Babypips Forex Notes

1/102

Earn XP

Description and Tags

Notes from the Babypips.com website preschool module https://www.babypips.com/learn/forex/preschool

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

103 Terms

Currency Pairs

There are HUNDREDS of these in existence, but not all can be traded in the FX market.

The base currency

In this image, what is “EUR“

The counter/quote currency

In this image, what is “USD“

The bid price

In this image, what is “1.1051“ (the first number)

The ask price

In this image, what is “1.1053“ (the second number)

2 pips

In this image, how large is the spread

Major currencies

The most traded currencies in the world, typically from countries with large, stable economies.

Major currencies

Highly liquid and widely accepted in the forex market

Major currencies

USD, EUR, JPY, GBP, CHF, CAD, NZD, and AUD

Minor currencies

Currencies from smaller or emerging market economies.

Minor currencies

These currencies are still traded in significant volumes but are less liquid compared to the major currencies.

Minor currencies

Often come from countries with developing economies or smaller financial markets.

Exotic currencies

Currencies from smaller, less developed, or emerging market economies.

Exotic currencies

Less liquid and more volatile compared to major and minor currencies.

Exotic currencies

Trading these currencies often involves higher spreads and can be riskier.

Base Currency

First currency in any currency pair.

USD

Normally considered the “base” currency for quotes, meaning that quotes are expressed as a unit of 1 of this currency per the other currency quoted in the pair.

Quote Currency/Counter Currency

The second currency in any currency pair.

Quote Currency/Counter Currency

Frequently called the pip currency and any unrealized profit or loss is expressed in this currency.

Pip

The smallest unit of price for any currency.

Pipette

a fractional pip.

Pip

percentage in point

Pip

The standard unit of measurement for price movements in the forex market

Pipette

One-tenth of a pip.

Pipette

Allows for more precise entry and exit points in trading, which can be important for high-frequency trading strategies.

Bid Price

The price at which the market is prepared to buy a specific currency pair in the forex market.

Bid Price

Price shown on the left side of the quotation.

Ask Price/Offer Price

The price at which the market is prepared to sell a specific currency pair in the forex market.

Ask Price/Offer Price

At this price, you can buy the base currency.

Ask Price/Offer Price

Shown on the right side of the quotation.

Spread

The difference between the bid and ask price

Big Figure Quote

The dealer expression referring to the first few digits of an exchange rate

Big Figure Quote

These digits are often omitted in dealer quotes.

Quote Convention

The standard way in which exchange rates are expressed

Spread

The transaction cost for a round-turn trade.

Round-turn

A buy (or sell) trade and an offsetting sell (or buy) trade of the same size in the same currency pair.

Spread Formula

Transaction cost (spread) = Ask Price - Bid PriceCross-Currency Pairs

Any currency pair in which neither currency is the U.S. dollar.

Cross-Currency Pairs

These pairs exhibit erratic price behavior since the trader has, in effect, initiated two USD trades.

Cross-Currency Pairs

Frequently carry a higher transaction cost

Leverage

The ratio of the amount of capital used in a transaction to the required security deposit ( the “margin“)

Leverage

The ability to control large dollar amounts of a financial instrument with a relatively small amount of capital.

Leverage

ranges from 2:1 to 500:1

Order

An offer sent using your broker’s trading platform to open or close a transaction if the instructions specified by you are satisfied

Order

How you will enter or exit a trade.

Market Order

An order instantly executed against a price that your broker has provided

Pending Order

An order to be executed at a later time at the price you specify

Market Order

Order type of Buy and Sell

Pending Order

Order type of Buy Limit, Buy Stop, Sell Limit, and Sell Stop

Market Order

An order to buy or sell at the best available price

Market Order

When you place a ___ ___, depending on market conditions, there may be a difference between the price you selected and the final price that is executed (or “filled”) on your trading platform.

Limit Order

An order placed to either buy below the market or sell above the market at a certain price

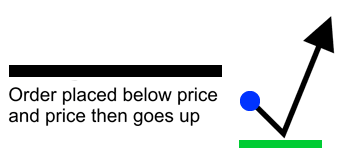

Buy Limit

Order to buy at or below a specified price

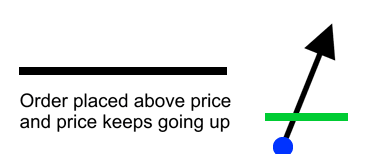

Sell Limit

Order to sell at a specified price or better

Limit Order

Can only be executed when the price becomes more favorable to you

Limit Order

You use this type of entry order when you believe the price will reverse upon hitting the price you specified!

BUY

A limit order to ___ at a price below the current market price will be executed at a price equal to or less than the specified price.

SELL

A limit order to ___ at a price above the current market price will be executed at a price equal to or more than the specific price.

Stop Order

Used when you want to buy only after the price rises to the stop price, or sell only after the price falls to the stop price

Stop Entry Order/Stop Order

Placed to buy above the market or sell below the market at a certain price

Buy Stop

Order to buy at a price above the market price, and it is triggered when the market price touches or goes through the stop price.

Sell Stop

Order to sell when a specified price is reached.

Stop Entry Order/Stop Order

Can only be executed when the price becomes less favorable to you.

Stop Loss (Order)

An order to close out if the market price reaches a specified price, which may represent a loss or profit.

Stop Loss (Order)

Order linked to a trade for the purpose of preventing additional losses if the price goes against you

Sell Stop/Sell Stop Order

Stop loss order in a long position

Buy Stop/Buy Stop Order

Stop loss order in a short position

Stop Loss (Order)

Remains in effect until the position is liquidated or you cancel this order

Stop Order

NOT guaranteed a specific execution price and in volatile and/or illiquid markets, may execute significantly away from its stop price.

Stop Order

May be triggered by a sharp move in price that might be temporary.

SELL

If triggered during a sharp price decline, a ___ stop loss order is more likely to result in an execution well below the stop price.

BUY

If triggered during a sharp price increase, a ___ stop loss order is more likely to result in an execution well above the stop price.

Trailing Stop (Order)

A stop loss order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify.

Trailing Stop (Order)

a type of stop loss order attached to a trade that moves as the price fluctuates.

Market Order

Once the market price hits your trailing stop price, a ____ ____ to close your position at the best available price will be sent, and your position will be closed.

Stop Order

Activates an order when the market price reaches or passes a specified stop price

Limit Order

Can only be executed at a price equal to or better than a specified limit price

Stop Price

A threshold for your order to execute; At what exact price that your order will be filled at depends on market conditions.

Limit Price

A price guarantee that your order only gets executed at your limit price (or better) with the caveat that the market price may never reach your limit price, so your order never executes.

Time-in-Force Orders/TIF Orders

Special instructions that tell a broker or trading platform how long an order should remain active before it is canceled if not executed

Good For the Day/GFD

This is the default TIF for most trading platforms. The order remains active until the end of the current trading day. If not filled by then, it is automatically canceled.

Good ‘Till Cancelled/GTC

The order remains active until it is either filled or manually canceled by the trader. Yep, that’s right. A GTC order remains active in the market until you decide to cancel it.

Immediate or Cancel/IOC

The order must be filled immediately in full or in part. Any portion of the order that cannot be filled immediately is canceled.

Fill Or Kill/FOK

This is similar to IOC but stricter. The entire order must be filled immediately; otherwise, the whole order is canceled.

Good Till Date/GTD

The order remains active until a specified date. If not filled by the end of that date, it is canceled.

TIF Order

Allows you to specify when you want your order to be executed, giving you more control over the timing of your trades

TIF Order

Can avoid unexpected price movements that might occur if your order remains active for too long

IOC

Certain TIF orders, like ___ and FOK, can help you get your trade executed quickly if there is enough liquidity in the market.

Conditional Orders

Linked orders that become active based on specific conditions being met

One-Cancels-the-Other/OCO

Consists of two orders linked together. If one order is executed, the other order is automatically canceled.

One-Triggers-the-Other/OTO

Consists of two orders linked together. The execution of one order triggers the placement of the other order.

One-Triggers-the-Other/OTO

Often used for entering trades and setting up subsequent actions based on the initial trade’s outcome.

One-Triggers-the-Other/OTO

You set a(n) ___ order when you want to set profit-taking and stop loss levels ahead of time, even before you get in a trade.

Conditional Orders

Require careful planning and understanding of the underlying mechanics to use effectively.

Buy Stop/Buy Stop Order

Used to open a long position at a price higher than the current price

Sell Stop/Sell Stop Order

Used to open a short position at a price lower than the current price

Buy Limit/Buy Limit Order

Used to open a long position at a price lower than the current price

Sell Limit/Sell Limit Order

Used to open a short position at a price higher than the current price

Buy Stop/Buy Stop Order

Buy Limit/Buy Limit Order