Quarter 2 Review Problems in Personal Finance

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Central Tendency

Statistical measures to summarize data.

Outliers

Extreme values affecting data representation.

Median Price

Middle value in a sorted price list.

Mode Price

Most frequently occurring price in data.

Mean Price

Average price calculated from total values.

Average Car Price

Expected price based on market research.

Weekly Salary

Earnings calculated over a week.

Agency Fee

Percentage charged by employment agency.

Paycheck Frequency

Number of paychecks received annually.

Overtime Pay

Extra earnings for hours worked beyond regular.

Piecework Pay

Earnings based on units produced or completed.

Commission

Payment based on sales performance.

Health Care Contribution

Employee's share of health insurance costs.

Vacation Days

Paid time off accrued based on employment duration.

Pension Calculation

Retirement benefit based on average salary.

Taxable Income

Income subject to taxation after deductions.

Federal Tax Rate

Percentage of income paid to federal government.

Sales Tax

Tax added to the sale price of goods.

Biweekly Paycheck

Payment received every two weeks.

Semimonthly Paycheck

Payment received twice a month.

Total Earnings

Sum of all income sources.

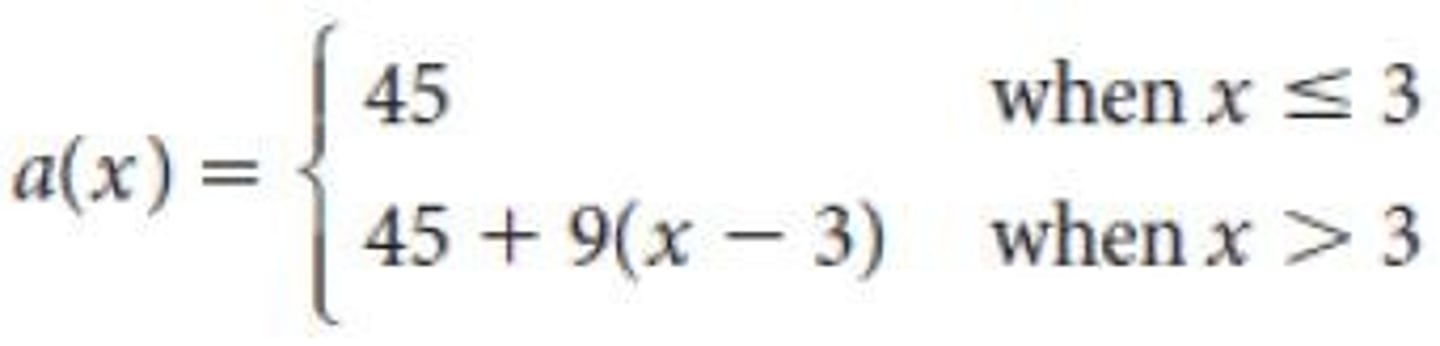

Tax Deferred Account

Savings account reducing taxable income.

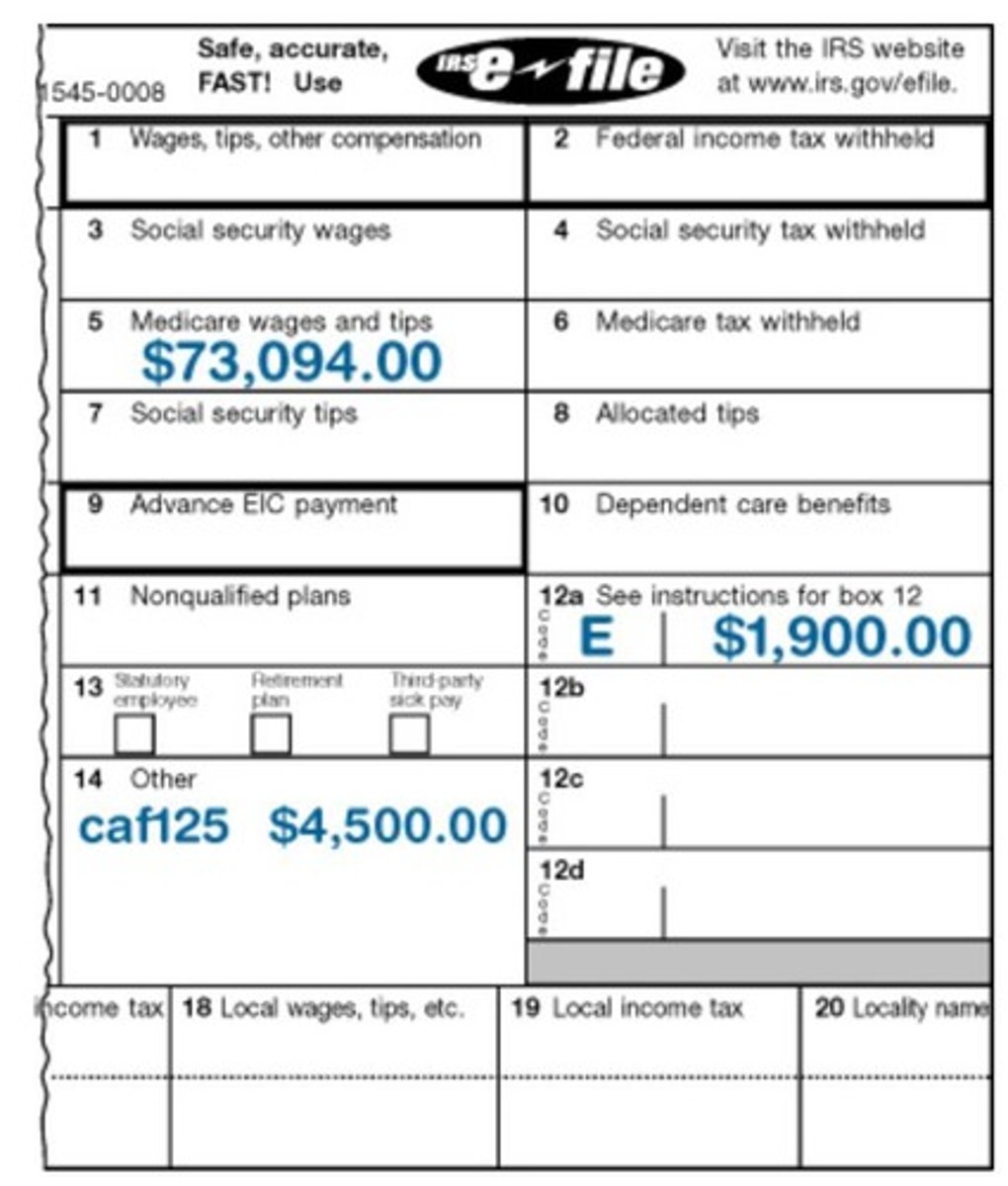

W-2 Form

Tax form reporting annual wages and withholdings.

1099 Form

Tax form for reporting non-employment income.

Piecework Rate

Payment per unit produced or completed.

Hourly Rate

Earnings calculated per hour worked.

Sales Commission Structure

Payment model based on sales performance.

Employee Benefits

Compensation beyond salary, like health insurance.