale, while still allowing consumers to enjoy a variety of goods.

Which of the following statements accurately differentiates between internal and external economies of scale?

I) External economies of scale are always short-term phenomena, while internal economies of scale have long-term implications for trade patterns.

II) Internal economies of scale occur when the cost per unit of output depends on the size of a firm, whereas external economies of scale relate to the cost per unit based on the size of the industry.

III) Internal economies of scale arise from the growth of the industry, while external economies of scale are specific to the expansion of an individual firm.

IV) External economies of scale result in a monopolistic market structure, while internal economies of scale support a competitive market with many firms.

II) Internal economies of scale occur when the cost per unit of output depends on the size of a firm, whereas external economies of scale relate to the cost per unit based on the size of the industry.

Which of the following statements best describes the relationship between economies of scale and the structure of industries in the context of international trade?

I) Both internal and external economies of scale lead to industries dominated by a few large firms, resulting in imperfect competition.

II) Industries benefiting from internal economies of scale tend to be imperfectly competitive due to the cost advantage of large firms, whereas those with external economies of scale are often perfectly competitive with many small firms.

III) The presence of either internal or external economies of scale in an industry always results in perfect competition, irrespective of firm size.

IV) Industries characterized by external economies of scale are typically dominated by large firms, while those with internal economies of scale have many small, competitive firms.

II) Industries benefiting from internal economies of scale tend to be imperfectly competitive due to the cost advantage of large firms, whereas those with external economies of scale are often perfectly competitive with many small firms.

Which of the following is NOT a main reason for cost reduction when concentrating production of an industry in one or a few locations, even if individual firms remain small?

I) Knowledge spillovers, where firms benefit from shared information, innovations, and expertise within the concentrated area.

II) The ability to pool labor resources, leading to a workforce with specialized skills tailored to the industry’s needs

III) Access to specialized equipment or services that cater specifically to the industry.

IV) Reduced transportation costs due to proximity to consumers.

IV) Reduced transportation costs due to proximity to consumers.

Which of the following statements accurately describes the supply curve under external economies?

I) Under external economies, the supply curve is forward-falling, indicating that as the industry’s output grows, the price at which firms are willing to sell decreases.

II) The supply curve remains constant under external economies, irrespective of changes in industry output.

III) External economies result in a backward-falling supply curve at first and an upward-sloping supply curve later.

IV) The supply curve is typically upward-sloping, reflecting the relationship between increasing costs and industry output.

I) Under external economies, the supply curve is forward-falling, indicating that as the industry’s output grows, the price at which firms are willing to sell decreases.

When external economies of scale exists, an industry forward-falling supply curve implies that each individual firm has a forward-falling supply curve.

I) True

II) False

II) False

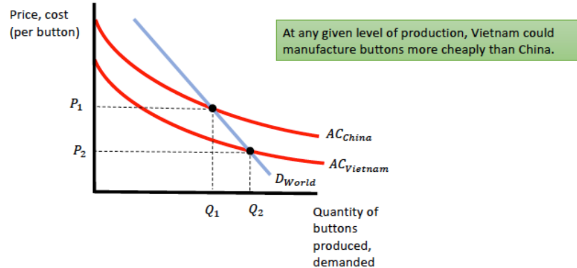

Look at the following graph for the average cost curves for Vietnam and China:

Would this imply that Vietnam will in fact supply the world market?

I) Yes, because China’s average cost is lower than Vietnam’s at any quantity.

II) Not if China has enough of a head start: when China is producing a large quantity, the average cost for China will be lower than Vietnam if the latter is only a startup industry.

III) No because they have the same average cost

IV) Yes, because Vietnam’s average cost curve is below China’s for all quantity.

II) Not if China has enough of a head start: when China is producing a large quantity, the average cost for China will be lower than Vietnam if the latter is only a startup industry.

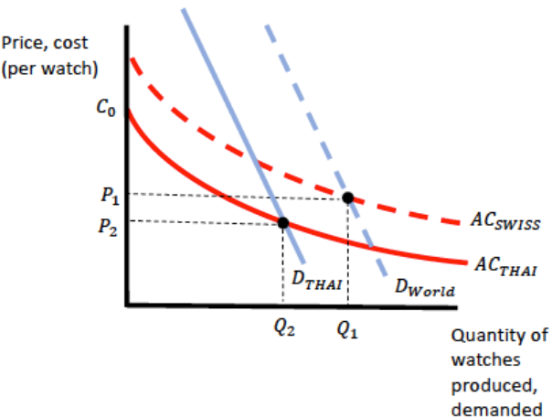

Suppose Thailand and Switzerland could both produce watches. Assume that Thailand could make watches more cheaply, but Switzerland got there first:

What’s the welfare implication for Thailand when it engaged in trade with Switzerland for watches instead of producing by itself?

I) Thailand is better off with trade than it would have been without trade because the price of watches is cheaper than it would have been if Thailand produced watches by itself.

II) Thailand is equally well off in either case.

III) Thailand is worse off with trade than it would have been without trade because the price of watches is more expensive than it would have been if Thailand produced watches by itself.

IV) We cannot say anything about the welfare of Thailand in this case.

III) Thailand is worse off with trade than it would have been without trade because the price of watches is more expensive than it would have been if Thailand produced watches by itself.