Financial Accounting Ch 9-11

1/146

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

147 Terms

What is the purpose of the statement of cash flows?

to provide information about the sources and uses of cash (cash inflows and outflows) for a specific period of time.

Which two financial statements are used to prepare the statement of cash flows?

balance sheet & income statement

Describe the three categories of cash flows that explain the total change in cash for the year.

cash from operating activities

cash from investing activities

cash from financing activities

Why is the statement of cash flows so important?

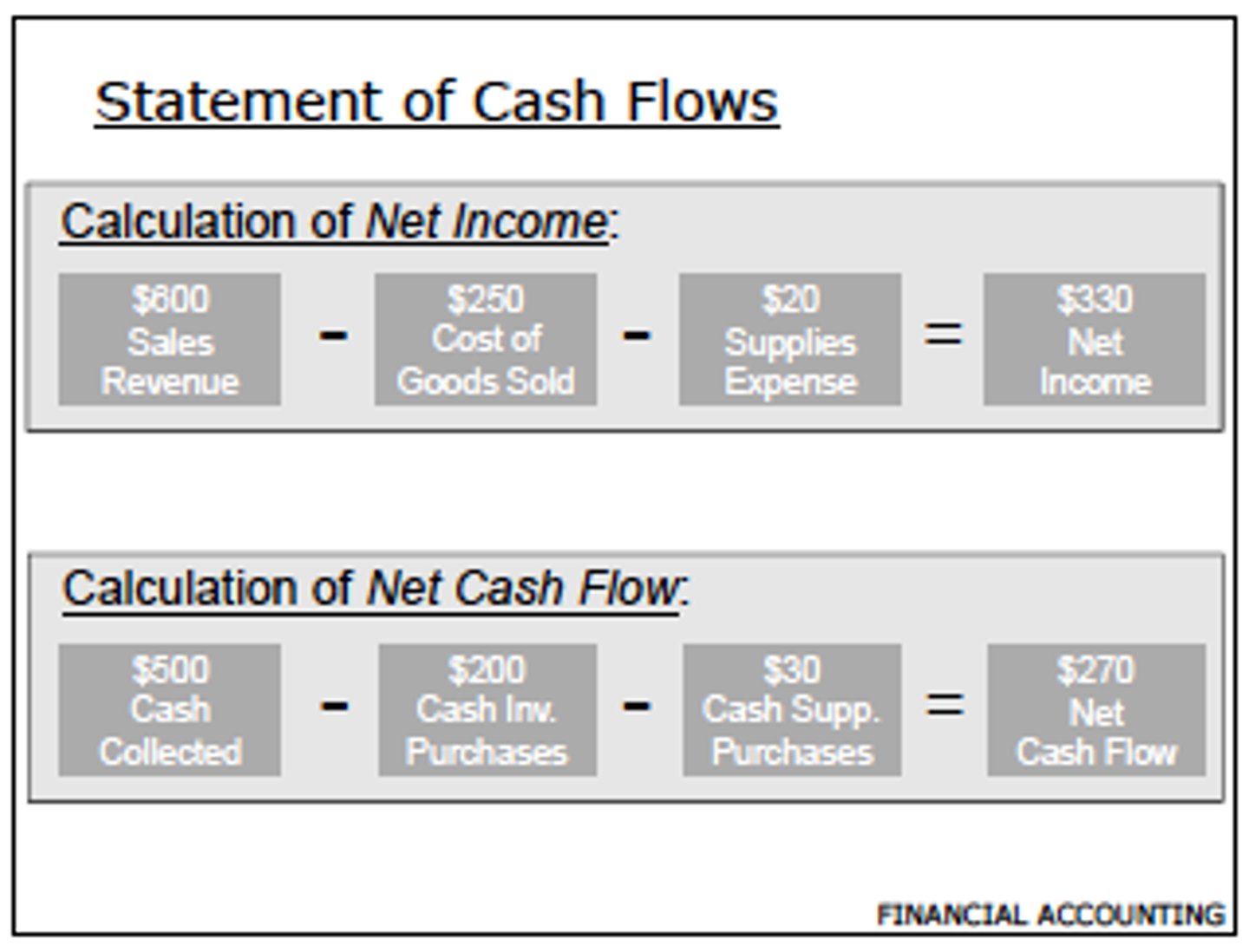

it presents financial information on a cash, rather than an accrual, basis.

What are the two traditional approaches for preparing and presenting the statement of cash flows?

direct & indirect method

Direct Method

Adjusts the items on the income statement

- directly show the cash inflows and outflows from operations

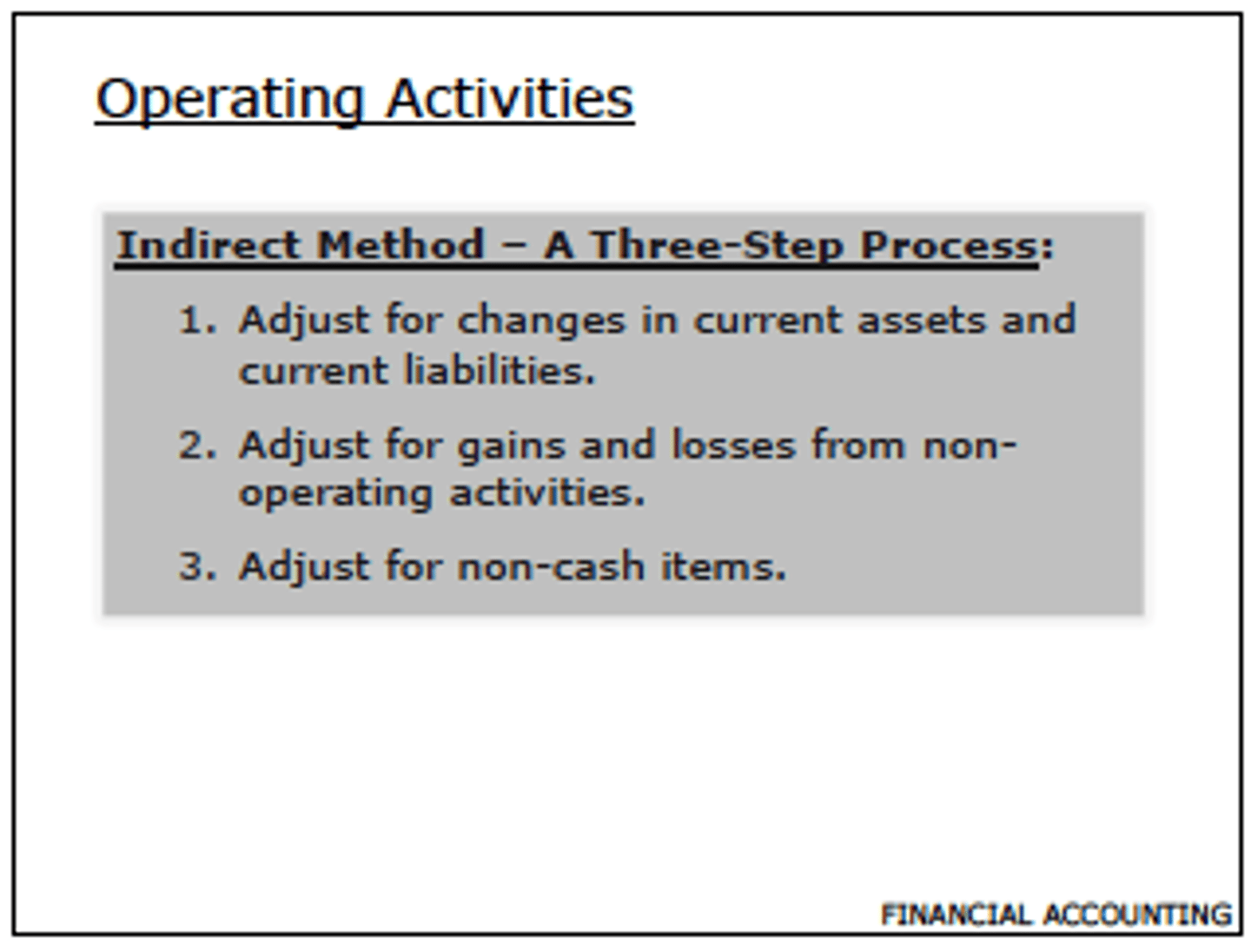

Indirect Method

net income is adjusted for items that do not affect cash

2. sales of a depreciated asset

3. depreciation/ amortization

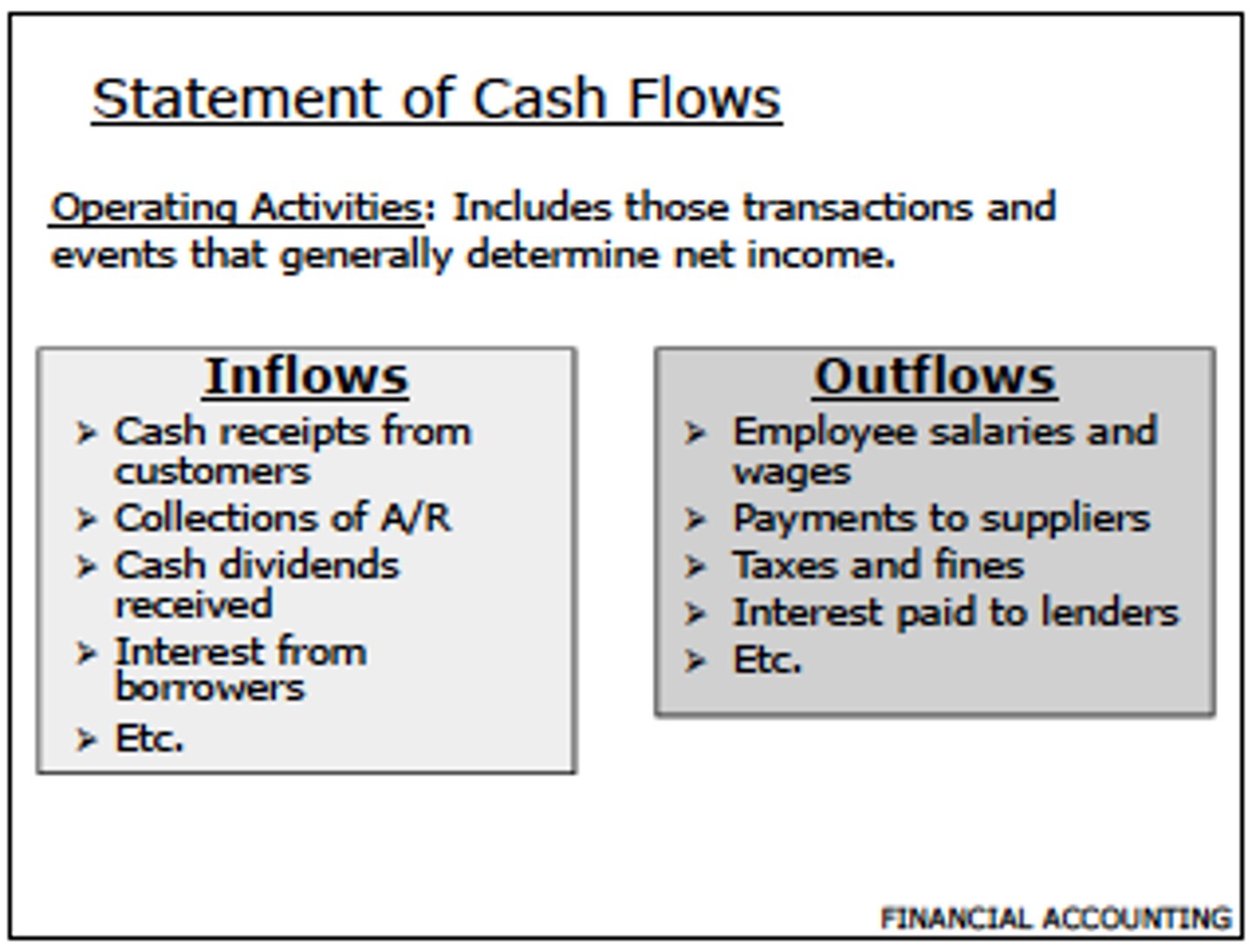

Which types of business transactions would result in cash from operating activities? Give three examples of transactions that would be classified as cash flows from operating activities.

Sales of goods and services result in operating cash inflows.

Payments for goods and services (to employees and creditors) result in operating cash outflows.

Examples of operating cash flows include payment of salaries, payments on accounts payable, and cash sales to customers.

Operating Activities

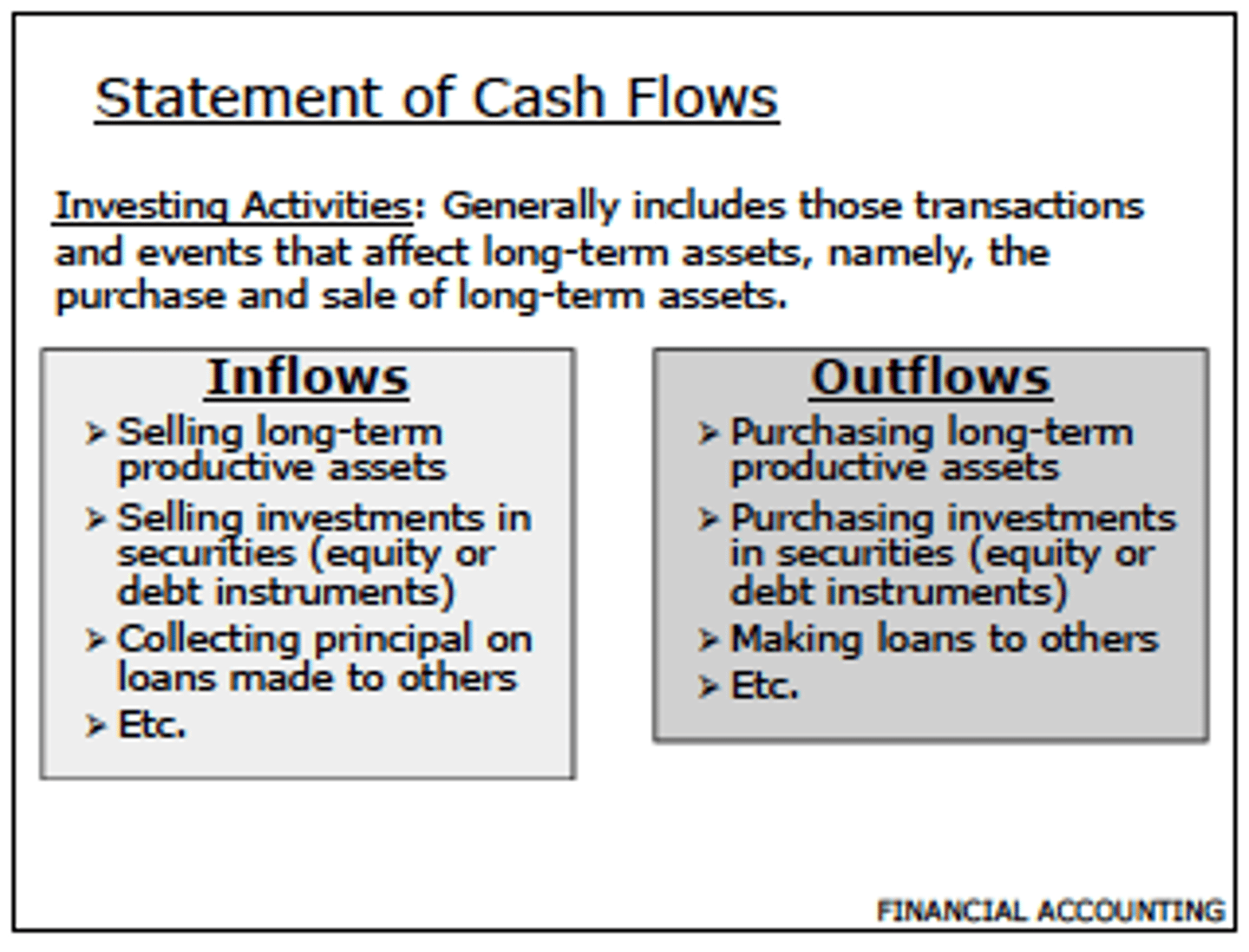

Which types of business transactions would result in cash flows from investing activities? Give three examples of transactions that would be classified as cash flows from investing activities.

Sales of long-term assets such as property, plant, and equipment result in investing cash inflows.

Purchases of these long term assets result in investing cash outflows.

Examples of investing cash flows include the sale of equipment, the sale of land, and the purchase of a building.

Investing Activities

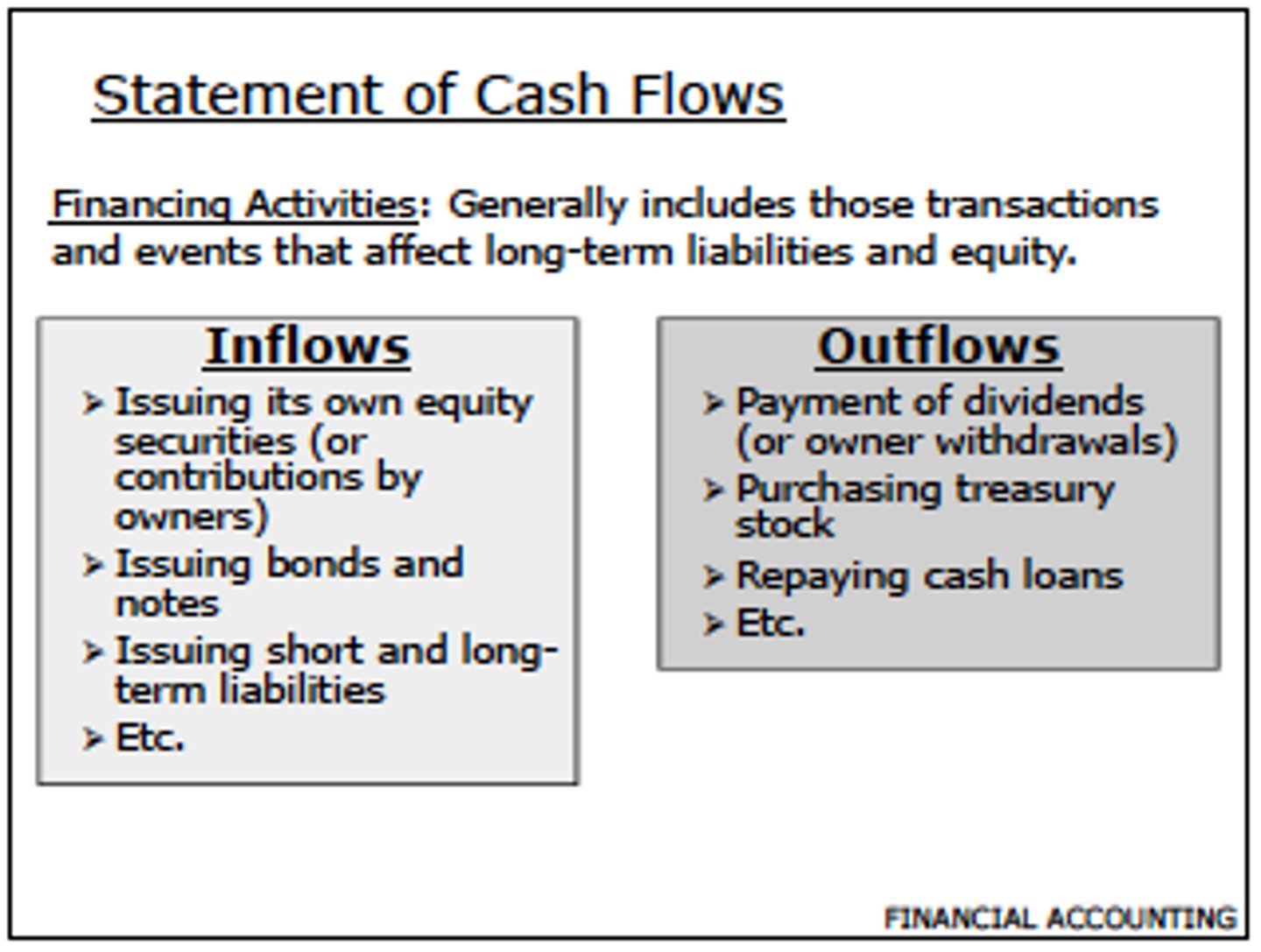

Which types of business transactions would result in cash flows from financing activities? Give three examples of transactions that would be classified as cash flows from financing activities.

Financing cash inflows result from the issuance of stock or debt.

Financing cash outflows result from the repayment of debt, the payment of cash dividends, or the purchase of treasury stock.

Financing Activities

How is depreciation expense treated when using the direct method of preparing the statement of cash flows? When using the indirect method?

direct method--depreciation expense is ignored--it has no effect.

indirect method--depreciation expense is added back to net income. It is a non-cash expense in the operating section.

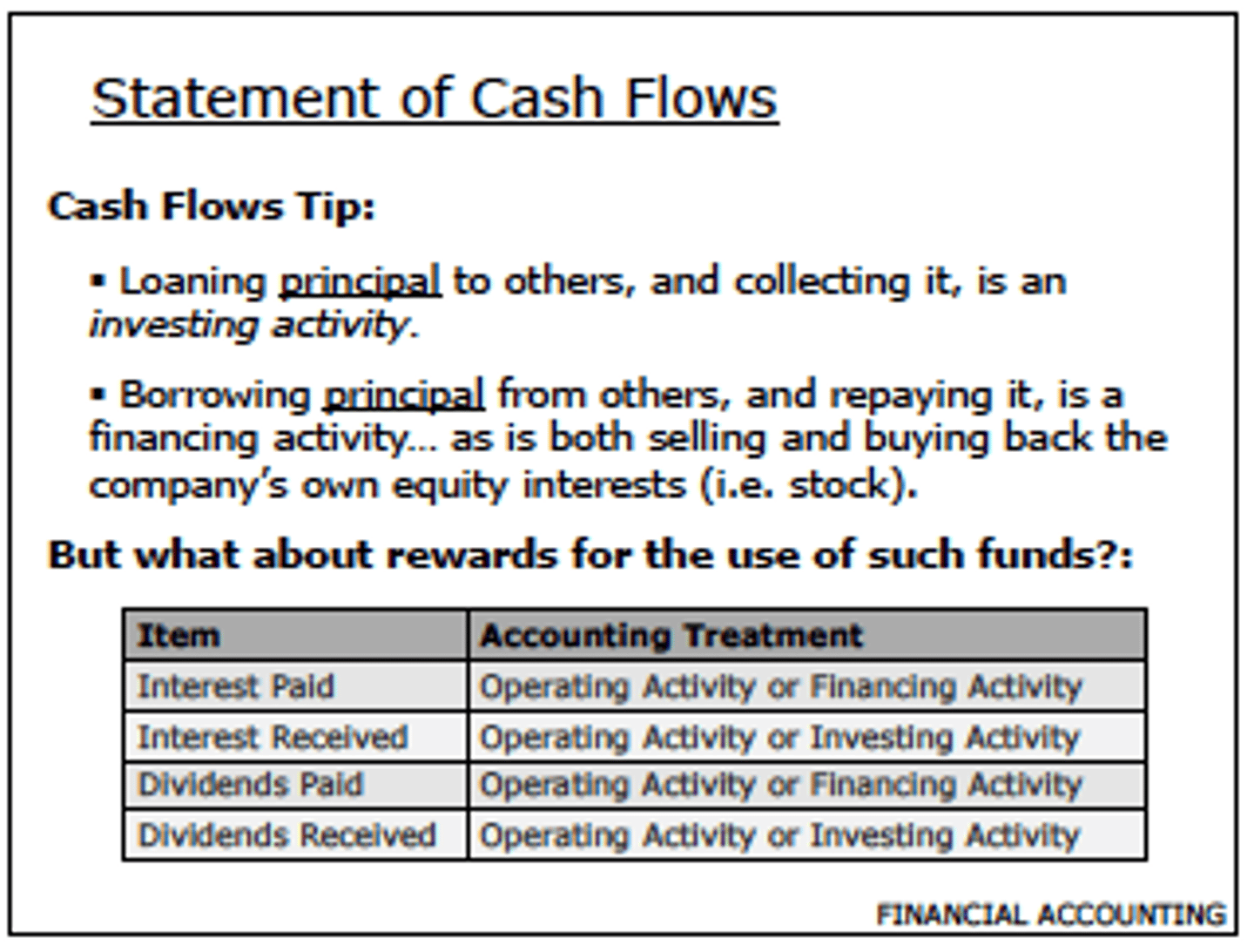

How to treat interest and dividends on the Statement of Cash Flows

Interest Paid -- Operating Activity

Interest Received -- Operating Activity

Dividends Paid -- FINANCING Activity

Dividends Received -- Operating Activity

Which account(s) must be analyzed to determine the cash collected from customers? How is this cash flow classified?

Sales Revenue and the change in the Accounts Receivable balance.

operating cash inflow.

Which account(s) must be analyzed to determine the proceeds from the sale of a building? How is this cash flow classified?

Building and the related Accumulated Depreciation account as well as the Gain or Loss on the Sale of Building account.

investing cash inflow.

Which account(s) must be analyzed to determine the cash paid to vendors? How is this cash flow classified?

Cost of Goods Sold, the change in Inventory, and the change in Accounts Payable.

operating cash outflow.

Which account(s) must be analyzed to determine the cash paid for dividends? How is this cash flow classified?

The Retained Earnings account is analyzed to determine dividends declared.

Dividends payable (on the balance sheet) will need to be considered. If it has a balance, this will be dividends declared but not paid.

financing cash outflow.

How is interest collected or interest paid classified on the statement of cash flows?

cash flow from operating activities.

Define free cash flow and explain what this amount indicates about a firm.

Free cash flow is net cash flow from operations less dividends and net capital expenditures.

It is a measure of the company's ability to engage in long-term investment opportunities and financial flexibility.

How might a firm misuse the statement of cash flows to give investors a better impression of the firm's operations?

Because analysts are looking for positive net cash flows from operating activities, management may misclassify operating cash outflows as investing or financing cash outflows.

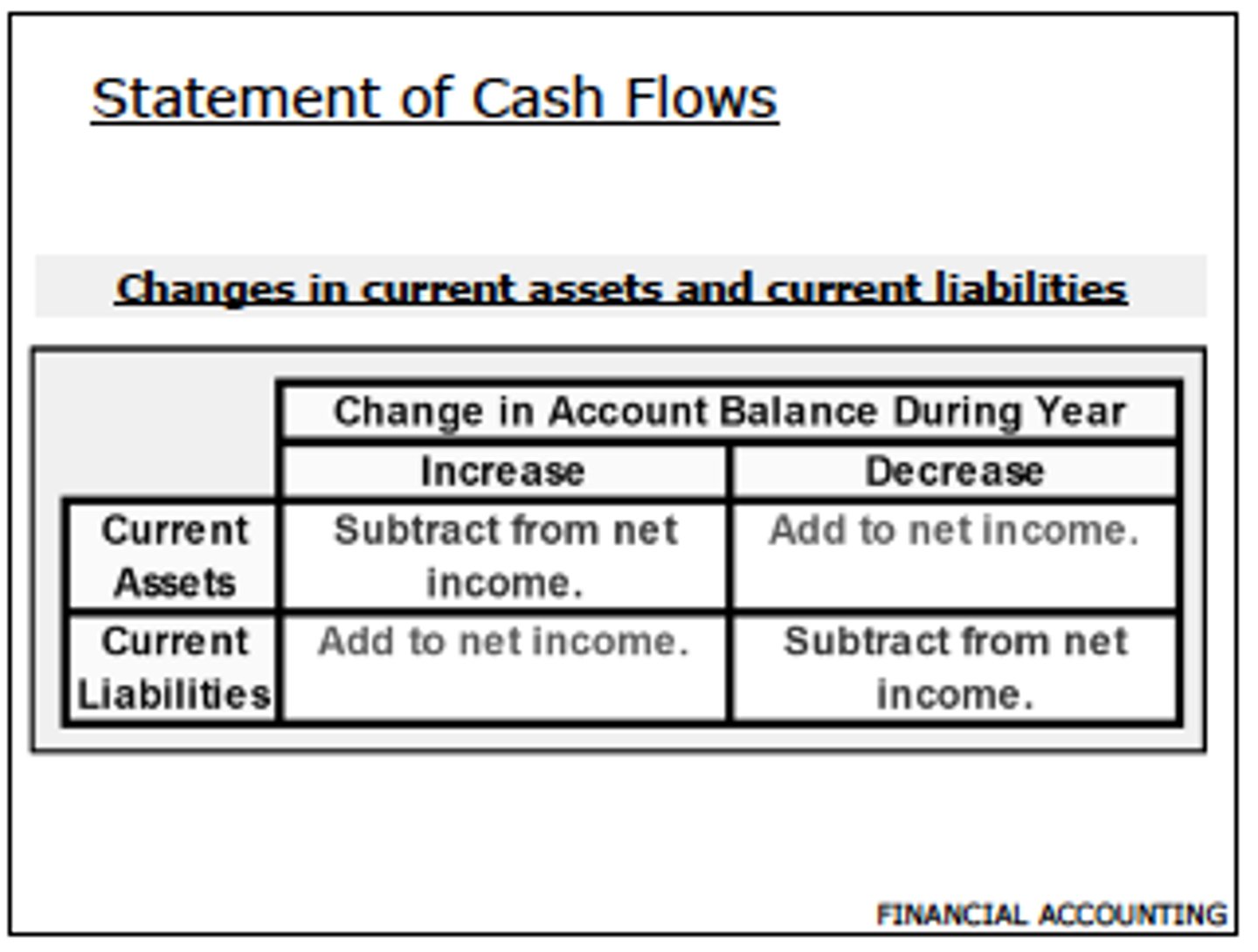

Statement of Cash Flows

Changes in current assets and current liabilities

Use the following information to answer questions 1-3.

Quality Products engaged in the following cash transactions during May:

Purchase of inventory $ 5,000

Cash proceeds from loan $ 7,000

Cash paid for interest $ 400

Cash collected from sales $26,500

New stock issued $25,000

Salaries paid to employees $ 4,600

Purchase of new delivery van $20,000

1. How much is net cash from financing activities?

a. $ 7,000

b. $25,000

c. $31,600

d. $32,000

d

New stock issued $25,000

Cash proceeds from loan $7,000

2. How much is net cash from investing activities?

a. $(20,000)

b. $(25,000)

c. $ 25,000

d. $ 32,000

a

Purchase of new delivery van $20,000

3. How much is net cash from operating activities?

a. $26,500

b. $ (3,500)

c. $16,500

d. $16,900

c

Purchase of inventory $5,000

Cash collected from sales $26,500

Salaries paid to employees $ 4,600

Cash paid for interest $400

4. Cash from the sale of treasury stock

a. would not be included in the statement of cash flows.

b. would be classified as a contra-equity cash flow.

c. would be classified as an investing cash flow.

d. would be classified as a financing cash flow.

d

5. The cash proceeds from the sale of a building will be

a. the cost of the building.

b. the book value of the building.

c. the book value plus any gain or minus any loss.

d. shown on the financing portion of the appropriate financial statement.

c

6. If a firm has net investing cash inflows of $5,000; net financing cash inflows of $24,000; and a net increase in cash for the year

of $12,000, how much is net cash from operating activities?

a. Net cash inflow of $17,000

b. Net cash inflow of $29,000

c. Net cash outflow of $17,000

d. Net cash outflow of $19,000

c

7. Depreciation for the year was $50,000 and net income was $139,500. If the company's transactions were all cash except those

related to long-term assets, how much was net cash from operating activities?

a. $139,500

b. $189,500

c. $ 89,500

d. It cannot be determined from the given information.

b

Use the following information to answer questions 8-10.

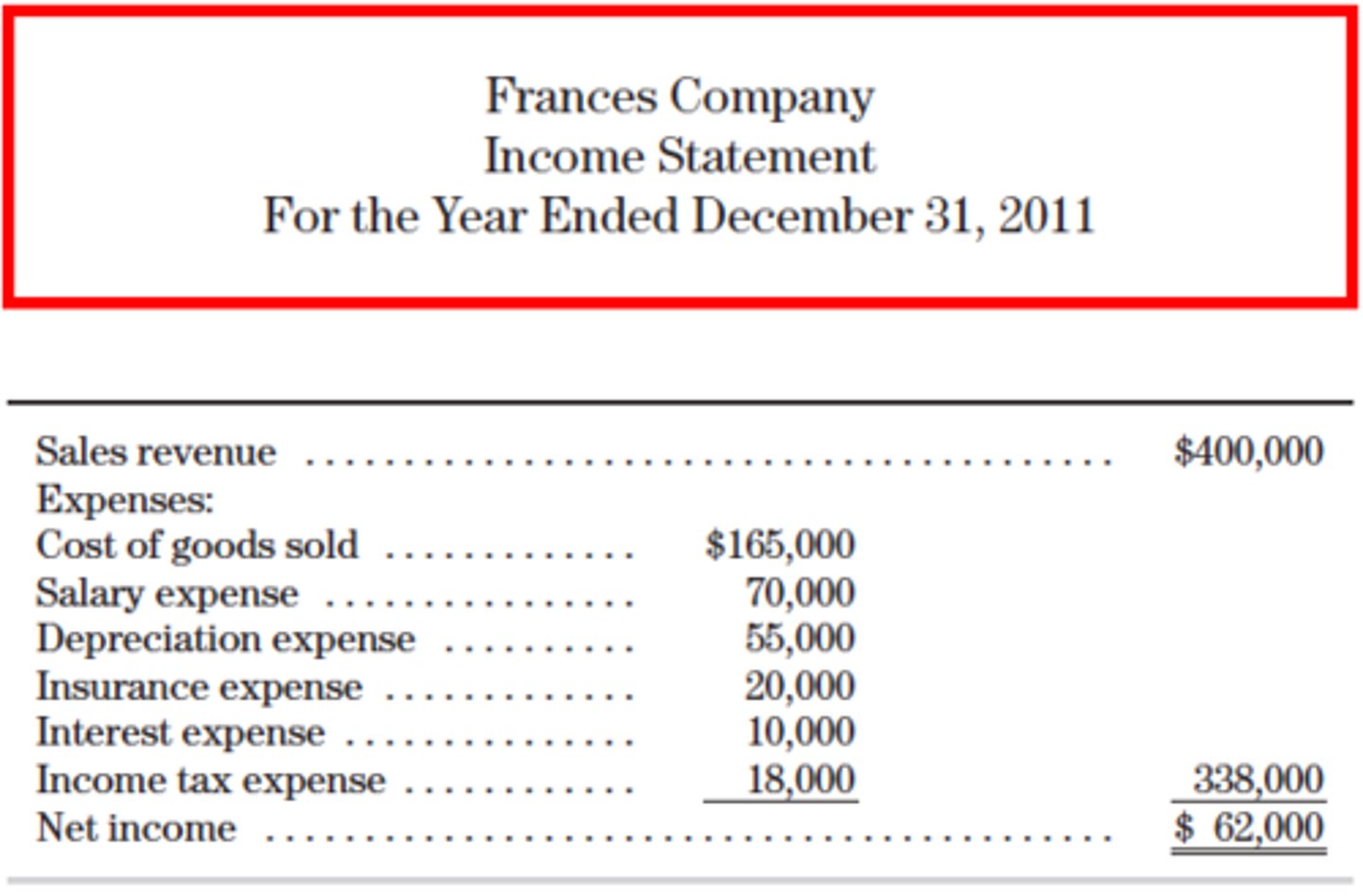

The income statement and additional data for Frances Company for the year ended December 31, 2011, follow:

Accounts receivable decreased by $12,000. Inventories increased by $6,000 and accounts payable decreased by $2,000. Salaries payable increased by $8,000. Prepaid insurance increased by $4,000. Interest expense and income tax expense equal their cash amounts. Frances Company uses the direct method for its statement of cash flows.

8. How much cash did Frances Company collect from customers during 2011?

a. $400,000

b. $412,000

c. $406,000

d. $388,000

b

$400,000

A/R decr $12,000 (Asset incr) = +12,000

Inventories incr $6,000 (Asset incr) = -6,000

A/P payable decr $2,000 (Liability decr) = -2,000

Salaries payable incr $8,000 (liability incr) = +8,000

Prepaid insurance incr $4,000 (asset incr) = -4,000

Interest expense = cash amt

income tax expense = cash amt

9. How much cash did Frances Company pay its vendors during 2011?

a. $173,000

b. $165,000

c. $167,000

d. $163,000

a

$165k

A/P payable decr $2,000 (Liability decr) = -2,000

10. How much cash did Frances Company pay for insurance during the year?

a. $20,000

b. $24,000

c. $16,000

d. $48,000

b

20k

Prepaid insurance incr $4,000 (asset incr) = -4,000

SE9-1A. Identify cash flows. (LO 1). Given the following cash transactions, classify each as a cash flow from:

(1) operating activities, (2) investing activities, or (3) financing activities.

Payment to employees for work done

(1) operating activities

Dividends paid to shareholders

(3) financing activities

Payment for new equipment

(2) investing activities

Payment to supplier for inventory

(1) operating activities

Interest payment to the bank related to a loan

(1) operating activities

Principal payment to the bank for a loan

(3) financing activities

Collection from customers to whom sales were previously made on account

(1) operating activities

Collection from customers for cash sales

(1) operating activities

Collection for sale of land that had been purchased as a possible factory site

(2) investing activities

Petty cash used to pay for doughnuts for staff

(1) operating activities

For each of the following items, tell whether it is a cash inflow or cash outflow and the section of the statement of cash flows in which the item would appear. (Assume the direct method is used.)

a. Cash collected from customers

Inflow -- Operating

b. Proceeds from issue of stock

Inflow -- Financing

c. Interest payment on loan

Outflow -- Operating

d. Principal repayment on loan

Outflow -- Financing

e. Cash paid for advertising

Outflow -- Operating

f. Proceeds from sale of treasury stock

Inflow -- Financing

g. Money borrowed from the local bank

Inflow -- Financing

h. Cash paid to employees (salaries)

Outflow -- Operating

i. Purchase of equipment for cash

Outflow -- Investing

j. Cash paid to vendors for inventory

Outflow -- Operating

k. Taxes paid

Outflow -- Operating

a. Cash paid to vendor for supplies

Outflow -- Operating

b. Purchase of treasury stock

Outflow -- Financing

c. Principal repayment on bonds

Outflow -- Financing

d. Interest payment on bonds

Outflow -- Operating

e. Cash paid for salaries

Outflow -- Operating

f. Cash from issuance of common stock

Inflow -- Financing

g. Cash dividends paid

Outflow -- Financing

h. Cash paid for rent and utilities

Outflow -- Operating

i. Purchase of computer for cash

Outflow -- Investing

j. Cash paid for company vehicle

Outflow -- Investing

k. Income taxes paid

Outflow -- Operating

Which types of business transactions would result in cash flows from investing activities? Give three examples of transactions that would be classified as cash flows from investing activities.

Sales of long-term assets such as property, plant, and equipment

Purchases of these longterm assets result in investing cash outflows.

Examples of investing cash flows include the sale of equipment, the sale of land, and the purchase of a building.

1. Define the items that the Financial Accounting Standards Board requires a firm to report separately on the income statement. Why is this separation useful?

discontinued operations & extraordinary items.

These items are separated because they are not expected to be repeated in the future and are therefore not part of ongoing operations.

Discontinued Items

refers to the disposal of a significant component or division of a business;

the income statement should reflect such a loss if this occurs

Extraordinary Items

unusual and infrequent material gains and losses

2. What criteria must be met for an event to be considered extraordinary? Give an example of an event that would be considered extraordinary.

unusual in nature & infrequent in occurrence.

Examples are eruptions of a volcano, a takeover of foreign operations by a foreign government, and effects of new laws or regulations that result in a one-time cost to comply.

3. What does it mean to show an item net of tax? Where is this done and why?

have had the income taxes related to the item subtracted from the value.

4. What is horizontal analysis? What is the purpose of this method of analysis?

evaluates financial statement items over time. It expresses the change in financial statement amounts in percentages rather than dollars.

(Analysis Period - Base Period) / Base Period

The purpose of the analysis is to identify trends.

5. What is vertical analysis? What is the purpose of this method of analysis?

Vertical analysis focuses on a single year's financial statements. Each item on the financial statement is expressed as a percentage of a selected base amount. The purpose of the analysis is to identify problem areas and for comparison with other companies.

Analysis Amt / Base Amt

[Base Amt = Total Assets (Balance Sheet) or Revenues (Income Statement)]

Common-sizing

The conversion of the numbers in a financial statement from dollar amounts to a percentage of a chosen value

6. What is liquidity? Which ratios are useful for measuring liquidity and what does each measure?

Liquidity refers to the company's ability to meet its short-term obligations. Liquidity ratios include:

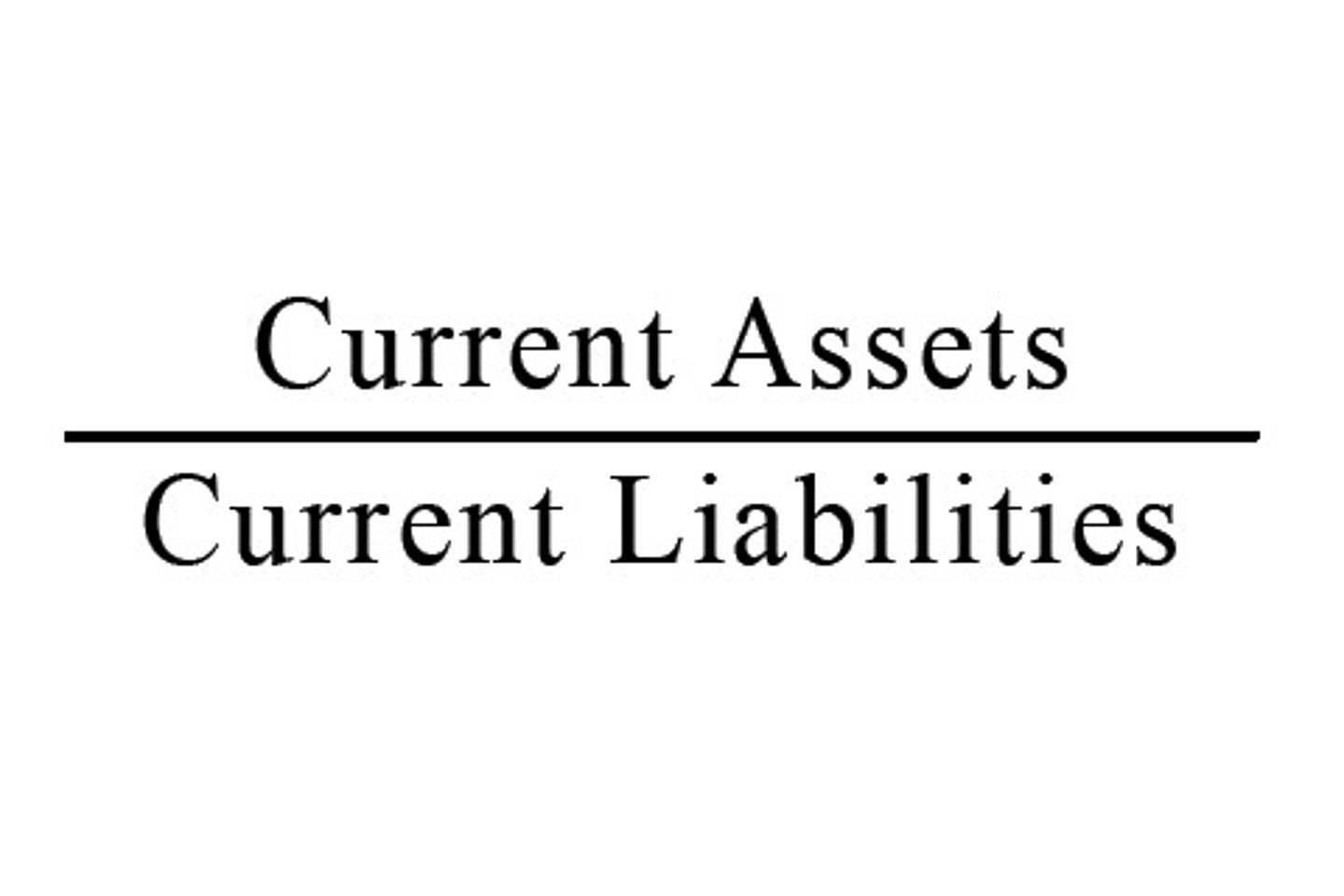

1) current ratio - measures a company's ability to pay current liabilities with current assets

2) working capital - measures a company's ability to meet its short-term obligations

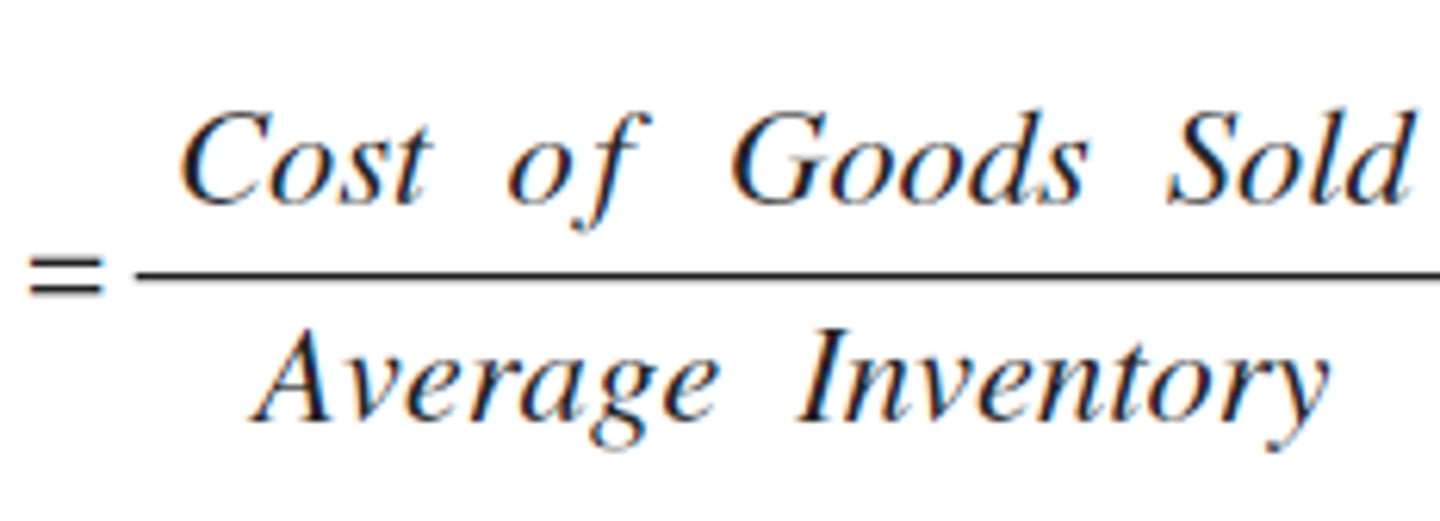

3) inventory turnover ratio - measures how quickly a company is selling its inventory

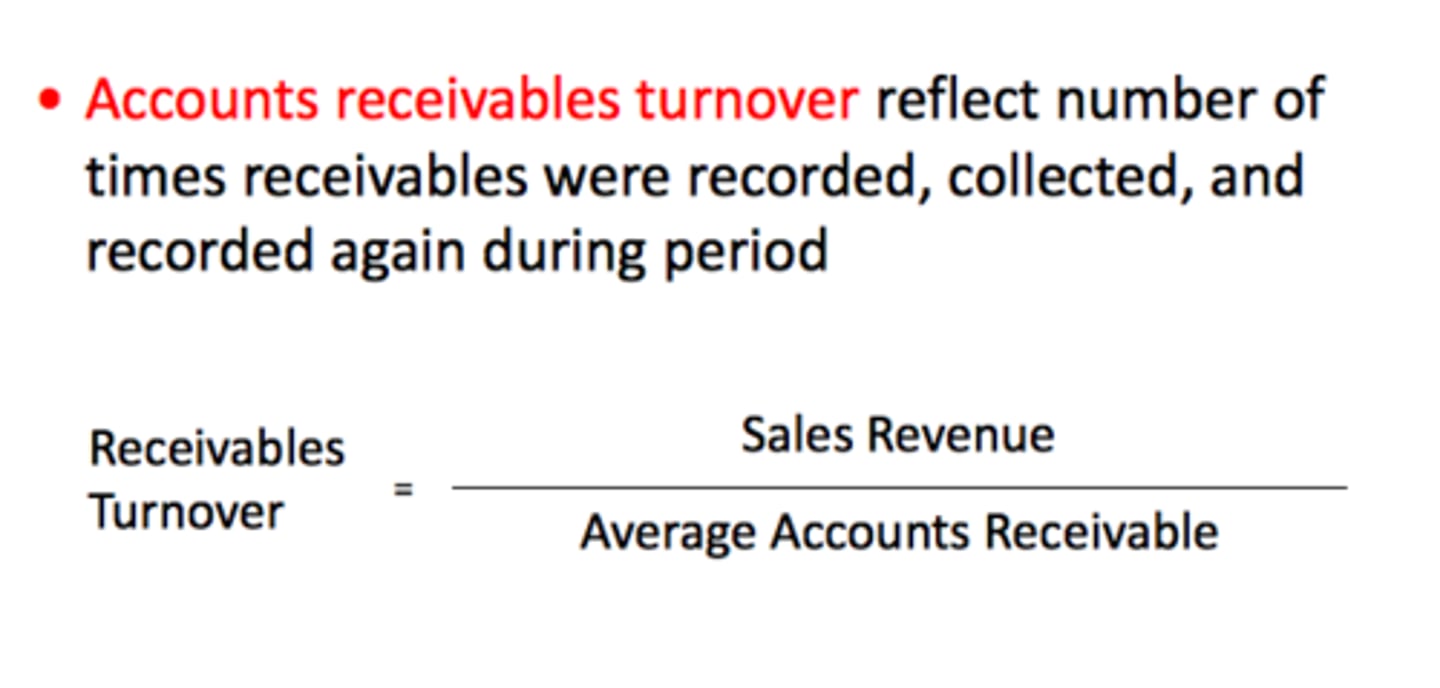

4) accounts receivable turnover ratio - measures a company's ability to collect the cash from its credit card customers

5) current cash debt coverage ratio - measures the company's ability to generate the cash it needs to pay current liabilities from operations

7. What is solvency? Which ratios are useful for measuring solvency and what does each measure?

Solvency refers to the company's ability to meet its long-term obligations. Solvency ratios include:

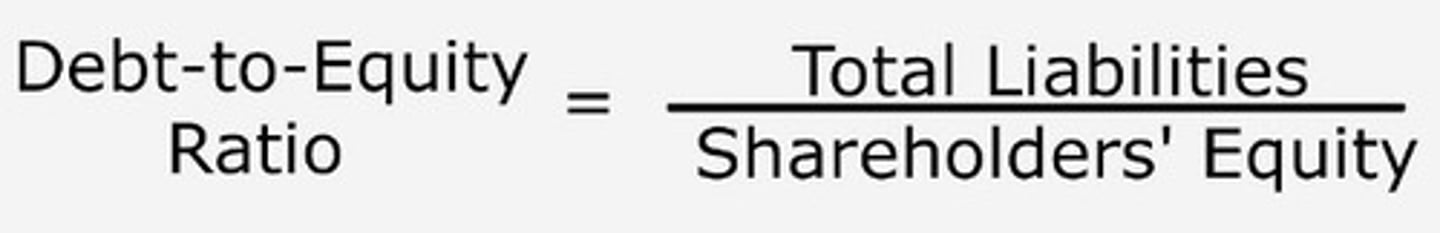

1) debt to equity ratio - compares the amount of debt a company has with the amount the owners have invested in the company

2) free cash flow - measures a firm's ability to generate the cash it needs for investing from its operations

8. What is profitability? Which ratios are useful for measuring profitability and what does each measure?

Profitability ratios evaluate the operating or income performance of a company. Profitability ratios include:

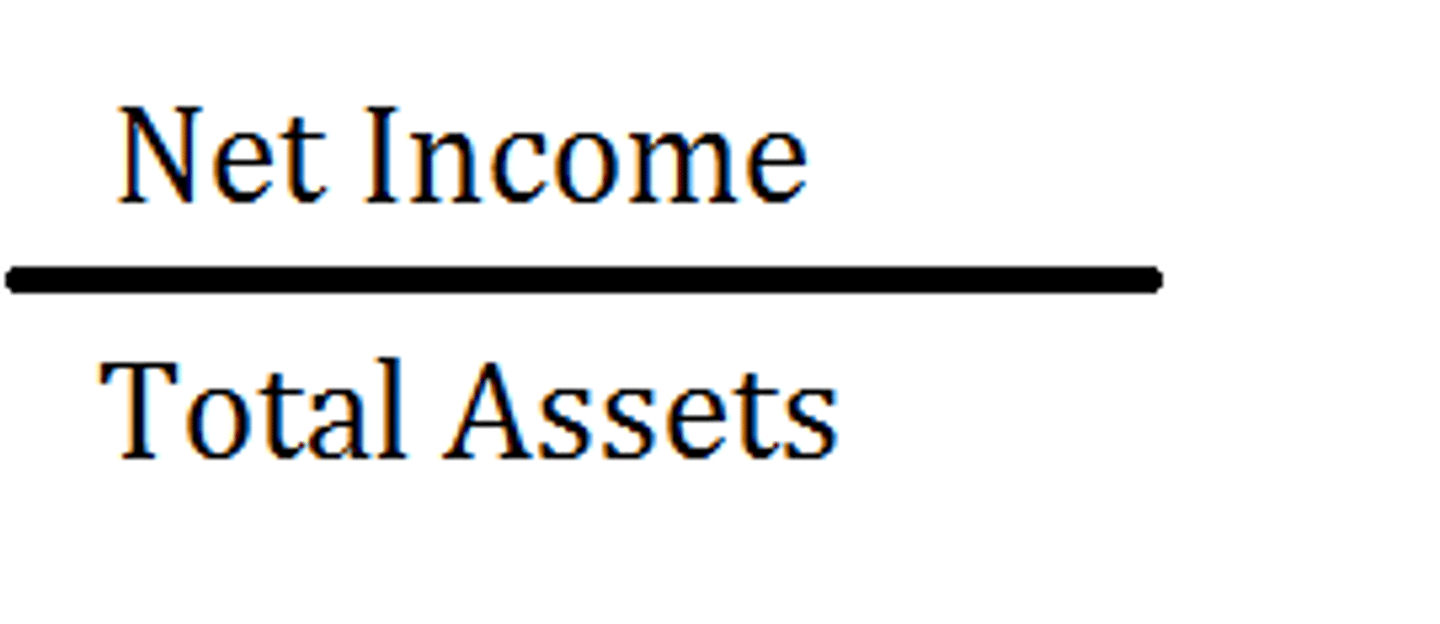

1) return on assets - measures a company's success in using its assets to earn income for owners and creditors

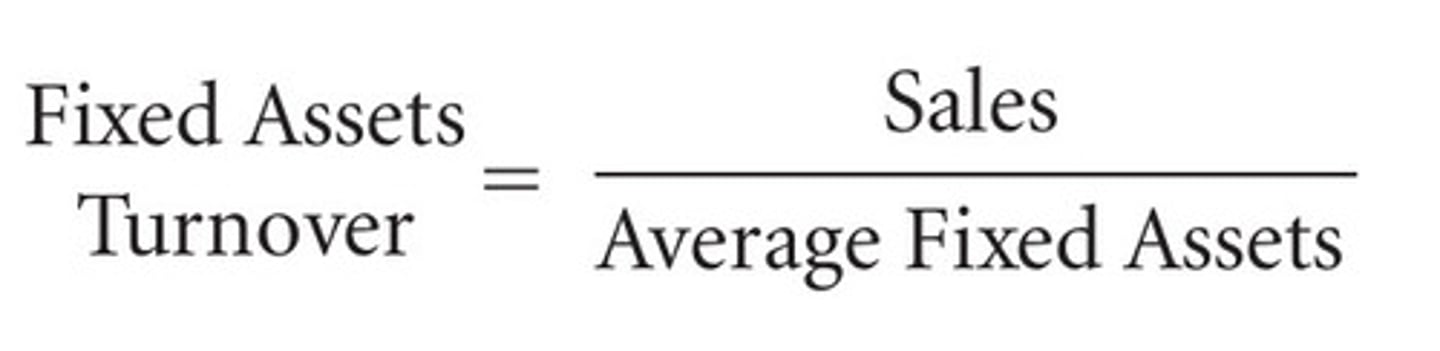

2) asset turnover ratio - measures how efficiently a company uses its assets

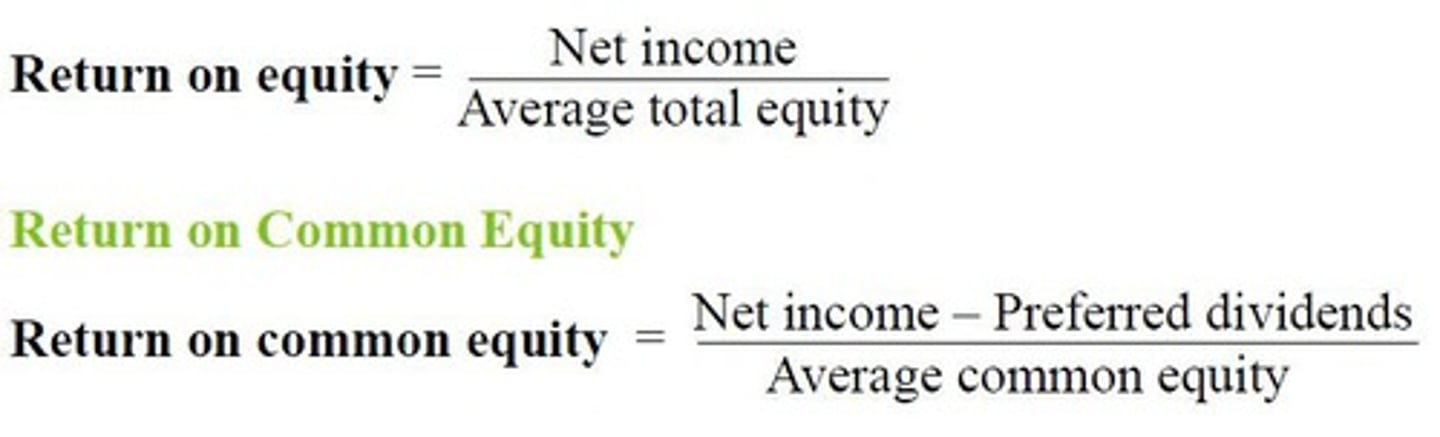

3) return on equity - measures how much income is earned with the common shareholders' investment in the company

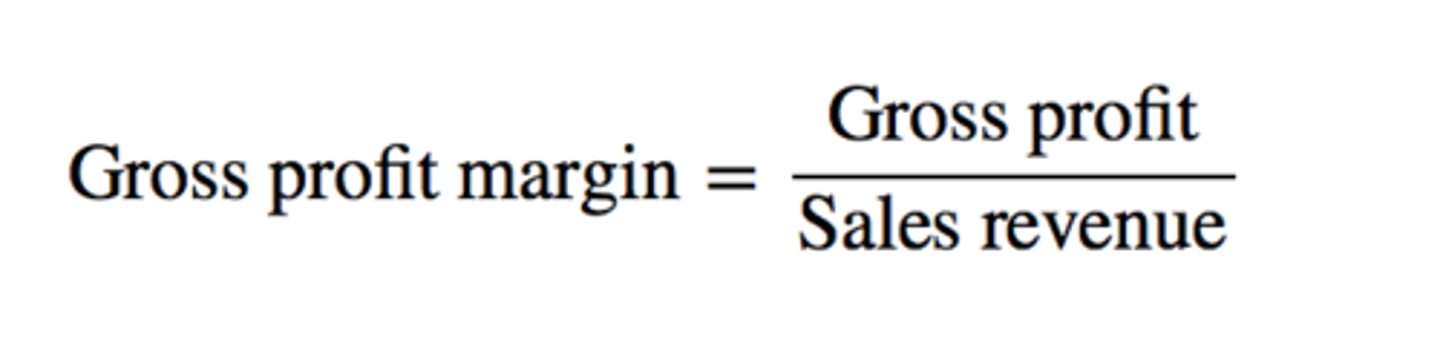

4) gross profit ratio - measures a company's profitability

5) profit margin ratio - measures the percentage of each sales dollar that results in net income

6) earnings per share - calculates the net income per share of common stock

9. What are market indicators? Which ratios are market indicators and what does each measure?

Market indicators relate the current market price of the company's stock to income or dividends. Market indicators include:

1) price-earnings ratio - the market price for $1 of earnings

2) dividend yield - calculates the percentage return on the investment in a share of stock via dividends

10. How are financial ratios used to determine how successfully a company is operating?

Financial statement ratios are used to evaluate the company's performance relative to the company's ratios in previous periods, the ratios of other companies in the industry, or industry averages.

1. Suppose a firm had an extraordinary loss of $300,000. If the firm's tax rate is 35%, how will the loss be shown in the financial statements?

a. On the income statement, below income from operations, net of tax savings, for a net loss of $195,000

b. On the income statement as part of the calculation of income from operations, before taxes, for a loss of $300,000

c. As supplementary information in the notes to the financial statements

d. As a cash outflow from financing on the statement of cash flows

a

2. Current assets for Kearney Company are $120,000 and total assets are $600,000. Current liabilities are $80,000 and total liabilities are $300,000. What is the current ratio?

a. 2.00

b. 2.50

c. 1.90

d. 1.50

d

3. Ritchie Company sold some fixed assets for a gain of $100,000. The firm's tax rate is 25%. How would Ritchie Company report this transaction on its financial statements?

a. On the income statement as part of the calculation of income from continuing operations, net of tax, in the amount of $75,000

b. As an extraordinary item, net of tax, in the amount of $75,000

c. As discontinued operations, net of tax, in the amount of $75,000

d. On the income statement as part of the calculation of income from continuing operations at the before tax amount of $100,000

d

4. Gerard Company reported sales of $300,000 for 2010; $330,000 for 2011; and $360,000 for 2012. If the company uses 2010 as the base year, what were the percentage increases for 2011 and 2012 compared to the base year?

a. 10% for 2011 and 10% for 2012

b. 120% for 2011 and 120% for 2012

c. 110% for 2011 and 110% for 2012

d. 10% for 2011 and 20% for 2012

d

5. On June 30, Star Radio reported total current assets of $45,000; total assets of $200,000; total current liabilities of $42,000; and total liabilities of $80,000. What was the current ratio on this date?

a. 0.56

b. 2.50

c. 1.07

d. 0.93

c

6. Talking Puppet Company reported a P/E ratio of 50 on the last day of the fiscal year. If the company reported earnings of $2.50 per share, how much was a share of the company's stock trading for at that time?

a. $20 per share

b. $125 per share

c. $50 per share

d. $47.50 per share

b

7. Singleton Company had sales of $2,000,000, cost of sales of $1,200,000, and average inventory of $400,000. What was the company's inventory turnover ratio for the period?

a. 3.00

b. 4.00

c. 5.00

d. 0.33

a

Inventory Turnover = Cost of Goods Sold / Average Inventories

Cost of goods sold = Beginning Inventories + Cost of Goods Manufactured - Ending Inventories

Cost of goods sold figure is reported on the income statement.

Average Inventories = (Beginning Inventories + Ending Inventories) / 2

8. Suppose a firm had an inventory turnover ratio of 20. Suppose the firm considers a year to be 360 days. How many days, on average, does an item remain in the inventory?

a. 5.56 days

b. 18 days

c. 20 days

d. 360 days

b

9. Suppose a new company is trying to decide whether to use LIFO or FIFO in a period of rising inventory costs. The CFO suggests using LIFO because it will give a higher inventory turnover ratio. Is the CFO correct?

a. Yes, the average inventory will be lower (the ratio's denominator) and the cost of goods sold (the ratio's numerator) will be higher than if FIFO were used.

b. No, the average inventory would be the same because purchases are the same no matter which inventory method is chosen.

c. The inventory method has no effect on the inventory turnover ratio.

d. Without specific inventory amounts, it is not possible to predict the effect of the inventory method.

a

10. If a firm has $100,000 debt and $100,000 equity, then

a. the return on equity ratio is 1.

b. the debt-to-equity ratio is 1.

c. the return on assets ratio is 0.5.

d. the firm has too much debt.

b

current ratio

measures a company's liquidity

inventory turnover ratio

measures a company's liquidity

accounts receivable turnover ratio

Sales on Account /

average A/R

measures a company's liquidity

debt to equity ratio

measures a company's solvency risk

return on assets

measures a company's profitability

asset turnover ratio

measures a company's profitability

return on equity

measures a company's profitability

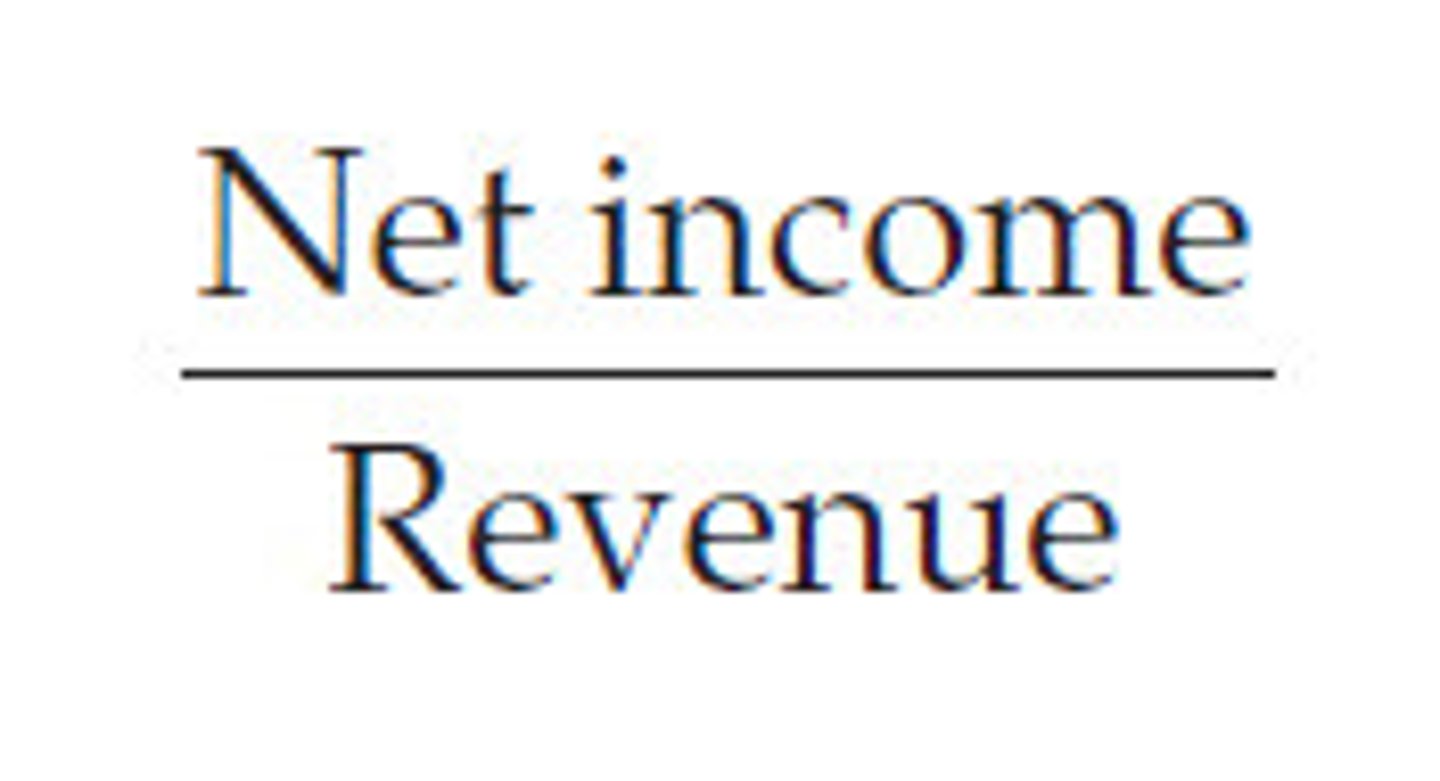

profit margin

measures a company's profitability

gross profit ratio

measures a company's profitability