Unit 1 & 2 Flashcards

0.0(0)Studied by 3 people

Card Sorting

1/83

Earn XP

Description and Tags

Last updated 10:49 PM on 4/10/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

84 Terms

1

New cards

Economics

The study of how to allocate scarce resources among competing ends

2

New cards

Macroeconomics

* The branch of economics that deals with the whole economy and issues that affect most of society

* These issues include inflation, unemployment, Gross Domestic Product, national income, interest rates, exchange rates, and so on.

* These issues include inflation, unemployment, Gross Domestic Product, national income, interest rates, exchange rates, and so on.

3

New cards

Microeconomics

* The branch of economics that looks at decision-making at the firm, household, and individual levels and studies behavior in markets for particular goods and services

* Ex: it models a firm’s decision of how much to produce and what price to charge for its goods or services

* Ex: it models a firm’s decision of how much to produce and what price to charge for its goods or services

4

New cards

Gross Domestic Product (GDP)

The total value of all final goods and services produced in a year within that country

5

New cards

The expression “*final* goods and services” indicates that to avoid ________________.

double counting

6

New cards

Excluded from GDP

* The value of intermediate goods like lumber and steel that go into the production of other goods like homes and cars

* The repurchase of used goods, which were included in GDP in the year in which they were first produced.

* Financial transactions such as the buying and selling of stocks and bonds, since there is no productive activity associated with them to measure.

* Public and private transfer payments

* Underground economic activities (both legal and illegal)

* Home production

* The repurchase of used goods, which were included in GDP in the year in which they were first produced.

* Financial transactions such as the buying and selling of stocks and bonds, since there is no productive activity associated with them to measure.

* Public and private transfer payments

* Underground economic activities (both legal and illegal)

* Home production

7

New cards

The media is prone to use changes in GDP as indicators of societal well-being.

Although an increase in this measure might reflect an increase in the standard of living, GDP also increases with expenditures on natural disasters, deadly epidemics, war, crimes, and other detriments to society.

8

New cards

National Income (NI)

* The sum of income earned by the factors of production owned by a country’s citizens

* It includes wages, salaries, and fringe benefits paid for labor services, rent paid for the use of land and buildings, interest paid for the use of money, and profits received for the use of capital resources.

* It includes wages, salaries, and fringe benefits paid for labor services, rent paid for the use of land and buildings, interest paid for the use of money, and profits received for the use of capital resources.

9

New cards

Personal Income (PI)

The money income received by households before personal income taxes are subtracted

10

New cards

Disposable Income (DI)

Personal income minus personal income taxes

11

New cards

Two primary ways of calculating GDP:

* Expenditure approach

* Income approach

* Income approach

12

New cards

Expenditure Approach

* One of the primary ways to calculate GDP

* Adds up spending by households, firms, the government, and the rest of the world

* Adds up spending by households, firms, the government, and the rest of the world

13

New cards

Expenditure Approach Formula: GDP = C + I + G + (X - M)

* Here **C** represents personal consumption expenditures by households, such as purchases of durable and non-durable goods and services.

* **I** represents investment in new physical capital, new construction (both commercial and residential), and additions to business inventories.

* **G** represents government purchases.

* **X** represents exports.

* **M** represents imports.

* **I** represents investment in new physical capital, new construction (both commercial and residential), and additions to business inventories.

* **G** represents government purchases.

* **X** represents exports.

* **M** represents imports.

14

New cards

Income Approach

* One of the primary ways to calculate GDP

* Makes use of the fact that expenditures on GDP ultimately become income. National income can thus be modified slightly to arrive at GDP

* Makes use of the fact that expenditures on GDP ultimately become income. National income can thus be modified slightly to arrive at GDP

15

New cards

Depreciation

* The decline in the value of capital over time due to wear or obsolescence

* Are subtracted from corporate profits before the NI calculation, so they must be re-added to capture the value of output needed to replace or repair worn-out buildings and machinery

* Are subtracted from corporate profits before the NI calculation, so they must be re-added to capture the value of output needed to replace or repair worn-out buildings and machinery

16

New cards

Subsidy Payments

* Given to businesses by governments as assistance

* Are not made in exchange for goods and services, so they are not part of GDP. Thus they must be subtracted from NI to find GDP

* Are not made in exchange for goods and services, so they are not part of GDP. Thus they must be subtracted from NI to find GDP

17

New cards

Net income of foreign workers

* Add the income of foreign workers and subtract the income of citizens working abroad

* Added to NI to find GDP

* Accounts for the fact that NI includes the income of all citizens, everywhere, whereas GDP includes the values of good produced domestically by anyone

* Added to NI to find GDP

* Accounts for the fact that NI includes the income of all citizens, everywhere, whereas GDP includes the values of good produced domestically by anyone

18

New cards

If George Lucas makes a film in France, his income will be part of the U.S. national income because he is a U.S. citizen, but…

but his foreign-made film is part of France’s GDP.

19

New cards

Income Approach Formula:

GDP = NI + Depreciation - Subsidies + Net income of foreigners

20

New cards

Net Domestic Product

* GDP minus depreciation

* This indicates how much output is left over for consumption and additions to the capital stock after replacing the capital used up in the production process.

* This indicates how much output is left over for consumption and additions to the capital stock after replacing the capital used up in the production process.

21

New cards

Circular Flow (Product Markets & Households)

To product markets → Expenditures

To households → Goods and services purchased

To households → Goods and services purchased

22

New cards

Circular Flow (Product Markets & Firms)

To product markets → Goods and services sold

To firms → Revenues

To firms → Revenues

23

New cards

Circular Flow (Firms & Factor Markets)

To factor markets → Wages, rent, interest, profits

To firms → Inputs

To firms → Inputs

24

New cards

Circular Flow (Households & Factor Markets)

To factor markets → Land, labor, capital, entrepreneurship

To households → Incomes

To households → Incomes

25

New cards

Goods flow from firms to households through the…

product markets

26

New cards

Inputs flow from households to firms through the…

factor markets

27

New cards

Aggregate Income

The total of all incomes in an economy without adjustments for inflation, taxation, or types of double counting.

28

New cards

Aggregate Expenditure

The total current value of all the finished goods and services in the economy.

29

New cards

GDP =

Aggregate income = Aggregate expenditure

30

New cards

Labor Force

Includes both employed and unemployed adults

31

New cards

To be considered unemployed…

A labor force participant must be willing and able to work, and must have made an effort to seek work in the past four weeks.

32

New cards

Labor Force Participation Rate

The number of people in the labor force divided by the working-age population

33

New cards

Unemployment Rate

The number of unemployed workers divided by the number in the labor force and then multiplied by 100 to get the percent.

34

New cards

Categories of Unemployment

* Frictional unemployment

* Structural unemployment

* Cyclical unemployment

* Seasonal unemployment

* Structural unemployment

* Cyclical unemployment

* Seasonal unemployment

35

New cards

Frictional Unemployment

* Occurs as unemployed workers and firms search for the best available worker-job matches.

* Included in this category:

* New labor entrants looking for new jobs

* Workers who are temporarily between jobs because they are moving to a new location or occupation in which they will be more productive.

* Included in this category:

* New labor entrants looking for new jobs

* Workers who are temporarily between jobs because they are moving to a new location or occupation in which they will be more productive.

36

New cards

Structural Unemployment

* The result of a skills mismatch

* Ex: As voice recognition software is perfected, skilled typists may find themselves out of work.

* Ex: As voice recognition software is perfected, skilled typists may find themselves out of work.

37

New cards

Cyclical Unemployment

* Results from downturns in the business cycle

* During recessions and depressions, firms are likely to hire fewer workers or let existing workers go.

* When the economy recovers, many of these cyclically unemployed workers will again find work.

* During recessions and depressions, firms are likely to hire fewer workers or let existing workers go.

* When the economy recovers, many of these cyclically unemployed workers will again find work.

38

New cards

Seasonal Unemployment

* The result of changes in hiring patterns due to the time of year

* Ex: ski instructors and lifeguards

* Ex: ski instructors and lifeguards

39

New cards

Discouraged Workers

* Those who are willing and able to work, but become so frustrated in their attempts to find work that they stop trying

* Do not count as part of the unemployment rate

* Do not count as part of the unemployment rate

40

New cards

Dishonest Workers

* Bias the unemployment rate upward

* These individuals claim to be unemployed in order to receive unemployment benefits when, in fact, they do not want a job or are working for cash in an unreported job.

* These individuals claim to be unemployed in order to receive unemployment benefits when, in fact, they do not want a job or are working for cash in an unreported job.

41

New cards

Natural Rate of Unemployment

* The typical rate of unemployment in a normally functioning economy

* About 5% in the U.S.

* The sum of frictional and structural unemployment

* About 5% in the U.S.

* The sum of frictional and structural unemployment

42

New cards

Full Employment

* *Not* 100 percent employment, but the level of employment that corresponds with the natural rate of unemployment

* No cyclical unemployment

* No cyclical unemployment

43

New cards

Okun’s Law

Economists, including the late Arthur Okun, have estimated that for every one percentage point increase in the unemployment rate above the natural rate, output falls by 2 to 3 percentage points

44

New cards

Inflation

A sustained increase in the overall price level

45

New cards

Deflation

The opposite of inflation- a sustained decrease in the general price level

46

New cards

Nominal Salary

The actual number of dollars

47

New cards

Real Salary

The purchasing power of the dollars

48

New cards

Money Illusion

When someone notes an increase in their salary but not the general price of goods. Can lead to excessive spending.

49

New cards

Menu Costs

Costs to change price listings on signs, shelves, computers, and wherever else they are recorded to keep up with inflation

50

New cards

Detrimental Effects of Inflation

* People on fixed income or income that grows at a slower rate than that of the inflation are at a loss

* Interest rates do not increase with inflation hurting lenders and savers

* Causes social tensions

* Costs in time and effort (ex: dropping by the ATM to withdraw more cash)

* Standard monetary unit of measurement is unstable

* Sustained inflation can drastically increase the money supply

* Interest rates do not increase with inflation hurting lenders and savers

* Causes social tensions

* Costs in time and effort (ex: dropping by the ATM to withdraw more cash)

* Standard monetary unit of measurement is unstable

* Sustained inflation can drastically increase the money supply

51

New cards

Benefits of Inflation

Those who borrowed money at fixed interest rates pay back amounts that are worth less in real terms due to inflation.

52

New cards

Nominal Interest

Actual interest payment in dollars

53

New cards

Real Interest

The purchasing power of an interest payment

54

New cards

Price Indices

Used to measure inflation and adjust nominal values for inflation to find real values

55

New cards

Consumer Price Index (CPI)

* The government’s gauge of inflation. It is used, for example, to adjust tax brackets and social security payments for inflation.

* To find it, the Bureau of Labor Statistics checks the prices of items in a fixed representative “market basket” of thousands of goods and services used by typical consumers in a base year.

* To find it, the Bureau of Labor Statistics checks the prices of items in a fixed representative “market basket” of thousands of goods and services used by typical consumers in a base year.

56

New cards

The CPI is calculated as

Cost of base year market basket at current prices/cost of base year market basket at base year prices x 100

57

New cards

The inflation between years Y and Z (Z being the more resent year) can be calculated using the following formula:

\[CPI in Year Z/CPI in Year Y - 1\] x 100

58

New cards

And any year’s nominal GDP (or any other nominal figure) can be converted into real base year dollars using the following formula:

Nominal GDP/CPI for the same year as the nominal figure x 100

59

New cards

Flaws in the CPI

* May overestimate the inflation rate, primarily due to to its inflexible dependency on the base year market basket

* Because it relies on a fixed market basket, substitutions for less expensive goods and services are not accounted for in its measure of inflation

* Quality improvements and price changes in new products that were not in the base year basket are also excluded

* Because it relies on a fixed market basket, substitutions for less expensive goods and services are not accounted for in its measure of inflation

* Quality improvements and price changes in new products that were not in the base year basket are also excluded

60

New cards

Producer Price Index (PPI)

* Similar in calculations to the CPI, but it applies to the prices of wholesale goods such as lumber and steel

* Sometimes a good predictor of future inflation because producers often pass their cost increases to consumers

* Sometimes a good predictor of future inflation because producers often pass their cost increases to consumers

61

New cards

Gross Domestic Product Deflator

An alternative general price index that reflects the importance of products in current market baskets, rather than in base year market baskets, which become less relevant over time

62

New cards

GDP Deflator =

Cost of current year market basket at current prices/Cost of current year market basket at base year prices x 100

63

New cards

GDP Deflator usually registers a…

lower inflation rate than the CPI because it accounts for substitutions of higher priced goods and services.

64

New cards

The value of the GDP Deflator can be substituted

for CPI values in the formulas for inflation and real GDP

65

New cards

Business Cycle

* A recurrent fluctuation of financial and economic activity, which occurs non-periodically within a certain period of time

* Also called an Economic or Trade Cycle

* Also called an Economic or Trade Cycle

66

New cards

Business cycles reflect the accelerations and decelerations in significant economic variables, such as:

Product, income, or employment

67

New cards

What is used to measure business cycles?

Growth rates of GDP

68

New cards

Classical Economists

Theorize that wages, prices, and interest rates fluctuate quickly, clearing (bringing to equilibrium) labor and capital markets, and allowing input and output prices to stay in line with each other

69

New cards

Say’s Law

* The idea that supply creates its own demand

* When supplying goods, workers can earn money to spend or save, and savings end up being borrowed and spent on business investments

* Classical economists believe this

* When supplying goods, workers can earn money to spend or save, and savings end up being borrowed and spent on business investments

* Classical economists believe this

70

New cards

Classical Economics

There should be no problem finding demand for the goods and services produced, because the income from making them will be spent purchasing them.

71

New cards

Classical Economics

Supports the classical contention that the government does not need to concern itself with policies that maintain demand at a desirable level.

72

New cards

Critics of Say’s law argue that…

Savings might not equal investment, because the interest rate does not fluctuate freely enough to clear the capital market

73

New cards

John Maynard Keynes

Argued that investment demand depends more on expectations about the prosperity of the economy than on interest rates

74

New cards

If savings exceed investment…

* Some of the nation’s real GDP will not be purchased

* Firm inventories will expand

* Resulting in layoffs and subsequent production below full employment output

* Firm inventories will expand

* Resulting in layoffs and subsequent production below full employment output

75

New cards

If savings are less than investments…

* Expenditures will exceed real GDP

* Firm inventories will deplete

* Resulting in inflation and production beyond full employment output

* Firm inventories will deplete

* Resulting in inflation and production beyond full employment output

76

New cards

General Description of the Long-Run Aggregate Supply Curve

Explains that real GDP rests at Y(f) in the long run after wage adjustments have had a chance to catch up with price adjustments

77

New cards

If wages can adjust quickly, as classical theory suggests…

They will remain in line with prices, and changes in the price level will not result in changes in real GDP even in the short run

78

New cards

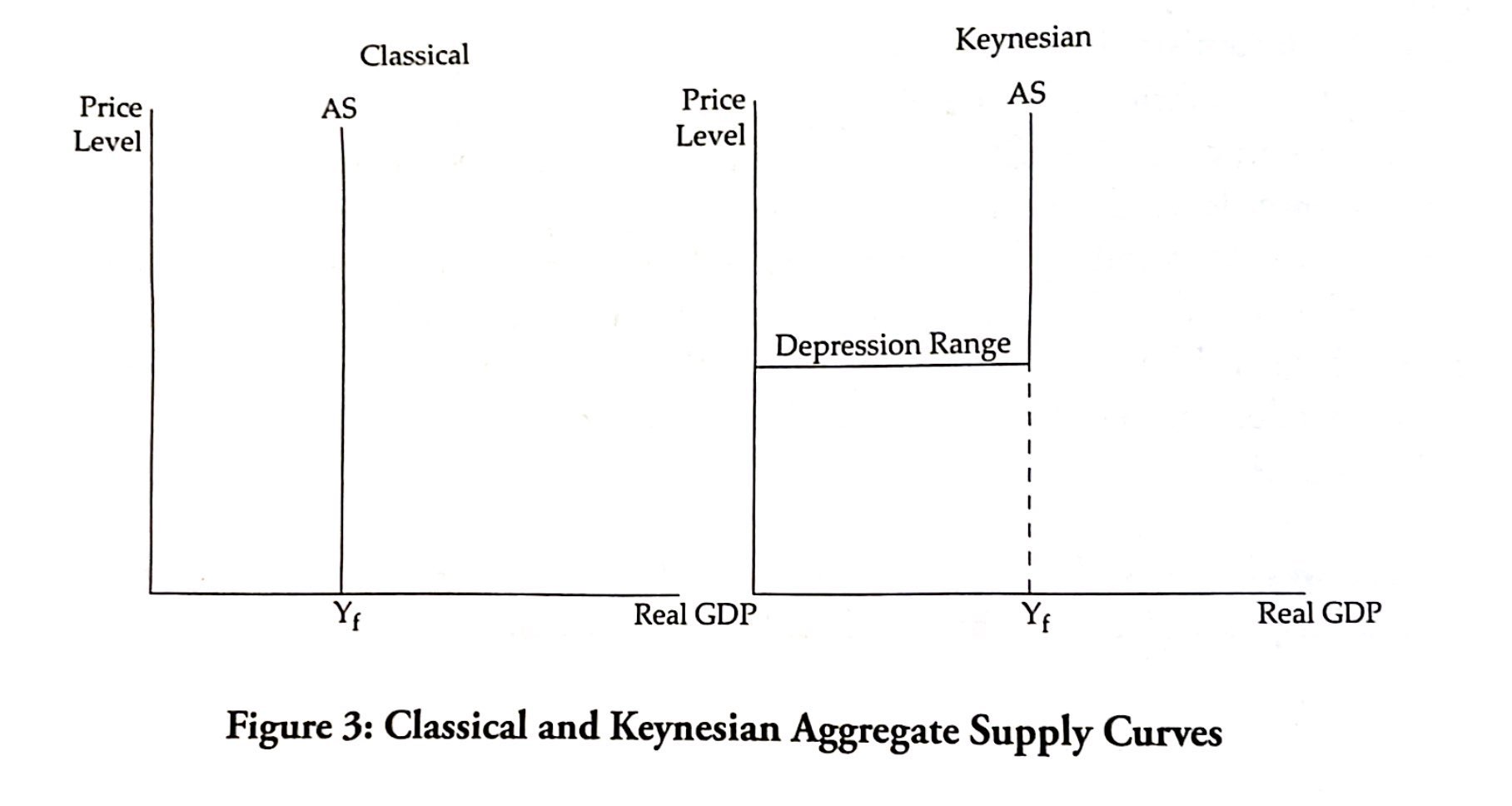

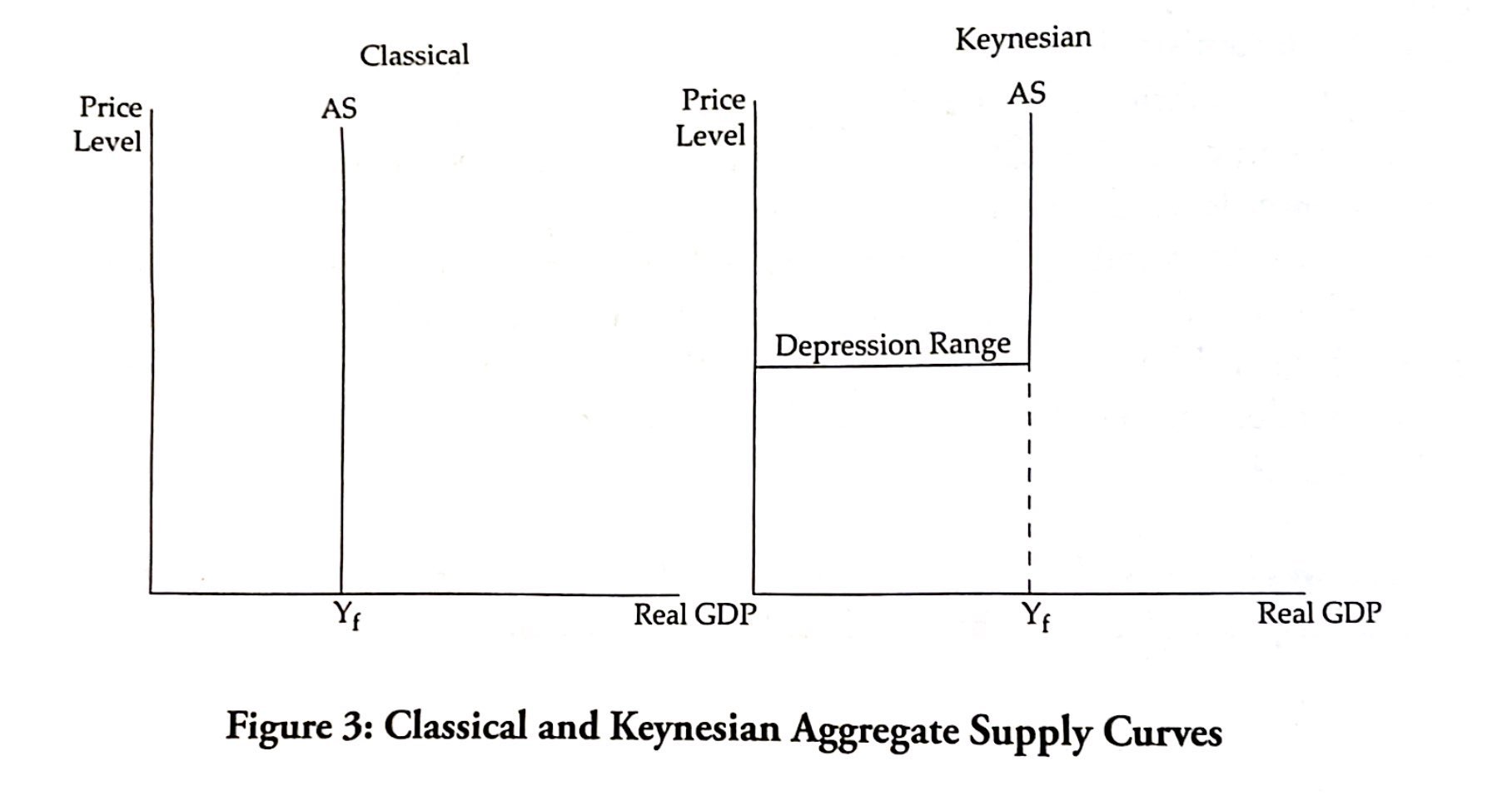

The assumption of flexible wages thus corresponds with a vertical aggregate supply curve as in the…

Left side of Figure 3

79

New cards

One result of a vertical AS is that increases in aggregate demand (due to expansionary policy or other wise) will increase the price level while having…

no effect on real GDP

80

New cards

The Keynesian AS curve is horizontal until the full-employment level of output, where it becomes vertical, as classical theory predicts.

Right side of Figure 3

81

New cards

Keynes focused on…

The horizontal “depression range” of AS where excess capacity and unemployment allow increases in output and income without forcing the price level to increase

82

New cards

Keynes blamed the existence of unemployment and the inability of the economy to self-adjust…

To full-employment output largely on “sticky” wages, particularly in the downward direction

83

New cards

Keynesians argue that wage contracts are typically adjusted no more than once a year…

And such influences as unions, tradition, and a reluctance to threaten company morale effectively prohibit decreases in wages

84

New cards

Keynesian Analysis

* If wages cannot adjust to match changes in price levels, deviations from full employment output might persist until the government steps in with monetary or fiscal policy to bolster or tame the economy.

* This is in contrast with the classical economists’ preference for laissez-faire (hands-off) governmental policy.

* This is in contrast with the classical economists’ preference for laissez-faire (hands-off) governmental policy.