AP Macroeconomics Practice 11 (Graphs Loanable Funds) - CCHS - Five Cawley

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

35 Terms

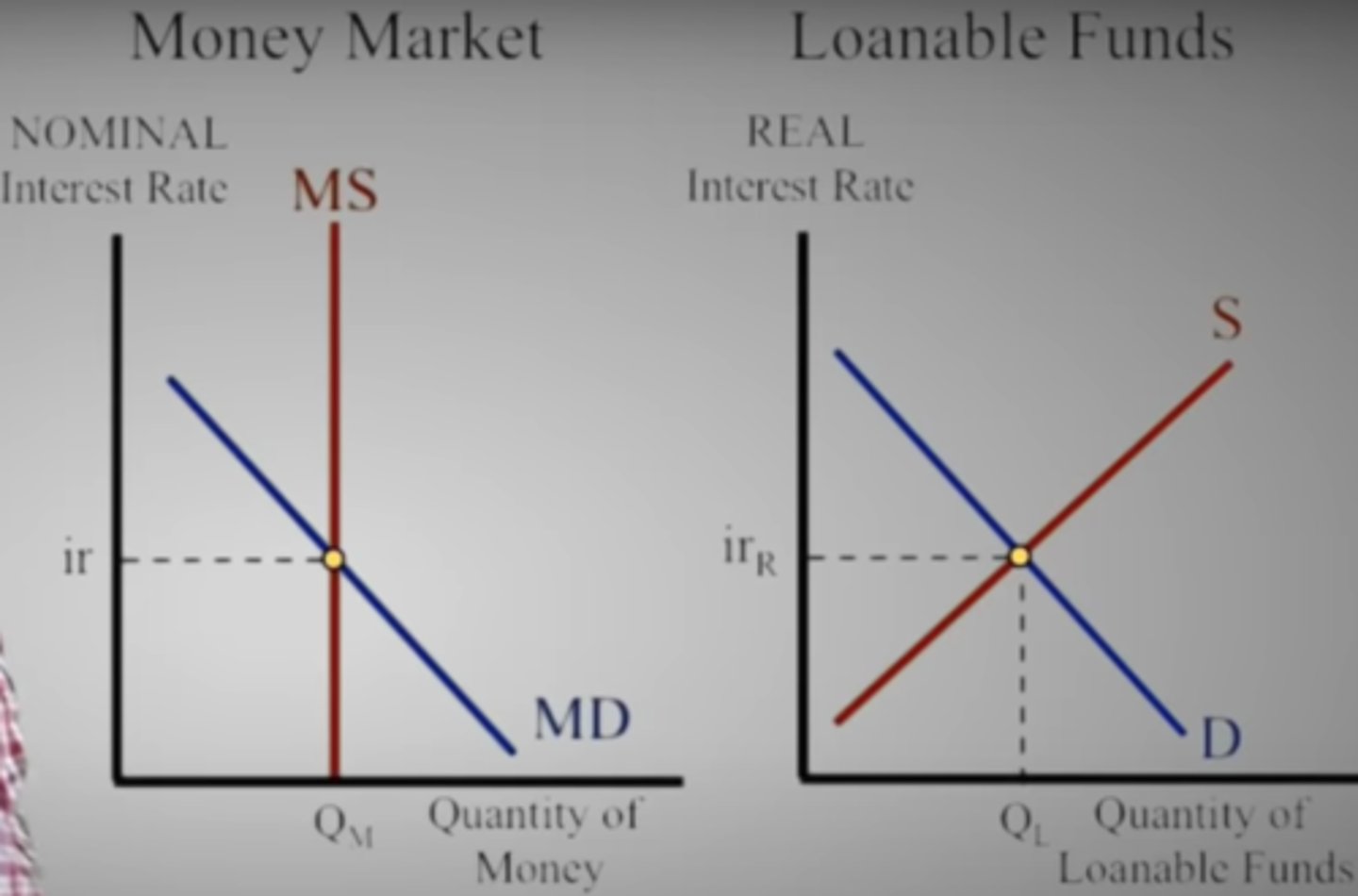

What are the two economic graphs that show interest rate?

Loanable Funds

Money Market

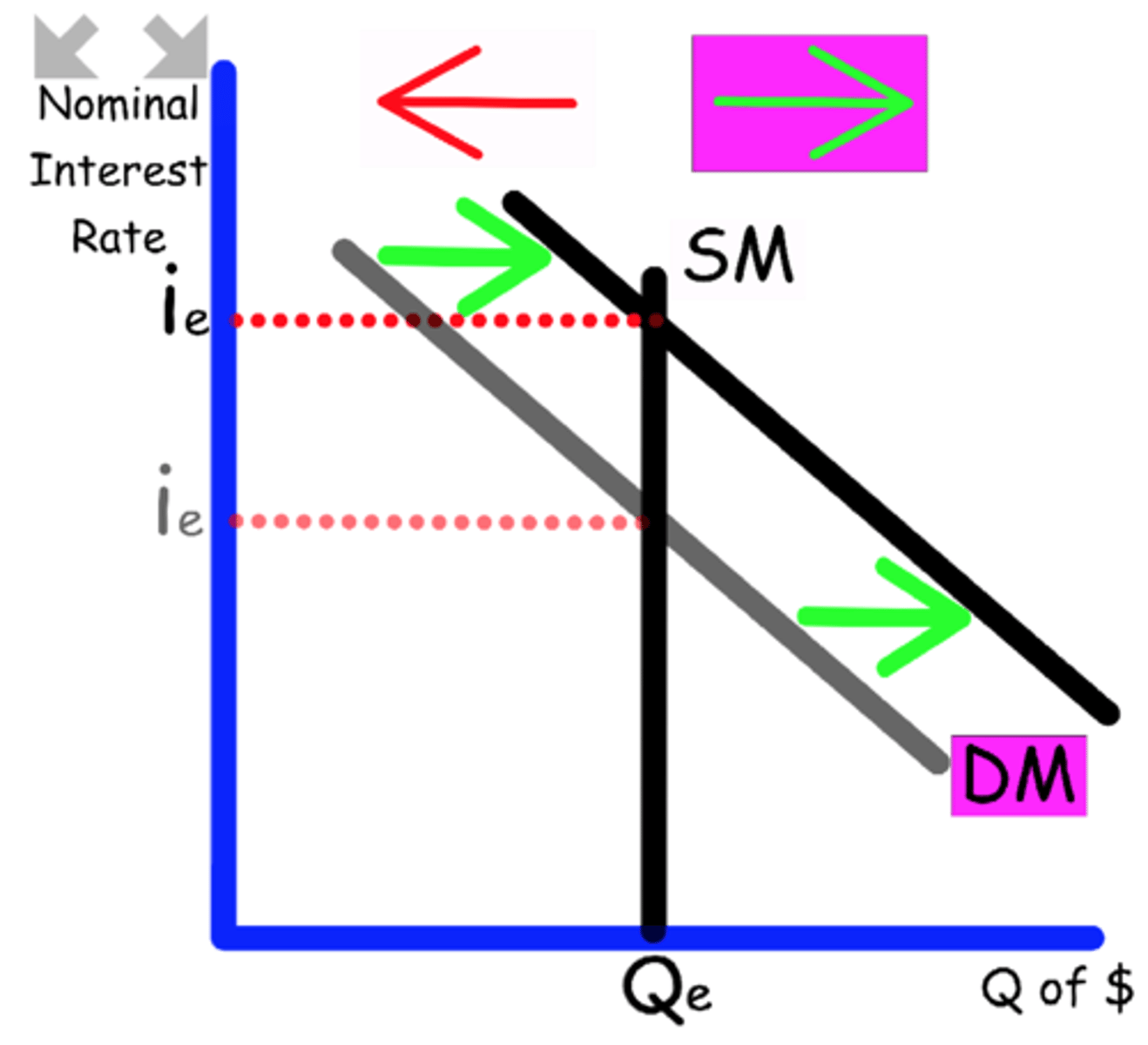

Which graph shows the nominal interest rate and impacts the short-run?

A. Loanable Funds

B. Money Market

B. Money Market

Which graph shows the real interest rate and impacts the long-run?

A. Loanable Funds

B. Money Market

A. Loanable Funds

What is the difference between nominal interest rate and real interest rate?

nominal interest rate = real interest rate + inflation rate

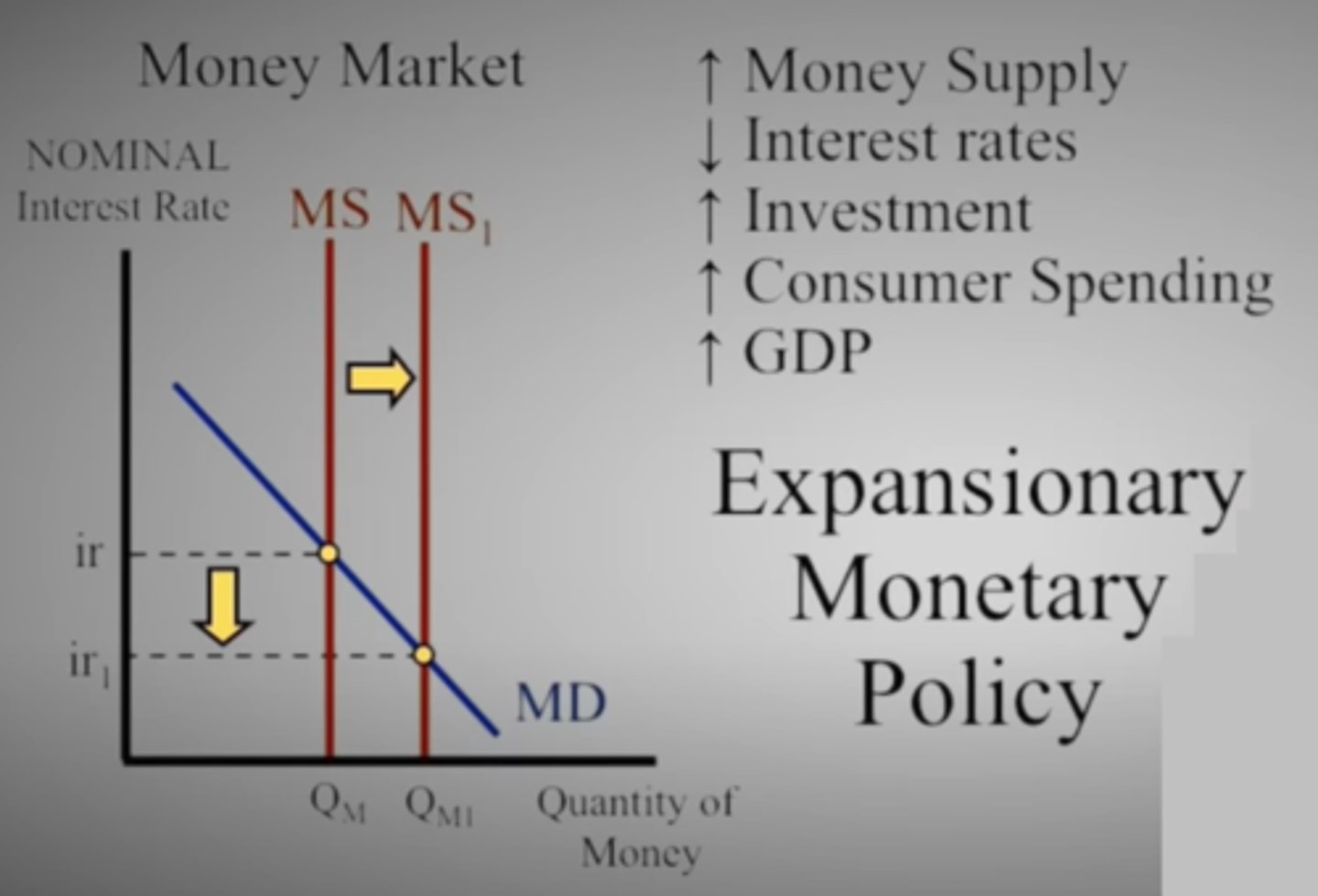

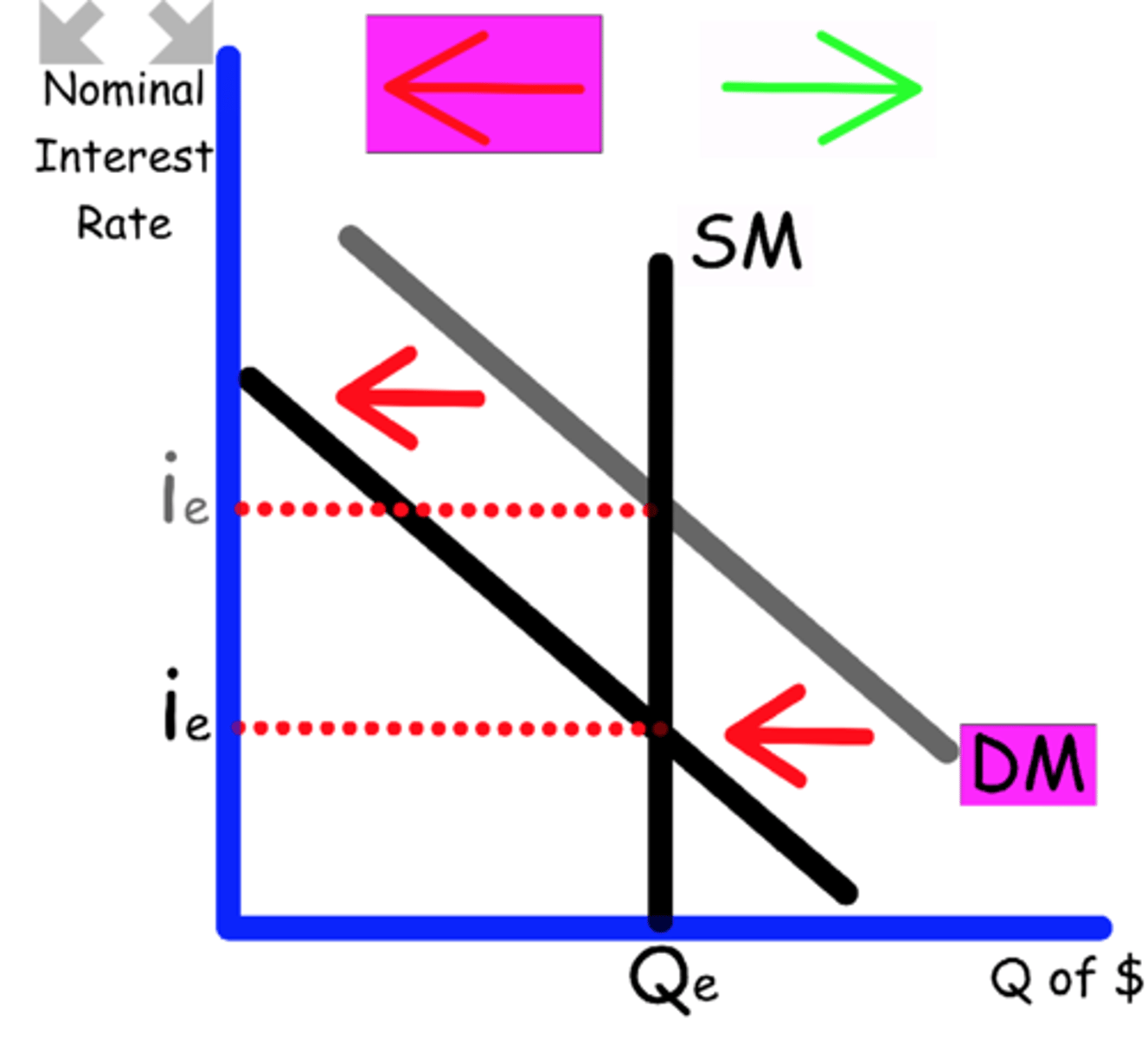

In the Money Market graph, what happens to nominal interest rates when the money supply is increased?

Nominal interest rates decrease

Investment goes up

Consumer spending goes up

GDP goes up

All Expansionary Policy

Remember - this is short-run

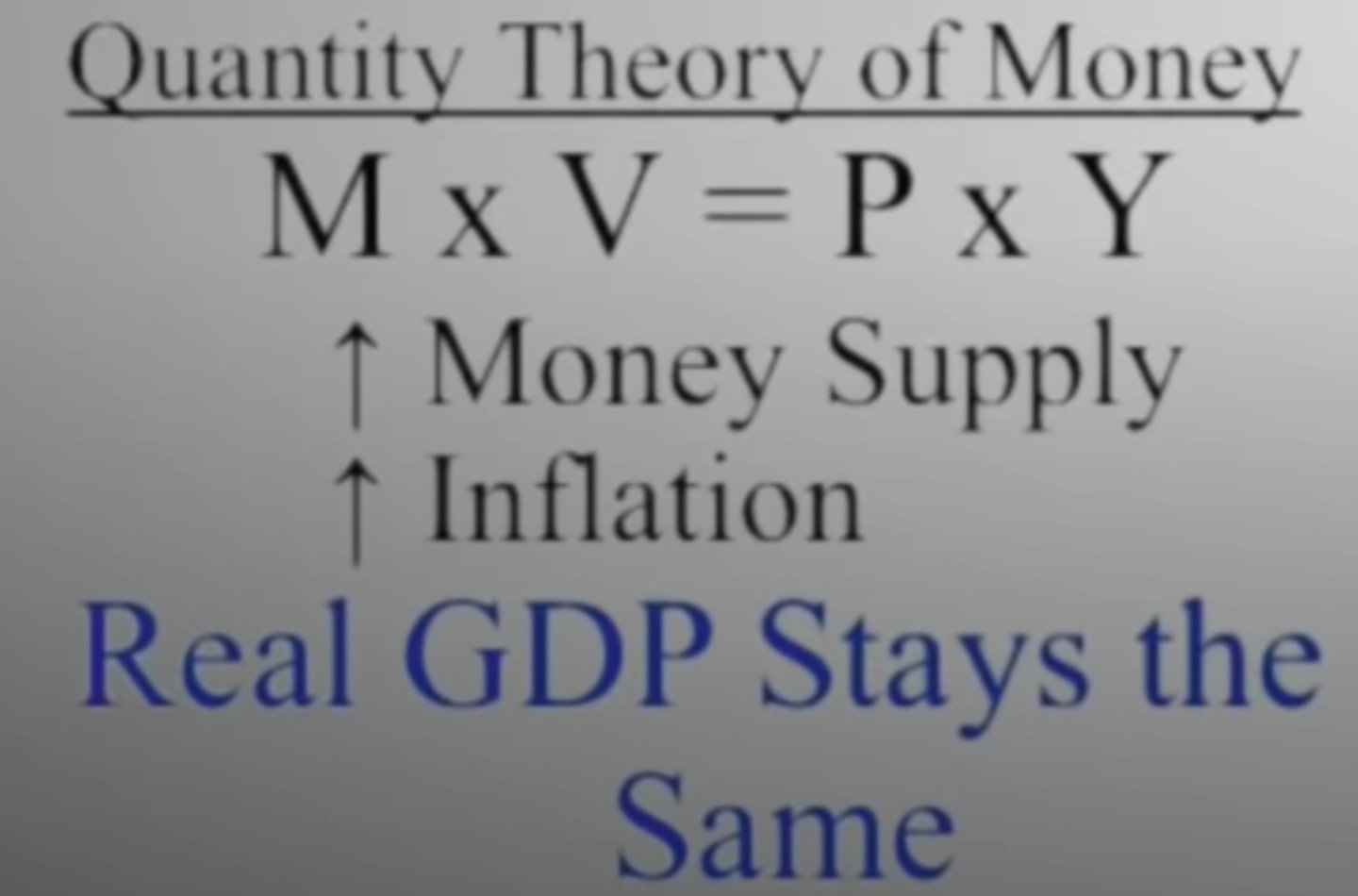

What is the Quantity of Money Theory?

The quantity of money available determines the price level and the growth rate in the quantity of money available determines the inflation rate

MV = PQ

If the money supply increase, prices will increase (inflation) and real GDP will stay the same

Remember - this is long-run

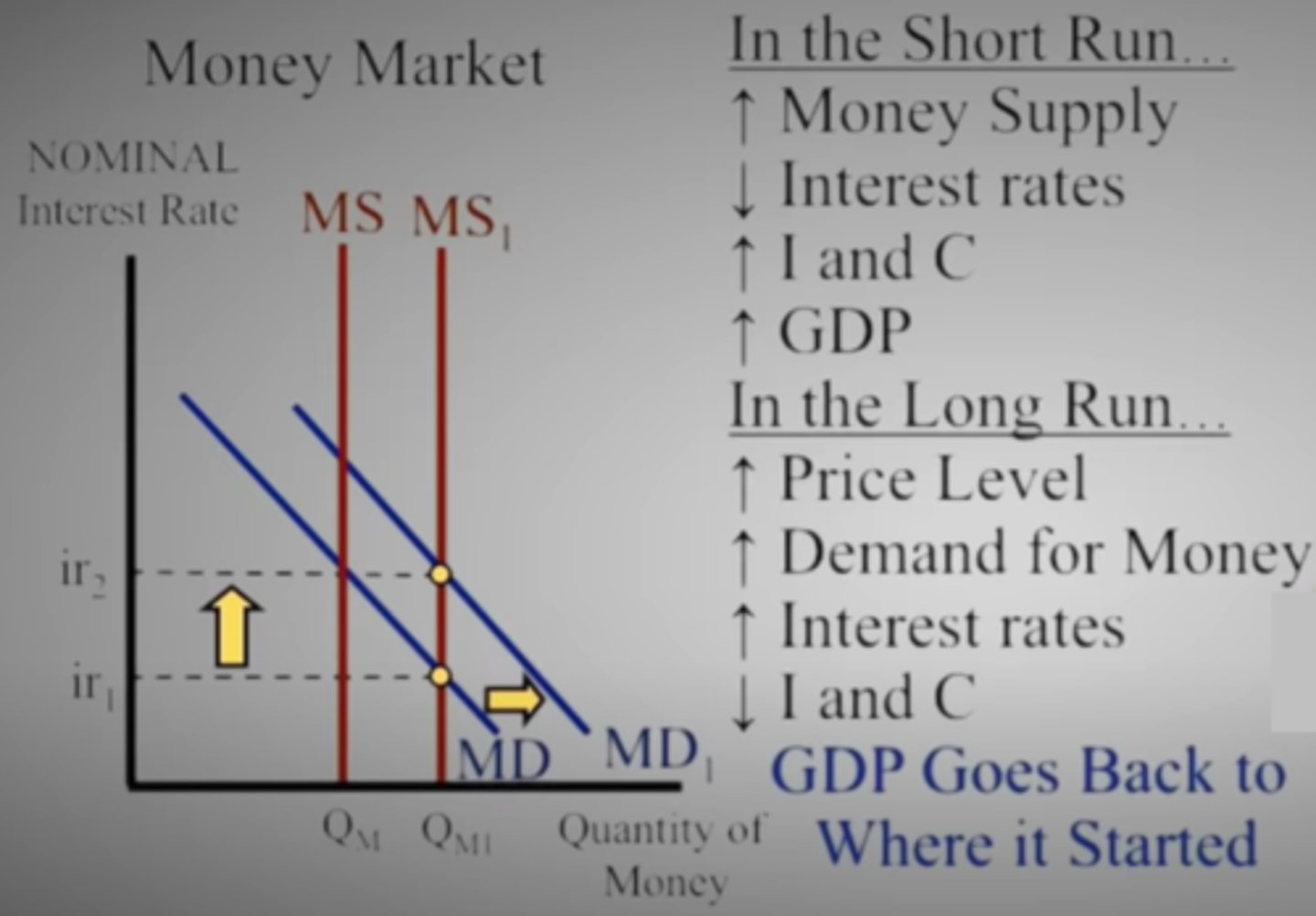

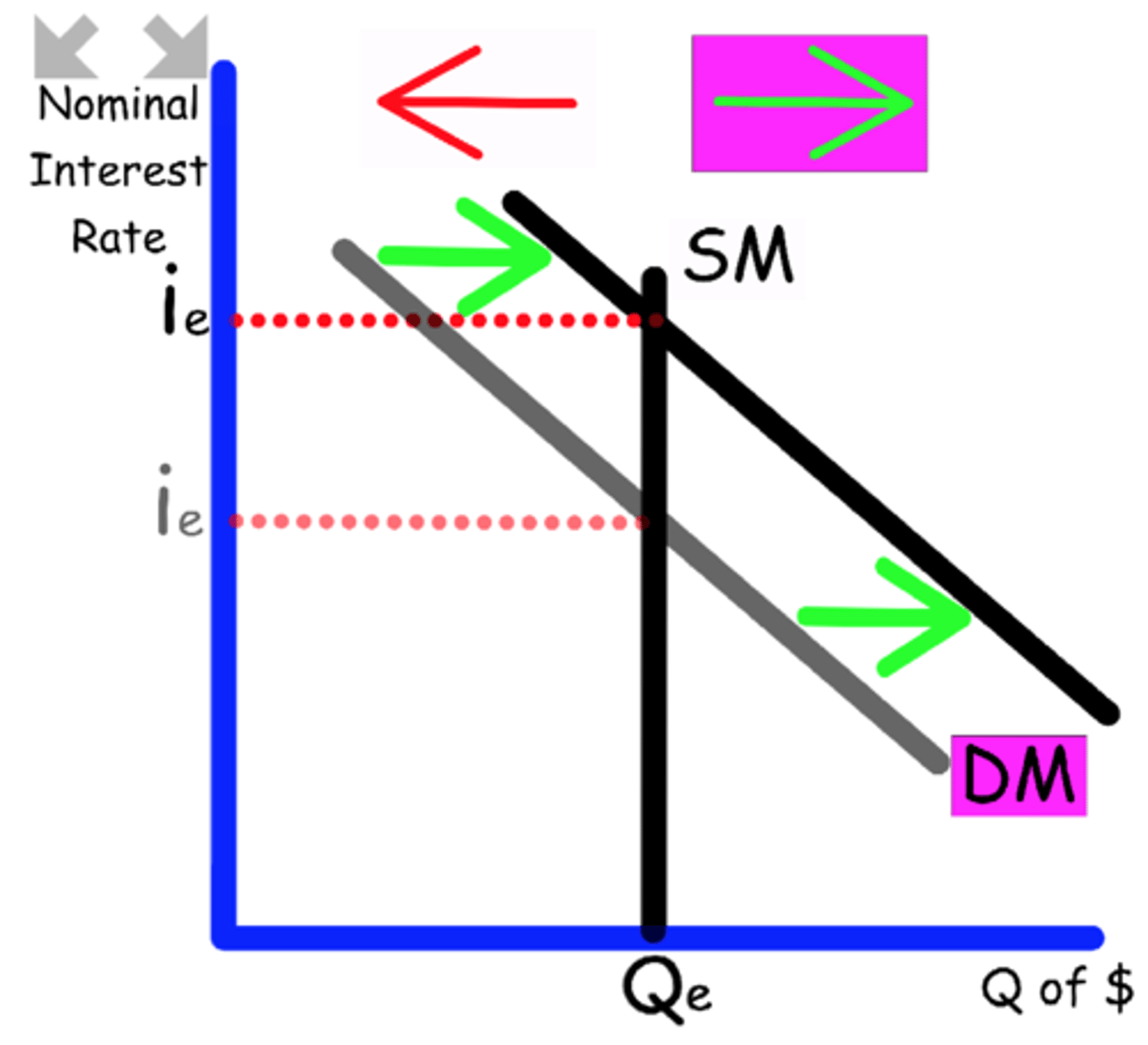

Explain how an increase in the Money Supply can increase GDP in the short-run but return GDP to equilibrium in the long-run?

The money supply will shift to the right causing the nominal interest rate to decrease.

A lower interest rate, will cause the demand for money to shift to the right in the long-run, returning GDP to equilibrium.

This matches the Quantity Theory of Money in the long-run.

What is the Fischer Effect?

An increase in expected future inflation drives up the nominal interest rate, leaving the expected real interest rate unchanged

What is the opportunity cost for holding money (say under your mattress)?

The opportunity cost for holding money is the interest rate that could have been earned if the money were saved in a CD, money market, savings account.

With higher interest rates, more money will be saved in a bank increasing loanable fund supply.

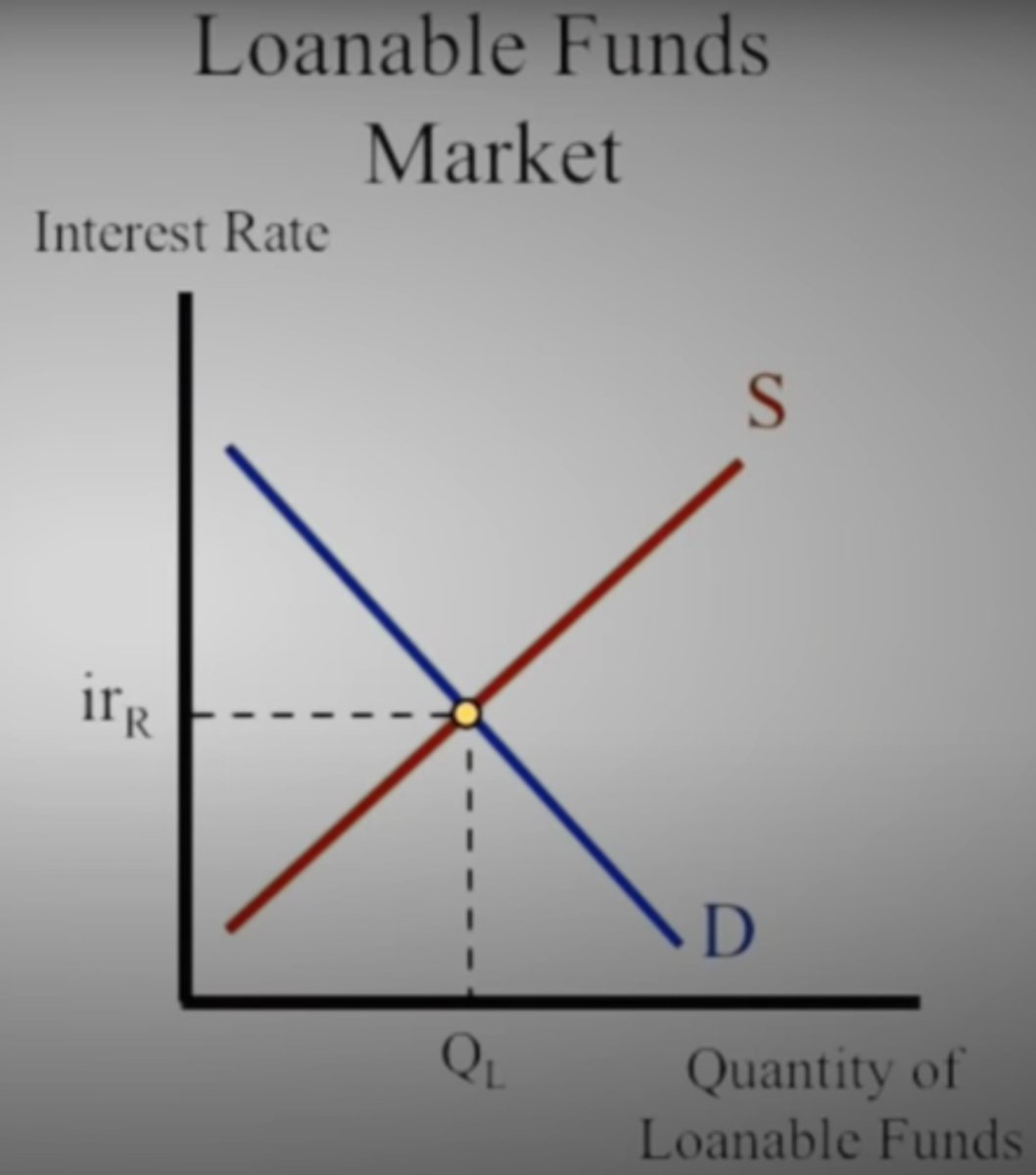

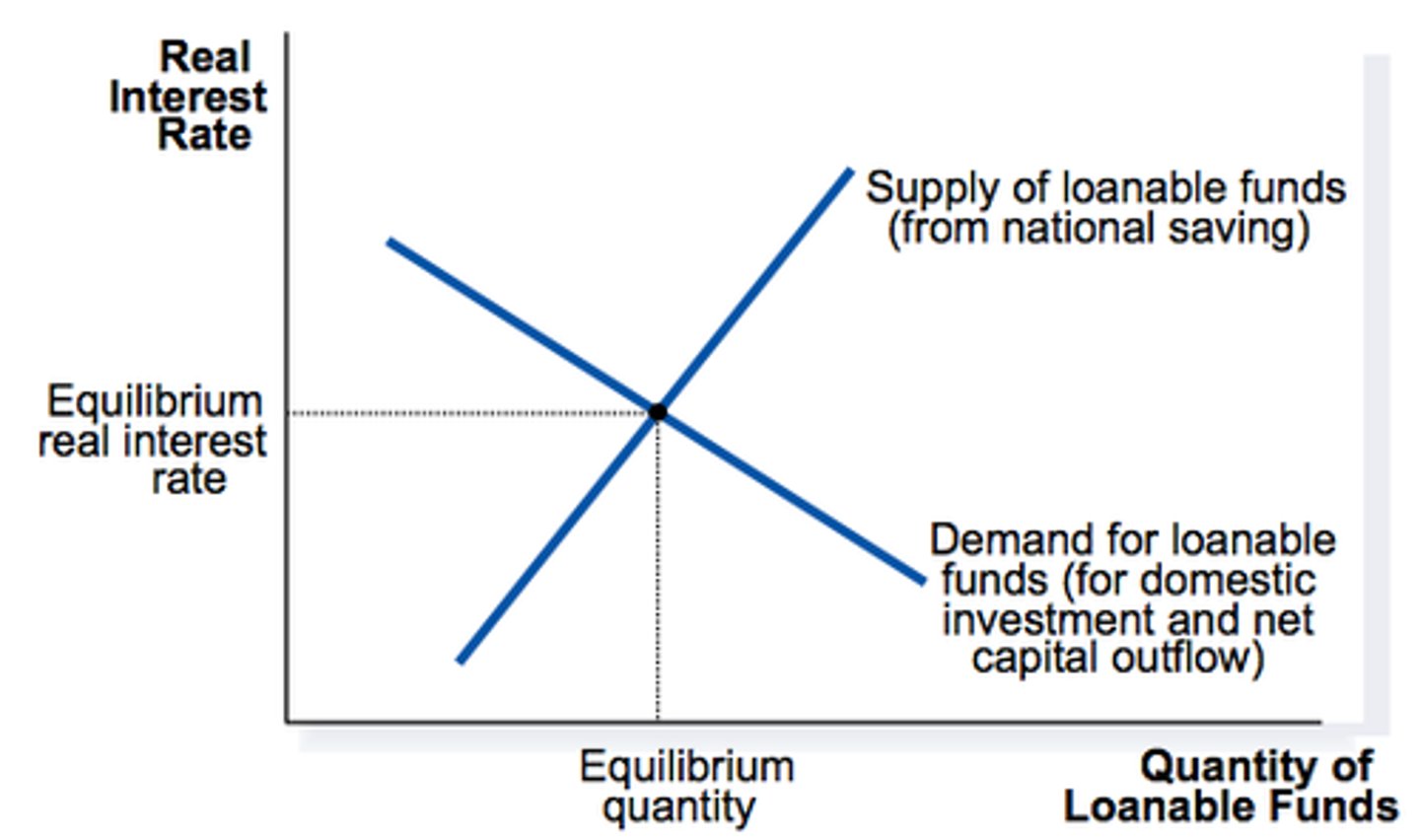

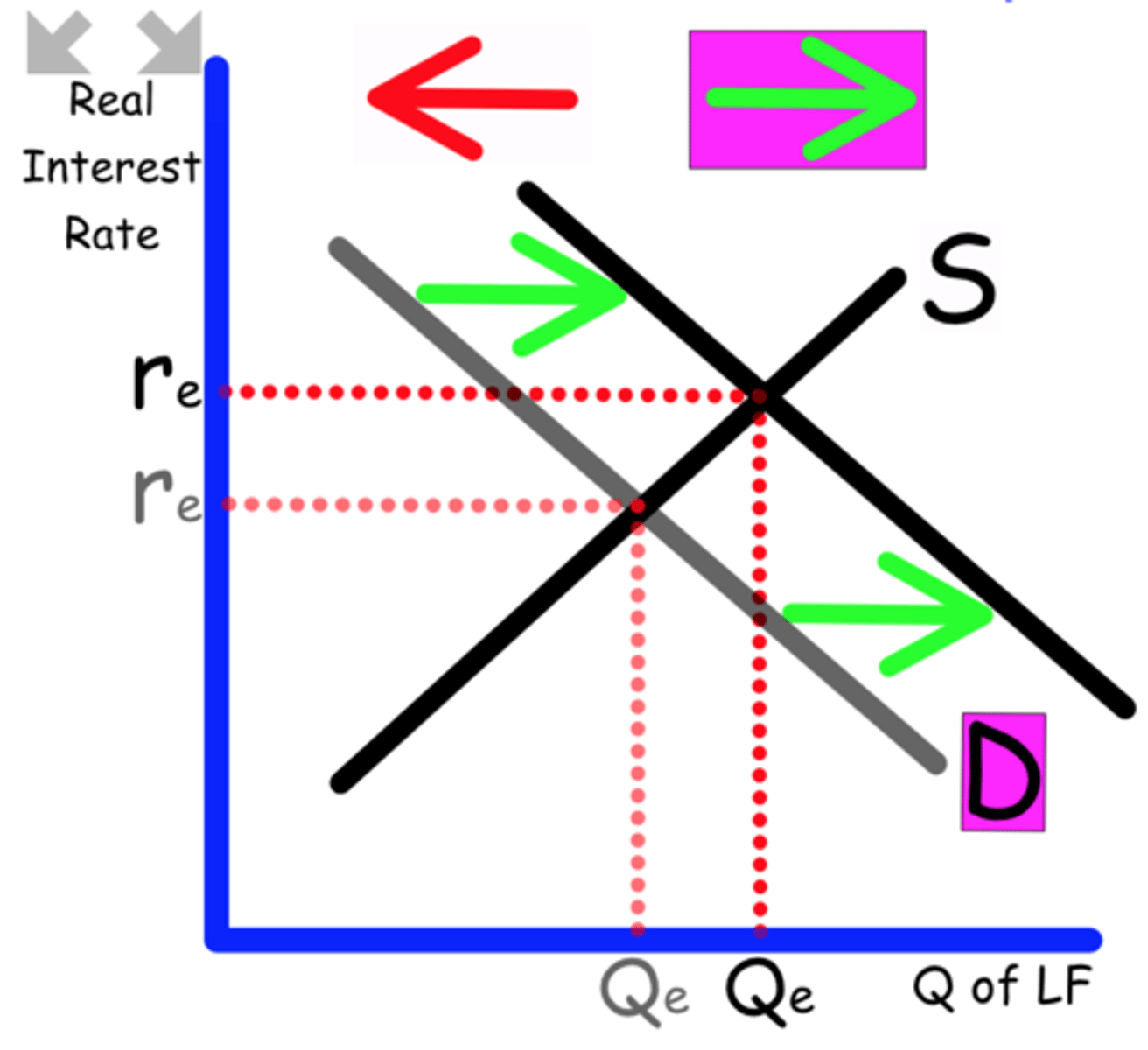

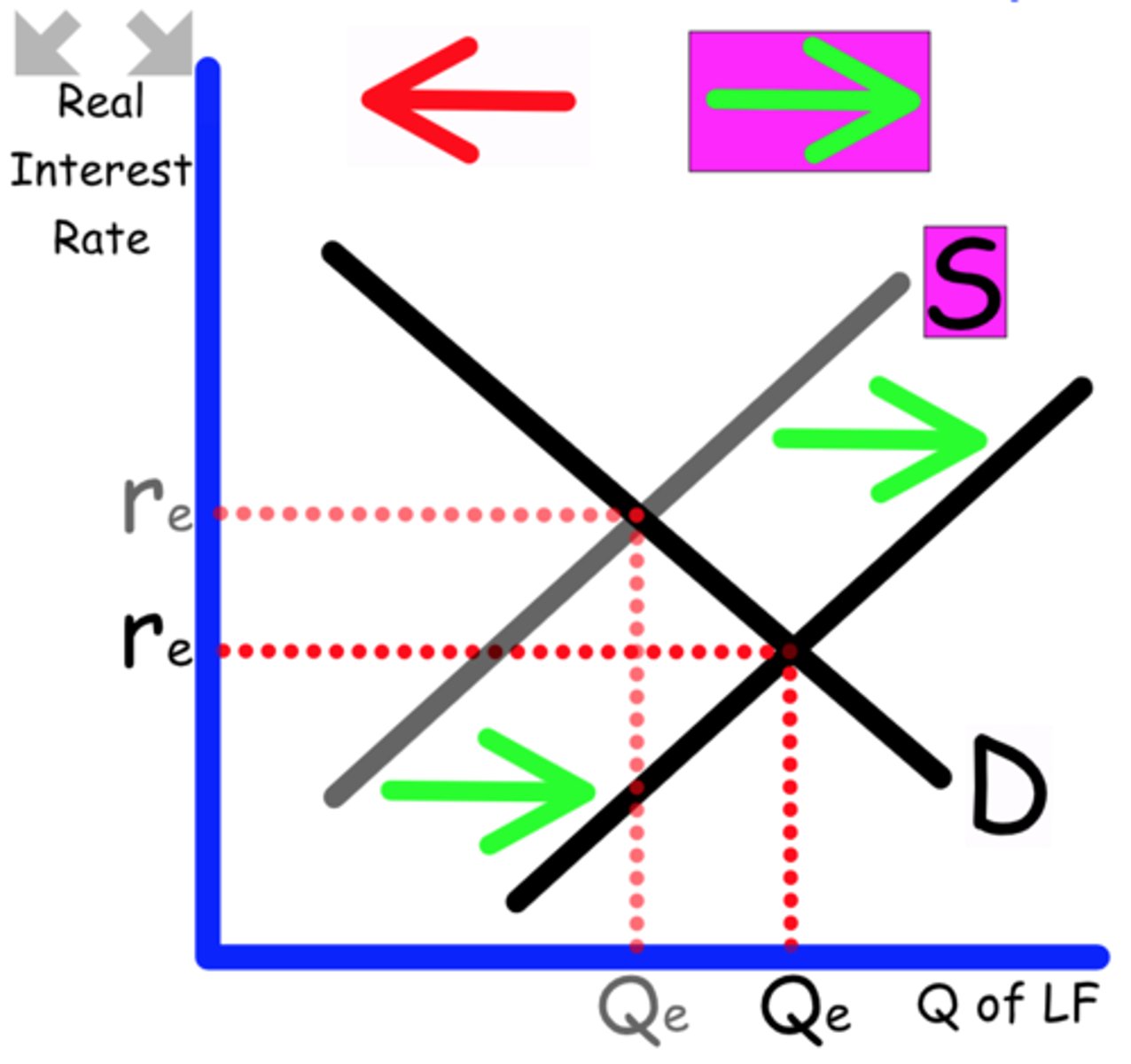

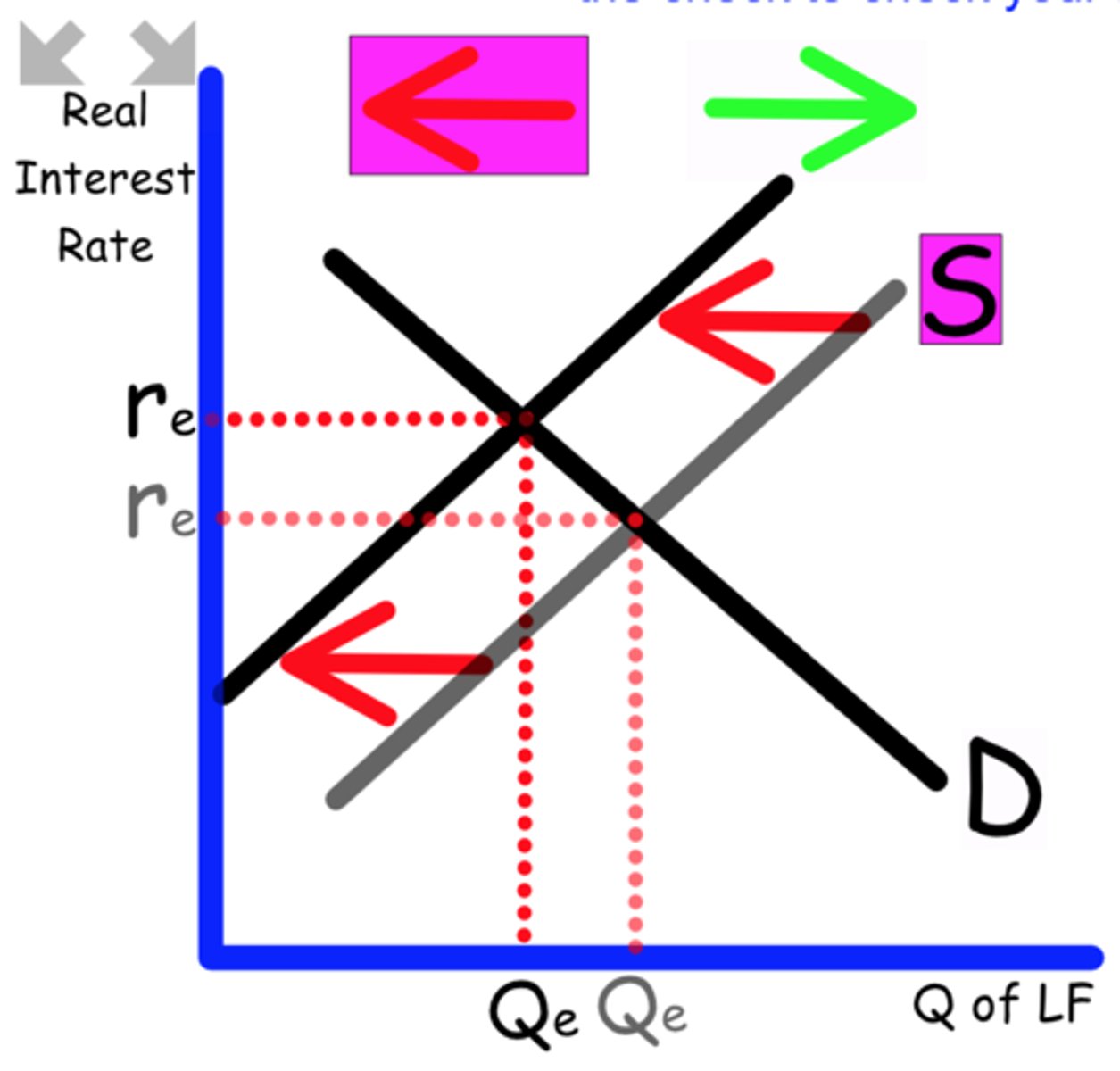

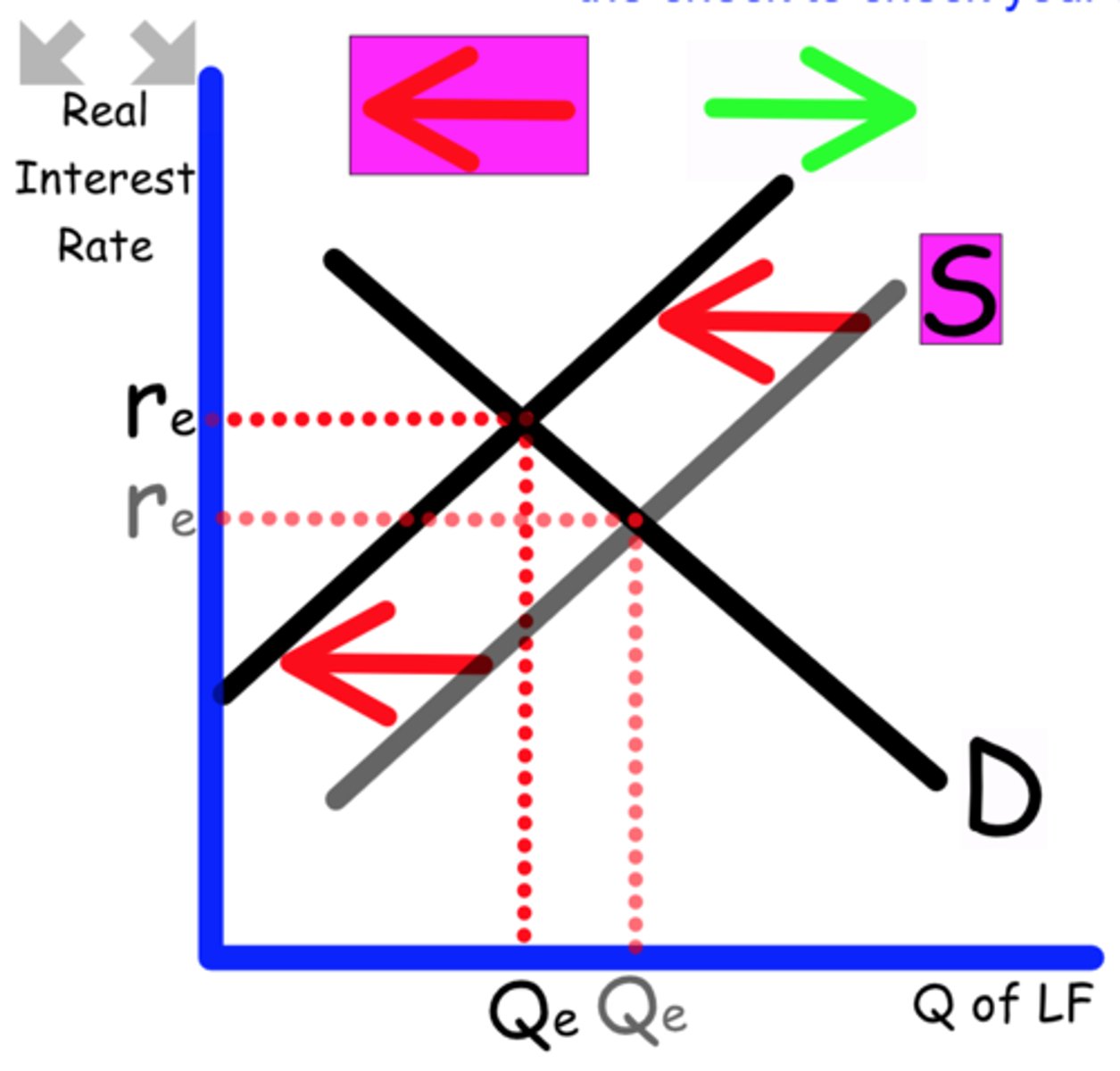

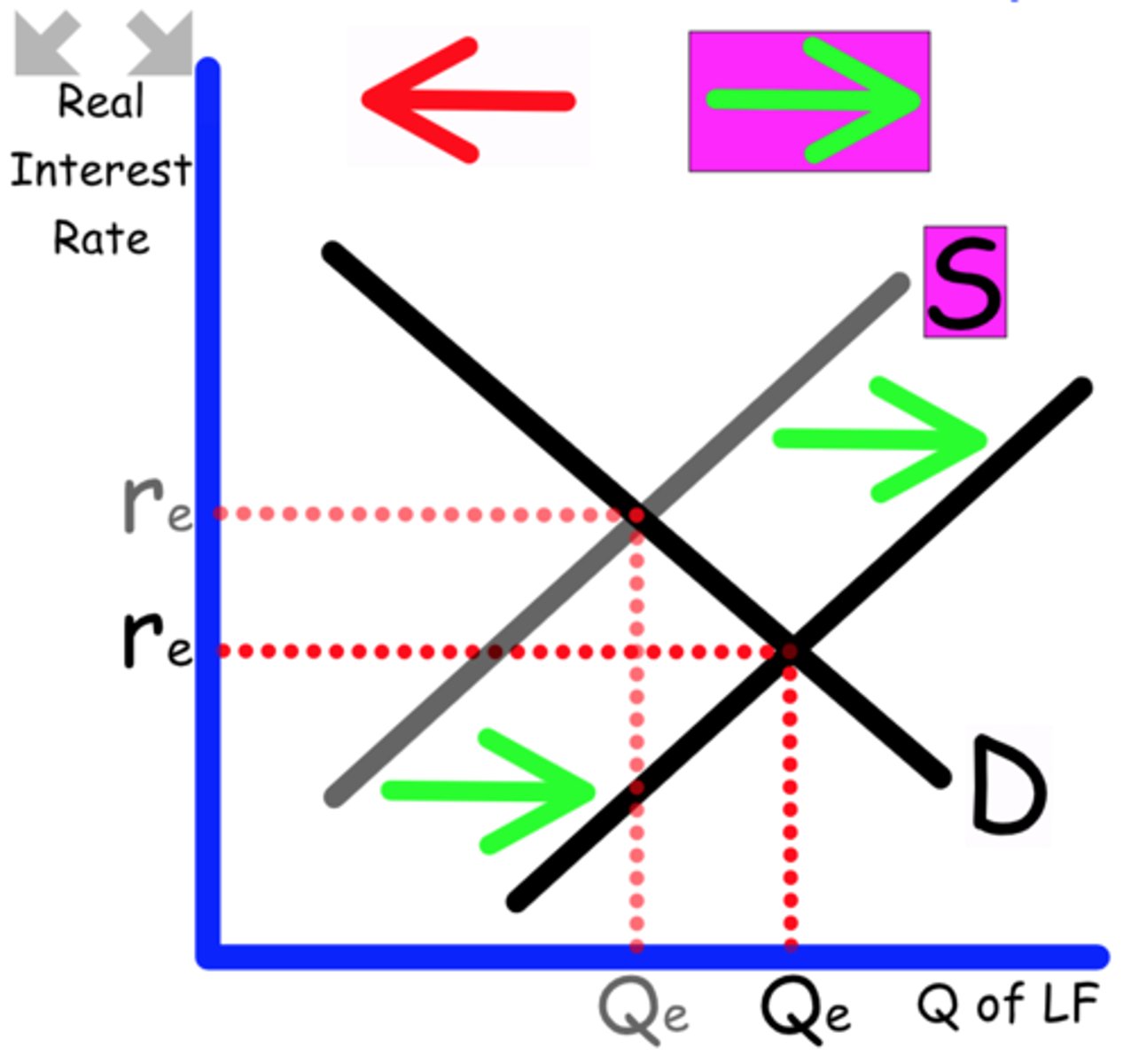

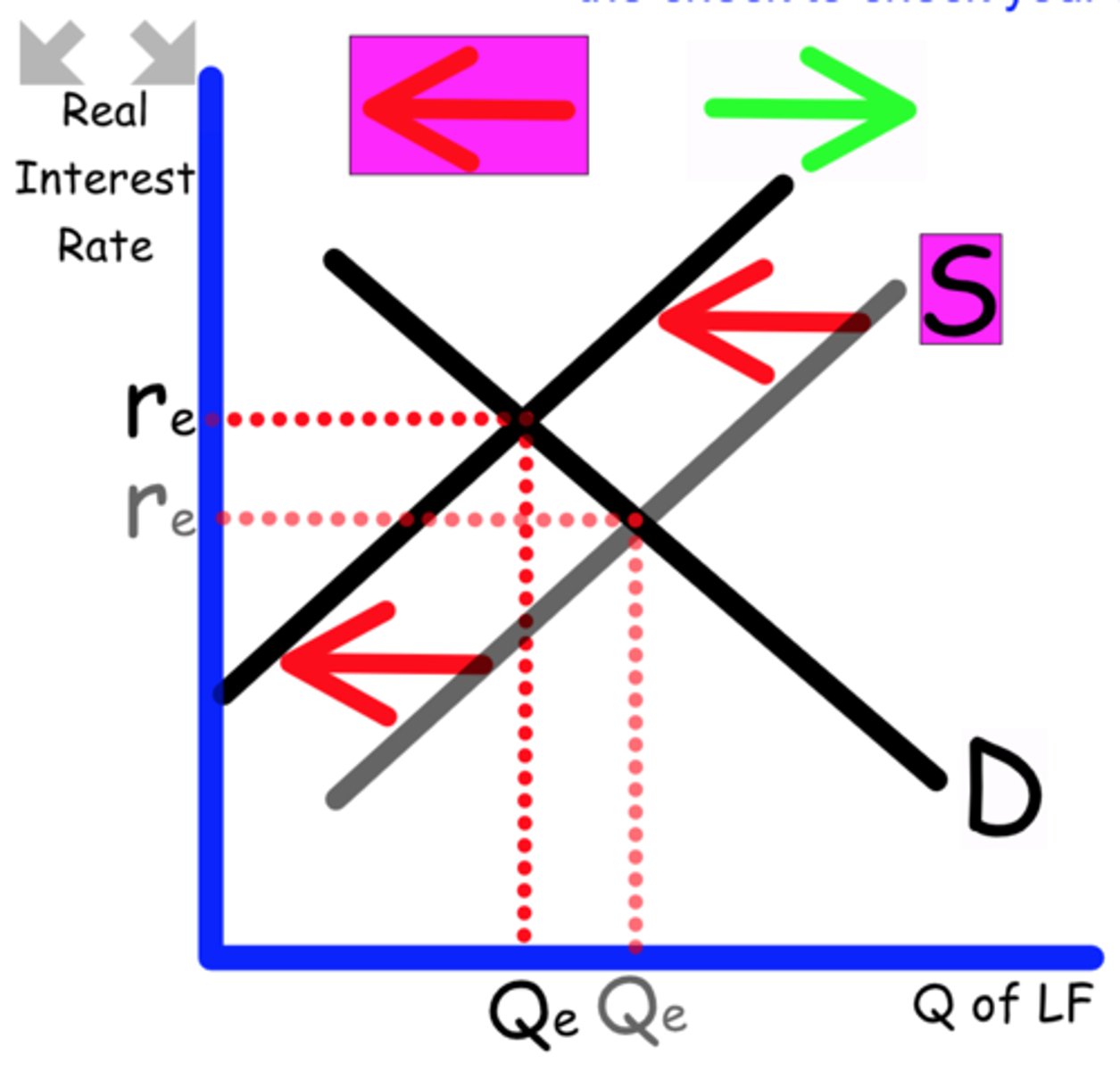

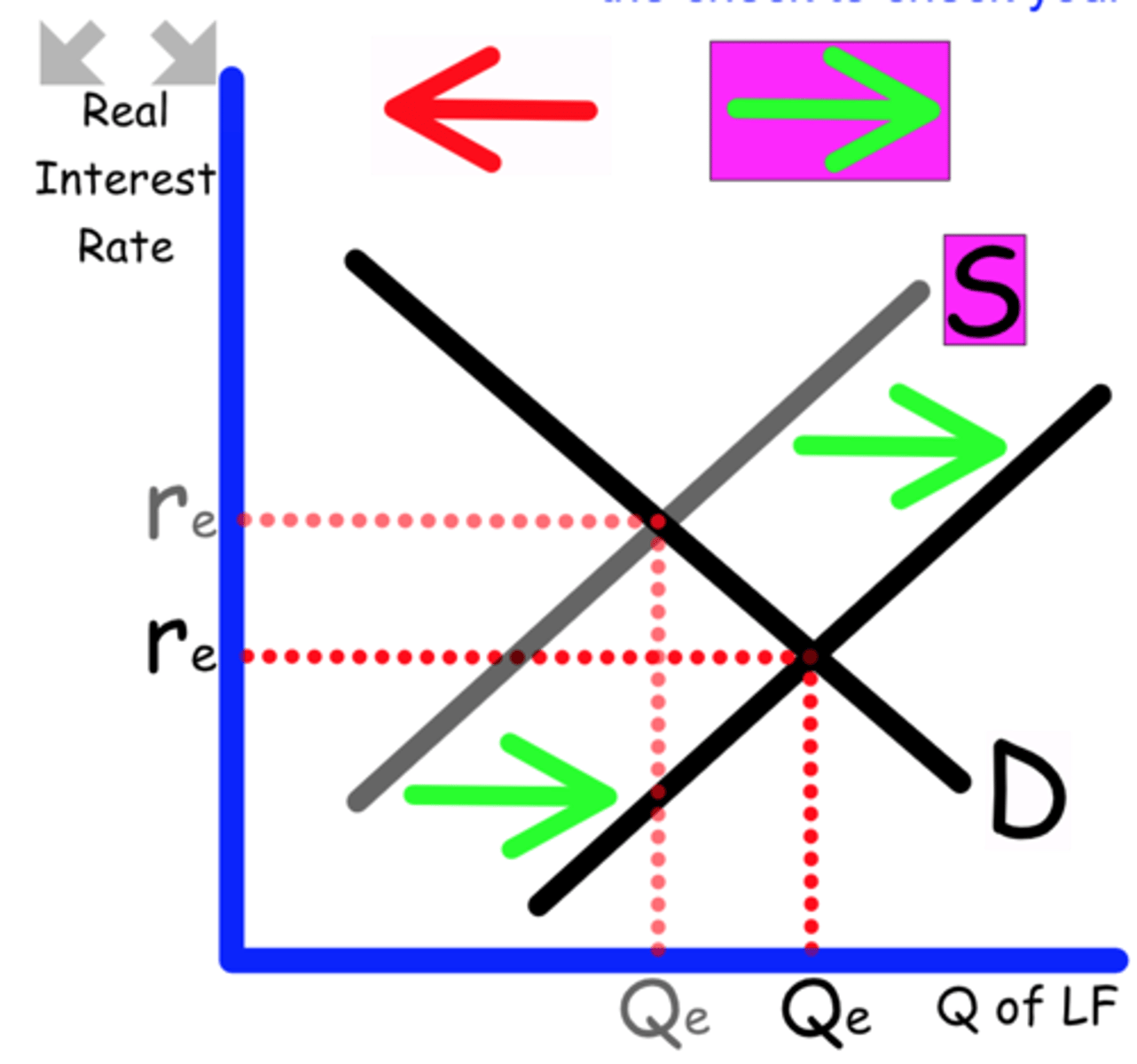

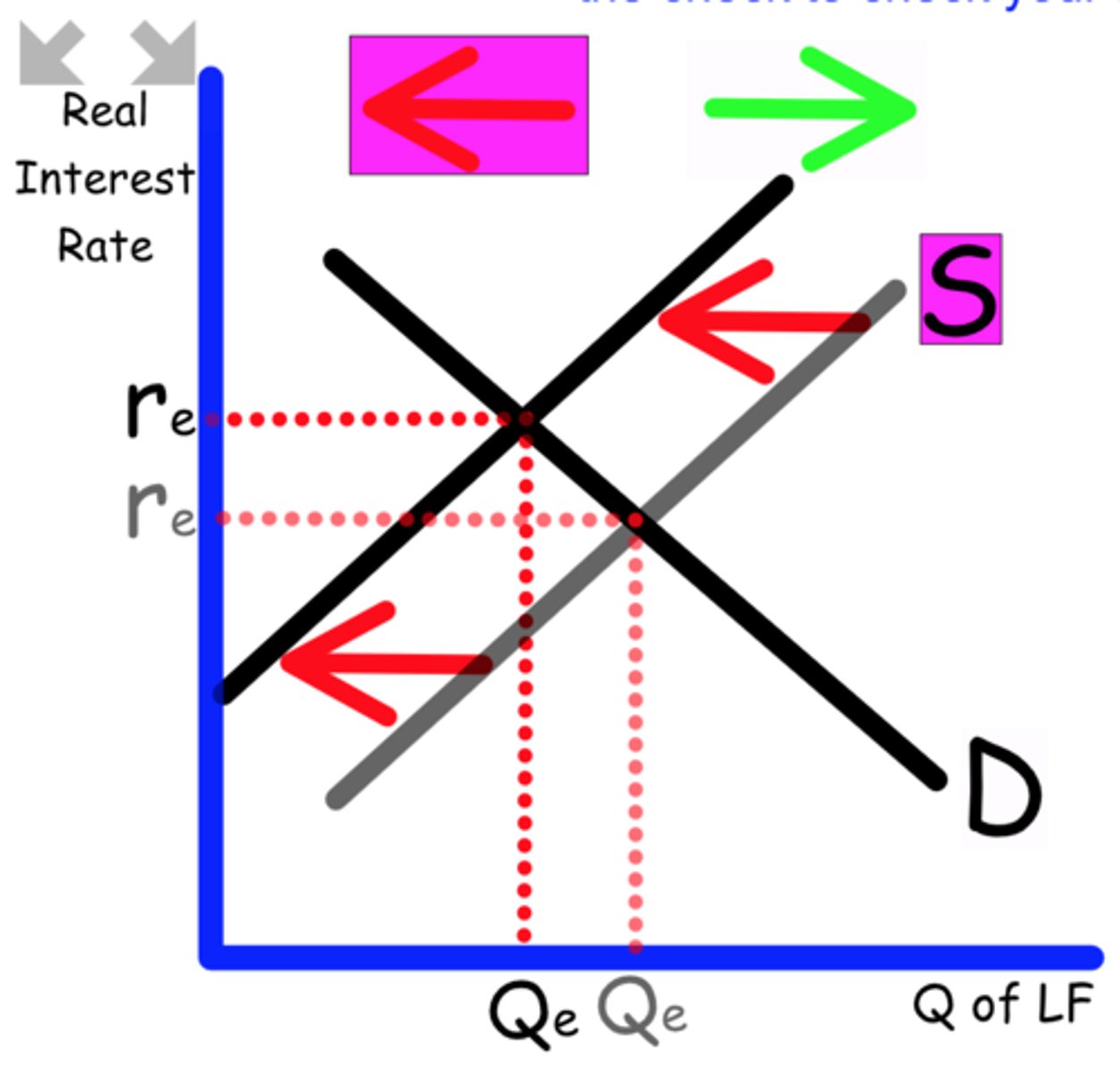

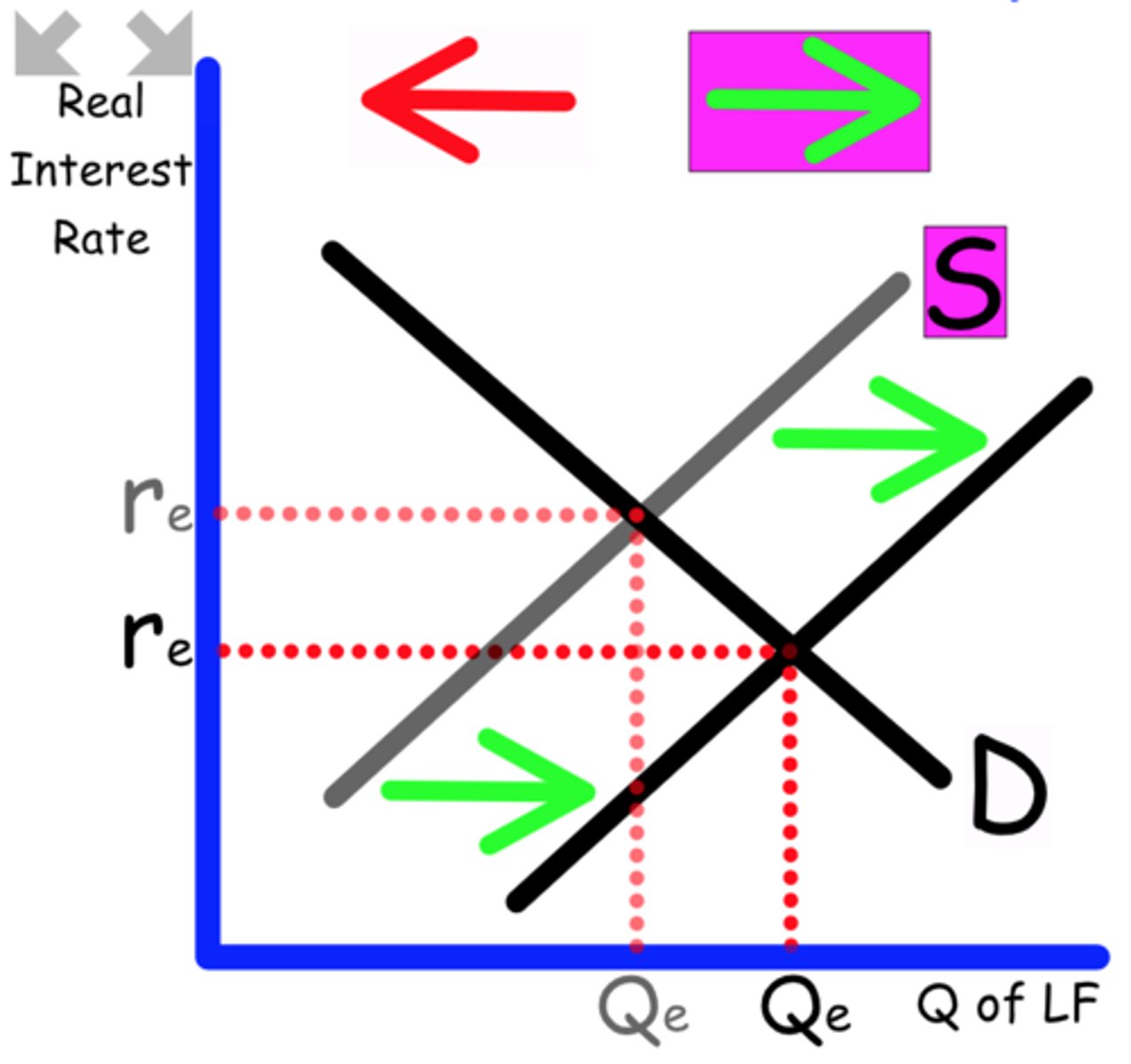

Draw and label the Loanable Funds graph with the correct interest rate.

money available for lending and borrowing

What are the three shifters of money demand in the Money Supply graph?

Price Level

Income

Technology

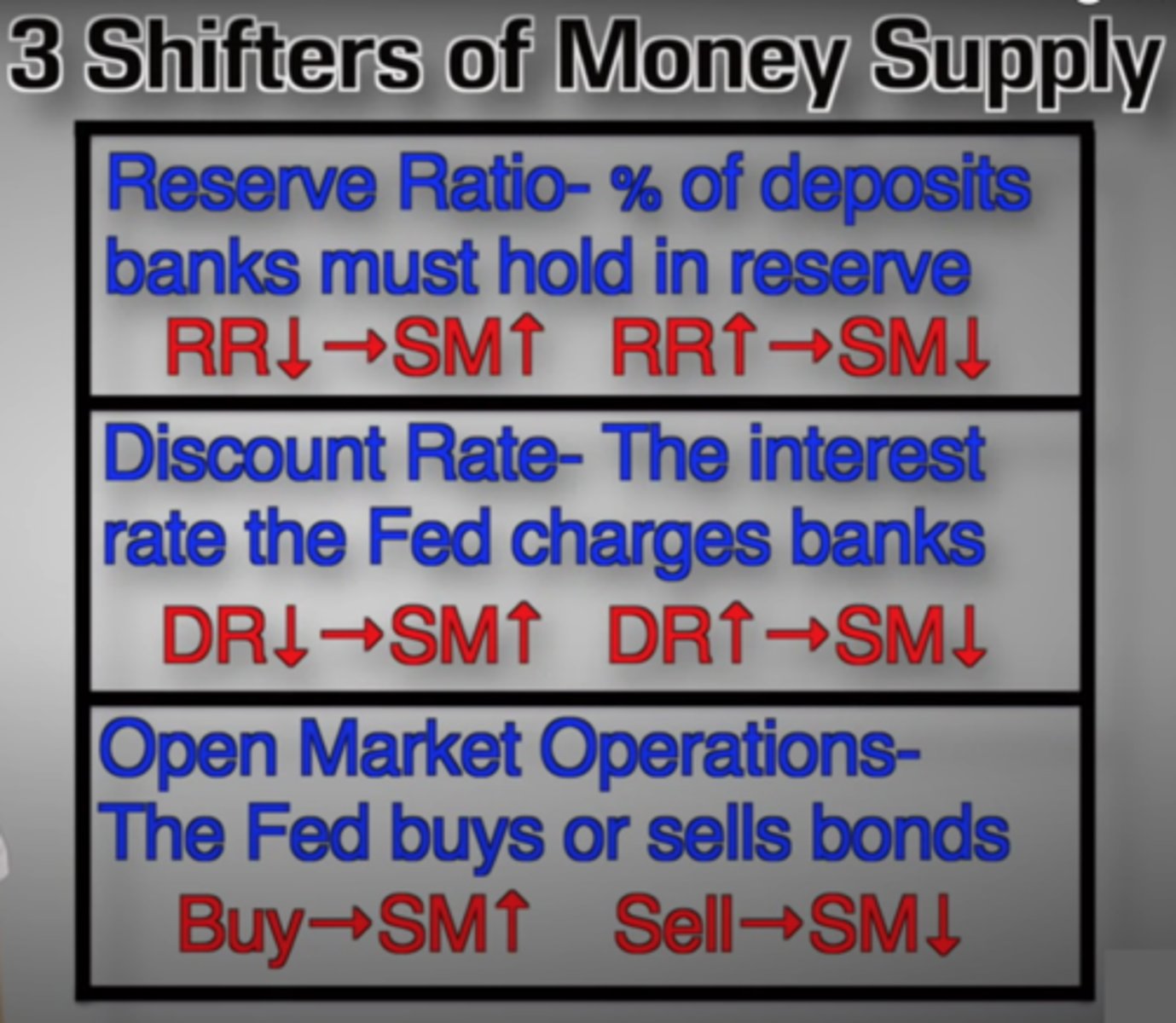

What are the three shifters of money supply in the Money Supply graph?

The Federal Reserve is the only way to shift the supply of money.

They use

the Reserve Requirement

the Discount Rate, interest rate

the Open Market buy and sell bonds

Explain what happens to the Loanable Funds graph when

Technological advancements increase productivity for firms that make investments.

Businesses will invest more

Demand shifts to the right

Explain what happens to the Loanable Funds graph when

Businesses expect recession to continue

Businesses invest less

Demand shifts to the left

Explain what happens to the Loanable Funds graph when

The government provides a tax credit for business investing.

Business invest more

Demand shifts to the right

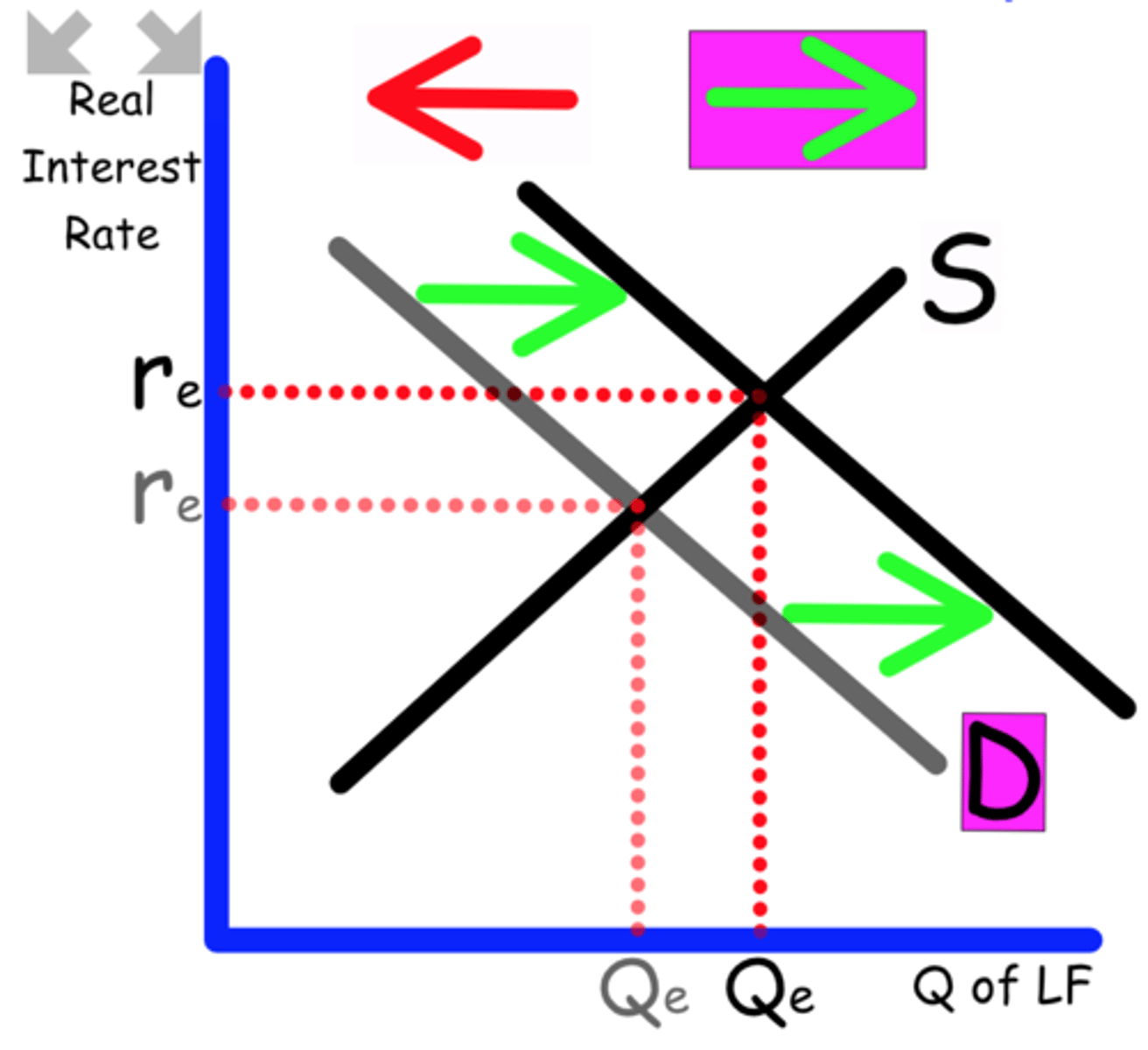

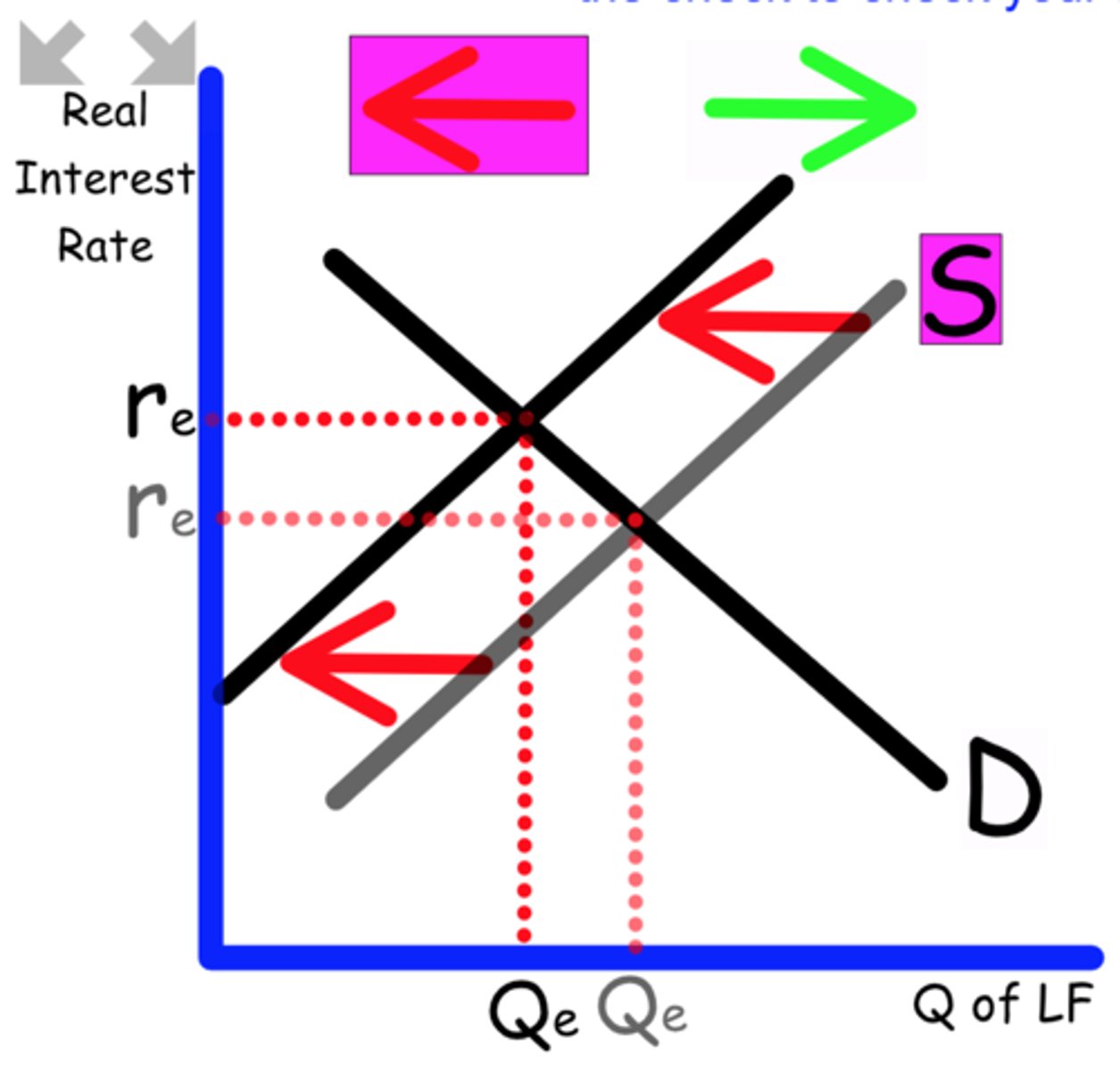

Loanable Funds graph is mainly used to show the impact of deficit spending.

Explain what happens when the government spends a $billion on infrastructure to fix bridges and roads.

This will increase the deficit, removing money from the banks

Supply shifts to the left

Explain what happens to the Loanable Funds graph when

Government cuts spending on social services.

The government is decreasing it's deficit spending leaving more money

Supply shifts to the right

Explain what happens to the Loanable Funds graph when

The government decreases taxes to stimulate the economy.

This will increase the government deficit

Supply shifts to the left

Explain what happens to the Loanable Funds graph when

Interest rates rise in other countries

Money flows out of this country because they can make more in other countries

Explain what happens to the Loanable Funds graph when

Political instability in other countries cause more investment in this country.

Foreign countries bring more money into this country

Supply shifts to the right

Explain what happens to the Loanable Funds graph when

American consumers are bullish (positive) about the economy.

They will feel comfortable to spend and save less

Supply shifts to the left

Explain what happens to the Loanable Funds graph when

Disposable income rises

With more disposable income, consumers will more savings.

Supply shifts to the right

Explain what happens to the Loanable Funds graph when

High levels of inflation continue.

Consumers are forced to spend more to buy the same items

Supply shift to the left

Explain what happens to the Loanable Funds graph when

The average propensity to save increases.

Consumers will save more money

Supply shifts to the right

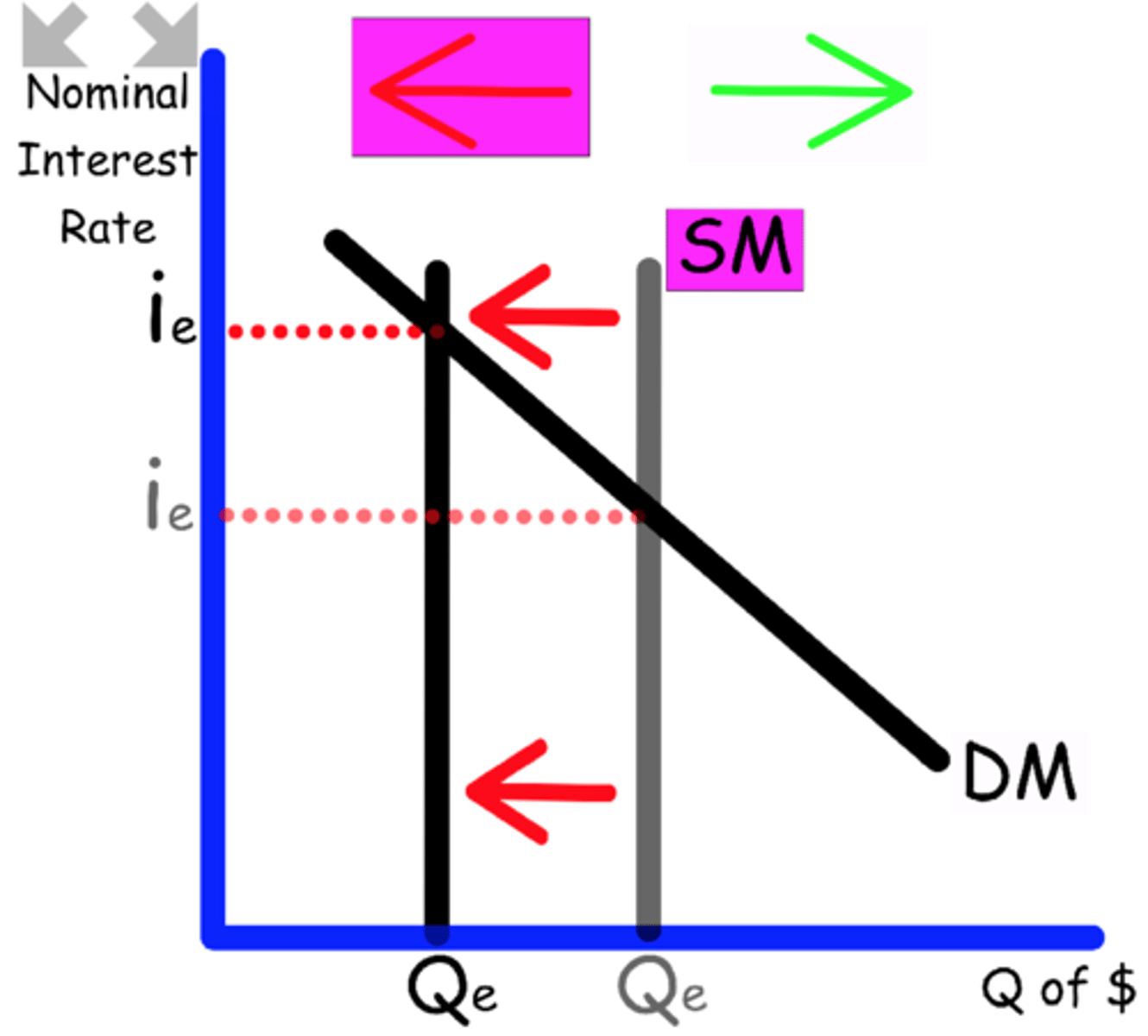

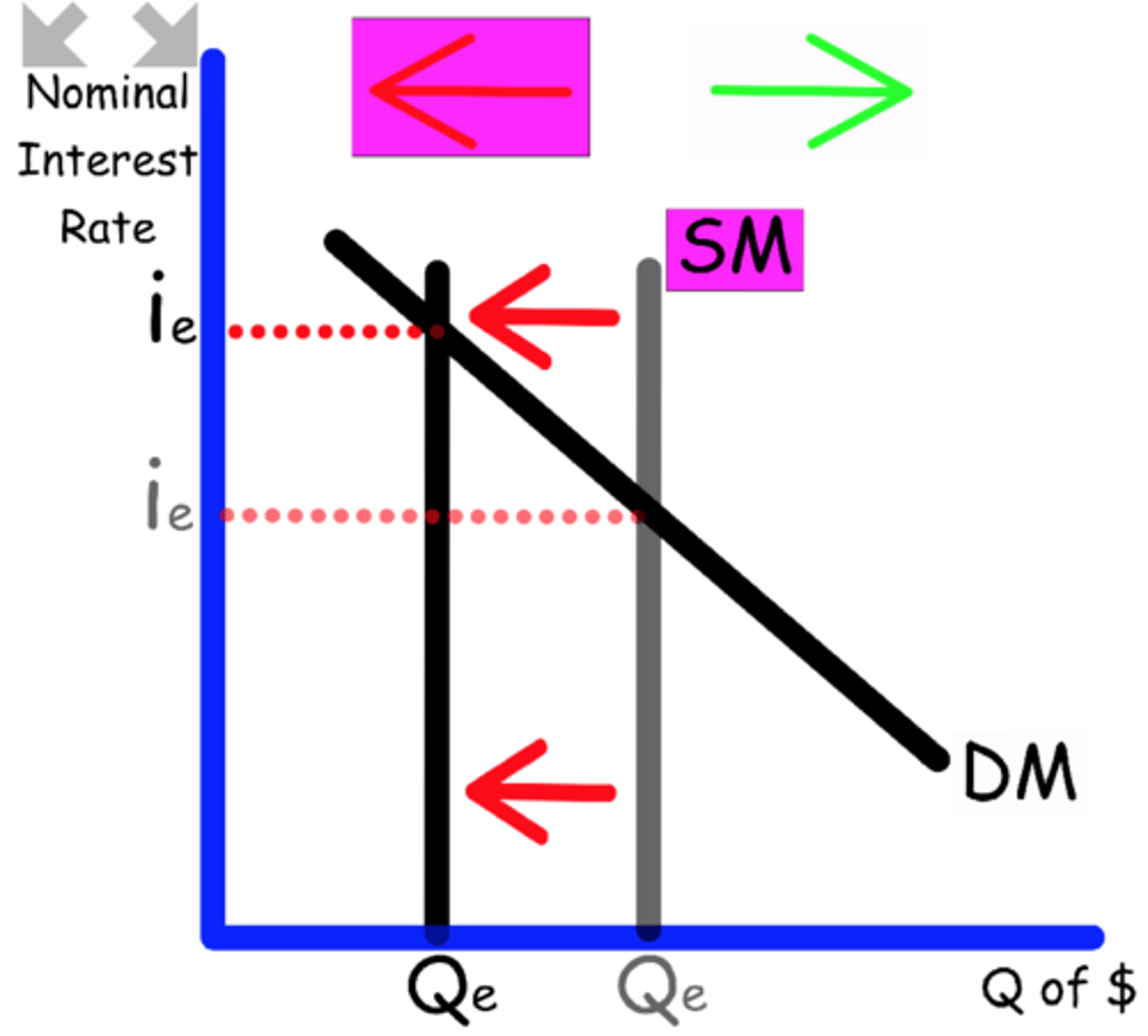

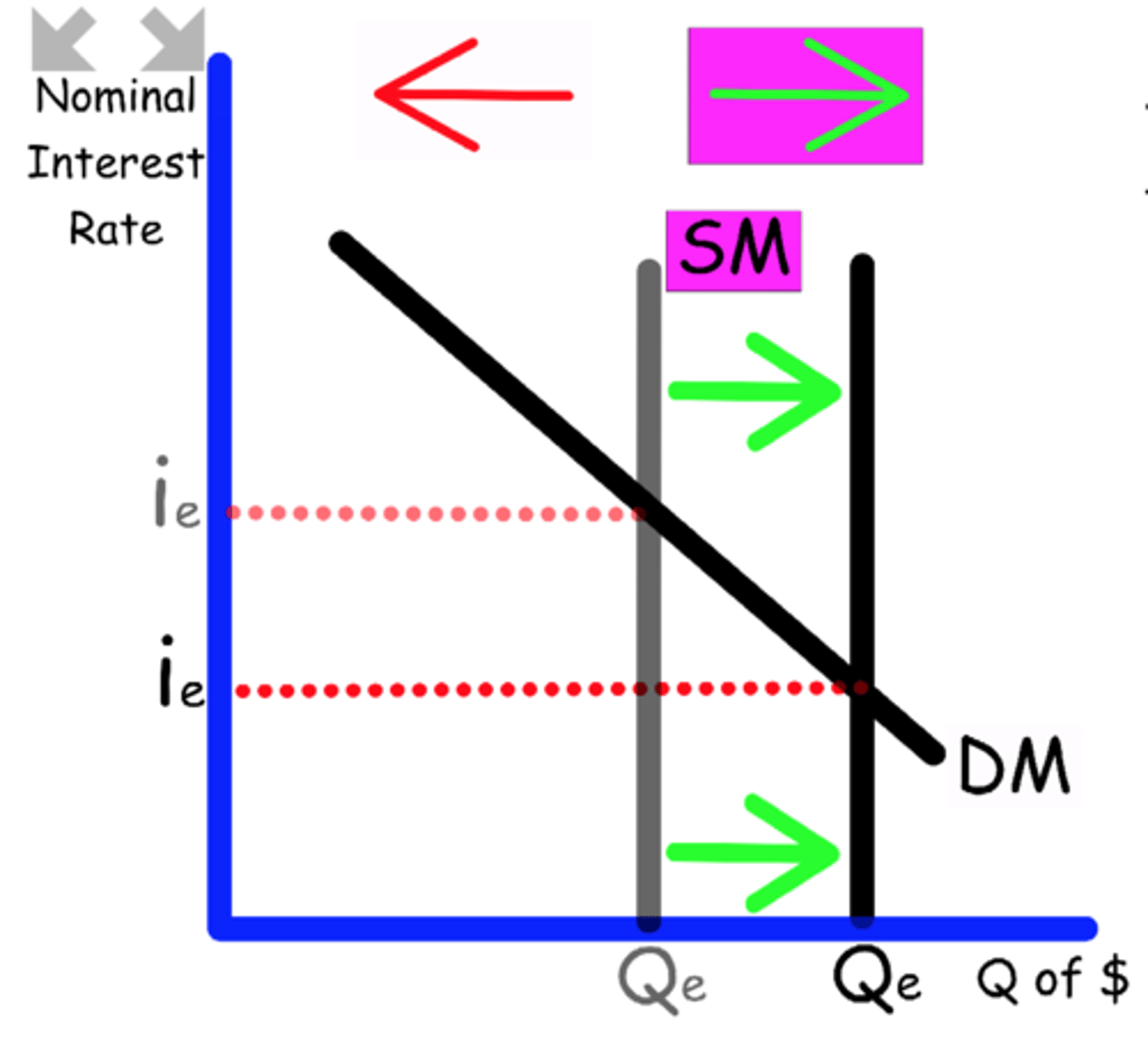

Explain what happens to the Money Market graph when

The Central Bank increases the discount rate.

Money is more expensive, less available

Supply shifts to the left

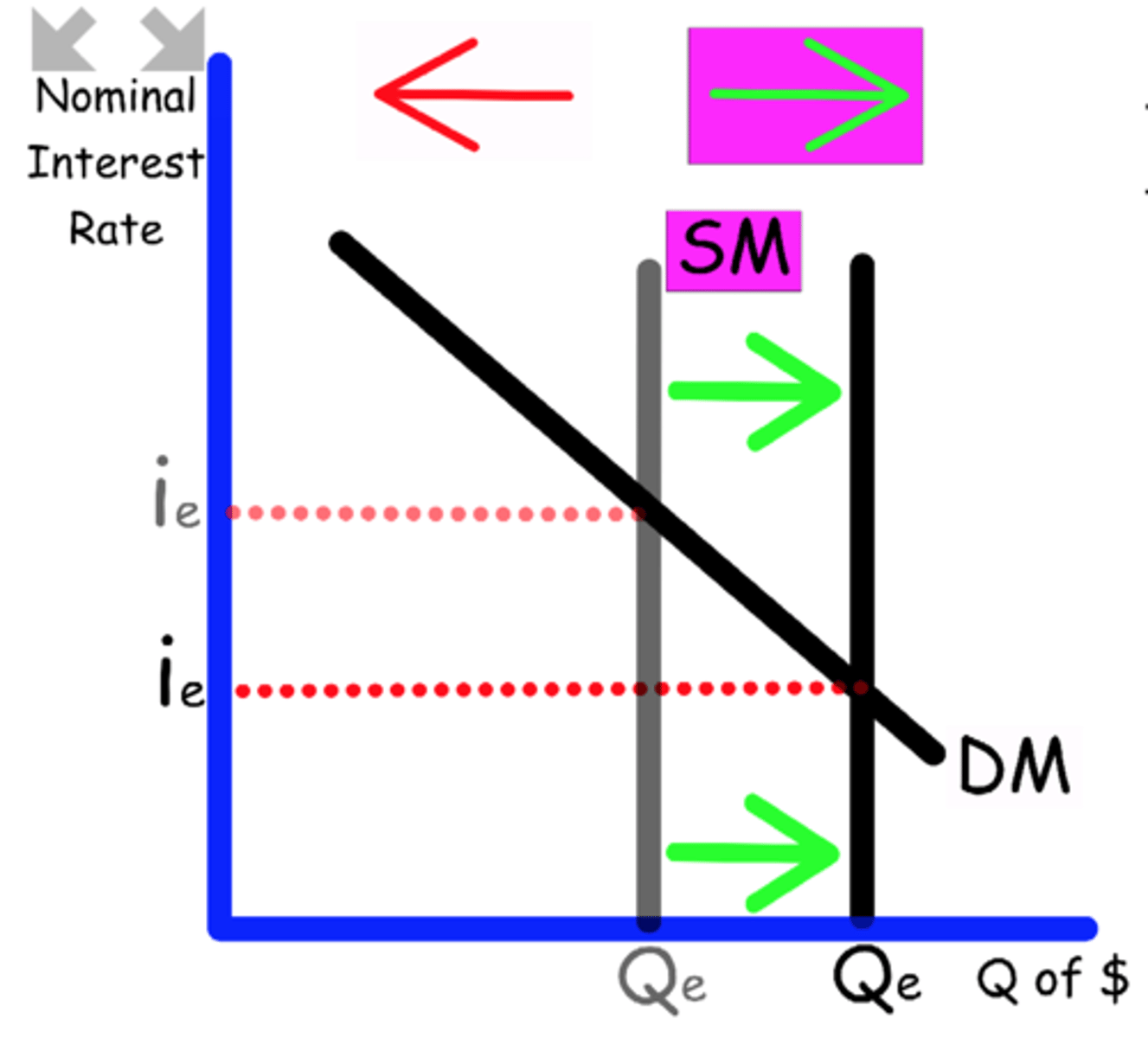

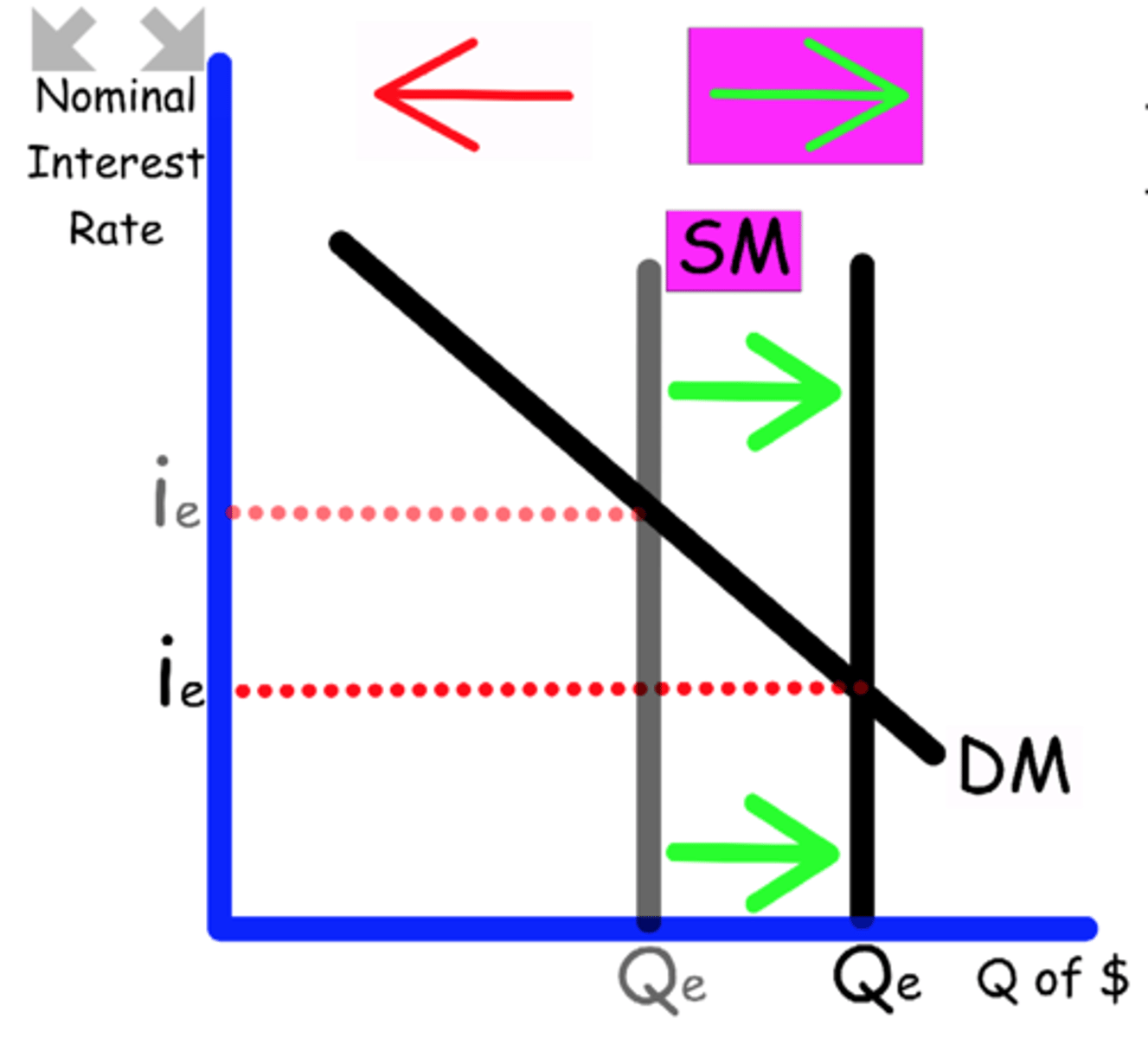

Explain what happens to the Money Market graph when

The Central bank lowers the discount rate.

Money get cheaper, and is more available

Supply shifts to the right

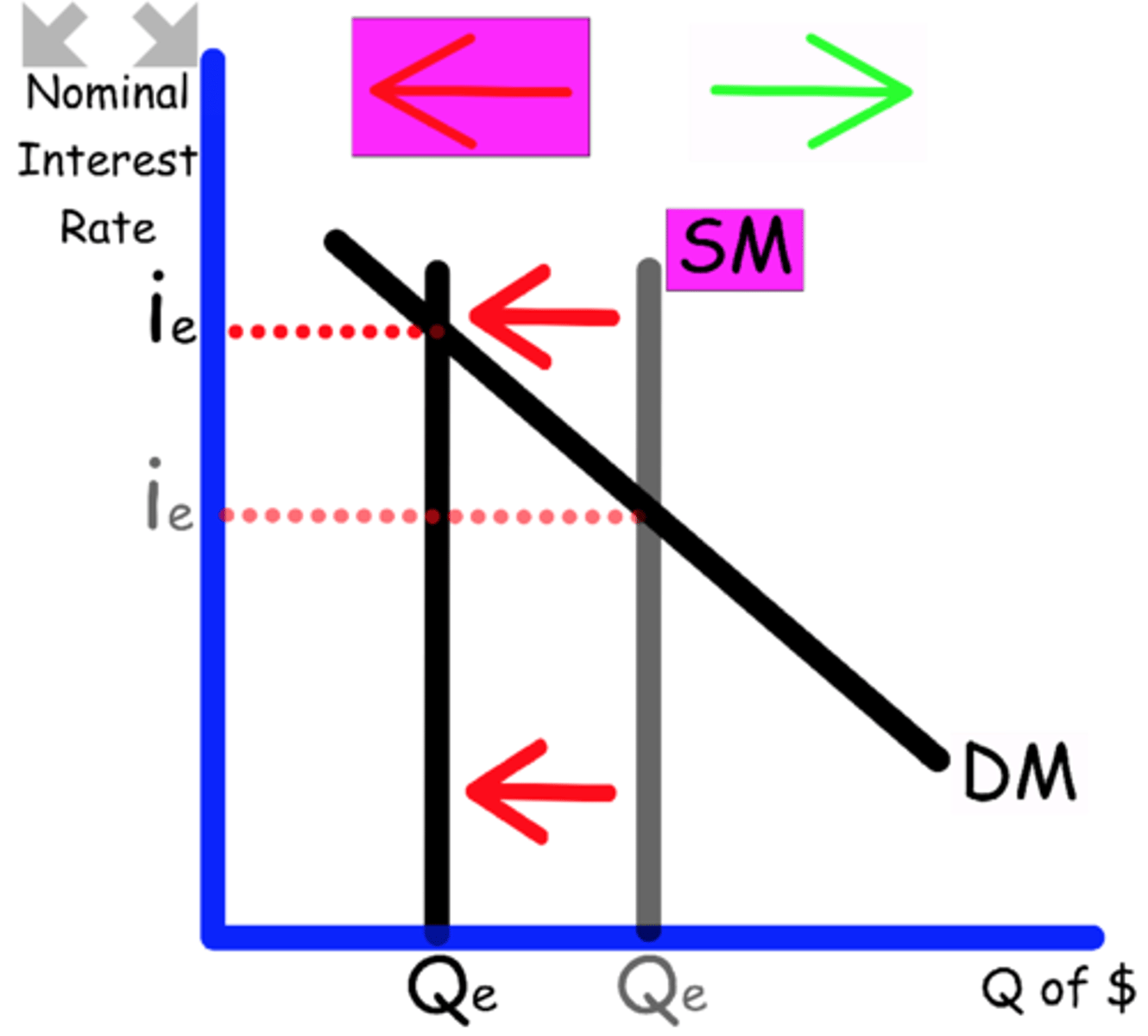

Explain what happens to the Money Market graph when

The Central Bank uses contractionary policy in the Open Market.

The government buy bonds, removing money

Supply shifts to the left

Explain what happens to the Money Market graph when

The Central Bank lowers the reserve requirement.

Banks have more money available to loan out

Supply shifts to the right

Explain what happens to the Money Market graph when

Central banks buys bonds

Buying bonds adds money to the market

Supply shifts to the right

Explain what happens to the Money Market graph when

The Central Bank raises the reserve requirement.

Banks have less money available to loan out

Supply shifts to the left

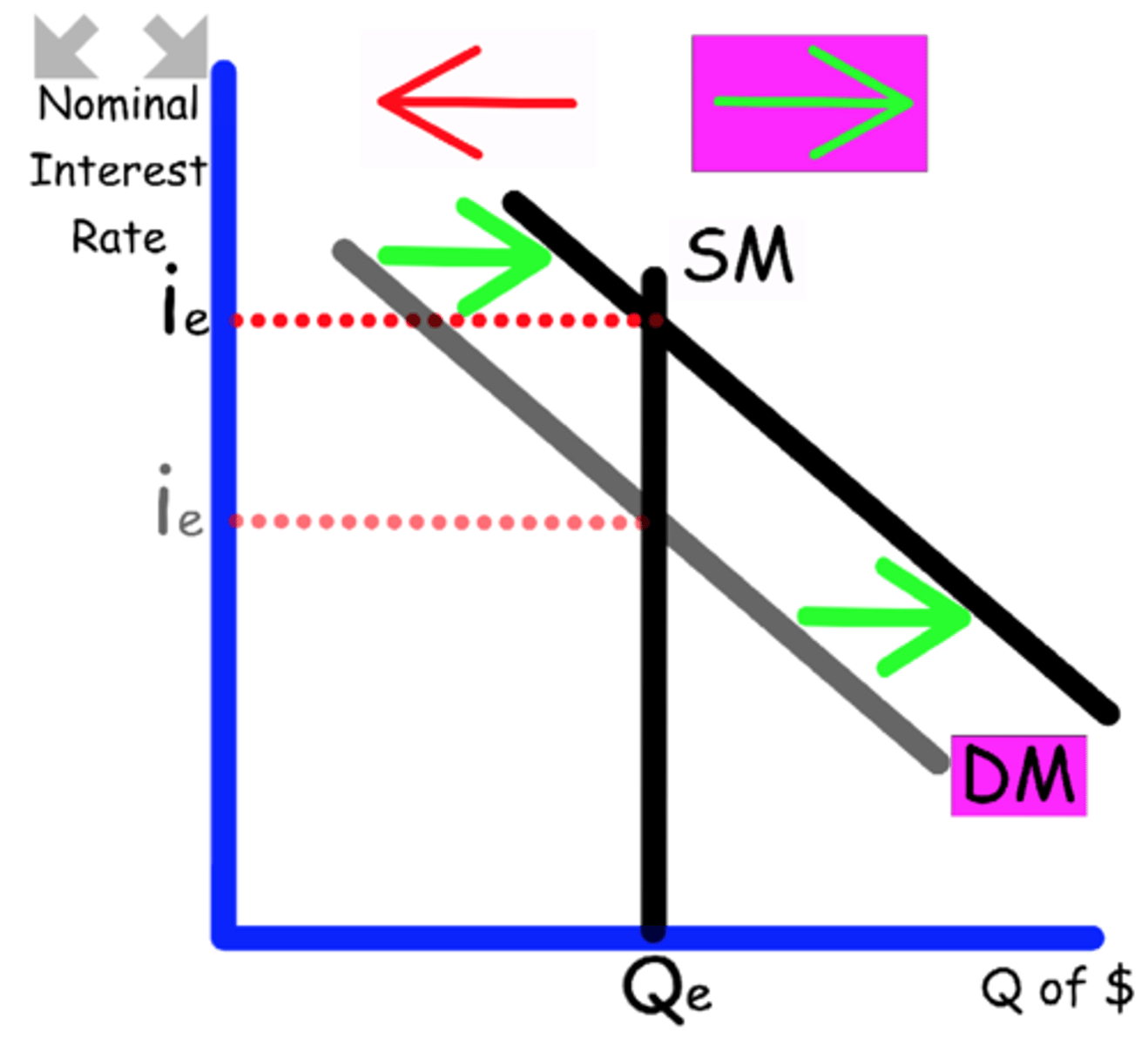

Explain what happens to the Money Market graph when

There is an increase in exports.

Exports impact GDP, the money supply

Demand shifts to the right

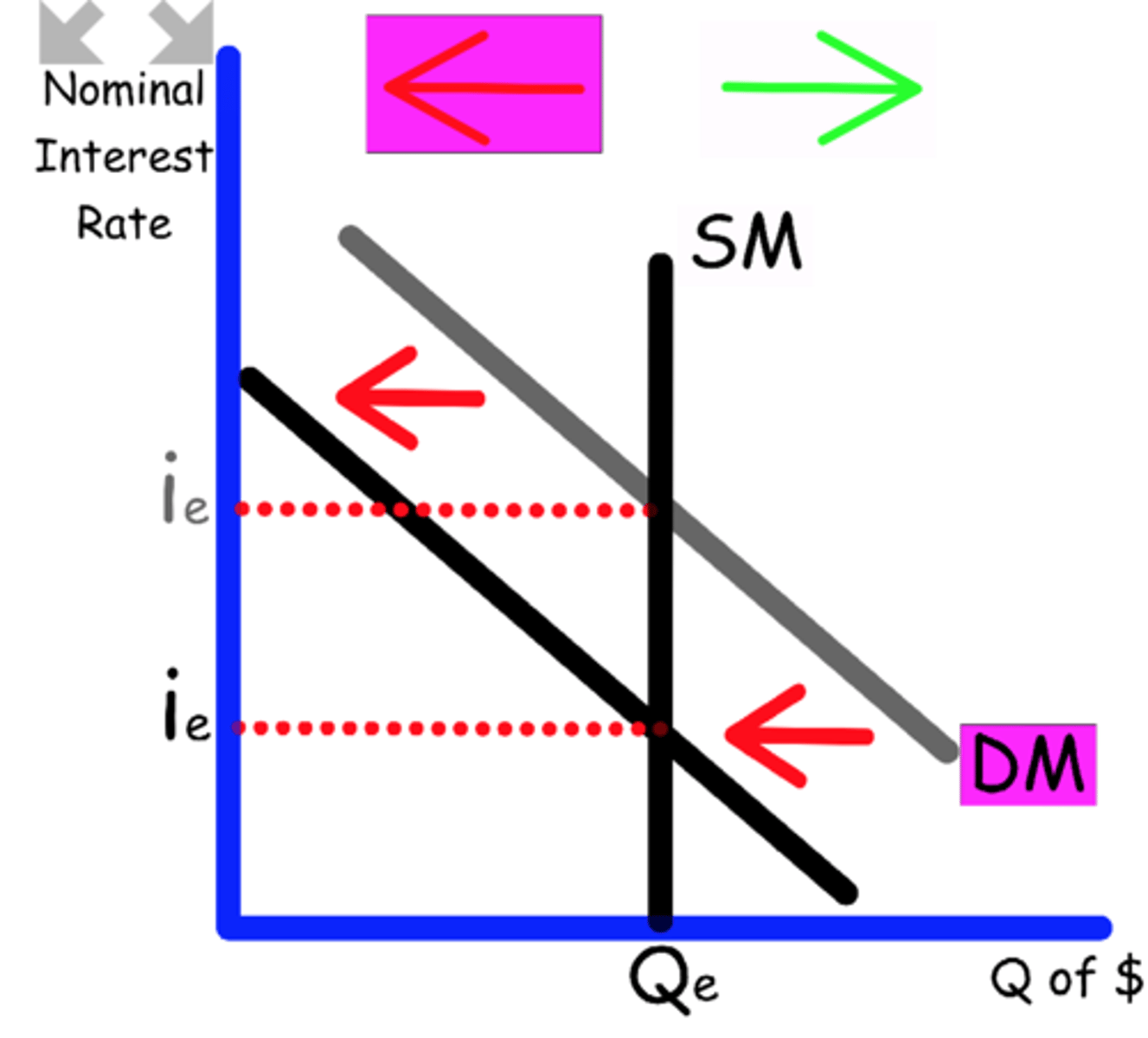

Explain what happens to the Money Market graph when

Government spending decreases.

Government spending is part of GDP, impacts demand

Demand shifts to the left

Explain what happens to the Money Market graph when

Consumers use their credit cards more since they are easier than cash.

Technology removes the use of money

Demand shifts to the left

Explain what happens to the Money Market graph when

Corporations expect a recession.

Businesses will hold more cash money to prepare for bad times

Demand shifts to the right

Explain what happens to the Money Market graph when

Consumer Spending increases

Consumer Spending is part of the GDP

Demand shifts to the right