Booklet 3 - Balance of Payments

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

52 Terms

What do you Discuss when Asked about - The Concept & Structure of Australia’s Balance of Payments

Define Balance of Payments

State the Formula for the Balance of Payments

Define Credits

Define Debits

The Concept & Structure of Australia’s Balance of Payments

Balance of Payments Definition:

A record of all economic transactions between the residents of Australia & the residents of the rest of the world, consisting of the current account & the capital & financial account.

The Formula for the Balance of Payments:

BOP = Current Account + Capital & Financial Account = 0

Credits Definition: An inflow of money into Australia from a foreign resident.

Debits Definition: An outflow of money into Australia to a foreign resident.

What do you Discuss when Asked about - The Concept of the Double Entry System

Double Entry System

Example

The Concept of the Double Entry System

Explanation of the Double Entry System:

every transaction is represented by two entries of equal and opposite value which reflects the inflow and outflow element of each exchange. This means that every transaction will be recorded twice, once as a debit and once as a credit.

For example, an Australian resident purchasing a TV from Japan for AUD$1 000. This is an import of a good and will be recorded in the current account as a debit of $1 000. In exchange for the TV there is an export of Australian currency to Japan and this is recorded as a $1 000 credit in the financial account. In this example the sum of the credit entries (+1 000) are offset by the sum of the debit entries (-1 000) and the balance of payments balances.

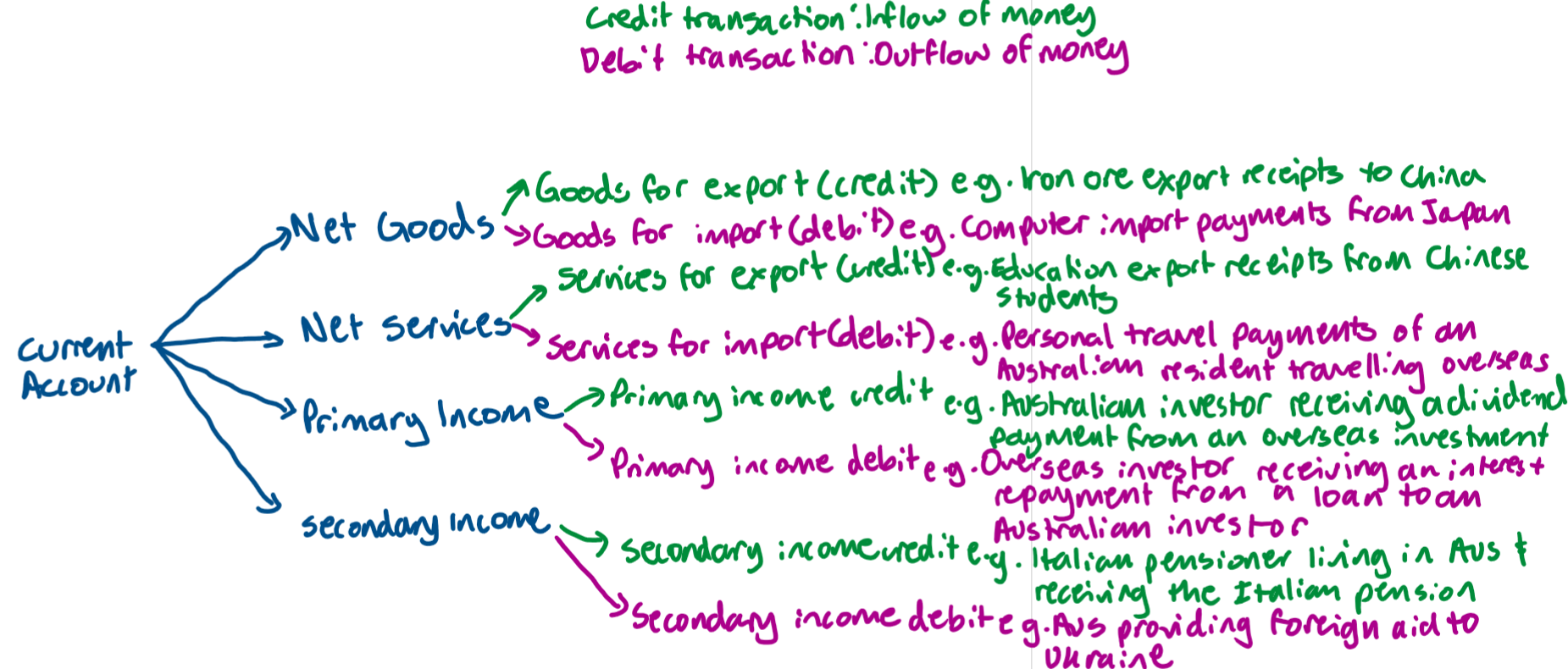

Definition of the Current Account

Records all transactions involving the exchange of net goods, net services and net income between Australian residents and foreign residents.

Definition of a Current Account Deficit

When the debits for net goods, net services and net income exceeds the credits for net goods, net services and net income.

Definition of a Current Account Surplus

When the credits for net goods, net services and net income exceeds the debits for net goods, net services and net income.

The formula for the Balance on the Current Account

Balance on the Current Account = Balance of Goods and Services + Net Income

What do you Discuss when Asked about - the Structure of the Current Account

Net Goods

Net Services

Trade Balance/Balance of Goods & Services

Net Primary Income

Net Secondary Income

Income Balance/Net Income

The Structure of the Current Account Diagram

Net Goods Component of the Current Account

Net goods, the largest component of the Current Account, record the value of tangible merchandise trade (exports (credits) &imports (debits)) such as raw materials, manufactured goods, minerals & fuels, food, and rural products. Australia’s exports are dominated by commodities from the agricultural and mining sectors, including iron ore, coal, natural gas, and beef, reflecting the nation’s comparative advantage in primary production. In contrast, imports largely comprise intermediate and capital goods used by industry—such as machinery, vehicles, and refined petroleum—along with consumer goods. The balance between these exports and imports determines the net goods outcome within the Current Account.

Net Services Component of the Current Account

Net services, accounts for around one quarter of the Current Account & measures the value of service exports (credits) minus service imports (debits). This component includes transactions related to transport (freight and shipping), travel and tourism, education services, ICT, and financial services. Australia typically records a deficit in net services—where debits exceed credits—though the long-term trend shows it is trading upwards. Australia’s service exports are dominated by education and tourism, key contributors to export revenue, while service imports are mainly business services and tourism-related spending by Australians overseas.

Trade Balance/Balance of Goods & Services Component of the Current Account

The Trade Balance is the sum of Net Goods and Net Services in the Current Account. It measures the difference between credits (exports) and debits (imports). A positive trade balance occurs when credits exceed debits, resulting in a trade surplus, while a negative trade balance indicates a trade deficit when debits exceed credits. In December 2024, Australia recorded a trade surplus of $7,494 million, reflecting strong export performance—particularly in mining and agricultural commodities—relative to import levels.

Net Primary Income Component of the Current Account

Net Primary Income is the largest of the two income components in the Current Account and mainly reflects investment flows between Australia and the rest of the world. It measures the difference between income earned by Australian residents from foreign sources (credits) and income paid to foreign residents by Australians (debits). Primary income includes two categories:

Compensation of employees — wages and salaries paid to Australians working overseas or to foreign workers employed in Australia.

Investment income — returns on financial capital, including dividends from foreign equity investment and interest payments from foreign debt.

Australia typically records a deficit in net primary income because the value of income paid to foreign investors exceeds that earned from Australian investments abroad.

Net Secondary Income Component of the Current Account

Net Secondary Income is a relatively minor component of the Current Account and has little impact on the overall balance. It records one-way transactions where real or financial resources (such as goods, services, or money) are transferred without receiving anything of economic value in return. This includes foreign aid, gifts, donations, and pensions between Australia and other countries. While small compared to other components, it reflects Australia’s role in international assistance and remittance flows.

Income Balance/Net Income Component of the Current Account

The Income Balance is a component of the Current Account that combines Net Primary Income and Net Secondary Income. It records the difference between income credits (income received from overseas) and income debits (income paid to foreign residents). A positive income balance indicates an income surplus, while a negative income balance indicates an income deficit, where debits exceed credits. As of December 2024, Australia recorded an income deficit of $2040 million, reflecting higher income payments to foreign investors compared to income earned abroad.

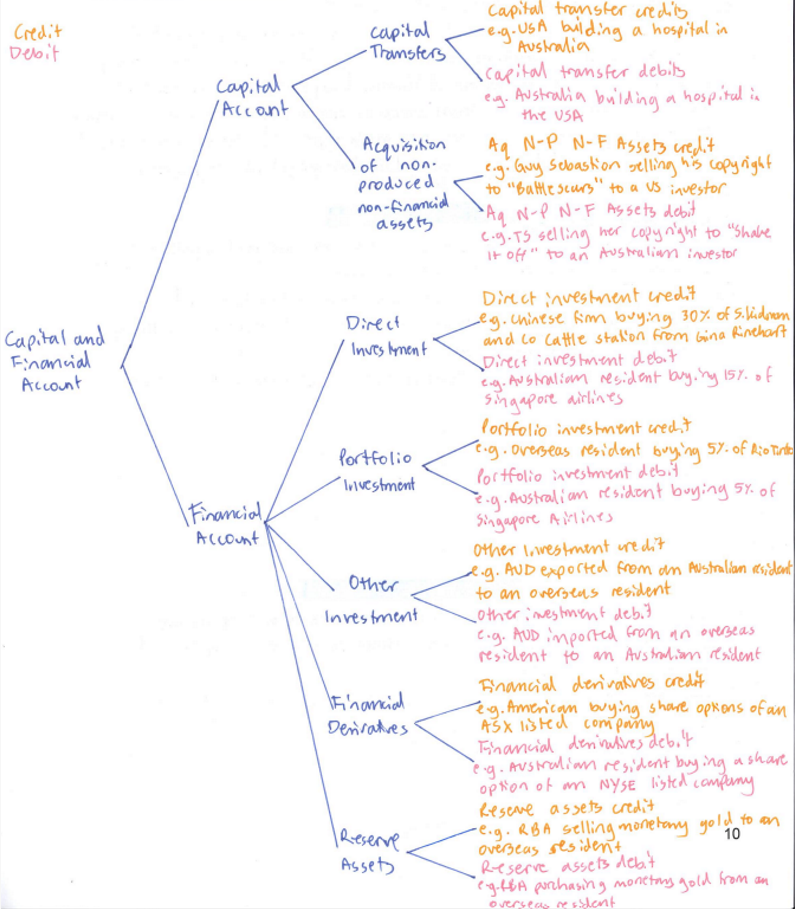

What do you Discuss when Asked about - the Structure of the Capital & Financial Account

Define the Capital Account

Capital Account Composition:

Capital Transfers

Acquisition of Non-Produced Non-Financial Assets

Define the Financial Account

Financial Account Composition:

Direct Investment

Portfolio Investment

Other Investments

Financial Derivatives

Reserve Assets

The Structure of the Capital & Financial Account Diagram

Definition of the Capital Account

Definition of the Capital Account:

Records financial transactions that do not affect income or production.

Capital Transfers as a Component of the Capital & Financial Account

Capital Transfers are the most significant component of the Capital Account, recording non-financial asset transactions and capital flows between residents and non-residents. Capital transfers involve the movement of funds or assets where one party provides capital and receives no economic value in return. This includes migrant transfers and capital-related aid (grants for infrastructure or equipment). These transfers contribute to capital formation but represent a small proportion of Australia’s overall external accounts compared to financial flows.

Acquisition of Non-Produced Non-Financial Assets as a Component of the Capital & Financial Account

Acquisition of Non-Produced Non-Financial Assets is a minor component of the Capital Account, referring to transactions involving intangible assets that have not been produced but hold economic value. These include copyrights, patents, trademarks, franchises, and leases. Such transactions occur when ownership of these assets is transferred between residents and non-residents, for example, when an Australian firm purchases intellectual property rights from an overseas company. While relatively small, these transfers facilitate innovation and international business activity.

Direct Investment as a Component of the Capital & Financial Account

Direct Investment is a key component of the Financial Account, involving the purchase of 10% or more ownership in a company or asset to gain a lasting interest and managerial influence in a foreign enterprise. It includes the establishment of new subsidiaries or significant equity stakes. A credit occurs when foreign investors invest in Australian firms or assets, while a debit occurs when Australians invest in overseas enterprises. Direct investment reflects long-term capital flows and contributes to Australia’s economic growth and integration into global markets

Portfolio Investment as a Component of the Capital & Financial Account

Portfolio Investment is a component of the Financial Account, referring to the purchase of less than 10% ownership in a company or asset, such as shares, bonds, or other securities. It is generally short-term and speculative, as investors do not seek to influence management or operations. A credit occurs when foreign investors purchase Australian assets, while a debit occurs when Australians invest in overseas assets. Portfolio investment represents volatile capital flows that can fluctuate with changes in interest rates, exchange rates, and investor confidence.

Other Investment as a Component of the Capital & Financial Account

Other Investment is a residual category of the Financial Account, capturing transactions that do not fit into Direct Investment or Portfolio Investment. It includes:

Currency — the export (credit) or import (debit) of money linked to trade and foreign investment.

Deposits — cross-border bank deposits or withdrawals.

Trade credits — short-term credit extended by an importer to pay for goods after they are received.

This category reflects short-term and miscellaneous capital flows that facilitate international trade and finance, ensuring all financial transactions are recorded in the balance of payments.

Financial Derivatives as a Component of the Capital & Financial Account

Financial derivatives involve contracts whose value is derived from the price of an underlying financial asset or index. for example, future contracts or option contracts.

Reserve Assets as a Component of the Capital & Financial Account

Financial assets controlled by the RBA, for example, monetary gold, foreign exchange currencies & government bonds.

What do you Discuss when asked about - Reasons for Australia’s Current Account Balance (the Trade Balance)

Definition of Trade Balance

Trade Balance Formula

Factors Affecting the Trade Balance

Commodity Prices

Global Demand of Exports/Global Economic Conditions

Exchange Rates

Domestic Economic Conditions

Free Trade Agreements

Technological Change

Transportation & Infrastructure

Income Balance Definition

The difference between the value of a country’s exports and imports of goods and services.

Income Balance Formula

Net Goods + Net Services

or

Total Exports - Total Imports

Commodity Prices as a Factor Affecting the Trade Balance

Commodity prices are a key factor affecting Australia’s trade balance, measuring the difference between exports (credits) and imports (debits) in the Current Account. As a major exporter of minerals (iron ore, coal), agricultural products, and energy resources, Australia’s export earnings are sensitive to fluctuations in global commodity prices. For example, an increase in iron ore prices raises the value of Australian exports, boosting Net Goods credits and improving the trade balance. Conversely, a decline in commodity prices would reduce export revenue and weaken the trade balance.

Global Demand of Exports/Global Economic Conditions as a Factor Affecting the Trade Balance

Global demand for exports is a key factor influencing Australia’s trade balance, measuring the difference between exports (credits) and imports (debits) in the Current Account. Economic conditions in major trading partners, particularly China and other Indo-Pacific countries, affect demand for Australian goods and services. For example, during periods of high economic growth in China, demand for Australian commodities rises, increasing export values (Net Goods credits) and improving the trade balance. Conversely, a slowdown in these economies would reduce export demand and weaken Australia’s trade position.

Exchange Rates as a Factor Affecting the Trade Balance

Exchange rates influence the competitiveness of Australian goods and services in global markets, directly impacting the trade balance — the difference between exports (credits) and imports (debits). When the Australian dollar (AUD) appreciates, exports become more expensive for foreign buyers (reducing credits), while imports become cheaper for Australians (increasing debits), worsening the trade balance and the Current Account Balance (CAB). Conversely, a depreciation of the AUD makes Australian exports more affordable and imports more expensive. For example, a weaker AUD would increase demand for exports such as tourism and education services and reduce demand for imports like passenger motor vehicles (PMVs), thereby improving the trade balance.

Domestic Economic Conditions as a Factor Affecting the Trade Balance

Domestic economic conditions influence both imports and exports, thereby affecting the trade balance - the difference between export credits and import debits. When domestic GDP growth is strong, higher national income and labour demand increase household disposable income, leading to greater demand for imports such as passenger motor vehicles (PMVs) and outbound tourism, which can reduce the trade balance. However, robust growth can also boost domestic production capacity, increasing exports of goods and services and improving the trade balance. The overall effect depends on the relative change in credits and debits - whether rising import demand outweighs or is offset by increased export performance.

Free Trade Agreements as a Factor Affecting the Trade Balance

Free Trade Agreements (FTAs) influence the trade balance (the difference between export credits and import debits) by altering trade barriers such as tariffs. Reducing or eliminating these barriers expands export markets and can increase credits through higher export values, while also potentially raising debits as imports become cheaper. The overall impact on the trade balance depends on the relative change in exports and imports. For example, following the China–Australia Free Trade Agreement (ChAFTA) in 2015, tariffs on Australian commodities exported to China were removed, boosting exports and improving the trade balance by increasing credits in Net Goods.

Technological Change as a Factor Affecting the Trade Balance

Advances in technology influence trade patterns by altering the types of goods and services demanded and produced, thereby affecting the trade balance - the difference between export credits and import debits. Technological progress can improve production efficiency and shift a nation’s export composition toward higher-value goods. For example, in Australia, advancements in mining technology have facilitated a transition from traditional agricultural exports such as wool to high-value commodities like LNG and gold, increasing export credits in Net Goods and strengthening the trade balance

Transportation & Infrastructure as a Factor Affecting the Trade Balance

Transportation and infrastructure influence the trade balance — the difference between export credits and import debits — by affecting the efficiency, speed, and cost of moving goods overseas. Improvements in transport and logistical infrastructure enhance the international competitiveness of Australian exports by reducing costs and delivery times. For example, upgrades to Australia’s infrastructure can increase export credits in Net Goods and Net Services, strengthening the trade balance. These factors are interrelated, and policymakers monitor them closely to ensure trade policies maximise Australia’s economic gains.

Define the Income Balance

The Australian income balance reflects the net income earned by Australian residents/firms from foreign investments minus the income paid to foreign investors by Australia residents/firms. It consists of both primary and secondary income, but it is primary income that is by far the larger and more important of the two.

Income Balance Formula

Net Primary Income + Net Secondary Income

&/or

Total Income Inflow - Total Income Outflow

What do you Discuss when Asked about - Factors Affecting the Income Balance

Interest & Dividend Payments

Foreign Aid Remittances

Exchange Rates

Global Economic Conditions

Interest & Dividend Payments as a Factor Affecting the Income Balance

Interest and dividend payments significantly affect the income balance, which measures the difference between income credits (received from overseas) and debits (paid to foreign investors). Australia has a savings–investment gap, meaning foreign investment inflows exceed outflows, creating a net foreign liability position. Since foreign investment must be repaid through dividend payments (for foreign equity) and interest payments (for foreign debt), increases in foreign investment lead to higher primary income debits. For example, if Australia increases foreign direct, portfolio, or other investments, dividend and interest repayments rise, decreasing the income balance within the current account

Foreign Aid Remittances (Income - Wages & Salaries) as a Factor Affecting the Income Balance

Foreign aid and remittances influence the income balance, which records the net flow of income between Australia and the rest of the world. Foreign aid (such as monetary assistance provided to other nations) is recorded as a debit in the secondary income category, as resources are given without receiving economic value in return. For example, if Australia increased financial aid to Ukraine, this would raise debits and decrease the income balance. Conversely, remittances, including wages and salaries earned by Australian residents working overseas, are recorded as credits in the primary income category, increasing the income balance by bringing income into Australia.

Exchange Rates as a Factor Affecting the Income Balance

Exchange rates influence the income balance, which measures the net flow of income between Australia and the rest of the world. Since interest and dividend payments to foreign investors are converted into foreign currencies, fluctuations in the Australian dollar (AUD) directly impact these transactions. For example, if the AUD appreciates, Australian residents who have borrowed from overseas will need to pay fewer AUD to service their foreign debt. This reduces debits in the primary income category, thereby increasing the income balance. Conversely, a depreciation would increase repayment costs, decreasing the income balance.

Global Economic Conditions as a Factor Affecting the Income Balance

Global economic conditions refer to the overall state of economic activity, including growth, interest rates, and business profitability, both in Australia and its trading partners. These factors influence income flows recorded in the income balance, which measures net primary and secondary income transactions. For example, during an economic boom in Australia, profits earned by Australian firms increase, resulting in higher dividend payments to foreign investors. These outflows are recorded as debits in the primary income category, thereby decreasing the income balance, particularly in sectors with significant foreign ownership such as mining.

What do you Discuss when Asked about - The Current Account Balance & the Savings/Investment Gap

Define Savings/Investment Gap

Savings/Investment Gap Formula

Current Account Balance Formula

What it is

Definition of the Savings/Investment Gap

The difference between the domestic supply of savings and the domestic demand of investment.

Savings/Investment Gap Formula

Savings/Investment Gap = Savings (S) – Investment (I)

Current Account Balance Formula in Reference to the Savings/Investment Gap

Current Account Balance = Savings/Investment Gap

What is the Savings/Investment Gap

The savings-investment gap occurs when a country’s domestic savings (S) and domestic investment (I) are unequal. If S > I, the country has excess savings, contributing to a current account surplus, whereas if S < I, the country has insufficient savings to fund investment, contributing to a current account deficit. Historically, until 2019, Australia had a negative savings-investment gap as investment, particularly in the mining and resources sector, exceeded its limited domestic savings due to a small population, resulting in a current account deficit. During 2020–2023, increased domestic savings and reduced consumption during the pandemic led to a positive savings-investment gap and a current account surplus. Since 2024, Australia’s investment has again exceeded savings, driven by drawing down pandemic-era savings and increased foreign investment inflows, creating a negative savings-investment gap and a current account deficit.

What do you Discuss when Asked about Forms of Foreign Investment to Fill the Savings/Investment Gap

Foreign Equity - Inflows

Foreign Debt - Inflows

Foreign Equity Inflows

Foreign equity inflows occur when foreign residents or firms invest in Australian assets such as company shares or land, seeking dividends or rent payments in return. These inflows help fill Australia’s savings-investment gap by supplementing domestic savings to fund investment. However, an increase in foreign equity also increases primary income debits in the current account as dividends are paid to foreign investors, which reduces the income balance and consequently the current account balance.

Foreign Debt Inflows

Foreign debt inflows are loans provided to Australian residents or firms by foreign investors, who expect interest repayments in return. These inflows help fill Australia’s savings-investment gap by supplementing domestic savings to fund investment. However, higher foreign debt increases primary income debits in the current account through interest payments, which reduces the income balance and, in turn, the current account balance.

Trends in Australia's Current Account & Financial Account over the Last Ten Years.

Over the last ten years, Australia’s Current Account Balance (CAB) and Financial Account have experienced significant fluctuations driven by trade, income flows, domestic conditions, and foreign investment.

From 2015–2019, the CAB deficit was falling. The trade balance improved due to rising commodity prices, such as iron ore following a dam collapse in Brazil, and strong global demand, particularly from China, which increased credits in Net Goods. The income balance deficit decreased as low global interest rates reduced debits on foreign debt, while increased profitability of Australian businesses raised dividend receipts from foreign equity.

During 2020–2023, Australia recorded a Current Account Surplus, driven by strong commodity prices for minerals and energy due to the Ukraine War, agricultural price rises from global supply shortages, and high international demand for exports. Domestic conditions such as slow post-Covid recovery reduced import demand, while depreciation of the AUD boosted export competitiveness. The income balance also improved as accumulated savings reduced foreign investment outflows, lowering interest and dividend payments abroad, while higher domestic savings increased income from overseas investments.

In 2023–2024, the CAB shifted to a deficit. The trade balance declined due to falling commodity prices (iron ore, coal) and reduced export volumes (e.g., wheat), while domestic economic recovery increased imports of consumer and capital goods. The income balance improved slightly with higher credits from Australian foreign equity and lower debits from reduced dividends to overseas investors.

The Financial Account reflects Australia’s persistent savings-investment gap. Traditionally, domestic savings have been insufficient to meet investment demand, resulting in a financial account surplus. From 2019–2023, this surplus decreased as pandemic-related high domestic savings eliminated the gap, leading to a temporary financial account deficit. Since 2024, the financial account has returned to surplus due to reduced domestic savings and increased foreign investment inflows.