IFM- chapter 2 - Overview of the financial system

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

58 Terms

what is the goal of financial markets

To channel funds from those without investment opportunities (Lender-Savers) to those who do (Borrower-Spenders), and to improve economic efficiency.

Give examples of 4 lender - savers

. Lender-Savers (those who provide funds):

These are entities that have excess money and are willing to lend or invest it:

Households (e.g. individuals saving money)

Business firms (with profits but no immediate investment plans)

Government (when running a budget surplus)

Foreigners (investing in domestic markets)

give 4 examples of borrowers - spenders

2. Borrower-Spenders (those who use funds):

These are entities that need extra money to fund expenditures or investments:

Business firms (to expand operations or invest in projects)

Government (to fund public services or deficits)

Households (for buying homes, cars, education, etc.)

Foreigners (borrowing from domestic markets)

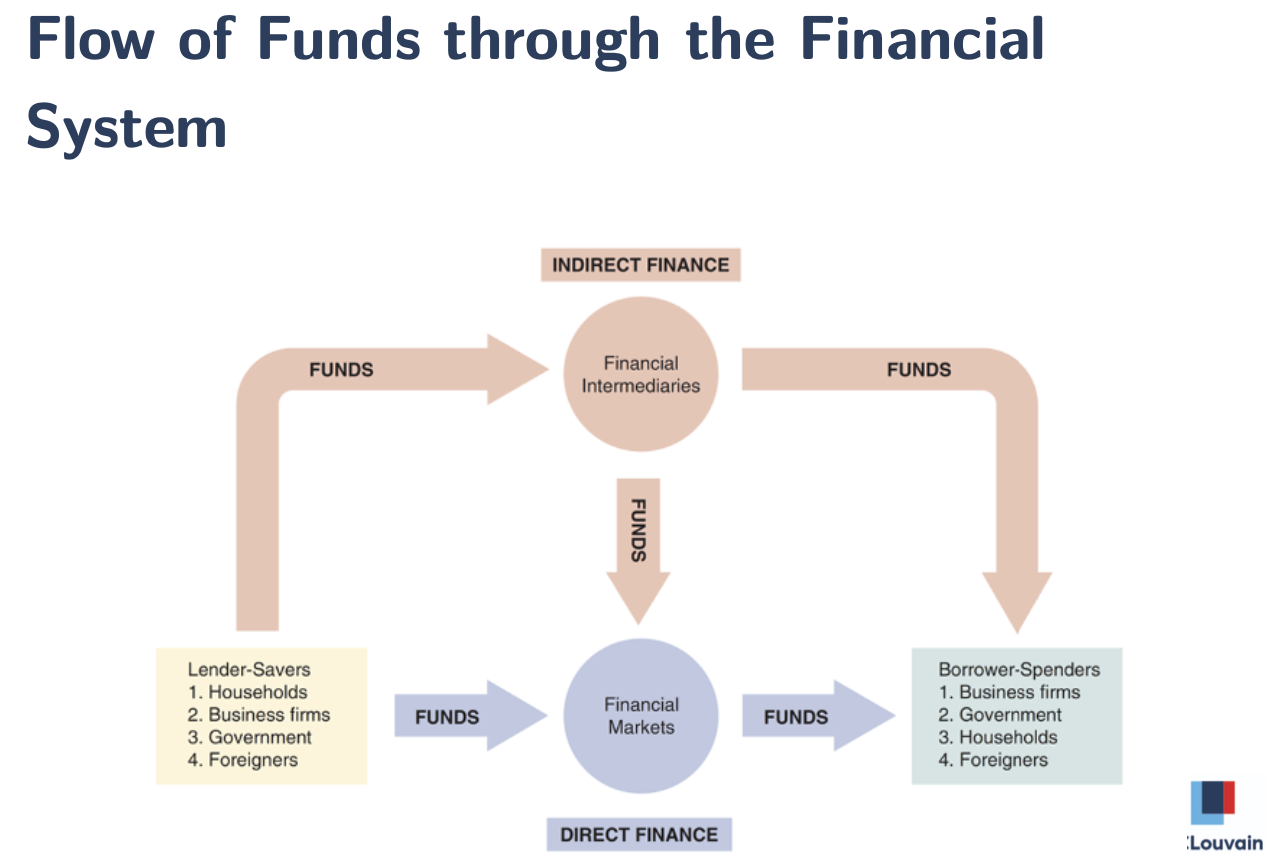

what are the two segments of financial markets

1. Direct Finance

What happens?

Borrowers get money directly from lenders by selling financial instruments (like stocks or bonds).Where?

In financial markets.What are financial instruments?

They represent claims on the borrower’s future income or assets.

2. Indirect Finance

What happens?

Borrowers get money indirectly through financial intermediaries (like banks or mutual funds).How?

Intermediaries collect money from savers and then lend or invest it.What do borrowers provide?

They still issue financial instruments, but not directly to the end lenders.Again, these are:

Claims on the borrower’s future income or assets.

look

why are financial markets important?

are the reason we can earn interest or return;

are critical for producing an efficient allocation of capital, allowing funds to move from people who lack productive investment opportunities to people who have them.

also improve the well-being of consumers, allowing them to time their purchases better.

what is a bond issuer?

the entity that borrows money - typically governments or corporations

what is the principal in a bond?

the amount borrowed, also called par value or face value

what is the coupon rate of a bond?

The interest the issuer agrees to pay, typically annually, semi-annually or quarterly; it can be fixed or floating.

what is the maturity date of a bond?

the date when the bond matures and the principal is repaid to the bondholder, signaling the end of the bond's life.

what are embedded options in bonds?

Embedded options in bonds are special features written into the bond contract that give either the issuer or the bondholder certain rights before the bond's maturity. These options affect how, when, or if the bond can be repaid or redeemed early.

what is the difference between price and value of a bond

Price: Amount paid to acquire the asset

Value: What the asset is worth to a particular party

how are bonds classified based on maturity?

Short-term: < 1 year

Intermediate-term: 1–10 years

Long-term: > 10 years

what do stocks represent?

ownership claims in a firm and potential dividend payments

what happens in the primary market?

New securities are issued and sold to initial buyers, usually with the help of an investment bank

What happens in the secondary market?

Previously issued securities are bought and sold between investors.

Give examples of secondary markets.

The New York Stock Exchange (NYSE) and Nasdaq.

Who is involved in the secondary market?

Brokers and dealers facilitate the buying and selling.

Do firms receive money from transactions in the secondary market?

No, the firm does not receive any money from secondary market transactions.

What are the two main functions of the secondary market?

Provides liquidity – makes it easy to buy/sell securities.

Establishes prices – helps determine the market value of securities.

what is an exchange?

A centralized location where trades are conducted (e.g., NYSE, Euronext).

What is an OTC (Over-the-Counter) market?

A decentralized market where securities are traded directly between parties, without a centralized exchange.

What is the Money Market?

A segment of the financial market where short-term borrowing and lending of funds occurs, typically in debt securities with maturities of one year or less.

What is the Capital Market?

A segment of the financial market where long-term debt and equity securities are bought and sold, typically involving maturities of more than one year.

What is a foreign bond?

A bond issued by a foreign entity in the currency of the investor's country, typically to raise capital in that market.

What is a Eurobond?

A bond issued in a currency different from that of the country where it is issued, typically sold to investors in multiple countries. It allows issuers to access a broader base of investors and often bypasses local regulations.

ex. A Canadian company issues a bond in U.S. dollars, but sells it in Europe — that’s a Eurobond (specifically, a Eurodollar bond).

why are eurobonds important?

Larger than the U.S. corporate bond market

Over 80% of new bonds are Eurobonds

Often denominated in dollars

What are Eurocurrencies?

Deposits held in banks outside their home country, typically in a different currency.

aka any currency deposited in a bank outside the country where that currency is the official money.

what are eurodollars?

Eurocurrencies specifically held in U.S. dollars, typically deposited in banks outside the United States.

what are the two key features of eurodollars?

Earn short-term interest

Not related to the Euro currency

What is financial intermediation? and why is it important?

the process of moving funds from lenders to borrowers through a financial intermediary (e.g., a bank).

It’s a more important source of finance than securities markets

It helps reduce transaction costs, enables risk sharing, and addresses asymmetric information

how do financial intermediaries make profit?

by reducing transaction costs for savers and borrowers.

How do financial intermediaries reduce transaction costs?

By developing expertise

By economies of scale

what are liquidity services?

Services that make it easier for customers to conduct transactions, e.g., checking accounts.

what is asset transformation?

Converting risky assets into safer assets for investors.

what is diversification?

Spreading investments across a portfolio to reduce overall risk.

what is asymmetric information?

One party has more or better information than the other, affecting decision-making.

what is adverse selection?

Occurs before the transaction when a party with hidden risks seeks an agreement.

Example: Unhealthy people applying for insurance.

what is moral hazard?

Occurs after the transaction when the informed party behaves in a way that harms the other party.

Example: Borrower takes risky actions after receiving a loan.

what are economies of scope in financial markets?

Using the same info for multiple services to lower production costs (e.g., loans, insurance).

What is a conflict of interest in financial intermediation?

A conflict of interest in financial intermediation occurs when a financial intermediary (like a bank, investment firm, or insurance company) has multiple roles or incentives that might compromise their duty to act in the best interest of their clients.

What are the two categories of financial intermediaries according to the ECB?

Monetary Financial Institutions (MFIs)

- Central Banks

- Credit Institutions

- Money Market Funds

- Other InstitutionsOther Financial Intermediaries (OFIs)

What is the main role of Central Banks as financial intermediaries?

Central Banks conduct monetary policy for a specific area by way of a legal mandate.

What defines a Credit Institution?

An institution that receives deposits from the public and grants credit for its own account, or

An entity that issues electronic money but does not take deposits or give credit.

What are the two main reasons for financial regulation?

Increase information available to investors

Ensure the soundness of financial intermediaries

How do regulators increase information to investors?

Require companies to disclose financial information

Restrict insider trading

This reduces adverse selection/moral hazard and improves market efficiency.

Why must the soundness of financial intermediaries be ensured?

Depositors may not assess if institutions are sound. If they have doubts, they may withdraw funds, causing financial panic and large public losses.

What are the six types of regulations to ensure soundness of financial intermediaries?

Restrictions on Entry

Disclosure

Restrictions on Assets and Activities

Deposit Insurance

Competition

Supervision

What is meant by “Restrictions on Entry”?

Only qualified individuals/groups can start financial intermediaries. They must obtain a banking license, proving they meet legal standards for protecting customer data and funds.

What does "Disclosure" regulation require from financial intermediaries?

Follow strict bookkeeping rules

Be subject to periodic inspections

Make key financial information public

What are "Restrictions on Assets and Activities"?

Intermediaries must:

Avoid risky activities

Hold only prudent levels of risky assets

To ensure client funds are safe and obligations to clients are met.

What is “Deposit Insurance” and what is the EU’s approach?

Deposit Insurance protects depositors from losses if a bank fails.

EU’s DGS (Deposit Guarantee Scheme) reimburses up to €100,000, funded entirely by banks — no taxpayer funds used.

How does competition contribute to the soundness of financial intermediaries?

According to the Bank of England:

Healthy competition keeps banks safe

Prevents “too big to fail” situations

Encourages responsible banking among smaller firms

What does the ECB say about changing competition in banking?

Changes in competition between banks, and between banks and non-bank financial providers across borders, can affect risk in banking.

How should supervisors consider competition in financial regulation?

They must ensure risks are well-managed and banks are resilient.

There is no evidence that EU regulation limits banks’ ability to compete.

Overburdening supervisors with competition objectives could undermine their main mandate.

What is the role of the EBA (European Banking Authority)? and how do they achieve it?

The EBA ensures stability and effectiveness of the EU financial system through simple, consistent, transparent, fairregulation and supervision.

How?

Develops harmonised rules

Promotes supervisory convergence

Advises on financial innovation and sustainable finance

What does the ECB (European Central Bank) do in financial supervision?

The ECB takes timely and appropriate action if a bank:

Fails to comply with prudential requirements

Is (or may be) engaged in unsafe/unsound practices

What is the ECB’s goal in supervision?

To ensure sound risk management, early necessary action, and compliance with prudential requirements.