economics (market failure)

5.0(11)

Card Sorting

1/58

Earn XP

Description and Tags

Last updated 7:30 PM on 5/11/25

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

59 Terms

1

New cards

market failure

failure of the market to achieve allocative efficiency

2

New cards

types of market failure

overprovision of demerit goods (negative externalities of consumption)

underprovision of merit goods (positive externalities of consumption)

underprovision of public goods

underprovision of positive externalities of production

overuse of common access resources

threat to sustainability (negative externalities of production)

asymmetric information

underprovision of merit goods (positive externalities of consumption)

underprovision of public goods

underprovision of positive externalities of production

overuse of common access resources

threat to sustainability (negative externalities of production)

asymmetric information

3

New cards

demerit goods

goods that are bad for the consumer and society as a whole

in a free market, demerit goods will be readily available and relatively inexpensive

overprovided

consumers of these goods are unhealthy, unproductive, and don't contribute to society

society has to pay for their healthcare costs

in a free market, demerit goods will be readily available and relatively inexpensive

overprovided

consumers of these goods are unhealthy, unproductive, and don't contribute to society

society has to pay for their healthcare costs

4

New cards

merit goods

goods that benefit the consumer as well as society as a whole

in a free market, merit goods will be rare, expensive, and only consumed by the wealthy

under-provided

educated people are more productive, commit less crimes, pay more taxes, and have jobs, and cost society less in health care

in a free market, merit goods will be rare, expensive, and only consumed by the wealthy

under-provided

educated people are more productive, commit less crimes, pay more taxes, and have jobs, and cost society less in health care

5

New cards

public goods

goods which benefit society and are non excludable and non rivalrous

like street lights

like street lights

6

New cards

non excludable

impossible to prevent someone from using it once its provided

7

New cards

non rivalrous

when someone consumes the good it is still there to be consumed by others

8

New cards

free rider problem

people use public goods without having to pay

9

New cards

quasi public good

goods that don't neatly fit the description of non-rivalrous and non-excludable, but might serve a public good

example would be museums

example would be museums

10

New cards

common access resources

essentially free to the user and anyone can get access to the resource

rivalrous and non excludable

rivalrous and non excludable

11

New cards

government intervention

if the free market results in market failure it is the role of the government to interfere

12

New cards

earn government revenue

reason governments may want to intervene

earn revenue from indirect taxes by placing them on goods with price inelastic demand

earn revenue from indirect taxes by placing them on goods with price inelastic demand

13

New cards

support firms

reason governments may want to intervene

aid small firms or firms in areas the government want to grow through subsidies or price floors

aid small firms or firms in areas the government want to grow through subsidies or price floors

14

New cards

support households on low incomes

reason governments may want to intervene

support poor households through subsidies or direct provision

support poor households through subsidies or direct provision

15

New cards

influence the level of production

reason governments may want to intervene

support firms that produce merit goods

through subsidies, price floors

support firms that produce merit goods

through subsidies, price floors

16

New cards

influence the level of consumption

reason governments may want to intervene

increase consumption of merit goods and decrease consumption of demerit goods through subsidies or indirect taxes and legislation and regulation

increase consumption of merit goods and decrease consumption of demerit goods through subsidies or indirect taxes and legislation and regulation

17

New cards

correct market failure

reason governments may want to intervene

governments are the only ones that can fix market failure

governments are the only ones that can fix market failure

18

New cards

promote equity

reason governments may want to intervene

fix the unequal distribution of wealth that the free market creates

fix the unequal distribution of wealth that the free market creates

19

New cards

negative externalities

external costs that are paid by a third party (society) due to a financial transaction

20

New cards

negative externalities of production

when there is a cost to the community that is greater than the cost of production paid by the firm

MSC is greater than MPC

example. production of fossil fuels

MSC is greater than MPC

example. production of fossil fuels

21

New cards

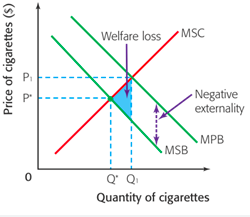

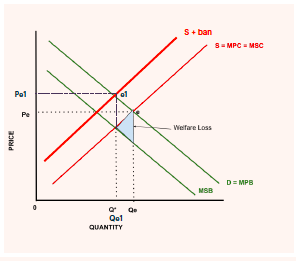

welfare loss

when the market is not able to achieve allocative efficiency and community surplus is reduced

22

New cards

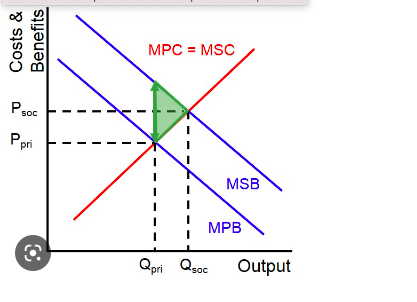

positive externalities of production

when there is a benefit to society that is greater than the private benefit of the producer

MSC is greater than MPC

example. tree farms

MSC is greater than MPC

example. tree farms

23

New cards

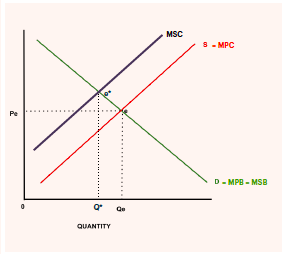

negative externalities of consumption

when society would benefit if less of a good or service was consumed

MPB is greater than MSB

example. drugs, cigarettes

MPB is greater than MSB

example. drugs, cigarettes

24

New cards

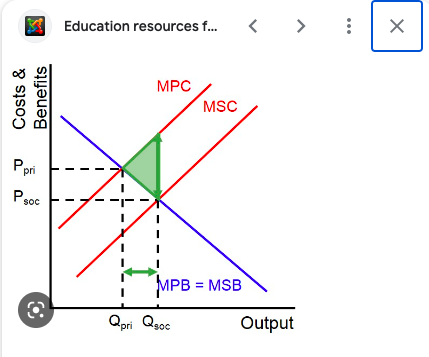

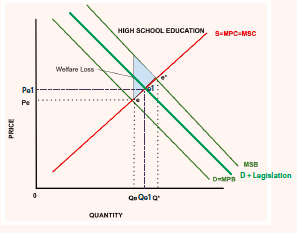

positive externalities of consumption

when there is a benefit to society that is greater than the private benefit of the consumer

MSB is greater than MPB

example. education

MSB is greater than MPB

example. education

25

New cards

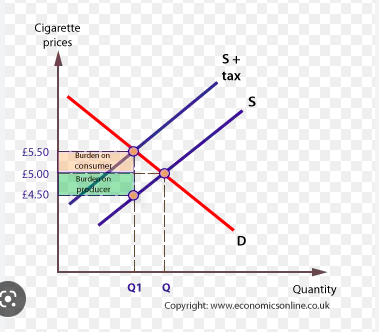

indirect tax (pigouvian)

type of government intervention

tax placed on the firm for every unit of output of a good or service

firms raise prices and the consumer pays for part of the tax indirectly

shifts supply to the left

placed on demerit goods

shifts supply vertically up or down

tax placed on the firm for every unit of output of a good or service

firms raise prices and the consumer pays for part of the tax indirectly

shifts supply to the left

placed on demerit goods

shifts supply vertically up or down

26

New cards

carbon tax

type of government intervention

indirect tax placed on producers who emit carbon into the atmosphere

the more carbon emitted the higher the tax

firms raise prices and the consumer pays for part of the tax indirectly

indirect tax placed on producers who emit carbon into the atmosphere

the more carbon emitted the higher the tax

firms raise prices and the consumer pays for part of the tax indirectly

27

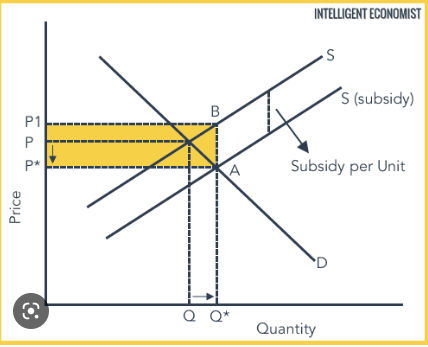

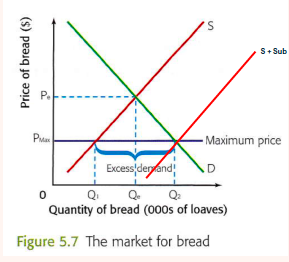

New cards

subsidies

type of government intervention

payments to a firm to encourage the production of a good or service

used for merit goods

reduce costs for firms

shift supply to the right

payments to a firm to encourage the production of a good or service

used for merit goods

reduce costs for firms

shift supply to the right

28

New cards

government responses to market failure

subsidies

indirect taxes

carbon taxes

tradable permits

direct provision

contracting private firms

price floors

price ceilings

legislation and regulation

education

self governance

international agreements

indirect taxes

carbon taxes

tradable permits

direct provision

contracting private firms

price floors

price ceilings

legislation and regulation

education

self governance

international agreements

29

New cards

tradable permits (cap and trade)

type of government intervention

potential solution to carbon emissions and global warming

government places a CAP on how much each firm can pollute, firms are issued permits to pollute a certain amount

firms who keep their level of pollution under the cap can TRADE their remaining permits to a firm who can't keep their pollution levels under the cap

supply is fixed and demand will go down

government can reduce the cap, shifting supply to the left and reducing carbon emissions

potential solution to carbon emissions and global warming

government places a CAP on how much each firm can pollute, firms are issued permits to pollute a certain amount

firms who keep their level of pollution under the cap can TRADE their remaining permits to a firm who can't keep their pollution levels under the cap

supply is fixed and demand will go down

government can reduce the cap, shifting supply to the left and reducing carbon emissions

30

New cards

evaluation of tradable permits

uses the market to solve market failure, supply and demand are set by the price of permits, firms are motivated by profits to reduce emissions

cap can be reduced over time, further reducing carbon emissions

reduce carbon not the output

firms that switch to lower pollution levels with the least expense will do so

what should the cap be? how much is enough pollution? how high do the fines need to be?

any fine or tax will increase costs of firms making them less competitive

it will take a lot of regulation and policing to enforce this

political favoritism is an issue

cap can be reduced over time, further reducing carbon emissions

reduce carbon not the output

firms that switch to lower pollution levels with the least expense will do so

what should the cap be? how much is enough pollution? how high do the fines need to be?

any fine or tax will increase costs of firms making them less competitive

it will take a lot of regulation and policing to enforce this

political favoritism is an issue

31

New cards

evaluation of subsidies

increase in consumer and producer surplus

government loses money

society benefits

government loses money

society benefits

32

New cards

evaluation of carbon taxes

reduces consumer and producer surplus

government earns money

society benefits

government earns money

society benefits

33

New cards

evaluation of indirect taxes

reduces consumer and producer surplus

government earns money

society benefits

government earns money

society benefits

34

New cards

direct provision

type of government intervention

government directly providing merit goods, public goods

government directly providing merit goods, public goods

35

New cards

evaluation of direct government provision

consumer surplus increases because they have more goods at little to no cost

governments lose because they have to spend time and resources to provide these goods

society benefits from these public and merit goods

governments are not motivated to keep costs low because there is no profit motive

governments lose because they have to spend time and resources to provide these goods

society benefits from these public and merit goods

governments are not motivated to keep costs low because there is no profit motive

36

New cards

contracting private firms

type of government intervention

governments hire private firms to provided public and merit goods

paid for with tax revenue

firms bid on contract and government selects the best bid

governments hire private firms to provided public and merit goods

paid for with tax revenue

firms bid on contract and government selects the best bid

37

New cards

evaluation of contracting private firms

consumers benefit because consumer surplus increase and live better overall

producers benefit because revenue and producer surplus increases

government doesn't benefit due to opportunity cost and spending money and resources

society benefits because there are more public and merit goods

producers benefit because revenue and producer surplus increases

government doesn't benefit due to opportunity cost and spending money and resources

society benefits because there are more public and merit goods

38

New cards

legislation and regulation

type of government intervention

legislation are laws that ban or limit the supply/consumption of a good or service

regulation are rules that limit the consumption or production of goods and services

can be laws that ban or limit demerit goods

educate people on merit goods

maintain consumption of common access resources

legislation are laws that ban or limit the supply/consumption of a good or service

regulation are rules that limit the consumption or production of goods and services

can be laws that ban or limit demerit goods

educate people on merit goods

maintain consumption of common access resources

39

New cards

evaluation of legislation and regulation

consumers and producers of demerit goods are hurt as they loose surplus and revenue

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

40

New cards

legislation and regulation on demerit goods

41

New cards

legislation and regulation on merit goods

42

New cards

education

type of government intervention

using education inititatives

using education inititatives

43

New cards

evaluation of education

consumers and producers of demerit goods are hurt as they loose surplus and revenue

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

44

New cards

international agreements

type of government intervention

sustainability and global warming require cooperation of all nations to address

some governments place global competition above environmentalism

who is gonna monitor and control international agreements

sustainability and global warming require cooperation of all nations to address

some governments place global competition above environmentalism

who is gonna monitor and control international agreements

45

New cards

evaluation of international agreements

consumers and producers of demerit goods are hurt as they loose surplus and revenue

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

consumers and producers of merit goods are helped as they gain surplus and revenue

government doesn't benefit as they have to spend more resources to enforce these laws

society benefits as society is healthier and more productive

46

New cards

collective self governance

type of government intervention

everyone works together without government intervention

to work: everyone must have a way of communicating with each other and there must be clearly defined boundaries

everyone works together without government intervention

to work: everyone must have a way of communicating with each other and there must be clearly defined boundaries

47

New cards

evaluation of collective self governance

consumers and producers of demerit goods are hurt as they loose surplus and revenue

consumers and producers of merit goods are helped as they gain surplus and revenue

society benefits as society is healthier and more productive

consumers and producers of merit goods are helped as they gain surplus and revenue

society benefits as society is healthier and more productive

48

New cards

asymmetric information

when one party in an economic transaction possesses more information than the other party

49

New cards

adverse selection

type of asymmetric information

when one party has more information than the other party about the quality of the product

when one party has more information than the other party about the quality of the product

50

New cards

moral hazard

type of asymmetric information

when one party takes risks that another party might have to pay for like insurance of financial advisors

when one party takes risks that another party might have to pay for like insurance of financial advisors

51

New cards

government responses to asymmetric information

legislation, warning ads, regulation, provision of information, licensure, screening, signalling

52

New cards

licensure

government response to asymmetric information

rules and regulations which require professionals to have a license or certificate to practice

rules and regulations which require professionals to have a license or certificate to practice

53

New cards

signaling

government response to asymmetric information

used by the party with more information (usually the seller)

technique in which seller convinces buyers that the product is good quality

examples. warranties

used by the party with more information (usually the seller)

technique in which seller convinces buyers that the product is good quality

examples. warranties

54

New cards

screening

government response to asymmetric information

method used by the party with less information (usually the buyer)

when consumers seek to obtain more information about the product

method used by the party with less information (usually the buyer)

when consumers seek to obtain more information about the product

55

New cards

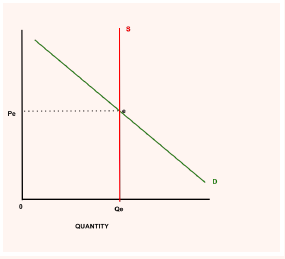

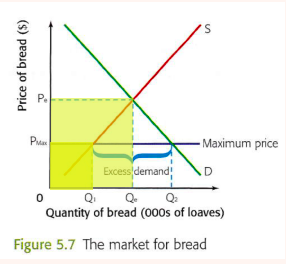

price ceilings

type of government intervention

when the government places a maximum amount that a producer can charge for a good or service

designed to protect consumers

most common for food and housing needs

must be below equilibrium to have an effect

requires government subsidies on top of it to work and shifts supply to the right and removes excess demand so that producers and consumers both win

when the government places a maximum amount that a producer can charge for a good or service

designed to protect consumers

most common for food and housing needs

must be below equilibrium to have an effect

requires government subsidies on top of it to work and shifts supply to the right and removes excess demand so that producers and consumers both win

56

New cards

evaluation of price ceilings

shortages and excess demand

some consumers get the good at a lower price and some consumers get nothing because of excess demand

producers have a reduction in producer surplus and revenue decreases

society loses becuse welfare loss is created and too few resources are allocated for production however it might be worth the loss, market failure remains

government are losers: either the government doesnt apply subsidies and increases unemployment or government pays for subsidies to eliminate excess demand

eliminates price rationing so the development of underground markets may occur

some consumers get the good at a lower price and some consumers get nothing because of excess demand

producers have a reduction in producer surplus and revenue decreases

society loses becuse welfare loss is created and too few resources are allocated for production however it might be worth the loss, market failure remains

government are losers: either the government doesnt apply subsidies and increases unemployment or government pays for subsidies to eliminate excess demand

eliminates price rationing so the development of underground markets may occur

57

New cards

non price rationing

first come first serve

distribution of coupons

sell to favorite consumers

underground markets

distribution of coupons

sell to favorite consumers

underground markets

58

New cards

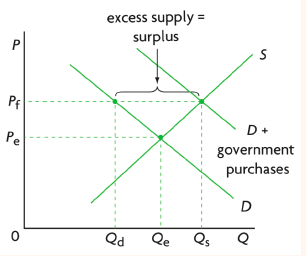

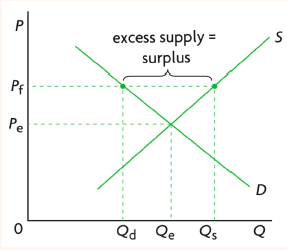

price floors

type of government intervention

when the government places a minimum amount that a producer can charge for a good or service

designed to protect producers

most common for essential firms

must be above equilibrium to have an effect

requires government purchases on top of it to work and shifts supply to the right and removes excess surplus so that producers and consumers both win

when the government places a minimum amount that a producer can charge for a good or service

designed to protect producers

most common for essential firms

must be above equilibrium to have an effect

requires government purchases on top of it to work and shifts supply to the right and removes excess surplus so that producers and consumers both win

59

New cards

evaluation of price floors

surpluses and excess supply

consumers are losers: reduction in consumer surplus as price goes up and demand goes down, some consumers will not be able to afford the good

producers charge a higher price for their good as price goes up and demand goes down, will not sell much og their goods

revenue goes down

society loses because welfare loss is created and too many resources are allocated for production however it might be worth the loss, market failure remains

government are losers: must buy products from producers to eliminate excess supply, can give excess supply to poor communities, and opportunity cost of the money for surplus

consumers are losers: reduction in consumer surplus as price goes up and demand goes down, some consumers will not be able to afford the good

producers charge a higher price for their good as price goes up and demand goes down, will not sell much og their goods

revenue goes down

society loses because welfare loss is created and too many resources are allocated for production however it might be worth the loss, market failure remains

government are losers: must buy products from producers to eliminate excess supply, can give excess supply to poor communities, and opportunity cost of the money for surplus