Subsidy and market failure

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

6 Terms

In what scenario would a subsidy be implemented with externalities

Subsidies would be granted to goods with positive externalities to encourage consumptions of these goods

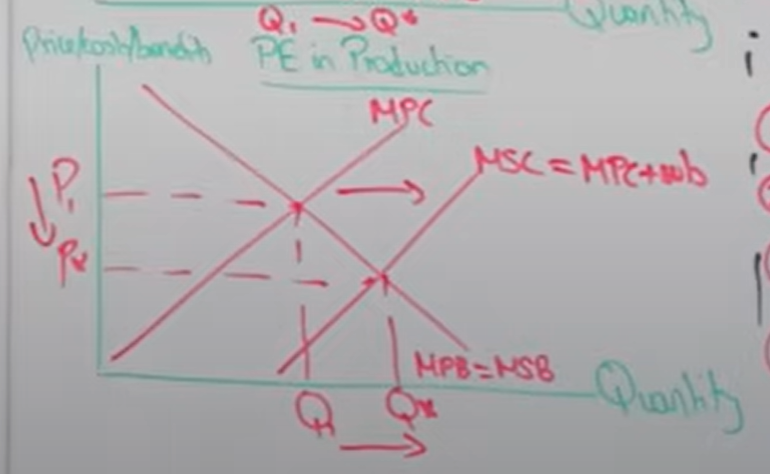

Draw the effect of an subsidy on a positive production externality

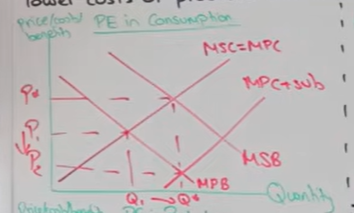

Draw the effect of a indirect tax on a positive consumptions externality

Define subsidy

Money grant given by the government to firms with no return with the intention of lowering costs of production to encourage an increase in production

Analyse the implementation of a subsidy on a positive externality

A subsidy lowers a firms costs of production as the subsidy covers it

So they can drop their price and expand their output

So underconsumption or underproduction is dealt with

This moves the equilibrium toward allocative efficiency and we gain welfare

What is the drawbacks of using subsidies to correct underconsumption / production of a positive externalities

Opportunity cost and admin cost of paying every firm in this industry

Imperfect information could lead to the government under or over subsidising

Could cause subsidy dependencies = x inefficiency instead of decreasing price/ expanding output. Or the fact that in the long run the subsidy cannot be halted else these firms will go under

If demand is inelastic then the decrease in price will only increase demand marginally resulting in a waste of gov spending