ECON 2113 Exam 2

5.0(3)

Card Sorting

1/63

Earn XP

Last updated 3:59 AM on 2/22/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

64 Terms

1

New cards

The buyers' willingness to pay can be represented through...

The demand curve

2

New cards

The sellers' costs of producing a good can be represented through..

The supply curve

3

New cards

The consumer surplus benefits the...

Buyer

4

New cards

The producer surplus benefits the...

Seller

5

New cards

What is the total surplus?

The sum of consumer and producer surplus, the total benefit in society/economy

6

New cards

What is welfare economics?

The study of how the allocation of resources affects economic well-being

7

New cards

What is willingness to pay?

Maximum amount that a buyer will pay for a good

8

New cards

How is consumer surplus calculated?

A buyer's willingness to pay minus the price the buyer actually pays

9

New cards

The price on the demand curve represents...

The willingness to pay of the marginal buyer

10

New cards

On the demand curve, the consumer surplus is...

The area below the demand curve and above the price

11

New cards

When the price falls, the consumer surplus...

Increases

12

New cards

What is cost?

The value of everything a seller must give up to produce a good

13

New cards

How is producer surplus calculated?

The amount a seller is paid for a good minus the seller's cost

14

New cards

The price on the supply curve represents...

The willingness to supply by the marginal seller

15

New cards

How is producer surplus represented on the supply curve?

The area above the supply curve and below the price

16

New cards

When price rises, the producer surplus...

Increases

17

New cards

Total surplus is...

The value to buyers + cost to sellers

18

New cards

What is efficiency?

Allocation that maximizes total surplus

19

New cards

What is equity?

Fair distribution of well-being in society

20

New cards

At the market equilibrium price, buyers...

Who value the product more purchase it

21

New cards

A free market allocates goods to buyers with...

The highest willingness to pay

22

New cards

At the market equilibrium price, sellers...

With the lowest costs produce the product

23

New cards

How does a free market affect sellers?

Makes the most efficient sellers to produce

24

New cards

T/F: Total surplus is minimized at the market equilibrium

False. It is maximized at the market equilibrium

25

New cards

If the amount produced is smaller than the equilibrium quantity...

1. The value of the product to buyers is \__________ than the cost to sellers

2. Total surplus would rise if output \____________

1. The value of the product to buyers is \__________ than the cost to sellers

2. Total surplus would rise if output \____________

1. The value of the product to buyers is greater than the cost to sellers

2. Total surplus would rise if output increases

2. Total surplus would rise if output increases

26

New cards

If the amount produced is larger than the equilibrium quantity...

1. The value of the product to buyers is \__________ than the cost to sellers

2. Total surplus would rise if output \__________

1. The value of the product to buyers is \__________ than the cost to sellers

2. Total surplus would rise if output \__________

1. The value of the product to buyers is less than the cost to sellers

2. Total surplus would rise if output decreases

2. Total surplus would rise if output decreases

27

New cards

Markets are efficient when

There are perfectly competitive markets and no externalities

28

New cards

T/F Market equilibrium may not be efficient if perfectly competitive markets and no externalities exist

True

29

New cards

T/F: If there is market failure public policy will not remedy it

False, it can potentially remedy it

30

New cards

Inefficiency means...

Market outcome with less than maximum total surplus, leads to deadweight loss

31

New cards

Examples of public policy are...

Taxes, subsidies, quotas, price ceilings, price floor

32

New cards

What are some effects of market failure?

Underproduction and overproduction

33

New cards

What is underproduction?

Less is traded than determined by the market equilibrium

34

New cards

What is overproduction?

More is traded than determined by the market equilibrium

35

New cards

When the quantity traded is different from the efficient levels, there is...

Deadweight loss

36

New cards

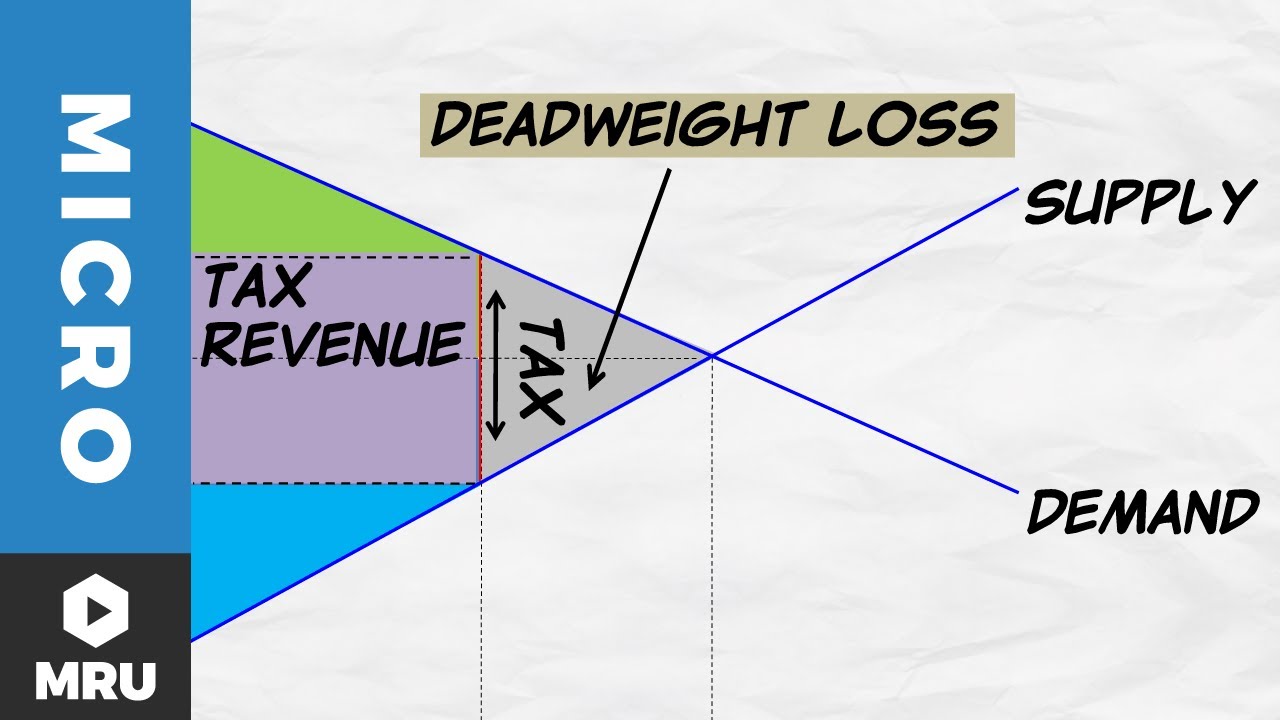

What is deadweight loss?

A decrease in both consumer surplus and producer surplus due to inefficient level of production

37

New cards

If a buyer has to pay a certain dollar for each unit of a good purchased...

It causes a decrease in demand

38

New cards

T/F: The demand curve shifts down by the amount of the tax levied

True

39

New cards

T/F: Taxes encourage market activity

False, they discourage it

40

New cards

T/F: Both buyers and sellers share the burden of taxes

True

41

New cards

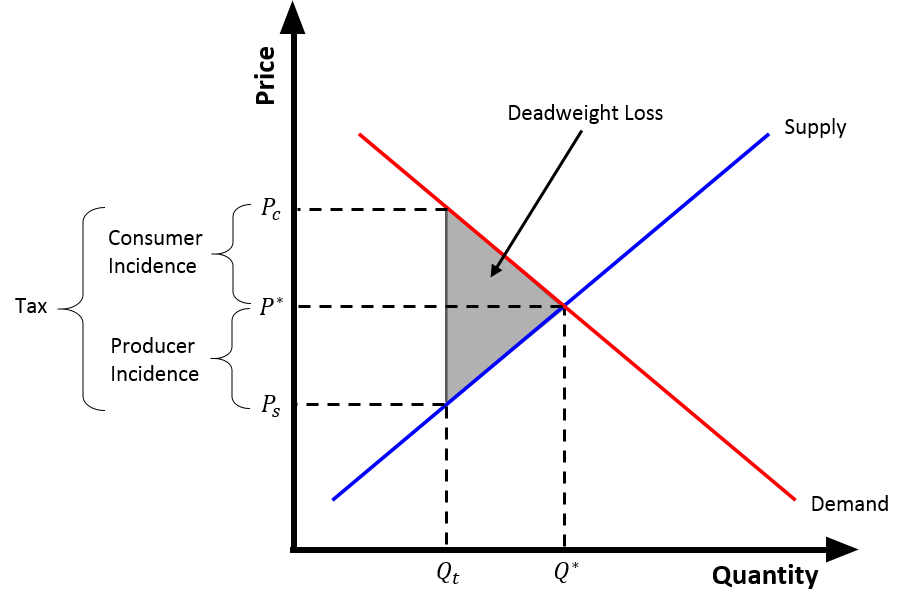

What is tax incidence?

How the burden of a tax is shared

42

New cards

How do higher prices due to taxes affect the consumer surplus?

The consumer surplus must go down

43

New cards

How do sellers experiencing lower prices affect the producer surplus?

The producer surplus must go down

44

New cards

T/F: Since buyers send taxes to the government, only the buyer pays for the tax

False, BOTH buyers and sellers pay for tax

45

New cards

T/F: Due to taxes, the buyer has to pay more, and the seller receives less

True

46

New cards

If taxes are added to the supplier, the supply shifts \____________ by \____________

The supply shifts up by the amount of the tax

47

New cards

T/F: Regardless of who pays the tax to the government, the burden to buyers and sellers is the same

True

48

New cards

T/F: The burden of tax is always shared equally, even in inelastic/elastic markets

False, it can depend if the supply is elastic and the demand inelastic, or vice versa

49

New cards

Elastic supply/demand is represented by... (flat/steep curve)

Flat curve

50

New cards

Inelastic supply/demand is represented by... (flat/steep curve)

Steep curve

51

New cards

With elastic supply and inelastic demand, who pays more?

The buyers

52

New cards

With inelastic supply and elastic demand, who pays more?

The sellers

53

New cards

In general, the less elastic side of the market pays \___________

More

54

New cards

How is the tax wedge calculated?

The buyer's price minus the the seller's price

T \= Pb - Ps

T \= Pb - Ps

55

New cards

How is tax revenue calculated?

Tax revenue \= T * Q

T \= height of the tax wedge

Q \= quantity sold under the tax

T \= height of the tax wedge

Q \= quantity sold under the tax

56

New cards

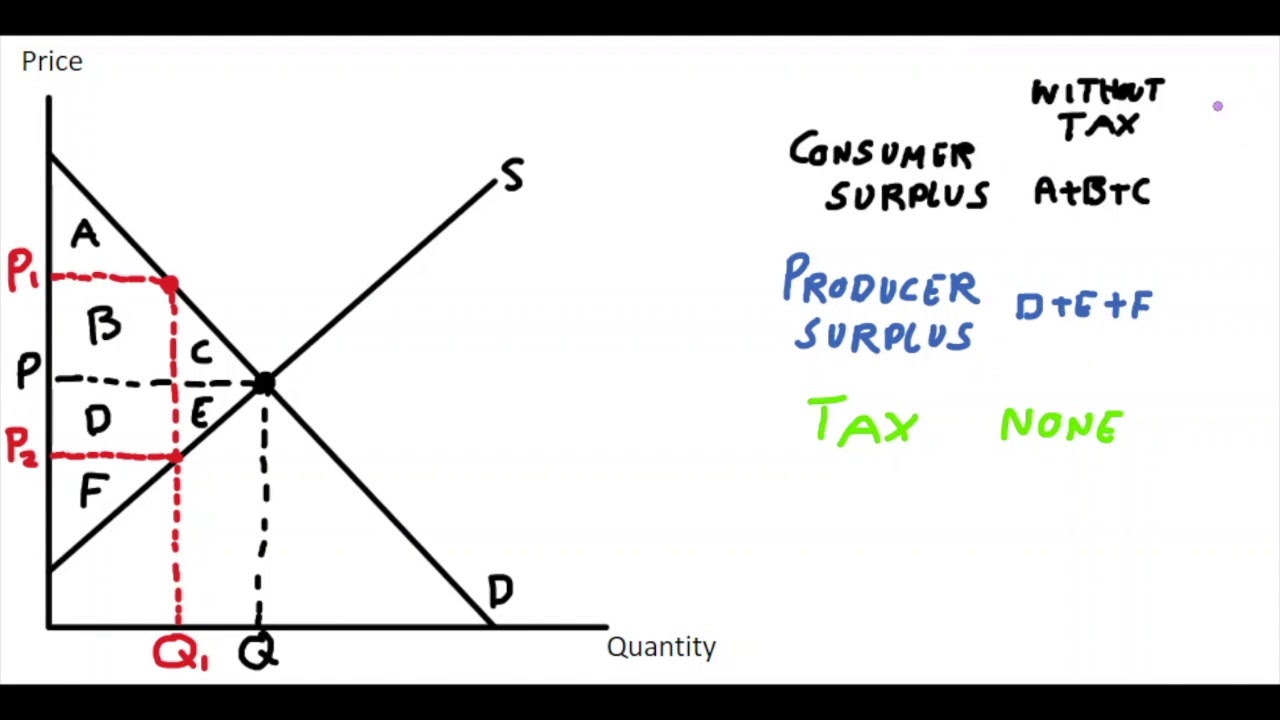

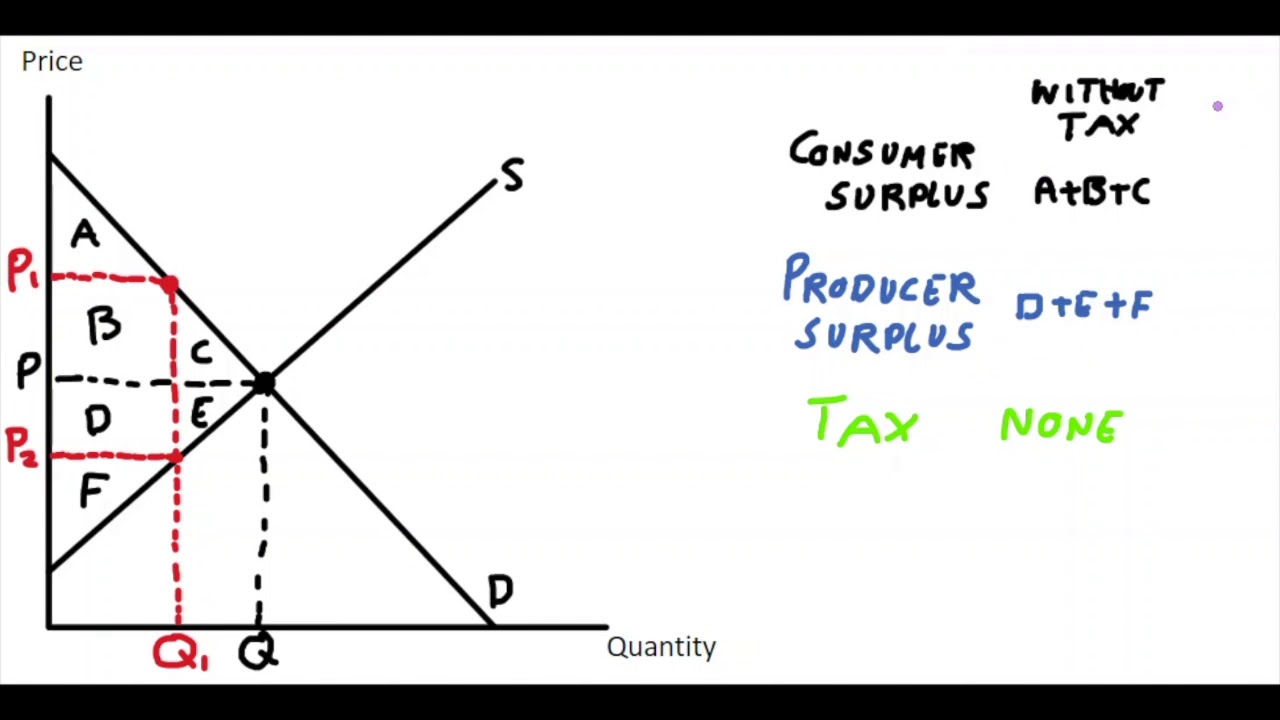

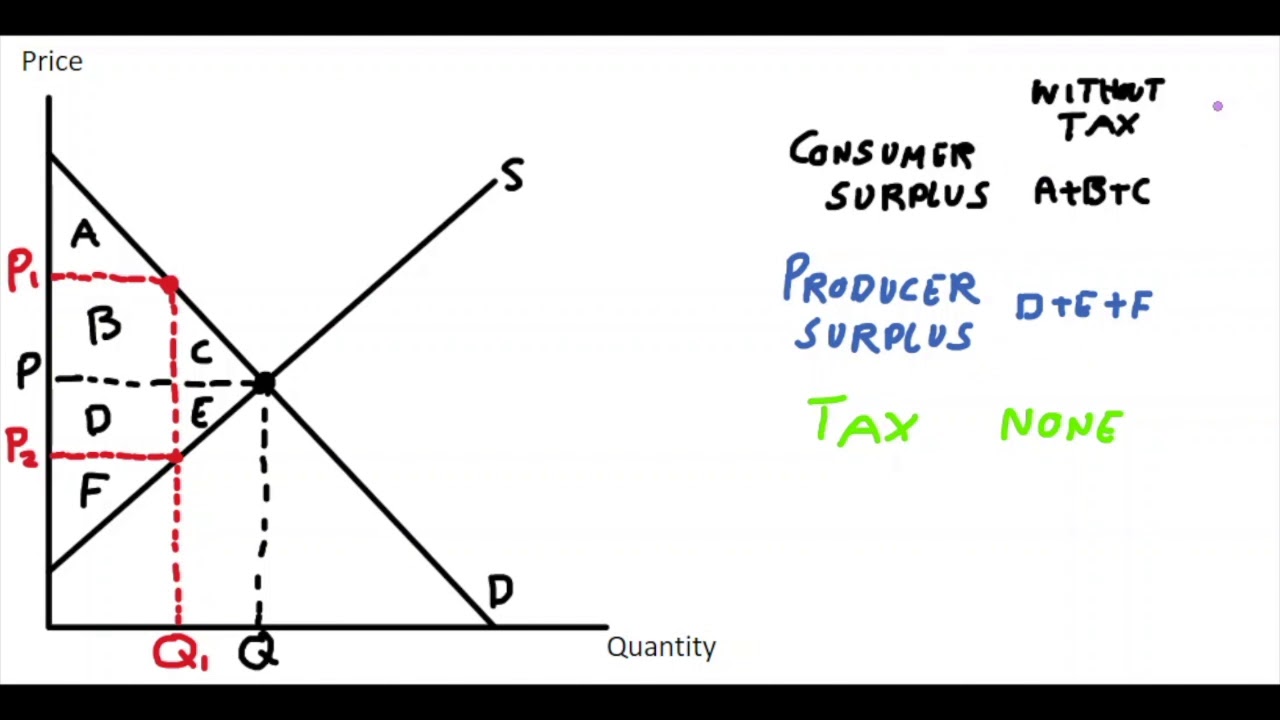

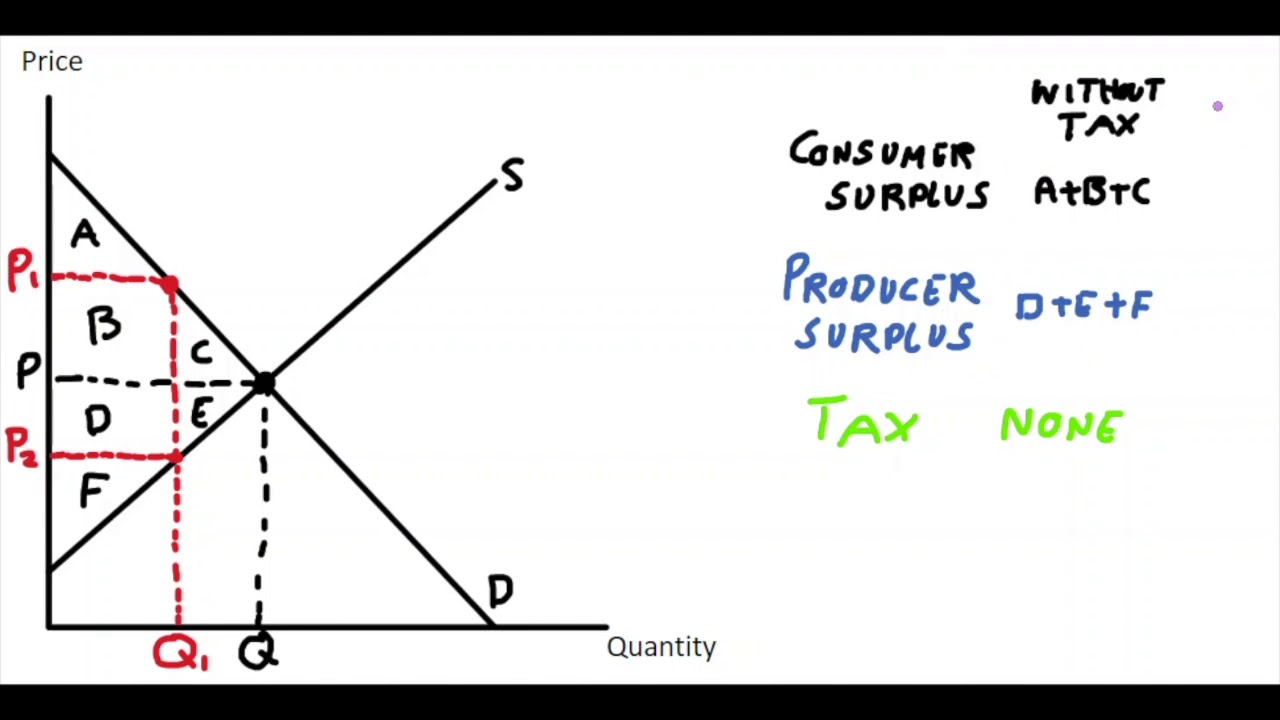

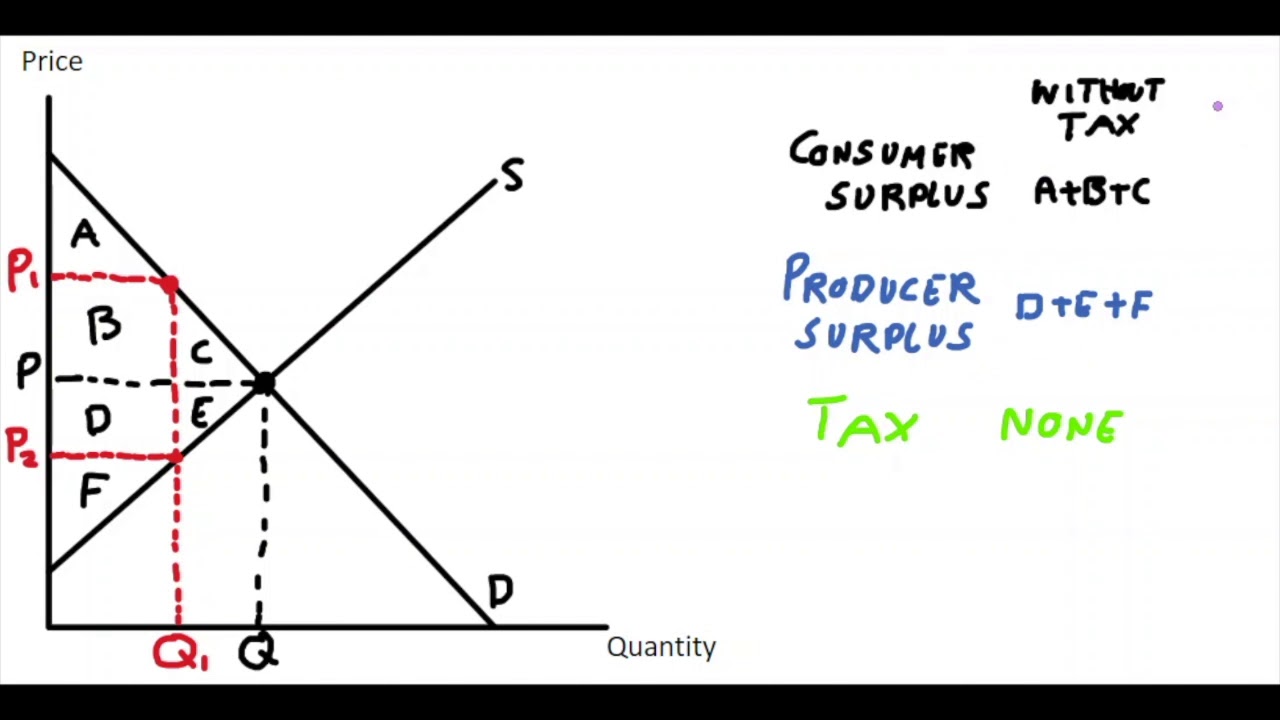

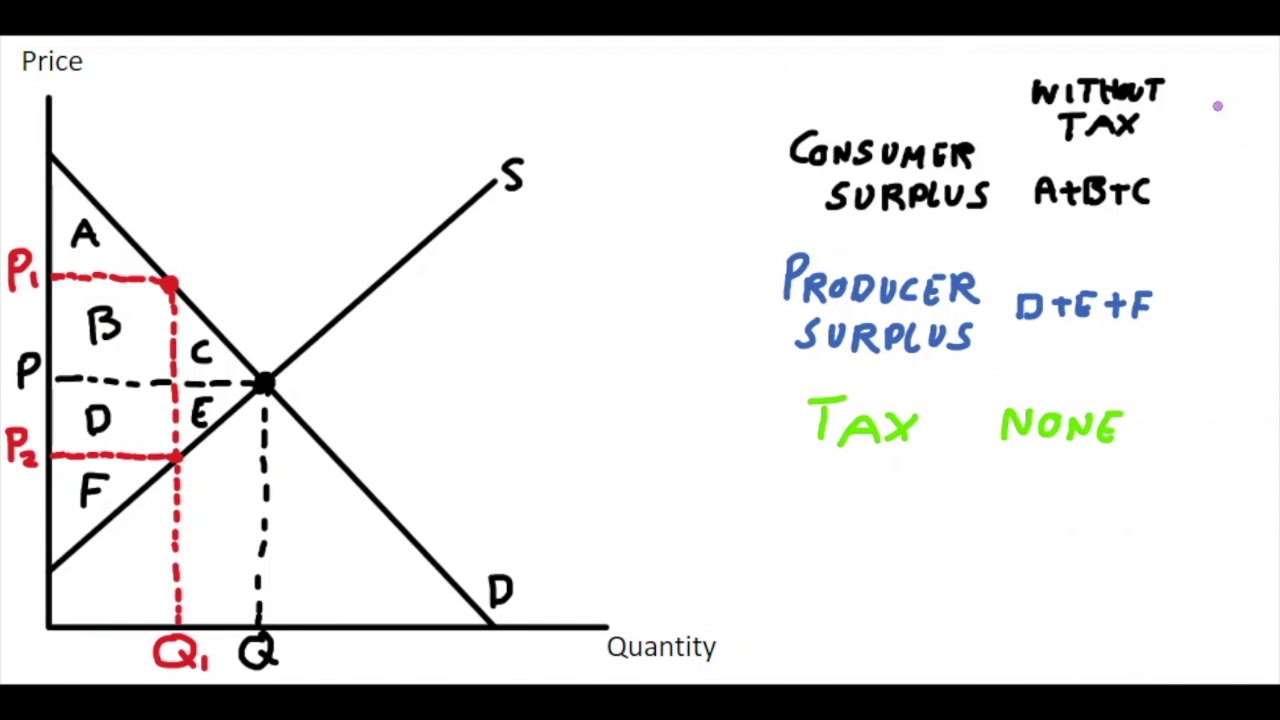

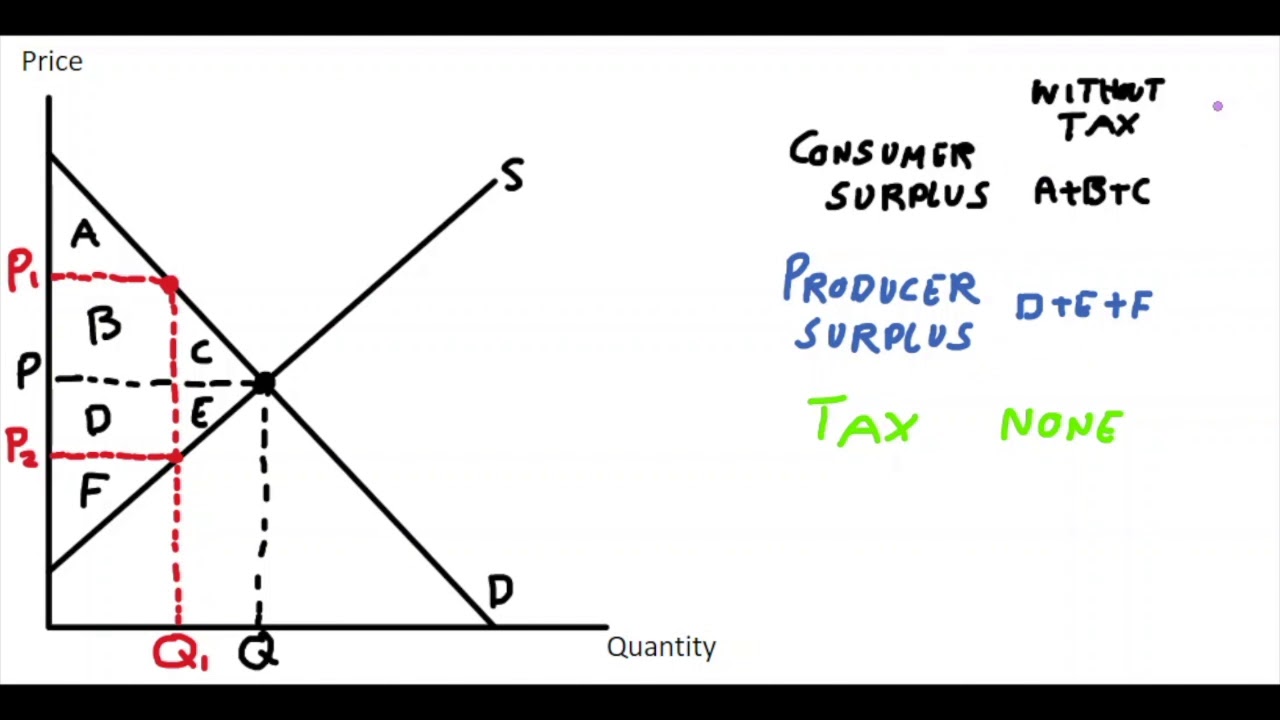

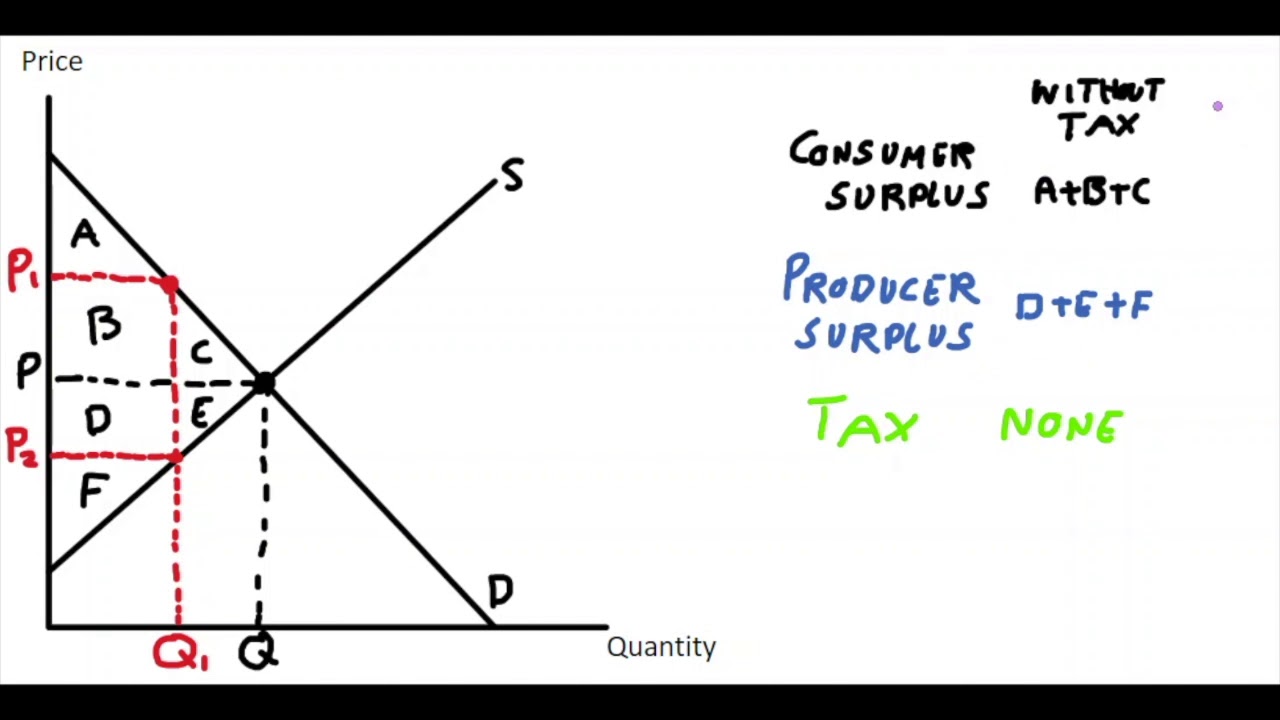

What is A and F on the graph?

A \= Consumer surplus after tax

F \= Producer surplus after tax

F \= Producer surplus after tax

57

New cards

What does the area of A, B, C and D, E, F refer to?

A, B, C \= consumer surplus before tax

D, E, F \= producer surplus before tax

D, E, F \= producer surplus before tax

58

New cards

Total surplus (on the welfare analysis graph) is equal to

(A + B + C) + (D + E + F)

59

New cards

Consumer surplus (on the welfare analysis graph) changes by \____________ after tax

\- B - C

60

New cards

Producer surplus (on the welfare analysis graph) changes by \_____________ after tax

\- D - E

61

New cards

Tax revenue (on the welfare analysis graph) changes by \____________ after tax

\+ B + D

62

New cards

Total surplus changes by \_____________ after tax

\- C - E

63

New cards

C + E represents....

Deadweight loss

64

New cards

Deadweight loss (in relation to taxes) refers to...

The fall in total surplus that results from a market distortion, such as a tax